Signs of Spring

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 34

Bitcoin has taken a bout of miner selling in its stride, an encouraging sign in a macro environment that should be bullish, contrary to the popular risk-off narrative. ByteTrend, meanwhile, might be starting to tell us something about the areas of future crypto growth.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | What relative strength on ByteTrend is telling us |

| On-chain | Miner sales are getting absorbed |

| Investment Flows | No change. Stable in BTC, outflows in ETH |

| Macro | Ruffer webinar, liquidity conditions good for bitcoin |

| Crypto | A reminder of the risks |

Technical

We’re delighted that so many of our subscribers have told us how much they appreciate ByteTrend. As a means of filtering the crypto world, it’s saving investors a huge amount of time. Despite the miserable few weeks we’ve had, this is a good time to be watching closely. Outperformance in a tough bear market is useful information, and those achieving it merit investigation. Price action is sorting the sheep from the goats.

The recent carnage in crypto means that the vast majority of coins and tokens reside on a ByteTrend score of 0/5. While ByteTrend identifies trends (as opposed to levels), there is one thing to say when a score is zero: it can’t get worse. Of course, prices can continue to decline, but a change in direction has a message. When everyone is bearish, it’s a good time to be sharpening your pencils. As and when scores start to move off the floor, you’ll be in a good position to act.

Of the 100 or so tokens that we track, only 10 have a score of 3 or above (click on “Score” to sort). Note that they are all quite small (<US$10bn market cap) and relatively unheard of. The three largest by market cap (Cosmos, Near and Fantom) are better known in crypto-land, but Ecomi, Lukso, Content Value Network, Leo Token and Deapcoin - the only ones with scores of 4 and above - will be a mystery to most.

Do they share anything in common? Clicking on the “info” button, we can find a description for each. Except for Leo Token, it appears that they are all built to serve the world of digital entertainment, particularly gaming, social media, music and video. Perhaps this is telling us something about the utility phase of decentralised networks. This is not a recommendation, more a pointer as to where the next phase of growth may be coming from.

Meanwhile, Bitcoin remains on a zero score and Ethereum on 1/5. Bitcoin needs to do a lot of work to re-establish a bull trend. It needs to reach around US$43,400 before the ByteTrend lights start coming back on. Until then, we must be conscious that rallies may be short-term relief only. The level for Ethereum, on the same basis, is around US$3,400.

On-chain

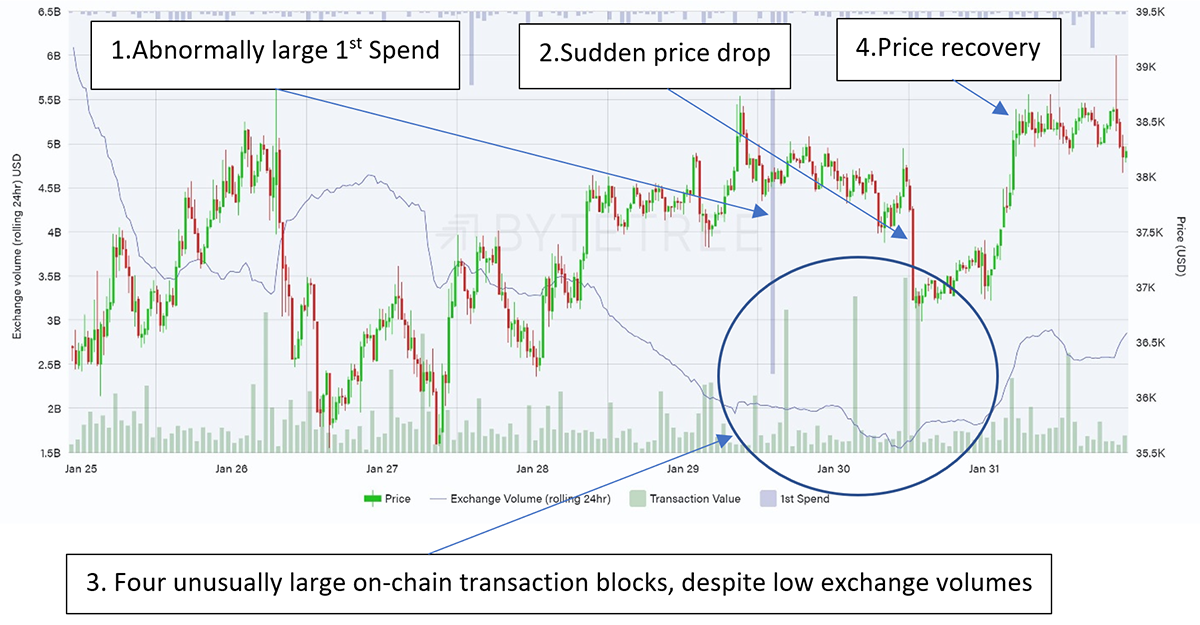

We saw a large miner sale over the weekend, with around 2,000 previously unspent coins (worth ~US$76m) sold into the market. The usual daily “First Spend” is closer to 500-550 coins. As often happens, the market lurches lower after a surge like this, and this time was no different. This is shown by the “Reference” chart on the ByteTree Terminal (below).

Interestingly, in this episode, four substantial blocks (LHS) were transacted in the immediate aftermath, at a time when exchange volumes were extremely low. It suggests that there is a substantial appetite for inventory when it becomes available. To see this amount of supply easily absorbed, and for the price to subsequently bounce, is a cause for quiet optimism.

Source: ByteTree. Bitcoin reference chart since 25 January.

By the way, the recent uptick in selling by the miners has turned on the Miner’s Rolling Inventory (MRI) signal in the Network Demand Model. This was last on in May 2021 when the bitcoin price was US$54,000. With short-term transactions also turning back on, the modelmoves from 0/6 to 2/6 this week. Still not a bull, but an improvement nonetheless.

Macro

Last week we were delighted to host Duncan MacInnes of Ruffer in the second of our monthly Bitcoin & Gold in 2022 webinars, a recording of which can be found here. Duncan is in the unique position of being the fund manager of a well-known UK institution that has bought (and sold) bitcoin for a publicly listed company.

While cautious about the current trading environment, particularly the regulatory backdrop and what he sees as frothiness in the crypto ecosystem, we were left in little doubt as to his view that bitcoin and crypto are here to stay. Like Ray Dalio of Bridgewater, he sees bitcoin ownership as “an option on a future store of value”. When asked whether he’d prefer to own Microsoft or bitcoin on a 10-year view, the answer was unequivocally bitcoin.

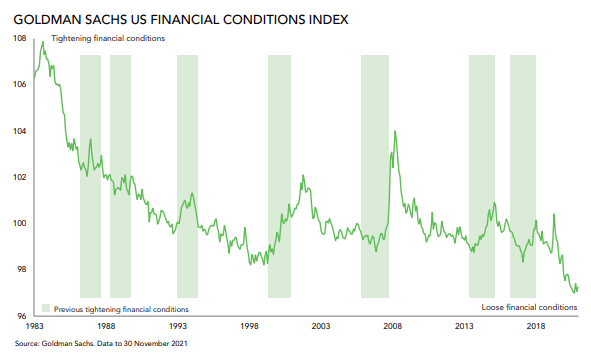

We talked in some detail about inflation and the market’s inability to price it properly. This, of course, is going to be the test for bitcoin as a long-term store of value. The following slide, which comes from the Ruffer Investment Capital annual report, shows just how loose financial conditions are at the moment.

Source: Ruffer Investment Capital. Goldman Sachs US Financial Conditions Index.

Taken in conjunction with Russell Napier’s comments about the growth of US bank lending in the previous webinar, and the impact that has on money supply (2-month annualised loan growth is now running at 13%), this bodes incredibly well for liquidity, certainly in the first half of the year. The US economy is running red hot.

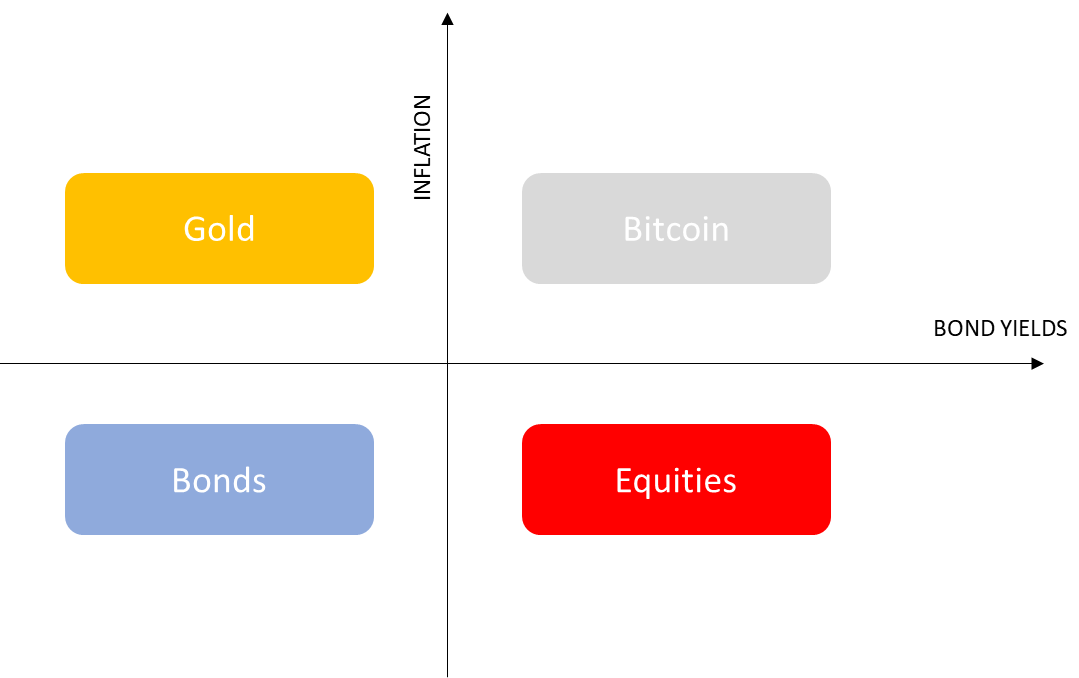

Contrary to widespread fears about the tightening cycle, this should be a strong backdrop for bitcoin. It might be that the Fed acts swiftly and brutally to contain the situation, but they are a long way behind the curve (in Napier’s view the Fed is largely irrelevant anyway, a stance which Duncan was more reserved about).

Nonetheless, we are in an inflationary growth period. This is the ideal backdrop for bitcoin to perform, as shown on the ByteTree money map.

Source: ByteTree. The Money Map.

Investment Flows

The decline in bitcoin held by funds that we saw from mid-December has been halted. Since the 11th of January, fund holdings have gently appreciated. The bleeding has stopped.

Source: ByteTree. Bitcoin held by funds over the past three months.

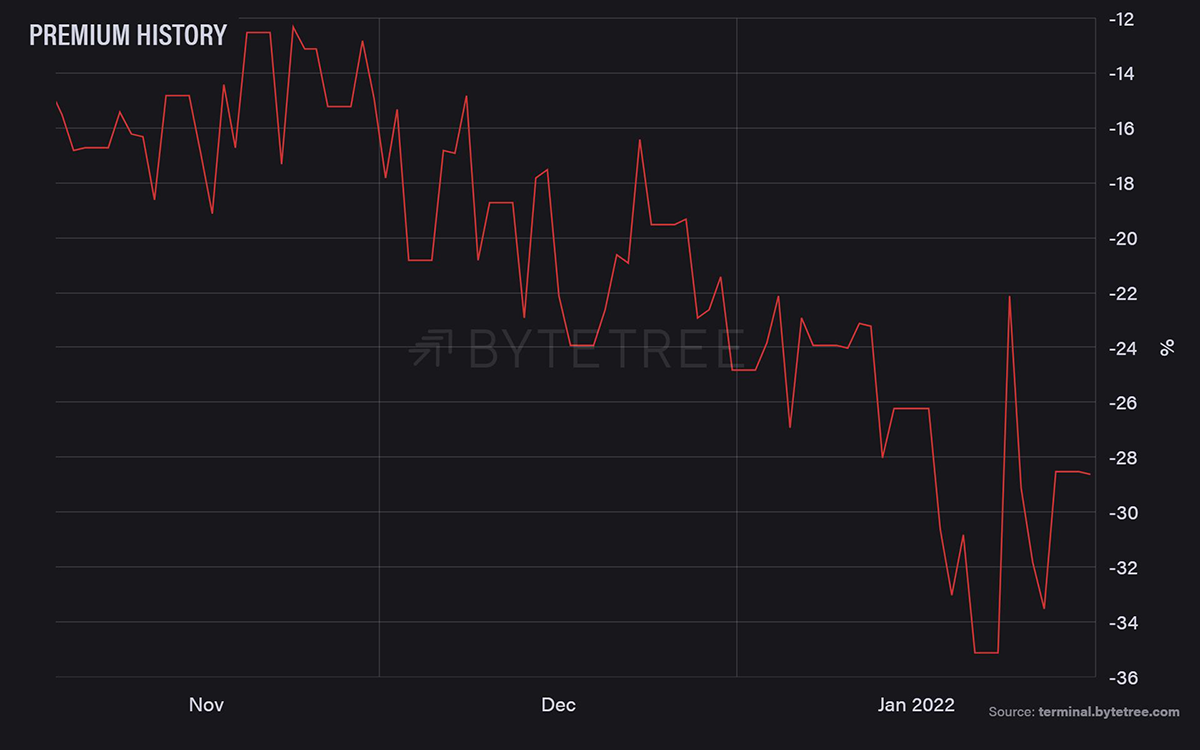

The Grayscale discount remains huge at 28.5%, but it’s off the bottom. It’s hard to see it getting materially worse and a good contrarian indicator of widespread institutional bearishness.

Source: ByteTree. GBTC Premium history over the past three months.

More interesting is that Ethereum fund flows continue to be negative, perhaps on concerns about regulation. With the price of ETH today having bounced sharply from a low of US$2,400 to US$2,770, it begs the question of what happens when the funds do start buying again.

Source: ByteTree. ETH held by funds and price over the six months.

The Cryptonomy

The Cryptonomy has started February relatively positively. While there isn’t much to report on industry-wide ByteTrend moves just yet, Bitcoin’s price action has inched higher somewhat, and as a result, so have the prices of other digital assets.

With that said, concerns have been raised recently about the recent outperformer, Terra (LUNA), and its native stablecoin, UST. Long story short, it was revealed that the founder of the ‘Abracadabra’ protocol – a DeFi lending platform – has close ties with Daniele Sesta, founder of a previously corrupt, controversial exchange called Quadriga. Abracadabra itself creates a lot of demand for UST, due to its link to the Anchor protocol – a yield-generating savings application built on Terra. Put simply, users can collateralise borrowed UST by over-leveraging to make up to 100% APY on Abracadabra. When the news about Daniele came out, the demand for UST fell, and so did the price of LUNA. Encouragingly, even in the face of market contagion and a sell-off, UST maintained its peg. Discouragingly, this indicated the wild west nature of crypto currently: unregulated and risky. It also shows that this is not a sustainable method of creating demand long-term for UST.

Overall, the last week has also shown some inter-sector dispersion among digital assets. Layer-1 and DeFi tokens have been the worst performers, whereas NFT/Metaverse tokens, such as MANA and NFTX, have outperformed the market. Nevertheless, things can change quickly in crypto, and if the current chop continues, we could see a reversal of this trend.

Summary

There are small signs that Spring is in the air. Liquidity is abundant, and miner selling is being comfortably absorbed. But we’re not out of the woods yet and we’ve had a salutary reminder of the riskiness of the altcoin space. This is a time for careful asset selection and cautious optimism.

Comments ()