Positive Real Interest Rates a Near-Term Headwind

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 84;

The recent shift to a positive real-rate environment has presented a headwind for the bitcoin price, but the network remains vibrant, and the technology continues to evolve. After a period of relentless BTC dominance, there are the tiniest of hints that we might start to see better relative performance from ETH over the next few months.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Deterioration, may be range-bound for a while |

| On-chain | Fees start to normalise |

| Macro | Positive real rates may favour ETH over BTC |

| Investment Flows | Moribund |

| Cryptonomy | Congestion highlights the importance of Layer-2 |

Technical

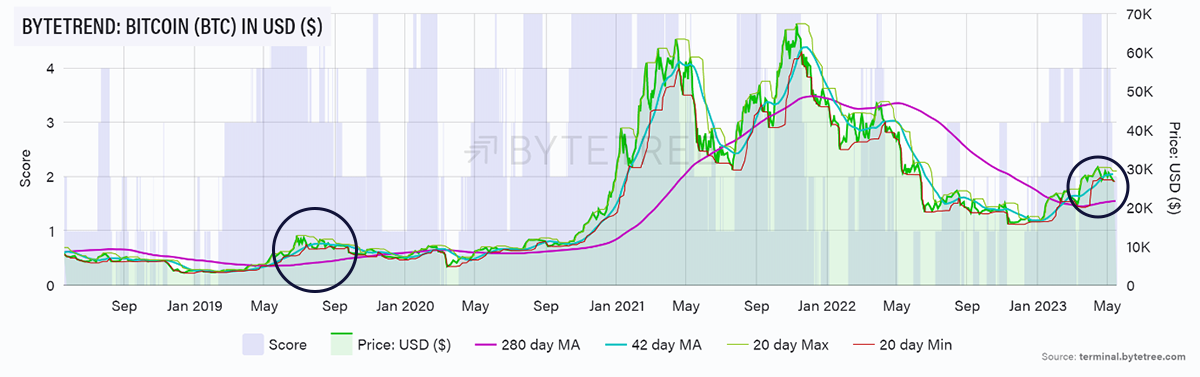

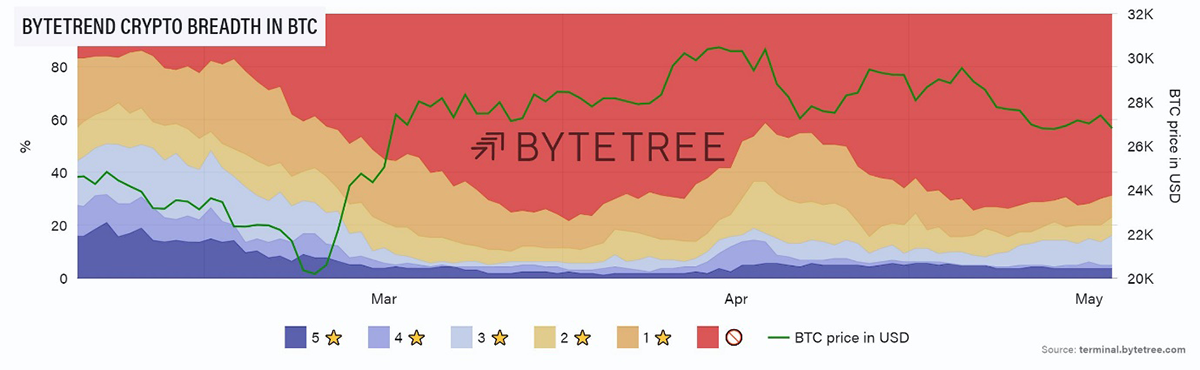

The technical setup for bitcoin has deteriorated from a trend-following perspective. BTC now only has a 2-star score on ByteTrend. The 5-year chart is shown below. The price is still some way above the long-term moving average; perhaps we’re just in a range until the latter catches up.

Source: ByteTree Terminal

It raises the question of whether we will see a similar pattern as we did at the end of the last cycle, back in 2019. You can see that the rally from the 2018 lows ran out of steam in July 2019, and, aside from the COVID shock of March 2020, the price was rangebound until the following September when all hell broke loose.

Bitcoin’s broader ownership, greater liquidity and significantly larger market capitalisation are surely factors in a decline in its volatility, so it’s unlikely that we’ll see such large swings in the next cycle. Nonetheless, it fits with our view that we’re in the early stages of that next cycle.

On-chain

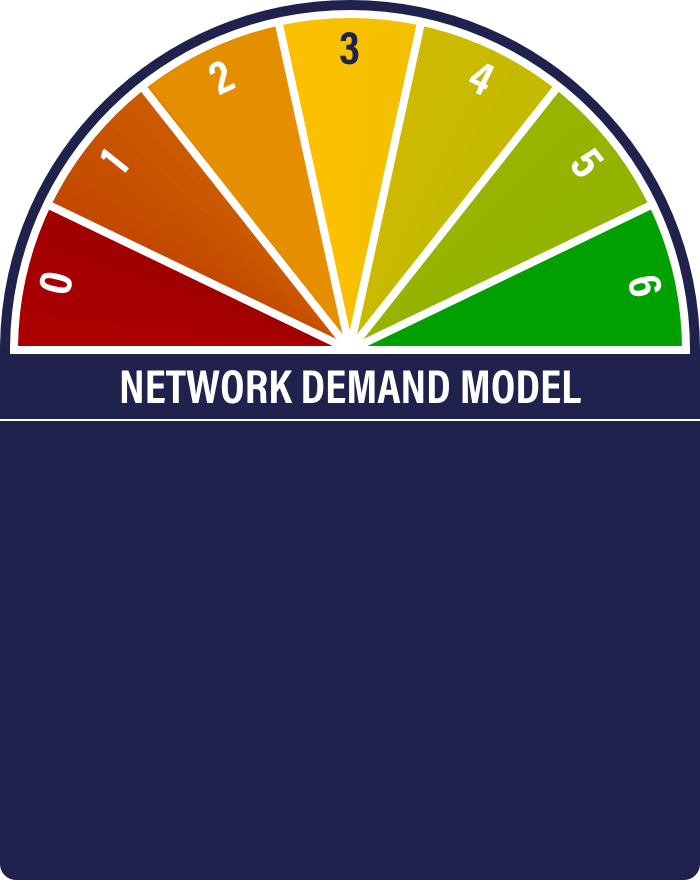

The Network Demand Model moves from 4/6 to 5/6, with the short-term transaction value signal turning back on.

The only signal that is off is MRI, but as that’s reading 101.1%, we shouldn’t worry about it. The miners continue to steadily sell the coins that they earn into the market with no price impact. The Bitcoin Network is in excellent shape.

Source: ByteTree

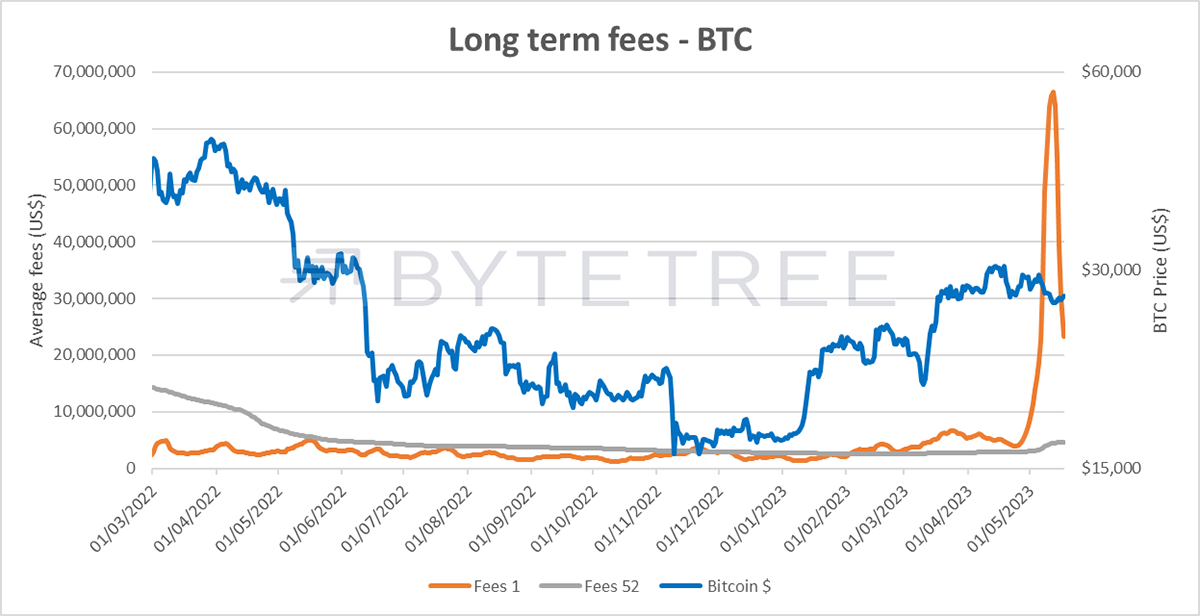

The recent aberration has been fees. As we’ve mentioned before, it is important for bitcoin’s long-term viability that fee income is healthy. One day there won’t be much in the way of income for the miners from minting new coins, so the incentive for providing verification of blocks and security will have to come from fees. The recent spike, shown above, comes from the Ordinals craze. While at this stage, it’s speculative and “meme-ish”, it nonetheless shows that the Bitcoin blockchain can be built on. ByteFolio believes this is a positive evolutionary step.

For an excellent discussion on this topic, take a look at this article by Nic Carter of Coin Metrics.

Macro

The recent fall in US inflation (April 4.9% YoY) below the Fed Funds rate (5.25%) means that investors can earn a positive return on their cash for the first time since the pandemic, in theory at least. It feels odd writing that, but the central banks have done the first part of their job in fighting currency debasement. The second will be bringing nominal inflation rates back to the target 2% level. If they manage that, it would be a surprise not to see a commensurate reduction in policy rates, which is generally a good thing for high-growth assets.

We’ve been saying for a while that inflation is unlikely to run wild. Leading indicators like oil prices have been soft for some time (despite cartel intervention to prop them up), but the narrative gets led by lagging indicators like wages and consumption.

The next part of the show is to see how economies manage to service debt when growth is slowing and if central banks are slow to cut. Intuitively, it’s hard to believe that this will be an incident-free process. Indeed, the symptoms might already be showing up in areas like China’s notoriously leveraged property market. As Charlie Morris pointed out in this week’s TMAI, the dog that hasn’t barked this year is China, hence the softness in commodities. To paraphrase, strategists have predicted around 10 of the last 1 Chinese economic collapses, to the point where no one listens any more. It feels dangerous.

The other area to keep an eye on is private equity and venture capital. It is hard to believe that there isn’t some disaster or other waiting to happen in an industry that arbitrarily values assets; there is dreadful liquidity and substantial use of debt.

What does this mean for bitcoin and the rest of crypto? If we assume that bitcoin has outperformed this year because of its safe haven/sound money status, a return to a positive real interest rate environment is not going to be its friend (as the recent price behaviour of gold corroborates).

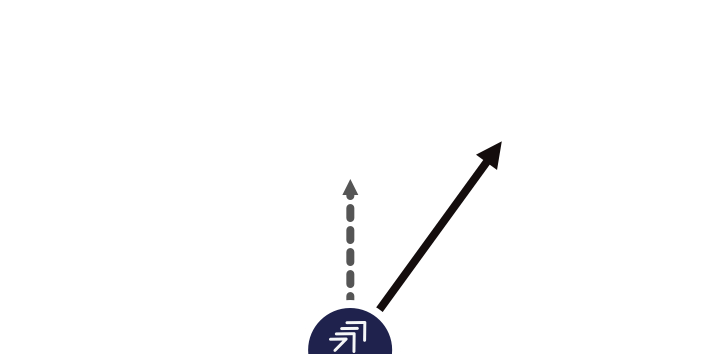

This shouldn’t automatically be the case for the rest of crypto, which ultimately will rise or fall according to its utility and usage. Perhaps then, it is time for ETH and others to outperform, although the regulatory barrage is depriving the eco-system of some of the liquidity that would make one more confident that this will pan out. Nonetheless, it will be important to keep a beady eye on the BTC/ETH cross and the system breadth more generally. You can see below that it’s formed something of a “flag” pattern.

Source: IG

Interestingly, during this latest bout of weakness, we see mild bitcoin underperformance, with the red skies in retreat. One swallow does not summer make, as they say, but we will keep you posted.

Source: ByteTree Terminal

Institutional Flows

Moribund. For both BTC and ETH.

Source: ByteTree Terminal

Source: ByteTree Terminal

Cryptonomy

It was somewhat depressing to see the Chair of the Treasury Select Committee, Harriet Baldwin, produce an article, titled “Crypto is gambling and consumers must be protected, MPs warn”, for The Times that was steeped in long-discredited arguments against crypto. The usual stuff: “fool’s gold”, “tulip bulbs”, “no intrinsic value”, “no social good”, “energy usage larger than entire countries like Norway or Sweden”. It was like reading an essay by a 12-year-old entitled “Why Crypto Is Bad”, although that’s a little unfair to 12-year-olds. It even managed to get the price wrong ($22,000 vs ~$27,000 at the time of publication).

The central argument is that “regulating retail trading in cryptocurrencies as a financial service…will create a halo effect, leading customers to believe this activity is safe and protected, when it is anything but.” No, regulating trading in cryptocurrencies enables ordinary individuals to allocate a portion of their savings to a new asset class that has the potential to be much larger. It also helps deal with the criminal fraudsters she cites in her article. No one can be sure about the future of crypto - least of all Harriet Baldwin - any more than ByteFolio can tell you what the weather will be like in Colchester in May 2025. Of course it’s risky, but investors are entitled to be the judge of what they do with their money, surely? It’s perfectly legal, after all, to own a 3x short silver ETF, but how many investors are dumb enough to put everything into those? And why would people think crypto is “protected” if regulated? Protected by what? Are equities protected? Lots of equities have gone to zero - should all equities be banned?

If every asset that halves in value from its peak should be treated as gambling, as the author avers, the FCA is going to be left with little to do. For those of us who think that BTC and ETH will hold value for the long term, paying no Capital Gain Tax (as per betting winnings) would be splendid. How do these people get into power?

The better news is that there are some grown-ups in the room next door, at least according to this LinkedIn post from the UK Cryptoasset Business Council. They make several points:

- The Treasury Select Committee isn’t part of the government and therefore doesn’t create legislation.

- The Government and the Minister responsible, Andrew Griffith, continue to be supportive of the sector

- A government spokesperson has already come out to say that the government would reject the TSC recommendation.

There is a great opportunity for the UK to step up to the plate in this exciting new industry, but not if the Baldricks are in charge.

Lightning Network

Those of you interested in the development of the Bitcoin Network as a global payments network might be interested in listening to this short interview with David Marcus, who is the CEO of Lightspark. Lightspark touts itself as one of the best ways to transact over the Lightning Network and is interesting because it makes it so easy for individuals and businesses to use.

The Lightning Network is built on top of the Bitcoin Network (known as a Layer-2 protocol) as an open, decentralised, global, quick, efficient and cheap way of transferring value from peer to peer, wherever you are and whatever time it is. The recent congestion on the Bitcoin Network highlights how important the Layer-2 solutions will be in future.

It’s the kind of thing that should be shown to the Treasury Select Committee so they can start trying to understand the real-life use case of the technology and, thus, where its worth will come from.