Ethereum's DeFi Domination

Disclaimer: Your capital is at risk. This is not investment advice.

Part II: Understanding the Size and Role of Ethereum's Largest dApps;

In part I of this series, we showed readers how Ethereum’s applications layer sets it apart from The Bitcoin Network. This is achieved primarily through its smart contracts, which enable developers to build financial innovation through decentralised applications, also known as dApps. In part II, we will provide readers with a deep dive into the ecosystem of digital applications, analyse the potential value generated from financial dApps on the Ethereum network and their capabilities to disrupt traditional finance.

DApps and tokens have greatly enhanced Ethereum’s utility and the value it provides to the digital economy. DApps enable users to put their assets to work through financial products like lending and borrowing protocols. Tokens and exchanges, which we will discuss in part III of this series, permit investors to have a stake in these dApps and influence their governance outlooks; this, in our view, will be more appealing for large institutions.

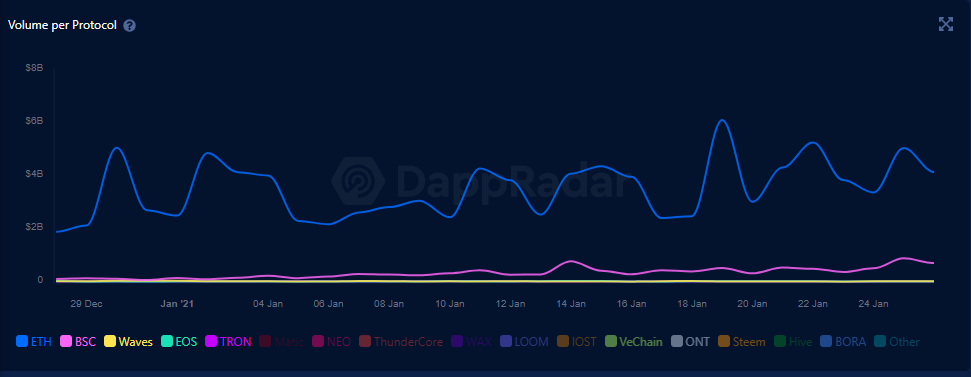

Ethereum Leads dApp Volume

The chart above shows the total dApp volume across top blockchains and their smart contracts. As we can see, Ethereum currently leads the race with $billions more volume than its closest competitor, the Binance Smart Chain (and its token $BNB). This shows that the investment opportunities for dApps and tokens are not exclusive to the Ethereum blockchain; although distribution favours Ethereum for the time being, we expect there to be greater competition in the near future.

What is driving the Dapp Transaction Volume?

We are in the early adopter stage of digital financial instruments. To date, Ethereum applications have experienced mostly organic user growth, meaning that new users have found these applications through internet searches, online communities and word-of-mouth. DApp adoption has primarily originated from two main groups of digital asset participants; Bitcoin users who want to put their assets to work and native Ethereum users.

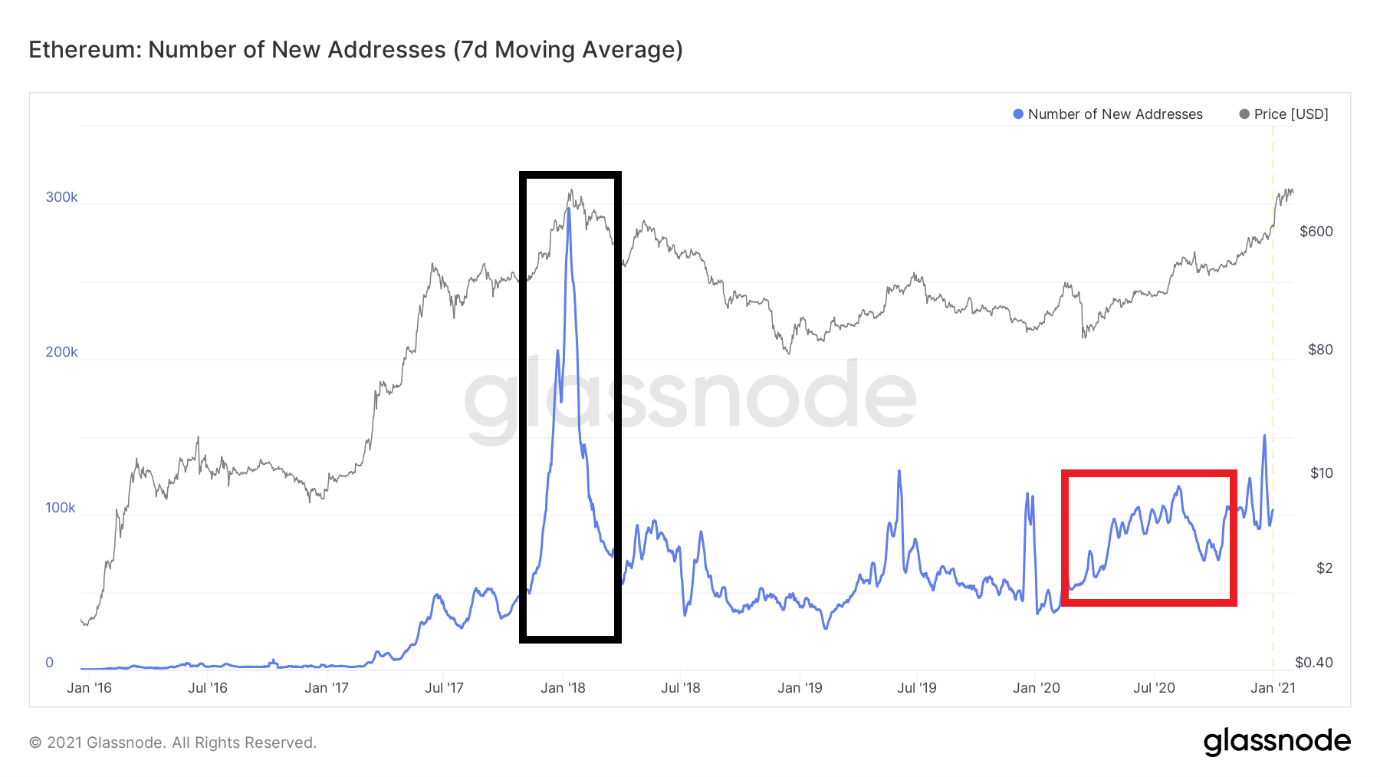

The chart above demonstrates the creation of new addresses on the Ethereum Network, from January 2016 to present day. The spike on the left correlates with the previous ETH all-time high ($1300) in 2018, which also saw a further 300,000 new addresses being created. However, the narrative around the most recent all-time high is different as it has not induced an influx of new addresses, as we can see to the right of the chart. This is surprising since ETH has returned holders over 80% since the start of 2021. Had it not been for the DeFi Summer spike, within the red box above, the number of active users would not even close to challenging the 2018 bull run.

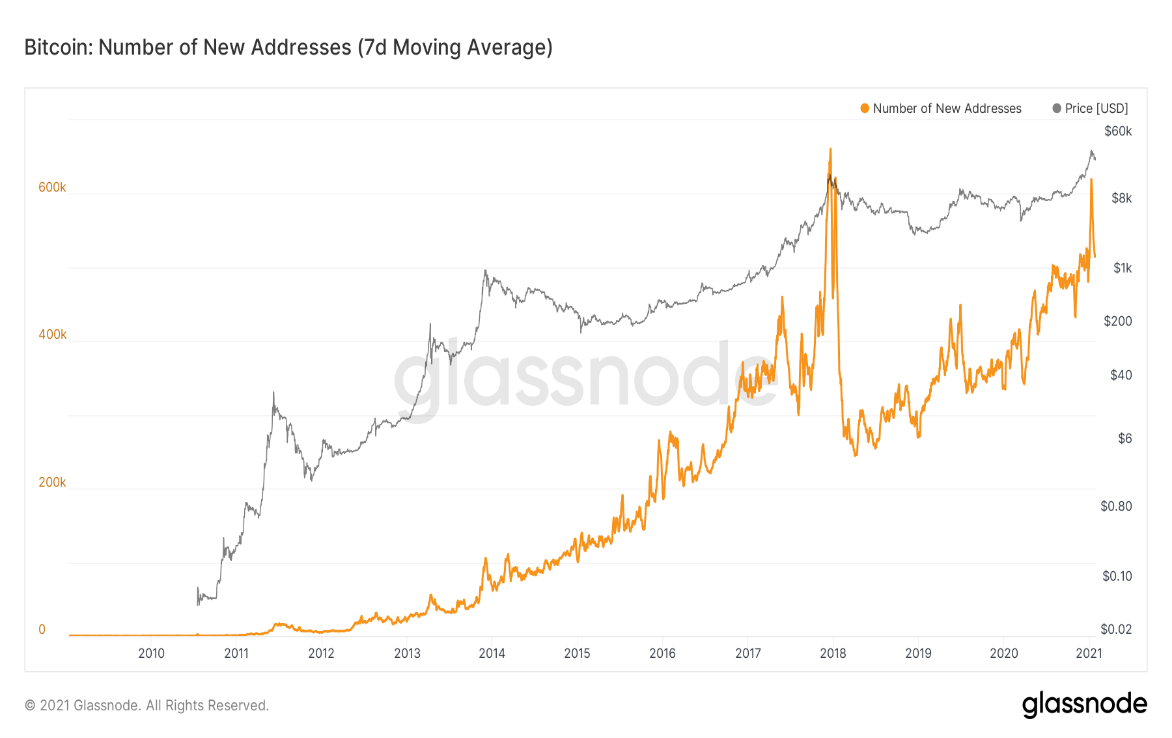

Bitcoin’s current bull run has also been described as ‘different this year’, reaffirming the sentiment around Ethereum. Institutional adoption from the likes of Stanley Druckenmiller and Michael Saylor’s Microstrategy have been the primary driver for the sharp uptick in Bitcoin since mid-2020. This institutional buying power has attracted new users into the digital economy, and subsequently to Ethereum as investors seek out “the next bitcoin”.

Ethereum offers an additional step in generating returns within the crypto asset markets, predominantly through providing access to yield generating products – one sector within the realm of Decentralised Applications (dApps). While Bitcoin has had the upper hand so far this cycle, we expect to see the rate of Ethereum-address-growth increase further as new entrants filter through Bitcoin and towards the Ethereum network in the coming months.

Bitcoin Adoption Is Good for the Entire Ecosystem

The chart above compares the total addresses of three digital assets; Bitcoin, Ethereum, and Litecoin. Bitcoin dwarfs other networks with its total addresses, but as Bitcoin grows, other digital assets tend to follow a similar trend (see marked area). Therefore, it is likely that the uptake in new Bitcoin addresses will continue to cause blanket adoption for other assets also in the future. We expect Ethereum to benefit the most from this, as it has the second-largest network value at $150bn (according to CoinGecko).

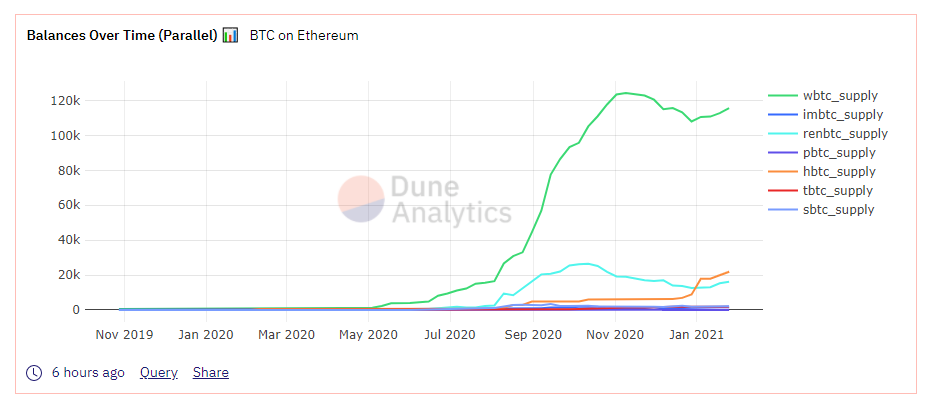

Bitcoin has been driving dApp volume on the Ethereum Network through several implementations of tokenised Bitcoin, used as a native reserve asset due to its lower volatility relative to other assets within the ecosystem. In most cases, these tokens are created as ERC-20 tokens on the Ethereum blockchain, making them directly redeemable for mainnet Bitcoin. The popularity of these alternatives is apparent; The total value of wrapped bitcoin on Ethereum is equivalent to 3.5% of Ethereum’s total network value. (according to Dune Analytics). Most importantly, these tokens provide investors with a way to put their assets to work on Ethereum’s financial dApps.

Positive sentiment on the long-term success of digital assets can be seen through the continued growth of tokenised Bitcoin on the Ethereum blockchain. The chart above shows that there are now over 159,055BTC, or just under 1% of the total BTC supply, being used on Ethereum dApps. Readers should know that the network value of all tokenised Bitcoin is over $4bn, which currently places it in the top 15 digital assets on Coingecko.

DeFi holds the Most Valuable DApps

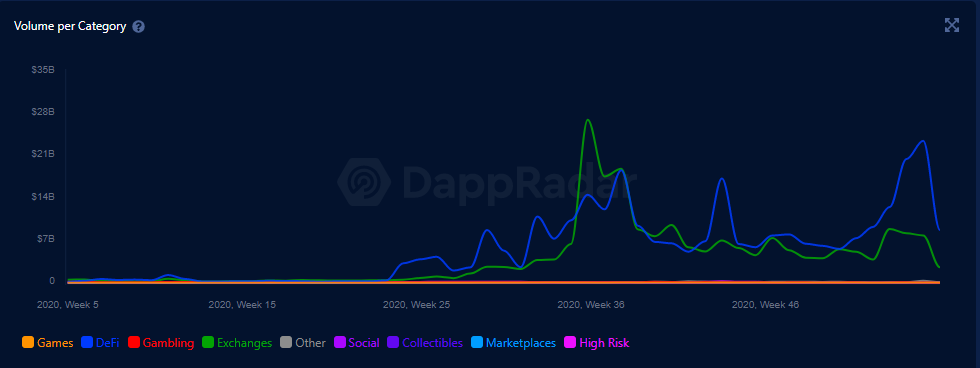

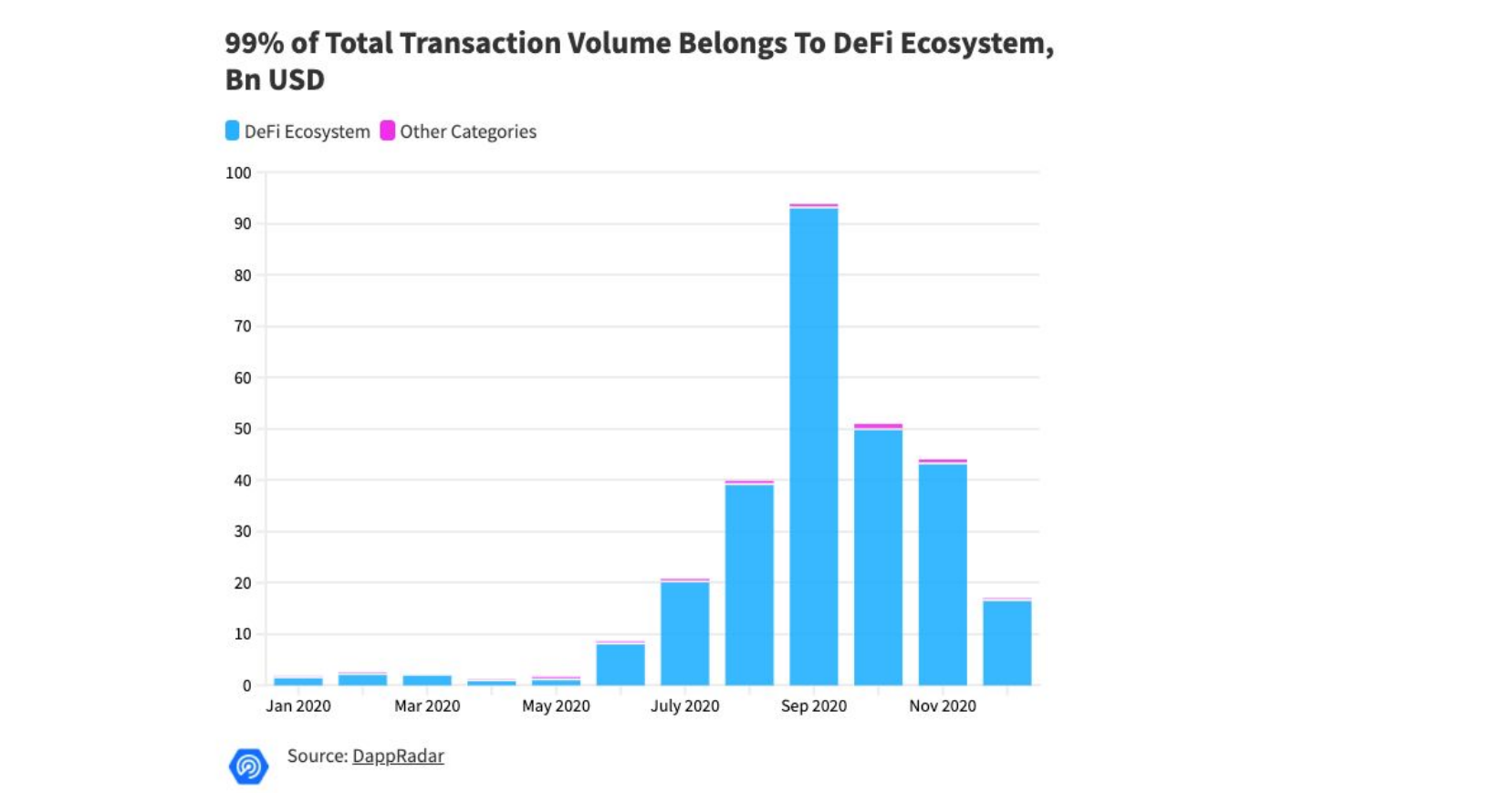

At present time, Decentralised Finance Applications, or “DeFi”, contribute the majority of trading volume within the dApp ecosystem. The main driver of this growth has been Compound.Finance, a lending and borrowing protocol on Ethereum, implemented at the start of summer 2020 (also known as the ‘DeFi Summer’).

The chart above shows the distribution of incoming volume to dApps on multiple blockchains over the last year. As we can see, DeFi and DEXs have dominated the space with aggregate volumes ranging from $3.5bn to $30bn.

According to DappRadar, the DeFi ecosystem accounted for over 95% of dApps volume in 2020, which is equal to $270bn. Not only does this put into perspective how large of a role Ethereum has in modern financial innovation, but it also illustrates the cause of its scalability issues.

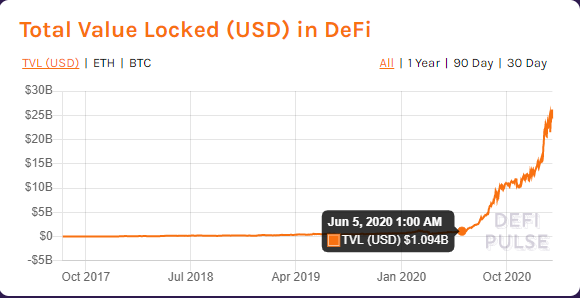

DeFi Has Presented a Multitude of Investment Opportunities

With the current momentum and clear growth potential of the DeFi ecosystem, it is safe to say that there are a number of investment opportunities to be had for savvy investors.

The chart above shows that the total value locked (TVL) on DeFi has seen exponential growth since the DeFi Summer. Although DeFi is a relatively new concept, it gained $1bn in TVL in just under 3 years. Currently, this would put the sector in the top 40 most valuable networks, according to CoinGecko. However, in the last 7 months, the TVL has skyrocketed from $1bn to over $25bn which would rank DeFi as the 3^rd^ most valuable digital asset network.

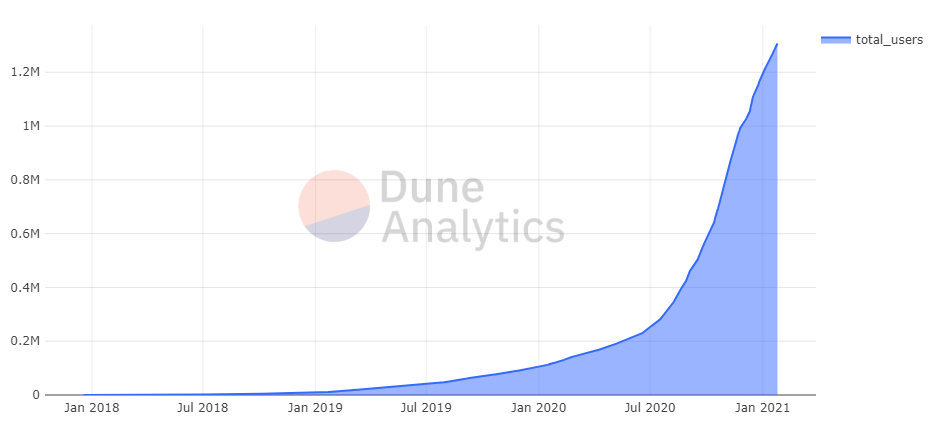

While the rate of growth of new Ethereum addresses has been constant, DeFi addresses have skyrocketed through a market-wide bull run. This is surprising as we would expect investors to draw profits on their assets through exchanges, rather than have them locked inside DeFi smart contracts. This indicates that users who participate in DeFi tend to put their digital cash to work, without the intention to leave the digital economy. It is possible that this reflects the sentiment of the broader macro-economic concerns investors have, particularly when it comes to loose global monetary policy and record levels of fiscal stimulus, as shared by Coindesk:

“Bitcoin (in October 2020) showed resilience in the face of a risk off environment caused by uncertainty in the stock market” [paraphrased]

| Token | Outstanding Loans ($) |

|---|---|

| DAI | 2,658,964,651 |

| USDC | 1,090,214,631 |

| USDT | 309,440,848 |

| WETH | 184,423,444 |

| WBTC | 126,235,135 |

| LINK | 75,723,512 |

| TUSD | 53,752,830 |

| YFI | 26,625,692 |

| ZRX | 24,902,957 |

| BUSD | 19,830,264 |

Source: Dune Analytics. The total outstanding loans on DeFi. Reformatted into a table by ByteTree.

As we can see from the table above, the aggregate stablecoin loans, which aim to mimic the price movements of the US dollar, outweigh Bitcoin loans by billions of dollars in value (see CoinGecko; prices accurate as of 27 January 2021). This is partly due to yearly lending returns on stablecoins being vastly superior to digital assets like Ethereum and Bitcoin

| Project | Outstanding Loans ($) |

|---|---|

| Compound | 2,204,031,715 |

| MakerDAO | 1,577,059,438 |

| Aave | 782,144,235 |

Source: Dune Analytics. Current outstanding loans on the top three DeFi projects. Reformatted into a table by ByteTree.

Overall, there are around 4.5 billion outstanding loans on the top three DeFi protocols. According to Dune Analytics, approximately 90% of them are for the top three stablecoins: DAI, USDC and USDT. With the next bearish cycle anticipated to accelerate DeFi usage significantly, along with the growth seen in protocols like Cream.Finance, we can expect these outstanding loans to grow exponentially.

Decentralised and Centralised loan providers, like Compound and BlockFi, have serious potential to disrupt loans and traditional banks; both avenues facilitate accessibility which is superior from any traditional financial products.

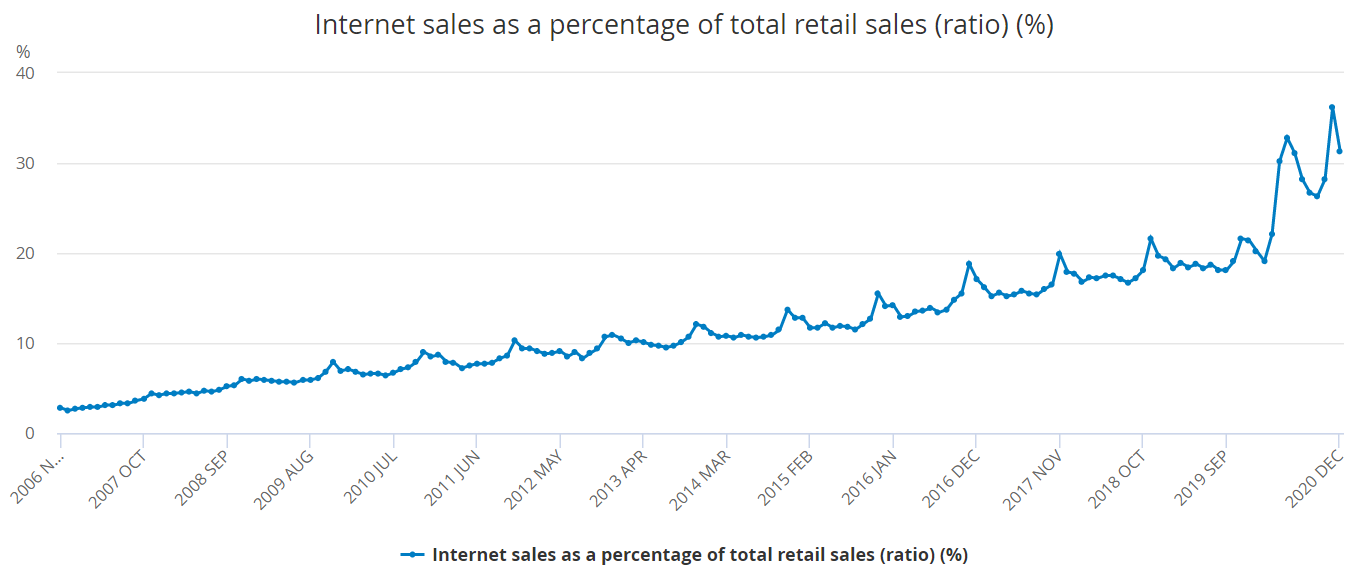

The traditional world of finance is no stranger to disruption; the chart above shows the rapid decline of high street retail sales in relation to online retail sales over the last decade. If DeFi drives a similar trend in financial products, then we would expect the sector to further capitalise on the future influx of new users as its potential becomes realised. Since DeFi is primarily based on the Ethereum Network, we would also expect to see Ethereum benefit from this greatly.

Ethereum has Great Promise, but a Long way to go

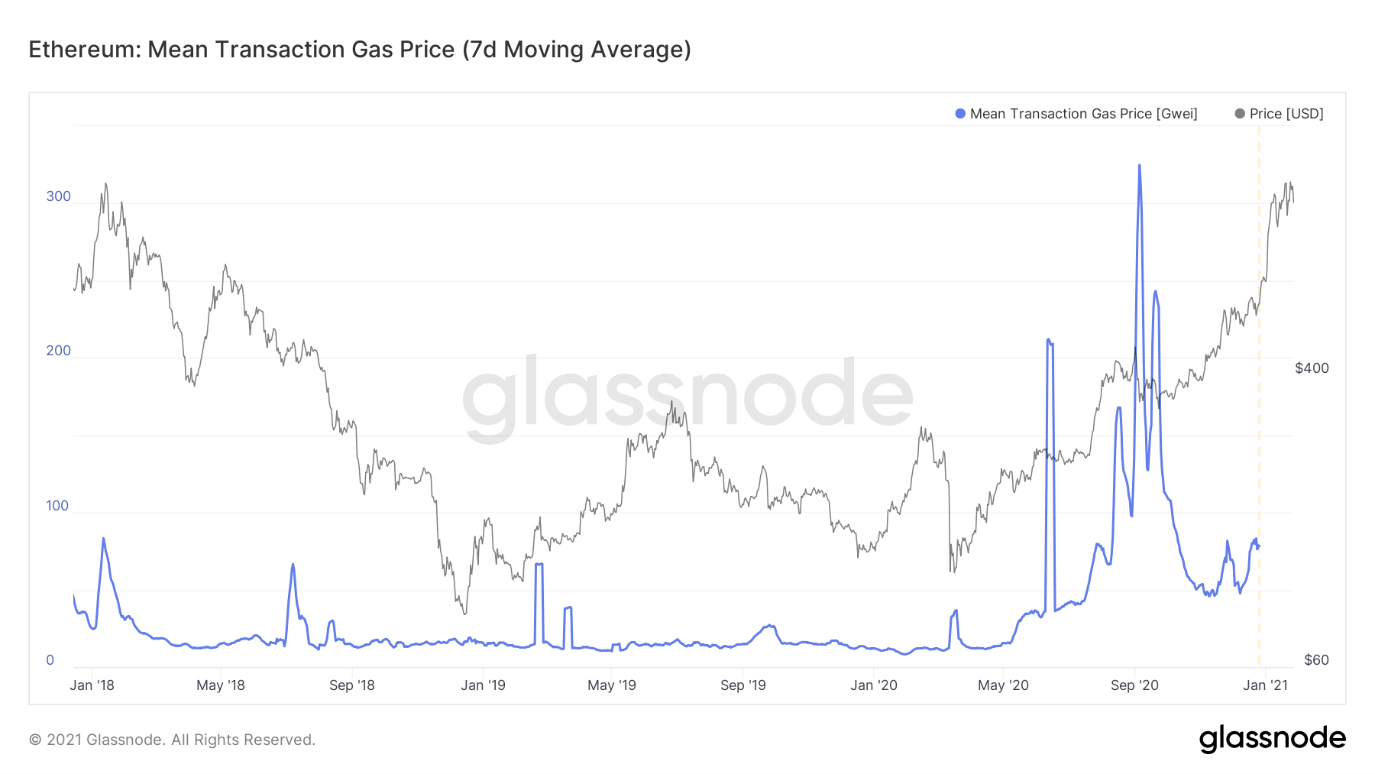

As I have touched on in a previous article, Ethereum’s dApp dominance comes as both a blessing and a curse. Ethereum has experienced issues with scalability on multiple occasions, culminating in CryptoKitties (NFT)bringing the network to a standstill in 2017. It became almost impossible to have a transaction written to the Ethereum blockchain. The creators of CryptoKitties for one have since learned from that experience, and recently released their new blockchain to remove their Kitties, and other future products, away from Ethereum to Flow.

The chart above clearly shows that the fees from 2017 are incomparable to the spikes we have experienced over recent months. This is because NFT dApps shy in comparison to the volume seen on Ethereum’s two most popular applications, DeFiand DEXs.

Ethereum developers have recognised the flaws on their network and have several proposed fixes for these scalability issues, most significantly ETH 2.0 and EIP-1559. Although these new features offer the best solutions, they require years of development and application before they will be implemented. While Ethereum struggles to fix its scalability challenges, the door is open for competing protocols to take significant market share. Investors should be aware that there are a number of opportunities to capitalise on.

Summary

Ethereum continues to lead the entire dApp ecosystem and, in particular, enables investors to put their digital cash to work in a market which is on course to disrupt open finance. While smaller sub-sectors like NFTs are moving away from the Ethereum Network, Ethereum continues to offer a great deal of value to investors through the financial dApps it supports. We recommend that enthusiasts and investors alike continue to follow developments on Ethereum closely.

In the next part of this series, we will take a closer look at Decentralised Exchanges (DEXs) and how they have taken trading volume from their centralised counterparts using token-based incentive mechanisms and yield generating opportunities.