Osmosis: A Custom Blockchain, Facilitating Trade on the Interchain

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: OSMO;

Osmosis is a custom-built blockchain on top of the Cosmos technology stack. It launched on June 18th 2021, with an Automated market-maker (AMM) exchange. Powered by its native token, OSMO, Osmosis works to bring DeFi to an ecosystem of independent and interconnected blockchains, known as the Cosmos ecosystem. Read the introduction to Cosmos.

Since the inception of Osmosis, the OSMO token has risen meteorically to a market capitalisation of $3.1bn. At the time of writing, the exchange has a total of $1.8bn in liquidity across 41 different cryptocurrencies. Trading volumes have steadily risen, peaking at $223m in 24h volume on February 24th 2022.

Osmosis, owes its success in part to the technology stack it is built around. As a blockchain within the Cosmos ecosystem, Osmosis is built on top of the Tendermint proof-of-stake consensus engine. It leverages the Cosmos SDK for a custom architecture, and is ready to connect with all new Cosmos chains, thanks to the Inter-blockchain Communication Protocol.

These technologies gave Sunny Aggarwal, one of the co-founders of Osmosis, all of the infrastructure he needed to create the first interoperable DeFi application within the Cosmos ecosystem.

A Clever Incentive Architecture

There are many more significant reasons for the rapid adoption of the Osmosis exchange. The chain is specifically designed for hosting and optimising the performance and functionality of the AMM exchange. Consequently, many clever incentive structures were put in place to incentivise the adoption of the exchange, and to remove OSMO from the liquid token supply, reducing selling pressure during bearish market conditions.

The first step was to incentivise community participation. Osmosis launched with an airdrop to Cosmos ATOM stakers. This onboarded a strong and passionate community, which now drives the Decentralised Autonomous Organisation (DAO), which governs the chain. This mechanism distributed 50% of the 100 million initial token supply to these community members. This incentivised trading, providing liquidity, staking, and participating in governance in order for airdrop recipients to receive their full allocation. Once this step was completed, the exchange was bootstrapped into life.

A key part of the Osmosis incentive architecture is its token model. Proof-of-stake chains require token emissions as a reward for producing new blocks and keeping the chain secure. Osmosis has an aggressive rate of emissions - 300m OSMO are currently being emitted throughout the first year, but reduced by a third every year until a max supply of 1bn tokens is reached.

Due to the custom-built chain, this clever token emission model does not just deliver new token emissions to Osmosis stakers (25%), but also to liquidity providers on the exchange (45%), developers (25%) and the community pool (5%).

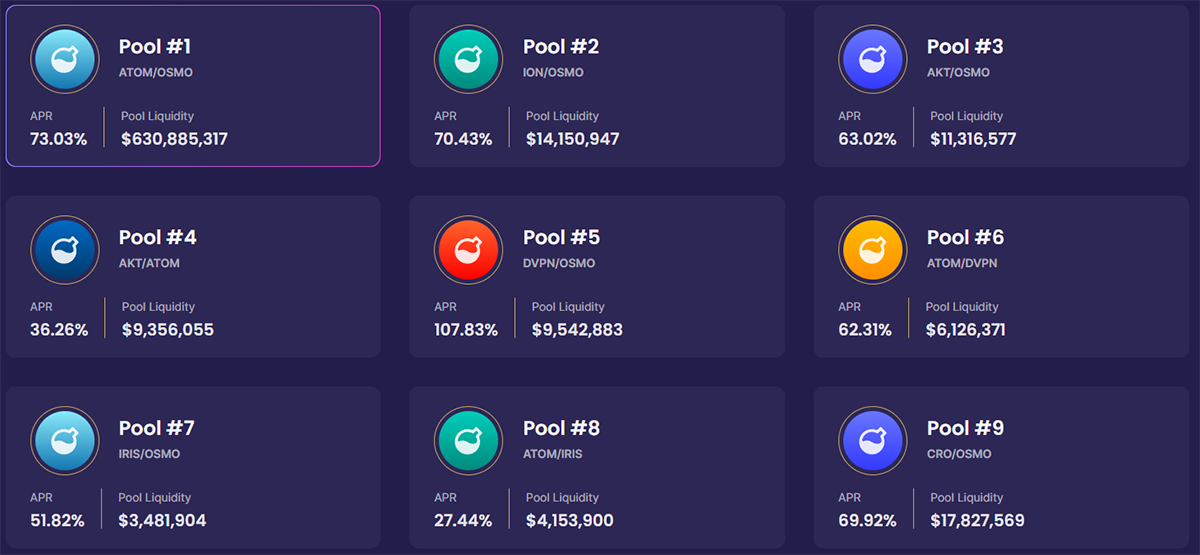

This means early participants are rewarded handsomely, earning significantly greater yields from staking or providing liquidity. OSMO staking rewards are around 79% P/a. In contrast, liquidity pool rewards range from 20%-100% (on average), with higher rewards generally emitted to liquidity pools with OSMO as one of the tokens in the pair. The high incentives (focused on liquidity pools) increase liquidity, making the exchange more attractive for users. The incentives also remove OSMO from the liquid supply and extend this benefit to other tokens listed on the exchange.

The final component of the OSMO token model is the need to buy and hold OSMO to transact on the Osmosis chain. Unlike the governance tokens of traditional AMM exchanges, such as Uniswap, Pancakeswap, or Quickswap, OSMO is also a fee token.

It’s worth noting that OSMO can capture value from additional applications, products or innovations around the Osmosis ecosystem. One of these innovations is superfluid staking. This security model allows tokens locked into liquidity pools to simultaneously be used to secure the Osmosis chain and earn staking rewards. This feature has just gone live on the ATOM/OSMO liquidity pool.

Osmosis as an Investment

It goes without saying that additional incentives for liquidity providers and high staking rewards will not be in play forever. These rewards offer an opportunity to early network participants and will reduce over time. The rewards, resulting from new tokens being emitted into circulation, may prompt the following considerations:

- The opportunity to earn yield on investment

- The impact of token emissions on the price appreciation of the OSMO token

Currently, yield opportunities play a part in many cryptocurrency investments. Yield can be earned by providing liquidity, staking, lending and borrowing, and from yield farming applications. However, many tokens do not offer yield opportunities natively on their applications, nor do they offer this from aggressive token emissions.

There are two things to note. Firstly, using the Osmosis exchange, could be an opportunity to earn yield on Cosmos-based tokens, including OSMO. Without the exchange, a high yield opportunity would not exist. For example, ATOM, the native token of the Cosmos Hub, currently rewards stakers with up to 15.29% APR from staking. However, if an investor deposits ATOM and OSMO into a liquidity pool on Osmosis, they can earn up to 74% APR and 18% from superfluid staking, as liquid OSMO tokens which can be converted into stablecoins, or compounded for greater returns.

Secondly, aggressive token emissions likely have a dampening effect on price, as tokens entering circulation means more liquid supply on the market. However, at the time of writing, OSMO is priced at $10.69, up 100% since launch and up over 600% since its lows in July 2021.

Given the aggressive inflation of the token supply, perhaps simply buying and holding Osmosis may be limited in opportunity, especially considering the high yield opportunity available to liquidity providers and stakers.

The reason why the high emissions have not had a significant negative influence on the price could be that newly emitted tokens are, for the most part, compounded back into the locked supply, rather than sold off for a steady yield. Another possibility could be that the exchange has simply grown in adoption at a more significant rate than the token supply has inflated. Consequently, the new demand for tokens absorbed the selling pressure caused by emissions.

Either way, as an investment, the OSMO token and the Osmosis exchange present an opportunity for exposure to the leading DeFi application in a rapidly expanding ecosystem. Yield opportunities are available for those looking for increased returns and can offset any negative impact of aggressive token emissions.

In the long term, this exchange is well-positioned, and emissions will decrease in relevance over time, as will yield opportunities. To be a winner in the long term, ultimately all that may matter is functionality, user experience, and the whole ecosystem’s success.

This article was written by Liam Connor from Confident in Crypto. Follow him on Twitter and YouTube.