Be Patient

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 17

For the record, the origins of ByteTree were banging the drum when there were clear and actionable lows in late 2015, then again in late 2018, and again in March 2020. They all worked out well. Calling the highs has always been trickier because they have tended to be drawn out affairs in comparison.

Highlights

| Technicals | BTC bearish |

| On-chain | Weak fees close to a 12-month low |

| Macro | Breakouts in oil and the dollar |

| Investment Flows | Stable |

| Crypto | Strike |

ByteTree ATOMIC

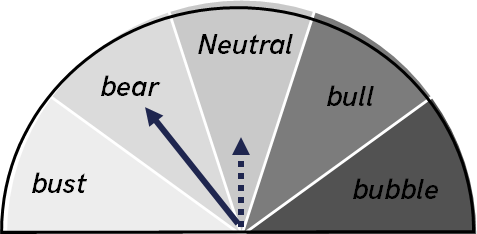

Last week, we sent a flash note downgrading bitcoin to a bear market. We remain long-term bulls on this space for ideological and technological reasons. Yet, unlike most analyses in this space, we pride ourselves on impartiality.

For the record, the origins of ByteTree were banging the drum when there were clear and actionable lows in late 2015, then again in late 2018, and again in March 2020. They all worked out well. Calling the highs has always been trickier because they have tended to be drawn out affairs in comparison to the lows.

Technical

Currently, the 30- and 200-day moving averages have a negative slope and the price trades below both. On the max/min lines, the last intraday touch was red, having not seen a blue in the interim. BTC currently has a ByteTrend score of zero.

Bitcoin trend

Source: Bloomberg. Bitcoin with 20-day max and min lines, 30-day and 200-day moving averages past year.

ByteTrend explained:

We urge you to become familiar with the ByteTrend score concept because it will become a major feature in ByteTree technical research. Quite simply, it enables a trend to be quantified, which helps to remove emotion and provide a comparison across many charts for cross-market screening.

A ByteTrend score gets a point for each of the following criteria:

- Price is above the 200-day moving average

- Price is above the 30-day moving average

- 200-day moving average slope is rising

- 30-day moving average slope is rising

- The last touch of the max/min lines was blue

A move above $45,375 would improve the ByteTrend score. But there is weakness across the board, as seen by breadth. This gave a bullish signal in July for the bear squeeze but currently shows continued deterioration.

Crypto breadth

Source: ByteTree. Percentage of top 100 coins trading above their 30-day moving average since April 2021.

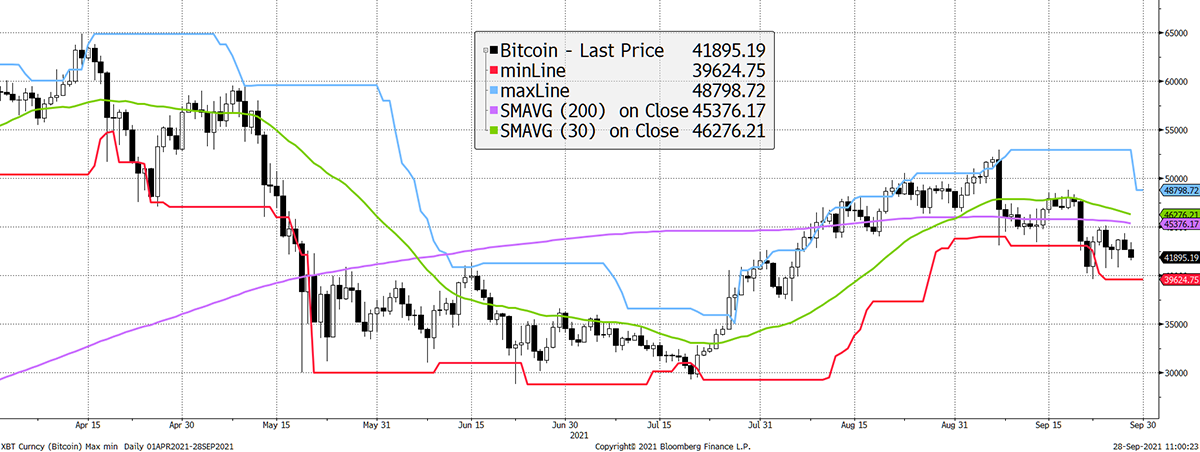

On-Chain

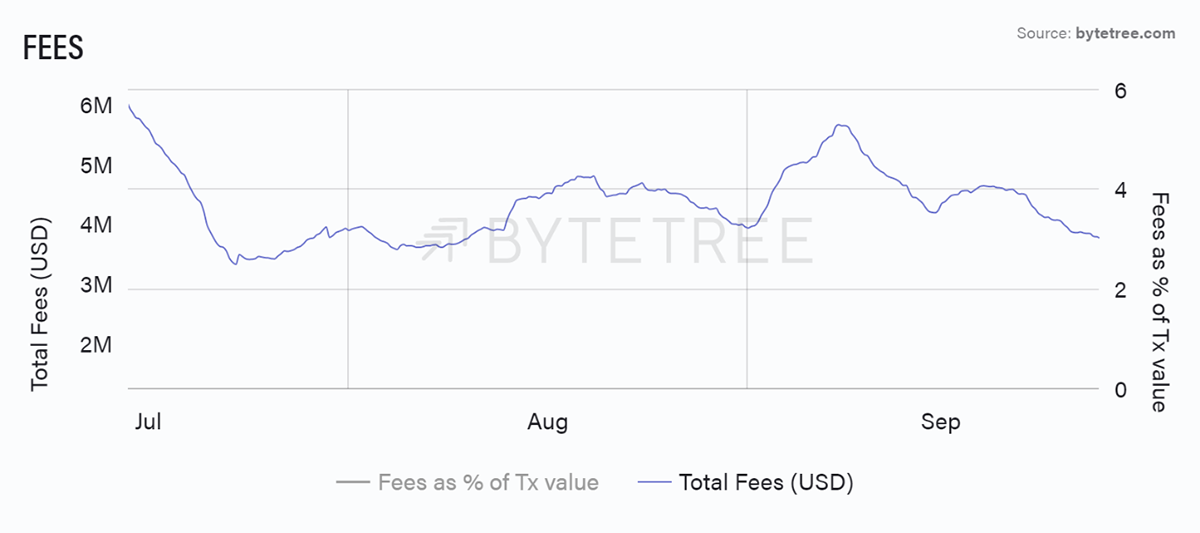

Fees rise and fall with the cycle. They spike when there is heavy demand for space on the blockchain and slump when there’s not. Last September, they were hovering around $5 million per week, having been below $1 million in April 2020.

Source: ByteTree Terminal. Total Fees in USD over the past year.

Having ballooned to $90 million in April, they are back under $3.8 million per week, perhaps testing the $3.5 million levels last seen in July. This is telling us there is a continued slump in on-chain demand; a message that has been loud and clear since the spring.

Source: ByteTree Terminal. Total Fees in USD since July 2021.

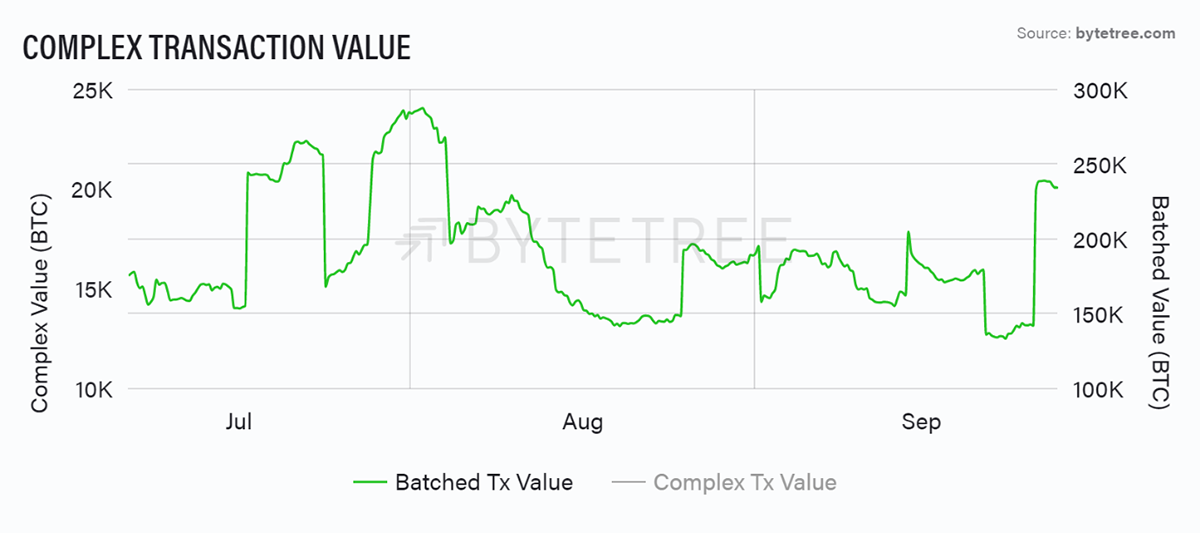

We focus on fees this week, as transaction value spiked on Sunday 26 September 06:00 UST when a $3 billion transaction was booked.

Source: ByteTree Terminal. The price of bitcoin (USD) and spikes in Transaction Value since 21 September 2021.

While exciting to see, ByteTree registered it as a batched transaction, which means it had a single input (was sent from one entity) and multiple outputs (distributed to multiple entities). We can’t be sure of the motivation behind this transfer, just that it was not economic.

Having extensively re-evaluated ByteTree’s processes for assessing transaction value, we are confident that our data is world-class, and competitors such as Glassnode and CoinMetrics are wrong.

Currently, batched transactions are included in our total, which impacts other indicators. This will be stripped out in due course, along with a deeper dive into bitcoin’s various valuation methodologies.

In any event, there is no method we can identify that reasonably puts bitcoin’s Fair Value much above $20,000. The rerun of 2014 and 2017, where prices remained detached from the network for several months, may be repeated.

Investment flows

We are seeing inflows into bitcoin, which is great, but they are too small to move the dial. Our preferred way to visualise this is with the 30-day chart removing First Spend (miner’s supply). ByteTree recently added the price, which helps with the visualisation.

Source: ByteTree Terminal. Bitcoin fund inflows, less miner selling, against the price of bitcoin (USD) since January 2019.

Inflows exceeded miner sales from May 2020, and that held until February. Yet the funds kept adding until April, but with the price so high, the dollars they invested couldn’t buy enough bitcoin, and so the network returned to a deficit.

Buoyant fund demand drove this bull market above and beyond all other factors. For a time, the funds created a bitcoin shortage, which is no longer the case.

Between January 2019 and May 2020, the network had a 25k BTC monthly deficit. That is, the miners sold more than the funds bought. Retail picked up the slack during a period when the average price was $7,667. Today, the network is back to a 25k BTC deficit.

The difference this time is the price is 5.5 times higher. Supporting the network back then required $191 million of non-fund inflows each month. Today that has grown to $1.05 billion.

Macro

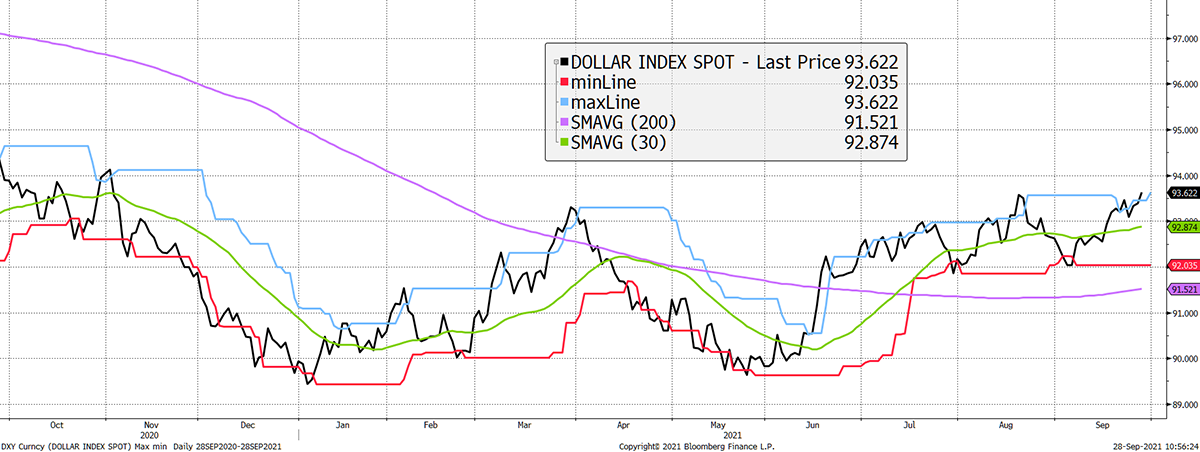

The US dollar has a ByteTrend score of 5, as do oil and other energy-related markets. A strong dollar tends to be a headwind for hard assets, as they are priced in dollars. The bitcoin price surge in 2020 coincided with a dollar collapse into January 2021. I would highlight that the dollar’s 200-day moving average has turned positive. Bull market.

Dollar bull market has begun

Source: Bloomberg. DXY US Dollar Index with 20-day max and min lines, 30-day and 200-day moving averages past year.

A stronger dollar impacts many things, so bitcoin is not singled out. But it is clearly a different macro environment from late last year, where it was all about the surge in the money supply.

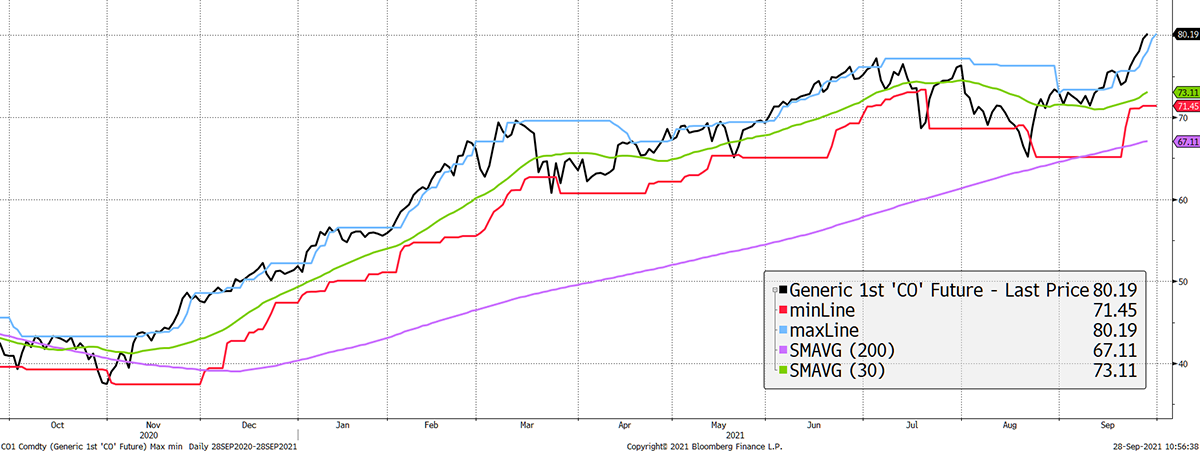

Higher energy prices are a problem for miners’ profitability, but that is an issue for them. If they can’t make a profit, the weak actors will sink, and mining difficulty will fall until profitability is restored. That is not a problem for the network at large as it is self-regulating.

That said, higher energy prices create a political and social problem. It is all well and good defending bitcoin’s energy usage when prices are low. It is another thing entirely when there is a global shortage and prices are through the roof.

The scramble for oil

Source: Bloomberg. Brent crude oil with 20-day max and min lines, 30-day and 200-day moving averages past year.

The story is that bitcoin miners use surplus power, much of it renewable or from wasted gas at the wellhead. That makes sense, and we hope it’s true, but the regulators won’t listen or even care. High energy prices provide a smokescreen for hammering this space on ESG grounds. A global energy shortage has become a major risk factor to consider.

Crypto

Breaking news last Thursday was the launch of Strike’s integration with Twitter for tipping. Strike’s creator, Jack Mallers, is one to watch. He was at the heart of the El Salvador Chivo wallet and has now persuaded Jack Dorsey to integrate Strike’s API with Twitter.

Strike is a payments system that sits on top of the Bitcoin Lightning Network. This aims to facilitate huge volumes of transactions, not just in bitcoin but in fiat currencies and pretty much everything else. It does this at near to zero cost.

We have questions and are investigating the details, which are hard to find. But on the surface, this is the sort of application we have been dreaming about for years. If bitcoin’s infrastructure really can support a global payments system, then the energy cost is low in comparison with the benefits for society.

Assuming all of this works as planned, it means the future of crypto is real. Yet developments in this space keep on coming. Ethereum was conceived during a bear market, as were many others. We like good news but only trade from data.

Summary

The Strike news did little for the price, which is another clue that this bull market is tired. Yet many months from now, Strike may become a thriving financial network, and if so, bitcoin will finally have utility for the world to see.

Utility means there will be more demand from value buyers (buy on weakness), who also dampen volatility. The price will rise, bitcoin will become mainstream, and the regulators will have to catch up.

In the meantime, this space is cooling. Be patient.

Comments ()