Sticking With Staples

American Consumer Staples stocks are up 15.4% in the last three months, while US tech stocks are down 1.

ByteTree Quality offers investment research and a model equity portfolio, which recommends large, liquid companies with sustainable profitable growth and durable competitive advantages, at low valuations.

American Consumer Staples stocks are up 15.4% in the last three months, while US tech stocks are down 1.

“A great business at a fair price is superior to a fair business at a great price… The investment game always involves considering both quality and price, and the trick is to get more quality than you pay for in price. It’s just that simple." - Charlie Munger

ByteTree Quality is an investment research service which does exactly that, run by ex-HSBC fund manager Charlie Morris, and Kit Winder, CFA.

Backed by a universe of the 300 best companies in the world, we focus on delivering excellent stock research, backed by a model portfolio. We recommend and manage a small portfolio of high-quality stocks when they are very attractively priced. Discipline is central to our process.

We seek to acquire exceptional businesses when they are undervalued and poised for growth, and share our research and results with you every step of the way.

Our investment philosophy defines quality as large, liquid and low-volatility companies with sustainable, profitable growth, durable competitive advantages, great management teams, and attractive valuations.

The service comes in the form of at least two monthly notes, made up of deep dives on new recommendations, updates on existing holdings, flash notes, and other commentary.

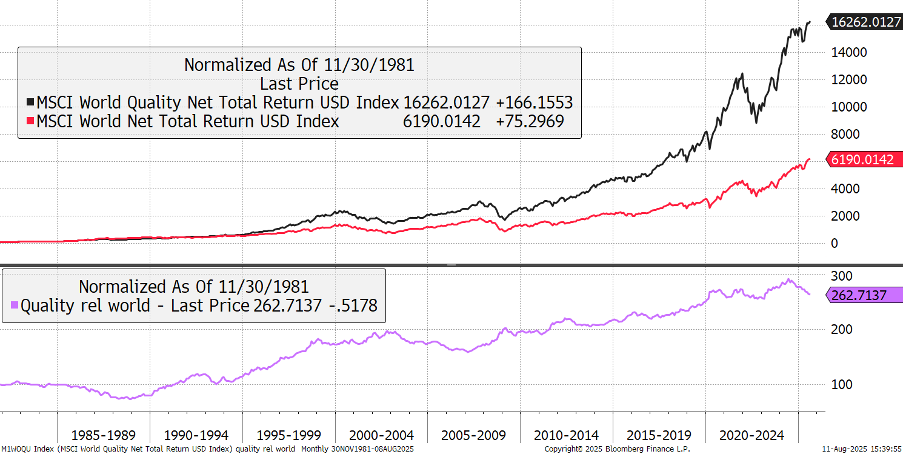

Quality has historically delivered outstanding performance relative to the market, over many decades. $100 invested into quality stocks, as defined by MSCI’s World Quality Index, turned into $16,262 (11.5% p.a.) from November 1981 to July 2025, which is three times that of the MSCI World Index (8.5% p.a.).

As US investment firm GMO put it,

"The fact that the highest quality quartile of the market has outperformed the lowest quality quartile by 4% per year is utterly counterintuitive, astonishing, and demands to be incorporated when building sensible equity portfolios."

ByteTree Quality has one simple goal: to make your investing life easier.

To view an example of what our research looks like, take a look at our first note on Diageo.

By recommending a concentrated portfolio of the best companies in the world, acquired patiently at attractive valuations, we hope to deliver the kind of investment performance that helps you sleep well at night.

We investigate and reject many companies too, either on valuation or resilience grounds. Our focus is on the highest quality companies, with very high conviction in their future performance, which could reasonably be held for decades. Many brilliant companies do not qualify, as uncertainty and the threat of disruption are too great. The discipline of what not to invest in is equally important.

We are very grateful for the feedback of our existing clients on Trustpilot, and the trust of the thousands of private investors who have been with us over the years.

"We aren't chasing the next meme stock or AI hype cycle. We apply rigorous, institutional discipline to identify the 300 best companies on earth, and then wait for the market to give us a discount. If you are looking for a get-rich-quick scheme, this isn't it. If you are looking for a durable, high-conviction portfolio built for the next decade, welcome to ByteTree Quality."

For extensive in-depth research on quality companies, an easy-to-follow model portfolio built and managed by HSBC's former star fund manager, at a very reasonable monthly fee...

Join ByteTree Quality today

It is included in the ByteTree Pro package, or is available at a discount alongside The Multi Asset Investor.

PS. We have also unlocked our second recommendation, which you can read in full below.

Charlie Morris is the Editor of The Multi-Asset Investor. Prior to this, he was the Editor of the Fleet Street Letter, a market newsletter for private investors published by Southbank Investment Research with a wide readership. He is also the Chairman and Chief Investment Officer of ByteTree, which he founded in 2014 as a platform to deliver independent, robust and thought-provoking market analysis.

Charlie has 25 years of fund management experience and is a pioneer of multi-asset investing. At HSBC Global Asset Management, he launched the Absolute Return Service in 2002, which grew to over $3 billion. Much of that success came from moving away from the crowd and embracing a wider range of asset classes that traditional investors were not familiar with at the time. Subsequently, Charlie managed the Total Return Fund at Atlantic House Fund Management until June 2020, at which point it was ranked number 1 out of 48 funds in the Trustnet Target Absolute Return Sector.

Prior to a career in finance, Charlie served as an officer in the Grenadier Guards, British Army, having graduated from the Royal Academy Sandhurst in 1994.

Kit Winder, CFA, is the senior equity analyst at ByteTree. After achieving a first-class degree in history from the University of Warwick, he has spent seven years working as an investment analyst, predominantly focused on equities at Southbank Investment Research. He joined ByteTree in March 2025, and is a Chartered Financial Analyst.

His great passion is in understanding companies, their business models, competitive advantages, and valuation, with a focus on quality. He has written for numerous highly successful research services, reaching thousands of clients and contributing to exceptional investment performance.

Outside of work, he is a keen cricketer and cook, former ski instructor, and speaks fluent French and German.

The technology sector has come under pressure this week, with sharp falls across several stocks, not just in software, but also in growth.

Through its roads, airports, and energy and physical infrastructure, our next recommendation serves 90% of our lives.

When seeking quality companies, the predictability of future earnings is a key consideration, alongside the resilience of sales during all

Today's addition dominates one of the most promising new markets in healthcare for the coming decades, and a return to outperformance looks likely.

We have identified a leading company in a core market for AI applications that we believe is of high quality and trades at a sufficient discount to merit inclusion in the ByteTree Quality portfolio.

We launched ByteTree Quality because we felt that true quality stocks were falling out of favour to an extreme degree, making it the perfect time to start building them into a portfolio.