DeFiChain: Addressing the Problems TradFi and Fintech Couldn't Solve

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: DFI;

In a world where financial institutions dictate almost everything related to money, power is centralised in the hands of those who control it. This means that users are cut off from the decision-making while also being unable to prevent their decreasing purchasing power. Enter Decentralised Finance (DeFi), the new era of finance that puts the power back in the hands of the users. It's their money, after all. In this two-part series, we will analyse the role of DeFiChain.

Overview

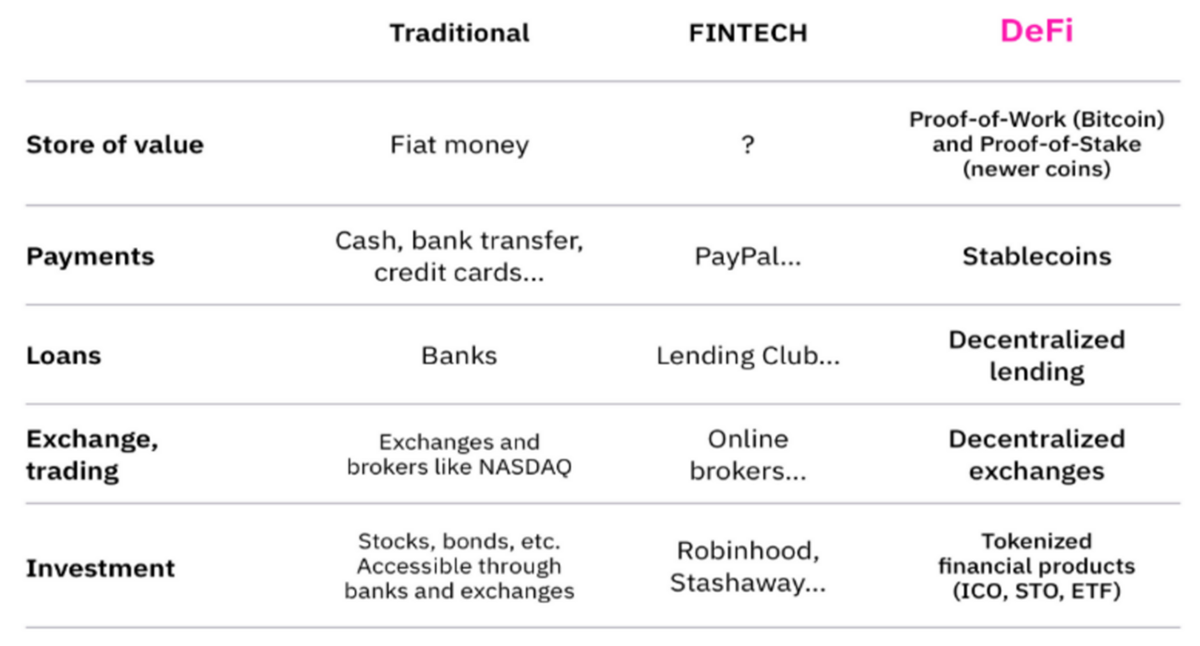

In principle, both centralised and decentralised finance have the same end goal; the difference is how they do it. In centralised finance, the asset classes and processes are managed by people or companies, while in DeFi, they’re managed by a set of smart protocols. The question is, would you trust a financial institution or code with your assets?

In a panic to uphold their economies, governments printed trillions of dollars during the COVID-19 pandemic, consequently diluting the buying power of citizens globally. Now, inflation is on the rise; 7.9% in the United States and 6.2% in the UK, highest in the past 40 and 30 years, respectively. Governments worldwide have made it very clear that they can print as much money as they like, regardless of the cost.

Fintech claimed to solve these problems, but it was unsuccessful and created new problems. Big players on Wall Street are in control of the markets, loan frauds have become common, the 2008 crisis, the Lehman Brothers’ fall, and the list goes on. At the end of the day, it’s the users who are drastically affected.

But that’s only for those lucky enough to have access to financial services in the first place. While bank accounts, loans and all other general financial services are common in Western countries, many in underdeveloped and developing countries have no financial access at all. Student loans, homeownership, insurance coverage, investing opportunities, and stable pay are all unfamiliar privileges to the unbanked. This is what DeFi is trying to address.

Understanding DeFiChain

DeFiChain is a blockchain platform supported by a distributed network of computers, with fast and transparent transactions accessible to anyone and anywhere. Specifically, DeFiChain was built to support financial services, such as borrowing, lending, investing, saving, and everything else that a commercial bank can do. The difference between DeFiChain and a banking network is that the former is decentralised, meaning that no single authority or entity can control the network.

To provide immediate security and immutability of the blockchain, DeFiChain anchors itself to the Bitcoin blockchain. Every few minutes, DeFiChain saves its most recent Merkle tree (hashing history) to the blockchain, similar to how Rootstock, a general-purpose smart contract platform, is secured by Bitcoin. In this fashion, the most recent chain is always fully secure and immutable and can be checked against the most recent record anchored to Bitcoin.

Additionally, DeFiChain keeps its own consensus mechanism and function set, enabling all those characteristics that Bitcoin does not inherently have. This is achieved by DeFiChain being a dedicated non-Turing-complete blockchain designed specifically for DeFi. DeFiChain provides full functionality for this specific DLT community segment, sacrificing other types of functionalities for simplicity, rapid throughput, and security.

Why Choose Bitcoin over Ethereum?

The sheer mass of dApps on Ethereum indirectly impacts other dApps on the network. The most obvious example was when CryptoKittiescongested Ethereum in 2017. Ethereum provides a Turing-complete command set for the development of multisig on-chain. However, the complexity of the code required for multisig makes it vulnerable. In 2017, more than 150,000 ETH was lost to a hack in the Parity multisig wallet, due to an error in the code.

According to data from DEFIYIELD, DeFi scams and hacks are reported to be over $3.8bn in total, where Ethereum contributes to over 30%. On 28th March 2022, DeFi saw its biggest hack to date, where $615.5m was stolen from Ronin, a blockchain project linked to the popular online game Axie Infinity.

Undoubtedly, security is a fundamental priority of any investor. After all, Bitcoin is the standard cryptocurrency, while the Bitcoin Core is the most robust and longest-running blockchain in the world. It has been operating with no disruptions since the genesis block in January 2009.

The DeFiChain Foundation’s outlook on Bitcoin is highly positive. Despite high market volatility, including instability in traditional financial markets and geopolitical issues, Bitcoin has retained its value and demonstrated resistance to attacks and hackers. Consequently, it has gained increasing respect from traditional financial investors.

Bitcoin is now accepted as a store of value and perceived as the standard by which other cryptocurrencies are measured. Furthermore, the tremendous community built around Bitcoin is a fundamental factor for long-term growth. While investment portfolios vary widely, almost every crypto investor will have a majority holding in Bitcoin.

For that reason, building decentralised financial services on Bitcoin represents a fantastic opportunity that has barely been tapped. However, Bitcoin comes with its own problems like scalability and supporting complex non-native smart contracts. Hence, DeFiChain keeps its own consensus mechanism and function set, allowing for all those characteristics that Bitcoin does not inherently have. Thus, building a DeFi Blockchain on top of Bitcoin would give the best of both worlds: Bitcoin’s security and immutability and DeFiChain’s scalability and functionality. An almost perfect relationship.

Tokenomics

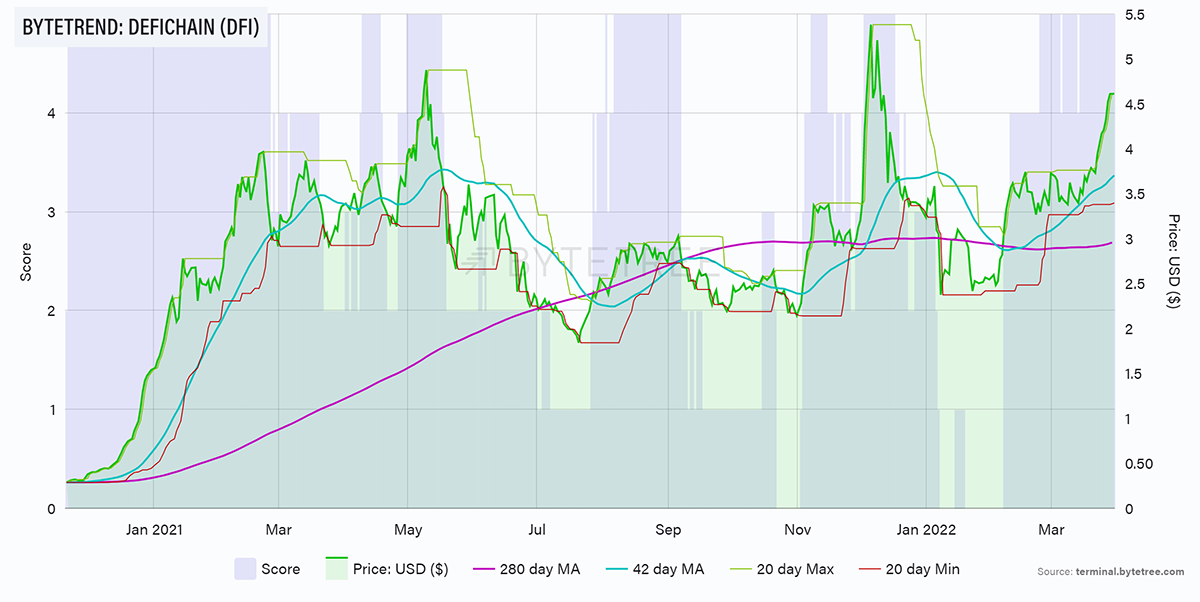

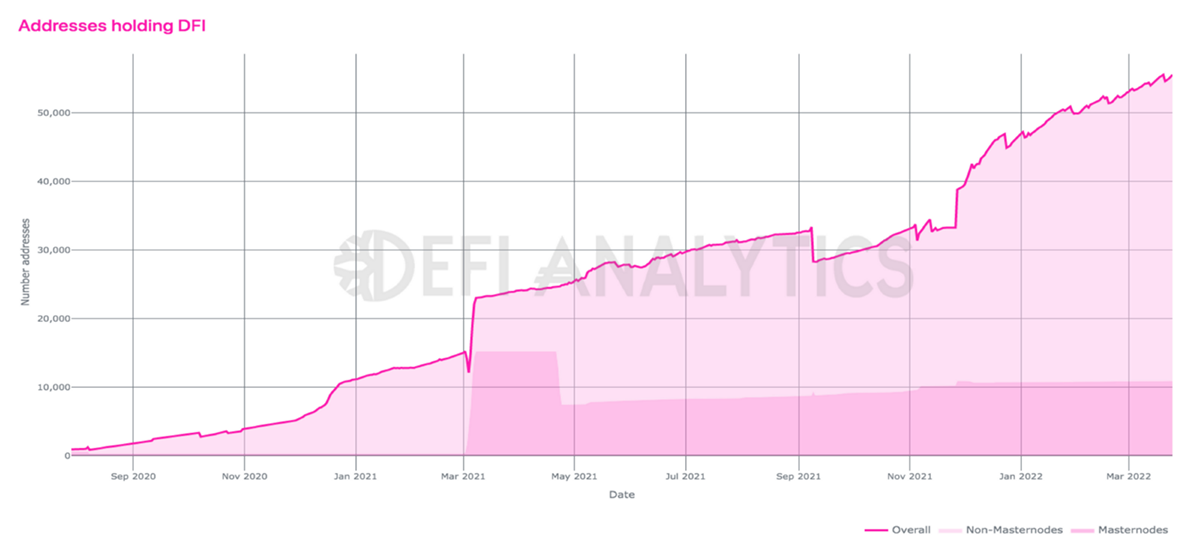

DFI is the native token of the DeFiChain blockchain and was first listed on LaToken in May 2020. After seeing substantial growth (45%) in the past month, DFI is priced at around $4.60, with a $2.3bn market cap. DFI has also been holding a 5/5 score on ByteTrend for quite some time, demonstrating a strong and relative price trend.

While DFI is capped at 1.2 billion tokens, it is divisible up to 8 decimal places. DeFiChain has a programmatic burn function whereby fees from transactions are burned automatically. To date, over 270m DFI have been burned.

DFI is used as fee payment for all transactions and smart contracts on DeFiChain, and governance/voting on improvement proposals. DFI is also used for the creation of new tokens on DeFiChain (DCT), where users can create new tokens for a fee of 100 DFI.

The current circulating DFI supply is around 507m. DFI can be staked for rewards on Cake DeFi, a DeFiChain partner that offers DeFi services and enables users to earn cash flow from their crypto assets for almost 35% APY. The yield is basically the issuance of the new coins. Once all the coins are minted, transaction fees will be used to reward stakers.

Founders and Funding

DeFiChain was founded by Julian Hosp and U-Zyn Chua. Julian Hosp is the Chairman of the DeFiChain Foundation and also the CEO and Co-Founder of Cake DeFi. U-Zyn Chua is the CTO and Co-founder of both DeFiChain and Cake DeFi and is the chief engineer of Zynesis, where he serves as a blockchain adviser to the Singapore Government. He also started one of the earliest Bitcoin exchanges in Asia in 2011.

Cake Defi is also a member of the Singapore Fintech Association and ACCESS (Association of Crypto Currency Enterprises and Start-ups Singapore).

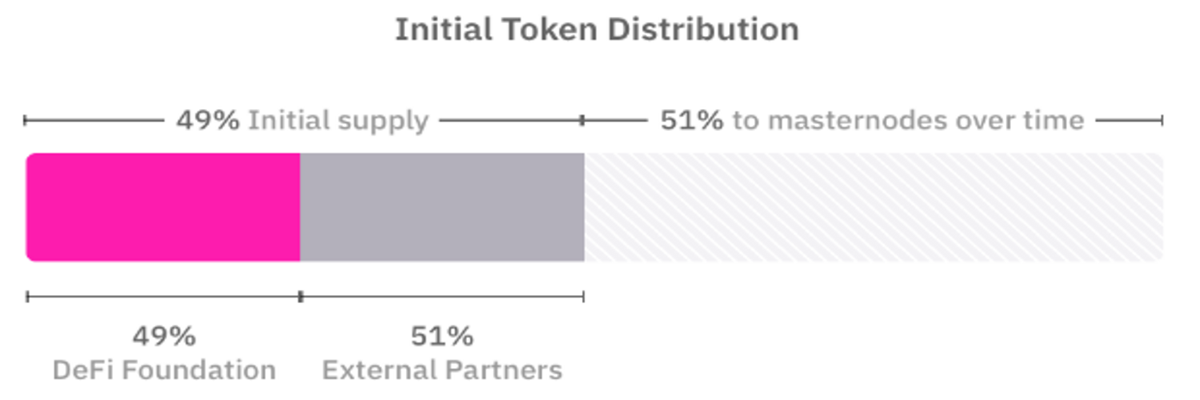

DeFiChain did not conduct any sales, nor did they participate in an ICO or IEO. Out of the roughly 1.2 billion DFI coins, 49% were issued to the DeFiChain Foundation at the start. Of the 49% initially issued $DFI coins, 49% will be kept by the DeFiChain Foundation. The rest were distributed to accredited investors, large funds and institutions, collectively known as external partners below, to fund the initial development of DeFiChain.

Conclusion

With the growth of the DeFi market, frauds and hacks have also seen an uptick. Because DeFiChain was built on Bitcoin, they can utilise its security while also making DFI favourable for investors. Considering their strong foundations, DFI’s out-performance of other cryptocurrencies in the last few weeks is rather unsurprising.

In the next part of this series, we will examine DeFiChain’s governance, recent developments, and comment on its future outlook.

Comments ()