Bitcoin Is Not in a Bear Market

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 89;

Bitcoin is softening, and the network is cooling, but we know where the low is. Good things could happen should ETFs get approval, and the next halving is just seven months away.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto Stocks.

Highlights

| Technicals | Slipping |

| On-chain | Weaker |

| Investment Flows | Softer… but the ETFs are coming |

| Crypto Stocks | Who are Square? |

| Macro | China |

| Regulation | The Travel Rule |

Technical

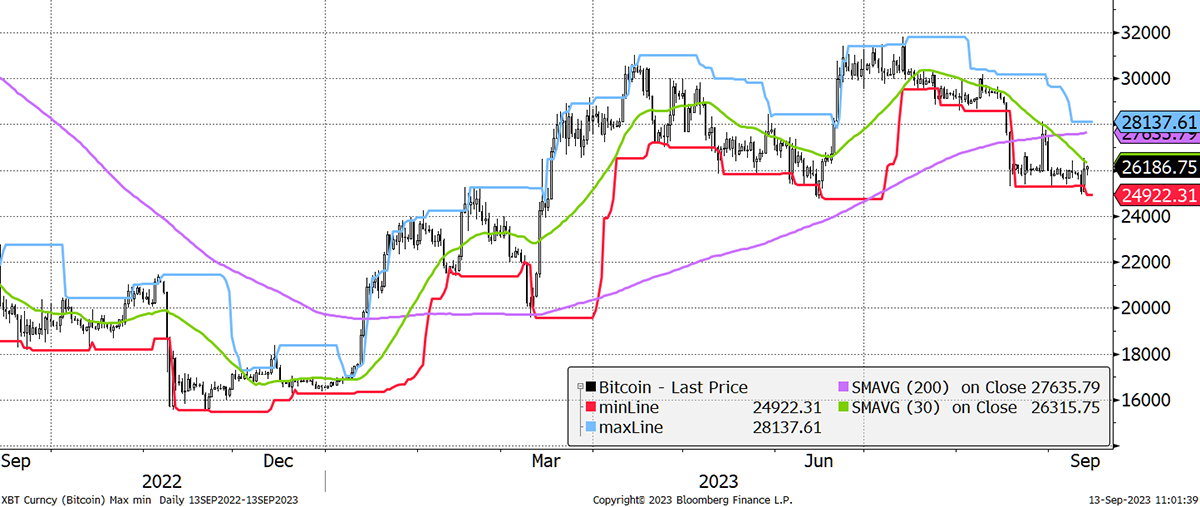

Bitcoin’s technicals are sliding. The only positive is the rising 200-day moving average. Price is trading around support at $26,000, but I doubt it is a hard floor.

BitUSD – Bitcoin in Dollars – ByteTrend Score 1 of 5

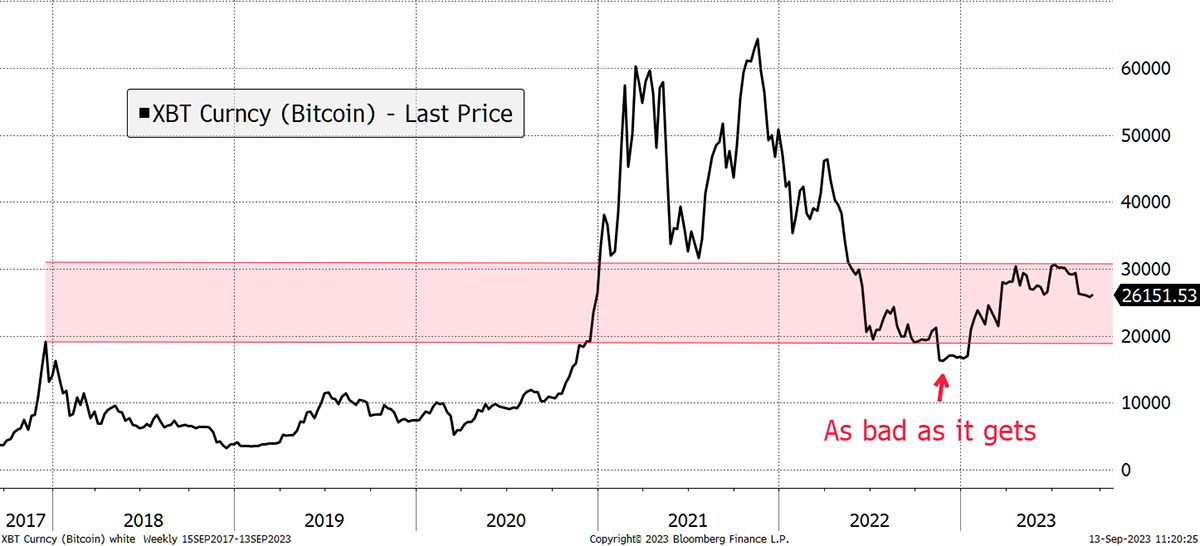

But that probably doesn’t matter much because Bitcoin was tested last year with a low of around $15,700. That was the time of the FTX crash, and I believe that is as bad as it gets. The red bands, which basically cover the 20 to 30 range, are probably where Bitcoin will remain inside until post-halving in April. That said, $30k is the cycle average, and historically, Bitcoin has always entered halving above the cycle average. A breakout is therefore possible, but so many things matter, from the macro to the ETF approval by the SEC.

Bitcoin since the 2017 High

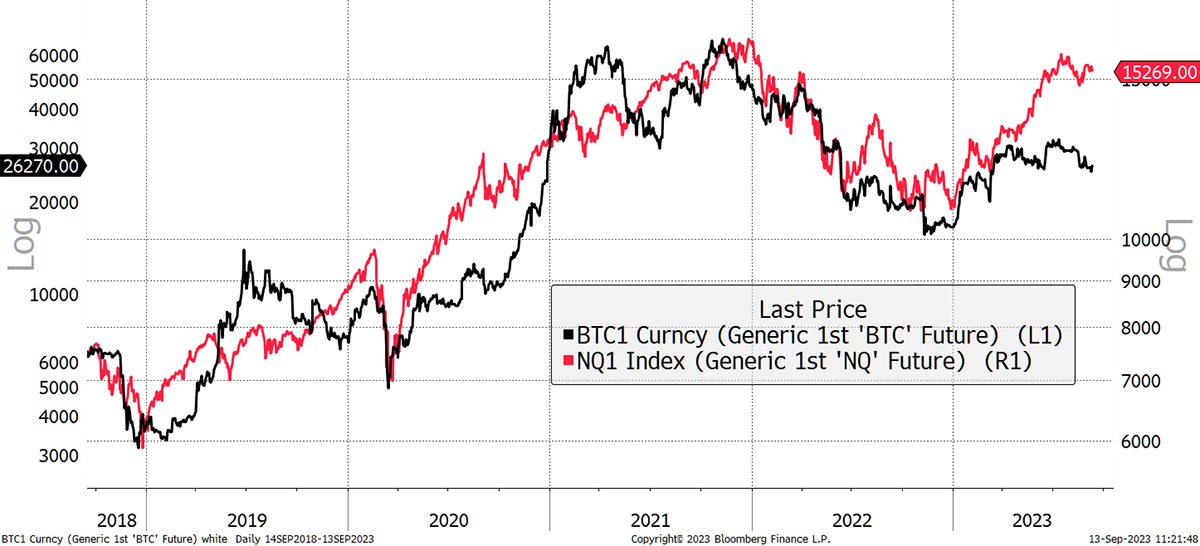

We mustn’t forget that Bitcoin could be telling us something. It has often been a leading indicator, and we know that there is a bubble in technology stocks of historical significance. BTC led the fall in late 2021, and technology followed. I would take this leading indicator seriously.

Bitcoin vs Nasdaq – Often a Leading Indicator

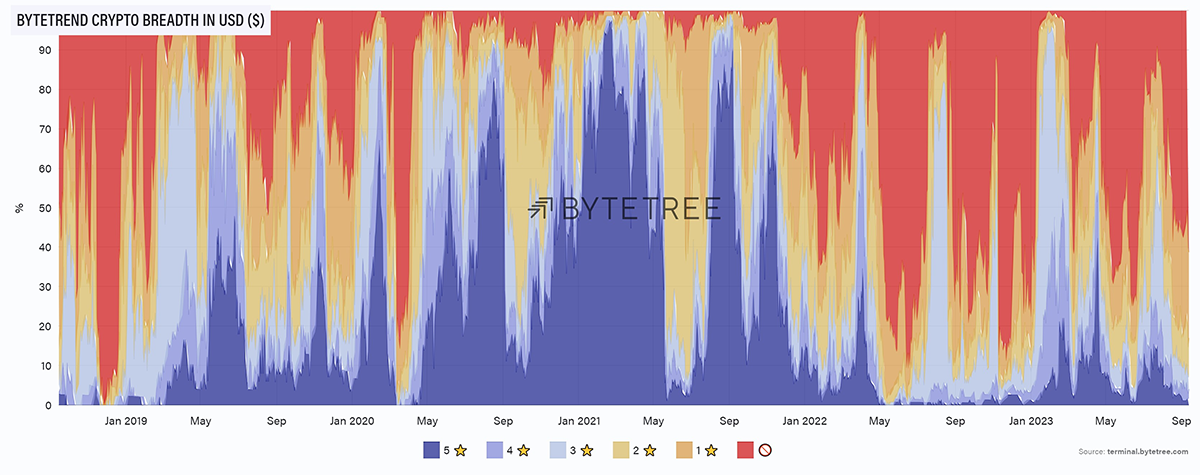

Yet, crypto is weak. There are a negligible number of blue uptrends in the top 100, and red downtrends are back on the rise. The last bear market, which ended in November 2018, saw blue dominate the scene thereafter. That era turned red in late 2021, where we have spent the last two years.

Crypto Breadth Remains Weak

We just have to wait for better times. They will come!

On-chain

The Bitcoin Network Demand Model scores 2/6.

The short-term fees are off for the same reason as the last couple of months: the ordinal boom from earlier this year has distorted the data. I would override that and say the fees were in good health. Certainly, daily transactions are still buoyant.

The Spend (network activity) is more of a concern because it is falling, and I have no excuses. That means while the number of transactions is robust, the value of them has declined. That determines fair value because Bitcoin’s primary role is to move money around. But at least our fair value is $27,702, which is above the current price. The bottom line is that the network is shrinking, which means we should remain cautious.

Bitcoin Fair Value

Investment Flows

It’s raining Bitcoin ETFs, or at least applications. I read that four of the top 15 global asset management firms have a Bitcoin ETF application with the SEC. The chairman, Gary Gensler, basically hates crypto, but US politics is full of surprises. Various senators are more supportive, and the SEC has to tread carefully. The SEC can only deny the ETFs for good reason, and we expect a delayed announcement in the first quarter of next year.

I have no doubt that US ETF approvals would be a game changer because, as I have been saying for years, Bitcoin is all about money. Get the blockchain humming with cash, and the price goes up. It’s that simple idea that the wealth management industry invests 1% of their assets and boom.

Back to earth in 2023 and the global Bitcoin ETFs have seen modest outflows. It is not large enough to worry about at this point.

While we are discussing wealth managers’ desire for Bitcoin, at least the past two years have seen growth. That hasn’t been the case with gold. It tells us they are getting ready to try something new.

I mentioned Block (SQ) in ATOMIC 88. SQ was founded by Jack Dorsey, who also founded X (Twitter). I liked SQ’s Bitcoin exchange, which was compliant for US investors and seemed to be doing god’s work.

I have had a closer look at the company. It is basically a payment app, which has done well, with $20 billion in annual sales. That compares to PayPal (PYPL), which has $28 billion in sales. However, PYPL makes $4 billion per year, while SQ might make a billion if it’s lucky. The trouble is that PYPL is valued at $69 billion and SQ $33 billion. But you doubt that because SQ never seems to pay much tax while managing to pay out similar stock-based compensation as PYPL to its employees.

While I salute SQ for growing the Bitcoin economy, as an investment, it fails the sniff test and, in my humble opinion, is overvalued. I tried to brush up further on SQ, but much of what I read made little sense. In the question of “What is Square?” I am none the wiser.

I will keep hunting for credible crypto stocks, but in ten years of studying this space, I have yet to find anything more credible than pure Bitcoin.

Macro

External pressures seem to be building, and I’ll start with China. Hong Kong’s Hang Seng Index has become a China proxy. Shown relative to the world index, HK peaked in 2009 and has been on the decline ever since. I have long believed that persistently weak stockmarkets warn of trouble ahead. The Hang Seng has been lagging for 14 years. Time’s up.

Hang Seng Index Relative to the World

The Hang Seng Index isn’t falling rapidly but has stalled while the world has been rising. That means something isn’t right. Naturally, we know about the property crash, but next comes the debt. We know there’s a problem because the banks are trading below book value, just as the Western banks did ahead of 2008.

The result has seen capital outflows, which ought to be good for Bitcoin in some ways, but capital controls less so, as the network only benefits once. The bottom line is that a weak China has led to a weak Renminbi (they’ve cut rates) and a strong US dollar. A strong dollar has been no friend of Bitcoin.

Then there’s the tech bubble, which will unwind sooner or later, and Bitcoin correlates with technology. That is unlikely to be good news in the short-term but provides the opportunity for Bitcoin to differentiate itself. That would be very bullish indeed.

FCA Travel Rule for UK Cryptocurrency Transfers

After a year-long grace period, the FCA will now enforce the Travel Rule on all crypto asset transfers in the UK from 1 September 2023. According to the FCA announcement, Virtual Asset Service Providers (VASPs) responsible for crypto asset transfers must comply with the Travel Rule for any transactions being sent or received within the UK or any other jurisdiction that has implemented the Travel Rule. Additional guidance was also provided for transfers entering jurisdictions where the Travel Rule has yet to be implemented.

It was first introduced to crypto assets by the Financial Action Task Force (FATF) in 2019, reworked from the original Travel Rule enforced on wire transfers (i.e. SWIFT). The Travel Rule is set to enforce anti-money laundering and counter-terrorist financing by requiring basic information about the payer and payee for each transaction.

Any measures to combat criminal activity would naturally be welcomed in any jurisdiction; well, in theory, anyway. Practically, there are some issues. With the crypto space bringing in some unique elements, like decentralised finance, peer-to-peer transfers and self-hosted wallets, the original guidance for wire transfer does not quite measure up. Additionally, as per a FATF statement from June 2023, “jurisdictions continue to struggle”, and only 35 countries have so far implemented the new Travel Rule, with many of them yet to come into effect. This imposes some quite unique challenges for the VASPs, where adhering to the Travel Rule must be easier said than done.

As of writing, only a few days have passed since the September deadline, and consequently, it’s too early to say what impact this will have on the UK crypto industry. I can’t help but see echoes of the Howey test, where regulators are trying to implement rules unfit for the uniqueness of the crypto space – a bit like trying to fit a square-shaped object into a triangle-shaped hole. It’s almost like we need fresh measures in place – Privacy Pools, perhaps?

Summary

Imagine what it must be like trying to regulate Bitcoin. I’m sure herding cats would be easier.

Bitcoin is softening, and the network is cooling, but we know where the low is. Good things could happen should ETFs get approval, and we approach halving in just seven months. It’s too late to be a bear.

Your feedback helps the team to build the best service we possibly can. Have no shame in making suggestions, and if you do not understand something, then please ask.