The Inflationary Elephant

Atlas Pulse Gold Report Issue 105;

…maybe, just maybe, inflation is the new elephant. I say that because inflation expectations are rising sharply, and I sense a new wave in the gold rush. The gold price may still be consolidating from the April high, but the gold miners, silver, and the platinum group metals have all perked up. Precious metals are once again an exciting place to be invested.

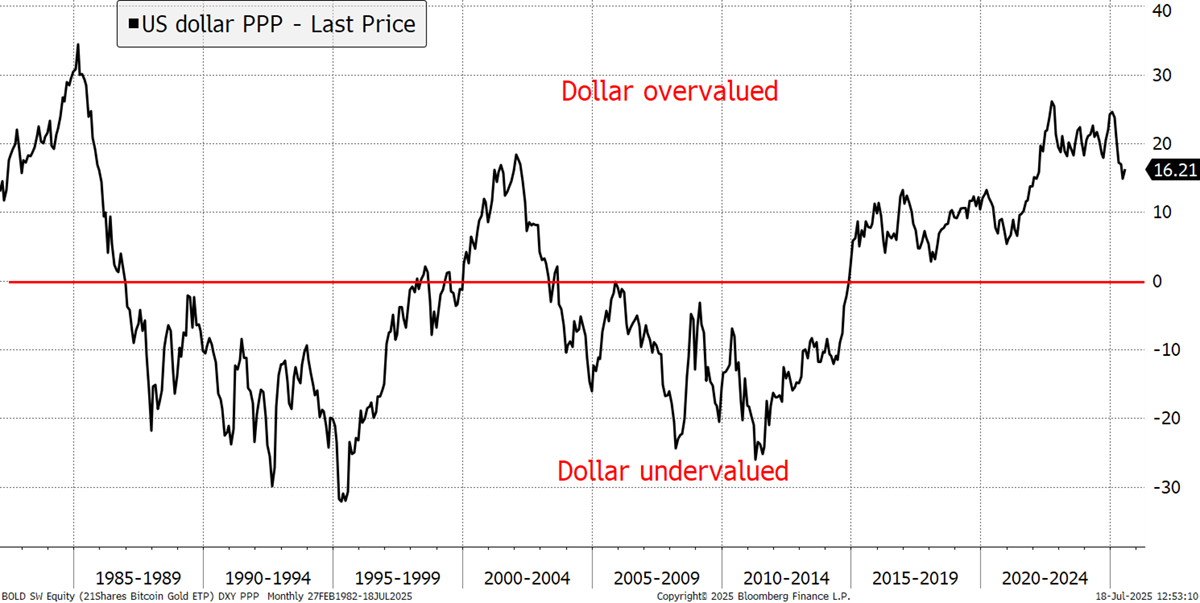

You often read that gold is going to the moon because the US dollar is falling. That certainly helps, but that can only be a part of the story, as the price of gold is rising strongly in all currencies. The dollar has weakened by 10% this year, yet it remains richly valued compared to its past. If a small drop in the dollar has caused a few trillion dollars of gains in the gold market, imagine what would happen if the dollar fell back down into cheap territory?

Dollar Purchasing Power Parity

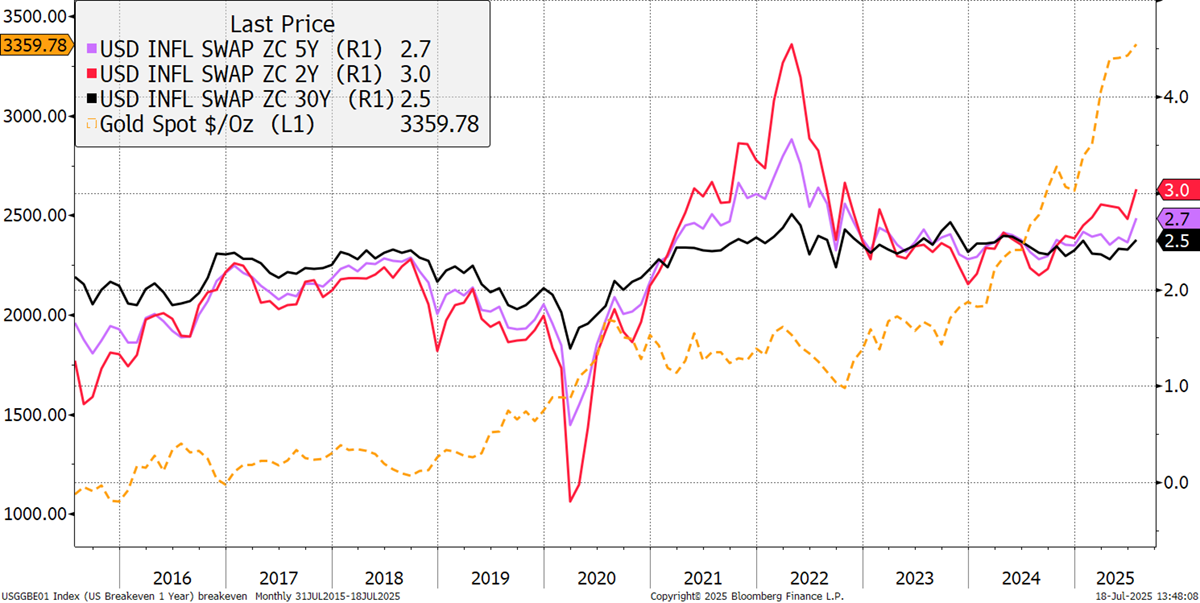

Naturally, there has been much more behind the rise in the gold price. Many commentators believe gold is a hedge against inflation, but in recent years, think it has failed. I show the inflation expectations in the US over 2 years (red), 5 years (purple) and 30 years (black). Gold rallied from 2018 to 2020 when inflation expectations fell. It remained flat between 2020 and 2022, when inflation rose sharply. Then, as inflation was coming down again, gold rose. Then inflation stabilised and gold surged. It is easy to be confused by this.

USA Inflation Expectations

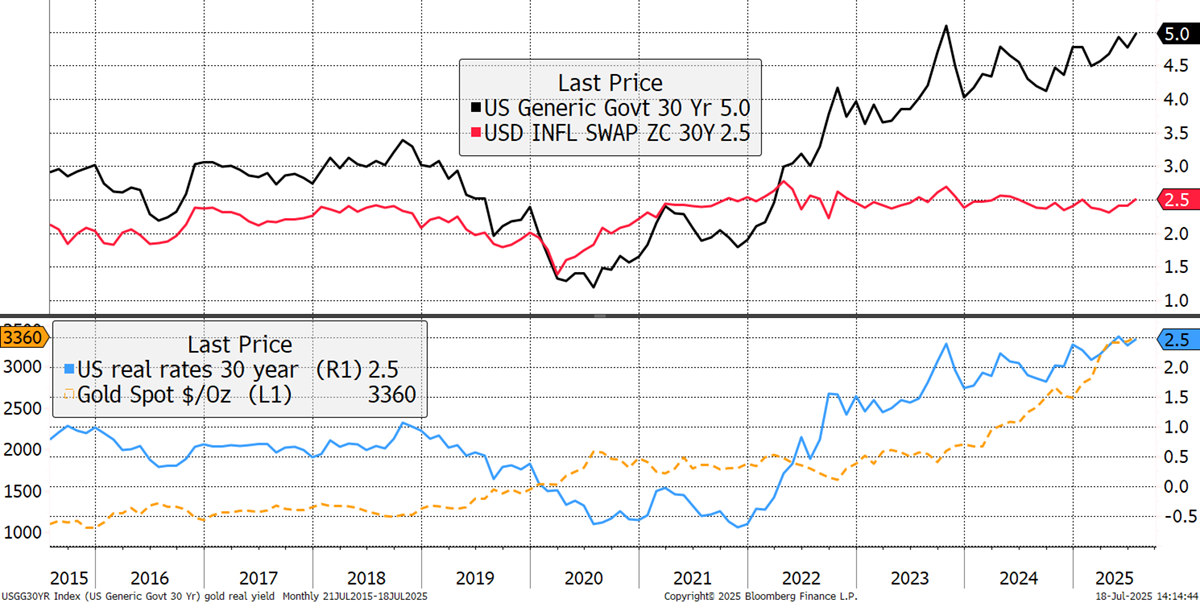

With gold behaving against the simple link with inflation, now that inflation expectations are rising again, you might think it’s time to worry that the price of gold could fall. I doubt that because, as is always the case with gold, it follows the elephant. From 2018 to 2020, inflation wasn’t the elephant; real yields were, which are shown below. They are the difference between the long bond yield and long-term inflation expectations. Gold watchers know that falling real yields are good for gold, and in the 2018/20 period, they collapsed, propelling the gold price higher.

Gold and the Real Yield

Then, between 2020 and 2022, when inflation surged, you could say that gold failed as an inflation hedge. But then again, gold had already risen by 60% since late 2018, while total inflation was less than 20% over the five-year period. Besides, the elephant became a euphoric stockmarket bubble, which often shifts gold to the sidelines.

Yet, from 2022, just as “transitory” inflation was cooling, the price of gold took off again. The war in Ukraine became the new elephant, as Russian sanctions led to many countries increasing their gold reserves.

But maybe, just maybe, inflation is the new elephant. I say that because inflation expectations are rising sharply (second chart above), and I sense a new wave in the gold rush. The price may still be consolidating from the April high, but the gold miners, silver, and the platinum group metals have all perked up.

Precious metals are once again an exciting place to be. In ByteTree’s portfolio service, The Multi Asset Investor, I include gold, precious metals, miners and crypto alongside traditional assets to deliver a truly diversified portfolio for clients. Currently, the hard/alternative asset allocation is above 30%, which has helped drive strong returns in the first half of the year.

Between this herd of elephants, there are underlying currents that are powerful. The world’s money supply is growing at nearly 8% p.a., and that feeds the gold price over the years. On this basis, gold was 40% undervalued in 2018, and today it may be 15% overvalued, but a new burst of inflation will soon see this off.