Blue Horseshoe Loves Anacott Steel

A Steel.

Issue 23: Large-cap Industrial;

A Steel.

thyssenkrupp (TKA Germany)

“As an international industrial and technology company we develop and produce technology-based solutions for future customer and market requirements.”

That statement is part of the problem because it is meaningless corporate guff, common on investor relations websites. In most peoples’ eyes, TKA is a heavy industrial engineering business with its roots in steel. In my opinion, it would help if they were proud of that rather than ashamed. It’s not enough to turn me away because I believe things are changing, and this is another “free” equity situation that I have been researching.

So far in Venture, we have snapped up the best of these low enterprise value (EV) situations for the time being, but others will come in good time. I have been pondering about TKA, a rare large cap in this category, because this opportunity shouldn’t exist.

TKA has a market cap of €3.3 billion and holds €7.1 billion in cash and €3.8 billion in long-term debt, of which just €692 million is actual debt. The rest are pension liabilities, which are falling, and long-term lease obligations, which are presumably necessary to carry out their business. After accounting for €829 million of preference shares, the EV is a mere €840 million, which is very low for a company with €36.7 billion in sales.

This is a balance sheet situation, and after decades of being turned into an industrial conglomerate, TKA is being dismantled, or at least restructured and slimmed down, but apparently from a position of strength. Normally, these situations arise from failure, but I reiterate that TKA is well capitalised. It is an interesting opportunity, but it has taken time to understand why the opportunity exists. Being a “dirty” steel business, I think TKA were a victim of the green agenda and perhaps overdid the apologies. They also had to face powerful unions and a mishap in Brazil, but I believe these are more than priced in.

The former CEO, Martina Merz, and pin-up of the German corporate scene, unexpectedly resigned last summer following pressure from the board and was replaced by the CFO, Miguel Ángel López Borrego. She had been criticised for failing to restructure the company quickly enough. Presumably, the pressure was immense, but as a result of her actions, the company stopped bleeding cash.

The brief history is that the two German steel companies, Krupp founded in 1811 and Thyssen founded in 1891, merged in 1999. Let’s not dig into what happened in the middle of the 20th century, but in recent years, they became an industrial conglomerate with multiple divisions spanning lifts, cars, maritime, hydrogen, energy, construction, chemicals and so on. Like America’s GE, conglomerates can become too big.

Old conglomerates are full of hidden gems, but not deemed to be exciting because they are asset heavy in an era that values apps over industry. Students of the Money Map know that in an inflationary environment that should reverse, and I believe that at some point it will.

TKA got into trouble in 2005 following a large investment into Brazilian steel production. It cost them €8 billion and their reputation, and they have been backpedalling since. The combination of high debt and low or negative cashflow, is kryptonite for a share price. Then came the pandemic.

thyssenkrupp Debt and Cashflow

On 28 February 2020, just before the pandemic, TKA sold their valuable elevator business, TK Elevator, to a consortium for €17.2 billion. That was the high-margin business that fetched the magical price. Compared to a competitor, the Swiss lift manufacturer Schindler, the TKA sale was impeccable timing and fetched a high price.

Up and Down for Shindler

The sale fixed the balance sheet, and restructuring combined with the post-pandemic recovery, have fixed the cashflow. This is now positive and expected to continue.

The divestments keep on coming. In a recent statement, TKA announced it was in talks with Carlyle (a defence company) to evaluate cooperation on the planned separation of the marine business. As I said, don’t mention the 20th century, but thyssenkrupp Marine Systems is a specialist in submarines and other specialist maritime defence and is thought to be worth €1.5 billion. Once again, this shows good timing because European defence stocks have been rerated.

There’s also a hydrogen business, thought to be worth €6 billion, but that was an FT article published in January 2022, when the energy sector still believed in fairies. Still, it’s another valuable subsidiary which is not priced by the market.

There’s also the steel business, which supplies Germany’s automotive sector. It’s currently struggling, but it’s a cyclical industry, and with steel production shutting down across Europe, they will still be standing when the good times return. I’d buy that alone. Never underestimate how cash-generative the steel industry is during an upswing.

This is a complex company to analyse because there is so much going on, but the bare numbers and the direction of travel indicate change is underway. As it simplifies and stabilises, the value will be realised.

As usual, the analysts look at short-term earnings to value the company while paying less attention to the balance sheet and hidden gems. Of the 11 analysts who cover TKA, 3 are buys, 7 holds and 1 sell. The current price is €5.13, with a consensus forecast of €7.34 or 43% upside. I prefer the price forecast from analyst Christian Obst from Baader Bank, who targets €16. He is focused on the long-term value of a European survivor in the steel industry, which is not a bad position to take.

This is about value realisation, and with Harris Associates, the US activist, holding 5% of the company, shareholders are keeping the board under pressure to carry that out on their behalf.

Risk

TKA has seen the 90-day share price volatility fall to 35% from over 100% in 2020 (Bitcoin 44%) as the balance sheet has strengthened. 35% is typical for a cyclical blue-chip stock. Liquidity is excellent, with around €18 million traded each day. On that basis, and with hidden value and a strong balance sheet, this could be a stock for Whisky, but the risks go further.

There are unknowns, such as unions, governments, ESG regulation, and economic cycles. It is too complex for Whisky but certainly stacks up for the thoughtful risk-taker. The company would be medium to high risk, but the unknowns take it to high risk. I say that because if it was a small cap, the “free” equity would be easy to understand. This is not Speedy Hire; it’s a 213-year-old giant, and it is unusual to see free equity in this type of situation.

Keeping things simple, the management has been buying the shares. Maybe that’s all you need to know.

Management Are Buying TKA

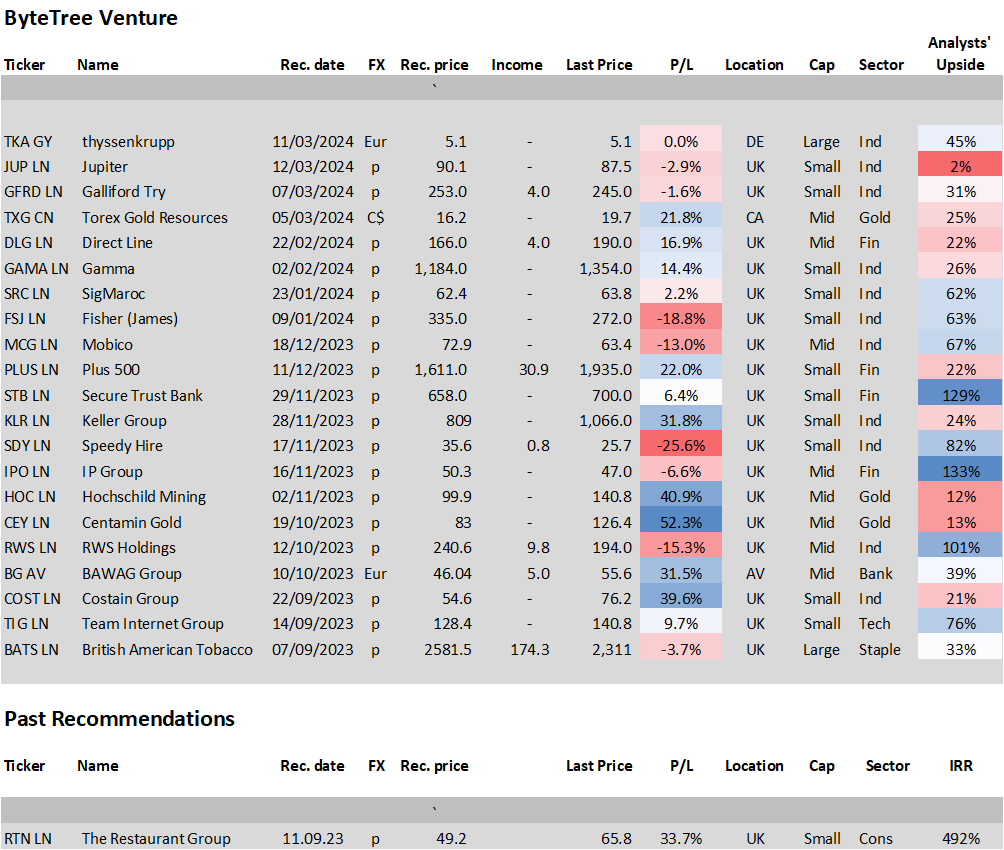

Venture Update

Speedy Hire’s (SDY) Trading statement was at the lower end of expectations, knocking the shares 10% this morning. Yet they closed up on the day, on a down day for the FTSE. That’s reassuring.

Fisher (FSJ) was also up 8.5% on no news. Maybe it’s a market rotation into small cap value, which is long overdue.

BAWAG (BG AV) fell 6.1% or €3.65 as it went ex-dividend, having paid out €5.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com or tweeting me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, Venture

Venture is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority. https://register.fca.org.uk/

© 2024 Crypto Composite Ltd