Spiritual Opium

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 9

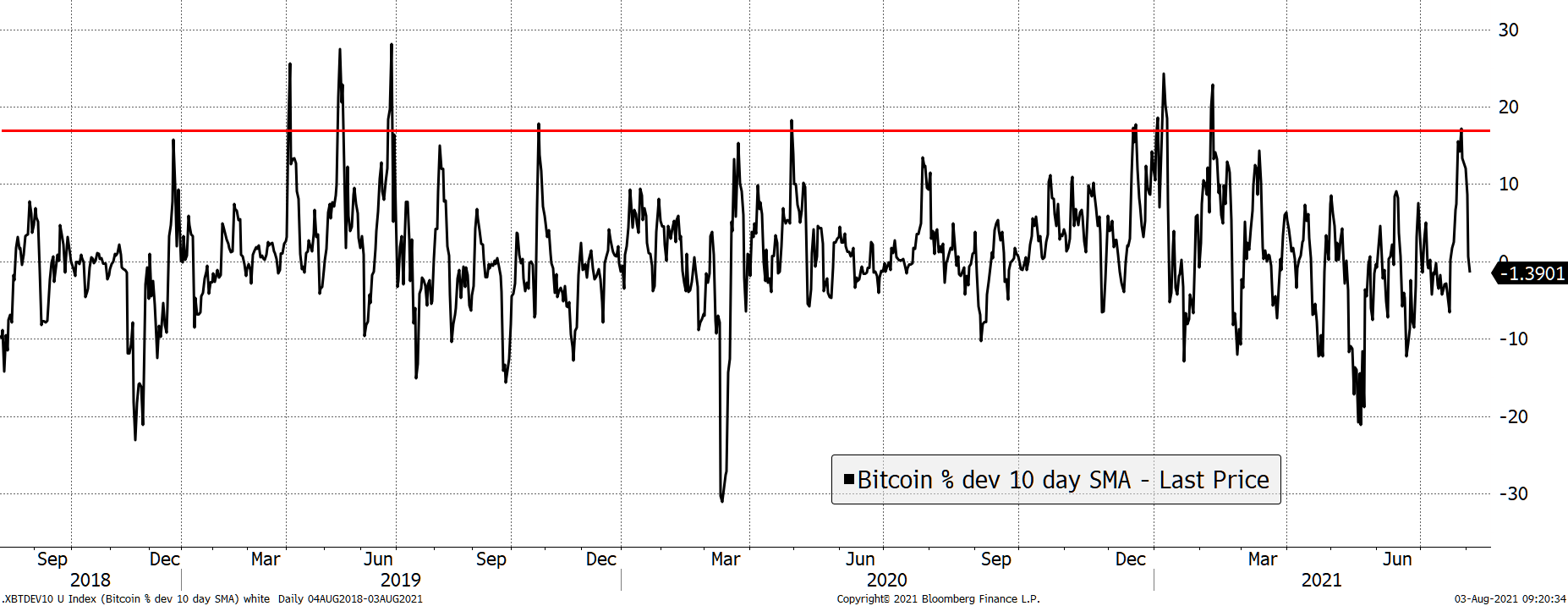

A high deviation from trend, either positive or negative, normally means a price has moved too quickly and needs to take a rest. To emphasise this point, we show the deviation from the 10-day moving average which reached +17%. That is the fourth highest reading in the current epoch, and only seen nine times over the past three years.

ByteTree ATOMIC

| Technicals | Price stalls after the surge |

| On-chain | Focus on velocity |

| Macro | Spiritual opium |

| Investment | Flows Neutral is not enough |

| Crypto | Breadth fires up |

Technical

The big rally stretched to $42k before reversing. First there was a move through the 30-day moving average, then a 20-day price high before a charge towards the 200-day moving average, which is where we find the post-April downtrend line.

Bitcoin trend

Source: Bloomberg. Bitcoin with 20-day max and min lines, 30-day and 200-day moving averages past six months

A high deviation from trend, either positive or negative, normally means a price has moved too quickly and needs to take a rest. To emphasise this point, we show the deviation from the 10-day moving average which reached +17%. That is the fourth highest reading in the current epoch, and only seen nine times over the past three years.

Bitcoin was overbought

Source: Bloomberg. Bitcoin deviation from a 10-day moving average past three years

Things are back to normal on this measure, and indeed on many measures. The price action is still in consolidation. A break below $34k (30-day ma) should urge caution, while a break above the red trendline to the upside, at $44k, will fuel a quick move to $50k. Recall there has been little trading between $40k and $50k so resistance has been thin.

On-chain

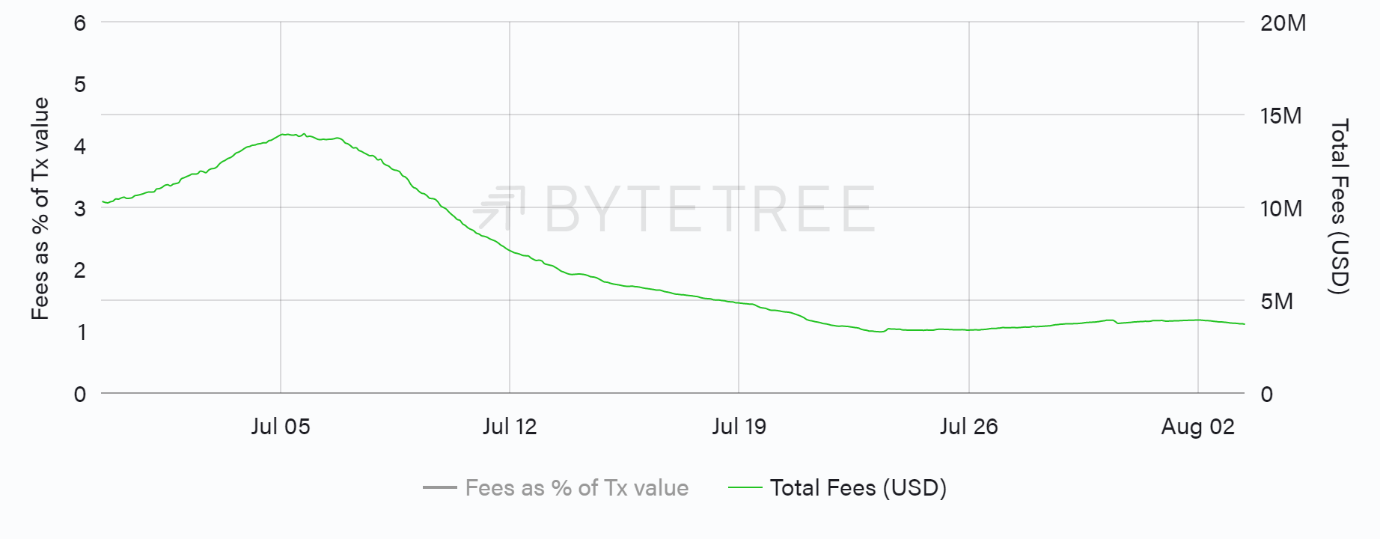

Bitcoin bull markets tend to coincide with rising fees. The recent rally saw fees rise, but already, transactions are being processed at $2 each. Recall how this was $50 in April.

Fees picked up two weeks ago but are already cooling. This may be short-term, but it is evidence against a sustained bullish move. It goes without saying that things can change quickly, but that is what we are currently seeing.

Fees cool

Source: ByteTree

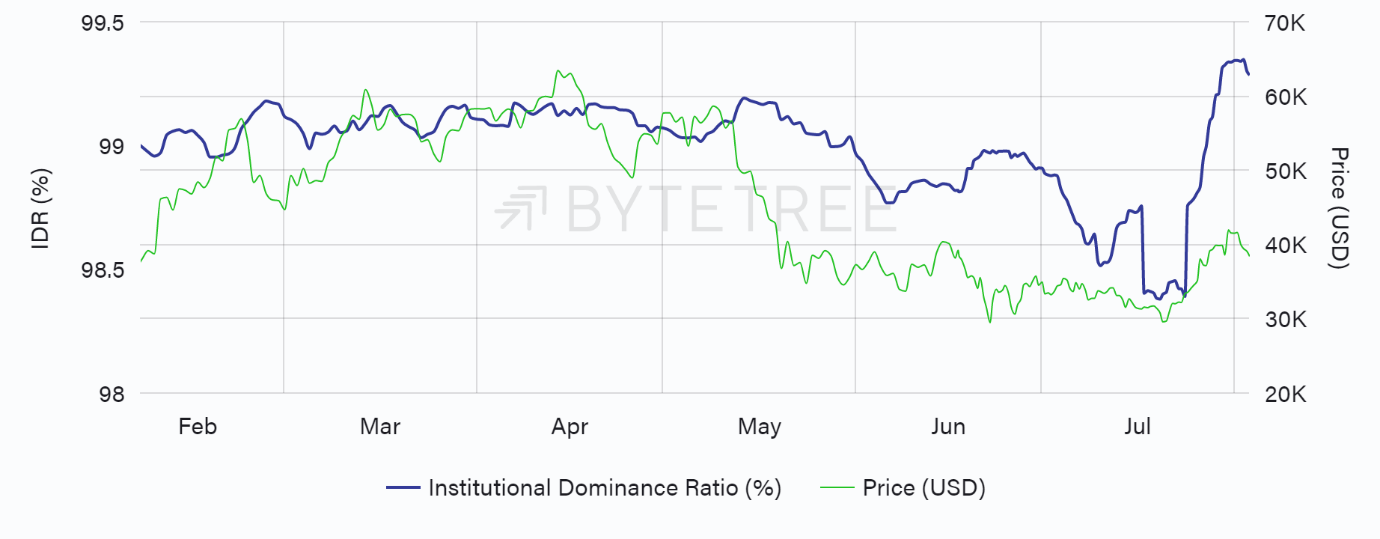

The most remarkably thing about the recent rally was the amount of big money that piled in so quickly. IDR jumped to the highest reading this year meaning that the new transactions were unusually large. This is confirmed by velocity which recently doubled, meaning twice the number of BTC were on the move compared to a month ago. This is network activity at its best, but can it last?

Institutional dominance soared

Source: ByteTree

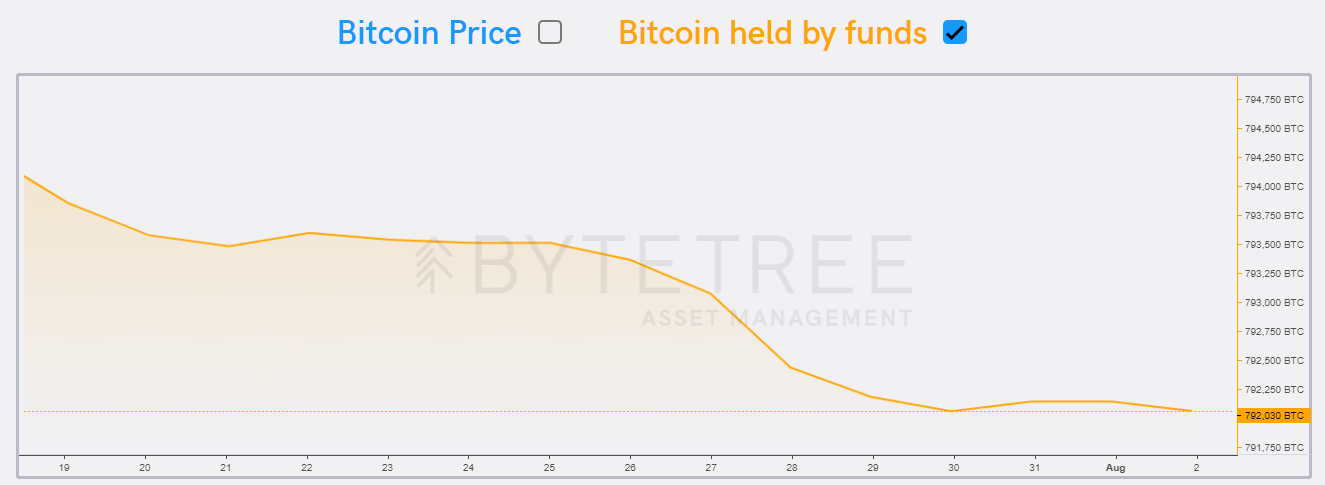

For whatever reason, the big guns bought Bitcoin. No doubt there was some short covering but there was also some outright heavy buying. What is strange is that there was absolutely zero increase in the investment flows, which would confirm confidence from the institutions.

Investment flows

Is it really possible that there can be a surge in on-chain demand, but an absence of institutional demand? Apparently so. The ETFs saw minimal outflows, but more importantly no inflows.

Source: ByteTree

Macro

The Chinese government described computer gaming as “spiritual opium”causing share prices of companies like Tencent to take a beating.

The crackdown may have started with crypto but has now moved way beyond into education, rents, wealth distribution and so on. It demonstrates how the Chinese Communist Party’s anti-crypto legislation was ideological as opposed to being economic.

Given crypto is pro-freedom, it stands to reason that those standing in its way are anti-freedom. We hope the regulators occasionally consider whether their personal beliefs align with those of the CCP or Churchill.

There are a few things brewing in macro, but the past few weeks have been broadly supportive. The dollar has softened as real rates have cooled (see last week’s issue) but the next challenge will be the US budget. It will be interesting to see how future spending, policy and stimulus discussions play out as Congress is forced to have that periodic conversation about balancing the budget and ever-rising debt levels.

Crypto

Tether is the tsunami that could sink this space, or at least cause severe damage. This is a podcast by Grant Williams. He interviews Bennett Tomlin, a forensic tether critic, and the Wall St legend George Noble. It is worth listening to because Tether is not what it seems, and the numbers are vast. If that was all there was to it, then fine. The problem is that the characters behind Tether are as dodgy as they come. What to believe?

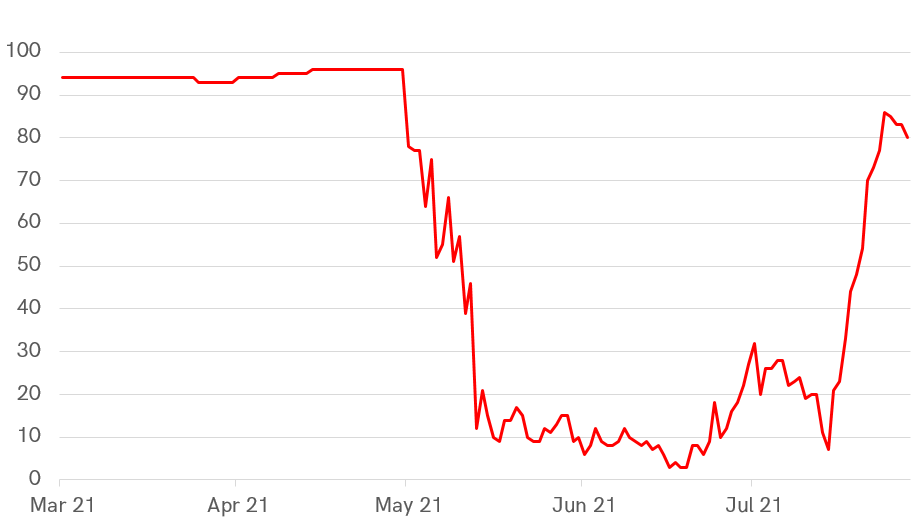

In better news, here is the updated breadth chart. The past two weeks have seen the number of cryptos that trade above their 30-day moving average rise back to 80%. This tends to stay high during bull markets but hasn’t reached the May levels quite yet.

Percent of top 100 crypto above their 30-day moving average

Source: ByteTree

This is an important chart that separates the signal from the noise. It will be added to PREMIUM in due course.

Summary

As Buffett says, it is when the tide goes out that you see who is swimming naked. It strikes us that a Tether failure is much more likely to happen with crypto on its knees, than when it is riding high. Hence if Bitcoin were to break below $30k, this is the sort of thing that would raise its head. But with a buoyant price, the pain will be postponed unless the regulators force its hand.

Despite decent price action, it is hard to see how Bitcoin can thrive without inflows, and the lack of fund flows helps us keep the dial at neutral for the time being.