Vinter ByteTree BOLD1 Index

Disclaimer: Your capital is at risk. This is not investment advice.

Monthly Rebalancing Report | July 2023;

The ByteTree BOLD1 Index (BOLD1) rose by 0.4% in June, taking the return for the year to 20.5% in USD terms. Over the month, Bitcoin rose by 12.1%, Gold fell by 2.2%, global equities were +5.9%, and US Treasuries were -2.6%.

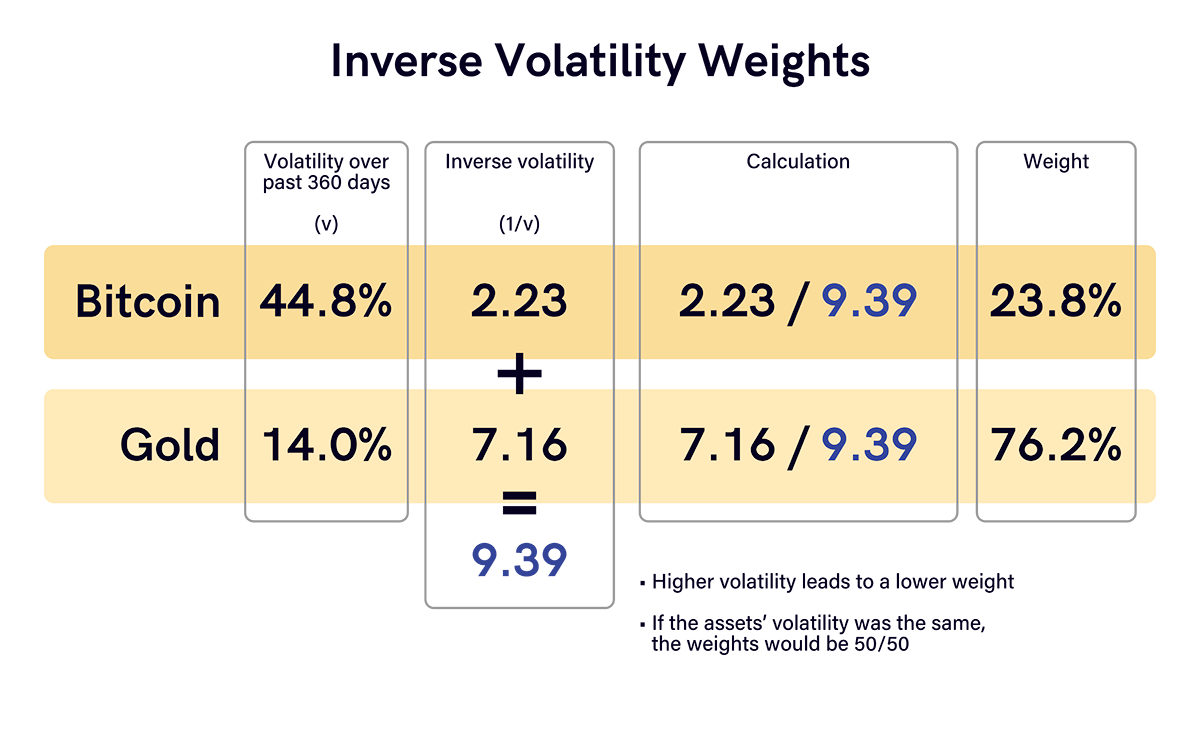

The new weights on 30 June for the BOLD1 Index are 23.8% Bitcoin and 76.2% Gold.

US equities think it’s a bull market, European equities are scratching their head, while Asian equities see a crisis. In contrast, surging interest rates fight stagflation, commodities see a recession, and the long bond a depression. Gold softness reflects relief in global tensions, while Bitcoin advances with confidence. Markets are giving mixed messages, but BOLD carries on regardless.

Over the past year, Gold has matched the return from a 60/40 balanced portfolio, while Bitcoin has advanced by 57%. This reflects the timing as the Terra LUNA crash occurred in June last year, which boosts the YoY comparison.

BOLD1, Bitcoin, Gold and a 60:40 Portfolio over One Year

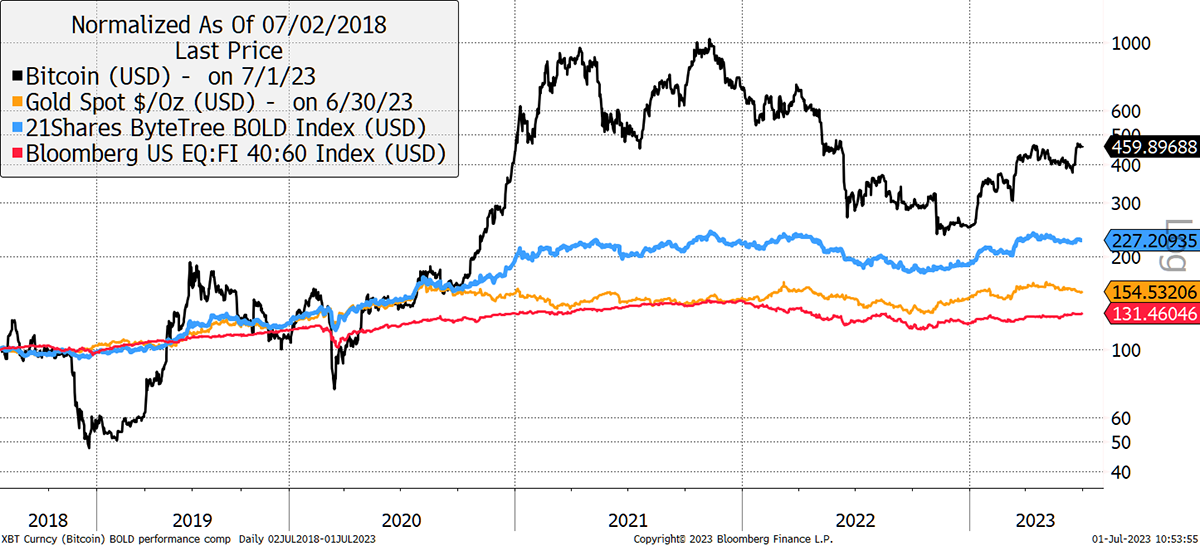

The LUNA crash is clear on the 5-year chart. Bitcoin is up 460% and BOLD 127%, which is 4x better than a 60/40 portfolio. Gold was nearly 2x a 60/40 portfolio.

BOLD1, Bitcoin, Gold and a 60:40 Portfolio over Five Years

The 360-day volatility for Bitcoin and Gold reached 44.7% and 14.0%, respectively. Once again, this recent fall reflects the removal of the price action surrounding the Terra LUNA crash. The long-term downward trend in Bitcoin volatility continues, and assuming there are no shocks, it could potentially touch 40% by the year-end as the FTX crisis flushes out in late November.

Bitcoin and Gold past 360-day volatility

Risk-weighted asset allocation techniques are commonly used in finance to improve risk-adjusted returns. BOLD1 uses the “inverse volatility” methodology, which means the more volatile asset has a lower weight in the basket and vice versa.

The BOLD1 Index has completed its monthly rebalancing. The new target weights are 23.8% for Bitcoin and 76.2% for Gold. Due to price changes in June, BOLD ended the month with 25% exposure to Bitcoin and 75% to Gold. As a result, Bitcoin has seen a decrease of 1.2% while Gold increased by the same amount.

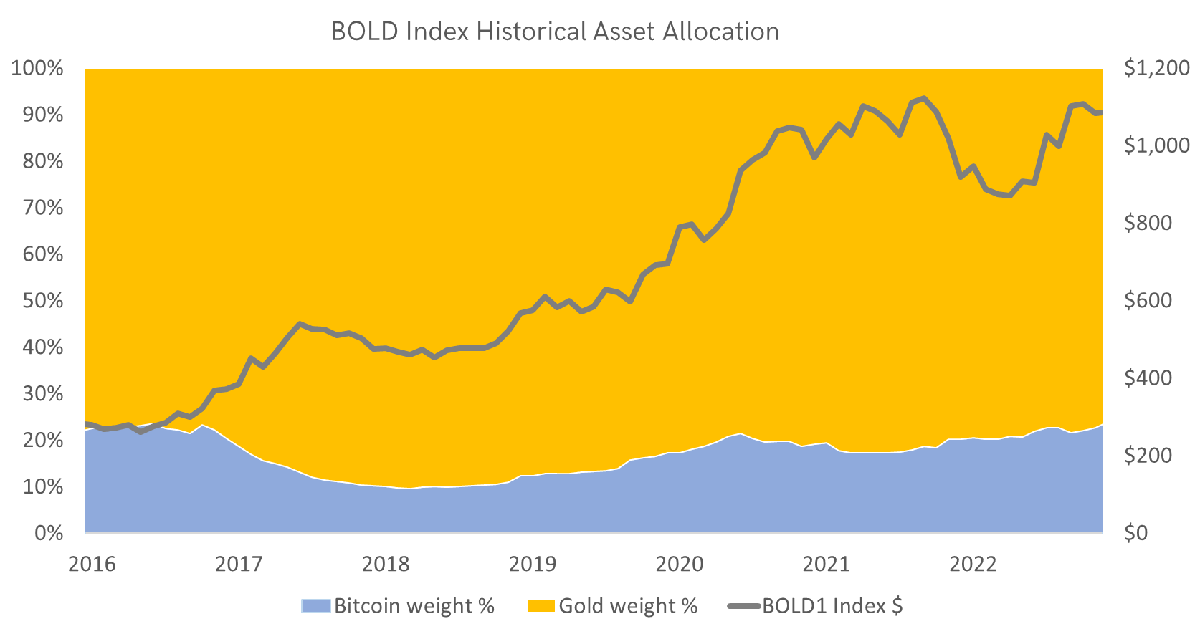

With 23.8% exposure to Bitcoin as of the beginning of July, this is the highest recorded Bitcoin weight, surpassing the 23.6% recorded in January 2017. This period of low volatility was followed by a Bitcoin price surge in 2017. As the volatility rose by the year-end, Bitcoin’s weight fell to 13.0% and averaged 10.7% during the 2018 bear market. In contrast, Gold’s volatility remained consistently low.

If Gold’s volatility remains stable and Bitcoin’s drops to 40%, then Bitcoin exposure in the BOLD1 Index would rise to approximately 26% by late 2023.

BOLD not only benefits from capital appreciation from rising Bitcoin and Gold prices but also from monthly rebalancing transactions and risk management from asset allocation.

By repeatedly rebalancing, there is an additional return from “volatility harvesting”, which in simple terms, means buying low and selling high. Bitcoin and Gold naturally have a low correlation, and it is rare that both assets perform well or badly at the same time. This makes rebalancing more effective than rebalancing corrected assets such as French and German equities. The excess return from monthly rebalancing transactions is estimated to have been 5%-7% annually over the past five years.

Gold is already a high-quality asset, while Bitcoin is aspiring to become one. As its volatility falls, its quality improves. The risk weighting steers the portfolio away from the riskier asset, with higher exposure to the safer asset. This ensures the exposure to each asset is appropriate and earned on merit.

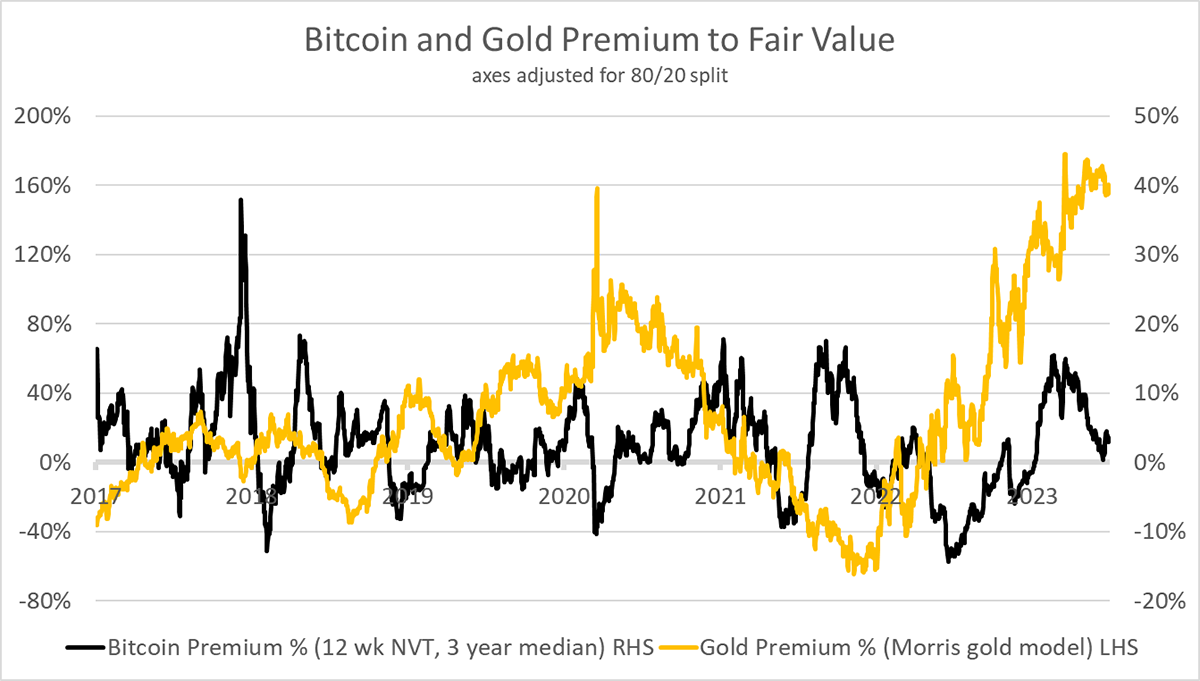

Gold is currently trading at a premium to ByteTree’s fair value, while Bitcoin is trading close to fair value. Gold has held up well in 2022 and is giving up some ground in contrast to Bitcoin, where network growth has resumed. Furthermore, the next halving is just ten months away.

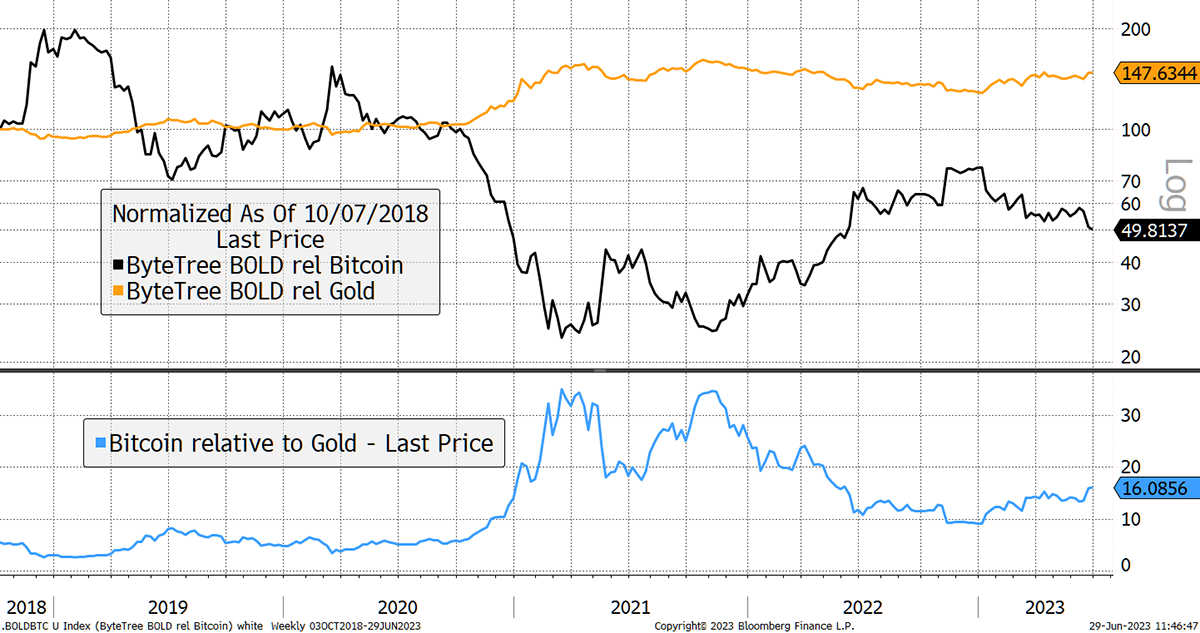

A Bitcoin is worth 16 ounces, as shown in blue, up from 10 ounces at the beginning of the year. With Bitcoin outperforming Gold, BOLD holders are beating Gold and lagging Bitcoin, as shown. BOLD holders are always lagging one or the other, but over time it doesn’t seem to matter which it is.

Bitcoin versus Gold

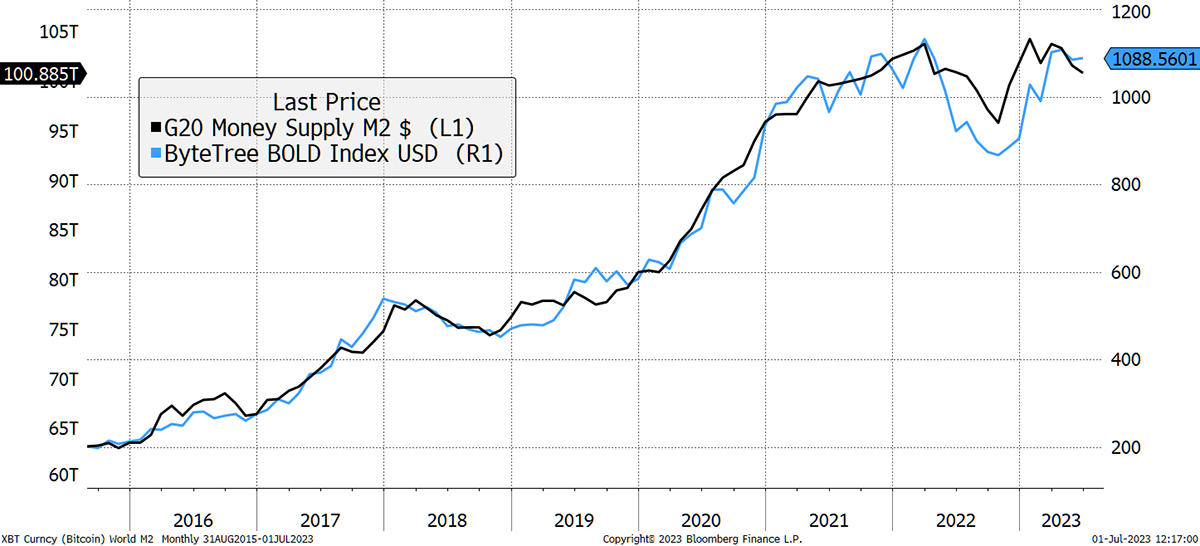

BOLD1 gives investors exposure to the two most liquid alternative assets on a risk-weight basis. This is a highly efficient asset strategy that has mirrored the growth in the global money supply more closely than any other asset combination. Since 2015, the G20 money supply has grown at 6.2% per annum in contrast to BOLD1, which has grown at 24% p.a., or 3.9x faster.

BOLD1 Has Been an Effective Hedge Against Global Monetary Supply Growth

The money supply is currently shrinking, which historically should urge caution for financial markets. If the dollar remains soft, which it has this year so far, there seems to be enough juice in the tank for markets to remain calm. Yet should the US dollar start rising again, this will put downward pressure on asset prices.

The one thing we can be sure of is that any fall in the money supply will be short-lived, as one of the few long-term certainties in markets is that they always print more money.