The Benefits of 30-Year Mortgages

Disclaimer: Your capital is at risk. This is not investment advice.

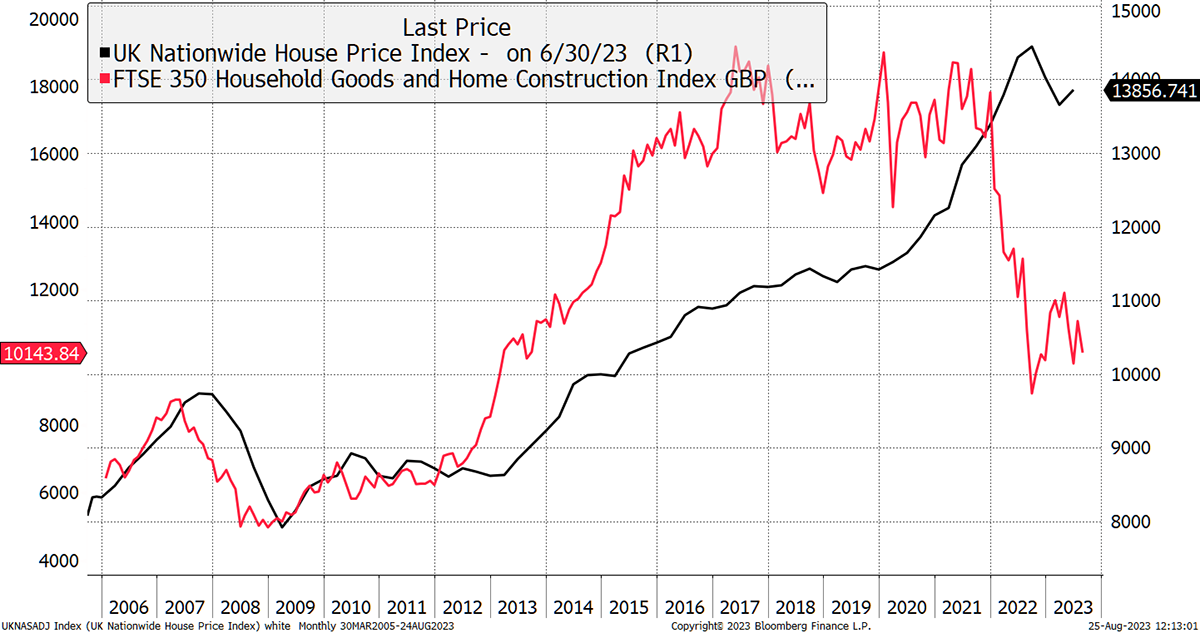

UK House prices are back in the news because they have been coming under pressure. Unsurprisingly, that has sent the housebuilding stocks downwards, some more than 50%. That appears to be a painful correction, given how shallow this fall in house prices has been thus far.

Are the Housebuilders Forecasting a Major Correction?

The blame goes straight to the Bank of England, who have been raising interest rates at the fastest pace for a generation. Rates averaged 5% in the 1920s, dipped below 5% in the 1930s and 1940s, only to spend the next five decades generally at 5% or higher, occasionally much higher. The last decade’s experiment with rates at zero seems to be an anomaly that is finally over.

Back to the 1920s

The way in which the UK house builders have collapsed might seem alarming, but the facts are that the housebuilders’ profits have collapsed, and share prices generally follow the profits. In the case of Persimmon, the UK’s largest housebuilder, sales were £2.14 billion in the second half of 2020, which compares to £1.19 billion for the first half of this year. That’s one hell of a drop.

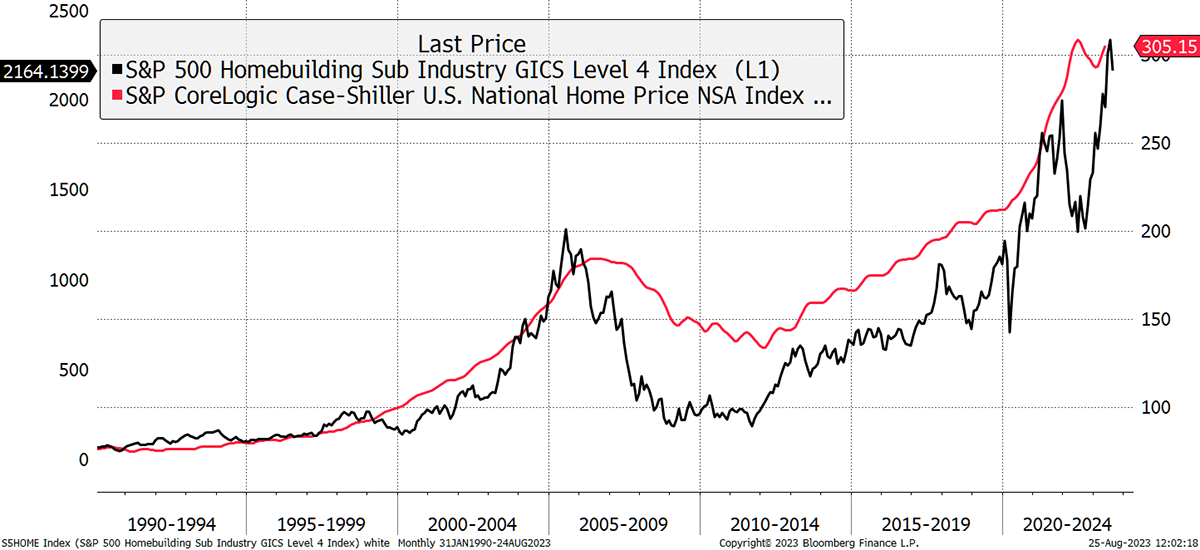

Over the pond, US house prices have also doubled since the 2009 low, with the housebuilders up more than 10-fold. Just like over here, US house prices are a little off the highs, but the house builders haven’t missed a beat. Even Buffett came out admitting to picking up a billion dollars of stock last quarter.

US Home Builders Push Higher

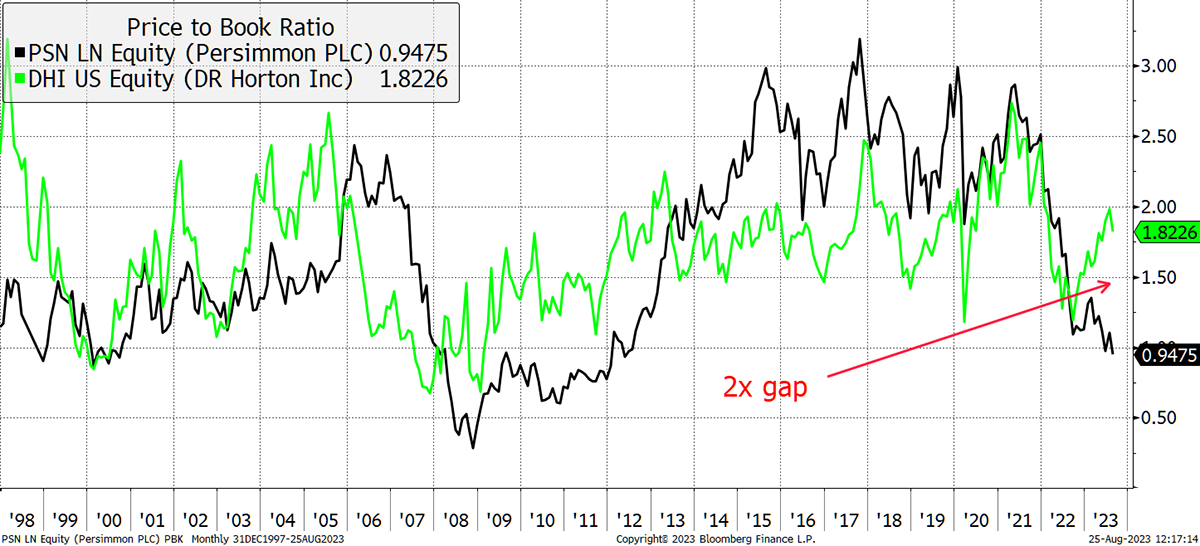

There’s a housing shortage, or so they say. I compare the two largest housebuilders in the US and the UK side by side. Going back 25 years, it’s fair to say that the price-to-book valuations (market cap compared to assets such as stock and land, less debt) have been similar and correlated for both companies most of the time. Yet today, there is a divergent gap. Persimmon trades slightly below book value, in contrast to DR Horton (a housebuilder, not a doctor), which trades at a 1.8x premium. Back in 2008, both stocks traded significantly below book value.

Valuation Comparison

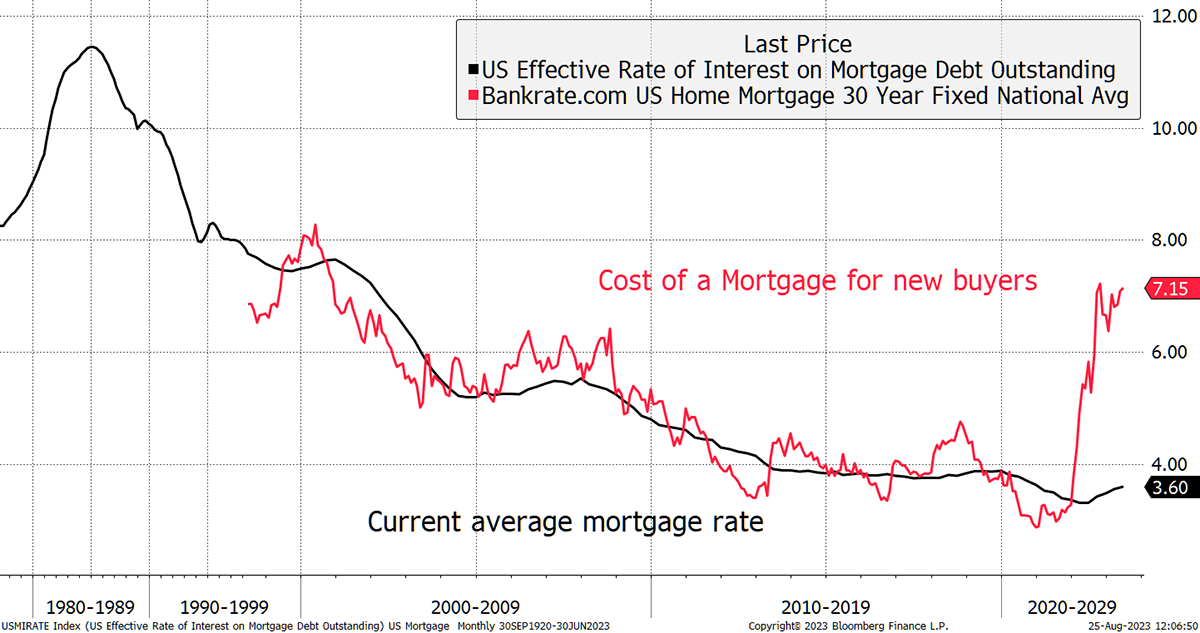

There are many differences between the US and the UK, one being that the UK was once a great capitalist system, while the US still is. Another is their 30-year fixed-rate mortgages, which provide long-term stability for homeowners. In the UK, the maximum fixed period is around five years. With the rate hikes starting in December 2021, an increasing number of mortgage holders will feel the impact of higher rates over the coming years. In the US, that impact will take years longer, as the average mortgage has only risen from 3.3% to 3.6%. Little wonder homeowners aren’t panicking. At least not yet.

US Mortgage Rates

The trouble is that there is never a free lunch. What is happening is that US homeowners are now stuck and cannot move because that requires a new mortgage, which would cost over 7%. That freezes market liquidity, which has been (mis)interpreted as a housing shortage. There are too few homes for sale, not because there aren’t enough homes, but because homeowners would rather stay put. This is a market freeze.

DR Horton has been one of the great post-2008 trades, up 12x since. It may surprise you to learn that Persimmon is up 15x, or at least it was until the 2021 peak. Around the world, house prices are high because easy money has provided fertile conditions for the sector. But it’s hard to imagine them going much higher until the rate cycle turns down again.

The good news is that the UK housebuilders are back into value territory, which means when rates do eventually settle down, it’ll be another great opportunity to capitalise on. In the meantime, I suspect things get worse before they get better.

A Week at ByteTree

Last week, I talked about China and how the system is freezing up. In most countries, interest rates are rising while theirs are falling. Is that a good thing? No, it is telling us that the economy is no longer growing like it once was and may (very likely) become problematic. You know it’s serious because they are cancelling lines of economic data such as youth unemployment. A weak China is going to become a major headwind for the global economy, and as an investor, your most important objective should be to stay out of trouble. Do not buy the housebuilders anytime soon.

In the Multi-Asset Investor, I also provided a short list of cash funds, which take advantage of current rates, which are ever more appealing.

Next week, we will be publishing ByteFolio on Tuesday due to the UK Bank Holiday on Monday. It will be a busier week with the usual publications as well as my Atlas Pulse Gold Report and Robin and Rashpal’s Adaptive Asset Allocation Report (AAA). Gold is looking interesting because it seemingly refuses to be part of the solution rather than the problem. In particular, I‘ll be focusing on silver.

Have a great bank holiday weekend,

Charlie Morris

Founder, ByteTree

Comments ()