Left Pocket, Right Pocket

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 15

Most popular on-chain analysts are discussing supply and watching how the coins shift from the left pocket to the right pocket and back. If I have a million dollars in my left pocket and two million in my right, I am worth 3 million dollars. It’s no more complicated than that.

Highlights

| Technicals | All that progress for nothing |

| On-chain | Left pocket, right pocket |

| Macro | Energy prices soar |

| Investment Flows | Volatility keeps them away |

| Crypto | Saylor to the rescue |

ByteTree ATOMIC

We maintain a neutral stance.

Technical

Last week, there was a flash crash where the price fell by 19%. In terms of the ByteTree ATOMIC trend score, that has seen a complete turnaround of the situation from a score of 5 to 1.

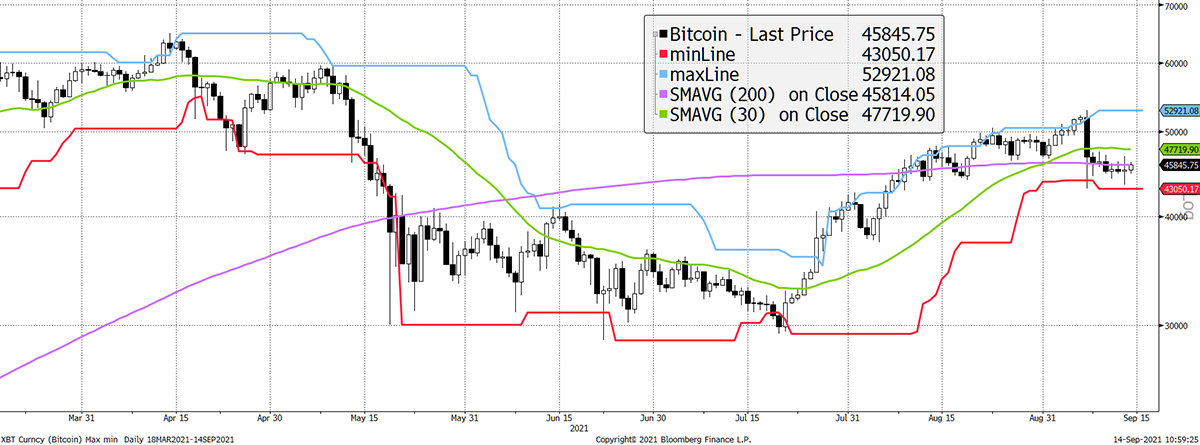

Bitcoin trend

Source: Bloomberg. Bitcoin with 20-day max and min lines, 30-day and 200-day moving averages past six months.

The 30 and 200-day moving averages have both turned negative (gradient), and the price trades below the 30-day moving average and a touch above the 200. On the max and min lines, the last touch (intraday) was red. This all means a score of 5 drops to a 1. It’s a reminder that a perfect trend score doesn’t always work out.

A breach of $43,000 would encourage me to shift the dial back towards bear.

The principle is that good trends are set-ups for “fat tail” trades that explode to the upside, but they don’t have to.

With BTC up 13-fold since the beginning of 2019, it remains true that 50% outperformance was achieved by only being invested when the trend score was a 3 or better.

By implication, the recent damage to the trend means a price spike is less likely than a week ago. Obviously, events can change everything.

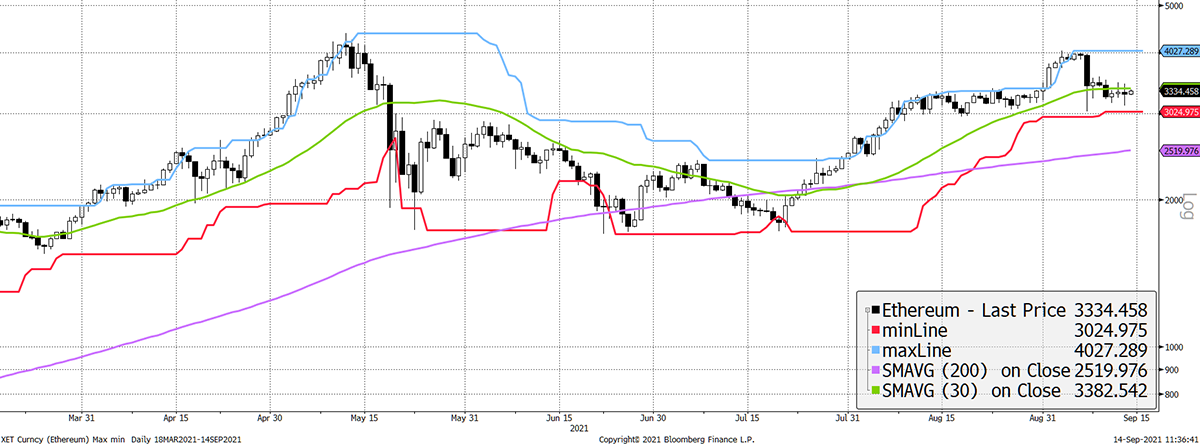

Ether comparison

Source: Bloomberg. Ether with 20-day max and min lines, 30-day and 200-day moving averages past six months.

ETH hasn’t touched the red. The 200-day MA is rising, and the price is above it. The 30-day is more challenged, but it still tots up to a 3 in contrast to BTC’s 1. Technically, ETH is stronger than BTC, but to really understand the price differences, we must look at a relative chart.

The relative trend favours ETH as the moving averages are rising, but until the charts can pass above the red line, ETH remains a long-term underperformer. The last relative high was in May when 1 ETH was worth 0.14 BTC. If that happens, then the odds of flippening will increase.

ETH still lags BTC

Source: Bloomberg. ETH relative to BTC with 30-day and 200-day moving averages since 2017.

On-chain

When ByteTree talks about on-chain data, we are primarily talking about demand. In crypto, the supply is known, and therefore no mystery, yet demand varies. Demand is the most important driver of price, and all of our metrics exist to try to measure it.

Most popular on-chain analysts discuss supply and watch how the coins shift from the left pocket to the right pocket and back. If I have a million dollars in my left pocket and two million in my right, I am worth 3 million dollars. It’s no more complicated than that.

Does it matter if the coins are owned by whales with large balances or retail investors with small balances? Not really, although it’s true that some patterns have emerged over time with minor links to price. But these links are simply an outcome.

If the price surges, whales (big players) must sell to new investors, and as it collapses, they must buy it back. All markets work this way, as all assets must be owned by someone.

Look at the shareholder registry of a dud company. The shares hardly trade but must be owned by someone. This is what happens at the depths of a bear market when liquidity dries up. As things improve, the shares start to change hands, and by the next boom, the shareholder registry will be well oiled and seeing ownership change on an intraday basis.

It is interesting to know who holds a company’s shares, as it can be comforting if someone like Buffett is aboard. In that sense, analysis of the shareholder register can add value, but serious investors do not focus on how often the shares move around between different actors. Yet in crypto, it is a popular idea many consider to be on-chain analysis. For the record, this is not what we do at ByteTree.

It is the size of the network, which can also get caught up in hype cycles, that truly matters. This is boosted by increased adoption, usage and capital. Everything else is literally shifting value from one pocket to the other.

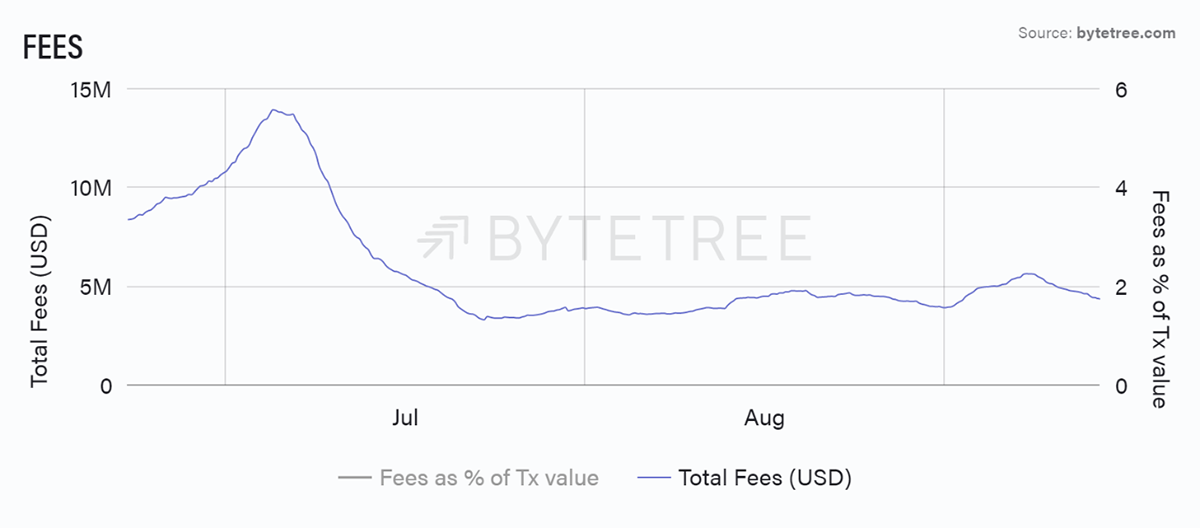

Fees have turned down again, which means a new high is unlikely in the near term, thus justifying a neutral rating.

Source: ByteTree Terminal. Bitcoin Total Fees (USD) over the past 12 weeks.

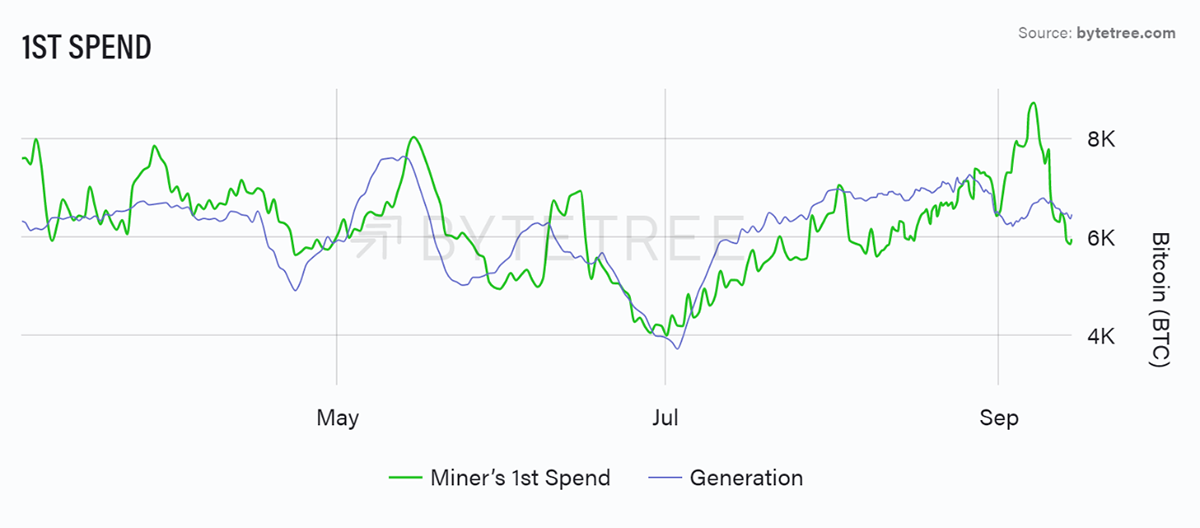

The miners like the summer bounce and have jacked up their rigs, boosting the new supply from the low in early July. They were selling until last week (First Spend spike) but seem to have backed off. That implies a weaker market bid.

Source: ByteTree Terminal. Bitcoin First Spend and Generation since March 2021.

Investment flows

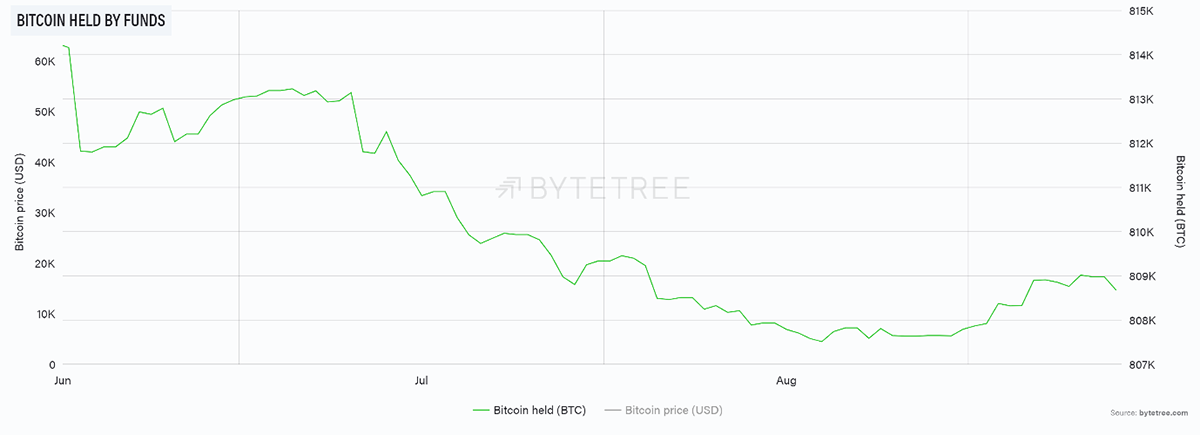

Just as the fund flows into BTC were about to turn the corner following the summer drop, it’s all over. The volatility shock has put off the funds. Will the crypto space ever learn?

Source: ByteTree Terminal. Bitcoin First Spend and Generation since March 2021.

The crypto space wants the institutional investors because their money will suck up the supply. The institutional investor likes the idea of an alternative, natively digital asset with inflation hedging credentials, but why such nonsense with it?

Ether continues to see better flow data, with 2.9% being added to the fund supply since the May peak. That would certainly have helped with the recent price bounce.

ETH and fund demand

Source: ByteTree; Bloomberg. ETH fund holdings and price since April 2021.

Macro

It has been a quiet week in macro, at least in the sense of nothing new to report. We want to reiterate a risk for proof-of-work blockchains.

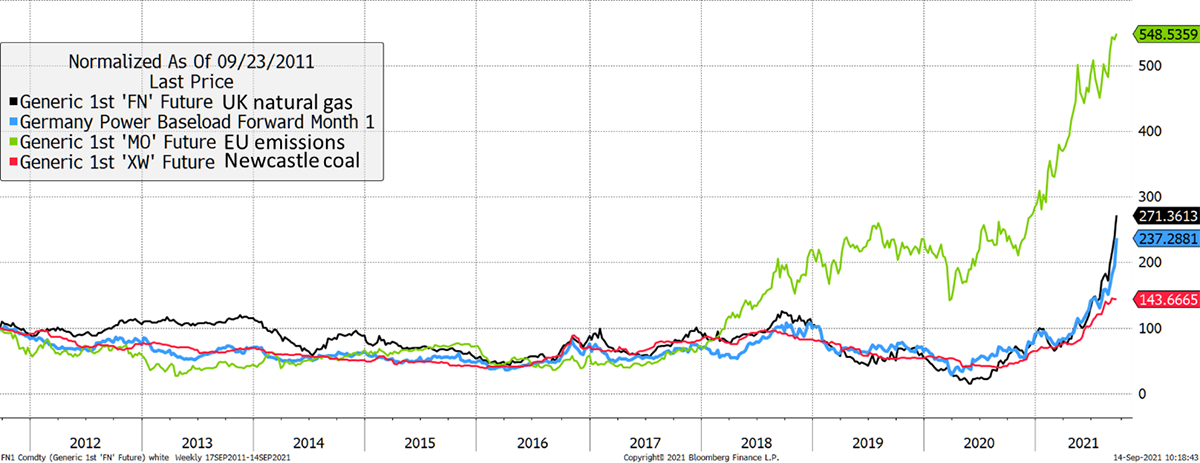

What happened to cheap energy?

Source: Bloomberg. EU emissions futures (green), German baseload electricity (blue), Newcastle, Australia, Coal (red) and UK natural gas (black) rebased to 100 since 2011.

Energy prices are surging, and without a strategy to do the tried and tested thing and produce more, we are moving into a world of limited supply. Bitcoiners understand what that means, so long as demand holds up.

The green lobby has gone from strength to strength, and you can imagine how they will want to ration energy. They will use high energy prices as an excuse to clobber bitcoin. This is a risk that probably isn’t being factored in.

The blockchain will plod on regardless, but an energy super-spike will provide a smokescreen for any anti-Bitcoin legislation you can imagine. The baddies can’t stop this space, but they can make life extremely difficult if they want to.

Crypto

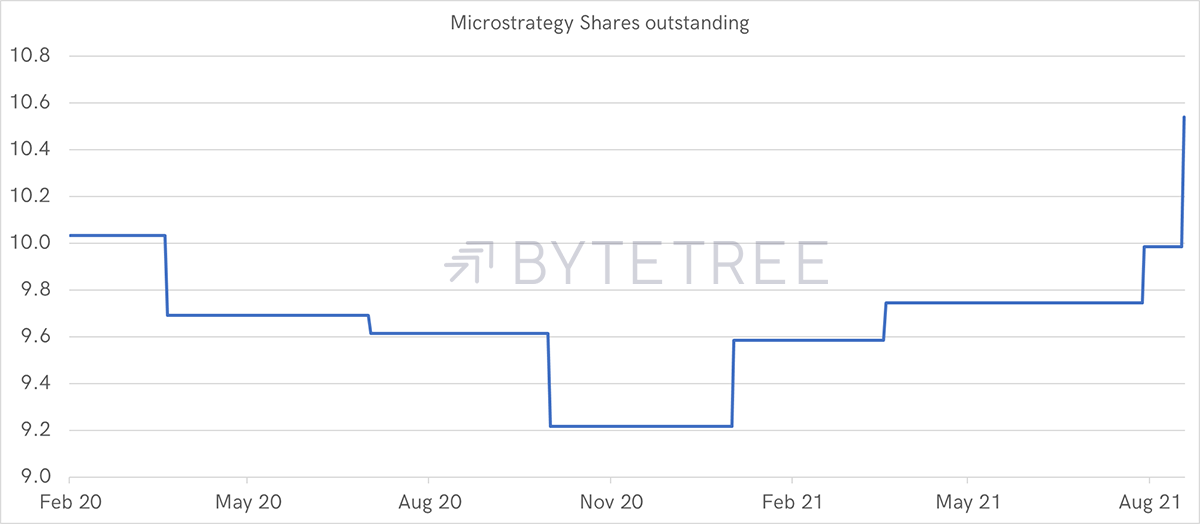

Microstrategy came to the rescue and bought some more BTC, funded from the sale of his company’s shares, which were trading at a premium.

Source: ByteTree. MicroStrategy shares outstanding since February 2020.

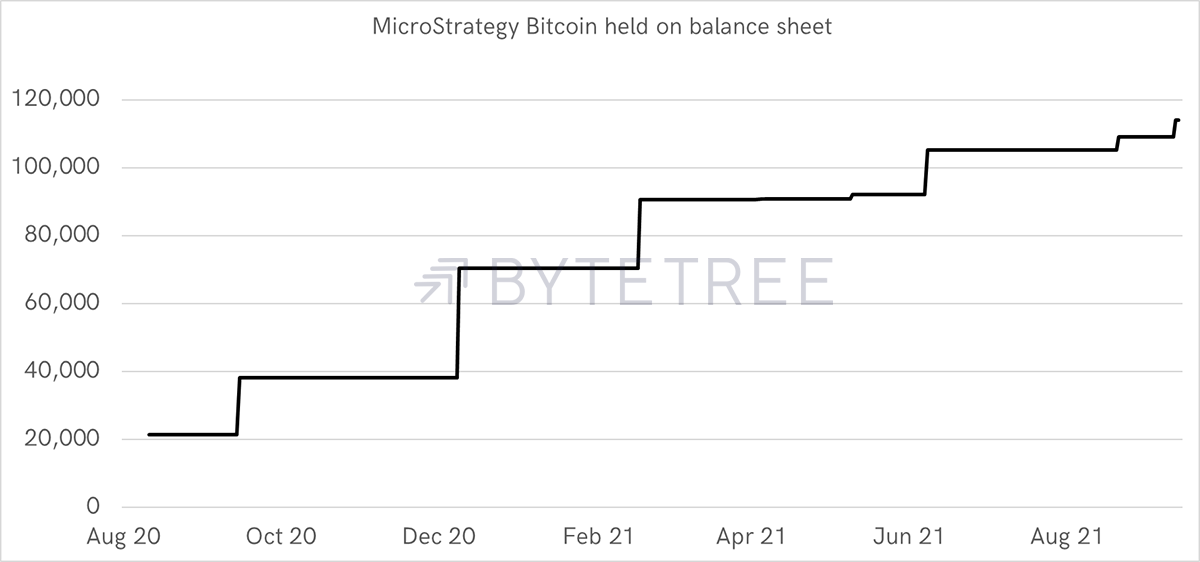

Issuing new shares has allowed Michael Saylor to purchase more BTC for his company. Microstrategy now owns 114,042 BTC.

Source: ByteTree. MicroStrategy bitcoin held on balance sheet since August 2020.

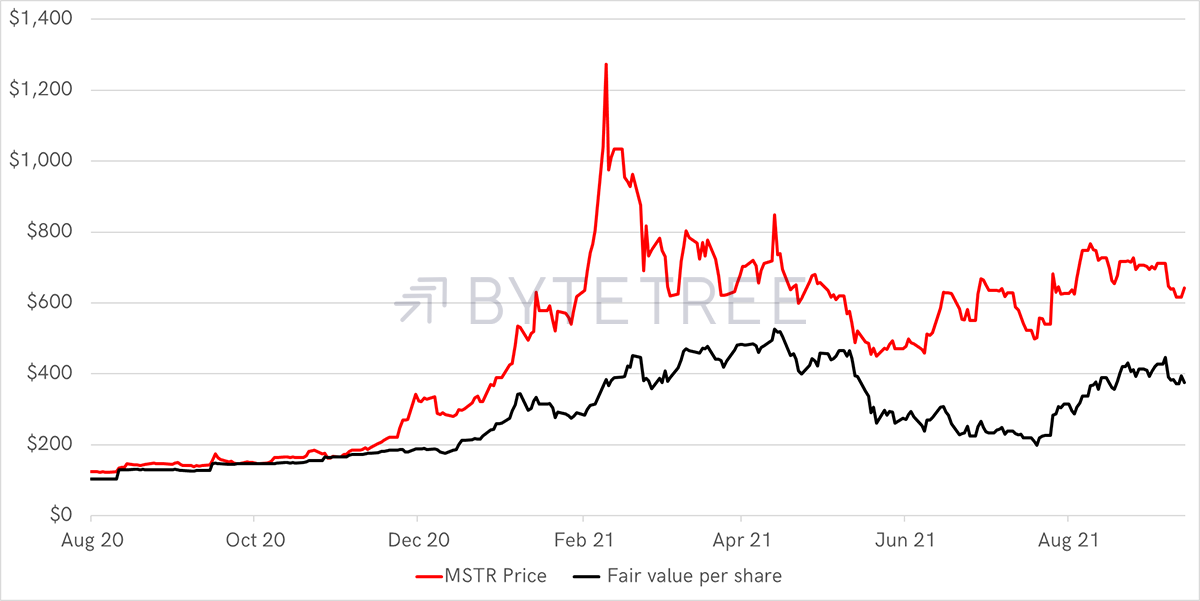

This has been a good deal for legacy shareholders, but a terrible one for the new shareholders. It has been notable how the fair value per share has doubled since July, due to leverage, whereas the share price has barely moved.

Source: ByteTree. MSTR price (red) and fair value per share (black), since August 2020.

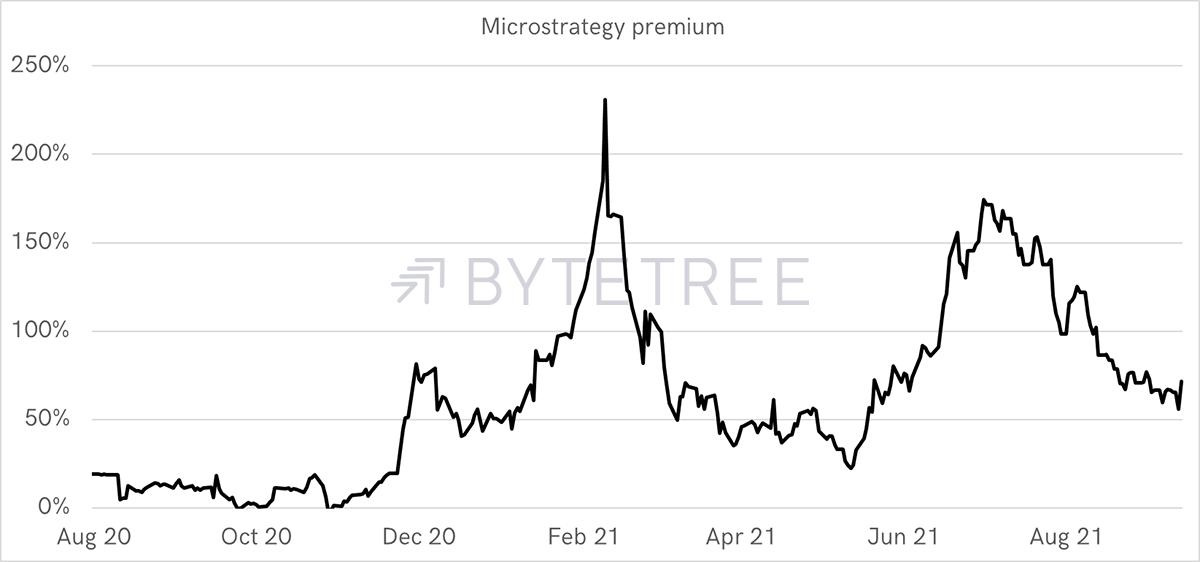

This means the premium has fallen. When that was over 100%, it was cheap for MSTR to raise equity capital. As the premium vanishes, so will his ability to access new cash. Just like GBTC, where the premium drove the inflows, a similar picture is emerging here.

Source: ByteTree. MicroStrategy shares outstanding since February 2020.

With lots of debt, and soon lots of equity, what will his next trick be to acquire more BTC? His business plan is simple: BTC price go up…and that’s it.

Summary

With a strong case for neither weakness nor strength, we maintain a neutral stance.