DeFi-ing the Traditional Financial System

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: DeFi;

In this two-part series, we will evaluate the potential of the digital asset and blockchain industry to shape the future of the financial system. Sadly, this will be the last article series that Tom will publish on behalf of ByteTree.

The role of Finance in Recent History

Today, living without the all-encompassing grip of the financial sector seems impossible. Contrastingly, the pre-industrial financial sector was merely focused on developing a medium of exchange – a substantially smaller scope than the modern-day financial services industry, which alone contributed nearly 10%, or $165bnto the UK economy last year.

FinTech, the marriage between technology and finance, has been the biggest step forward for the global financial system in this century. The synergies created by this merger are a response to the 2008 credit crisis and the pursuit of trustless systems at the expense of trusting financial institutions.

For those who require more of an explanation, Philippe Gelis, CEO of Kantox, wrote one of the best descriptive statements I’ve found on FinTech:

“Fintech is changing the finance sector just like the Internet changed the written press and the music industries. In what is a stagnant sector monopolised by banks, finance is ripe for innovation and fintech is unquestionably the catalyst needed for change”

In literal terms, blockchain represents FinTech 3.5, whereby the birth of FinTech after the 2008 credit crisis marked 3.0. However, don’t misinterpret a .5 jump as not having the power to disrupt the traditional world as that couldn’t be further from the truth.

Traditional Banks Are Catching On

Before we move onto the more general future of the financial system, let’s focus on a sub-sector, banking, which is already trying to bridge the gap between the traditional and digital.

| Institution | No. of Investments | Total Value of Investments |

|---|---|---|

| Standard Chartered | 6 | $380 million |

| BNY Mellon | 5 | $321 million |

| Citibank | 14 | $279 million |

| UBS | 5 | $266 million |

| BNP Paribas | 9 | $236 million |

Source: Business Insider. Top Five Crypto investments via Big Banks, as of August 2021.

This cycle has seen a significant change in how banks view crypto. Years ago, rejection and claims of fraudulent/criminal activity plagued crypto in the eyes of banks. The adoption of FinTech 3.5 began when they realised the opportunity of custody, retail and institutional facing products, and the broader embracing of blockchain technology.

The Link Between Traditional and Digital

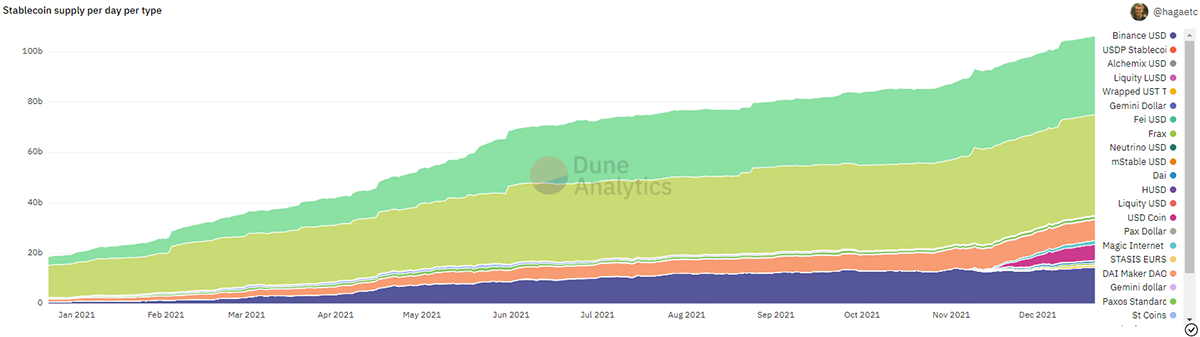

DeFi is, and will continue to be, intertwined with the existing financial system. That DeFi is not independent of TradFi is evidenced by the rate of adoption of stablecoins.

Stablecoins are a tokenised substitution of fiat currencies that can be both hard- and soft-pegged to fiat currency reserves. Typically, USD synthetics dominate the stablecoin sector within crypto. Stablecoins prove that the future of the financial world is not merely for the traditional and established; it is for the innovators unhinged from constraining regulation and old-timer misconceptions. One place that is currently free to develop and innovate is Decentralised Finance.

What is Decentralised Finance?

Decentralised Finance (DeFi) is widely considered the future of finance due to how accessible it is compared to its traditional counterparts. DeFi is a direct challenge to our current financial system, similar to how neo-banks (e.g., Monzo) have disrupted traditional banks like Barclays. DeFi is more than just a concept and already offers solutions to some of the inherent problems in the traditional financial infrastructure.

DeFi is a peer-to-peer system that acts outside the control of any centralised institution. The removal of any middleman provides DeFi users with added safety. This safety is compounded by the fact that DeFi’s trustless system is built using smart contracts, which are coded solutions for any complex transactions that traditionally appear behind a bank’s closed-door, such as a lending or borrowing instrument.

Is DeFi Fit to Replace the Current Financial System?

DeFi was born out of the failures of traditional finance and has chosen to standardise certain characteristics to fix previous financial system issues, such as the counterparty problems from 2007. The inclusion of smart contracts is accompanied by the inherent transparency that comes with a blockchain.

The Characteristics of DeFi

| Decentralisation | The democratisation of decision-making and reduction of dependency on centralised institutions. |

| Open Banking | The ability for anyone with an internet connection to gain access to financial instruments, across borders. |

| Tokenisation | Enabling real assets to be used across the digital financial system. |

| Permissionless | Users can participate without the need for an institution to authorise them. |

| Immutability | On-chain transactions are unable to be changed. |

| Non-custodial | Giving users sole control over their assets (i.e. private key); a feature that is not possible in the traditional world. |

| Disintermediation | The elimination of counterparties or middlemen, which has historically been problematic in traditional finance. |

| Distributed Ledger Technology (DLT) | Providing transparency and immutability to the digital financial system. |

| Programmability | The ability of smart contracts to be flexible enough to cater to a consumer’s specific needs, which is unheard of in the traditional world. |

| Interoperability | The ability for protocols and financial instruments to operate in conjunction with others. |

| Speedy | Due to blockchain technology, transactions are often settled in a matter of minutes. |

| Open Source | Enabling constant development within the digital financial system, contrary to the closed institutions in traditional finance. |

The key benefits of DeFi can be summarised as follows:

- Transparency is the ability of DeFi users to directly access and inspect the rules which govern the financial products they are interested in.

- Control, where DeFi reallocates financial control to its users/investors. The individual is given the power over their assets and is not compelled to trust anyone else except themselves.

- Accessibility in DeFi enables anyone with an internet connection to access digital finance, which is not possible with singular banks that often have closed systems. According to World Bankfigures from 2017, a staggering 1.7 billion people globally do not have access to a bank account.

Readers shouldn’t underestimate how much easier DeFi is to comprehend than a settlement layer like Bitcoin. While Bitcoin is primarily a unique technology, DeFi improves on an established but outdated system. This ease of understanding has contributed to its ever-increasing adoption rate.

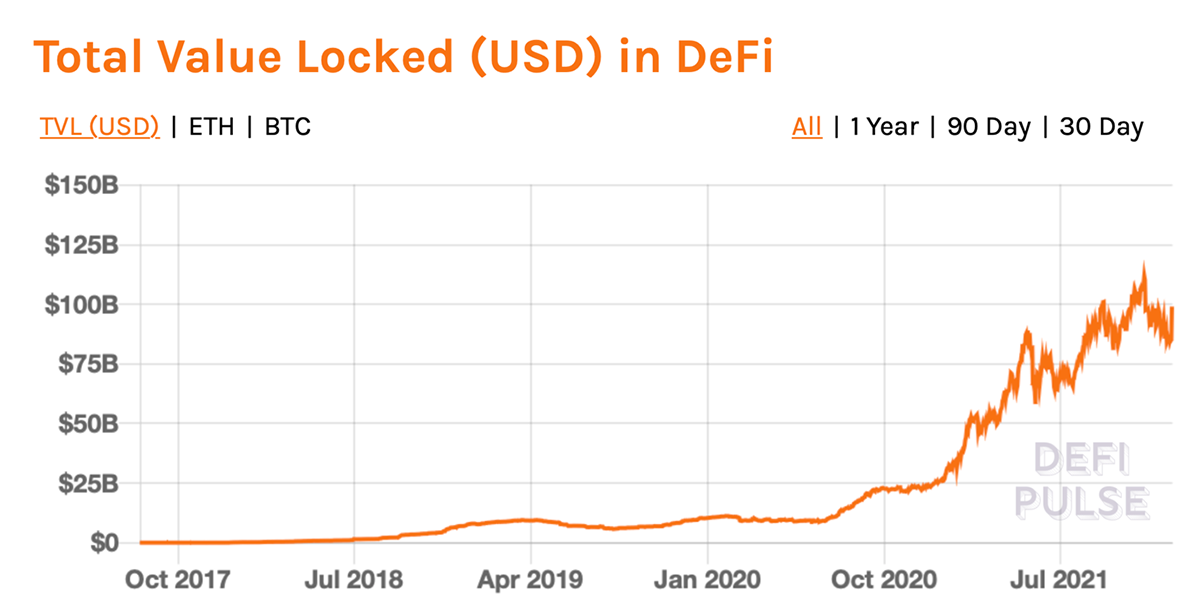

As we can see above, DeFi has experienced astonishing growth over the last few years. Sure, it is still minuscule in comparison to its traditional counterpart, but as we always say in crypto: “We are still early”. This much is true when referring to DeFi, and remember, centralised finance began in Mesopotamia around 6,000 years ago.

Conclusion

The view that DeFi is the future of finance is gaining traction. The events leading up to the advent of bitcoin, and subsequently the wider digital asset ecosystem, have introduced an ideological passion favouring intermediary-free networks. This comes at the expense of the established institutions that have a monopoly on control and access. Control, transparency, and accessibility are the fundamental key benefits of DeFi that seek to redress the limitations of the traditional financial system.

In part two, we will provide readers with a further comparison of DeFi with traditional finance, outline the regulatory risks, and finally share our predictions on how this digital phenomenon will shape the future of finance.