Crash or Inflate?

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 55

Commodity prices have been cooling, which is encouraging markets to suppose that the battle against inflation is being won. That, in turn, is drawing the conclusion that we’re near the end of the rate hike cycle. Hurrah, risk-on.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | System weak, clues about the next generation |

| On-chain | Steady, inventory holding up |

| Macro | Tough policy choices |

| Investment Flows | Flat is good |

| Cryptonomy | A modern-day Robin Hood |

Technical

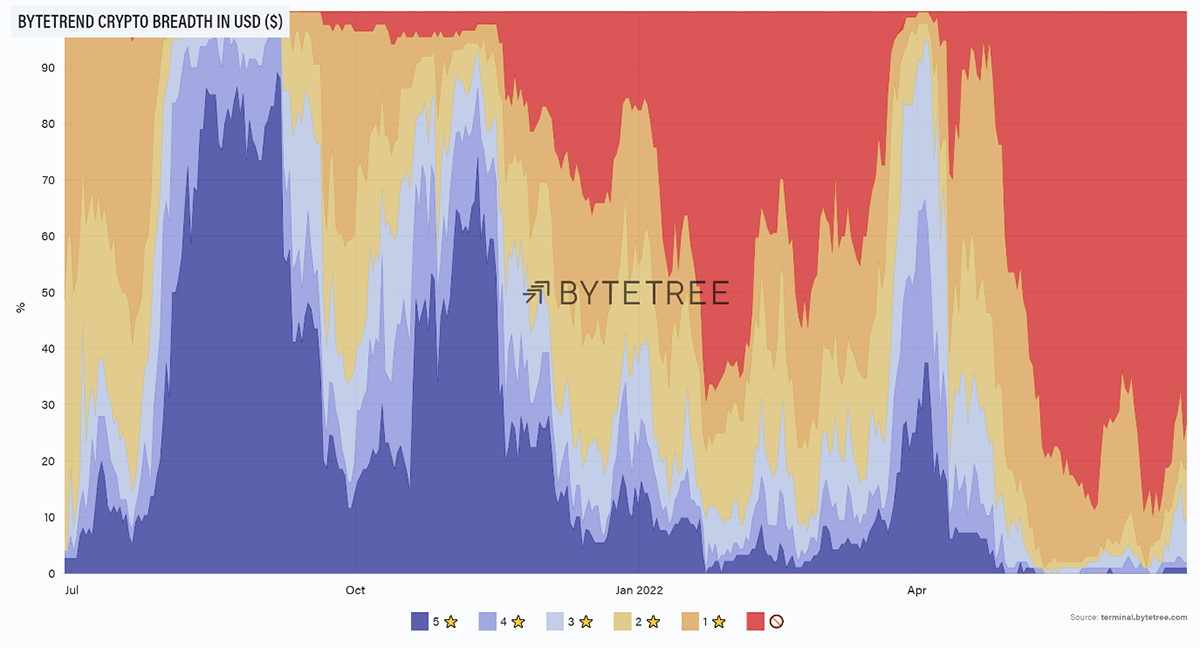

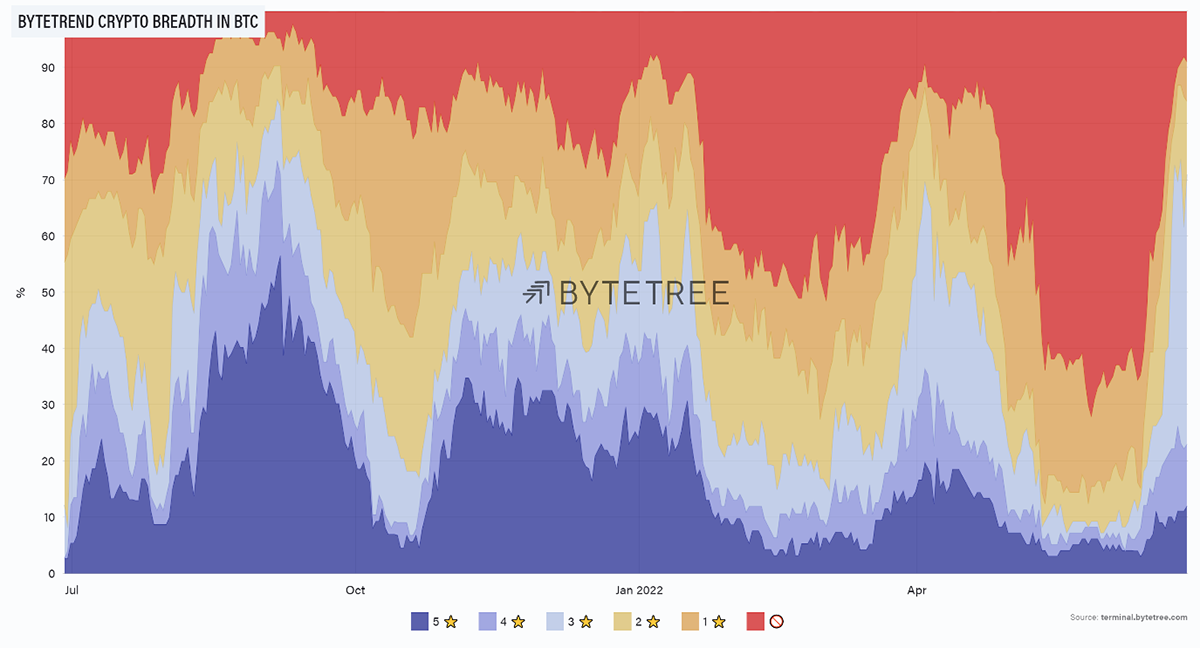

Against the US$, the crypto universe, as defined by ByteTrend, has yet to confirm any sort of recovery. However, activity within the ecosystem is more encouraging, with several coins and tokens performing well against both BTC and ETH.

The large red sky in the chart below tells us that very little in the crypto world is registering more than one star against the US$. The scale of the recent decline has left a huge amount of technical damage to the ecosystem.

Source: ByteTree. ByteTrend crypto breadth chart in USD over the past year.

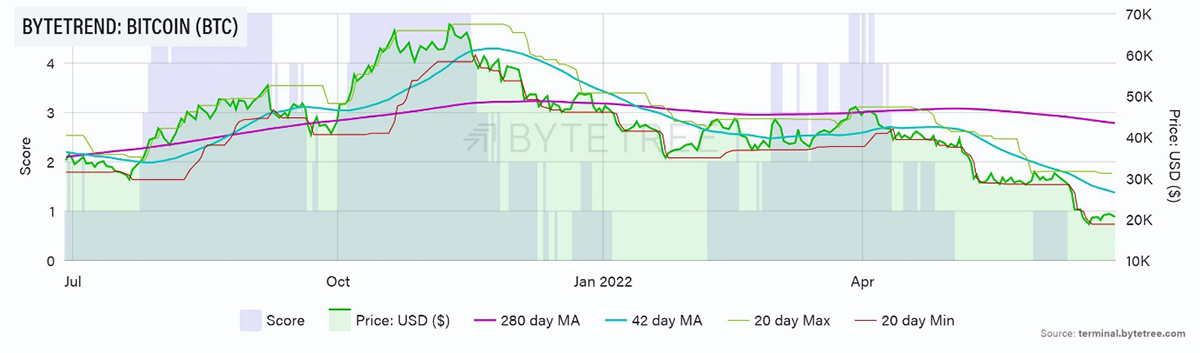

Both Bitcoin and Ethereum remain on zero stars in US$.

Source: ByteTree. ByteTrend for Bitcoin, measured in USD, over the past year.

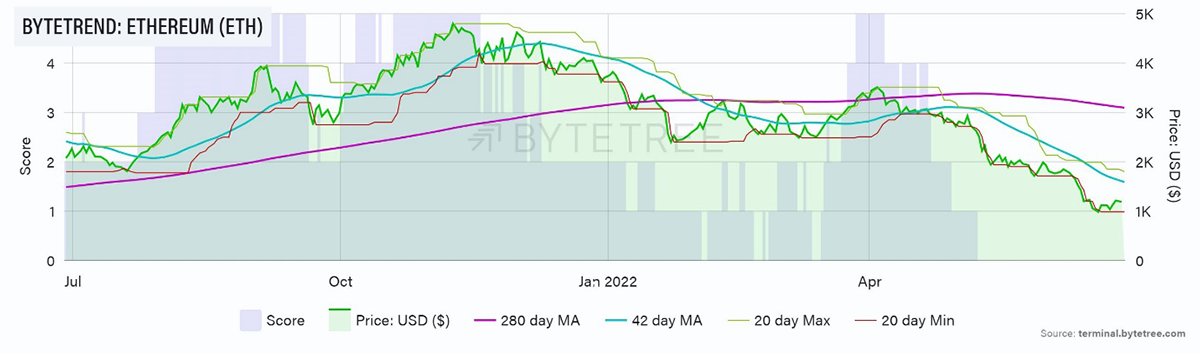

Source: ByteTree. ByteTrend for Ethereum, measured in USD, over the past year.

Activity within crypto has been more constructive, however. The scale of the fall in altcoins has clearly enticed bargain-hunters, and many stars are coming on, as shown in the next chart (stars coming on relative to BTC). This is going to be a tremendous indicator of next-cycle strength as we are already getting a glimpse of the early leaders. We just need affirmation that the tide has turned for the whole sector before getting overexcited.

Source: ByteTree. ByteTrend crypto breadth chart in BTC over the past year.

ON-CHAIN

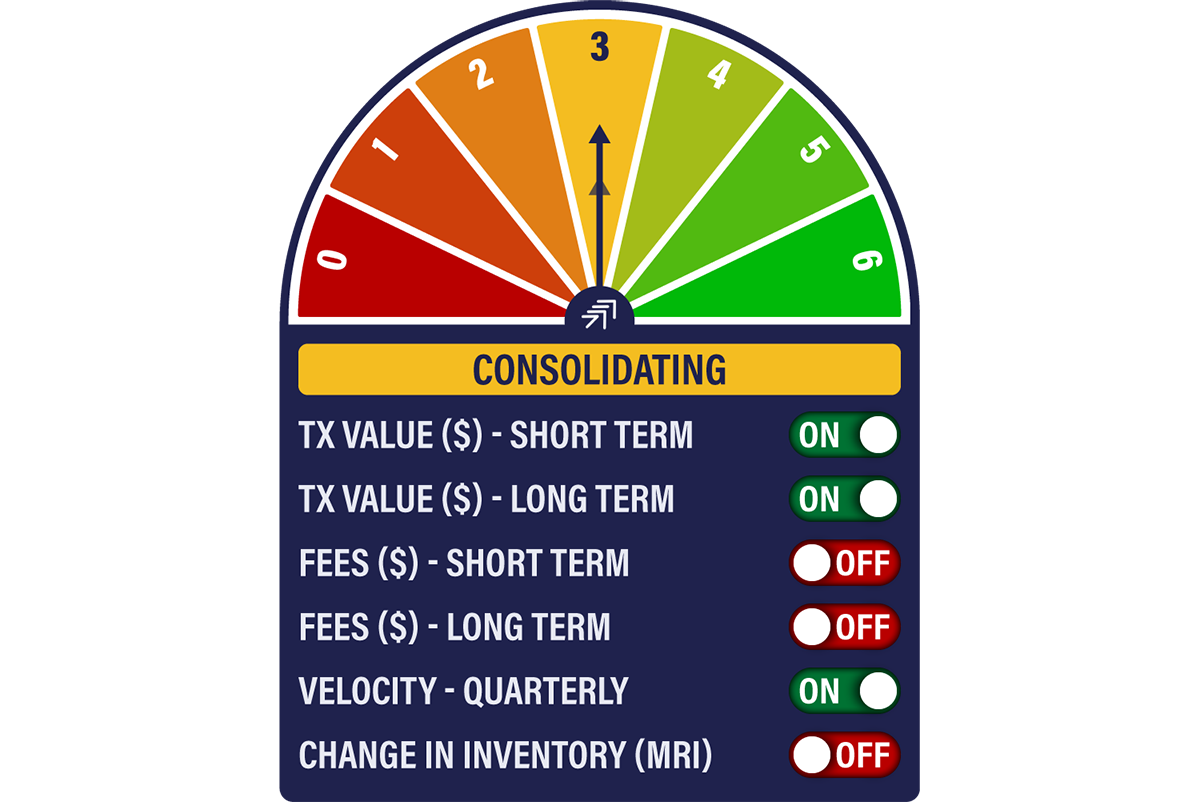

The Network Demand Model remains on 3/6 this week, with no change in signals. Both long- and short-term transactions remain on, as does velocity. The transaction data has been flattered by two waves of capitulation, the first over four days in mid-May, the second over six days in mid-June, where we saw huge volumes. As these exceptional periods come out of the numbers, the moving averages will again decline. The network is doing its job, but we need to see more consistent activity to claim that we are tracing out a bottom.

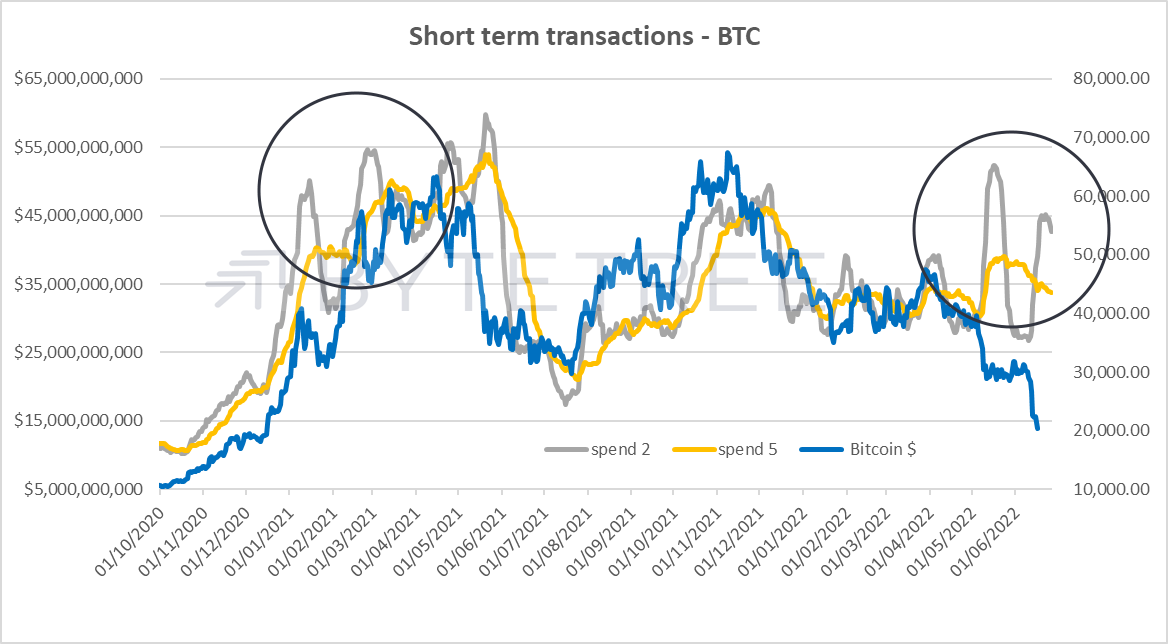

The chart below shows the recent spikes in on-chain volumes. Note how the pattern works in both directions. In the bull market of early 2021, we saw ascending waves of transaction behaviour (grey lines) before the price crash in April. This time we see the opposite. A healthier picture will resume when we see steady transaction volumes accompanied by a steady price.

Source: ByteTree. Short-term BTC transactions and price since October 2020.

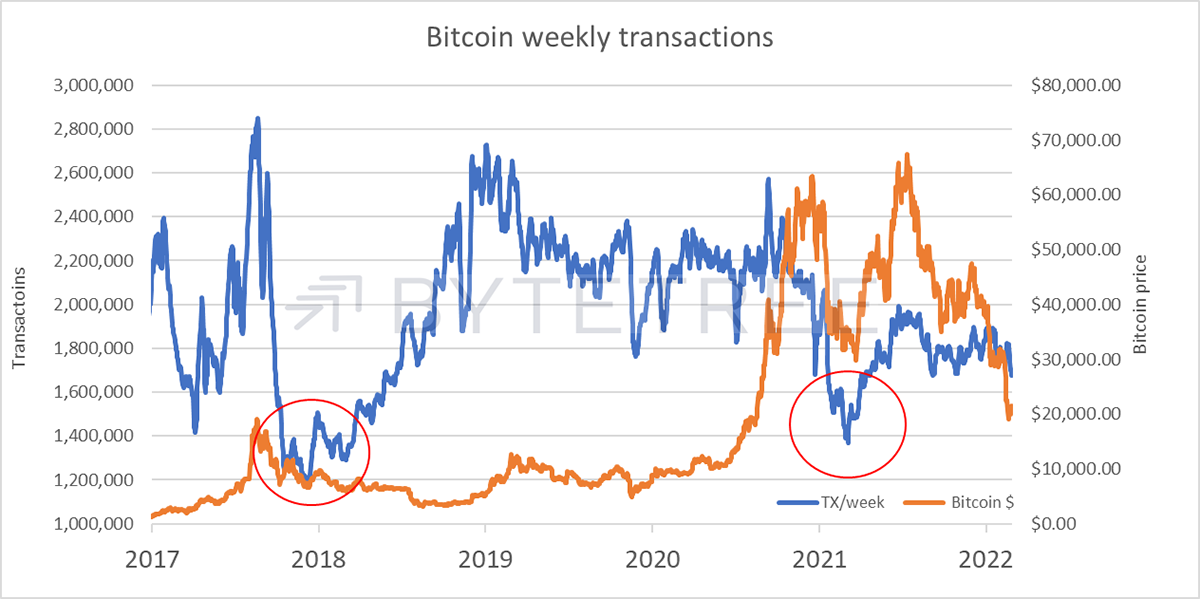

The number of transactions has been declining, although the correlation to the price of bitcoin has been historically weak. That said, previous lows were accompanied by a collapse in the number of transactions, as circled in red below. We are not there yet on this measure.

Source: ByteTree. Number of weekly bitcoin transactions and price since 2017.

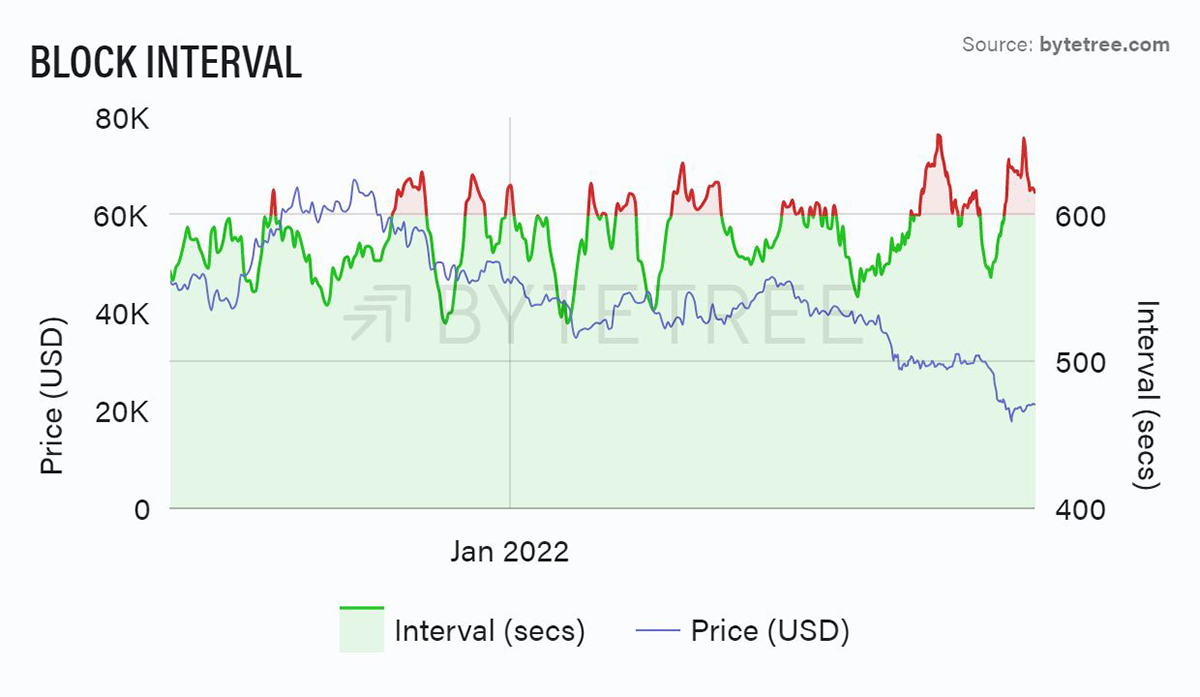

It’s obviously a much tougher environment for the miners, and we can see that in the change in the intervals between blocks. Remember that the code is set for one block to be mined every 10 minutes. When this starts to drift over 10 minutes, it tells us that the mining community is allocating less computing power to the network. Once every two weeks, the “difficulty” of mining is adjusted to recalibrate the network back towards the required rate.

Source: ByteTree. Bitcoin block interval and price since September 2021.

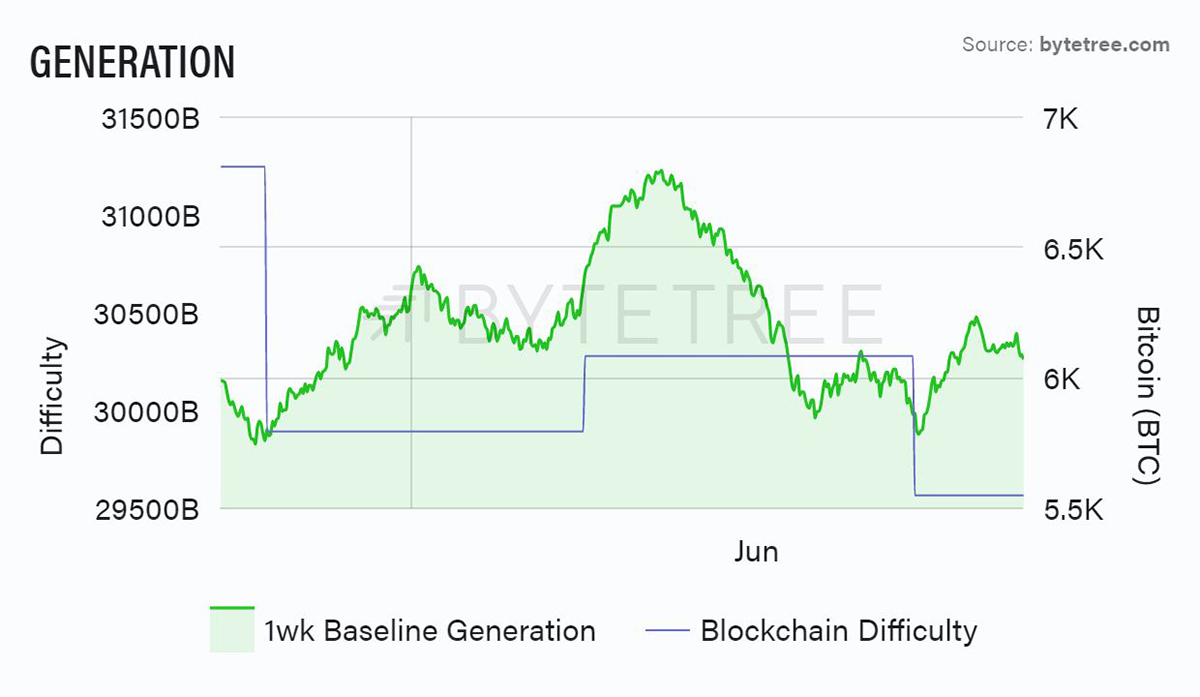

We see below that each lurch downwards is removing computing power from the network. As a result, network difficulty is also coming down.

Source: ByteTree. Bitcoin block generation and difficulty since May 2022.

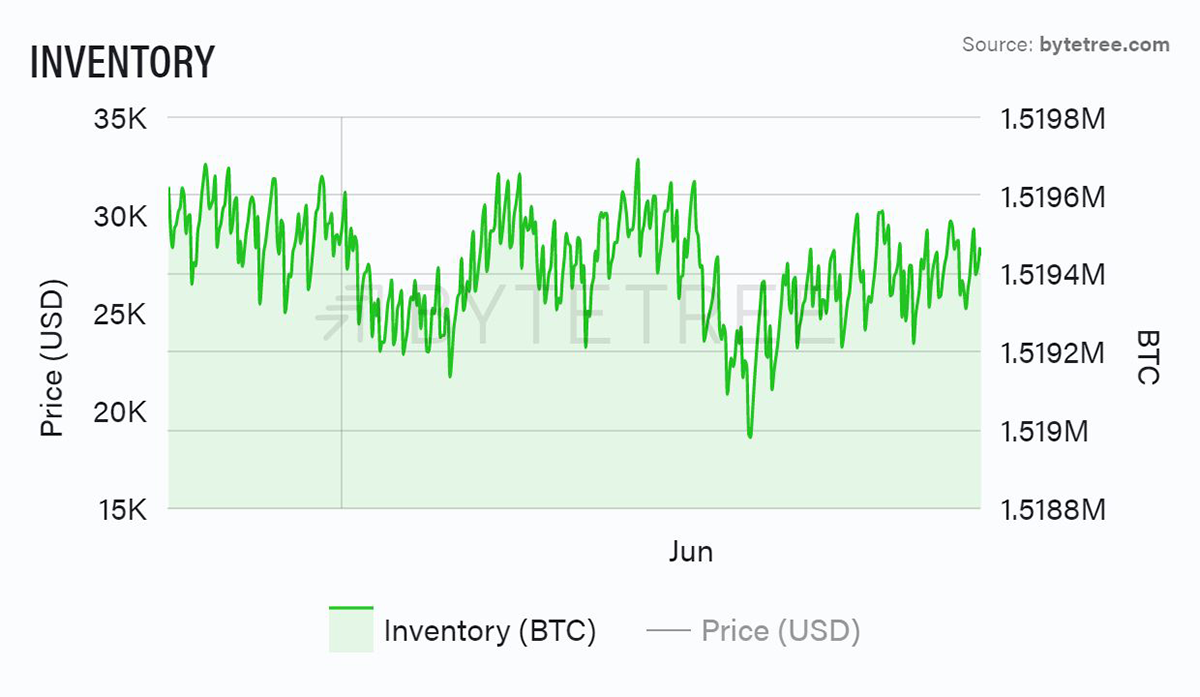

Of note is the fact that, despite numerous scare stories in the press about miners being forced to sell inventories, the data shows that the number of unspent coins (inventory chart) remains pretty much flat.

Source: ByteTree. Bitcoin miner inventory since May 2022.

MACRO

Commodity prices have been cooling, which is encouraging markets to suppose that the battle against inflation is being won. That, in turn, is drawing the conclusion that we’re near the end of the rate hike cycle. Hurrah, risk-on.

The problem is that any loosening of financial conditions reinvigorates the conditions that got us here in the first place. The uncomfortable truth is that supply-side constraints, particularly in the energy complex, aren’t easy to fix. As President Macron told President Biden yesterday, Saudi Arabia has the ability to increase production by only 150,000bpd (world oil demand is 5.7m bpd). At the same time, the UAE is producing near-maximum capacity, Ecuador may suspend oil production because of protests against the government, and Libya has indicated it may suspend oil exports from the Gulf of Sirte amid a deteriorating political crisis. Libya’s oil production has already halved to 600,000bpd since mid-April, according to Bloomberg.

Meanwhile, the movement to remove fossil fuels from the global energy diet, institutionalised under the ESG banner, means an industry incapable of responding to price signals. There is simply no spare capacity. “By the end of the year global oil demand will have exceeded available capacity for the first time ever, with no ability to bring on new production in the short term”, according to the MacroStrategy partnership.

This puts policy-makers in an unenviable position. Any indication that they are inclined to ease off in terms of tightening measures will reignite inflationary pressures at a stroke. On the other hand, it is clear that even the current settings have provoked a major economic slowdown.

The good news - for this year at least - is that the gods have smiled on the world’s farmers (albeit in terms of production rather than input costs). According to the Australian Department of Agriculture, Water and the Environment, 2022 is set to produce the second-highest value of crop production on record. Meanwhile, the USDA reports that Brazilian corn production is set to rise 33% on last year.

The confluence of slowing economic activity and plentiful harvests seems to have doused inflationary concerns for the time being, but it’s an uneasy truce. The danger is that the Fed and other central banks convince themselves that the battle has been won and alter the direction of monetary travel, at which point inflation will just kick on again. And maybe the harvest won’t be so good next year.

Inflation expectations are sitting at around 2.4% for the long term, as defined by the UK 10yr Treasury. In their most recent website update on 17 June, the Bank of England expect it to “be close to 2% in around two years”. With an energy supply-side problem that will take many years to fix, if it can be fixed at all, that suggests that either we’ll see a major economic retrenchment, or it’s simply wrong.

Central banks are faced with the unenviable choice of collapsing the world economy or feeding the inflation tiger. The political consequences of the former are hard to stomach, suggesting that any evidence that the inflation is coming under control will be leapt upon and policies eased. Because inflation is at its core a monetary phenomenon, it will not go away under those circumstances.

This is why gold and bitcoin will be important components of an investment portfolio for years to come. Not because they are guaranteed to rise (we don’t know the future), but because they act as a hedge against policy error in both directions in an inflationary era. Too lax, own bitcoin. Too tight, own gold.

FLOWS

Little to add from last week. It’s good to see that the fund holdings remain steady, despite the bad news that continues to emanate from the crypto world. The slight increase over the week adds weight to our assertion that the withdrawal from the Purpose ETF (which caused last week’s fall) was a one-off rather than the start of a trend.

Source: ByteTree. Bitcoin held by funds over the past 12 weeks.

Cryptonomy: A modern-day Robin Hood

By Laura Johansson

The FTX Exchange and CEO Sam Bankman-Fried (SBF) are making the headlines again this week. A Bloomberg report published on Monday 27 June stated that FTX might be acquiring investing and trading platform Robinhood. SBF, who bought a 7.6% stake in RobinHood last month, denied the acquisition rumours soon after the “news” broke. However, that didn’t stop HOOD shares from rocketing by 14% yesterday.

The fact that we are in “crypto winter” makes it easier to spot the shining stars that keep burning bright despite the market conditions - FTX is undeniably one of them at the moment. In the current industry hiring freeze, FTX joins Binance, Kraken and OpenSea in procuring new talent. Additionally, FTX has recently helped centralised entities BlockFi and Voyager stay afloat after they came under financial pressure following the crash in crypto markets. According to the Financial Times, SBF lent $250m to BlockFi, while Voyager received $485m, earning him some essential “street cred” in the crypto world.

Even by crypto standards, FTX is a relative newcomer. The platform launched in 2019 with the aim to address the gaps in the crypto futures market and is now the second most popular spot exchange by market cap after Binance. The partnerships that FTX formed over the years have further accelerated its growth. They have numerous sponsorship deals with major sports entities, they’ve partnered with payments giant Stripe, and earlier this year, they became the first to gain a licence to operate the exchange in Dubai. Similarly, SBF has made a name for himself in the crypto industry (and beyond). He is listed on the Forbes Billionaires and 30 Under 30 lists, and has confirmed that he will eventually donate his wealth to charity - a modern-day Robin Hood?

As Charlie says, this is the time to look for the long-term winners in the crypto space, and FTX and SBF seemingly can’t do much wrong at the moment. For a more detailed account of FTX, I highly recommend that you read ByteTree analyst Seran Dalvi’s Token Takeaway on the exchange and its native token, FTT.

Comments ()