Value Investors Gain the Upper Hand

Disclaimer: Your capital is at risk. This is not investment advice.

It’s been a heavy week of data. Inflation fell in Europe and the UK, and the Bank of England and the Federal Reserve paused their aggressive interest rate hikes. Phew. Relief, you might think, but US and European bonds sold off again while growth stocks took a tumble. Gold held firm.

In my monthly gold piece, Atlas Pulse, I looked at China’s increasing influence on the gold price. It was triggered by the return of the Shanghai Premium, which comes around every other year or so. It shows that the price of gold in China is higher than in the rest of the world. That tends to be bullish as it reflects high demand.

This recent Shanghai Premium is the highest on record and has supported the gold price. Gold has shrugged off both falling inflation and higher bond yields, which means something’s up. Most likely China’s official gold reserves.

The Shanghai Gold Premium

China is boosting its gold reserves as it seeks to gain more influence around the world at a time when growth is slowing. But I wonder if that slowdown is specific to China or is a global theme. After all, China has been the engine of growth in the 21st century, so it seems unlikely it can suddenly become irrelevant without consequences.

Growth versus Value is a well-trodden investment discussion. Is it better to buy cheap and tangible old-school things or go-go growth stock? Like everything in investing, it’s a cycle, and growth has played out. Lockdown was a boon for the internet, fueled by trillions of freshly printed money. Move forward a few years, into a world with no travel restrictions or free money, and the tables have turned.

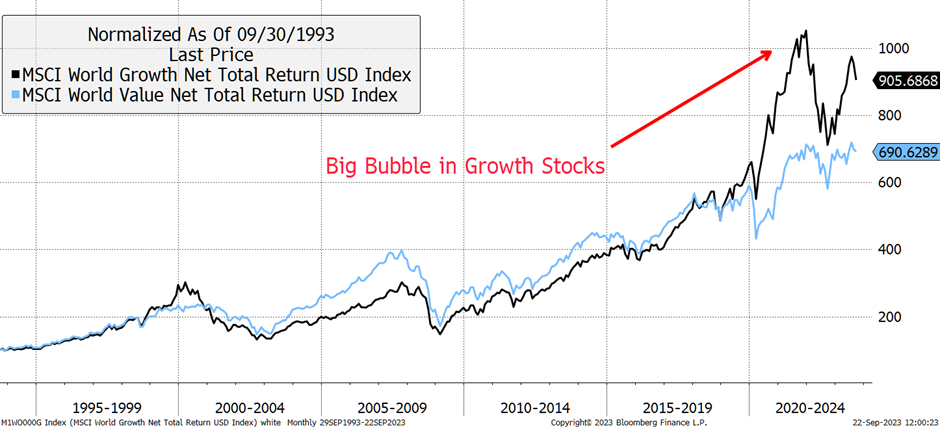

Global Growth vs Value

The remarkable thing is how the two strategies periodically crossover. Growth led into 2000, but then took years to recover the brutal losses from the 2000 to 2002 bear market. The last decade has seen growth pick up while value has lagged. Recent exuberance in growth makes another rotation back to value inevitable.

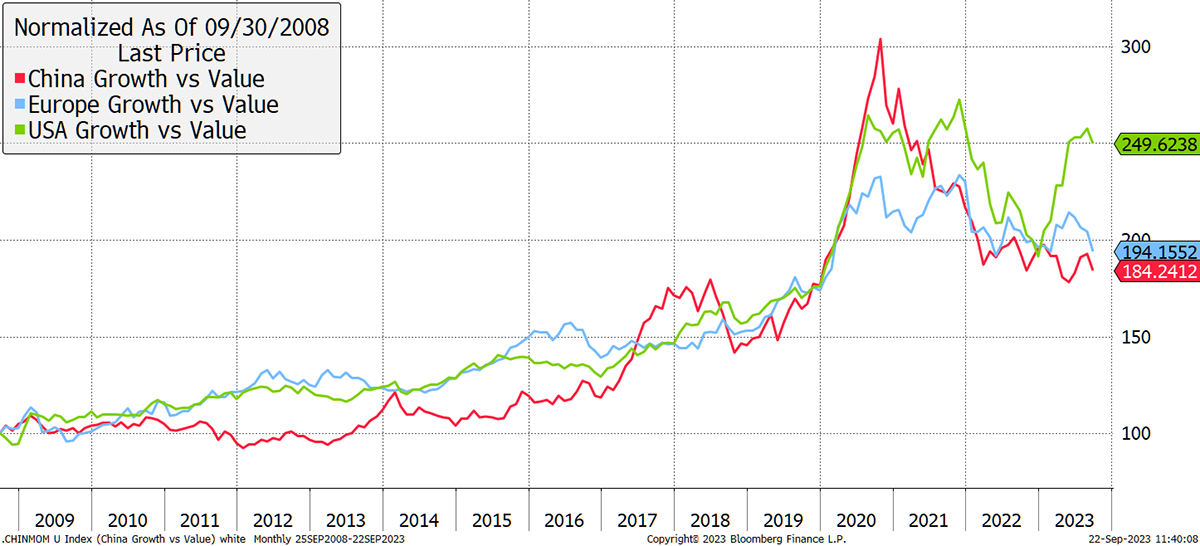

Growth versus value can be split by region, in this case, China, the USA and Europe. It is remarkable how the outcomes have been so similar over the past few years. Chinese growth stocks peaked three years ago. Europe’s held on a little longer, but US growth has been holding firm.

Growth vs Value by Region

But the harsh realisation is that rising bond yields remain a threat to growth stocks, as we saw last year and again this week. Moreover, growth stocks are expensive and priced for perfection, and therefore lack wiggle room. One advantage of cheap assets is they have plenty of wiggle room and can absorb bad news.

Apple has just launched a new phone which appears to be a bit like the last one. They will never recreate the magic of 2007 when the iPhone was truly revolutionary. Now, it’s barely evolutionary, yet Apple trades on 28x earnings and is worth slightly more than the FTSE 100. I understand the FTSE doesn’t set the world on fire, but it is globally diversified and resilient. It is much easier for Apple to disappoint than the FTSE.

Value investing is ByteTree’s specialty. Last week in Venture, which is our new place to highlight value stocks and other special situations, I highlighted a company that is 149 years old, debt-free and dirt cheap. The analysts think it’s a potential two-bagger. I say three.

In the Whisky Portfolio, I travelled to northern Italy (virtually at least) and found yet another undervalued industrial giant. The surge in growth stocks has left behind rich pickings for value investors. I am loving it.

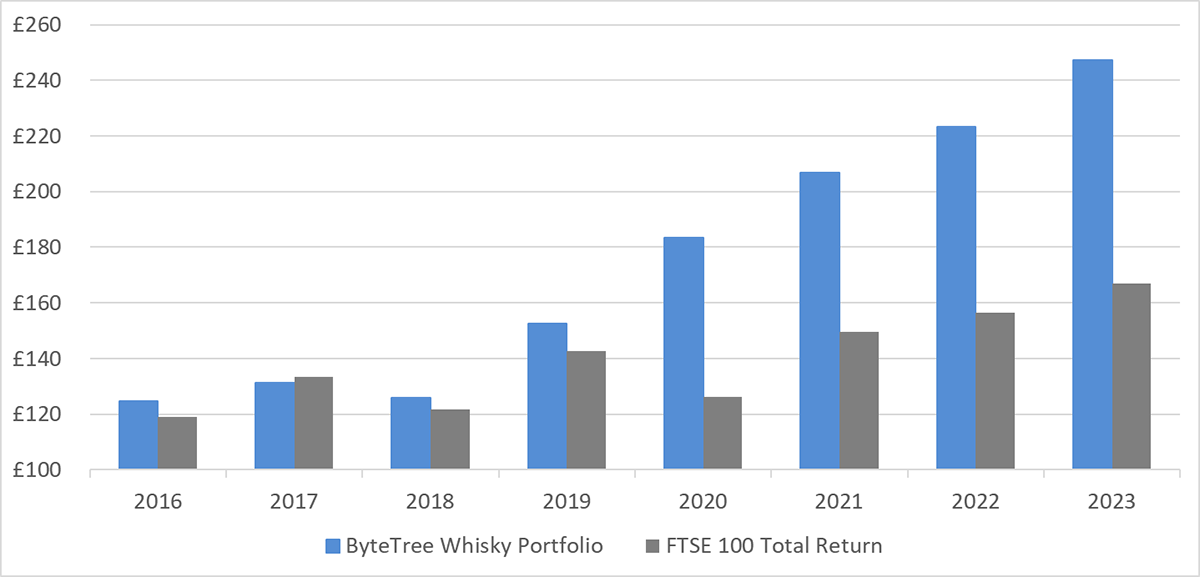

The Whisky Portfolio has had a good year, once again gaining ground ahead of the FTSE 100 after including dividends. Unlike Venture, the stocks are more robust and liquid and are mainly large caps.

ByteTree Whisky Portfolio

The Chinese saying, “may you live in interesting times,” is highly appropriate. These are times to think differently, think independently and steer well clear of the crowds.

Have a great weekend,

Charlie Morris

Founder, ByteTree

Comments ()