Arbitrum: Taking Ethereum to New Heights

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: ARB Token

Arbitrum is a Layer-2 scaling solution that addresses the scalability limitations of Ethereum. It uses Rollup technology to tackle Ethereum's computing capacity and high usage costs while preserving its security and decentralisation. This Token Takeaway will examine Arbitrum’s fundamentals and its significance within the Ethereum ecosystem and analyse the value proposition of its native token, ARB.

Overview

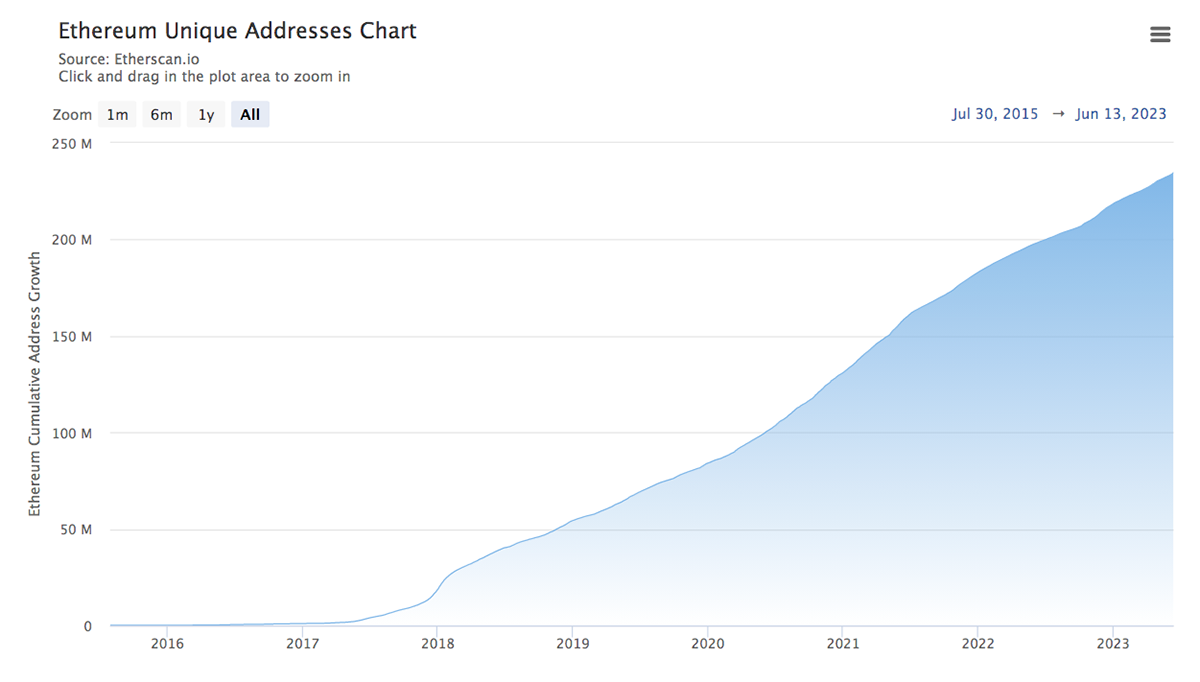

As the crypto industry continues to grow at a staggering rate, the largest and most popular smart contracts development platform, Ethereum, struggles with numerous challenges. Low transaction processing speeds and high usage costs are two of the most critical issues it faces. Layer-2 scaling solutions like Arbitrum were built to tackle these issues, ensuring that Ethereum functions efficiently.

Ed Felten, together with Steven Goldfeder and Harry Kalodner, launched Offchain Labs in 2018, the company behind Arbitrum. Arbitrum was created with a vision to provide an environment where developers can build highly scalable, cost-effective and fully EVM-compatible dApps that are secured by Ethereum.

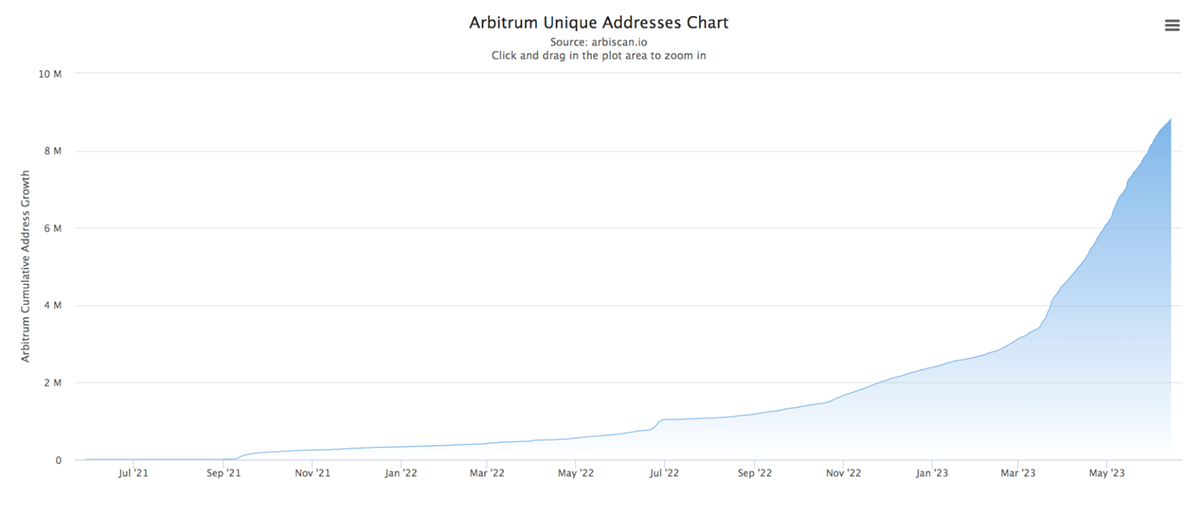

Currently, Arbitrum boasts over 5.8 million users and has remarkably saved nearly $1.3bn in gas fees for its users. It has also positioned itself as the dominant player in the Rollup market, capturing around 65% market share. Furthermore, in a significant milestone, Arbitrum launched its native governance token, ARB, in March 2023, officially transitioning the platform into a decentralised autonomous organisation (DAO). Before digging deeper into Arbitrum, let’s first establish what problem it solves.

Why Does Ethereum Need Scaling?

Before transferring to a Proof-of-Stake (PoS) consensus mechanism, Ethereum used Proof-of-Work (PoW). At the time, the focus was on making Ethereum decentralised and secure, and while Ethereum managed to accomplish those objectives, it faced limitations in terms of scalability. This is commonly referred to as the blockchain “trilemma”, where it’s very difficult for a blockchain to simultaneously achieve high scalability, strong security, and complete decentralisation.

As Ethereum amassed millions of users, billions in TVL and thousands of dApps and NFT projects, it became outrageously expensive and slow to use, especially during periods of high traffic. To inherently solve this issue, a new scaling roadmap (ETH 2.0) was introduced. The first phase of the roadmap, “The Merge”, successfully transitioned Ethereum from PoW to PoS on 15 September 2022, with additional upgrades set to be implemented in the future. However, even if all ETH 2.0 phases are 100% successful, the goal of 1 billion crypto users by 2030 could potentially breach Ethereum’s capacity.

There are alternative options to consider for Ethereum’s limitations. One option is to completely abandon Ethereum and opt for an alternative Layer-1 solution, such as Solana or Cardano. However, choosing this path would mean sacrificing direct access to the Ethereum ecosystem, as well as its decentralisation and security features. The other option is to adopt a Layer-2 scaling solution like Arbitrum. By doing so, you can leverage the advantages offered by Ethereum while simultaneously benefiting from Arbitrum's scaling capabilities and cost-effectiveness.

How does Arbitrum work?

Rollup Technology

Rollups refer to the technique of bundling multiple transactions together and processing them off the main blockchain, Ethereum, before storing a compressed summary of those transactions on the mainnet. This approach allows for more efficient and scalable transaction processing by reducing the computational load on the main chain. By batching transactions and verifying them off-chain, Rollups can significantly improve scalability and throughput while still benefitting from the main chain’s security and decentralisation.

Arbitrum’s Optimistic Rollup Technology

Arbitrum is a specific implementation of Optimistic Rollups. It utilises the off-chain computing and optimistic validation approach to significantly improve Ethereum's scalability. When a transaction occurs on the Arbitrum network, it is processed off-chain, resulting in faster confirmation times and reduced costs. The Rollup block, containing the batched transactions and their outcomes, is periodically submitted to the Ethereum mainnet.

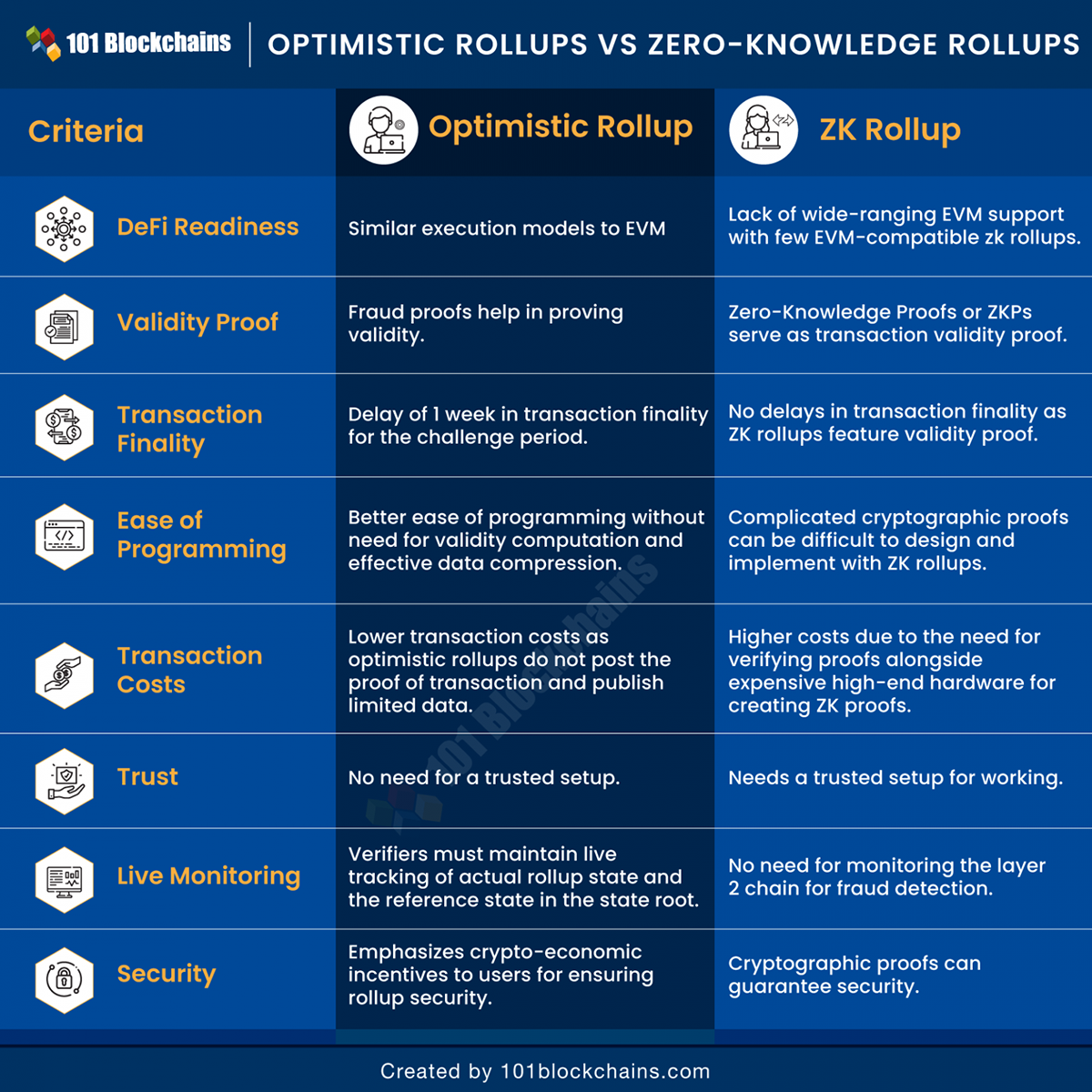

Optimistic Rollups are referred to as “optimistic” because they operate on the assumption that off-chain transactions are valid and do not need to publish on-chain proofs of validity for transactions. This sets them apart from Zero-Knowledge Rollups, which provide cryptographic proof of validity for off-chain transactions. Hence, Optimistic Rollups employ a fraud-proof mechanism to maintain the security of the Rollup. Any participant can submit fraud-proof if a fraudulent transaction or state transition is detected, triggering a dispute resolution process. This process ensures the integrity of the system.

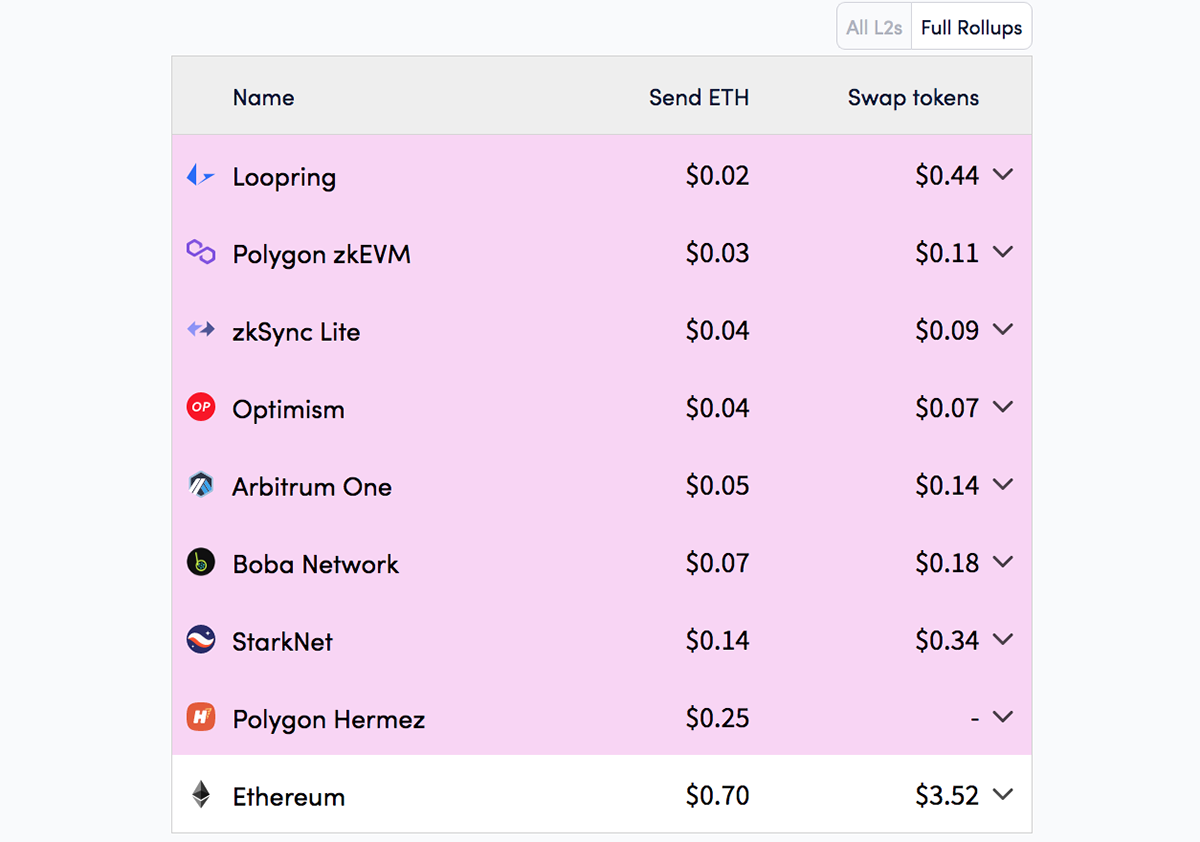

Utilising Optimistic Rollups enables Arbitrum to achieve a transaction processing speed of up to 40,000 transactions per second (TPS), which is significantly higher compared to Ethereum's 15 TPS. Additionally, as reported by l2fees.info, the cost of sending ETH through the Arbitrum One chain is $0.09, whereas it would cost $1.1 if the transaction were executed directly on the Ethereum mainnet. Similarly, swapping tokens on the Arbitrum One chain incurs a cost of $0.24, whereas the same operation on the Ethereum mainnet would cost $5.43.

Arbitrum Ecosystem

Arbitrum One

Arbitrum One, launched on 31 August 2021, is Arbitrum's official mainnet. It powers the entire ecosystem, processes transactions on the Arbitrum Virtual Machine (AVM), and is compatible with the Ethereum Virtual Machine (EVM).

On the launch day, the team also announced that it had raised $120m in a series B funding round led by Lightspeed Venture Partners and supported by Polychain Capital, Pantera Capital, Alameda Research and Mark Cuban.

Arbitrum Nova

Launched in August 2022, Arbitrum Nova is another chain created by Offchain Labs. Nova focuses on further reducing the fees on Ethereum by reducing the amount of data stored. Unlike Arbitrum One, which stores complete transaction data on Ethereum, Arbitrum Nova stores that data on the “data availability committee”, a third-party service like Google Cloud. The committee then signs a Data Availability Certificate (DACerts), and only these certificates are posted to Ethereum, significantly reducing the amount of data stored on Ethereum.

Nova is well-suited for GameFi and SocialFi applications, projects that involve extensive data processing and interactions with the blockchain. Notably, Reddit's community points program utilises Nova for its operations.

Arbitrum Ecosystem TVL

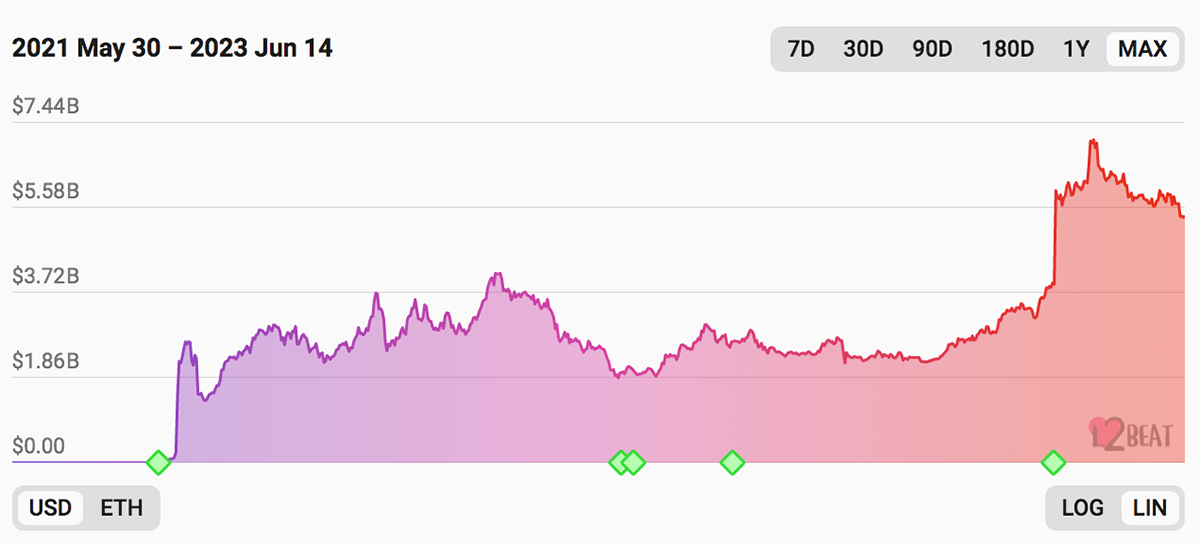

According to L2 BEAT, out of the $8.22bn in total TVL for all scaling solutions, Arbitrum accounts for over 64.5% ($5.33bn), making it the leading Rollup solution by TVL.

As illustrated in the above chart, TVL surged significantly following the ARB token airdrop (indicated by the last green Rhombus), where the TVL went from $3.9bn to $7bn in less than a month. The total TVL on Arbitrum consists of 23.5% ARB, 35.7% ETH, 33.2% Stablecoins and 7.5% other tokens. Although the TVL is currently down around 22.8%, the long-term chart looks good.

Arbitrum dApps Ecosystem

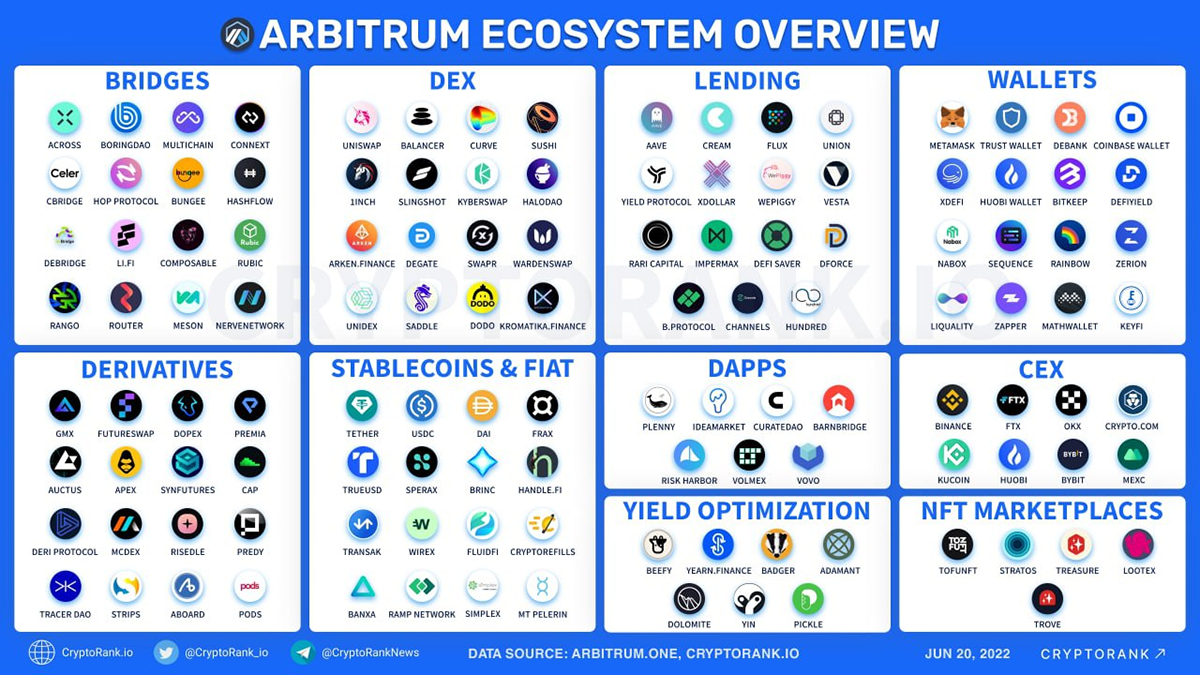

Arbitrum has hundreds of projects built on it, and you can find 432 of them listed on Alchemy. That’s too many to list them all individually, but the infographic below highlights the top projects on Arbitrum.

Notably, GMX is a decentralised spot and perpetual contracts trading platform and the largest dApp in terms of TVL contribution on Arbitrum. It provides low-cost swapping tokens and leveraged trading. The platform has just under 300k users and has processed over $134bn in total trading volumes with $111m in current open interest.

ARB Tokenomics

ARB is an ERC-20 token that is native to Arbitrum One chain. It was launched via an airdrop in March 2023. To be eligible for the airdrop, a user must have scored at least 3 points on the eligibility criteria. All qualifications in the eligibility criteria were based on prior on-chain activity and interactions on Arbitrum chains. Since it’s a governance token, ARB token holders have governance rights and can vote on important protocol decisions, such as funds allocation, investments in the ecosystem, and technical changes.

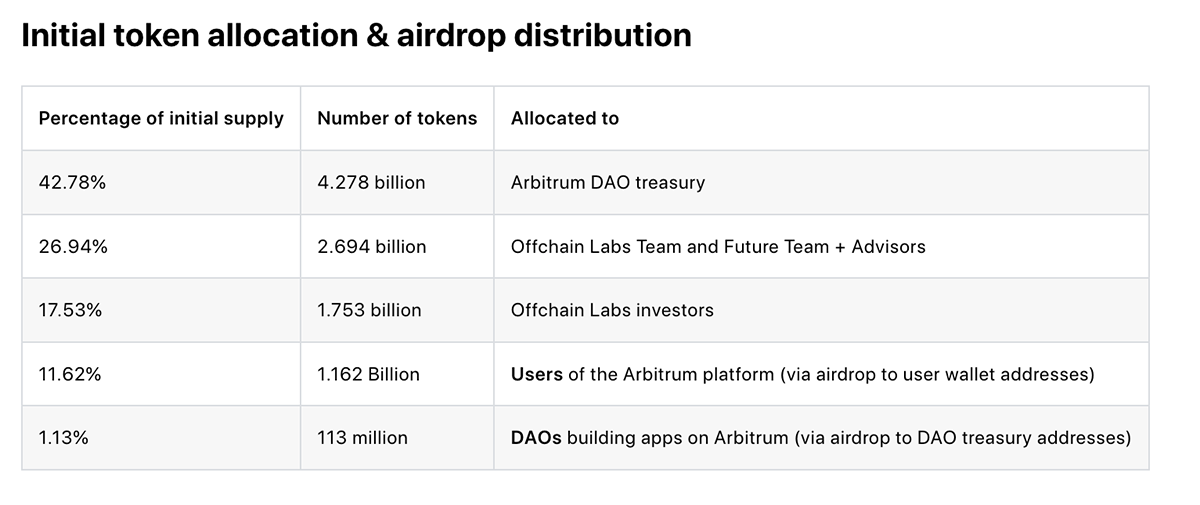

The initial ARB token supply was capped at 10 billion tokens, with a maximum yearly inflation of 2%. The initial token and airdrop distribution was as follows:

Of note in the above table is, out of the 10 billion total supply, 42.7% (4.27 billion tokens) were sent to the DAO treasury. At the current price of $1 per token, that’s worth $4.27bn.

After making a high of $1.8 on 18 April 2023, the price dropped significantly in the following days and weeks. Today, the ARB token is down around 44% from its all-time high.

The primary reason for the price drop was the controversy surrounding the protocol’s very first governance proposal. AIP-1.0 requested 700 million ARB tokens, worth over a billion dollars at that time, for various purposes, including special grants and operational expenses, to be managed by the Arbitrum Foundation. However, the community rejected the proposal with a 76% majority vote. The Arbitrum team claimed that AIP-1.0 was just a "ratification" and that some of the tokens have already been converted to stablecoins, meaning the DAO had already allocated the tokens regardless of the outcome of the vote. This undermines the value of the ARB token since its only current utility is to offer governance rights to holders, and if their votes are meaningless, the token has no use.

Supposedly, the ultimate aim of the proposal was to promote the growth of the Arbitrum ecosystem, which is expected to happen going forward. Despite the rough start, the governance process has since been running smoothly without any major issues or discrepancies.

Competition

Competition is one of the biggest threats to Arbitrum. Apart from Arbitrum, there are numerous Ethereum scaling solutions in the space, including Polygon zkEVM, Optimism and Loopring. These projects also solve similar issues with Rollups. In fact, according to l2fees.info there are multiple projects that are cheaper than Arbitrum.

Nevertheless, in terms of TVL, Arbitrum currently holds the majority stake in the Rollups space, indicating that more users trust Arbitrum with their funds over other Layer-2s. It is crucial that Arbitrum retains its market position as a leader by constantly improving and evolving to keep up with the fast-paced Rollups market.

Conclusion

As is evident from its revolutionary technology and ecosystem tools, Arbitrum is on track to be at the forefront of the future of Ethereum scaling. With impressive achievements like saving users $1.3bn in gas fees and capturing over 64.5% of the TVL in the Layer-2 scaling space, Arbitrum stands out as a platform favoured by users.

However, it's important to note that the utility of ARB, the platform's governance token, is very limited and not directly tied to the activity on Arbitrum chains. Consequently, the price of the ARB token may not always reflect the platform's success. Additionally, intense competition in the Layer-2 scaling arena poses a significant challenge to Arbitrum.

Nevertheless, if Arbitrum maintains its market position and contributes substantially to the growth of its ecosystem with the funds in the DAO treasury, it has the potential to remain a leading force in the Rollup market for years to come.