Axie Infinity: Forget Pay-to-Play. It's now Play-to-Get-Paid

Disclaimer: Your capital is at risk. This is not investment advice.

The Role of NFTs in Online Games;

Non-fungible tokens (NFTs) are a hot topic at the moment. They are digital tokens that are provably unique and, as we will discuss, can generate real value for people living and working in developing countries. While the current booming market may scare off value investors who have access to developed markets, NFTs have a unique role to play for a global audience without access to traditional investment products.

For crypto maximalists, it is in our nature to worry about the reasons behind this NFT hype. The 2017 initial coin offering boom, known as ICOs, proved that the line between utility and hype is often blurred in the digital economy. This article aims to guide investors through the benefits of finding the “real” opportunities within the digital asset market’s latest craze.

The NFT Art and Collectables Mania

At ByteTree, we believe that valuable features such as immutable ownership, provable scarcity and unparalleled ownership rights can bring real value to NFT tokens. However, the current market condition suggests that some NFT sectors are in danger of moving away from their fundamentals towards a speculator’s game, often at a high cost to the uninitiated investor.

The art and collectable sectors are the biggest contributors to this mania; perhaps Beeple’s “Everydays: The First 5000 days”Christie’s sale for $69m was the start of this euphoria.

The NFT gaming sector has really stood apart for current manic conditions by providing developing countries with a “global wage”, meaning a wage that does not consider their location. This is hugely beneficial to many countries who are experienced damaging macro conditions, as it enables exposure to currencies that are unaffected by hyperinflation.

A Macro-View: NFTs Can Provide Global Utility

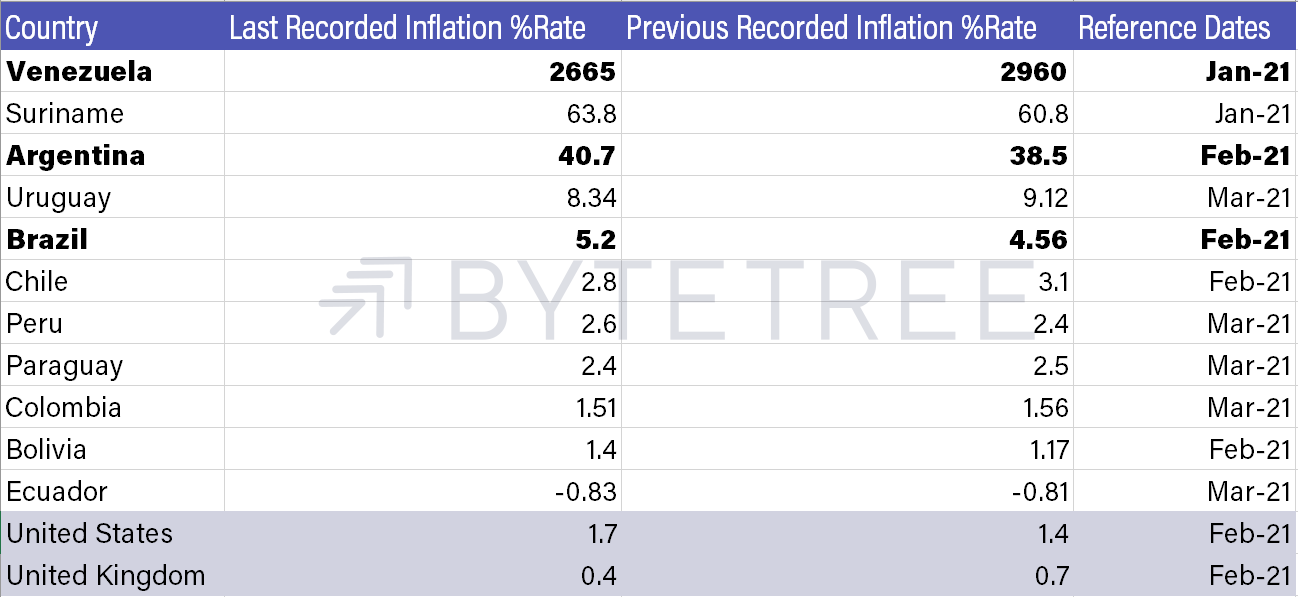

The global pandemic has accelerated currency debasement across certain countries within developing markets, notably Venezuela, Argentina, and Brazil.

Digital assets have provided economies in developing countries with added value that is unattainable through local means. This is partly due to the borderless nature of digital assets, enabling users to transfer funds globally without the problems that can occur via traditional means.

According to Katharina Buchholz in a recent survey;

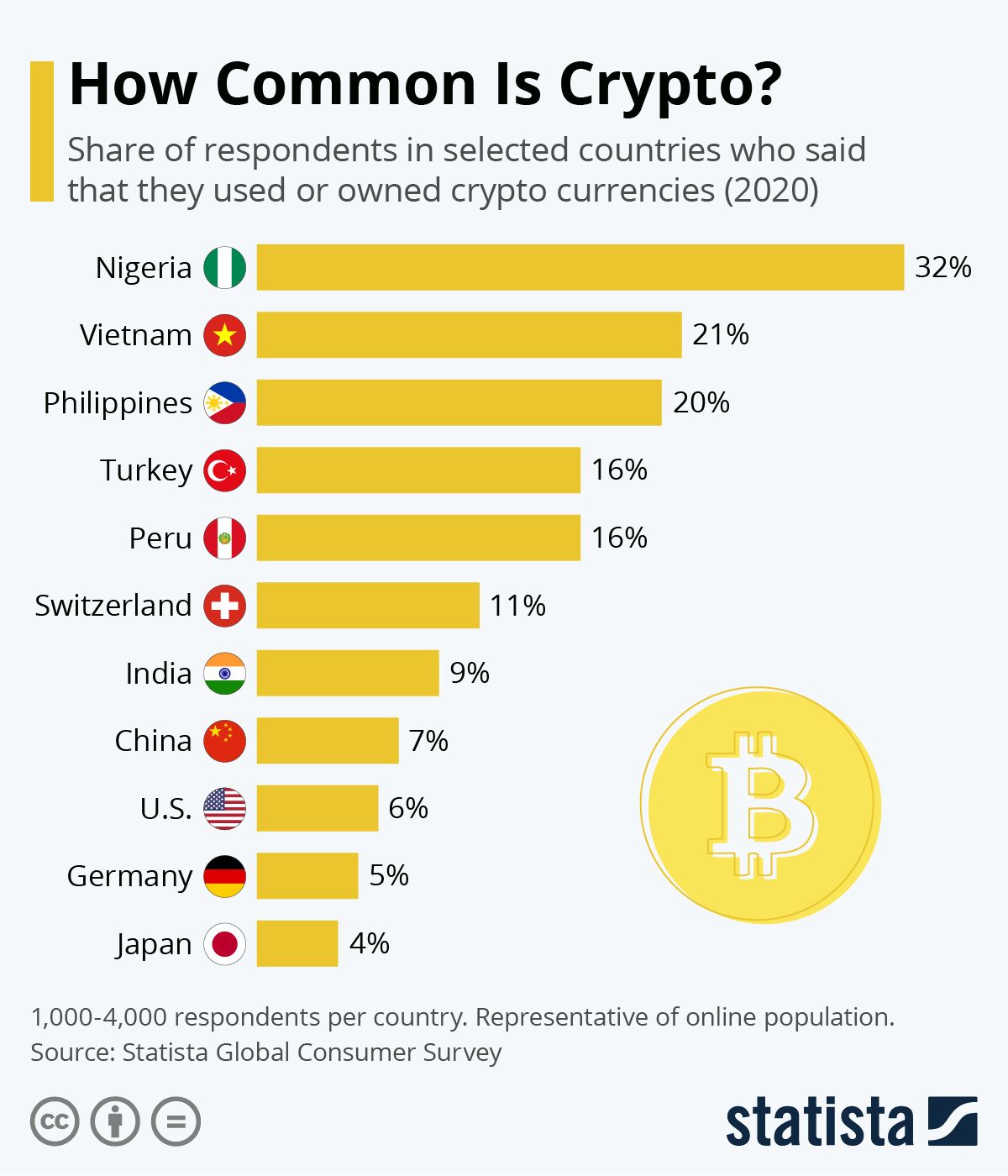

“Out of 74 countries in the Statista Global Consumer Survey, Nigerians were the most likely to say they used or owned cryptocurrency.”

The chart above highlights how popular digital assets are in countries struggling with macro conditions. For example, the Turkish Lira has recently collapsed due to governmental instability, which added a 15% drop in relation to the US dollar, adding to a 35% drop over the last four years. The result of this has been a significant uptick in Turkish digital asset popularity, according to Decrypt.

Nigeria’s enthusiasm for Bitcoin is mainly attributable to the high costs of conventional overseas and cross-border payments. Bitcoin, which can seamlessly transfer across borders for no additional fees, dramatically reduces this cost, making it significantly more popular. This practical aspect of Bitcoin has resulted in a 36% premium for it in Nigeria.

A premium typically indicates that continued demand for an asset outweighs the supply available at any given time. In Nigeria’s case, this was due to its Central Bank “banning all regulated financial institutions from producing service to cryptocurrency exchanges”. Perhaps trying to ban digital assets makes them stronger.

A Less Conventional side of digital assets: Axie Infinity, Venezuela, and The Philippines

Less conventional uses of digital assets are now finding a place within developing economies. One such example is the online gaming sector, where players can generate income by buying, training, and subsequently selling in-game NFTs. One such game that is writing the handbook on “the future of work” is Axie Infinity.

Axie Infinity, an adult version of Tamagotchi, is a decentralised game built on the Ethereum Network. There are several in-game based currencies/collectables, most notably, Axies. These are in-game creatures that can be used to earn digital rewards, which can then be traded on Axie’s primary marketplace and highly liquid decentralised exchanges (secondary market).

The Axie Infinity platform has experienced exponential growth over the past year due to its first-mover advantage and a wide range of investment opportunities for its users; collectables, rewards, and trading strategies.

How Can Axie Infinity Help in the “Real-World”?

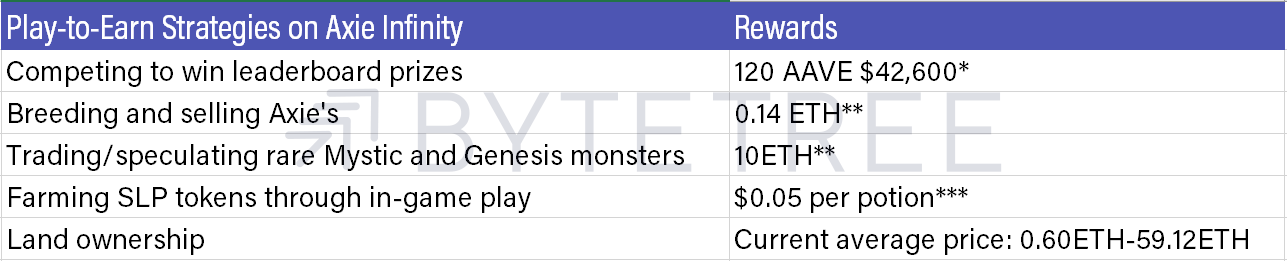

The Axie Infinity ecosystem is marketed as a “play-to-earn” platform. This is a new concept in the conventional gaming world, as most traditional games have a “pay-to-win” model. Meaning, gamers spend capital on a game to perform better, but in this case, they are “paid-to-play” the game.

When a digital game pays users with in-game items that can be sold for ETH, it gives players access to a “global wage” that does not directly expose them to the inflationary pressures of being paid in a local currency. They can then exchange ETH for a USD stablecoin and gain access to a more stable medium of exchange. Peer-to-peer services like LocalBitcoin are then used to actualise these returns, converting ETH into dollars or local currency.

Venezuela

Axie Infinity recently made the news for helping Venezuelan’s support their finances. According to The Lunacian, a typical Venezuelan public employee earns just $10 a month. With a small initial investment needed to play the game (three Axie monsters), Venezuelan users could expect to either supplement a significant portion of their monthly wage or, depending on their investments, could see exponential growth in their digital asset holdings through the platform.

The Philippines

Coindesk published a brilliant article titled “The NFT Game That Makes Cents for Filipinos During COVID”, which looks into stories from people who, in some cases, were earning over $200 per week playing the Axie Infinity game. Ijon Intoon was one of these people, and he commented:

“It’s food on the table, it’s money for their families and it’s saving them when they cannot even leave the house.”

This is a significant point when looking at the utility value that Axie Infinity can bring to people globally. These earning figures might not seem significant for the vast majority in the US and the UK. Still, this protocol can offer a partial lifeline to struggling populations in impoverished areas or harsh macro conditions.

How Can busy Investors Benefit from Axie Infinity’s Utility?

As illustrated in the case study above, the utility of Axie is unparalleled, and this generates a significant amount of value for its users. However, some investors do not have the time or perhaps interest to play the Axie game. For the more discerning investor, Axie Infinity has a governance token that is a perfect alternative to benefit from the platform’s utility.

An Axie Infinity Shard token, or AXS, is an ERC-20 governance token that grants holders the right to decide on the Axie protocol’s future and its ever-growing treasury.

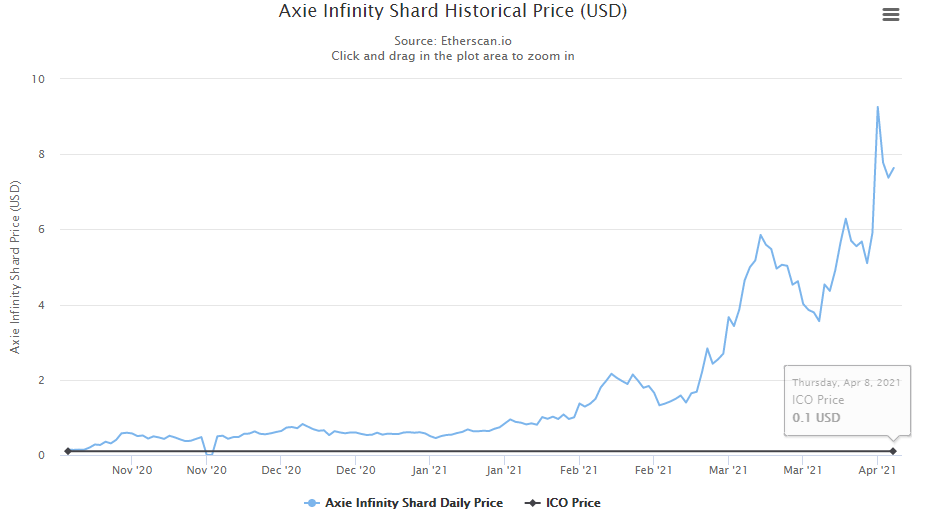

The token has a network value of $400 million and a current 24hr trading volume of $84 million according to CoinGecko. The demand for the platform, stemming from increasingly unstable macro conditions globally, has pushed a 6000% increase in its token price since November 2020.

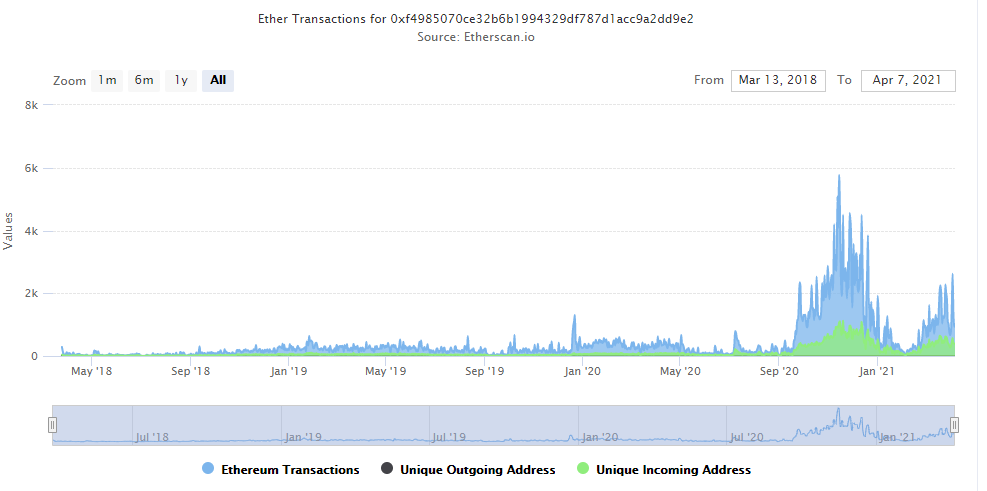

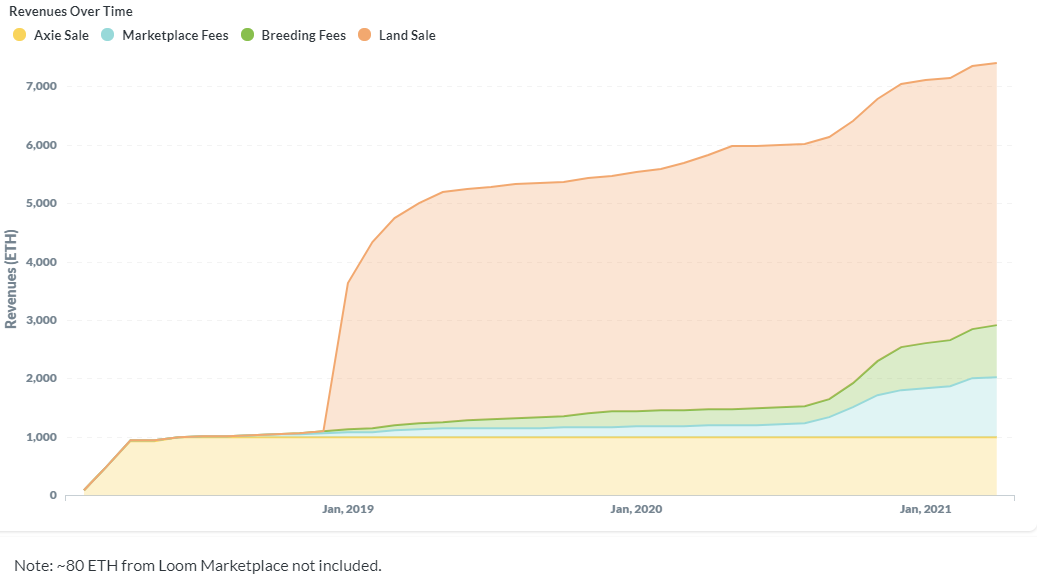

The chart above shows the fees generated from platform transactions that contribute to the protocol’s earnings. In future updates, AXS token holders will be able to govern the allocation of these revenues through voting on the use of the Axie Infinity treasury. If the protocol continues to grow, we will likely see fees increase and, consequently, the treasury. Token holders will significantly benefit from the continuously growing Axie Infinity network.

A positive aspect of using governance tokens is that active participants can choose to benefit the collective, i.e. all token holders and users). The whitepaper touches upon this point here;

“As the AXS yield is reduced the stakers can, through governance, vote in additional rewards from the DAO reserve pool”

For the less discerning reader, a “DAO” is a decentralised autonomous organisation, which gives token holders an input into the future of the protocol. This strong tie between participation and reward is a central concept of the network effect, creating an active and engaged group of token holders that can contribute to advancing the protocol.

Conclusion

The NFT gaming sector’s utility on a global scale significantly increases its value proposition to investors. Sure, you may not benefit directly from playing the game, but one should not underestimate the power of a truly global market. Games like Axie Infinity will continue to become more popular due to the increasing necessity to supplement wages for emerging markets.

While it is difficult to see the utility generated by most of the NFT sector, one thing should be clear; the leading gaming sector NFTs provide a lot. The number one question we receive on the digital asset space is, “Surely I am too late to join now”. The answer when looking at well-funded and real value-generating protocols should be; we are still very early.