ByteTree Measures Digital Asset Economies

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree CEO, James Bennett, speaks to CardRates

In a Nutshell: ByteTree is a blockchain data analysis engine that crunches more than 80 data points on several popular cryptocurrencies to project current and future values. The platform’s terminal is currently free to access, with a premium blog and customizable user accounts planned for mid-2020.

The Internet has created opportunities for people to make substantial sums of money. Not only have e-commerce platforms — namely Amazon, whose founder’s net worth is over $1.6 billion — taken a big bite out of brick-and-mortar retailers, but the investment world has also completely changed over the last two decades.

Instead of relying on investment professionals to choose their stocks and strategies, consumers can now take control of their investments by researching a nearly limitless supply of online documents, analysis, and projections.

The internet has led the way for blockchain technology, which laid the foundation for digital currencies. And as some ICOs see success and their values rise even faster than traditional stocks, many investors want in.

What’s missing in the new digital economy, however, is advanced investment analysis and projections that are omnipresent in stock market investing. ByteTree is changing that by analyzing digital asset data in real time to help crypto investors make informed investment decisions. The platform aims to help users understand and apply the data — which helps them make educated decisions quickly.

“At a high-level, blockchain networks are digital economies,” said James Bennett, CEO at ByteTree. “Through our understanding of how to interpret blockchain data, we are able to monitor the strength of these respective economies.”

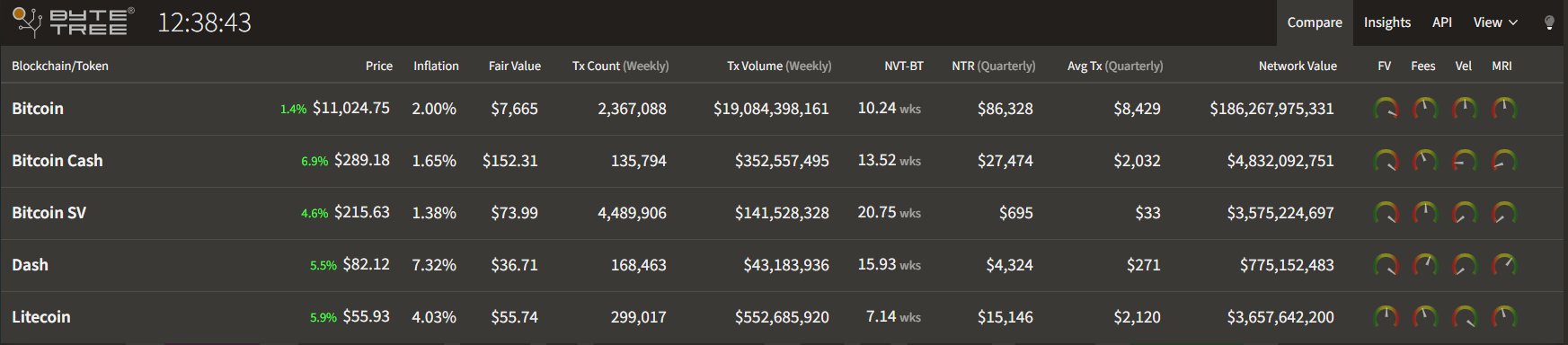

ByteTree’s proprietary technology collects, collates, and indexes more than 80 metrics for each blockchain network in real time. The platform runs a series of nodes for each of the assets it monitors to source its data.

The company started with its founder, Charlie Morris, and Mark Griffiths, CTO, and quickly expanded to a team that provides concise data analysis to traders throughout the world.

“Just like the non-digital world, the level of demand and supply taking place is a driver of growth,” Bennett said. “The difference with digital assets is that they are digital, but it means you can interpret the useful information available in the data even faster than in the non-digital world.”

ByteTree designed its insights to measure digital asset economies and comment on whether it’s a good time to buy or sell different tokens. And what makes the platform even more attractive to digital prospectors is the price.

A Free Platform that Aims to Educate Investors

Advice typically comes with a hefty price tag in the financial world. But ByteTree users can currently access a wealth of data at no cost. Completely free access may change at some point, but Bennett said the goal isn’t to drain investors of their capital.

“Our aim is to bring greater understanding to the value drivers of digital assets like Bitcoin,” he said. “Through keeping the terminal open to all, we hope to support the maturity of the asset class.”

Through ByteTree Insights, the team behind the platform regularly writes about its metrics to help users understand how digital assets gain or lose their value. Starting in July 2020, anyone can create a customizable user-specific terminal account, which Bennett said will differentiate between the new entrants and those who want to apply the data to enhance their investment decisions.

And these insights aren’t just fresh opinions. The ByteTree team has an extensive history providing in-depth analyses of the crypto trade. The project started in 2013 as The Crypto Post, a rundown that looked at the market technicals and current market happenings.

By April 2014, the analysis became the market’s first multicoin price index — then known as the Crypto Composite 10 (or CC10) — which weighed 10 coins according to market cap and prices. The team rebranded once more in 2018 to ByteTree and provides more data to investors than ever before, with plans to expand soon.

Upcoming Enhancements Enable Customized Dashboards for Paid Users

ByteTree’s current users are eagerly awaiting the ability to create personal accounts. The premium-paid customized dashboard expects to bring added value to users who seek the most data possible.

“We are also adding new metrics surrounding the Bitcoin miners,” Bennett said. “These are core infrastructure providers whose behaviors increasingly tell of the development of the space.”

The accounts will add entity analysis to identify different types of transactions, allowing users to better view the usage of each blockchain network. For example, instead of basing the pricing projections of a coin on press releases and current popularity polls, ByteTree instead looks at each coin’s utility and the value it adds to the market when determining its real-world value.

That may push against many popular opinions that latch onto certain coins and project tremendous gains based solely on hope.

ByteTree’s analytics seem to work when educating investors and helping them make more informed decisions. In late 2019, as the price of Bitcoin nearly reached $11,000, and investors jumped on with hopes of further climbs, ByteTree suggested that everyone pump the brakes.

At the time, Bennett wrote on the Insights blog that the coin traded 35% higher than its current value and predicted a sharp fall. The analysis based the coin’s value on its current utility as a payment network, not on its fame at the time.

Within weeks, the coin fell by nearly 20%, and many investors who had purchased at the higher cost took on steep losses. Those who listened to the warning got out just in time. Just one similar occurrence could easily cover the cost of the premium blog and account.

Investment Analysis for a Digital Age

Bennett insists that ByteTree isn’t just for investors. As this new digital economy continues to grow, he sees many forthcoming lessons that all consumers can benefit from.

“Anyone with an interest in economics, finance, or data needs to take a look,” he said. “It might seem complicated at first, but the insights that one can derive from blockchain networks are both fascinating and practical from an investment perspective.”

After all, trading cryptocurrency isn’t that different from trading traditional stocks. Neither provides a physical product, and they can both increase or decrease in value during a volatile market. That’s why it’s important to research and listen to the proper advice when it comes time to invest.

“Digital assets are native to the internet, and the internet is becoming ever more prevalent in our daily lives,” Bennett said. “There is no stopping the transition to fully digital value transfers in the coming decade, so I would urge people to get clued up.”

That transition will bring about changes that we expect, and some which we can’t currently predict. Traditional financial institutions have already awoken and taken notice of the growing trends in digital currency. The next step seems to be greater mainstream acceptance.

As this growth continues to play out on a global scale, the ByteTree team remains committed to its growing community — which Bennett said provides just as much knowledge as it extracts.

“Although we are very busy building out new products and features, we always engage and support our community on their learning journey,” he said. “After all, the future is being built. We are learning too.”

Editorial Note: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

This article was originally published on CardRates.com on 29th June 2020, and has been reposted here with permission from the original author.

Comments ()