What Do High Rates Mean for Equites?

Disclaimer: Your capital is at risk. This is not investment advice.

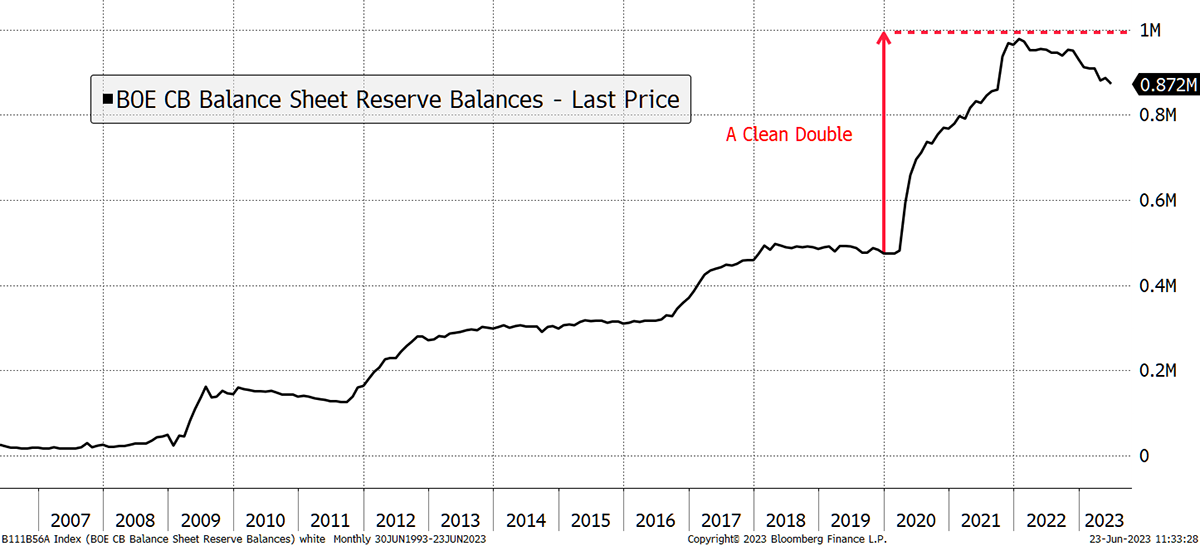

It is fair to say that our central bankers are out of practice when it comes to the hiking cycle. Traditionally they took away the punchbowl just as the party was getting going. This time they didn’t. In response to the pandemic, they printed money like never before in history, doubling their balance sheet in the process to a trillion pounds.

Bank of England Balance Sheet Ballooned

According to the Bank of England, and indeed other central banks, massive money printing, on a scale never previously undertaken, would not lead to inflation. In their eyes, it was the lockdown-induced constraints on the supply chain. The public doesn’t buy it, as it is obvious to most that a huge stimulus will lead to higher prices.

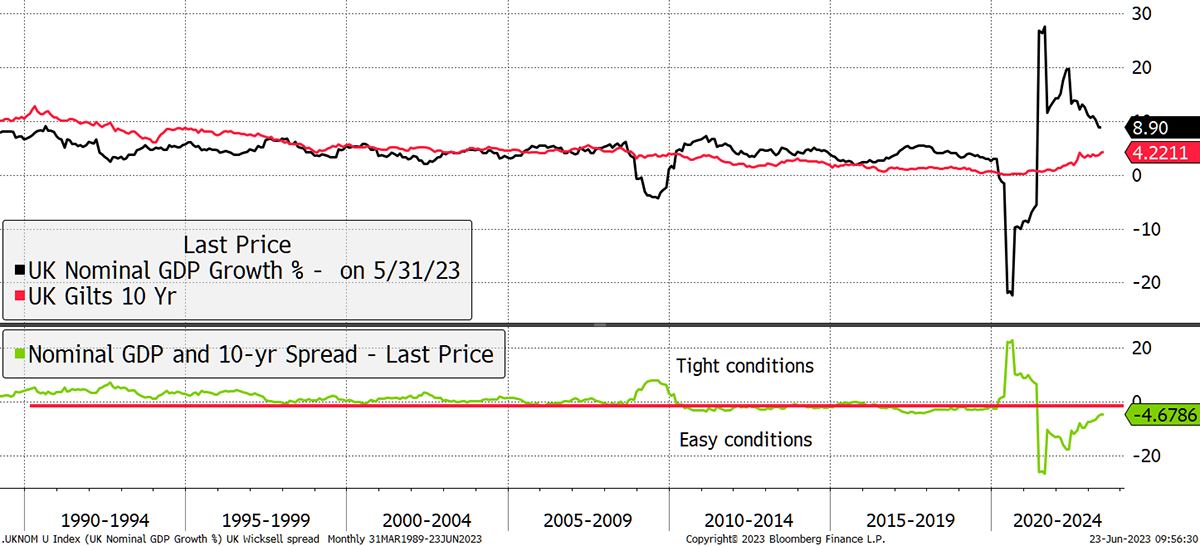

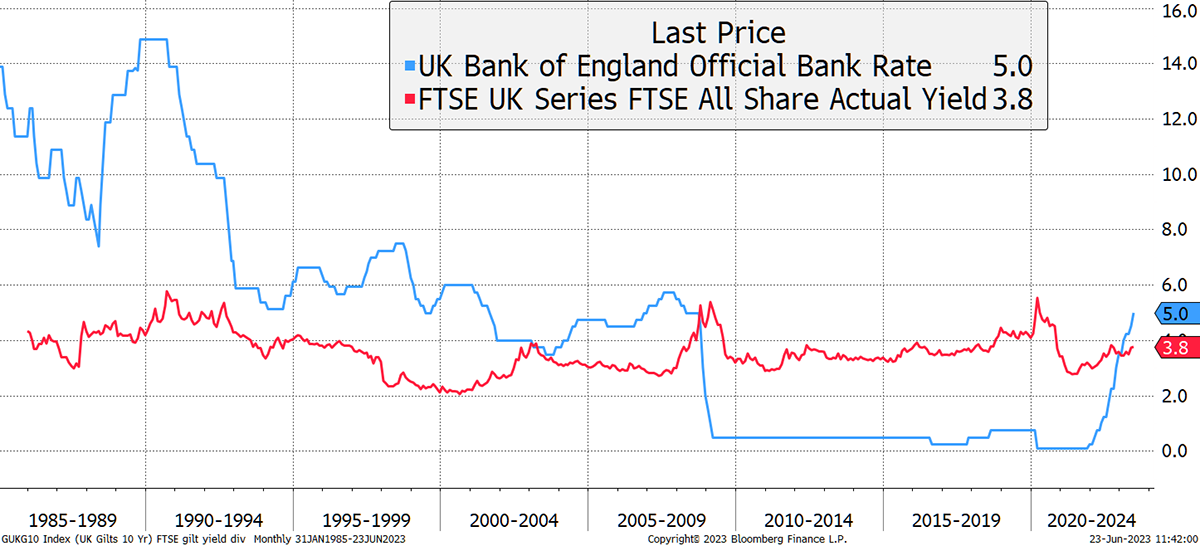

The hiking cycle has been underway since late 2021, which was a late start given the surge in prices earlier that year, not to mention the exuberance in asset prices at the time. But with 5% interest rates, they are catching up. Some say they are hiking too aggressively.

According to the Wicksell Spread (late Swedish economist), interest rates should be broadly equivalent to the nominal rate of GDP growth (growth plus inflation). UK growth has already ground to a halt and is a mere 0.2% over the past year, while core inflation (ex-food and energy) is 8.7%, meaning nominal GDP growth is 8.9%. This is high but falling. The Wicksell spread (green line) was extremely stimulative but is closing in on zero.

Pulling the Punchbowl

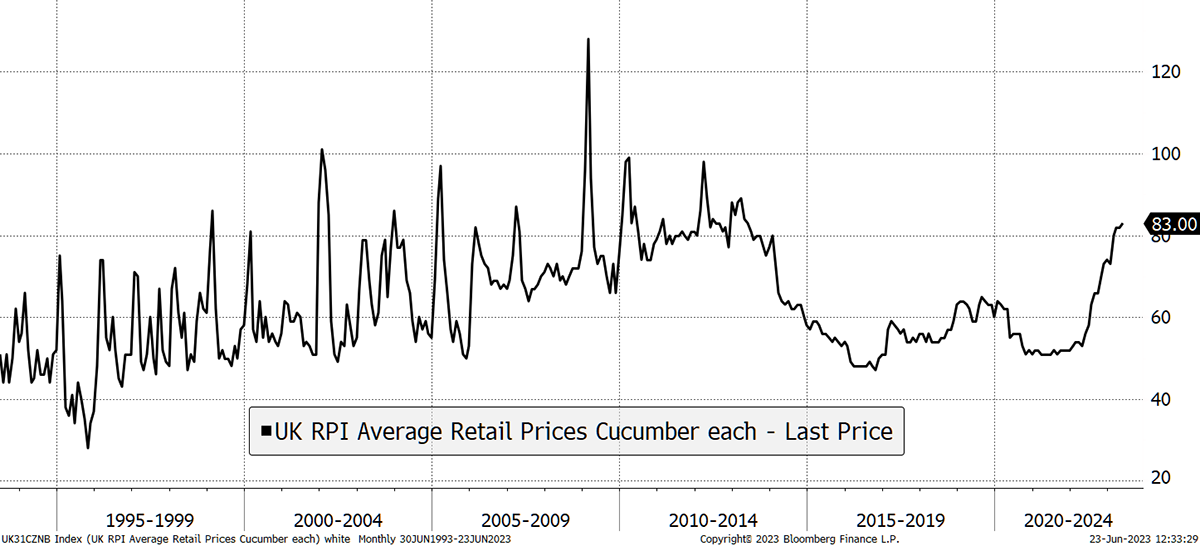

Ed Conway, author of the excellent book Material World, explained why food prices have remained so high in the UK, using cucumbers as an example. Prices have spiked, but from very low levels, which means they are still at the same level as 20 years ago. He points out they are merely back to trend.

Cucumber Prices

Technology from the Netherlands led to a productivity surge as cucumbers (and other foods) were grown cheaply in greenhouses using gas for heat, fertilisers and CO2 from a boiler. A surge in gas prices saw many greenhouses shut down, which led directly to a surge in food prices. As a result, the UK imports more food from the south. It seems this productivity gain has been reversed. I have long said food is basically derived from oil, which doesn’t sound very gastronomic.

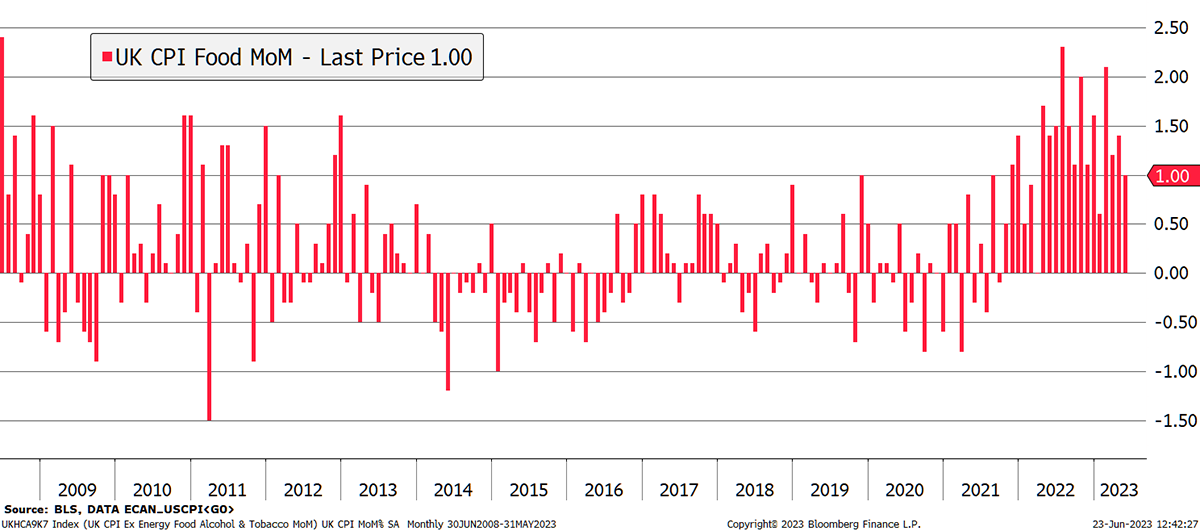

The good news is that UK food prices appear to be cooling, and I doubt this has anything to do with interest rates.

Food Prices Are Moderating

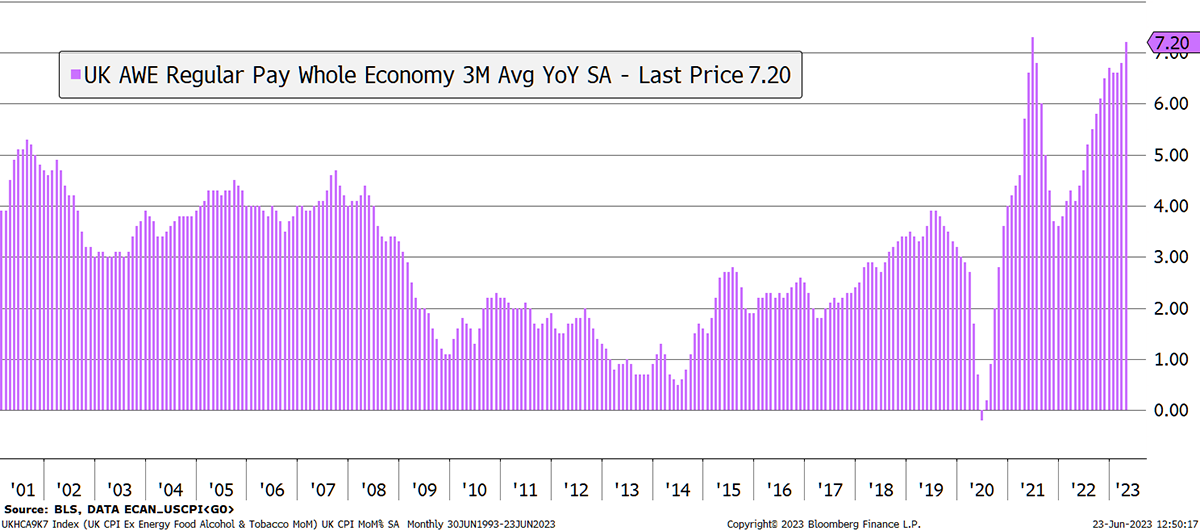

There are stronger pressures on wages, which remain stubbornly high. This is a far greater concern for the Bank of England as the public sector demands a pay rise.

Wage Pressures

But upward pressures on wages aren’t confined to the UK. These pressures are seen around the world, and this is the fight the central banks haven’t yet won. That people should skip a pay rise for the greater good is an unwelcome message and one developed countries haven’t heard since the early 1990s. This is painful for both politicians and the electorate alike.

What Do High Rates Mean for Equites?

Looking back a few decades, it seems that whatever interest rates have done, the dividend yield on UK equities has ranged between 2% (2000 bubble) and just under 6% (1990 recession, 2008 credit crisis, 2020 covid crash). At around 4%, UK equities are fairly priced but not without risk. But even if they did fall, they wouldn’t have to fall very far, and more importantly, for very long.

UK Equities and Gilt Yields

If bonds sold off aggressively, that would be damaging for the stockmarket, but they seem to have stalled. Instead, the yield curve is forecasting a recession, and that inevitability keeps bond yields in check. So, no need for rate hikes, perhaps?

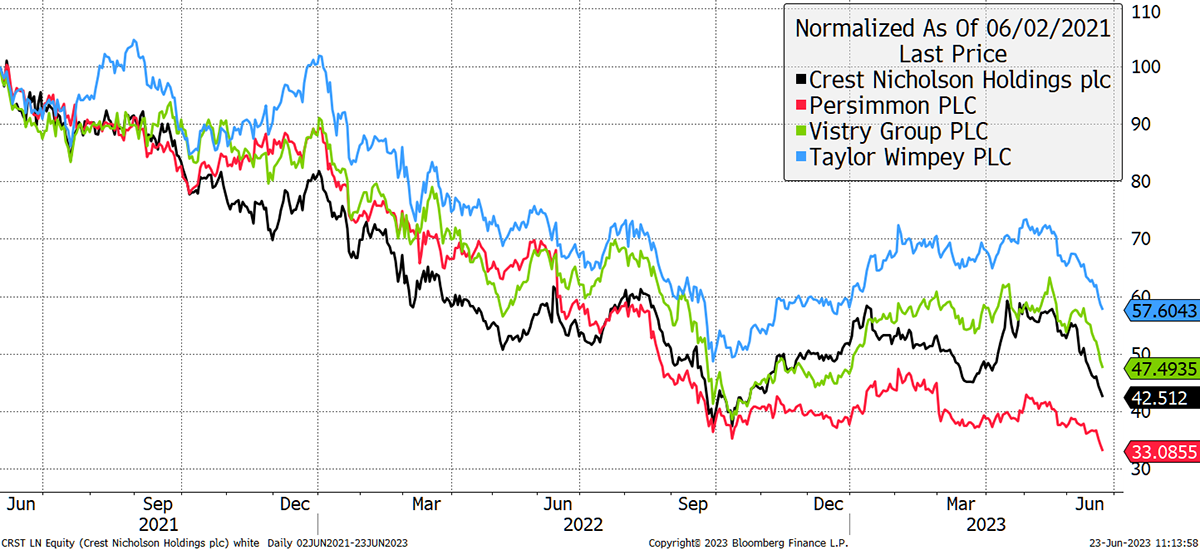

But a reminder that not all equities are the same and there will be casualties. Housebuilders are not enjoying tighter money one bit.

House Builders Suffer

The most important thing at times like this is staying out of trouble. That means steering clear of the storm and being ready to move when policy changes. The most money is made at the bottom of the cycle, and as they rightly say, you have to be in it to win it.

Last week, in The Multi-Asset Investor, I took profits in Melrose (MRO), which has been the best-performing UK stock this year + 80%, proving 2023 hasn’t been all bad.

The one asset that stands out in 2023, is Bitcoin. BlackRock, and seemingly everyone else, wants to launch an ETF. This was covered in ATOMIC.

Have a great weekend,

Charlie Morris

Founder, ByteTree

Comments ()