Bitcoin’s Energy Consumption

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 97;

I have been meaning to write the Bitcoin energy story for some time. Fiat money has no scarcity and consumes little energy in its life cycle. It is excellent for transactions, and, at times of low inflation, can even be a store of value like the Singapore Dollar or Swiss Franc. Experience shows us that things rarely turn out that well, and fiat eventually loses its value. Bitcoin and gold are alternative assets that hold fiat money to account. I do not believe such a proposition, at scale, is possible without significant energy consumption because it promotes scarcity.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto Stocks.

Highlights

| Mining | Bitcoin’s Energy Consumption |

| Technicals | Bullish |

| Investment Flows | Neutral |

| On-chain | Slowing |

| Macro | Deficits |

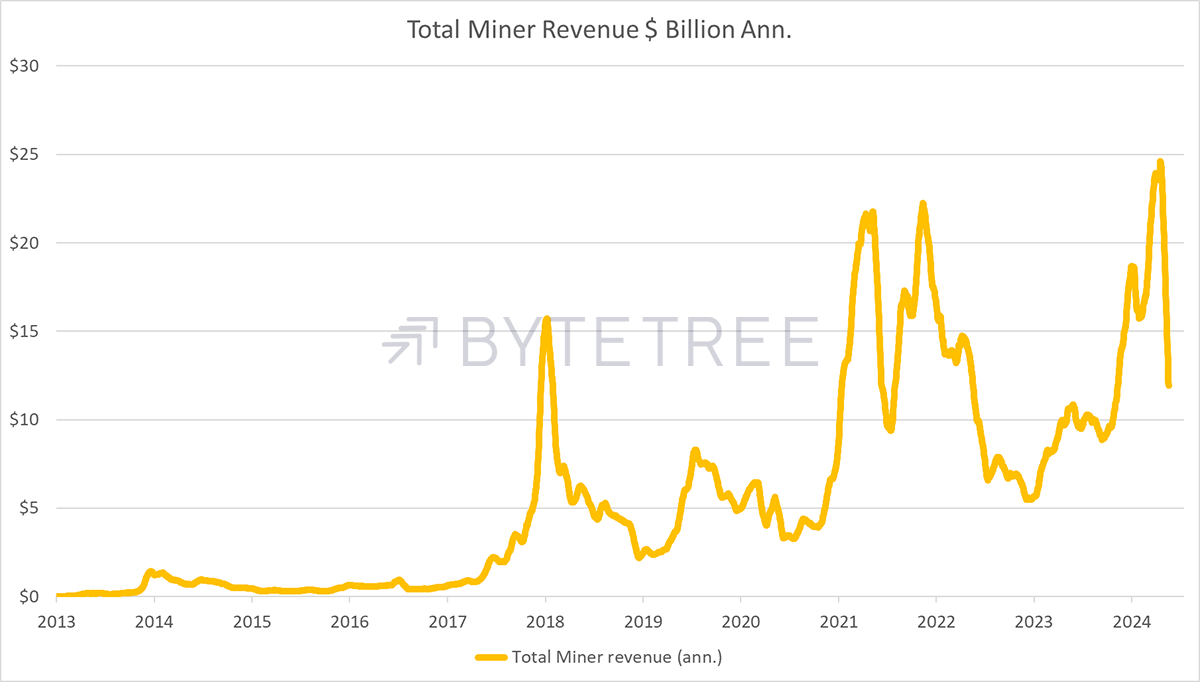

The latest Bitcoin Halving occurred over two months ago, and the network is adjusting to the new regime. The miners have taken an involuntary pay cut from 900 BTC per day to 450 BTC, as the “block reward” has halved.

After the previous halving in May 2020, the miners’ revenue took six months to recover, which is not dissimilar to what was seen in July 2016, when the revenue recovery time was also six months. If that bears out again, that takes us into October, or as Bitcoiners call it, Uptober. The bulls need to be patient.

Total Bitcoin Miner Revenue

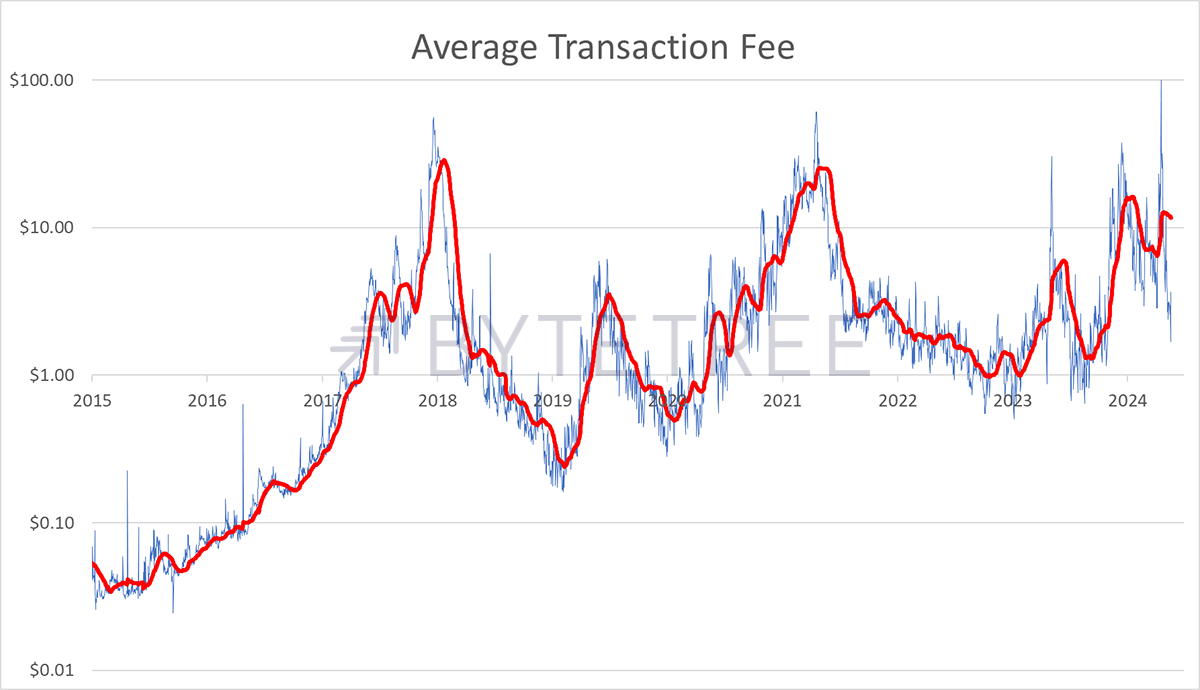

In past cycles, the lower revenues from the lower block reward have been partially offset by higher transaction fees. These surged after 2016 from ten cents to ten dollars before settling back down. But, after the 2020 halving, they once again surged from a dollar back above ten dollars, with extreme moments above $80.

Average Transaction Fee

High fees put downward pressure on the network because they put people off. With just two months of post-halving data, it is pleasing to see that high fees have been averted. They have even fallen slightly, which is in part due to the calmer market following the frenzy around halving, but also down to the Taproot upgrade, which is a software upgrade that improves the network efficiency.

Stable fees are bullish in the long term because they encourage transactions. There have been concerns that sustained higher fees from successive future halvings might impact Bitcoin transactions one day. That would harm the network and weigh on the price. It is wrong to think of a bitcoin as an item. Instead, think of it as a share of a vibrant and valuable network that is powered and enabled by the miners.

Bitcoin’s Energy Consumption

The way the system works is that powerful computers use an iterative process (guessing) to solve a mathematical problem. Equations we learned at school can easily be solved; if A = 2+3, then A=5. Make it more complicated if you like, but in cryptography, there is no reverse solution. That means you have to guess the answer using a “hash”. I quote from Investopedia:

“The hash is a 64-digit hexadecimal number that is the result of sending the information contained in a block through the SHA256 hashing algorithm. This part of the process takes little time to complete—in fact, you can generate a hash in less than one second, pasting some content into an online SHA256 hash generator. This is the encryption method used by Bitcoin to create a block hash. However, decrypting that hash back to the content you pasted is the difficult part: a 64-digit hash can take centuries to decode with modern hardware. A hash might look like this:

a54f83a5db7371eeefa2287a0ede750ac623e49a8ba29f248eb785fe0a678559

It is complicated, but the important point is that the process cannot be shortcut, hence the expression “proof or work”. The miners’ computers must do that work, and the Bitcoin software controls how difficult it is to do. It is a competitive system whereby the more hashing power there is, the more difficult it is to mine. The network wants a new block every ten minutes, and if things are happening too quickly, the network difficulty makes mining more difficult to slow it down, and vice versa.

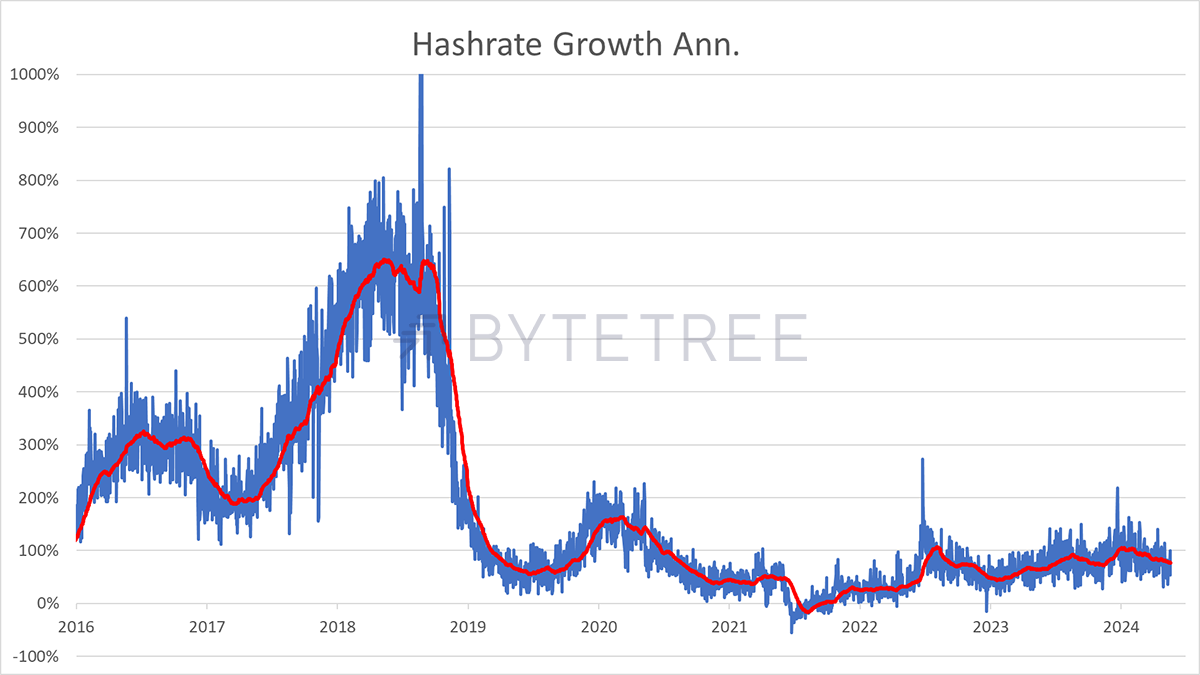

When Bitcoin was under a dollar, it could easily be mined on a PC. But at $70,000 per BTC, which amounts to $31.5 million per day in rewards, it has become a highly competitive process. As a result, the Bitcoin mining infrastructure has ballooned, and along with it, energy consumption. I show the annual growth in the hashrate, which is directly linked to energy consumption.

Bitcoin Hashrate Growth

Bitcoin mining statistics are published on Mining Pool Stats. It states that the network currently runs at 660 EH/s. That means 660 Exa hashes per second. You may recall:

| Kilo | Thousand | 1,000 |

| Mega | Million | 1,000,000 |

| Giga | Billion | 1,000,000,000 |

| Tera | Trillion | 1,000,000,000,000 |

| Peta | Thousand Trillion | 1,000,000,000,000,000 |

| Exa | Million Trillion | 1,000,000,000,000,000,000 |

What is 660 EH/s? It is 660 million trillion hashes per second.

Marathon Digital (MARA) is one of the world’s largest Bitcoin mining companies. They also run their own mining pool, which the Mining Pool Stats website tracks, enabling us to make a few assumptions. Their hashrate is 29.9 EH/s, which is 4.5% of the Bitcoin Network (i.e. they win 4.5% of the blocks). To do that, they consume 760 MW of electricity across 11 sites; nine in the USA, one in the UAE and one in Paraguay.

760 MW for 4.5% implies the total network consumes 16,888 MW or 16.9 GW. That means Bitcoin consumes around 150 TWh over the course of a year. Luckily, that figure squares with data from the Cambridge Electricity Consumption Index, which means this has been verified from three separate sources. If the average household consumes 30,000 KWh per year, Bitcoin’s yearly consumption equates to 500,000 households, or a little less than Northern Ireland, which has 728,000 households.

Is it worth it?

If it was easy to mine Bitcoin, it would not have the security and resilience that it has. The Bitcoin code is no secret as it is open source. Using data from Mining Pool Stats, it becomes clear that the hash rate is closely linked to network value.

You may recall the Bitcoin “forks”, whereby anyone can copy the code and the network’s history or blockchain data and carry on with their own version of Bitcoin. Despite many copies, Bitcoin remains the only valuable one. For example:

Bitcoin and Two Forks

- Bitcoin (BTC) consumes 660 EH/s, and the network (market cap) is $1.4 Trillion.

- Bitcoin Cash (BCH) was forked in 2017, consumes 3.87 EH/s, and the network value is $10 billion.

- Bitcoin (not) Satoshi Vision (BSV) was forked in 2018, consumes 760 PH/s, and the network value is $1.2 billion.

Notice how BTC is worth 140x more than BCH and has 170x more hashing power. BCH is worth 9x BSV and has 5x the hashing power. These numbers are broadly proportional. If the hashrate on the Bitcoin Network increases, it coincides with value creation and vice versa. The network's value is created not just by its users, liquidity, and scope but also by its hashrate.

The Cambridge site has another gift because it estimates the consumption of energy used in the gold mining industry and, more importantly, perhaps, their emissions. The data suggests that gold contributes 100.4 MtCO2e per year compared to Bitcoin’s 75.88 MtCO2e (metric tonne carbon dioxide equivalent). The site concludes that Bitcoin contributes 0.16% of the world’s carbon emissions and gold, a fraction more.

If gold was easy to mine, supply would be plentiful. Plentiful gold would maintain its other appealing qualities, including its beauty, but it wouldn’t be a form of hard money. For that, it must be scarce. I am a long-term bull of both Bitcoin and Gold because they are highly liquid monetary networks. One of the main reasons they achieved that status came from scarcity; it would not be possible without it.

Fiat money, such as dollars, yen, euros, etc., has no scarcity and consumes little energy in its life cycle. It is excellent for transactions, and, at times of low inflation, can even be a store of value like the Singapore Dollar or Swiss Franc. Experience shows us that things rarely turn out that well, and fiat eventually loses its value. Still, in any event, Bitcoin and gold are alternative assets that hold fiat money to account. I do not believe such a proposition, at scale, is possible without significant energy consumption because it promotes scarcity.

Yet both assets are doing their bit, as the Bitcoin and gold miners are improving their environmental credentials. Bitcoin, in particular, embraces surplus energy such as renewables and flared gas. Daniel Batten, a co-founder of methane mitigation fund CH4 Capital, claims that Bitcoin mining consumes 54.5% of renewables.

It is believable because while you can’t move the gold mine to the energy source, with Bitcoin mining rigs, you can. That means the world’s untapped energy can be utilised. Naturally, gold’s credible comeback is that once it has been mined, it doesn’t use any electricity at all!

Technicals

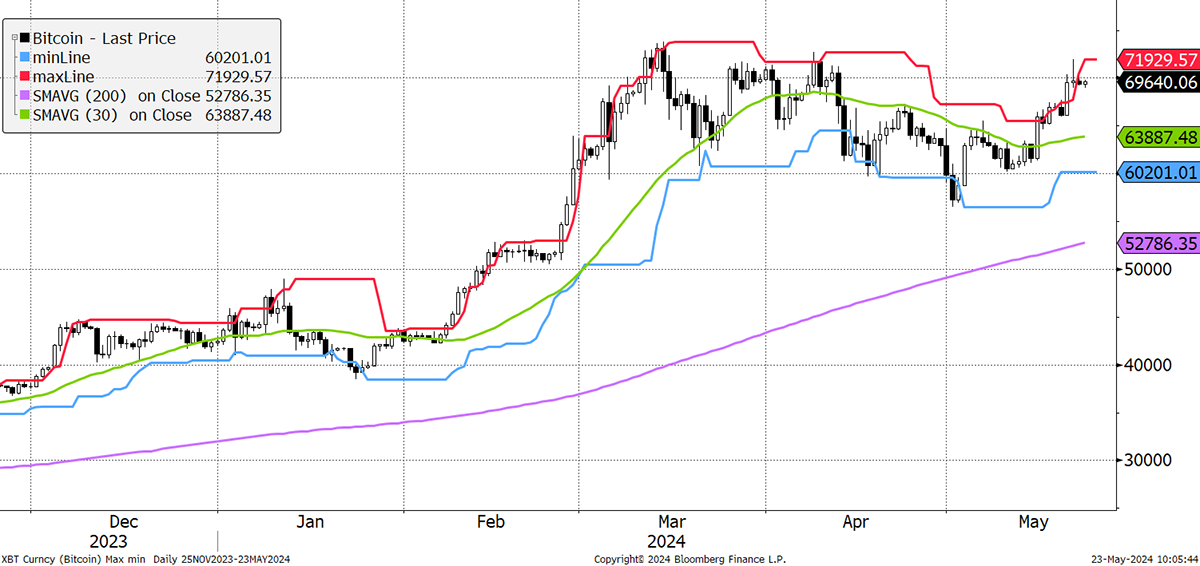

Back to Bitcoin: The trend is looking good, and it is on the verge of a new all-time high. It could happen at any time, but I am still holding out for October.

Bitcoin 5/5 trend score

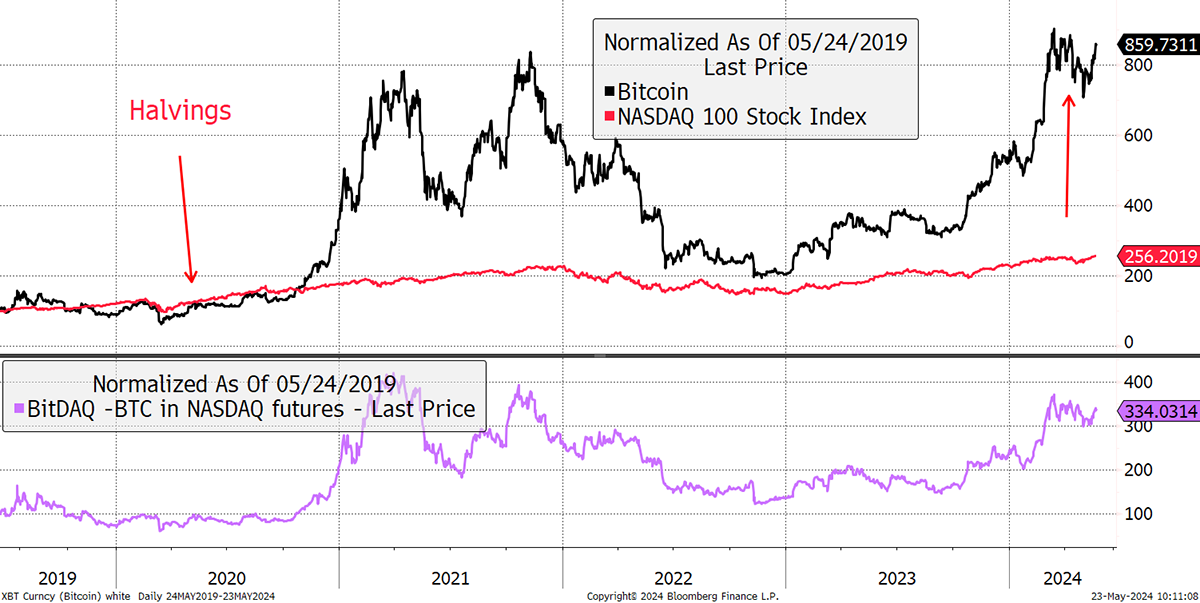

Yet another bullish trait is the BitDAQ, where the purple line shows how Bitcoin is beating the NASDAQ. The more institutional investors believe Bitcoin is a long-term winner that will beat tech, the more they will buy. That will drive the price higher.

BitDAQ 4/5 trend score

As we all know by now, Bitcoin and gold are both money-flow assets, and this is key. I tend to think of mining as a ceiling because they are natural sellers that must be countered with external buyers. At 450 BTC per day, $70,000 BTC requires $11,5 billion of inflows to balance the network. If you think that is a lot, gold is closer to $300 billion.

Investment Flows

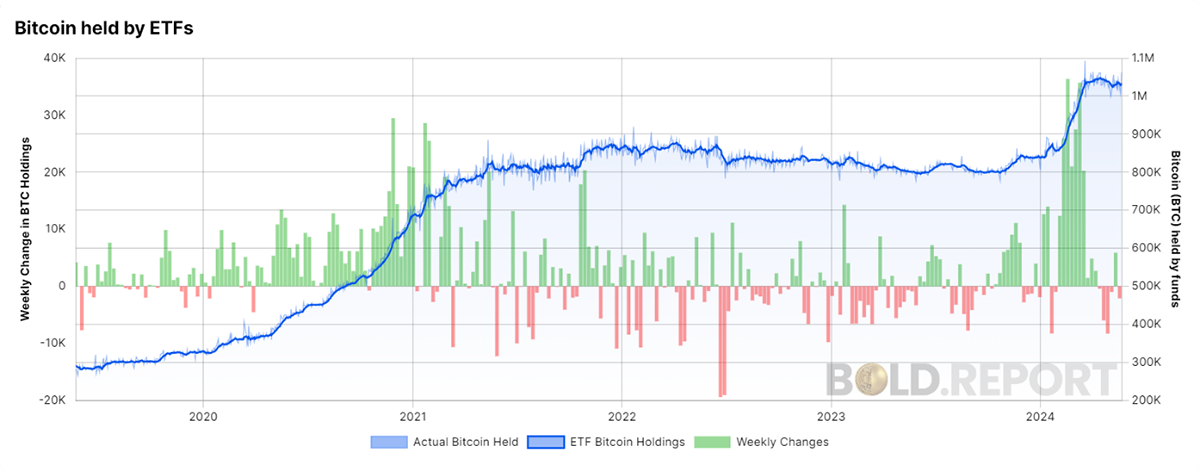

I show five-year charts, with the US ETF flows slowing back down to more normal levels. The heavy outflows from Grayscale (GBTC) seem to have settled and the fund now holds 290k BTC (down from (630k BTC), with the money shifting into iShares (IBIT) and Fidelity (FBTC). Net-net, Bitcoin flows have stabilised.

Bitcoin Held by ETFs

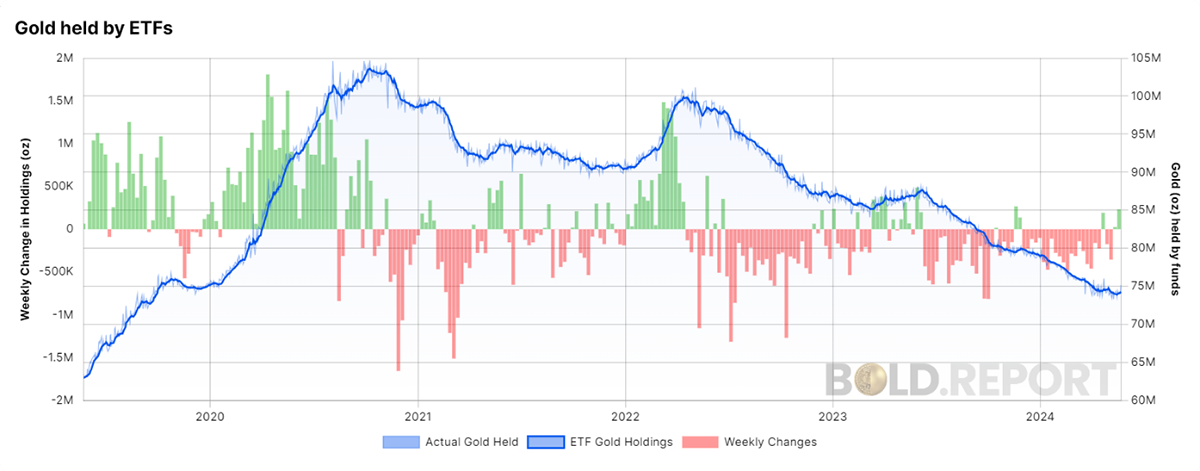

The flows will return to boom, but first, they need a natural pause. It is pleasing to see the European ETFs stabilising as well. The recent best-seller is the 21Shares Bitcoin Core (CBTC), which charges a modest 0.21%. Explore this data on BOLD.report, which also covers gold. Having suffered since 2020, the gold flows are starting to turn up.

Gold Held by ETFs

On-chain

The Bitcoin Network Demand Model scores 1 out of 4, with only the long-term fee indicator remaining, which is cool compared to last month's reading. Notice that I am measuring out of 4 rather than out of 6, and that’s because I have removed MRI and Velocity.

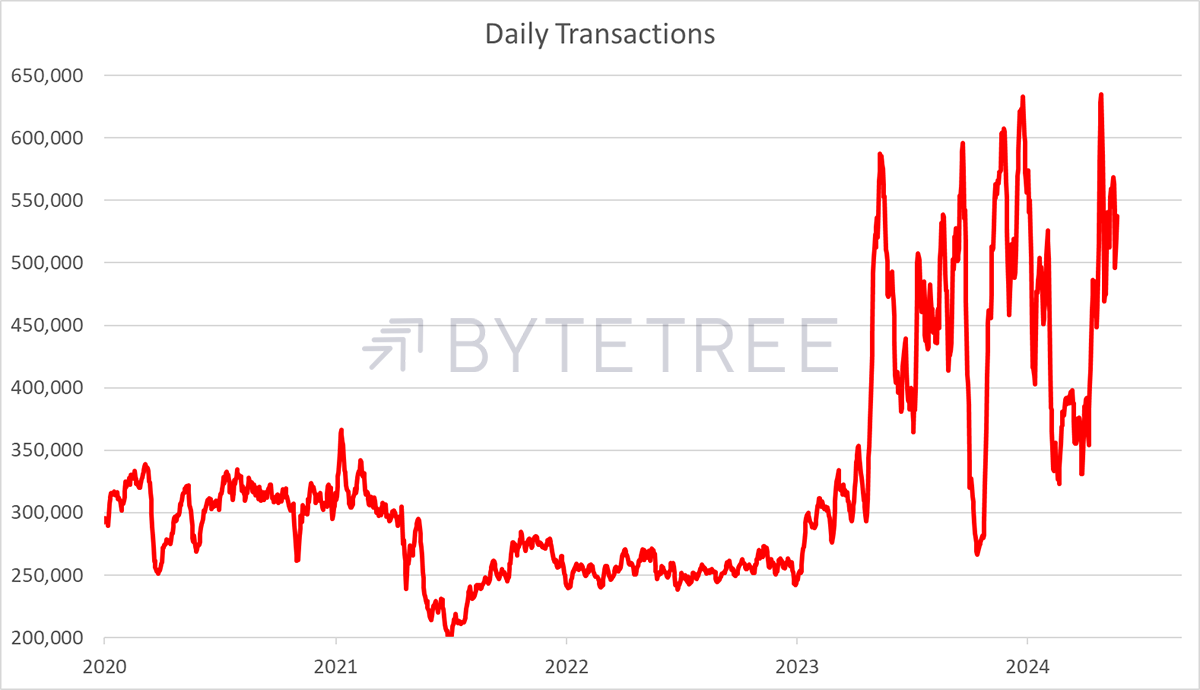

Since ByteTree switched off its live Bitcoin blockchain data, I am not satisfied with the reliability of the available data, especially for MRI, which tracks the miners’ bitcoins. The Velocity reading is no longer as useful as it used to be, so the on-chain data will simply look at the growth in network traffic. That has slowed, but there is no cause for alarm. Transactions are struggling to surpass 600k but seem to be stable.

Bitcoin Daily Transactions

Recall from earlier that average transaction fees are stable, which is positive.

I also show the fair value, which equates the money travelling through the network with the price. Bitcoin trades at fair value, but the network is slowing slightly.

ByteTree Bitcoin Network Fair Value

Macro

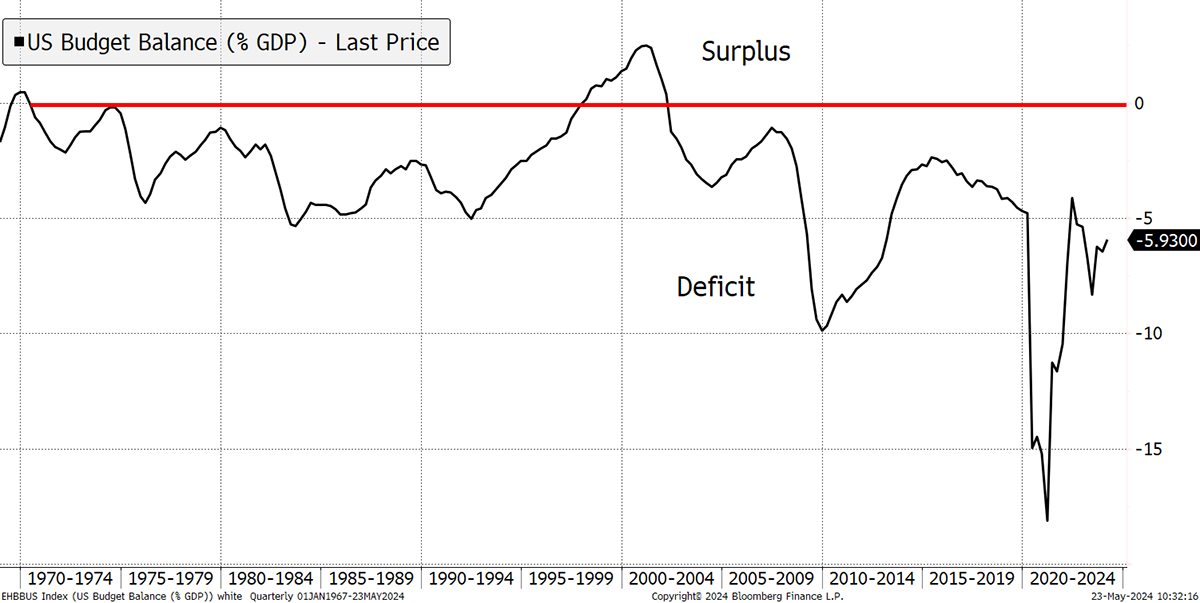

In case you are wondering what all the fuss on Bitcoin and gold is about, look not just at money printing by governments but their spending habits. The last US President to balance the books was Clinton, assisted by the stockmarket boom of the 1990s, and that didn’t last long.

US Budget Surplus and Deficit

It all points to monetary inflation that doesn’t seem to want to go away. Inflation means the purchasing power of money is falling, and that attracts investors into scare and liquid alternative assets of which the greatest are Bitcoin and gold. It was pleasing to see the 21Shares ByteTree BOLD ETP pass the $10 million mark for the first time.

BOLD Passes $10 million AUM

If you haven’t yet watched our BOLD video, it’s a must.

Read our monthly updates for more information about BOLD.

Summary

I have been meaning to write the Bitcoin energy story for some time, and it was made easy by excellent sources that all seemed to verify one another. That is another advantage of being digital. Everything is exactly as it seems.

Your feedback helps the team to build the best service we possibly can. Have no shame in making suggestions, and if you do not understand something, then please ask.