It is Safer to Hold Some Bitcoin Than None at all

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 47

With the authorities bashing Bitcoin in recent weeks, it was welcome news to see Square follow MicroStrategy in adding it to their balance sheet. But these companies are not alone. According to Bitcoin Treasuries, 15 listed companies own 601,479 BTC, which is nearly 3% of all coins outstanding. Grayscale and CoinShares dominate that, but still, there is more listed ownership than many realise.

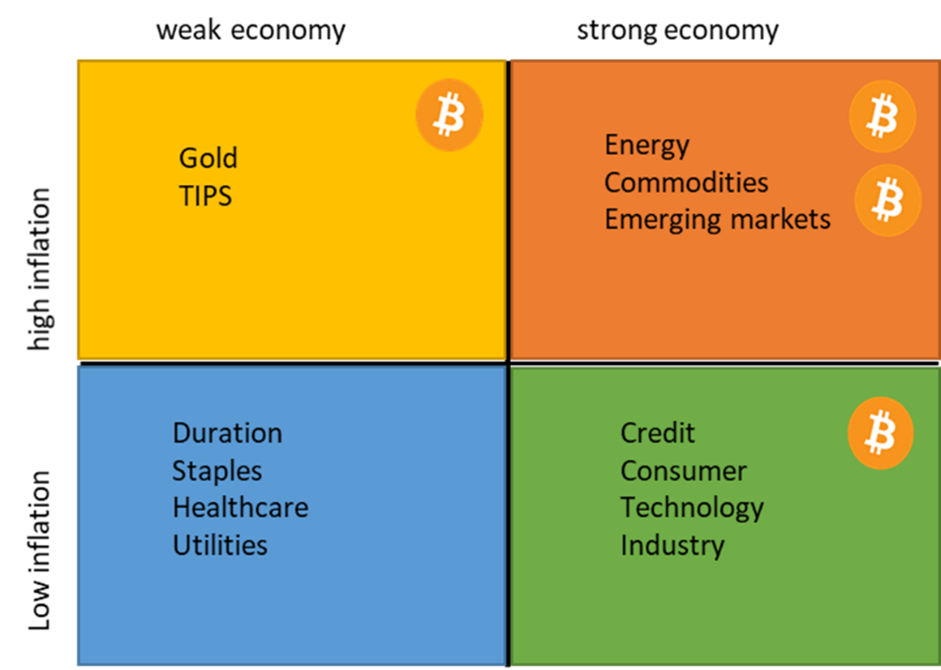

And why not? According to our work, Bitcoin is most likely to perform in a risk-on, inflationary environment. That is, 95% of its past gains have occurred during periods when the economy was stable or expanding, and general price levels were rising or stable.

Given the four options of a weak or strong economy with high or low inflation, we see Bitcoin most at home in the top right scenario. At times, it can perform in the top left alongside gold, and at other times, on the bottom right, alongside technology and growth. But Bitcoin loathes the bottom left scenario – deflation shocks.

Most investors recognise that the economy currently has deflationary tendencies as that is the trend that has been in motion for two decades (some might say more). Inflationary pressures have kept on falling, which has reduced bond yields. This largely explains why defensive and growth sectors have done so well. But crucially, bond yields have fallen faster than inflation expectations, which has boosted the price of gold. The reason for this is central bank induced stimulus packages that strive to boost inflation to avoid a debt deflation spiral.

Yet despite these interventions, the assets that have done worst are value assets such as energy, commodities, heavy industry, and emerging markets (ex-tech). And Bitcoin. You might not think that Bitcoin hasn’t done badly at all; after all it has doubled 17 times in a decade. But given its sensitivities to risk on, inflationary scenarios, the best maybe yet to come. Bitcoin has exploded higher with the wind and tide against it. Imagine what would happen when the stimulus overshoots and the top right scenario becomes the new normal. Better own some Bitcoin.

Tom Salter, our youthful analyst, has written a great piece on non-fungible tokens. This highlights yet another area of unstoppable growth in the digital space. Could diamonds finally become a liquid asset class?

Non-Fungible Tokens

A non-fungible-token, or NFT, is a token that represents a unique asset. NFT holders have strong digital ownership of these individual assets, and this ownership generates value for investors. This article will help readers to understand why NFTs are beneficial to investors and evaluate the variety of asset opportunities in the ecosystem.

‘Fungible’ goods are items that are interchangeable because they are identical to each other for practical purposes. Commodities, common shares, options, and dollar bills are examples of fungible goods.

NFTs on the Ethereum blockchain are usually one of two token types; ERC-721, and ERC-1155. The slight difference between these two tokens pertains to their fungibility. An ERC-721 token is completely non-fungible, which means that the token represents a unique asset. With a multi-standard ERC-1155, the tokens are ‘semi-fungible’ which means that the asset they represent can be both fungible (unique) and non-fungible (generic). An early example of an NFT is CryptoKitties, which is a platform where users can mint, breed, and trade virtual kittens. These kittens are all unique and cannot be duplicated. The most expensive crypto kitty sold was in September 2018; ‘Dragon’ kitty at the time sold for $170,000 (600 ETH). This sale shows that NFTs can have tremendous value.

How do NFTs Generate Value?

It is worth noting that there are different types of NFTs, and the main two, art and game NFTs, generate value in different ways. Overall, immortality generates value for all NFTs. Game NFTs such as CryptoKitties generate value through the journey of the individual NFT and the secondary market that the platform interacts with. Game NFTs can also generate value through the utility they offer, for example, Axie Infinity allows holders of their in-game ‘monsters’ to compete against other players in a turn-based game with the hope of being rewarded with DAI.

Art NFTs generate value for investors in similar ways to traditional art. The value of ‘real-world’ art is well proven; the ‘real-world’ art market was worth $67.4bn in 2019 and generates value for its collectors through the artist behind it, the historical significance, and sentiment. NFT art is no different; it creates value for investors in all the same ways but fixes one major issue with traditional arts portability.

To read the full article, please click here.

Network Demand Model

The score has surged back to a 5 from a 3, with just velocity remaining somewhat weak. The score never saw a 2, and in fact, it didn’t even come close when you look at the underlying signals. That means the ByteTree Network Demand Strategy has remained “on”.

Velocity is a complex nut to crack because it has been clear for some time that the supply side used in the equation should not be fixed. It doesn’t matter whether you use the coin supply, or the adjusted supply (removing inventory), there are still many coins that are lost or passive (LOP). As more savings vehicles come on stream, the number of LOP coins grow, which puts downward pressure on network velocity. That is not necessarily bearish because coins are divisible, and the network can still flourish regardless. But there can be no doubt that a busy network is a valuable network. If all the coins stood still, they would be worthless.

We have been saying that velocity > 600% (625% better still) is a positive signal. But just as the fiat world sees ever declining velocity, so does Bitcoin. We will be adjusting this calculation, not at a lower level, but at a dynamic level that responds to the LOP coins. More on this to follow.

Please visit our website if you would like to learn more about ByteTree Asset Management.

Comments ()