ByteTree BOLD Index Monthly Rebalancing Report;

The 21Shares ByteTree BOLD ETP (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their naturally low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

The target weights last month were 29.8% and 70.2% (Bitcoin to Gold). Price changes over the month led to the last day’s weights at 30.1% Bitcoin and 69.9% Gold. This means the latest rebalancing has seen 0.4% added to Bitcoin and reduced from Gold to meet the new target weights.

BOLD Performance

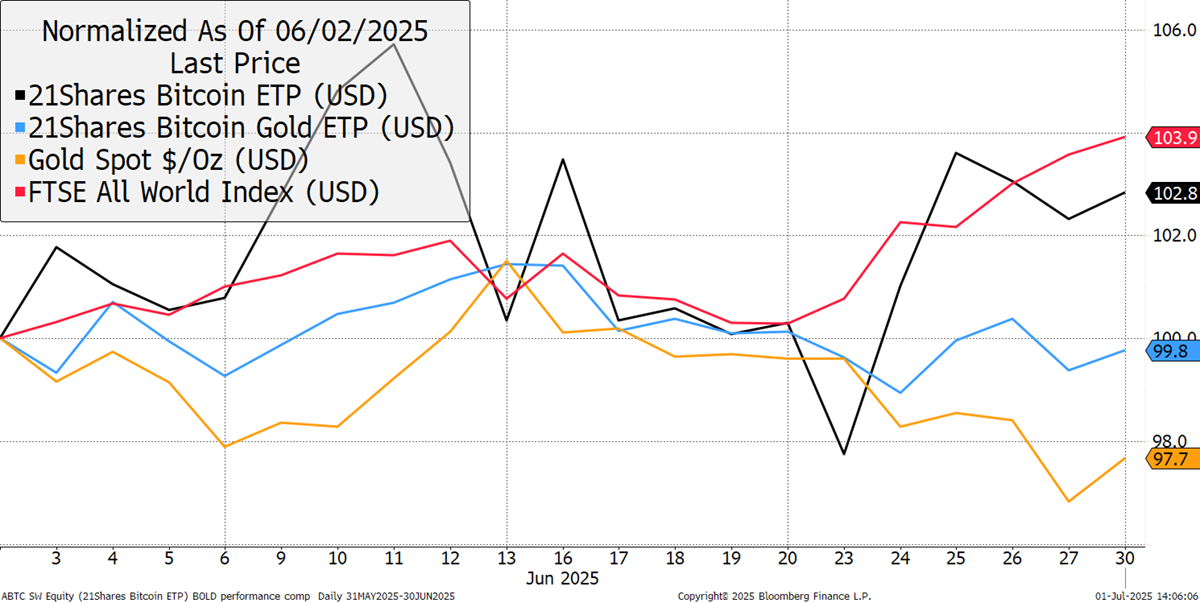

In June, BOLD fell by 0.2%, Bitcoin rose by 2.8%, and Gold fell by 2.3%, while global equities rose by 3.9% in USD terms. The US dollar was down 2.5%.

Bitcoin, Gold, BOLD, and Equities in USD – June 2025

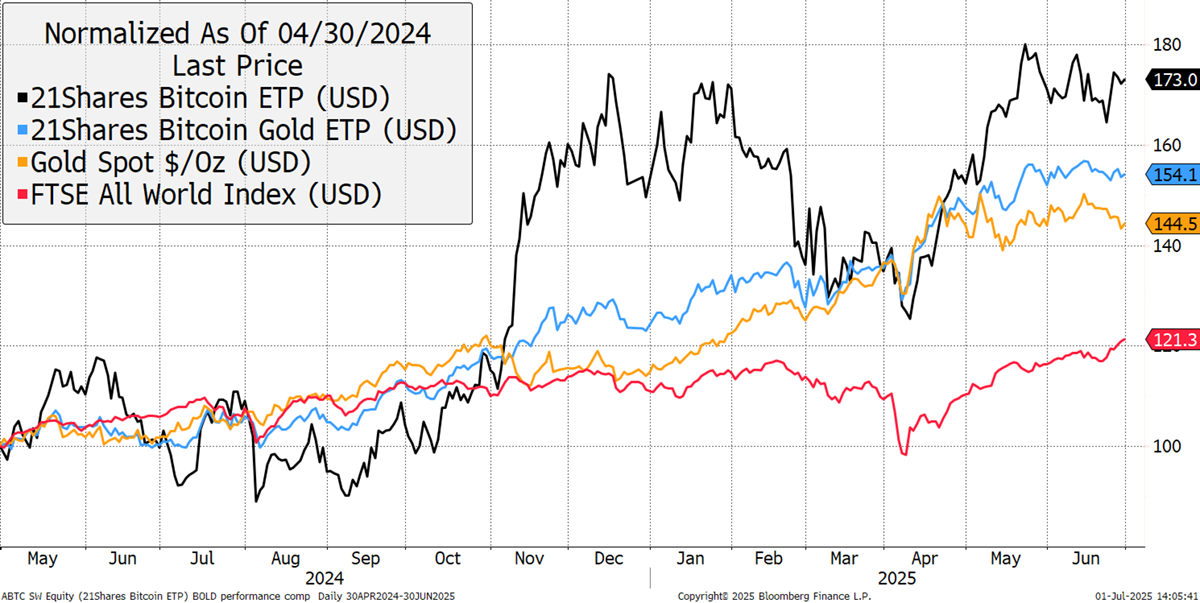

Over the past year, BOLD has returned 54.1%, Bitcoin has returned +73%, in contrast to Gold with a +44.5% gain, while equities have risen by +21.3%.

Bitcoin, Gold, BOLD, and Equities - Past Year

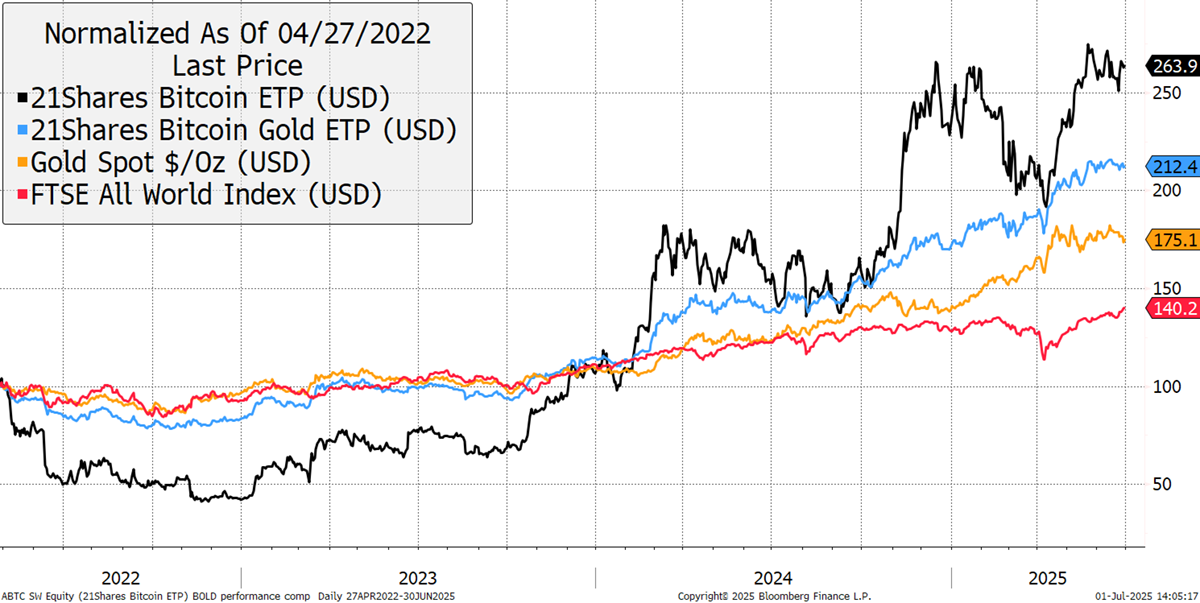

Since the 21Shares ByteTree BOLD ETP's inception on 27th April 2022, BOLD has returned +112.4%, Bitcoin has returned +163.9%, Gold is up +75.1%, while equities have risen by +40.2%.

Bitcoin, Gold, BOLD, and Equities - Since Inception

Monthly Rebalancing of the BOLD ETP

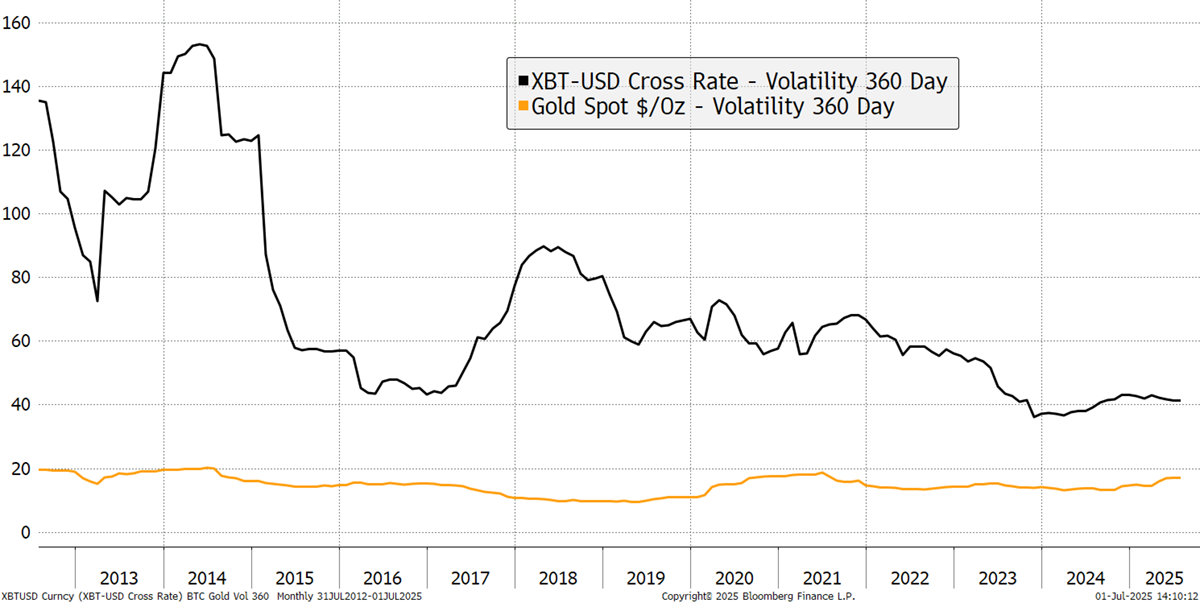

BOLD allocates to Bitcoin and Gold on a risk-adjusted basis using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the monthly rebalancing.

Bitcoin and Gold’s Past 360-day Volatility

Rather than having the same amount of value invested in each asset, the BOLD strategy aims to hold an equal amount of “risk” in each asset and is hence “risk-weighted”. The volatility for Bitcoin and Gold over the past 360 days was observed to be 38.8% and 17.1%, respectively. Bitcoin's 360-day volatility has fallen again over the past month, while Gold’s has risen. This is a continuation of what happened in April, and the gap between Bitcoin and Gold volatility is historically narrow. This has led to the highest Bitcoin weight on record for the BOLD Index.