The Dollar Fights Back

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 24

The key is to remain solvent. Or you can just HODL.

Highlights

| Technicals | ByteTrend falls from 5 to 4 for BTC and ETH |

| On-Chain | Softening |

| Macro | Dollar bull, euro bear |

| Investment Flows | More needed |

| Crypto | Ether College |

ByteTree ATOMIC

There’s a sense that financial markets have seen their best. Driven by state-sponsored Brrrr…, the stockmarket bubble is getting ridiculous. That is not crypto’s fault, but it can’t shake it off. Crypto may well come under pressure, but fear not, it will be back. The key is to remain solvent. Or you can just HODL.

Technical

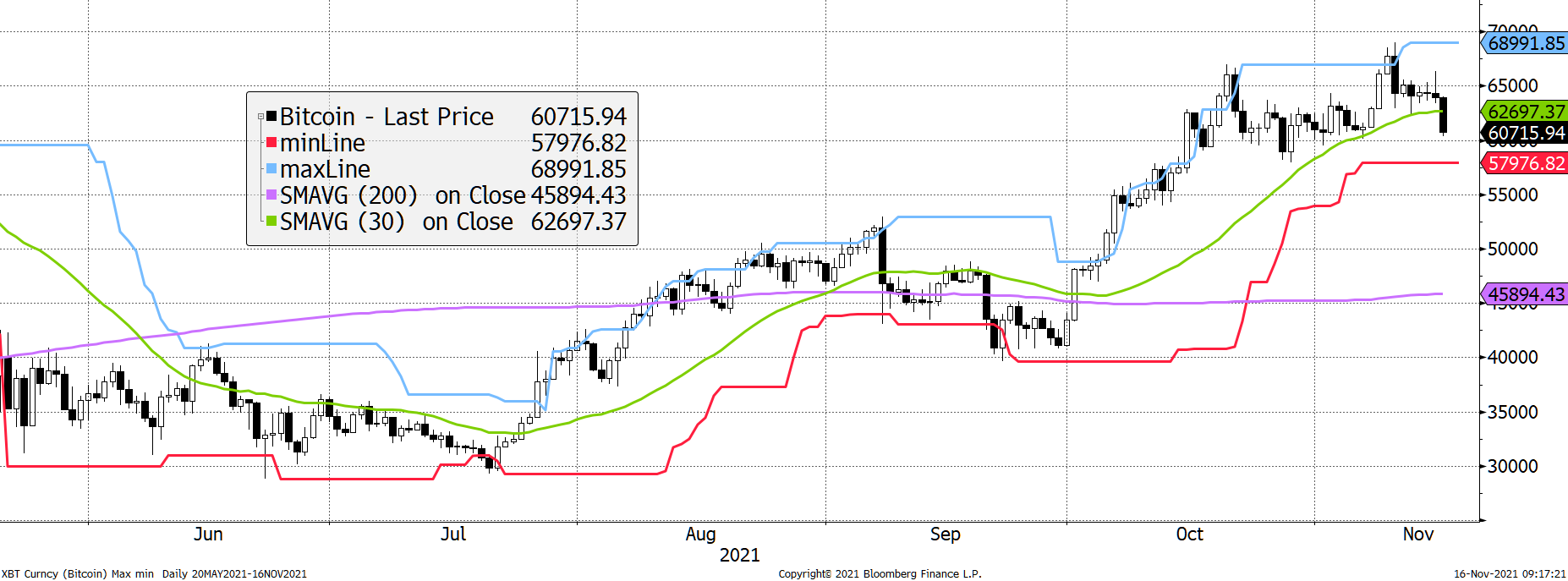

It’s interesting to see the heavy resistance on the last two all-time price highs. It is different this time, as we keep saying. Huge inward investment inflows (circa $1.9 billion per month) are required to sustain $60k, and we aren’t seeing them. This is the stumbling block.

The BTC price has dipped below the 30-day moving average. The 20-day min sits at $58k, and a break would see a change in sentiment.

BTC ByteTrend score 4/5

Source: Bloomberg. Bitcoin with 20-day max and min lines, 30-day and 200-day moving averages past six months.

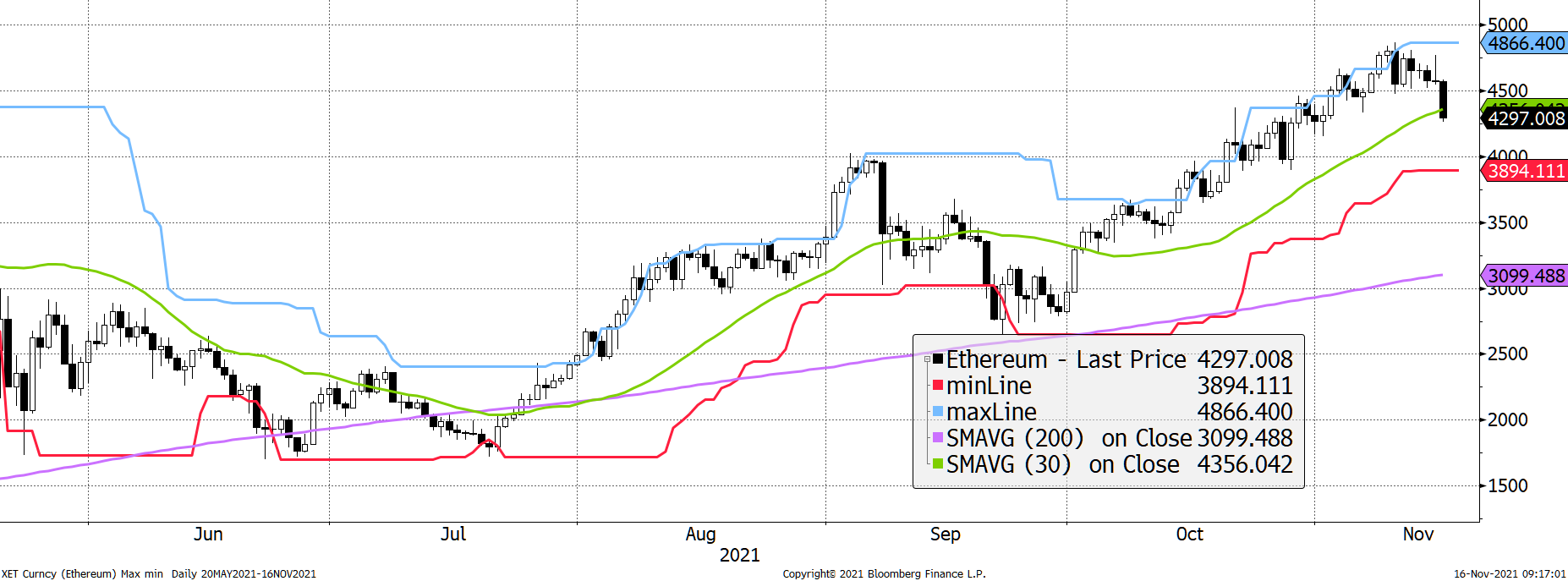

ETH has done a better job with its all-time high but still didn’t advance much since the May high of $4,379. Perhaps we are beginning a new era of the leading cryptos behaving more like large cap stocks, just with higher volatility.

ETH ByteTrend score 4/5

Source: Bloomberg. Ethereum with 20-day max and min lines, 30-day and 200-day moving averages past six months.

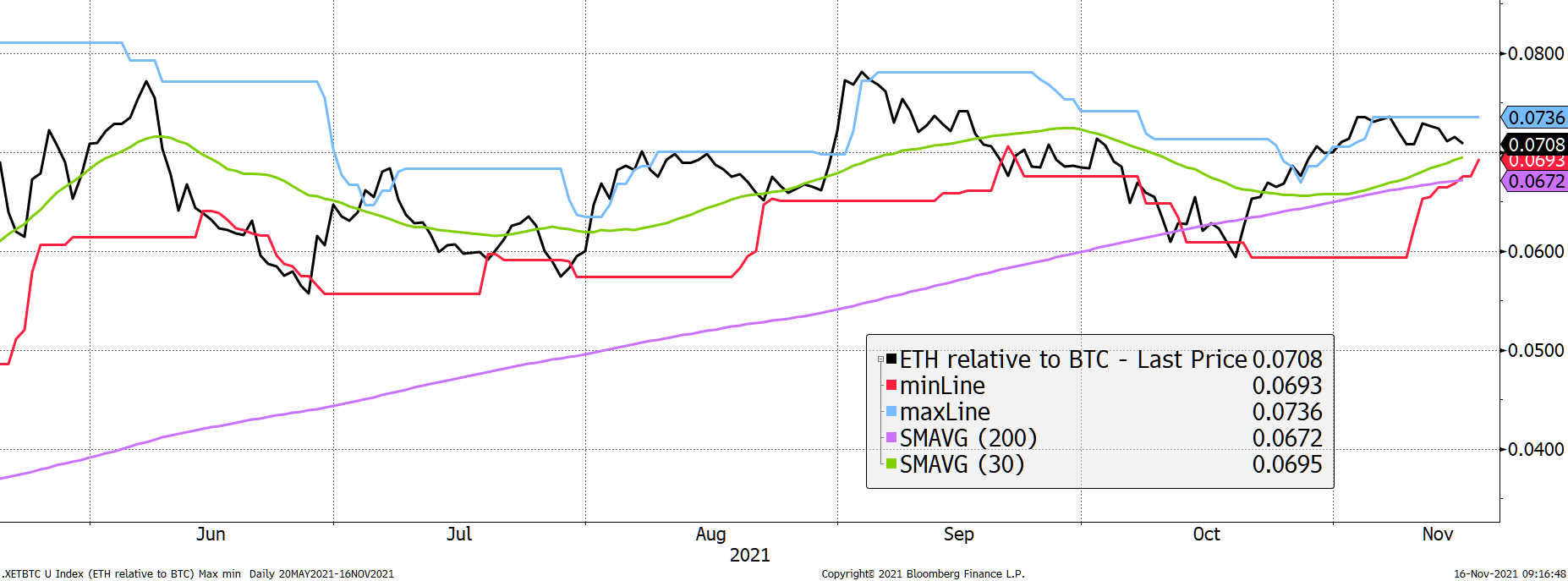

ETH remains in a strong trend vs BTC. But I suspect that just as ETH beat BTC in the bull run in recent weeks, it gives some back in a soft patch.

ETH (priced in BTC) score 5/5

Source: Bloomberg. ETH in BTC with 20-day max and min lines, 30-day and 200-day moving averages past six months.

ByteTrend explained:

We urge you to become familiar with the ByteTrend score concept because it will become a major feature in ByteTree technical research. Quite simply, it enables a trend to be quantified, which helps to remove emotion and provide a comparison across many charts for cross-market screening.

A ByteTrend score gets a point for each of the following criteria:

- Price is above the 200-day moving average

- Price is above the 30-day moving average

- 200-day moving average slope is rising

- 30-day moving average slope is rising

- The last touch of the max/min lines was blue

On-Chain

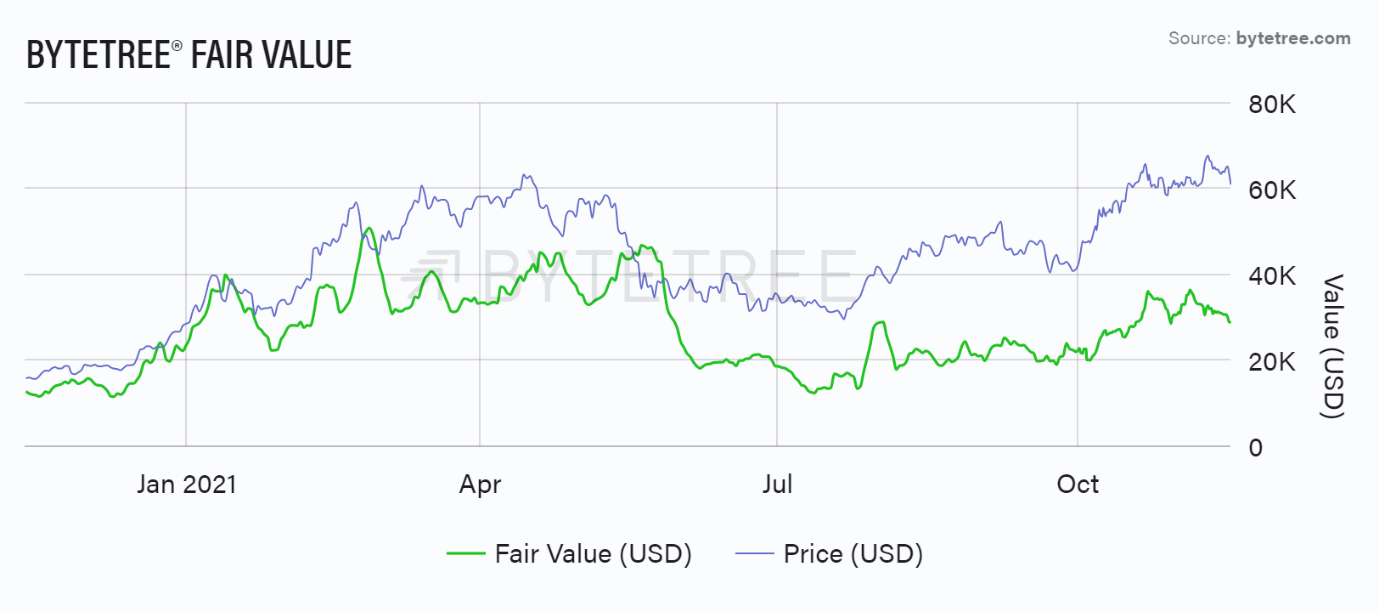

This whole fair value methodology will soon have an upgrade, so there will be a wider range of methodologies. We stand by the idea that the size of the network represents the intrinsic value of the network. Whatever calibration technique you choose, that still looks more like $30k than $60k. Historically, the reversion has never failed despite being somewhat slow in recent months.

Source: ByteTree. ByteTree Fair Value.

Recall that other data providers have this going to the moon, and their data is wrong. The network has shrunk since the spring, yet the price remains high.

Investment Flows

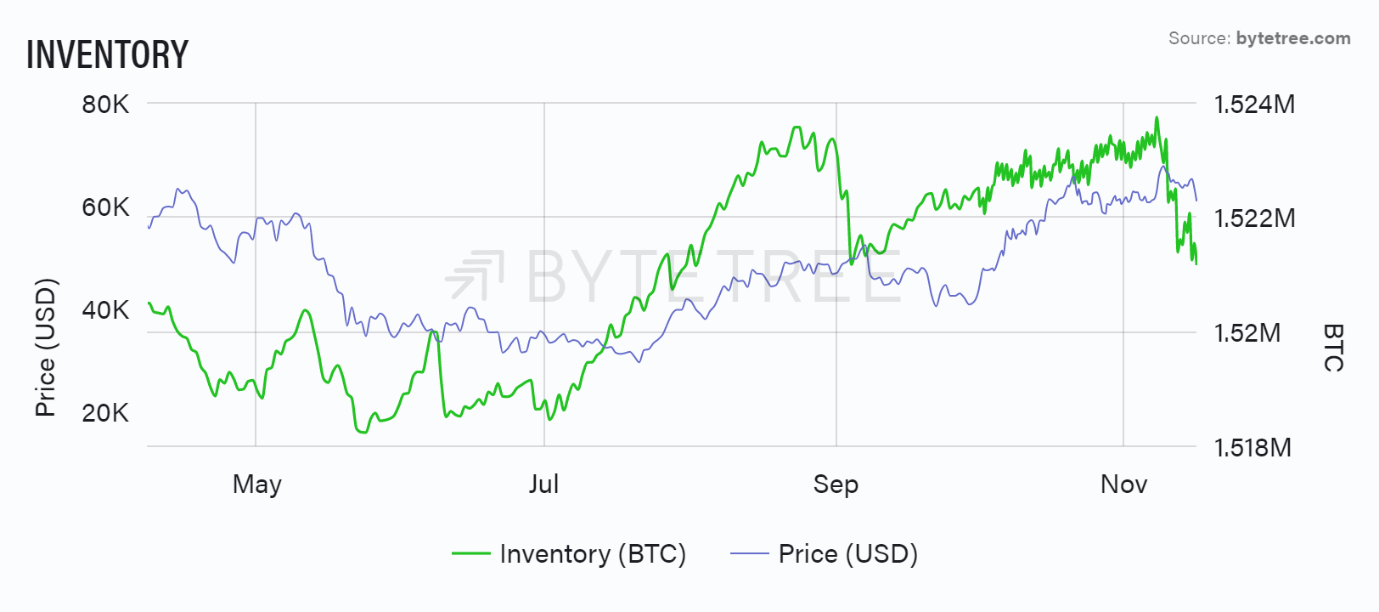

The BITO ETF provided a shot in the arm, but it hasn’t followed through. 7-day net flows (post miner sales) have returned to negative. There are still BTC and ETH inflows, but less than miner sales.

Source: ByteTree.

Those miner sales have accelerated, and BTC inventories are now falling, having grown since July. That had been price supportive but now weighs on price.

Source: ByteTree. Miner inventory (green) and the price of bitcoin (USD) since April 2021.

Macro

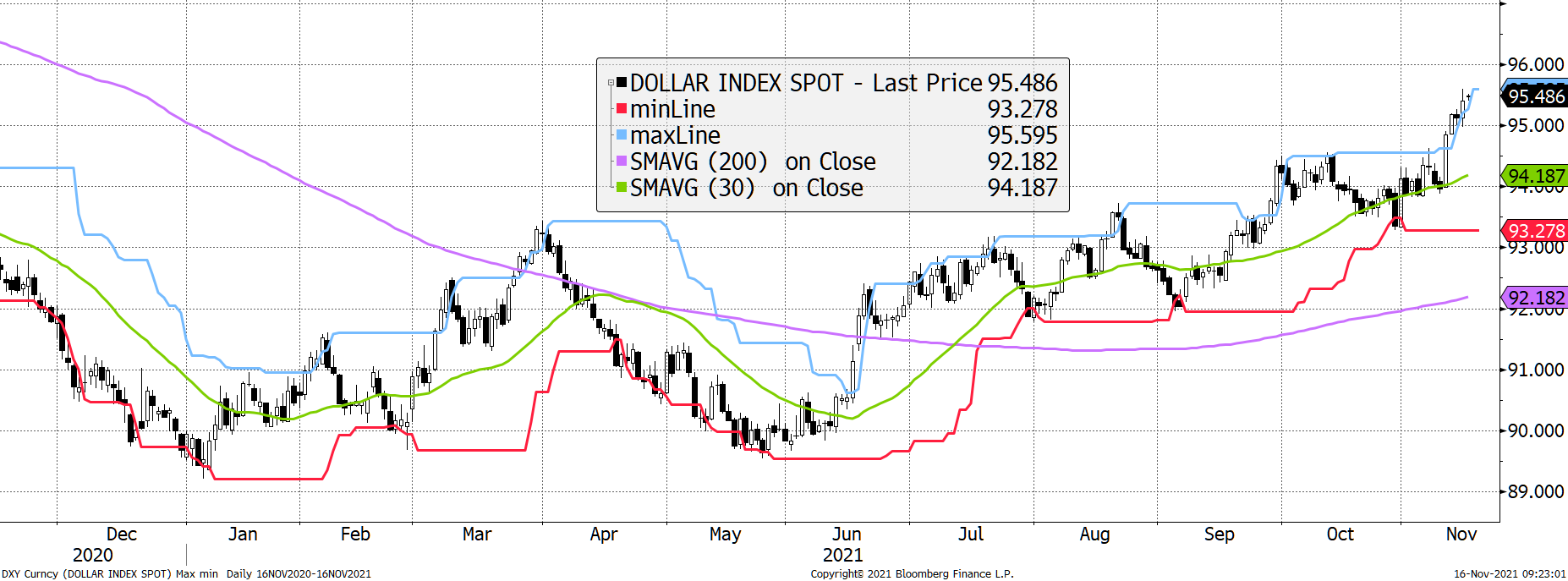

Last week, we showed how the US dollar tends to be negative for crypto. That doesn’t have to be the case, but it is definitely a headwind. The dollar trend is looking strong, despite continued money printing.

The US Dollar ByteTrend score 5/5

Source: Bloomberg. US Dollar Index ByteTrend past year.

The crypto-clueless warn of hyperinflation. That may come one day but no time soon. In fact, a dollar bull market means it will be the last currency to fail.

Which begs the question of which fiat currencies will fail first?

The Turkish Lira (TRY) is already failing, with emerging weakness in the South African Rand (ZAR). Next up are Southeast Asian currencies (THB, IDR, KRW) and Latam (BRL, MXN). An emerging market crisis is brewing, led by a China slowdown, which is very much RISK OFF.

This seems to be a growing risk, but we can’t say it’s happening imminently. Nevertheless, it certainly seems like a growing problem.

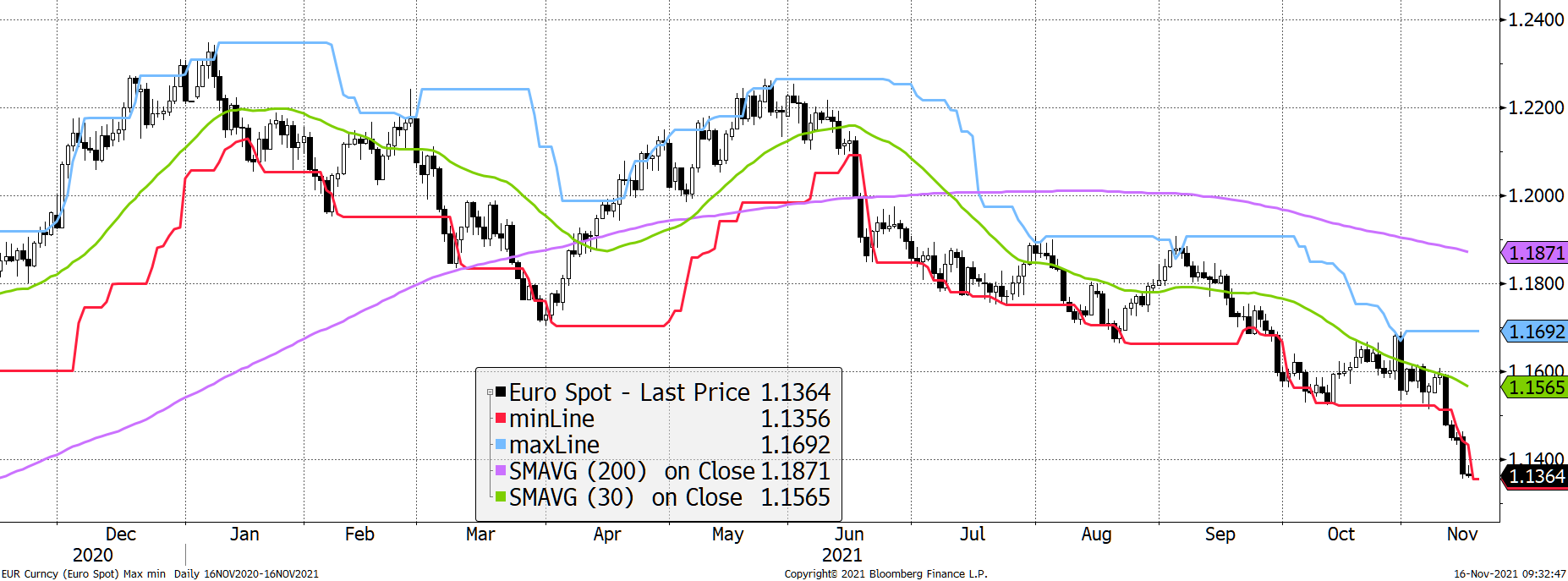

Don’t mention the Euro

The EUR has a ByteTrend score of 0 and is also looking sick. Why would that be so weak? We can only presume because while the US and places like the UK are reluctant to hike rates, the Eurozone have zero intention.

Perhaps they see a weak Euro as a good thing? Reminder, there are no wealthy nations with weak currencies. It’s generally the other way around, with Switzerland being the best example of a strong currency building a great nation.

The Euro ByteTrend score 0/5

Source: Bloomberg. Dollar versus Euro ByteTrend past year.

Ether College

- by Aun Abbas and Tom Salter

Gas Fees

Gas fees are a key indicator of Ethereum’s network health, but it’s not as simple as lower fees equal a better network. A healthy network requires the perfect balance between the value generation and the costs of using a given network.

That said, we have seen Ethereum become the highest fee smart contract blockchain with countless spikes in-network cost. This is not a new phenomenon. The first cracks started to show in 2017 when CryptoKitties, an NFT platform, crashed the Ethereum fee market. Since then, the cracks have only widened, with the mean transaction fee currently standing at $54.

ETH-Killers

When gas fees are high, transacting on the network becomes too expensive. Given that both developers and consumers are cost-sensitive agents, it is no surprise that the term ETH-Killers is now colloquially used in the ecosystem.

The ETH-Killers promise to do exactly what Ethereum has not yet been able to do: scale cheaply. Solana’s (SOL) recent price hike is invariably linked to the fact that the average transaction fee on its network is $0.00025. Similarly, Cardano’s (ADA) average gas fees come in at $0.40, and AVAX’s under $0.07. Low transaction fees and high throughput attract developers, but so do security, reputation and an established ecosystem. Granted, Ethereum doesn’t have the former two aspects just yet, but the latter factors are the reason it is the second biggest chain on the block.

On the flip side, we have protocols that leverage Ethereum’s security and competitive advantage. Indeed, these are scalability solutions built on top of Ethereum that limit the burden of extortionate gas expenses without ‘killing’ anything - ‘ETH-builders’, if you will. More on this next week.

Summary

There is a temptation to downgrade to bear with the macro winds turning against crypto. The network points to $30k, the flows are weak, and the miners are selling. The leveraged should turn cautious, and the cautious should take profits. Just don’t hold them in euros.