Reflexivity - Nothing Does It Like Bitcoin

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 19

George Soros came up with the theory of reflexivity, whereby the investment case for an asset improves as its price rises. Bitcoin is the most reflexive asset ever to exist.

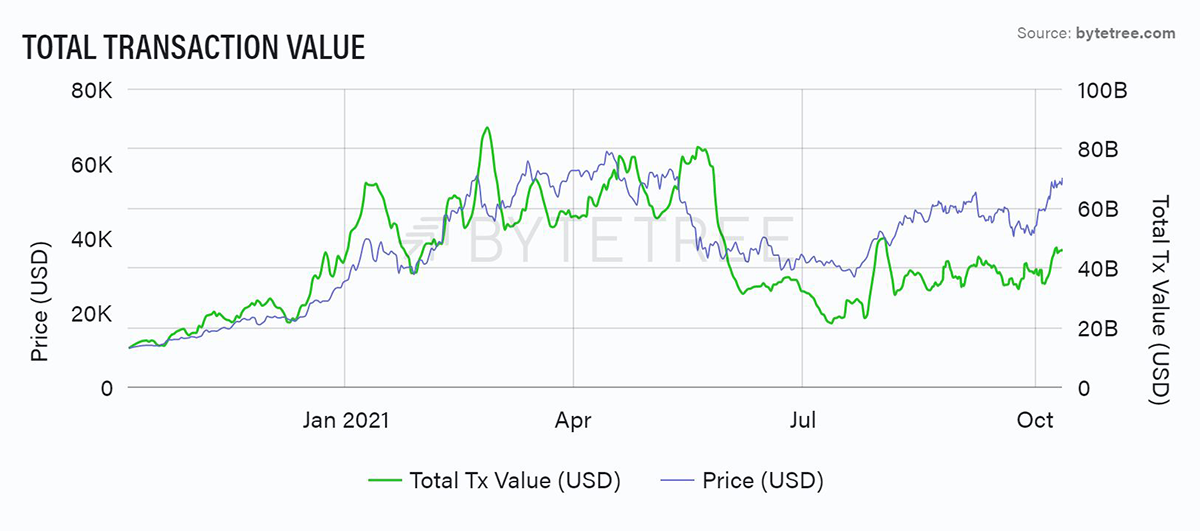

Bitcoin’s value is its network, and as the price rises, the network follows. The missing piece in the post-China world (April 2021 ban), is that the network remains roughly half the size it was before. Bitcoin is trading on an uncomfortably high valuation, which at some point could disappoint.

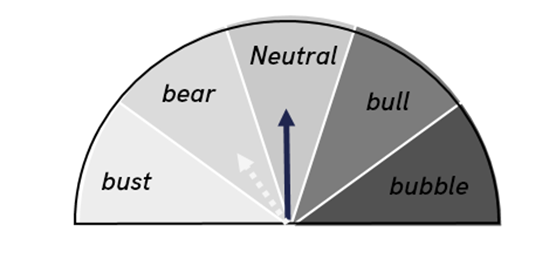

The chart is fabulous with a ByteTrend score of 5. Yet the rally is getting lonely as there is no longer widespread participation from altcoins. For example, ETH is now making lows when priced in BTC, which is being repeated across the space.

This flight out of alts and into bitcoin was a prominent feature of the 2014 and 2018 bear markets. The alts peaked, then they were exchanged for BTC, then finally BTC broke. History is being repeated.

The chart is good, yet the breadth is bad.

But if bitcoin is the new gold, then ‘so what’ about the network? That might be true, but I would remind readers that gold is a massively liquid market. It isn’t just the on-chain volume that is weak, exchange volume is too. Liquidity, and the certainty that it brings, is in itself a valuable asset.

Source: ByteTree Terminal. Bitcoin on-chain transaction value, showing the growing disconnect between price and transaction value.

But what about the Lightning Network? Off-chain transactions are growing and that could relieve on-chain transactions. True, but they are tiny.

The inflation narrative is favourable, and that is on side. But you can’t ignore China either in bitcoin, or the real world. She has been the engine of global growth since the 1980s and will crack.

The mammoth property bubble could lead to a devaluation in the yuan, which will spread deflationary forces around the world. When that happens, demand for commodities and shipping will collapse.

In any event, institutional adoption is on the rise, at least that’s the story. There are some flows into the ETFs, but nothing like Q4 2020 and Q1 2021 when demand surged. Also, the Grayscale Bitcoin Trust (GBTC) still hasn’t got a bid as the discount remains wide. Why can’t we see these institutions, merely hear about them?

Source: ByteTree Terminal. The enduring Grayscale discount.

Over the years I have become distrustful of narratives. I follow data.

The most popular sources in the space are Glassnode and Coin Metrics. They are plain wrong. Glassnode in particular is overstating transaction value by multiples, giving the impression that bitcoin is undervalued. Many will have acted on this misinformation, and I believe that has been a major driver of the current rally.

Bitcoin is not alone as there is a general bubble in asset prices around the world. When they crack, everything will be impacted. That will be the buying opportunity. How low and when? I don’t know, but it will be obvious when we get there, just as it was in March 2020.