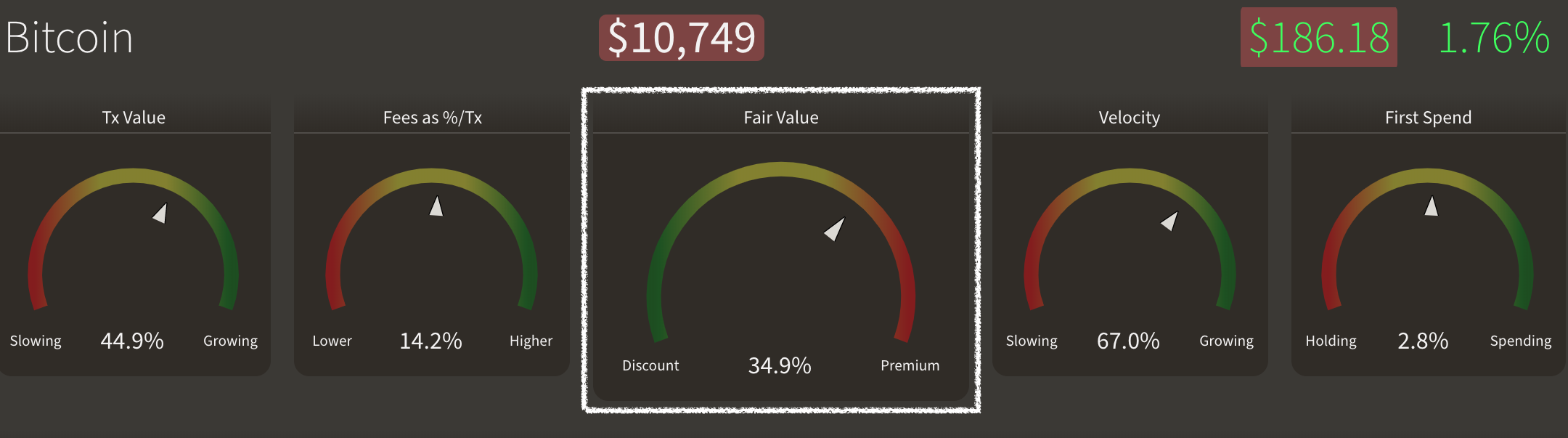

Bitcoin Trading at 35% Premium to Fair Value

Disclaimer: Your capital is at risk. This is not investment advice.

Bitcoin currently trades at a 35% premium to its fair value, despite a short-term surge in on-chain transaction (TX) volume.

Fair value is a measure of the price attributable to each bitcoin, relative to its utility as a global settlement network. We detailed the fair value in an earlier post, but in short it is calculated as follows:

`"Fair Value" = (NVT_("hist avg") xx "Transaction value"_"12 weeks") / "Supply"_(adjusted)`

This week bitcoin’s premium increased as on-chain transaction volume fell month over month while the network’s market value increased by around 9% - leading to a surge in bitcoin’s premium to 35%.

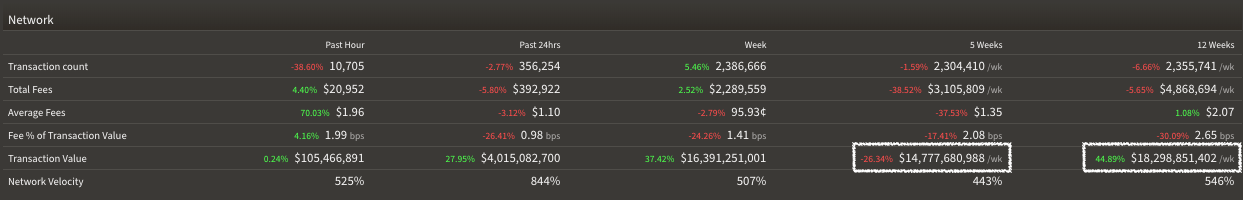

Monthly TX Volume Declines

Cumulative Transaction Volume growth remains positive versus the prior quarter (right box), measured on a rolling window. However, monthly cumulative transaction volumes are declining (left box):

While the weekly TX volume has increased by 44% quarter over quarter, this is attributable to the sharp increase in volume from mid-June to mid-July 2019. We have outlined how the daily on-chain TX volume impacts the quarterly trailing average on the graph below.

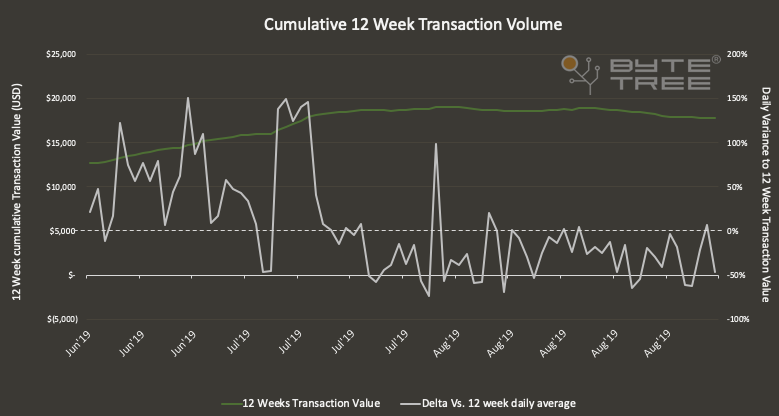

Quarterly Volumes Anticipating Significant Drop

The TX volume (grey line) was much higher earlier in the quarter, expanding the cumulative 12-weeks TX volume (Green line). The daily transaction volume then started to average below the 12-week cumulative volume from mid-July until present day, seen in the right-hand side of the chart:

In order to sustain or increase the cumulative TX volume, and thereby sustain bitcoin’s fair value, daily volume must be in excess of $2.8Bn in the coming weeks. While it is a big ask in context of the past month, TX volume has picked up significantly today, transferring in excess of $4Bn.

Bitcoin’s current and predicted fair value

We anticipate a sharp fall in bitcoin’s fair value in the coming weeks unless weekly and monthly transaction volumes reverse the current downtrend. At present time, the market value is $10.8k with a fair value just under $8K, marking a 35% premium.