Unlimited Supply

Disclaimer: Your capital is at risk. This is not investment advice.

I never highlighted Robin and Rashpal’s last AAA Report, which was published during the Christmas holidays. If you missed it, I wanted to show you Robin’s year-end closing remarks:

“We also noticed that there has been a disconnect between underlying fundamentals and market moves…. One of the problems has been that historically reliable recession indicators have all been pointing to a coming recession. It might even be a severe one, but in practice it has not happened yet. We don’t think it’s been cancelled but simply delayed. The indicators still point to it coming eventually, but the timing appears uncertain owing to the long-and-variable lags of monetary policy; our educated guess is somewhere in the first two quarters of next year.”

Robin has been following markets since the 1960s, and there’s not much he hasn’t seen. But this disconnect between the realities of life, such as the cost-of-living crisis, and high valuations in parts of the market is striking. Even for experienced market watchers, it is seemingly new ground.

It’s all about deficits, which seem to have replaced money printing. There seems to be an unlimited supply of government money, and for some reason, no one in politics is talking about it. At least this week saw the launch of the spot Bitcoin ETFs in the USA. It’s the first EFT in history that holds an asset with a limited supply.

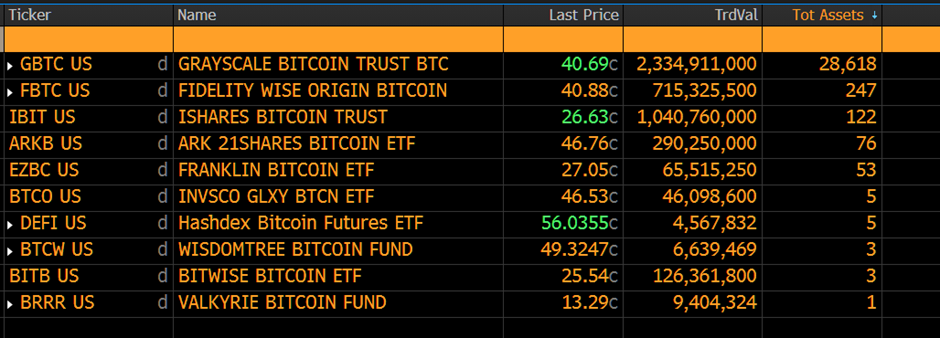

Here’s how the first day of the new US Bitcoin ETFs ended. Grayscale are yet to show their hand, but presumably, they had redemptions. The surprise is that Fidelity beat iShares on day one!

A Week at ByteTree

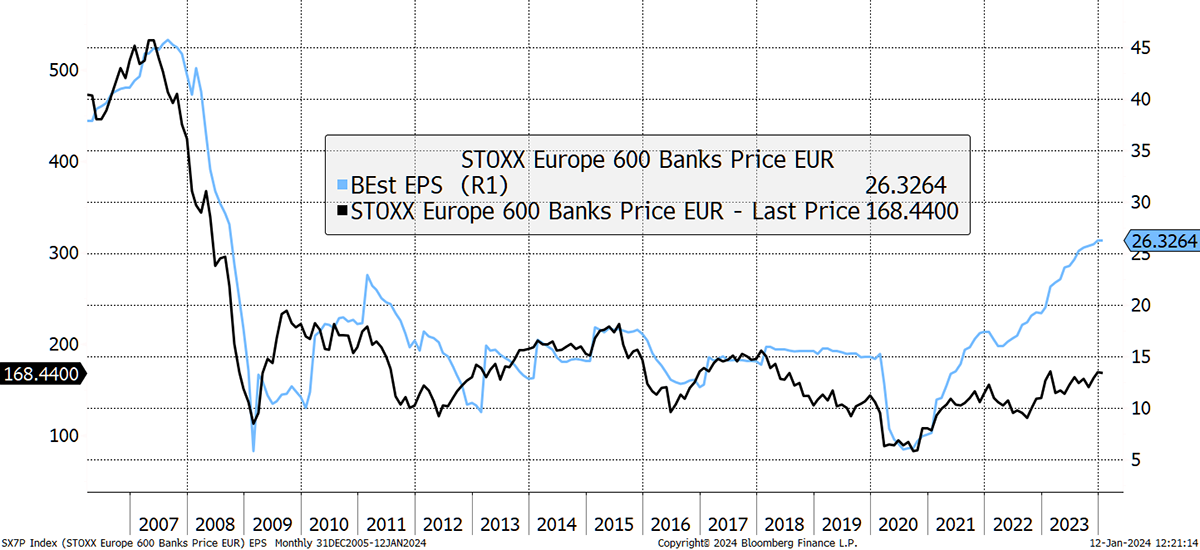

In The Multi-Asset Investor, I revisited the UK and European banks, which have had a sudden outbreak of something called “profit”. Quite remarkable and hard to ignore.

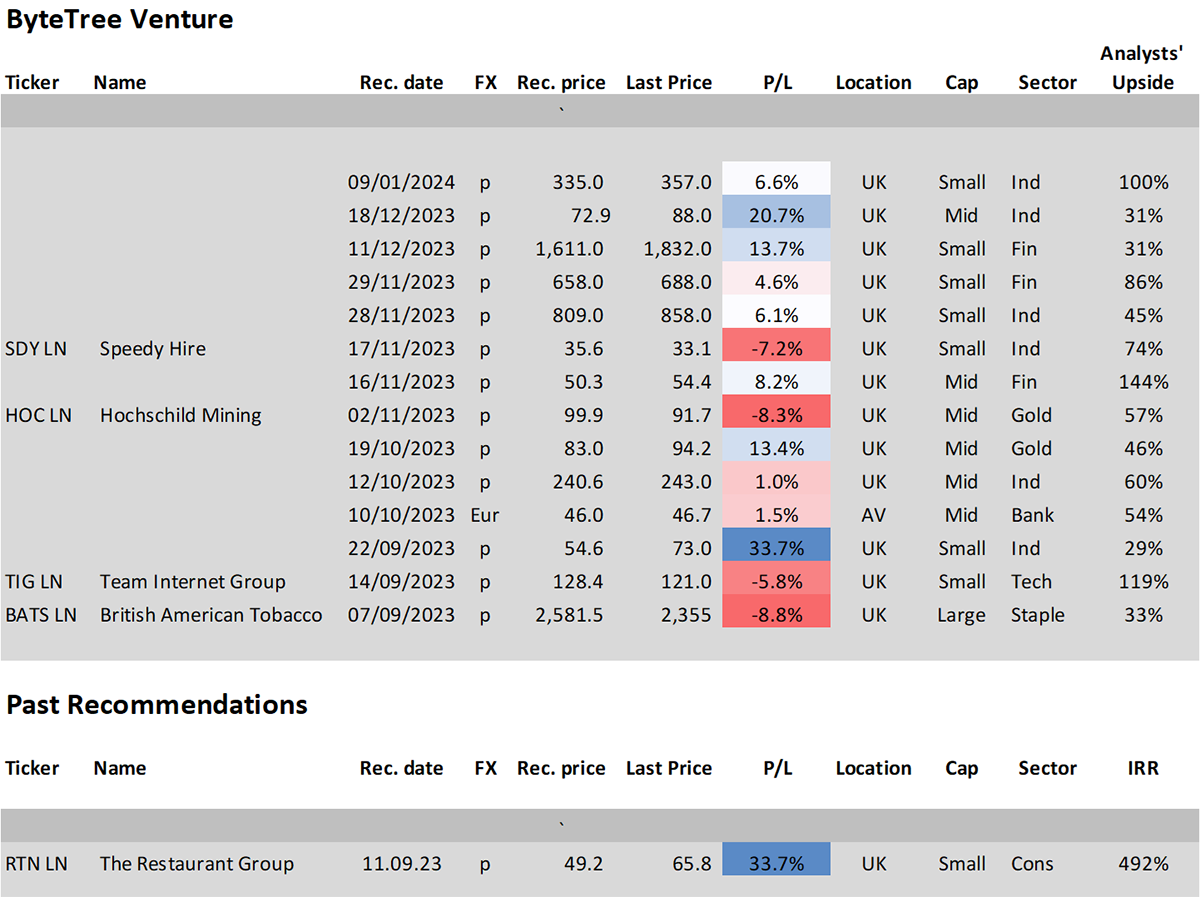

In Venture, I highlighted another deeply undervalued UK small cap in the shipping industry, where the brokers’ estimates point to 100% upside (one of them 180% from a mid-December review).

Venture started in September and was created for the more experienced investor. I felt there was a home for the opportunities I came across that weren’t suitable for the Whisky Portfolio, which need to be large and liquid. So, I started this separate service in mid and small cap stocks. As I dug further, it was clear just how many good, undervalued UK small and mid-caps there were. It’s a rare opportunity to see so many companies trading at levels last seen in 2008.

My approach was to use my large cap screens that I have been using for years and apply them to mid and small caps. It’s working well, and here is a taster, which so many keep on asking for. I’ve only shown the company names and tickers that are underwater since they were last tipped.

Until now, Venture has been a free sweetener within Morris on Markets and The Professional Investor. Now it’s tipped 15 stocks, with many more to come, that will soon change. Venture will become our most premium product and priced accordingly. This year UK deep value; next year, who knows. Wherever there’s avenue, that’s where I’ll be hunting for ideas.

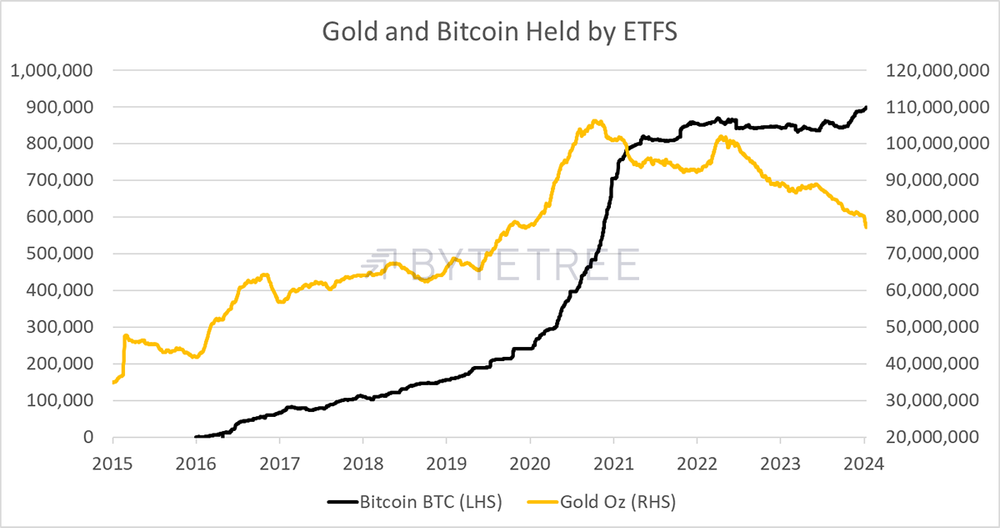

I also wrote Atlas Pulse, my gold publication, where I asked what the new US Bitcoin ETFs mean for gold. It’s an important piece, and the key question is whether bitcoin is stealing gold’s lunch. I don’t think it is, and in a rational world (fat chance of that), both would see strong inflows. Bitcoin and gold are not in competition; they are a team.

ByteTree will be tracking this data here soon.

Finally, in ByteFolio, we added a new token.

Have a great weekend,

Charlie Morris

Founder, ByteTree