The Rise of NFTs: How Did We Get Here?

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: NFTs

It’s nearly a year since the non-fungible token space well and truly exploded. This article examines how the space has evolved and why its popularity has grown over the past year.

A brief history of NFTs

The potential for NFTs was first realised by Colored Coins 10 years ago. Building on the Bitcoin Network, the concept was to turn fungible bitcoins (or even satoshis) into unique assets by marking them as colored coins. While drawing upon the benefits of bitcoin blockchain technology, colored coins could store the metadata for practically any type of asset in a bitcoin. While the project eventually fell through, it set the groundwork for what we now perceive as NFTs.

Following Colored Coins, the Counterparty protocol was created in 2014, enabling smart contracts on the Bitcoin blockchain. In 2015-2016, notable NFTs issued on Counterparty included in-game currency, trading cards and Rare Pepe memes.

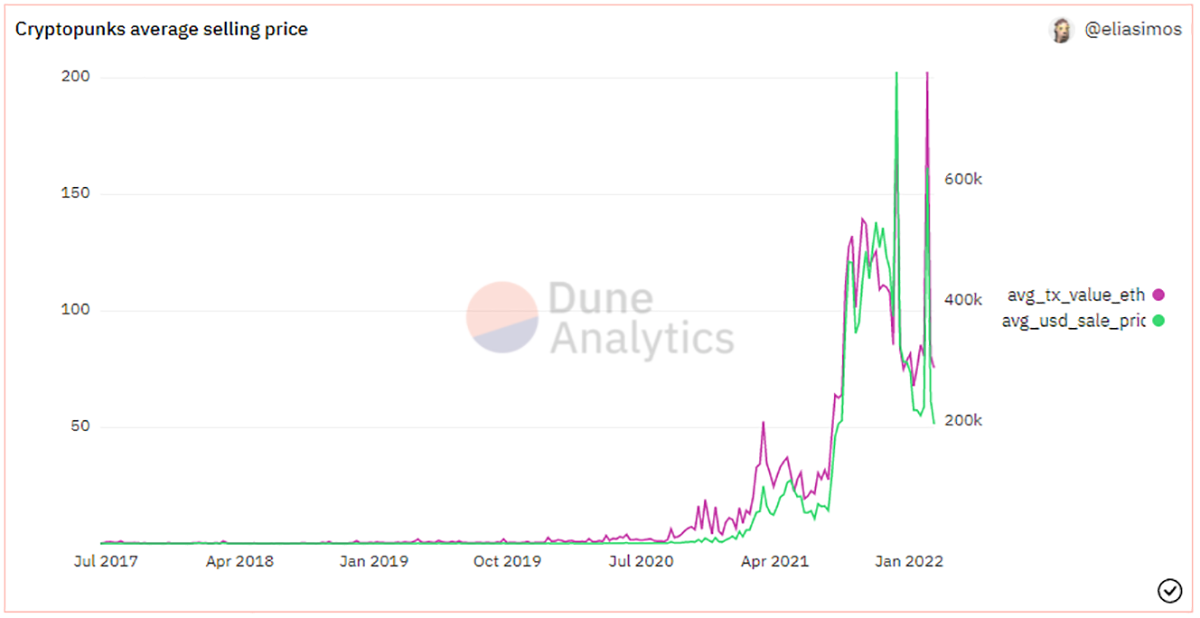

Then, NFTs started to migrate from Bitcoin to Ethereum as the latter grew in popularity. 2017 saw two of the most recognisable NFT projects launch on Ethereum: Cryptopunks (Larva Labs) and CryptoKitties (Dapper Labs). While Cryptopunks with its 10,000 unique characters is one of the earliest examples of collectable NFTs, CryptoKitties was one of the first blockchain games.

CryptoKitties was the first NFT project to go truly viral as the craze spiralled beyond what anyone could comprehend. With the explosion in demand fuelled by mainstream media coverage, the Ethereum Network became congested, highlighting its scalability problem. This still remains an issue today.

Gradually

In 2017 we really got our first taste of what was to come for the crypto space. With the Initial Coin Offering (ICO) boom, money started to flow into projects, and crypto suddenly appeared in the mainstream limelight. As Bitcoin and Ethereum observed new highs, we saw the rise of a new generation of crypto wealth. Since there weren’t many places within the crypto space that this money could go, some of it found its way to crypto collectables. When the market eventually turned bearish in early 2018, the excitement calmed down, but projects continued to work behind the scenes.

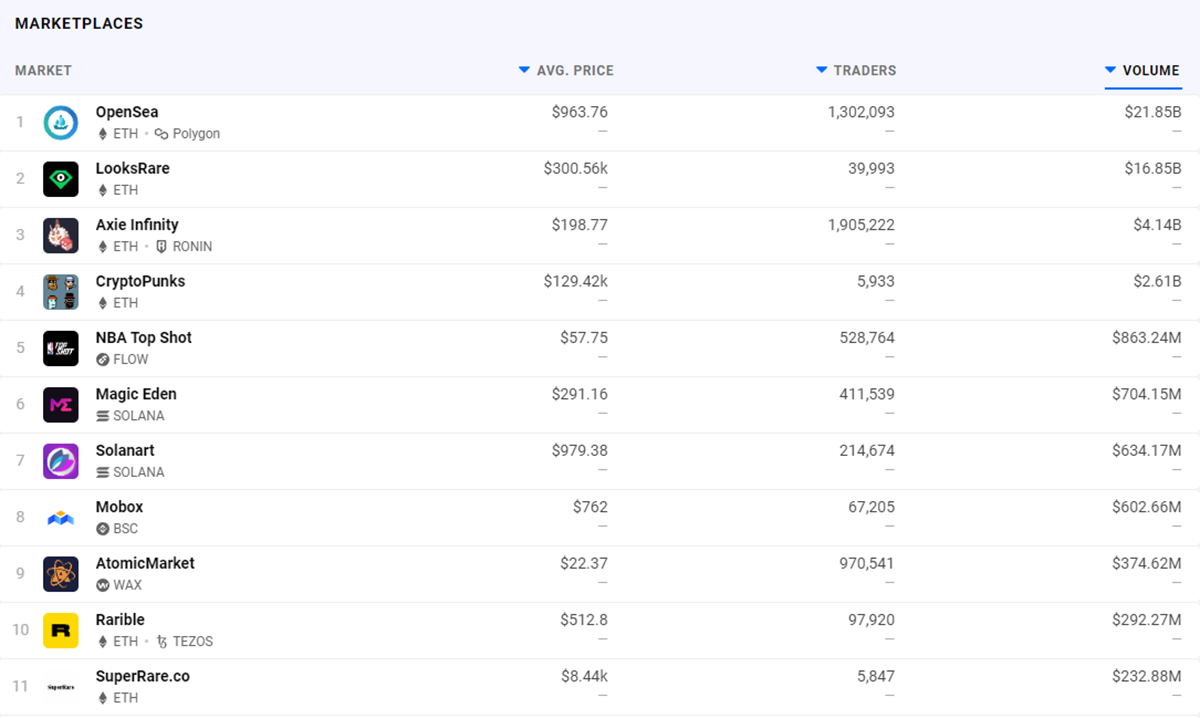

The unexpected success of CryptoKitties and CryptoPunks highlighted the need for something else: marketplaces. Devin Finzer and Alex Atallah could see a new digital asset market emerging and went on to join Discord channels to consult with early crypto adopters. In December 2017, OpenSea became the first open marketplace for Ethereum-based NFTs.

However, they were not the only ones who had noticed what was happening. John Crain, one of the founders of SuperRare, realised that NFTs could break a new frontier in the art world - not just for high-grossing artists but also for those who had yet to be discovered. While galleries were charging extortionate rates to display artwork, a digital marketplace would take a much smaller percentage of sales, lowering the entry barrier. The founders of SuperRare also took this a step further by coding in an additional percentage of artist profits for every time their art got resold. In the 21st century, who doesn’t enjoy a passive income?

The journey to success was slow at first. Crain began pitching the SuperRare platform to digital artists, and some took him up on his offer. In a New York Times article he recalled:

“Every person who joined was like super-excited, even if everyone else thought you were so crazy.”

But the sales remained low in value as the number of collectors were few. Before mid-2020, the NFT market remained relatively flat, trading at an average of $60k daily with 90% of the volume originating from Art (18%), Games (33%) and Metaverse (39%) categories.

Then suddenly

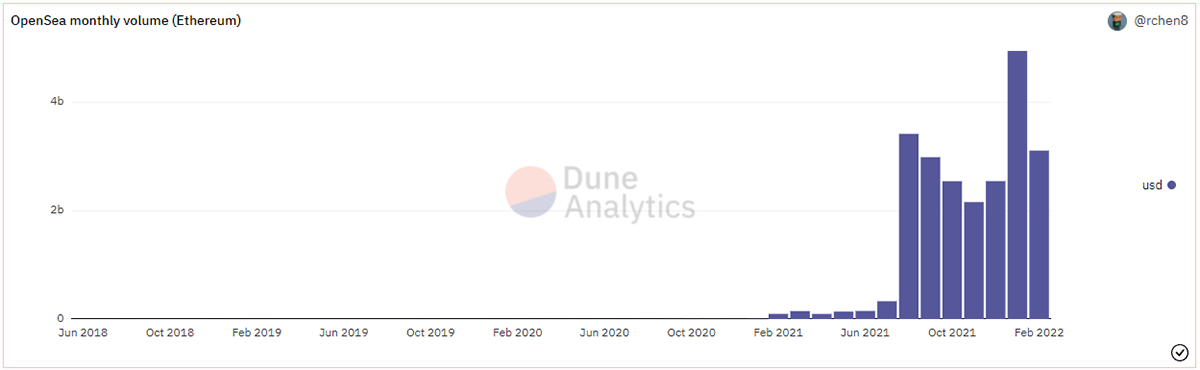

In July 2020, a few months into the global pandemic, we saw a surge in growth. By March 2021, the NFT market was trading at over $10 million on a daily basis, up by 150x from eight months prior.

According to an article from Matthieu Nadini et al., we did not just see explosive growth in value and demand, but also a shift in popular NFT categories. From a market volume perspective, the Art category dominated at 71%, followed by Collectibles at 12%. But if you look at the type of NFTs that were traded, Games and Collectibles accounted for 44% and 38% of the transactions, respectively, while Art attributed to only 10%. This was partly due to items categorised as Art would generally trade at higher prices, resulting in a lower number of total trades.

As more collectors entered the space, the secondary sales numbers went up exponentially. More importantly, while 66% of secondary sales were lower than primary sales in 2017, that number decreased to 27% in 2021. The original NFT collections like CryptoKitties and CryptoPunks benefitted hugely from this.

With the NFT market booming again, so came the rise of copycats. Bored Ape Yacht Club (BAYC), which copied the characteristics of CryptoPunks, entered in early 2021. The build-up to its success was largely due to targeting existing crypto communities on Twitter, but it was also a matter of the right timing. As the mainstream news picked up on the rise in NFTs, celebrities like Stephen Curry, Snoop Dogg, and Eminem caught on to the trend, and BAYC became their collection of choice. With only 10,000 versions in circulation, the scarcity formed an exclusive BAYC club that quickly became synonymous with the NFT revolution of 2021.

Developments

Although the most popular types of NFTs are images, we are seeing a rise in other applications. After Axie Infinity introduced the play-to-earn model, gaming is now set to be one of the next big frontiers. Ubisoft, a partner behind Axie Infinity, was one of the first major mainstream gaming companies to take an interest in blockchain technology. In late 2021, they launched the Ubisoft Quartz platform where users can buy and earn in-game playable items that have been tokenised as NFTs on Tezos. However, the beta testing revealed that pushing NFTs into a non-crypto audience was not an altogether popular move. Most of the criticism from users appears to stem from the environmental impact of crypto or views that NFTs are scams - opinions that I’ve personally seen reflected in my circle of friends. Still, it is very early days, and with time I believe the attitude will change towards a generally positive one.

Another development we’ve seen is the move away from minting NFTs on the Ethereum blockchain. The high fees, scalability issue, and environmental impact have prompted users to look for alternative blockchains. OpenSea, which supports minting on both Ethereum and Polygon, recently saw Polygon-based users exceed 1 million to Ethereum’s 1.2 million, thereby confirming that the appetite for alternative blockchains is growing.

Summary

In blockchain terms, the rise of NFTs has been a longer journey than many might think. The initial craze in 2017 set the building blocks for the boom in 2021. Although the NFT market continues to grow at a remarkable rate, it feels less frothy than last summer. However, it is still very early days, and with developments happening around the Metaverse and Web3, it will take some time before the market starts to mature. In the meantime, watch this space and the additional use cases outside of the art world that will power the next cycle.

Comments ()