Bitcoin Surges as Real Yields Collapse

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 8

Many picked up on Monday’s Bitcoin surge, yet few noticed the plunge in real interest rates to, on some time frames, the lowest levels ever recorded. Gold typically surges on such news, yet for the first time, Bitcoin did gold’s job. Is this a one-off or the start of something new? I’ll be investigating.

| Technicals | Price surge |

| On-chain | Blockchain kickstart |

| Macro | Record lows in real rates |

| Investment Flows | Moderate outflows |

| Crypto | Bitcoin leaves the tokens for dust |

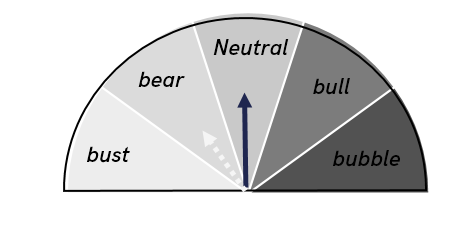

Having looked at the evidence, I am upgrading ByteTree ATOMIC to neutral, albeit with some caution. The bear case has been postponed.

Let’s look at the powerful price move.

ByteTree ATOMIC

Technical

A week ago, Bitcoin closed on the lowest price since New Year’s Day, only to stop and reverse. I previously highlighted that a price rise above $35k would mark a trend change. It managed to rally above $40k, which is impressive, although settling at $37k as I write.

Bitcoin trend

Source: Bloomberg. Bitcoin with 20-day max and min lines and a 200-day moving average 2021 year to date.

I would think the next technical hurdle is to break out of this triangle, marked by the $30k low and the downtrend since April. The lines converge at the end of this year. Which way and when? A positive move is now looking possible.

Trendlines for 2021

Source: Bloomberg. Bitcoin trendlines for 2021 log scale.

Volatility remains high, and so short-term trends are not to be trusted, but I feel the rally was too strong to doubt. It felt like a key reversal move. With a low to high of 38.3%, Fibonacci is at play. A break above $40k will see the trend break the downtrend with relative ease.

On-chain

Fees have turned up, which is good, along with transactions. Both rises are modest, but the important point is that they are no longer falling. Both fees and transactions remain low.

The Institutional Dominance Ratio (IDR) has picked up, which means large transactions drove the rally. This pick up in activity has been price-driven, and so there are few on-chain nuggets at this time.

Yet, the price is still roughly twice as high as on-chain activity. If it turns out to be real, I am confident that activity will pick up. This would be a rare case of price leading the chain. It has generally been the other way around.

Of some note, inventories are rising, and the miners have saved up 2,500 BTC with rising inventories. This discipline from the miners not selling into price weakness has been somewhat price supportive. I suspect they will unload soon.

Macro

Last week I was saying how it was gold’s turn to shine. I highlighted how my gold valuation model was $124 above the gold price. Bitcoin is supposed to like a shift to risk-on while gold prefers real rates to fall, which are typically a risk-off phenomenon.

This week that gap has grown to $215, while the gold price has remained flat. Never have I witnessed gold drop to a discount while its fundamental value (falling real yields or TIPS prices rising) has been rising. Discounts normally open up during bear markets rather than bulls.

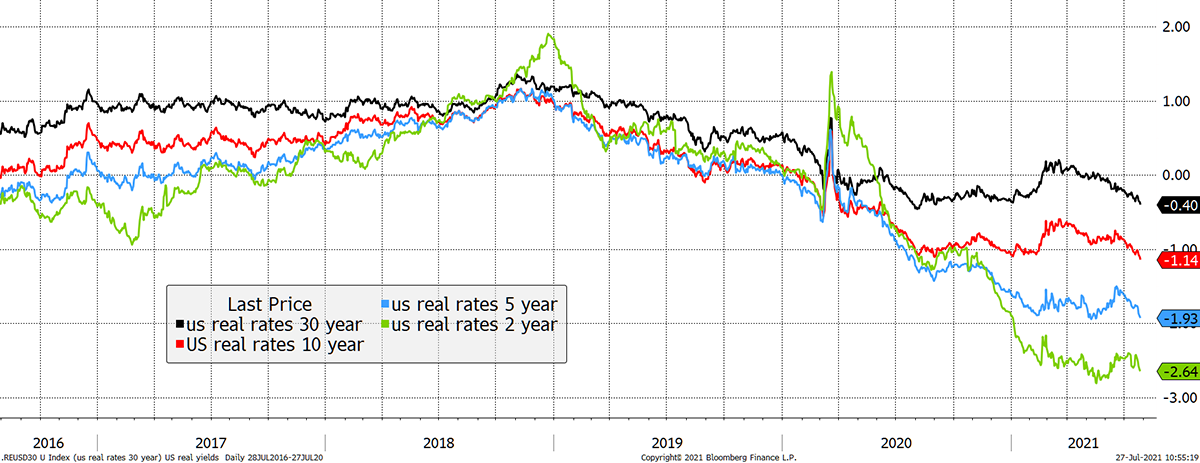

Here is the two-year real yield (2-year bond yield less 2-year expected inflation). It is -2.6% and recently started falling again. That is bullish for asset prices.

The twos in deep negative territory

Source: Bloomberg. USA two-year real yield (bond yield less breakeven) since 2005.

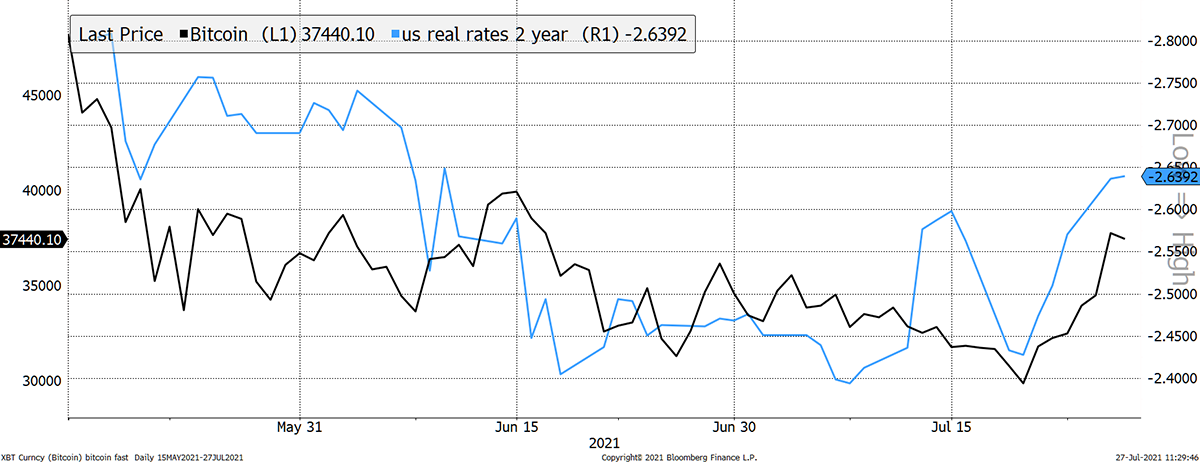

Notice how the peaks in the 2-year real yields served as Bitcoin buy signals. The end of 2014/15/18 and March 2020. All of these marked powerful lows.

The tops in the twos have been price supportive

Source: Bloomberg. USA 2-year real yield with Bitcoin since 2013.

It all points to Bitcoin having an increasing monetary role. That makes it more credible to institutional investors because they can point to something from the real world that would boost portfolio diversification. In this case, a hedge against deep negative rates will have appeal.

Putting the 2s alongside longer-term real rates, they have been leading the way down against the 5s, 10s and 30s.

Longer-term real rates are “catching down”

Source: Bloomberg. USA 2,5,10 and 30-year real yield since 2016.

My research has led me to believe gold responds best to the 20-year real yields, and evidence is building that Bitcoin is responsive to the shorter-term measures. Notice how the high for the 2s occurred a week ago. The next day it turned lower, and Bitcoin began to rally. On the chart, I show the 2s INVERTED.

The 2s and Bitcoin are becoming a closer thing

Source: Bloomberg. USA two-year real yield inverted (bond yield less breakeven) and Bitcoin since 16 May 2021.

I am going to write about gold tomorrow in the non-premium weekly email. If you haven’t already heard my gold valuation thesis, you may find the background helpful. One of the key Bitcoin “digital gold” arguments is that it will eventually adopt a gold-like valuation framework. That is, it moves away from adoption measures and locks onto macroeconomics.

That will take years to complete, but a link to the macro real world would see enormous portfolio inflows and drive the price higher. The 900k BTC coming to market by 2024 would be swallowed up in a heartbeat if institutions decided to allocate en masse.

Investment flows

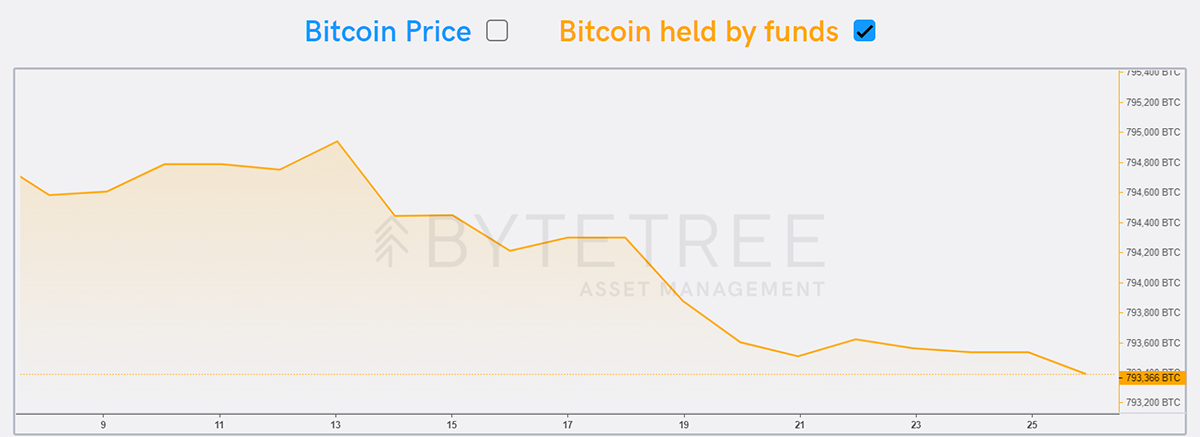

But that hasn’t happened yet, and currently, flows remain weak. I agree the outflows are moderate, but they need to turn up to support a bullish case. I would struggle to see how 2021 could end up strong without positive flows.

Source: ByteTree Asset Management. Bitcoin held by funds, since 8 July 2021.

In other news, the Grayscale Premium (GBTC) had a strong day coming in from a circa 10% discount to 5%. This is a sign of a tighter market, but these are still early days. Don’t forget how a premium used to be the norm during the good times.

Grayscale premium shrinks

Source: ByteTree Asset Management. Grayscale Bitcoin Fund (GBTC) discount to net asset value since the end of 2018.

There’s also the positive driver from the end of GBTC’s share issuance. If they aren’t printing shares anymore, this discount would close into a bull market.

Crypto

Such was the strength of Monday’s rally that our crypto technical model registered no relative highs (coins in front of Bitcoin), and dozens of relative lows. That just tells you it has been all about Bitcoin this week. The rest of the space will have to wait until its turn.

Disclosure: I closed my modest short in Microstrategy (MSTR). Share price $650. Implied value of shares at current Bitcoin prices, $281. Never fight the market.

Summary

I have upgraded Bitcoin to neutral on the ATOMIC process. That is not quite a bull market but an acknowledgement that the bear case has been fought off for the time being.