The Canary in the Coal Mine

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree BOLD Index Monthly Rebalancing Report;

The Vinter ByteTree BOLD1 Index (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their natural low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

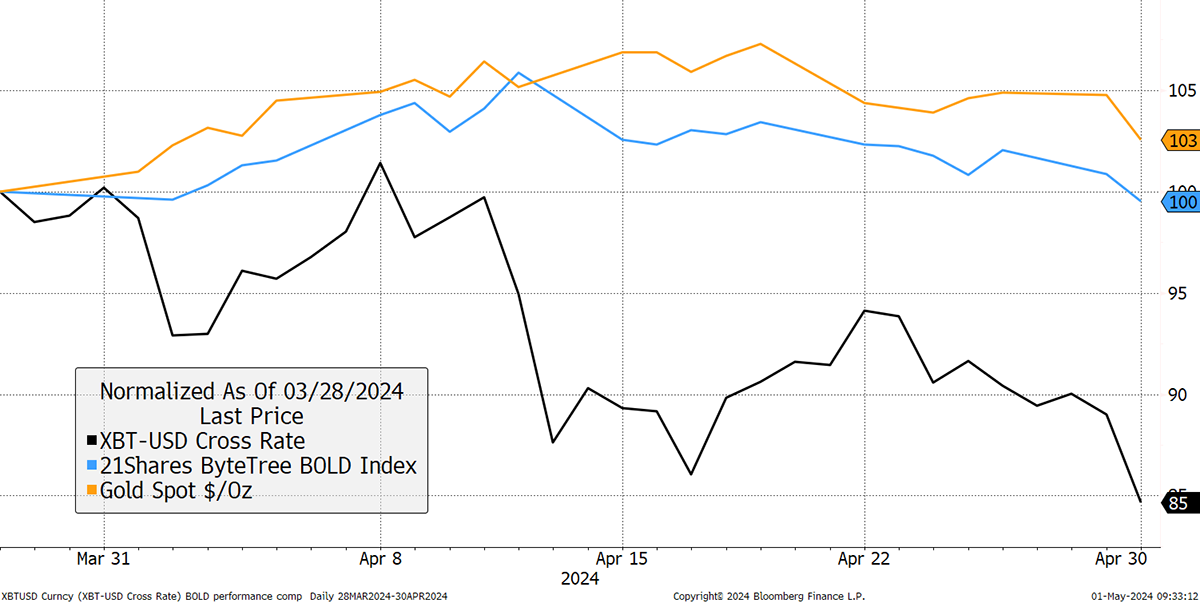

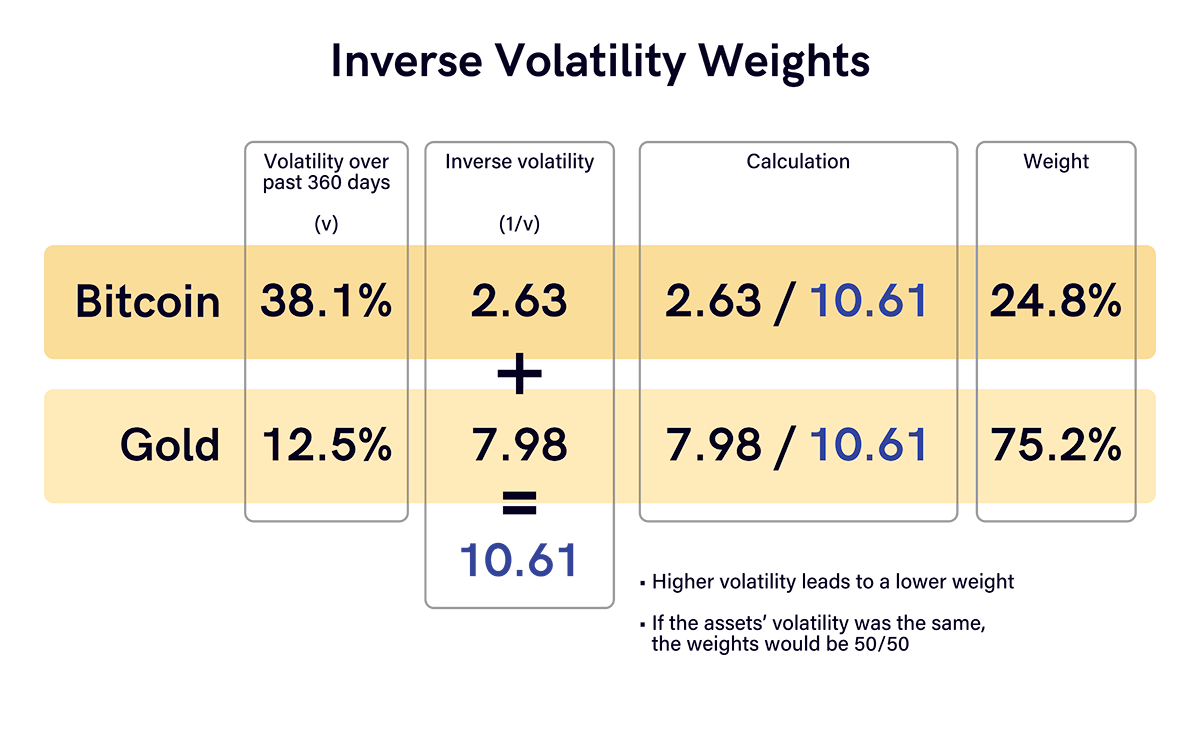

In April, BOLD fell by 0.5%, Bitcoin fell by 15.5%, Gold rose by 2.5%, and equities fell by 3.9% in USD terms. This month sees a more significant rebalance due to Bitcoin’s weakness. The target weights last month were 24.3% (Bitcoin) and 75.7% (Gold). Price changes over the month led to the last day’s weights at 20.7% and 79.3%. To meet the new target weights of 24.8% and 75.2%, this means the latest rebalancing has seen 4.1% added to Bitcoin and the same reduced from Gold.

Bitcoin, Gold, and BOLD in April 2024

Once again, Bitcoin is the canary in the coal mine. It has repeatedly proved useful as a leading indicator for asset prices in general. That, combined with resounding performance, is a good reason why it is such an efficient way to take risk in a portfolio. In the same vein, Gold has proved to be a reliable defensive asset over many years.

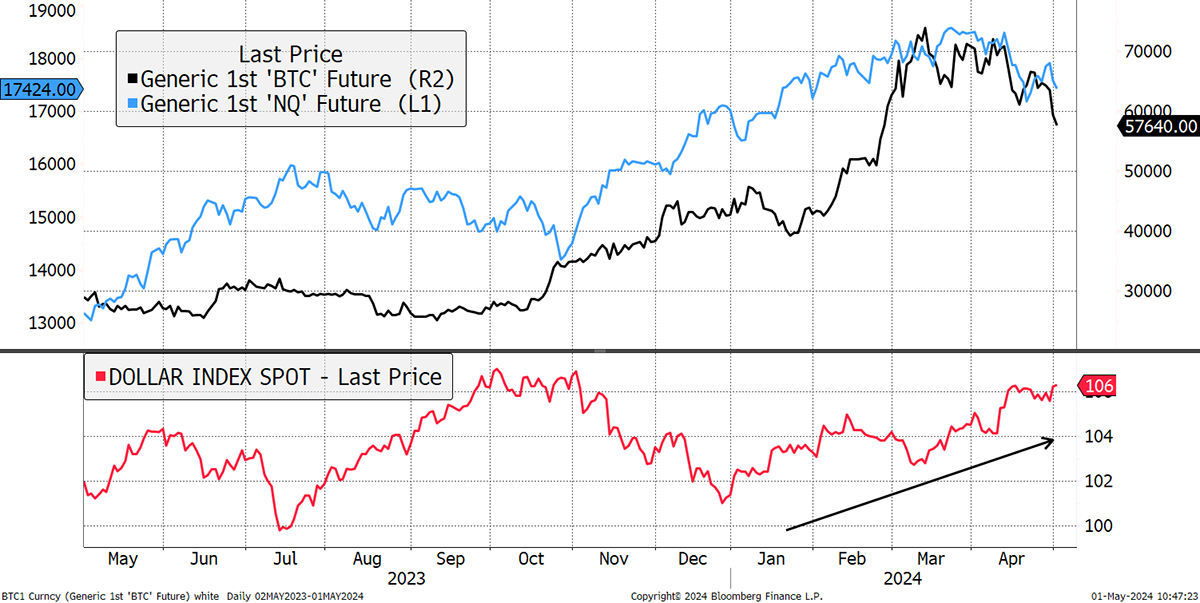

As for the recent peak, the price of Bitcoin was a week ahead of the Nasdaq futures (NQ1), peaking on 13th March, shortly before halving. The recent strength in the US dollar may signal market tightness ahead.

Risk-off Ahead

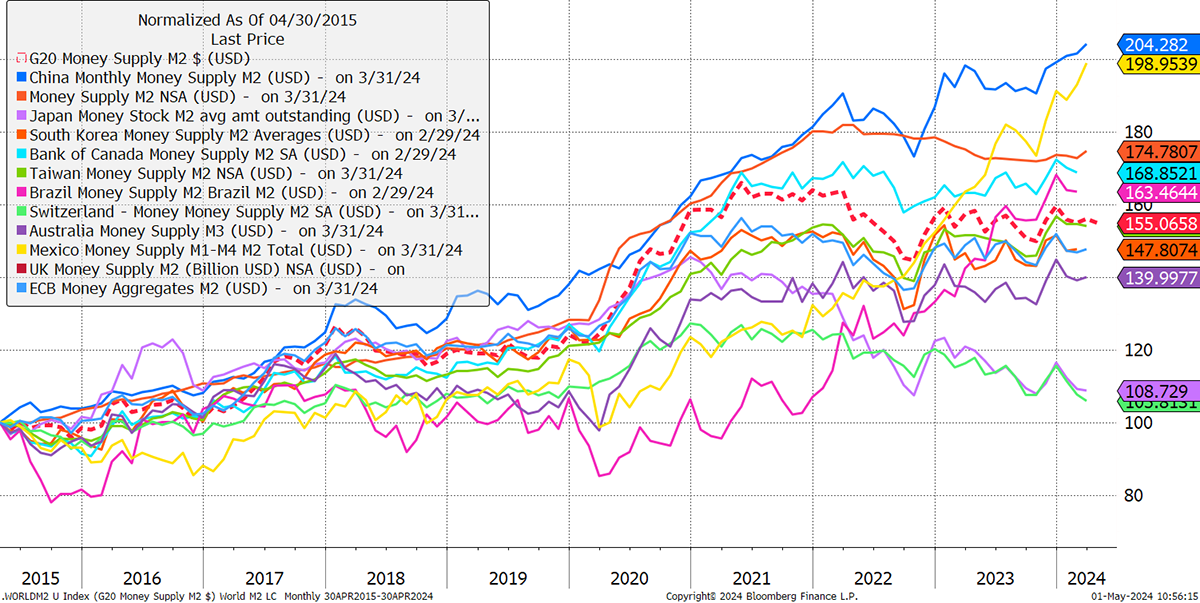

One issue that is worth noting is how the world’s money supply has stagnated. Naturally, there have been other outlets that have maintained overall market liquidity, but the red dashed line in the chart below is the global aggregate, and it has been flat since mid-2021. Thanks to Latin America and China where the money supply is still growing to match their higher levels of economic growth.

World Money Supply

A risk-off period always favours Gold over Bitcoin, and the surprise this time was its inability to make a new high when measured in Gold. The 35-ounce BTC peak has now failed twice, and it seems that a range between 15 oz and 35 oz may be challenged again. It is my belief that Bitcoin and Gold are somehow converging over time but will retain their low correlation. That would imply this range could last for some time.

Bitcoin Priced in Gold

The idea that Bitcoin carries on behaving like a super-high return asset is hopeful because the primary driver will be monetary, as we have seen with the impact of fund flows. If you missed my recent post-halving piece on Bitcoin, then please see the predictions for the next four years. I believe Bitcoin is normalising, which means it still appreciates but at a more moderate pace.

Bitcoin and Gold Flows

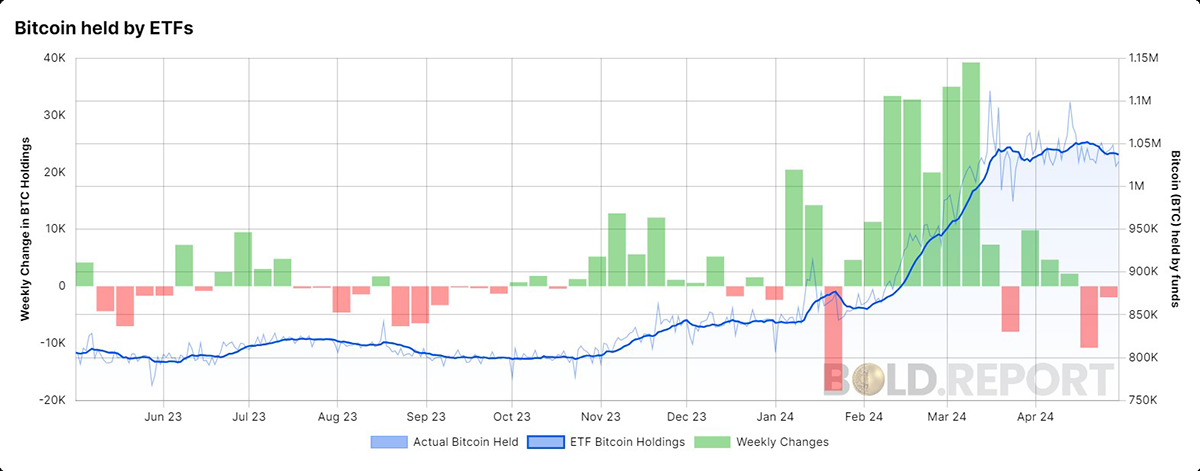

Halving passed without incident, but as they say, it is better to travel than arrive. The three bullish events, halving and the ETF launches in the US and Hong Kong are now behind us. Minor outflows have begun, and the price has softened with a break below $60k.

Bitcoin Held by ETFs

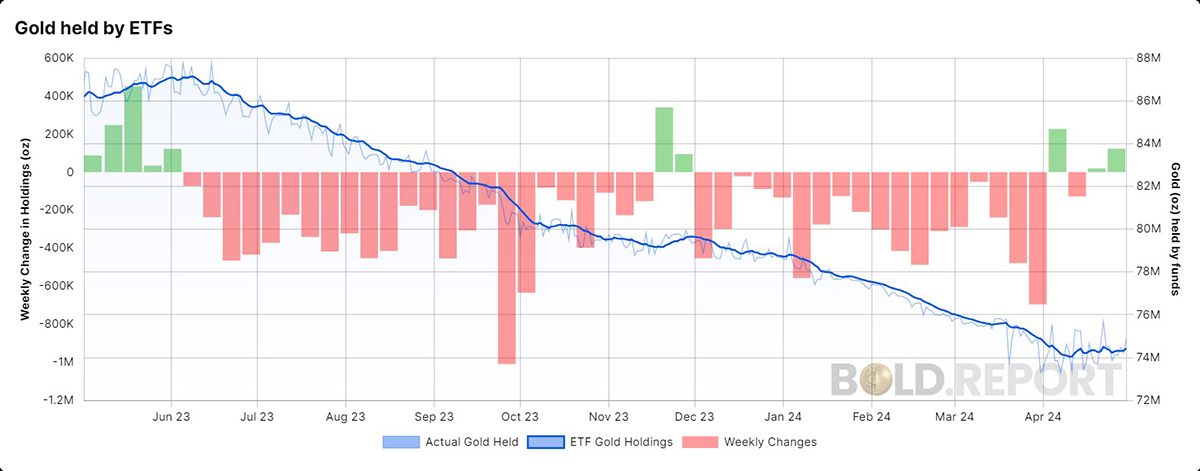

To demonstrate the low correlation between Bitcoin and Gold, just as the Bitcoin ETFs are now seeing outflows, the Gold ETFs are seeing inflows.

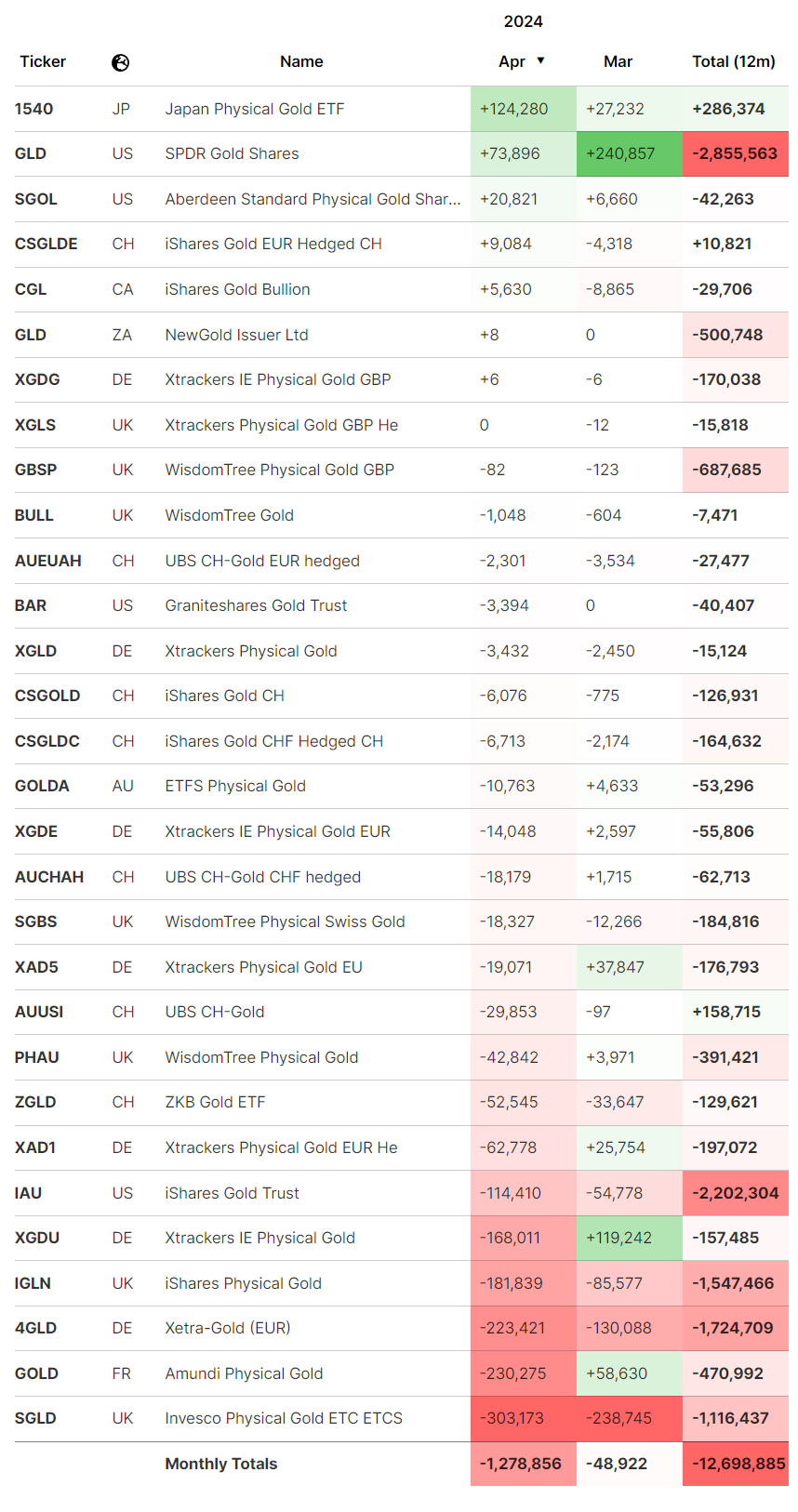

Gold Held by ETFs

These would be much bigger if Europe, and especially the UK, were not such enthusiastic sellers of Gold. Unsurprisingly, the Japanese are keen buyers with the weak yen. But Europe has been a persistent seller, and the UK’s Invesco Gold ETF (SGLD) has seen over a million ounces of Gold sold this year. If anyone knows why, please let me know.

Gold Fund Flows

That Gold can absorb such heavy selling pressure in the face of a stronger dollar, and rising bond yields, is a testament to the renewed importance of Gold’s role in the global financial system.

BOLD Performance

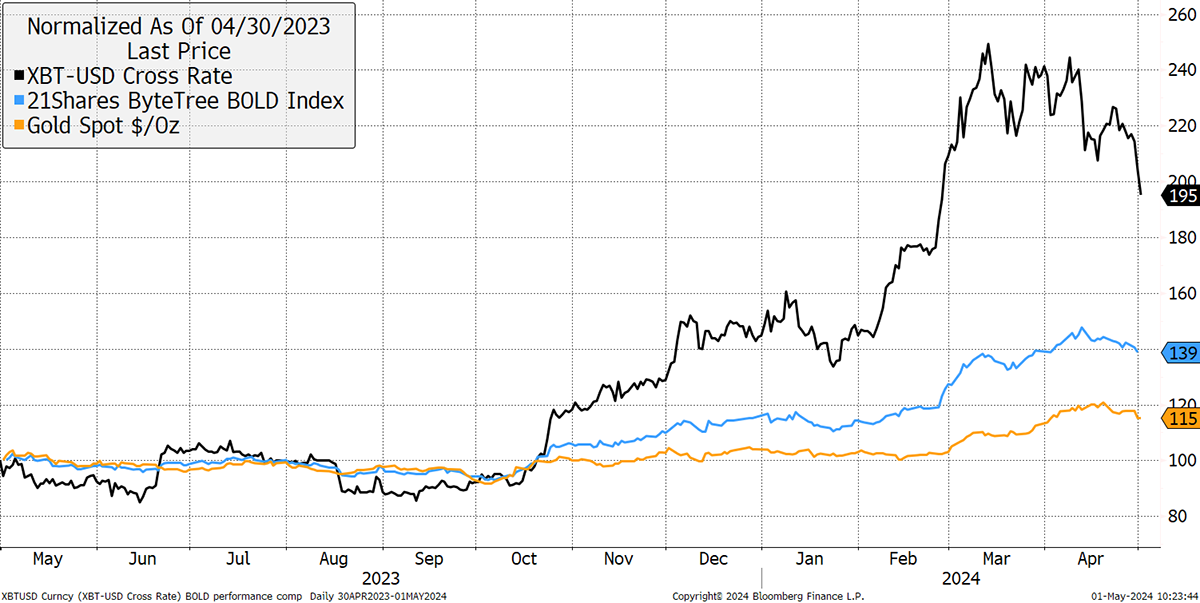

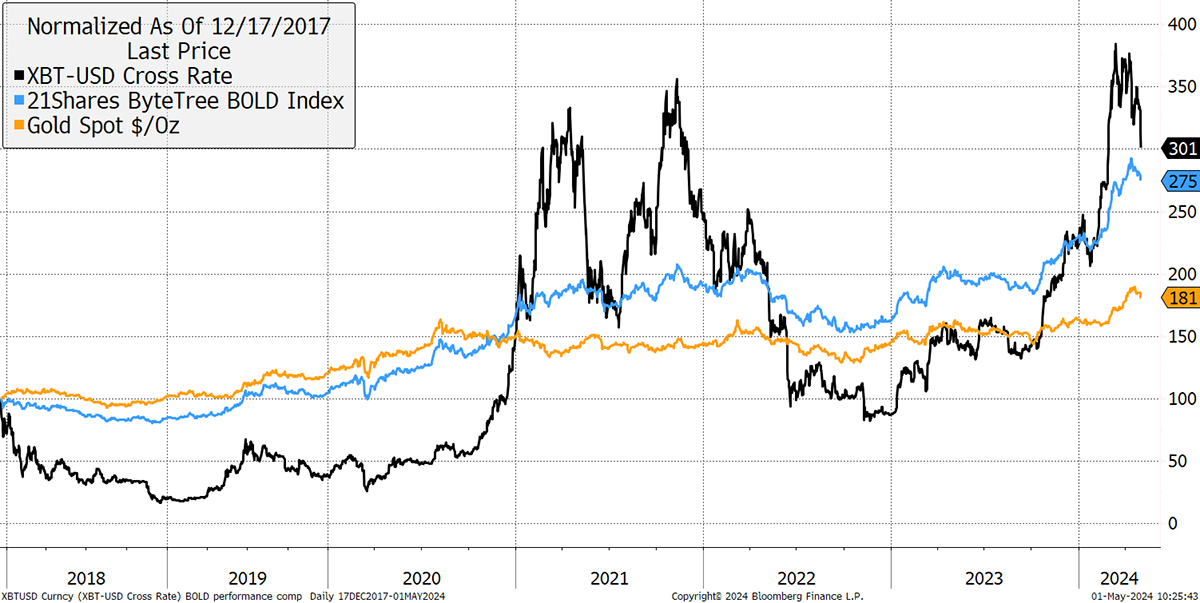

Over the past year, Bitcoin’s performance has returned 95%, in contrast to Gold, with 15%. BOLD managed a respectable 39% return.

Bitcoin, Gold, and BOLD in the Past Year

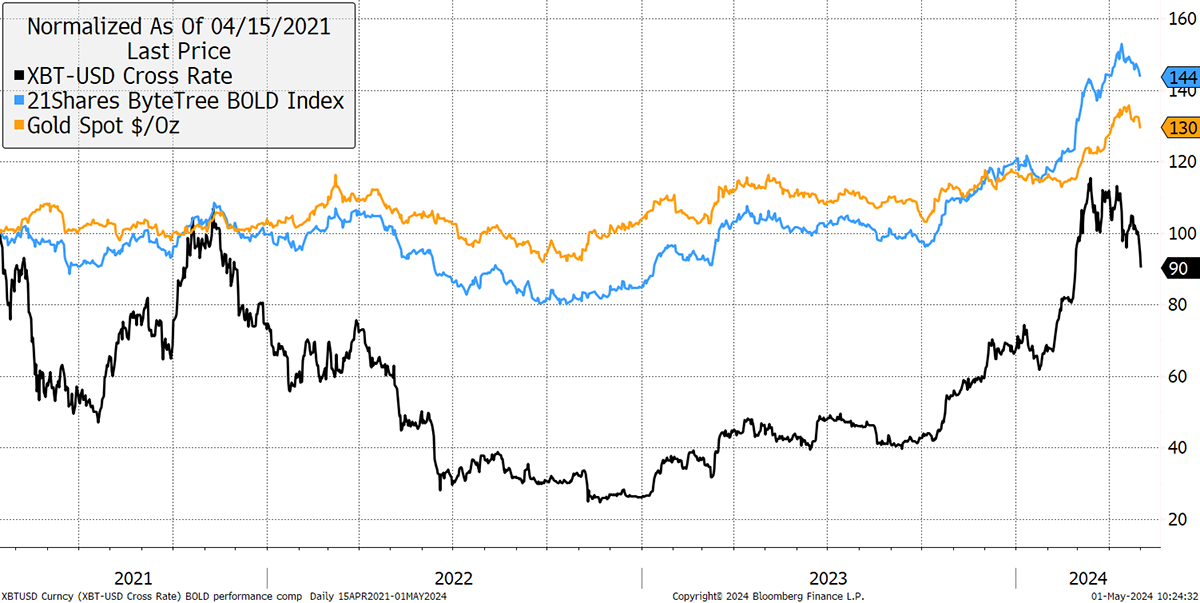

However, BOLD performs best, at least in relative terms, when Bitcoin is under pressure. Since the notable high in April 2021, ahead of the Chinese mining ban, BOLD has demonstrated the vitality of regular rebalancing. I remind people that BOLD was never designed to beat Bitcoin but to beat Gold.

Bitcoin, Gold and BOLD since the April 2021 Bitcoin High

And as I am so fond of showing, BOLD has returned nearly as much as Bitcoin since the 2017 high. Since then, Bitcoin is +201%, while Gold is +81%, and BOLD +175%.

Bitcoin, Gold and BOLD since the December 2017 Bitcoin High

April Rebalancing of the BOLD Index

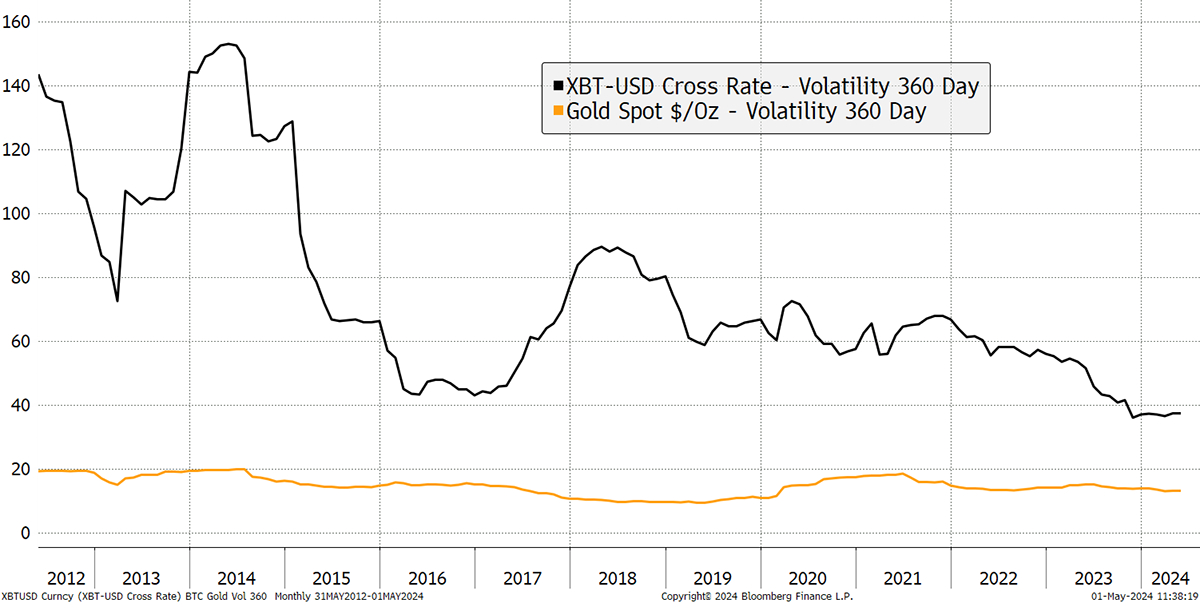

BOLD allocates to Bitcoin and Gold on a risk-adjusted basis, using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the monthly rebalancing. Bitcoin’s volatility, measured over a year, has fallen significantly since the early days and is now no more volatile than a typical blue-chip stock.

Bitcoin and Gold Historical 360-day Volatility

The volatility for Bitcoin and Gold over the past 360 days was observed to be 38.1% for Bitcoin and 12.5% for Gold. That means Gold’s volatility is slightly higher than last month, while Bitcoin is unchanged. This has resulted in new target weights of 24.8% Bitcoin and 75.2% Gold using this formula. Rather than having the same amount of value invested in each asset, the BOLD strategy aims to hold an equal amount of “risk” in each asset. Hence, it is “risk-weighted”.

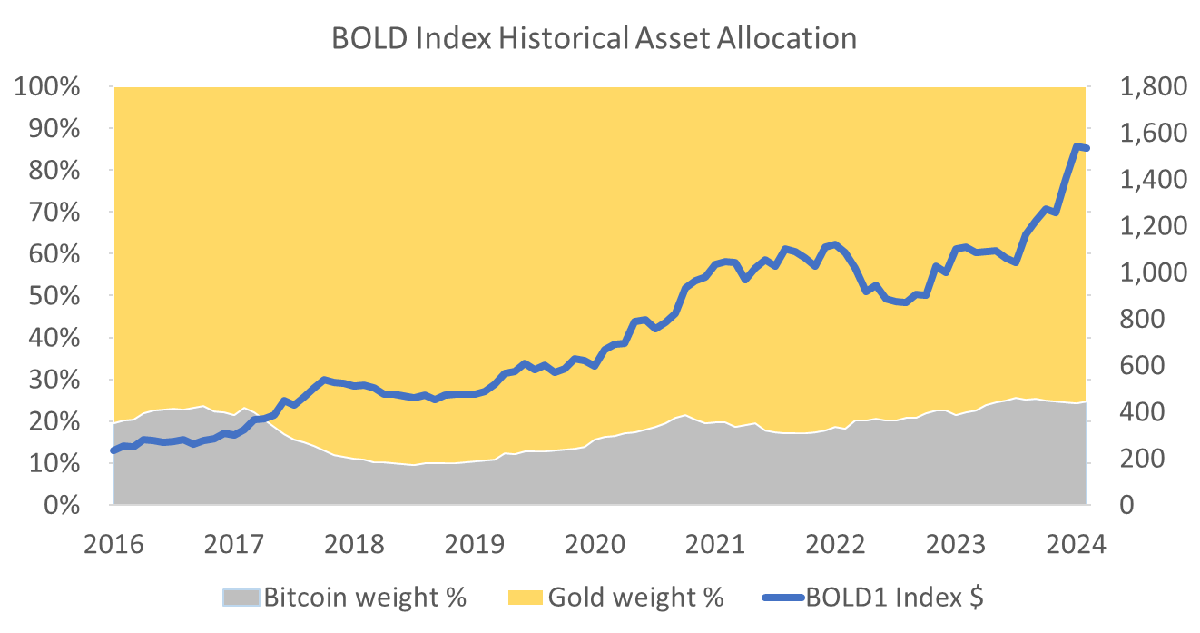

The BOLD allocation to Bitcoin was low in late 2017 and 2018 when Bitcoin’s volatility was high compared to Gold. Bitcoin exposure peaked at 25.5% in October but has been declining since the volatility spread has widened again. This is a key part of BOLD’s risk-management.

BOLD Historical Asset Allocation

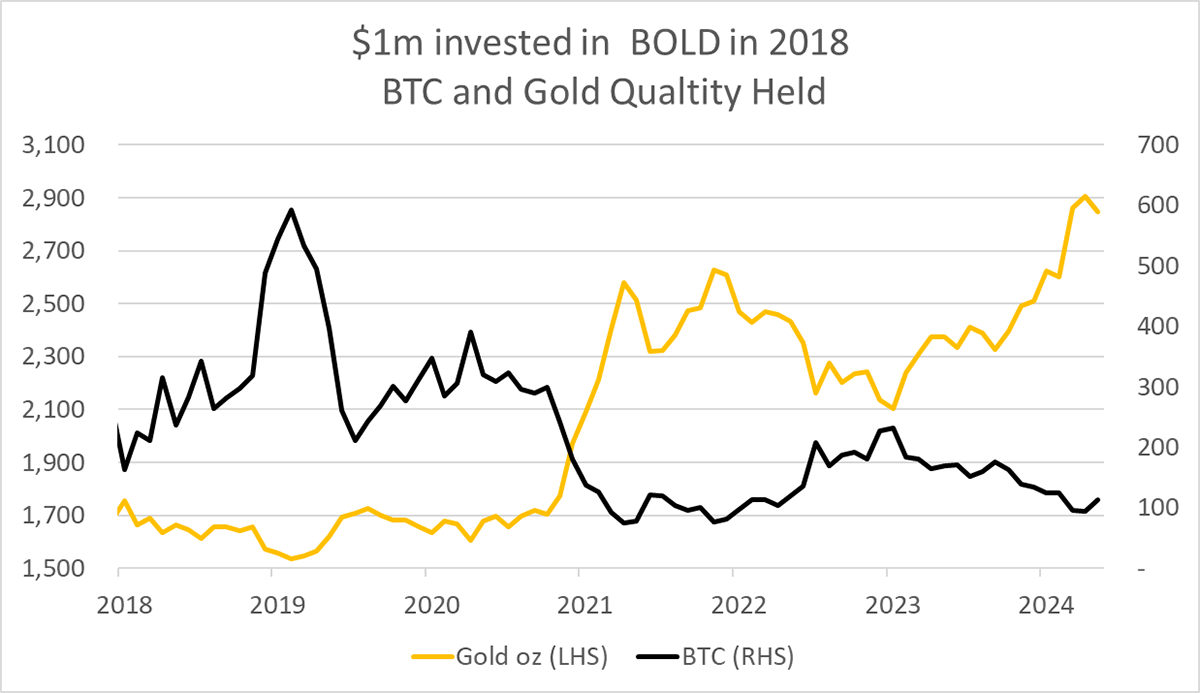

Rebalancing transactions occur at the end of each month, and this accumulates the weaker asset. In a Bitcoin bull market, that’s Gold, and in a Bitcoin bear market, that’s Bitcoin. Since the end of 2022, BOLD has been reducing Bitcoin and increasing Gold. As of this month, that has just reversed, and BOLD has increased Bitcoin at the expense of Gold.

This simple and repeatable investment process accumulates the lesser-performing asset over time. As Bitcoin and Gold’s performance converge, the result should see BOLD beat both assets in the future, provided the low correlation continues.

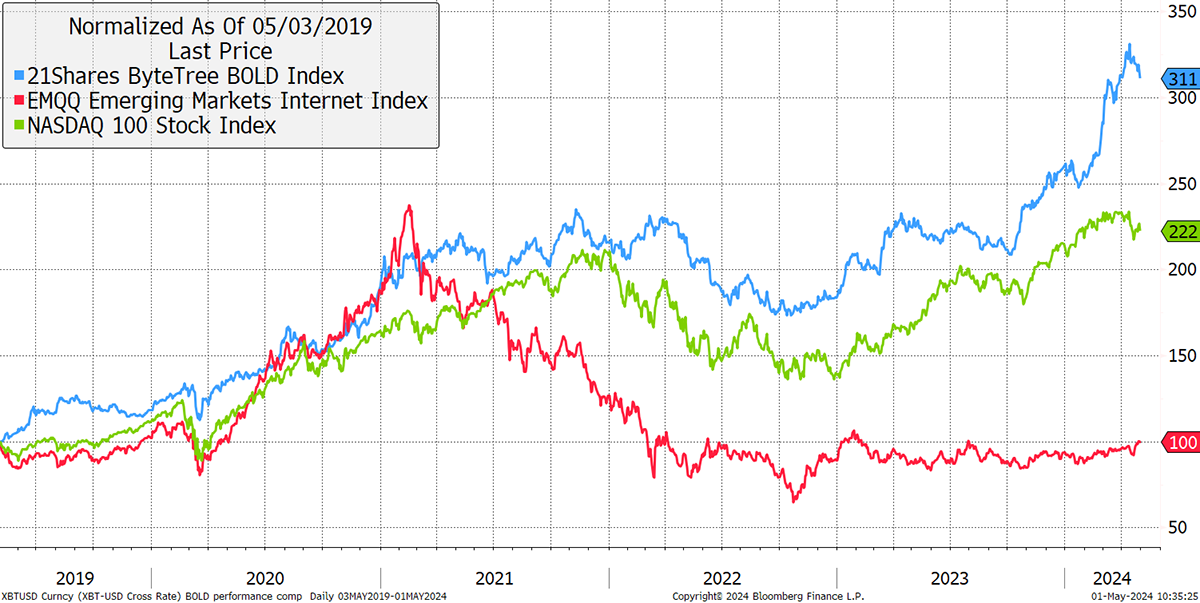

BOLD and Technology

A theme at ByteTree this past week has been emerging market internet stocks, shown in red. It looks like EMQQ will start to perform just as US tech peaks out. The observation is that BOLD has consistently beaten the Nasdaq index and, with Gold’s help, will prove resilient if the canary in the coal mine proves correct.

BOLD, Emerging Internet, and Nasdaq over the Past Five Years

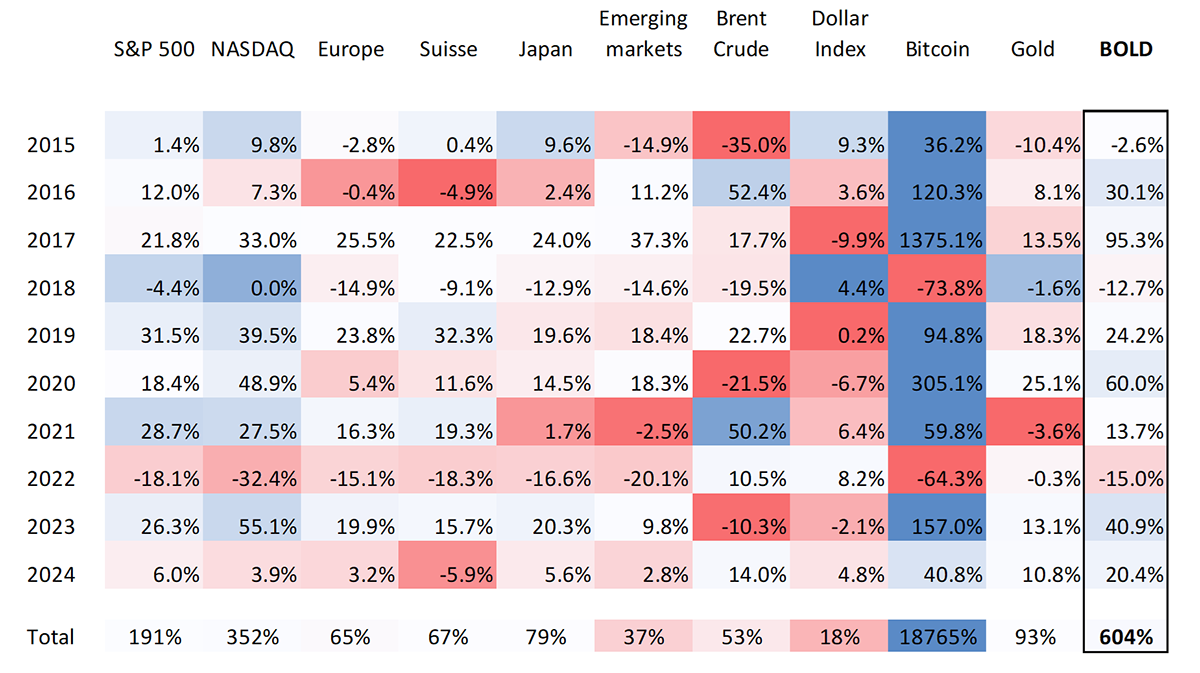

Finally, I have updated the asset return table. It shows the major stockmarkets and some commodities against Bitcoin, Gold and BOLD. It is pleasing to see BOLD nearly 2x the Nasdaq over the period.

Asset Class Returns Since 2015

Summary

Bitcoin is our favourite canary. It is warning of trouble ahead in financial markets, but we can be confident it’ll bounce back at some point. In a normal halving year, expect a new high after a few months. I suspect that’ll happen in October. If Bitcoin lags Gold in the interim, BOLD will be loading up on Bitcoin in time for the next rally. In the meantime, Gold will hold the line.

Contact

For information on investing in BOLD, contact bold@bytetree.com.

If your investment firm or media outlet would like a private briefing on BOLD, we will be happy to oblige. If a physical meeting is not possible, we can arrange a Zoom call.

Further Information

Vinter Index Provider

21Shares BOLD ETP

Research

ByteTree provides more in-depth research on Bitcoin and Gold for free on our website.