The NFT Landscape

Disclaimer: Your capital is at risk. This is not investment advice.

Hunting for the next digital Picasso;

A non-fungible-token, or NFT, is a token that represents a unique asset. NFT holders have strong digital ownership of these individual assets, and this ownership generates value for investors. This article will help readers to understand why NFTs are beneficial to investors and evaluate the variety of asset opportunities in the ecosystem.

NFTs on the Ethereum blockchain are usually one of two token types; ERC-721, and ERC-1155. The slight difference between these two tokens pertains to their fungibility. An ERC-721 token is completely non-fungible, which means that the token represents a unique asset. With a multi-standard ERC-1155, the tokens are ‘semi-fungible’ which means that the asset they represent can be both fungible (unique) and non-fungible (generic). An early example of an NFT is CryptoKitties, which is a platform where users can mint, breed, and trade virtual kittens. These kittens are all unique and cannot be duplicated. The most expensive CryptoKitty sold in September 2018; ‘Dragon’ kitty at the time sold for $170,000 (600 ETH). This sale shows that NFTs can have tremendous value.

How do NFTs Generate Value?

It is worth noting that there are different types of NFTs, and the main two, art and game NFTs, generate value in different ways. Overall, immortality generates value for all NFTs. Game NFTs such as CryptoKitties generate value through the journey of the individual NFT and the secondary market that the platform interacts with. Game NFTs can also generate value through the utility they offer, for example, Axie Infinity allows holders of their in-game ‘monsters’ to compete against other players in a turn-based game with the hope of being rewarded with DAI.

Art NFTs generate value for investors in similar ways to traditional art. The value of ‘real-world’ art is well proven; the ‘real-world’ art market was worth $67.4bn in 2019 and generates value for its collectors through the artist behind it, the historical significance, and sentiment. NFT art is no different; it creates value for investors in all the same ways but fixes one major issue with traditional arts portability.

How Liquid is the NFT Market?

Secondary markets that have been created to sell, mint, and buy all types of NFTs are significant because they create value for the landscape by making NFTs readily available to buy and sell. Digital ownership on the blockchain is a driver for NFT adoption; this enables users to hold a personal copy of an asset. For example, buying a ‘real-world’ gold bar will likely mean that it is stored in a Swiss vault, while, tokenising that gold bar gives users complete sovereignty, and this is incredibly beneficial to investors.

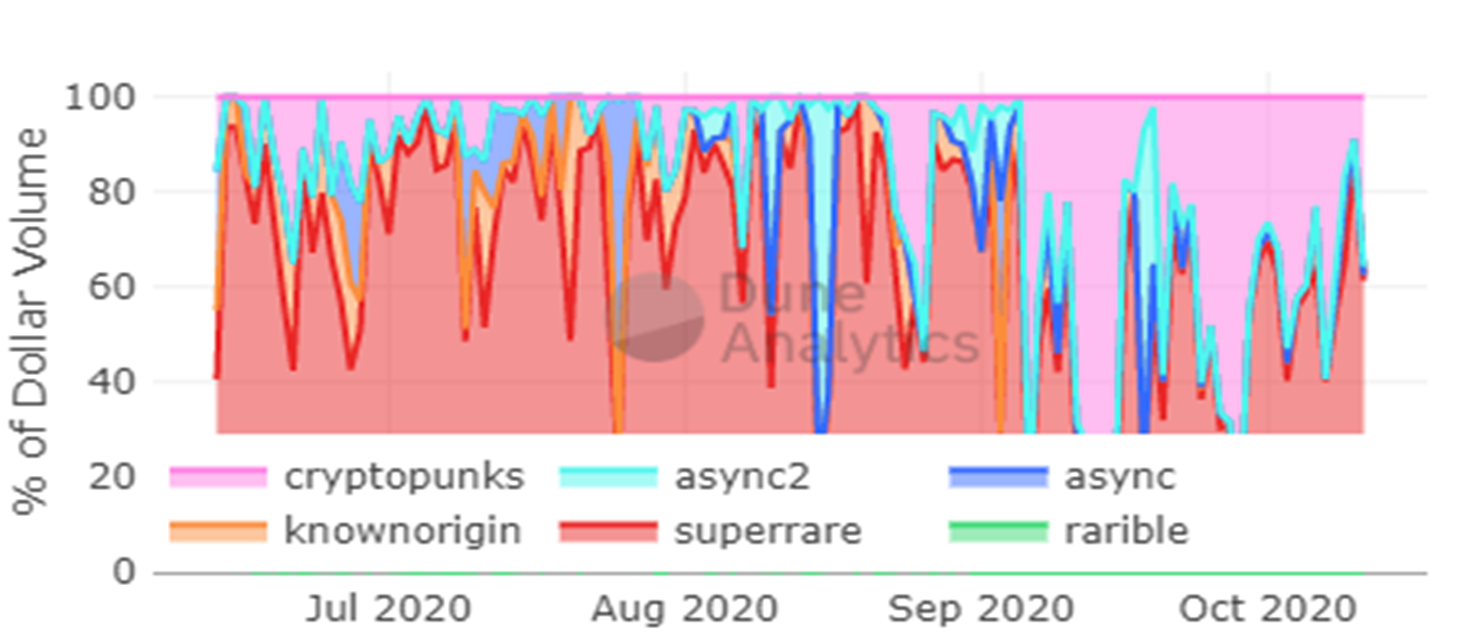

As we can see from the chart above, NFT marketplaces such as SuperRare have had continued dominance in the market, currently holding 48% of the total NFT marketplace daily $volume, which is equal to $81,018. SuperRare is an NFT marketplace for virtual artwork, where users can bid for digital art. You can also sign up as an artist, and this enables you to post your artworks on to the secondary marketplace. These artworks can be very lucrative. Recently, an audio and visual collaboration piece, ‘Elephant Dreams’, became the most expensive piece of digital artwork on SuperRare when it sold for $26,128.

Digital collectables such as ‘Elephant Dreams’ are completely virtual, however, on October 8th Christie’s Auction House sold an NFT for $131,250.

This artwork was created by an artist under the pseudonym Robert Alice and is called ‘Block 21’; it is a physical artwork with a digital NFT attached. ‘Block 21’ is part of a larger collection called ‘Portrait of Minds’, which is a three-year project that represents Satoshi’s original code. It aims to fragment Bitcoin’s base code into 40 pieces and distribute these pieces globally. NFT artwork is significant because it fixes the portability issues of ‘old-world’ art; this is achieved through the digital ownership which NFTs bestow on their holders. Further value generation can be achieved through artists using a platform called Async Art; this platform allows traits to be attached to the digital artwork. These traits can include royalties, which would enable artists to profit from future sales of their own art. These royalties will be stored on the blockchain and therefore are indisputable, which greatly benefits digital artists over traditional artists.

Tokenised Diamonds

A current trend in the digital asset space is the tokenisation of ‘real-world’ commodities, an example of this is Digital Gold Token (DGLD). One main issue with traditional gold relates to its portability, which can be fixed with a digital token as they are highly liquid versions of gold. In the NFT landscape, marketplaces have begun to try and be a part of this trend.

In the past, there has been several attempts to tokenise another traditional commodity, diamonds, which are highly valued in the ‘real-world’ because of their scarcity. The reason why previous diamond tokens have failed derives from the companies’ inability to verify the quality of the precious stone. Icecap, who hopes to launch a diamond NFT on the Ethereum network, believes that previous attempts have been unsuccessful due to their assumption that diamonds are a fungible commodity. Icecap NFT diamonds are certified by the Gemological Institute of America and are then sent to the Gem Certification & Assurance Lab for verification; if the diamonds are still not to the advertised standard Icecap will reimburse the price difference.

Traditional Investors have had to sell their diamonds at a steeply discounted rate because there is no secondary market. Icecap believes they can solve this issue by using the NFT marketplace, OpenSea, in-order to list their NFT diamonds. You can find them trading here. Tokenised commodities are very significant in the digital asset ecosystem, as they are a familiar investment for institutional investors. At ByteTree, we believe that driving as much institutional investment into the digital asset space is key to the future success of the entire ecosystem. NFTs can be a driving force of this adoption if assets like tokenised diamonds succeed in the space.

The Future of the NFT Landscape

Ethereum gas prices are a significant issue for the NFT landscape; some would argue that the Ethereum Network has been congested ever since the CryptoKitties boom in 2017. More recently, Decentralised Finance (DeFi) has been bottlenecking adoption from retail users by making returns from investments in DeFi lending, yield farming, and liquidity mining unviable through historically high gas fees. At ByteTree, we believe that the future of NFTs will be on the FLOW blockchain who aim to make a platform for NFTs that does not face the constraint of gas fees. Flow recently finished its community token sale for the release of its native FLOW token. The fundraiser took place on CoinList and attracted 12,000 investors with a total $19,500,000. Flow has a proven track record in the space, having created the infamous CryptoKitties back in 2017. They are also partnered with Dr Seuss, UFC, Samsung, Ubisoft, and the NBA, to name a few.

NFTs are an exciting venture that offers a unique and innovative opportunity within a niche sector of the digital asset space. At ByteTree, we expect to see the NFT landscape dramatically widen as both retail and institutional investors try to find the next digital Picasso.