Hindenburg

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 25

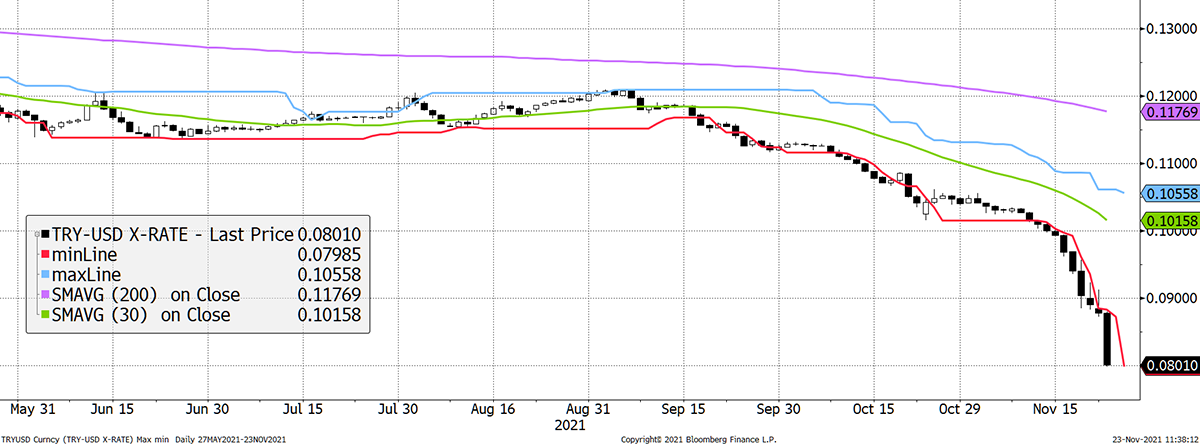

Last week I mentioned the dollar bull market, its impact on Turkey, South Africa and even the Euro. It’s now playing out, and the Lira has already devalued 34% since the summer.

Highlights

| Technicals | BTC falls to a 2, ETH to a 3 |

| On-chain | Softening |

| Macro | Hindenburg Omen |

| Investment Flows | Moderately bullish |

| Crypto | Ether College - part 3 |

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto

What does a bull and bear signal mean? A bull is a high conviction view that this asset is headed materially higher. A bear is a high conviction view that this asset is headed materially lower. With Bitcoin, that would mean $80k or more for bullish and sub $30k for bear.

Neutral therefore means the view is that the price stays within the 2021 price range.

Technical

This past week has seen both BTC and ETH weaken with ByteTrend scores of 2 and 3, respectively.

BTC ByteTrend score 2/5

Source: Bloomberg. Bitcoin with 20-day max and min lines, 30-day and 200-day moving averages past six months.

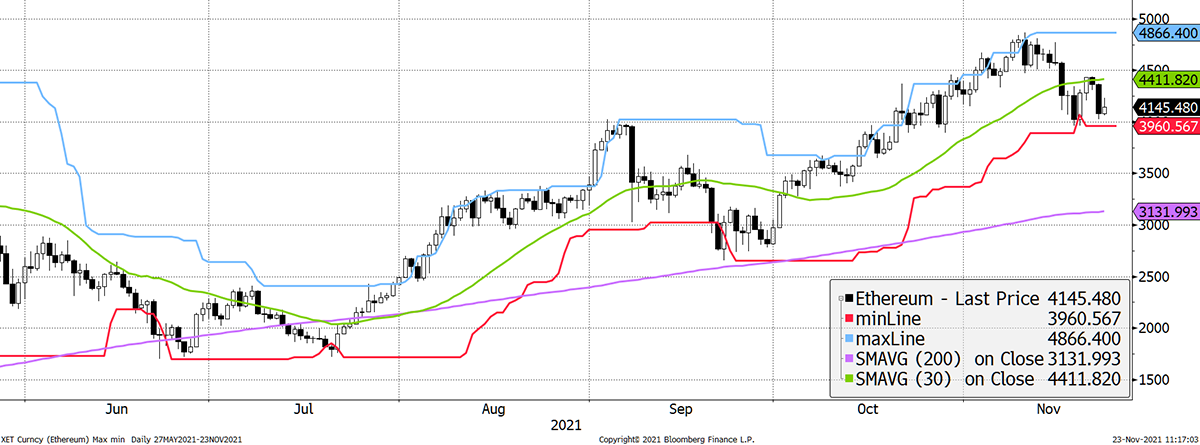

ETH ByteTrend score 3/5

Source: Bloomberg. Ethereum with 20-day max and min lines, 30-day and 200-day moving averages past six months.

Despite the noise surrounding ETH killers, the ETH price remains in a firm uptrend against BTC.

ETH (priced in BTC) score 5/5

Source: Bloomberg. ETH in BTC with 20-day max and min lines, 30-day and 200-day moving averages past six months.

On-chain

On-chain stories are fading in the sense that everything is working, Taproot has been successfully implemented, and the miners are back to equilibrium. With traffic fairly stable, that there is nothing to report is a good thing.

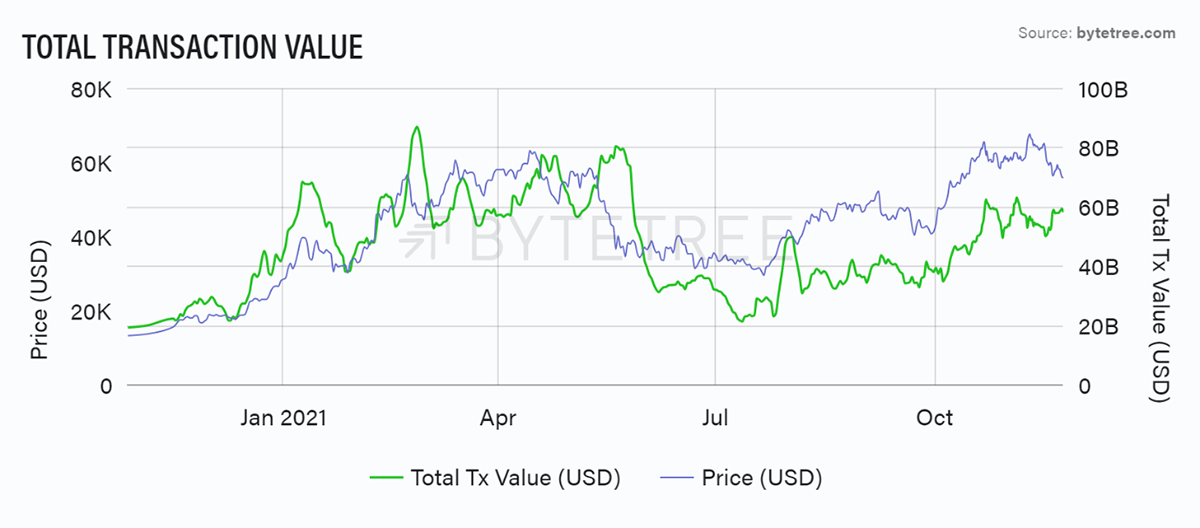

However, it remains the case that prices are elevated relative to network traffic.

Source: ByteTree. Bitcoin total transaction value (USD) and price (USD).

Investment flows

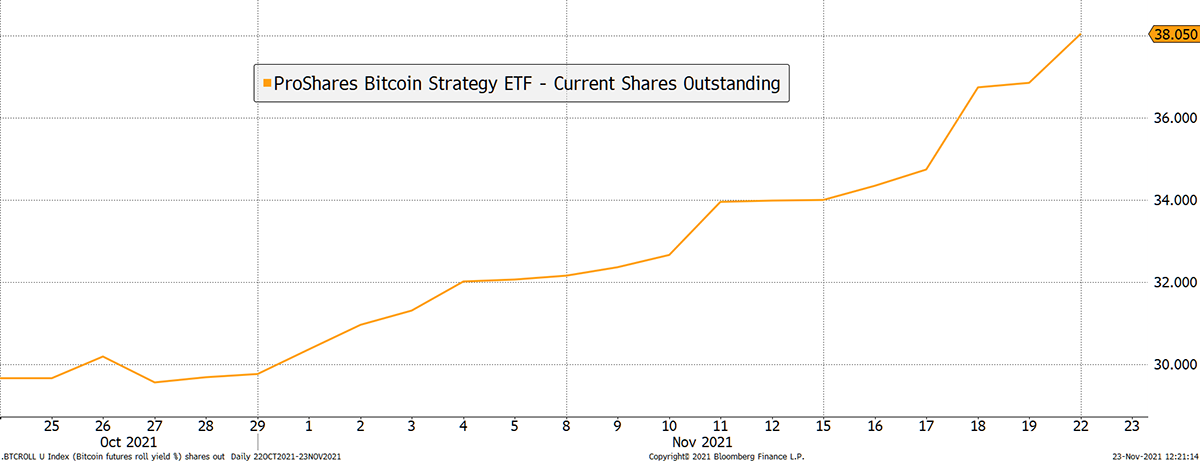

This is the most resilient of all the data. Unbelievably, investors are still throwing money at the ProShares Bitcoin Futures ETF (BITO). The new shares issued are shown below.

BITO still biting

Source: Bloomberg. BITO shares in issue since 22 October 2021.

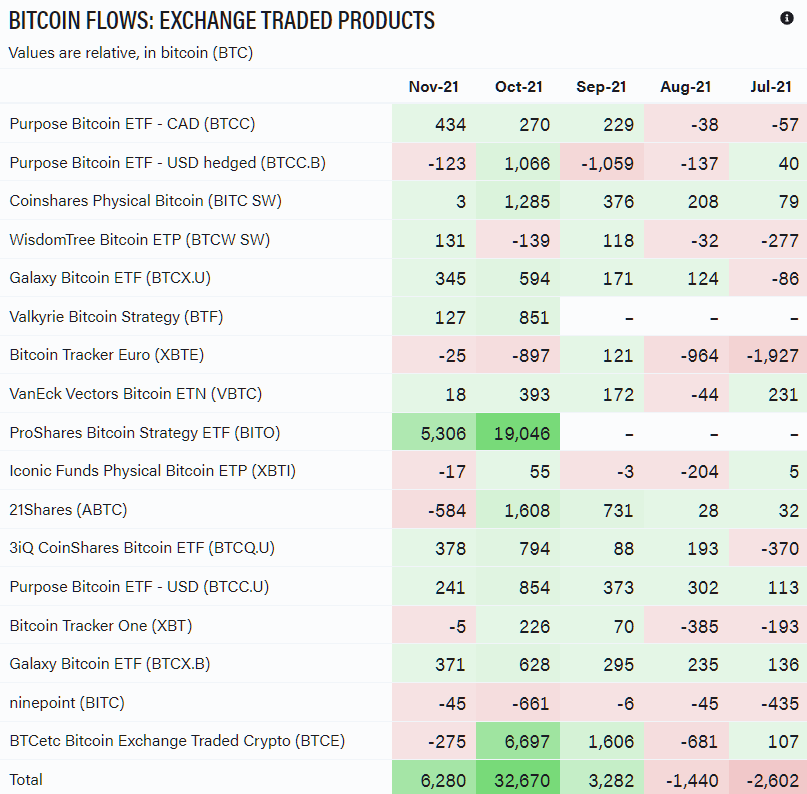

November has seen 6,280 BTC acquired by funds, yet 5,305 BTC came via BITO. This is still a force.

However, with the miners producing 6,600 BTC per week, there is still a wide funding gap that non-fund purchases must fill. It’s important not to forget that.

Macro

Last week I mentioned the dollar bull market, its impact on Turkey, South Africa and even the Euro. It’s now playing out, and the Lira has already devalued 34% since the summer.

Turkish Lira (USD) 0/5

Source: Bloomberg. TRY vs USD with 20-day max and min lines, 30-day and 200-day moving averages past six months.

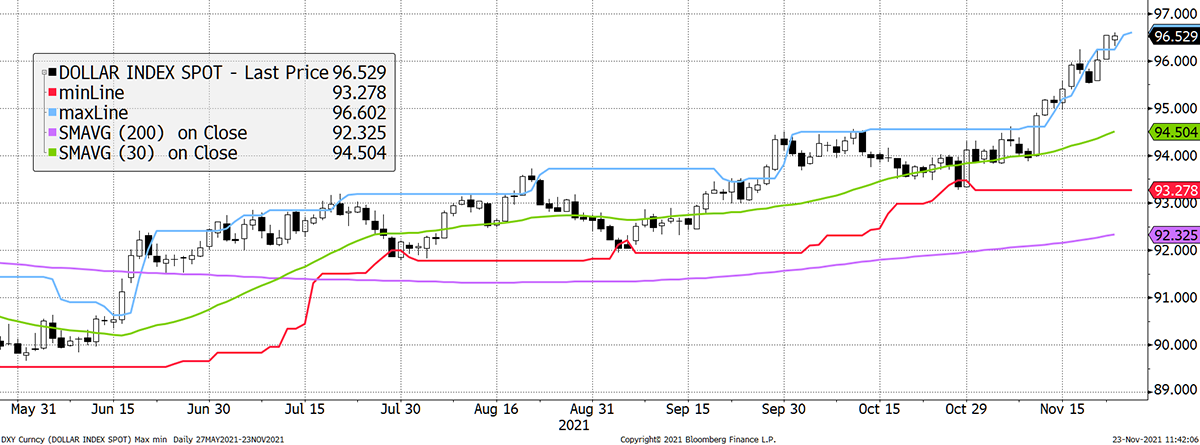

It should be clear that a rising dollar is troublesome, and the best investment is the dollar itself. Why? Because when the dollar is in a bull market, it sucks the life out of everything else.

The last great dollar bull runs were 2014, 2018 and March 2020. Did Bitcoin like it? It certainly did not.

But dollar bull markets can be fun because you can be sure that the risk is significantly reduced when they pass. That means when they finally end, there’s a buying opportunity.

US dollar Index (DXY) 5/5

Source: Bloomberg. DXY Index with 20-day max and min lines, 30-day and 200-day moving averages past six months.

Why is the dollar so strong?

The crypto answer is a lack of Brrrrr. Last year, there was loads of printing, but the rate is already effectively decelerating, considering the amount is fixed against a rising money supply. Now that we are talking about rate hikes and earlier tapering, the pressure valve sends the dollar up.

Consider the other side: the currencies faring the worst. In the Euro or Turkish Lira, they are talking about loosening. This dollar rally is unopposed.

US real rates

Source: Bloomberg. US real rates (rate less inflation) past year.

Even more noteworthy, but not surprising, is the recent Hindenburg Omen signal. This is a stockmarket warning indicator that cries foul a bit too often. But it has made great calls over the years, the last one being in Jan 2020.

This latest signal has identified declining breadth as the “McClellan Oscillator” is negative. On top of that, there has been an unusual degree of new highs and new lows occurring simultaneously. This combination spells market confusion. Things are weakening below the surface.

Hindenburg Omen issues a warning

Source: Bloomberg. Hindenburg Omen signals in yellow since 2002.

Ether College

- Tom Salter

Ethereum is undoubtedly bottlenecked by its gas issues. In recent weeks this problem has been highlighted by many – my theory for where the money lies within smart contracts is:

New money heads to Layer-2 solutions; old money is stuck on Ethereum Layer-1.

What are ‘layer-2’ solutions (or ‘ETH-builders’)? Layer-2s are scalability solutions built, in this case on Ethereum, to relieve network congestion, increase potential development and promote low-cost accessibility to dApps that have access to the largest digital asset money market, i.e. Ethereum.

Different Types of Scalability Solutions on Layer-2

ZK-Roll-Ups

This scalability solution batches transactions off-chain and generates cryptographic proofs settled on-chain. These validity proofs, known as SNARKs, verify the off-chain transactions.

Optimistic Roll-Ups

ORS are Layer-2 solutions that run in parallel with Ethereum and process everything running on Layer-1 by harnessing the Optimistic Virtual Machine, which is compatible with Ethereum’s virtual machine. These have the potential to scale Ethereum, which currently has 15 transactions per second, to between 200-2000 TPS.

Polygon

Polygon is an Ethereum sidechain that is one of the first to aggregate several scalability solutions (such as Layer-2 and sidechains). This comprehensive solution has proved very popular. Its easy-to-use bridge enables investors to seamlessly take their Ethereum-based assets and deploy them on the more efficient Polygon ecosystem.

Tune in next week, where we will be looking at community solutions (such as EIP-1559 and ETH 2.0) for the increasingly expensive Ethereum Network.

Summary

The headwinds are back. The network and the fund flows give us little to worry about in contrast to the macro, which does. A strong dollar sucks the life out of financial markets like a vampire leaving carnage in its wake. This is rarely a good time for commodities and currencies, but recall that a huge risk will be behind us when the rally is complete.