The Bitcoin Network Slumps

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 79

ByteTree data collected on Saturday 29 May confirmed the ByteTree Network demand model had downgraded to a score of 2 out of 6. That means Bitcoin’s underlying network activity has slumped. I shall highlight a few major developments, but please see the Network Demand Model for more information. This is what we are seeing.

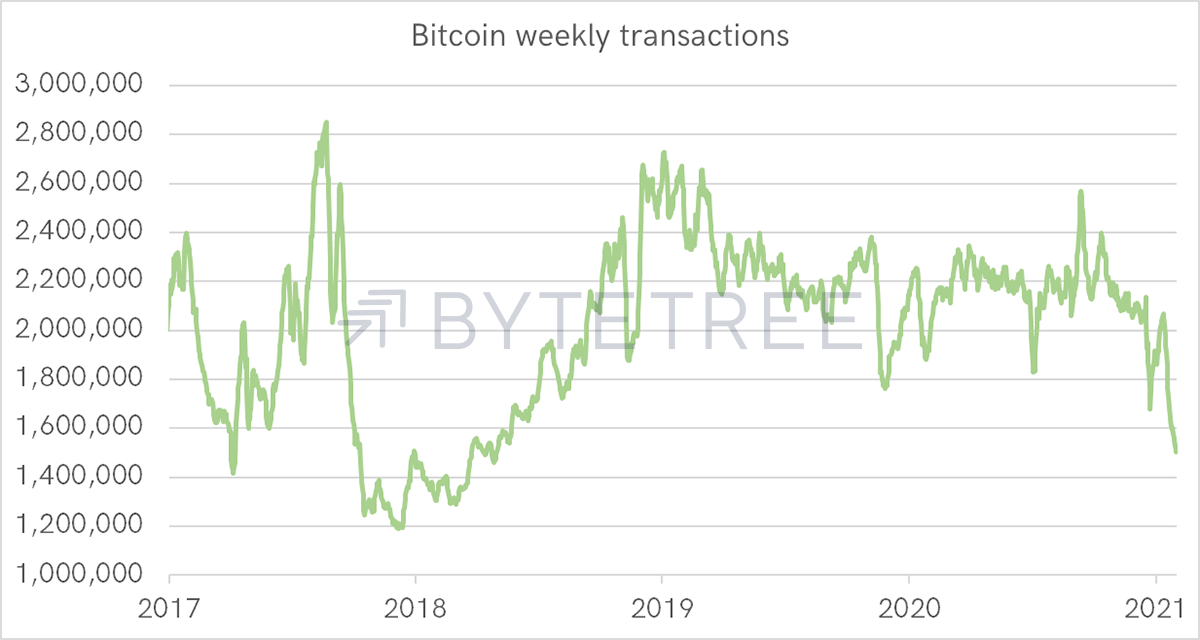

On-chain transactions have dropped off a cliff. The 4-year average, which includes a slump in 2018, is 1.67 million transactions per week. Last week saw 1.51 million. Notice the sharp decline following the late 2017 Bitcoin price peak.

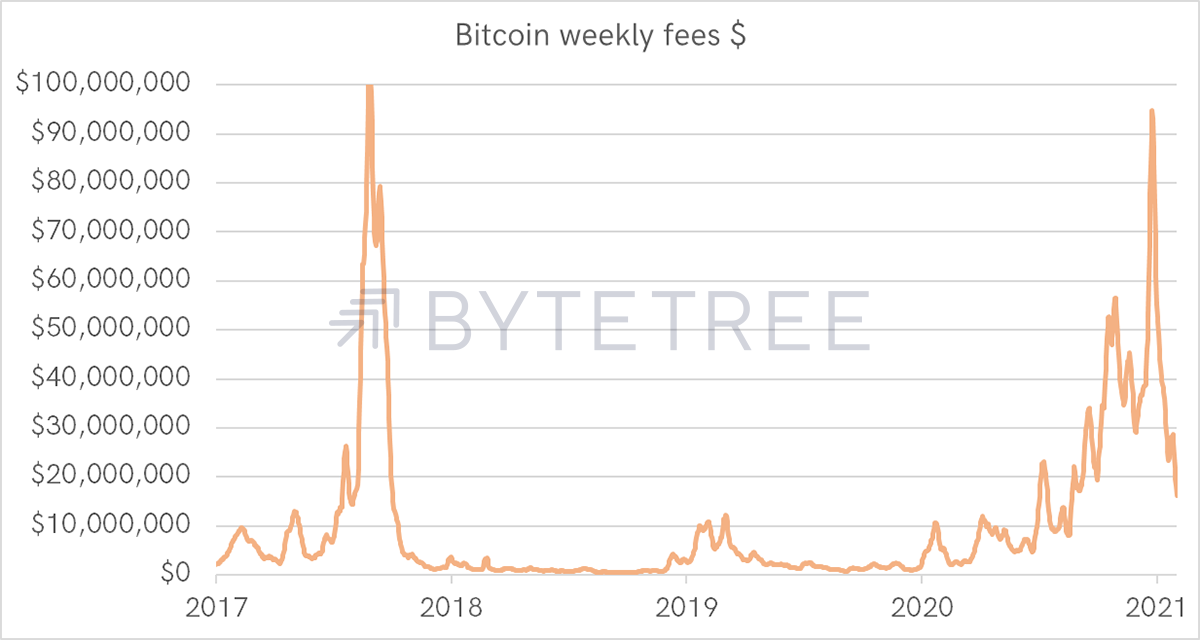

Some may point to the recent mining outage in China, which caused a bottleneck on the blockchain. That meant fewer blocks each day to process transactions. The typical result is higher fees as there is more competition for transactions to be confirmed on the blockchain.

Not this time as fees have collapsed. Today, the average transaction fee is going through the blocks at $7.56, having been over $50 in April. Once again, there are strong parallels with the aftermath of late 2017.

These are the core observations, but there are many more on our site. ByteTree has invested a huge amount of time and energy optimising the interpretation of on-chain data, which is the basis for the Network Demand Model.

This downgrade of “network health” means ByteTree officially sees Bitcoin in a bear market. Historically, we have seen the price hold up for weeks, or even months, following a significant fall in network activity. Still, the network and the price have never been able to diverge for a sustained period.

There is one hope, and that is we witness a significant pickup in on-chain activity. If that happens, ByteTree will be only too delighted to see a bullish signal reemerge.

The narrative versus the facts

The Bitcoin narratives see a perfect hard asset where price appreciation is coded into the system. There will be mass institutional adoption, perhaps even central bank adoption. Add in endless money printing (brrrrrrr), and all roads lead to lofty price targets.

I disagree with these narratives. Lofty price targets are pointless, misleading, unknowable and often (but not always) dishonest. Anyone touting them should be given a wide berth.

Bitcoin is a hugely volatile asset, and that hasn’t changed. Volatility, the statistical measurement, refers to the size of typical daily moves. That is high compared to mainstream assets, and the bullish narrative has even started to spin this into a good thing, as if only volatile assets can go to the moon. That is simply not true.

Amazon, and many other great stocks in recent years, have seen spectacular performance without much volatility. That is because price volatility is linked to certainty. The reason the Googles and Apples have surged on low volatility (brrrrrrr aside) is because the market knew that next year’s profits would be higher than last year’s, with a relatively low risk of material disappointment - hence few surprises and moderate price volatility.

Tech valuations may be high, but I suspect the real collapse in the sector will not get going until certainty shifts to uncertainty.

For Bitcoin, aside from halving events (every four years, the new Bitcoin supply is halved) the future is entirely uncertain. That is why volatility has been so high, especially during the booms and busts. It will remain high outside of the consolidation periods that occur in between the booms and busts.

The other kind of volatility, one without a well know financial statistic, is the investor’s heartbeat, panic attacks and euphoria across cycles. For Bitcoin, it isn’t just high, it’s off the scale. I’ll refer to this as cyclicality.

For Bitcoin to mature into a mainstream asset, both price volatility and cyclicality need to fall significantly. If that happened, there would be more institutional adoption, and lofty price targets might start to look more credible. I promise you; Bitcoin’s price forecasts are not embedded into the code. They remain entirely unknown, and that will never change.

Profiting from a cyclical asset

Investors accept that companies in shipping, steel, energy and mining (especially gold and silver mining) rise and fall by multiples over the cycle. Picking the highs and lows isn’t easy, but it’s not hard to capture some of the gains while avoiding most of the losses.

Bitcoin is a cyclical asset.

People think Bitcoin is an ultra-high return asset because they often use pre-2013 data to flatter historical returns. I know they happened, but they will never be repeated. Bitcoin may continue to appreciate over the long term, but there is no guarantee. (FWIW, I’m still a believer).

For those that bought a Bitcoin at the top of the last cycle (17 December 2017 at $19,000), they doubled their money. Who did? Surprisingly, many did, for that’s what bubbles do. Double money since late 2017 is about 20% less than a NASDAQ ETF. But still, nice trade.

But imagine the heartache associated with the cyclicality endured. Over the next three years, their $19,000 went to:

| BTC Price ($) | Date | Change (%) |

|---|---|---|

| $3,156 | by November 2018 | -83% |

| $12,773 | in June 2019 | +305% |

| $4,904 | by March 2020 | -62% |

| $63,419 | by April 2021 | +1193% |

| $37,000 | today | -42% |

There is no way that ByteTree, nor anyone else, could perfectly catch these highs and lows to perfection. But you only need to catch a portion of it to do much better. Imagine a half-decent strategy that reduced both the falls and the gains such that:

-83% becomes -50%

305% becomes 220%

-62% becomes -40%

1193% becomes 700%

and finally,

-42% becomes -42%

These are not particularly ambitious achievements, and ByteTree aims to do much better. The remarkable outcome of trimming losses, and in this example trimming gains too, sees that dude who bought at the $19,000 December 2017 peak, ending up looking quite clever. Today they’d have $100,000, which is multiples better than the NASDAQ.

My point is that Bitcoin is a cyclical asset, and this is highly unlikely to change in the next five years. It will go up and down, and that’s the opportunity. Back in 2017, the next turn in the trend didn’t come for over a year. ByteTree’s on-chain bullish signal didn’t appear until 3 April 2019, which was 470 days after the peak.

I sincerely hope we don’t have to wait that long, this time. There is far more interest in the crypto space, and it has much more credibility. There is also more demand for alternative assets, and there is more innovation.

But experts in shipping or gold mining may only see half a dozen cycles over a whole career. They are probably expert in understanding the cycle but rarely get to profit from that skill. Crypto is cyclical but comes around every four years or so. It really doesn’t get better than this. Cyclicality that keeps on coming.

I believe crypto is an ongoing and vitally important experiment in constructing an alternative financial system. It will succeed, but it will continue to be a roller coaster rise until we get there. Some parts will be adopted by the old world, while other parts will be rejected.

Which parts?

I don’t yet know, but I am keen to find out, and to do that, that means following the space. Many coins will blow up (financially), and there will be future winners that have not even been conceived. The most important thing to remember is that the highest gains are awarded to the early adopter. If you hear it from an Uber driver, you may be too late.

Just because crypto is probably entering a resting phase, this is the best time to learn and to prepare for the next bull run. ByteTree Premium is coming soon.