Let the Good Times Roll

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 42

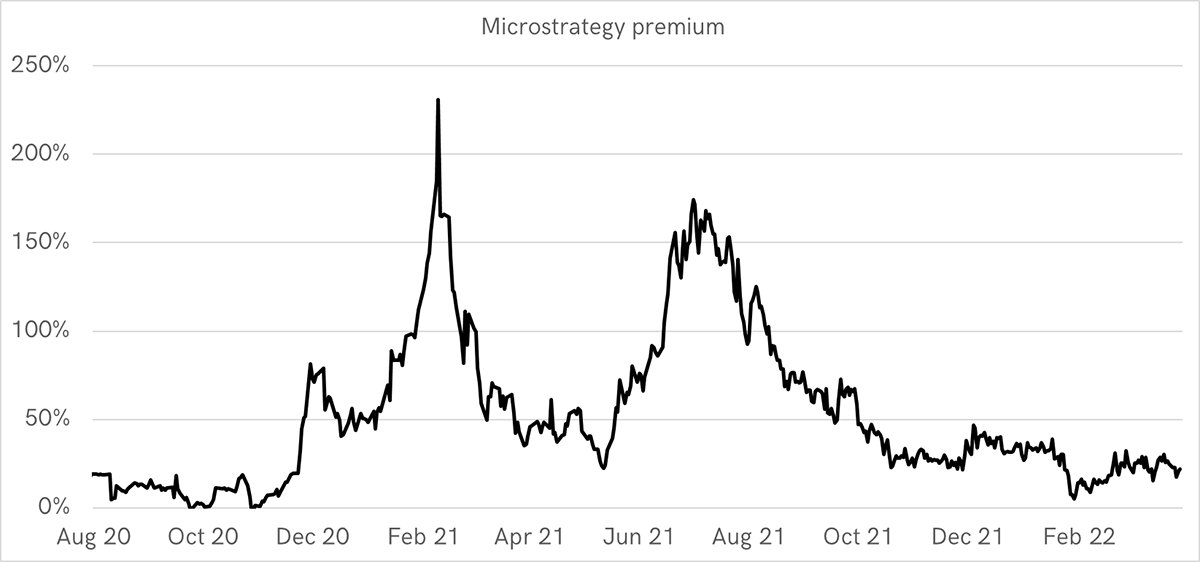

The MicroStrategy premium exceeded 200% in February 2021 before easing back. It then rallied to 150% in the summer and has since dropped to 22%. If you believe the software business is worth $2bn, then there is no premium at all.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Strong |

| On-chain | More transactions from sticky institutions |

| Investment Flows | MicroStrategy Premium shrinks |

| Macro | The Remarkable Ruble rebound |

| Crypto | A Wind of Change |

Technical

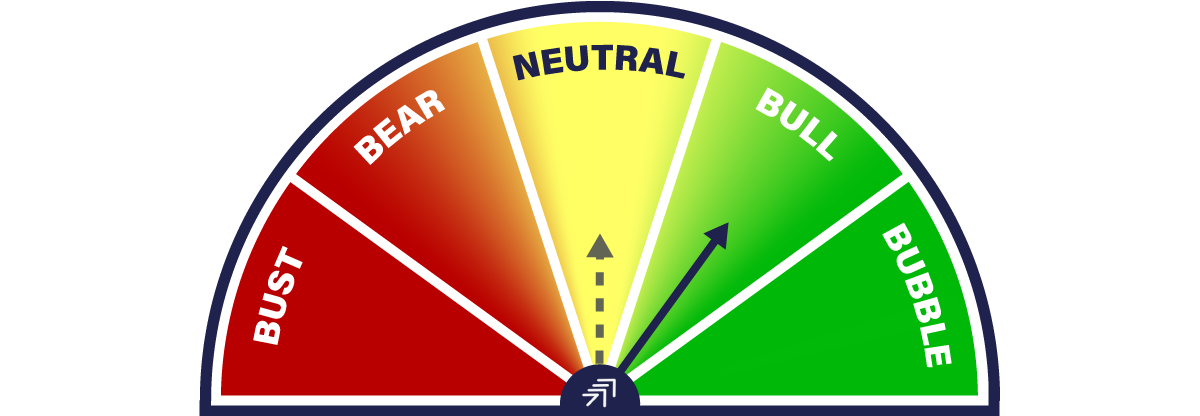

The ByteTrend star count for the top 15 tokens has jumped from 18 in early February to a whopping 62 over the past week. These are the most bullish conditions we have seen in months.

If all 15 coins had a 5-star trend, that would be 75 stars, which would reflect the max bullish technical conditions. This will be available in a historical chart in due course.

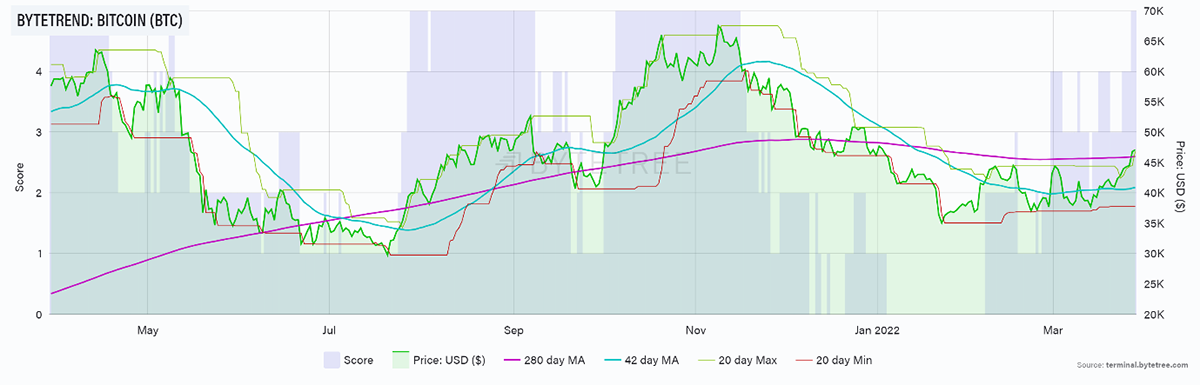

The bitcoin trend is alive and well with a recent jump above the 280-day moving average (200 in traditional markets equivalent where price rest at weekends).

Bitcoin upgrades to 5/5

Source ByteTrend. Bitcoin with 20-day max and min lines, 42-day and 280-day moving averages past year.

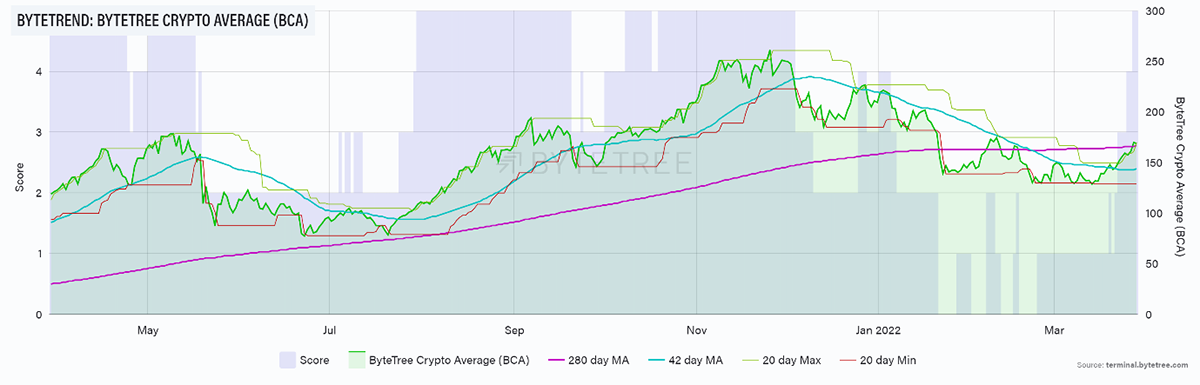

Better yet is the BCA (ByteTree Crypto Average), which I coveredlast week. It too has jumped to 5/5. This means the majority of coins are doing well.

BCA upgrades to 5/5

Source: ByteTrend. ByteTree Crypto Average (BCA) with 20-day max and min lines, 42-day and 280-day moving averages past year.

Another way to visualise this is to look at the ByteTrend coin list in USD and sort for 0 stars. Only seven tokens show up, with the majority scoring 3 or better. This is what a bull market looks like.

Only recently, I was dining out on the fact the bitcoin was ahead of the racy ARKK stocks (non-profit tech). Then I showed bitcoin moving in front of the NASDAQ. Today, I am pleased to show you bitcoin ahead of the S&P 500.

Bitcoin relative to the S&P 500 scores 5/5

Source: Bloomberg.

This is a powerful message, which seems different to previous occasions where we have seen strength against major markets. Back then, it was youthful bitcoin having a strong rally. Now it is enjoying similar behaviour while providing leadership.

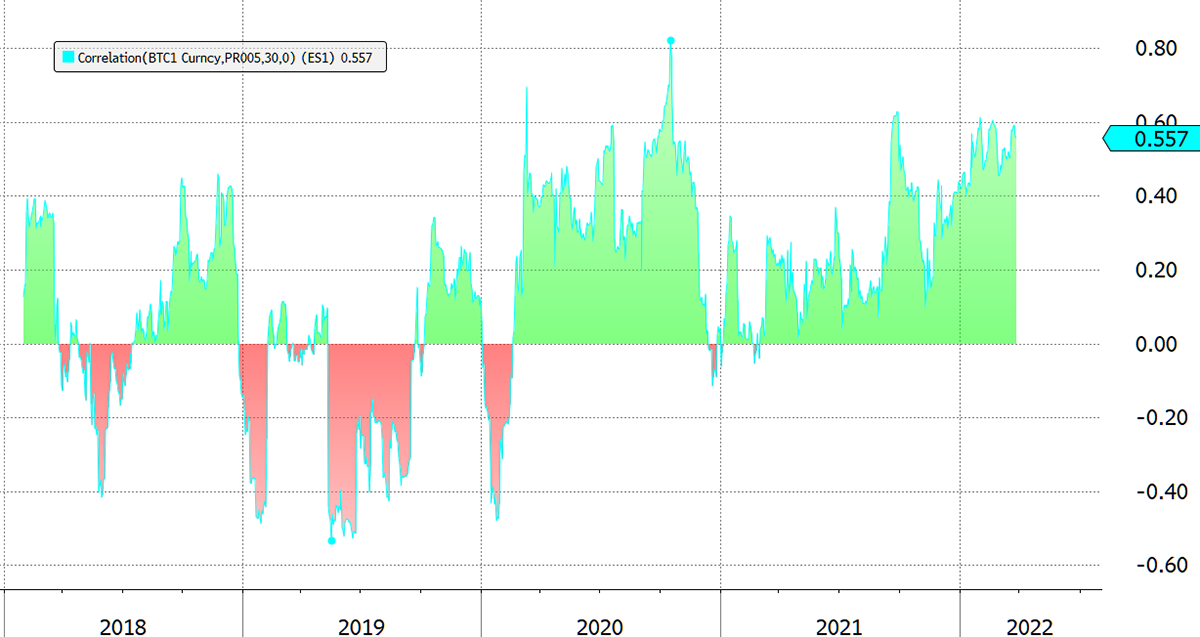

That comes through in correlation. There can be little doubt that bitcoin trades like risk assets, only with better performance. How many people realise the price is up in 2022, despite the strong dollar.

Bitcoin and S&P correlation is back

Source: Bloomberg

On-chain

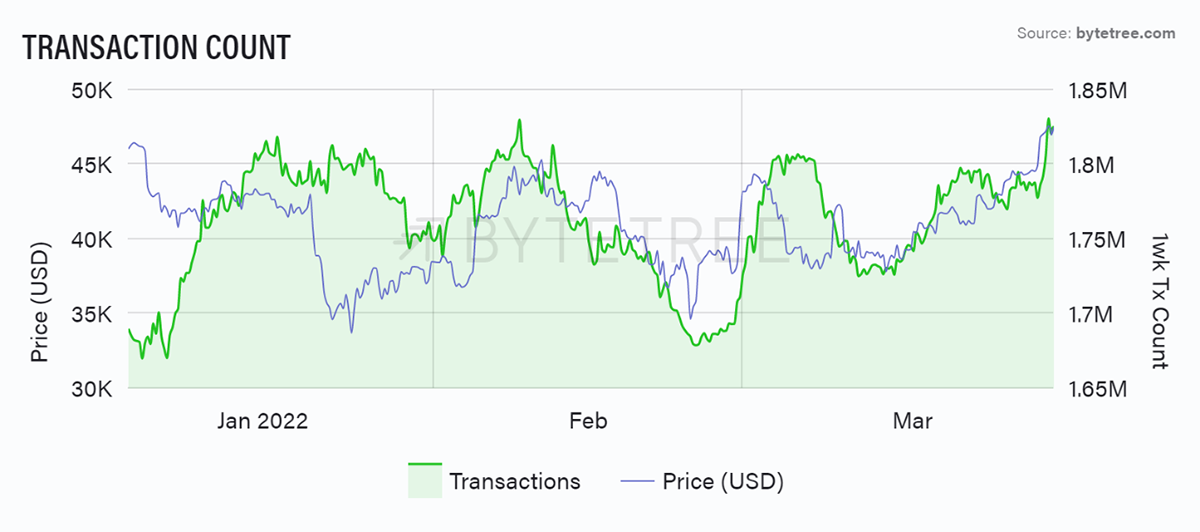

The chain is picking up. Weekly transactions broke 1.8 million, and the price agrees.

Source: ByteTree. Bitcoin transactions and price (USD) over the past three months.

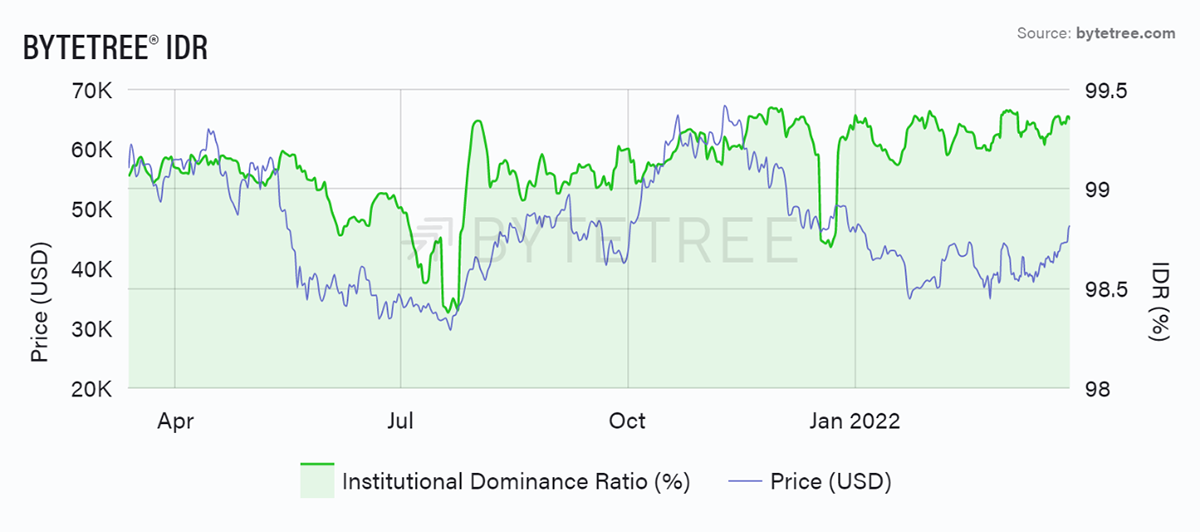

We should also remind ourselves how the Institution Dominance Ratio (IDR) has remained firm this year. This simply means that large transactions dominate all transactions by value, which means the institutions are still here. When it drops, they’ve gone.

Source: ByteTree. IDR and price (USD) over the past year.

All in all, on-chain is fine but clearly not flying.

Investment flows

Inflows into the ETFs are strong. Interestingly, they are much stronger in BTC than ETH, just as they are for gold over silver. I suspect the message is not to be overly heroic and stick to the more liquid areas.

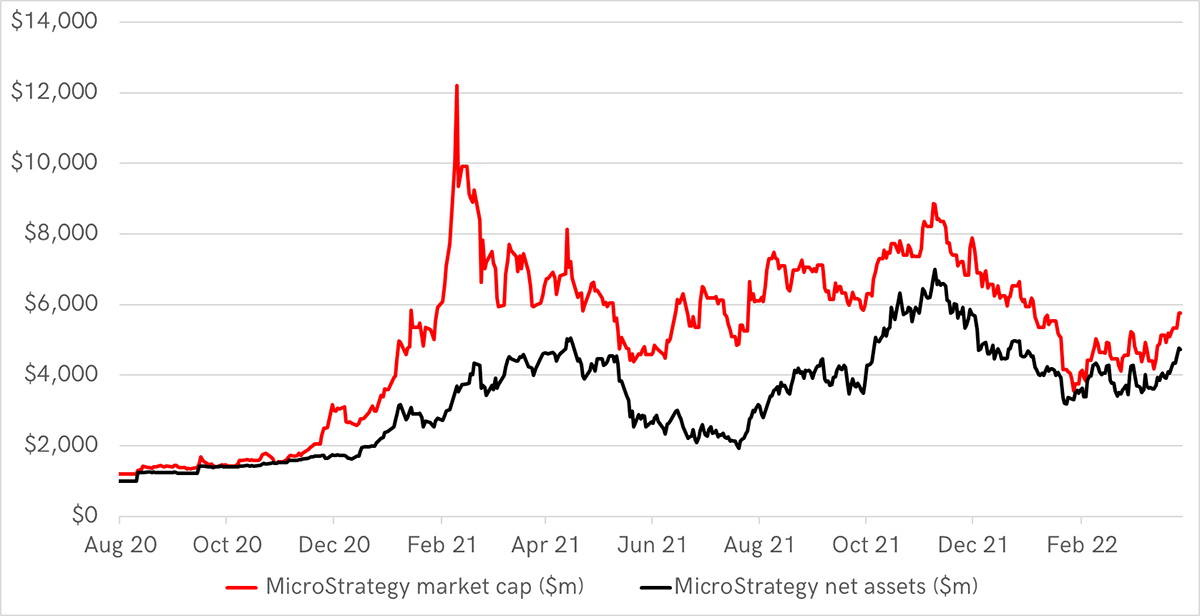

A great way to buy bitcoin is through MicroStrategy (MSTR). The CEO, Michael Saylor, is one of the great maximalists who now holds over 124,000 BTC on his balance sheet. The chart shows MSTR’s market cap, and its net asset value. I assume:

- 124,391 BTC held

- Software business is worth $1bn (this is higher than the enterprise value from 2017 to 2020)

- Debt of $2,200bn

- 11.285 million shares outstanding

Valuing MicroStrategy

Source: Bloomberg, ByteTree.

Last summer, I believed MSTR was a sell as it traded at a 150% premium to its tangible value. At the time, I was also bearish on bitcoin. Selling MSTR would be a double win. Bitcoin then started to rally off the sub $30k low, but MSTR shares less so.

The MicroStrategy premium exceeded 200% in February 2021 before easing back. It then rallied to 150% in the summer and has since dropped to 22%. If you believe the software business is worth $2bn, then there is no premium at all. Recall that with the leverage, you get 1.4x bitcoin’s upside on the rallies, so a small premium is deserved.

Source Bloomberg, ByteTree

The point is that if you are a fund manager, who would like some bitcoin but can’t, MSTR is finally looking like a good option.

Macro

The only thing that upsets me, and casts doubt on this rally, is the “everything bubble”. Oil and gold have cooled, while the Ruble has rallied. Whatever your politics, the risk of World War 3 has been postponed.

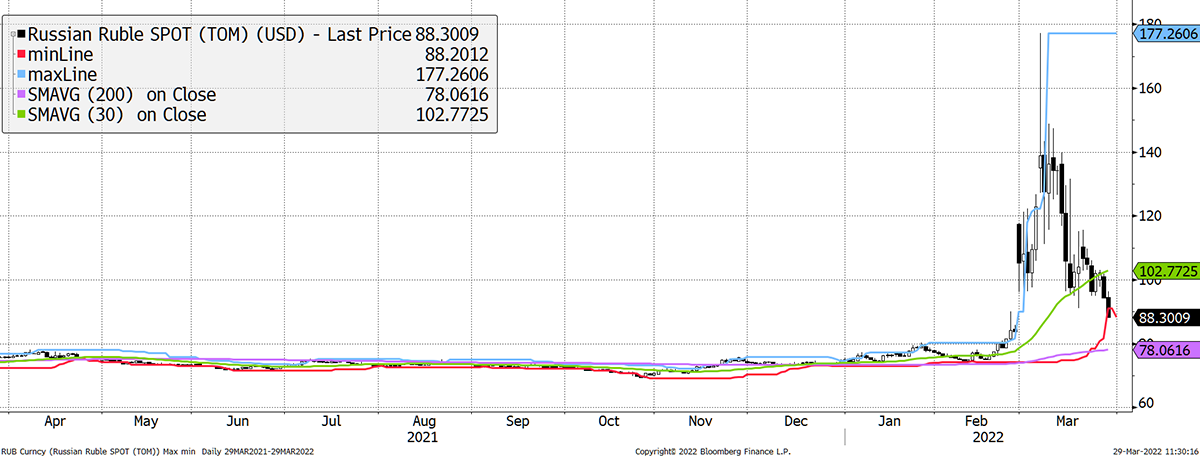

Remarkably, the Ruble trades at 88 to the USD, having touched 177. On the one hand, it tells us that sanctions have failed to cripple the Russian economy. On the other, that comes as a relief to financial markets because the risk of a market crisis has fallen.

The Ruble Recovers

Source: Bloomberg.

The evidence is clear that risk assets have rallied, with bitcoin alongside. If western leaders double down on sanctions, that could potentially prove to be painful for bitcoin. And everything else, of course.

It’s a risk.

In other news, bitcoin has done well despite a strong dollar. Just imagine how good it would be if the dollar cooled?

Dollar Index 5/5

Source: Bloomberg

Cryptonomy

- by Laura Johansson

Thinking back to what has happened globally and how the crypto space has evolved over the past couple of years is mind-blowing. Two years ago, the world came to realise the catastrophic impact that the pandemic would bring, and the markets responded accordingly. Then, just a year later, we saw Bitcoin’s 19th and 20th doublings. Now, here we are with war in Europe, with BlackRock CEO Larry Fink suggesting that being a catalyst for speeding up crypto adoption.

It was only in January 2021 that Fink expressed his fascination for Bitcoin but added that it has a very small market, huge volatility and remains untested. As evidenced by a shareholder letter published last week, it appears that he has at least partly changed his mind about the role of digital assets as he commentedon how the war would motivate countries to re-evaluate their currency dependencies.

In part, we have already seen this prediction come to fruition as both Ukraine and Russia have discovered the benefits of digital assets. In February, the Russian Ministry of Finance submitted a draft law to legalise crypto, which still remains an ongoing discussion. Meanwhile, Ukraine moved to legalise crypto after President Zelensky signed the law on virtual assets two weeks ago. The country has already amassed over $71.5 million in crypto donations from crowdfunding for the war effort. The Ukrainian Ministry of Digital Transformation is now launching an NFT collection covering the chronological events of the invasion. Titled “Meta History: Museum of War”, the collection aims to preserve the truthful history of real events while also collecting donations for the Ukrainian army and civilians.

Elsewhere in the world, there has been notable progress on crypto regulation this year. Two weeks ago, the European Parliament voted in favour of the Markets in Crypto Assets (MiCA) framework, while in the week before that, Biden issued an executive order on digital assets. Last Sunday, a CNBC article reported that British Finance Minister Rishi Sunak will announce a regulatory framework for crypto over the coming weeks. It is believed that stablecoins will have a prominent role, especially as the Bank of Englandis expected to begin consultations around “Britcoin” this year. At the request of Steve Baker MP, Charlie wrote a letter covering our thoughts on Britcoin, which was presented to Sunak and other ministers late last year. Read the letter here.

Some crucial developments in crypto have already happened this year, although the full impact of the war, as per Fink’s prediction, remains to be seen. But there is an undeniable wind of change, and it’s exciting to watch it unfold.

Summary

Things are looking up, and bitcoin deserves a higher status than it has. I only hope this rally is nice and gentle, with less volatility, as the fast ones end up eating themselves alive.