Inflation Cools, the Fed Skips While BlackRock Files for a Bitcoin ETF

Disclaimer: Your capital is at risk. This is not investment advice.

I wrote my 83rd issue of The Atlas Pulse Gold Report titled Zozobra, a Spanish term for a specific fear, with connotations reminiscent of the swaying of a ship that is about to capsize. I covered the highlights from the In Gold We Trust Report (INWT), US inflation, the weakness in the Yen and the Yuan, and the relaunch of a gold token DGLD.

Whenever you see Gold mentioned at ByteTree, you can be sure Bitcoin will sooner or later follow. We believe Bitcoin is real, and so, it seems, do BlackRock, who have filed to launch a spot Bitcoin ETF.

BlackRock!!!! The world’s largest asset manager wants a Bitcoin ETF. If this isn’t validation, I don’t know what is.

In ByteFolio, The SEC Gets Nasty, Charlie Erith covered the regulatory clampdown on tokens that the SEC believes should be securities and exchanges that have traded them. They’ve made life hell for crypto firms that have been trying to work with the regulator for years.

What’s remarkable is the timing of BlackRock’s filing, right in the eye of the storm. Bitcoin ETFs exist in the US using futures, but none using spot (physical Bitcoin) despite many applications, which the SEC have turned down. I presume BlackRock wouldn’t be applying unless they knew the application would be approved. Maybe the SEC wants the US crypto scene to be dominated by the old school rather than the new. Goldman next up?

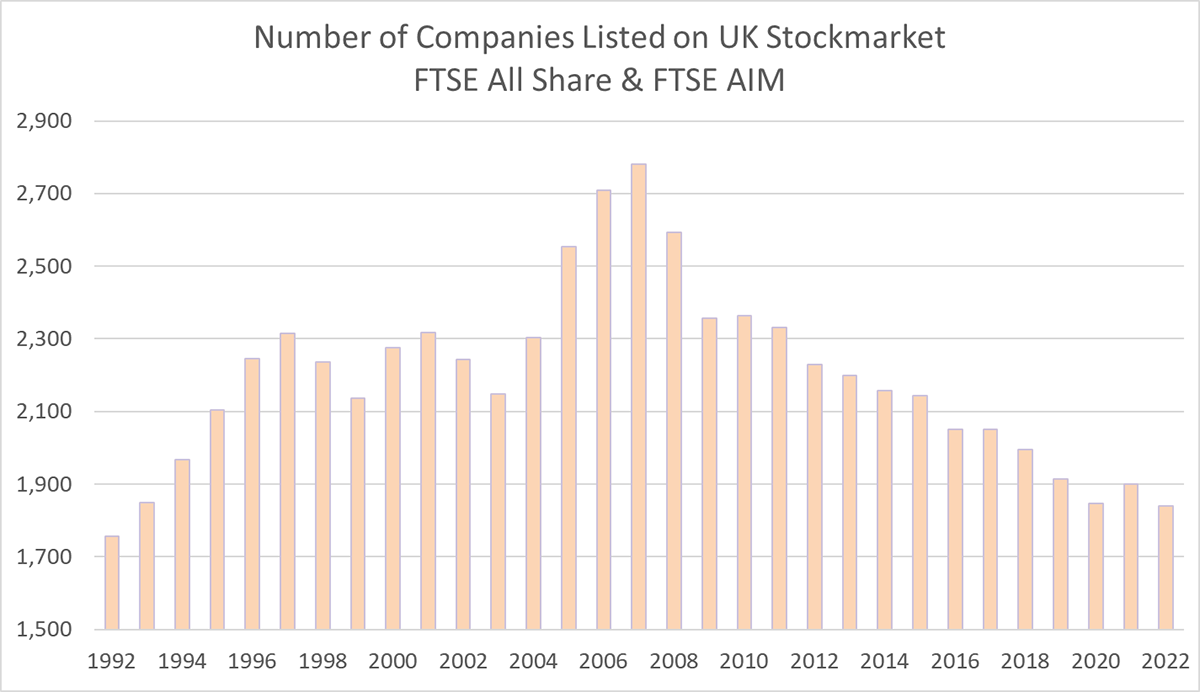

If this is approved, the UK’s FCA will need to reconsider their ban on crypto ETFs. They are under pressure, having been obsessed with consumer protection at the expense of UK Plc. The bottom line is that the UK stock market is running out of stocks, and the system deserves its fair share of the blame.

Times are tough, and any country wanting to survive will need to turn their back on the nanny state.

Legalise BOLD!

RATES AND INFLATION

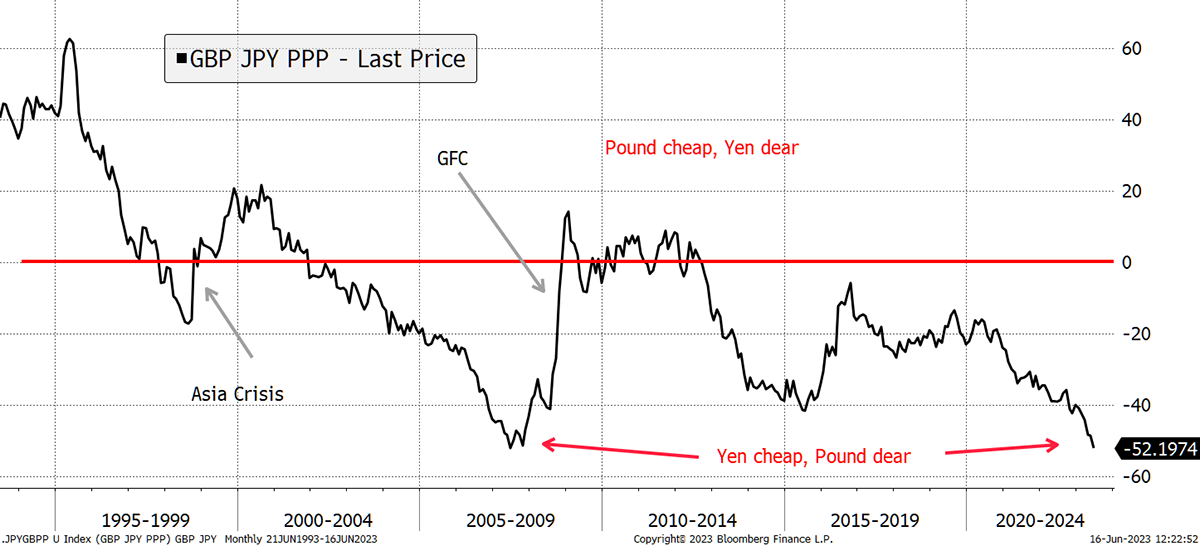

With inflation down to 4%, the Fed paused at 5.25% but hinted at more to come. The ECB hiked to 4%, with Eurozone core CPI at 5.3%. The Bank of England is expected to hike next week to 4.75% (core CPI 6.7%), causing the pound to soar. The Bank of Japan have once again dumbfounded markets and maintained zero rates. In China, they’re already cutting. Global macro has been so similar for so long that it’s remarkable how quickly it can diverge and by how much.

I highlighted the extraordinary value the yen offers and its ability to absorb shocks when things turn ugly. The extremity of this move has come about when the yen has fallen while the pound has surged. I have held this as a hedge since last summer. A little early, but I can think of no better trade that offers protection when the rate cycle comes to an end. When this happens, it tends to happen quickly.

Yen on Sale

Finally, in The Multi-Asset Investor, I had a look at Latin America, where real interest rates are mouthwatering, and valuations are attractive. Be sure to read it.

Have a great weekend,

Charlie Morris

Founder, ByteTree