Bitcoin Is More Than Digital Gold

Disclaimer: Your capital is at risk. This is not investment advice.

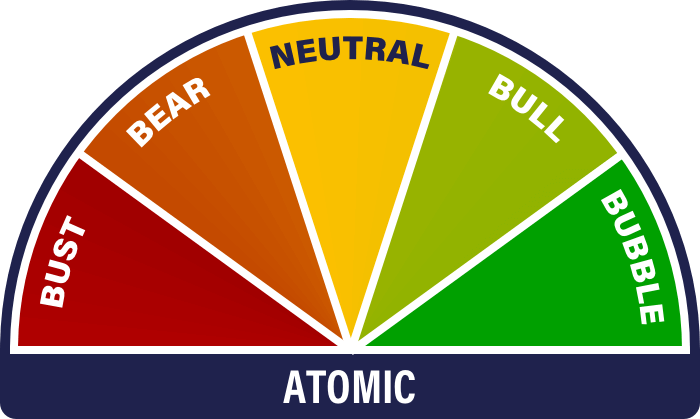

ATOMIC 83;

It seems likely that this hiking cycle is over. But the economic outlook remains precarious. Inflation levels and policy reactions are likely to remain volatile, particularly if deflation threatens. This will continue to drive asset allocators to sound money. Meanwhile, the surge in on-chain transactions demonstrates how bitcoin can move beyond a simple classification as “digital gold”.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Flag waving |

| On-chain | Transactions rocket |

| Macro | End of the hiking cycle, what next? |

| Investment Flows | Investors waiting for a breakout |

| Cryptonomy | Bhutan gets the memo |

Technical

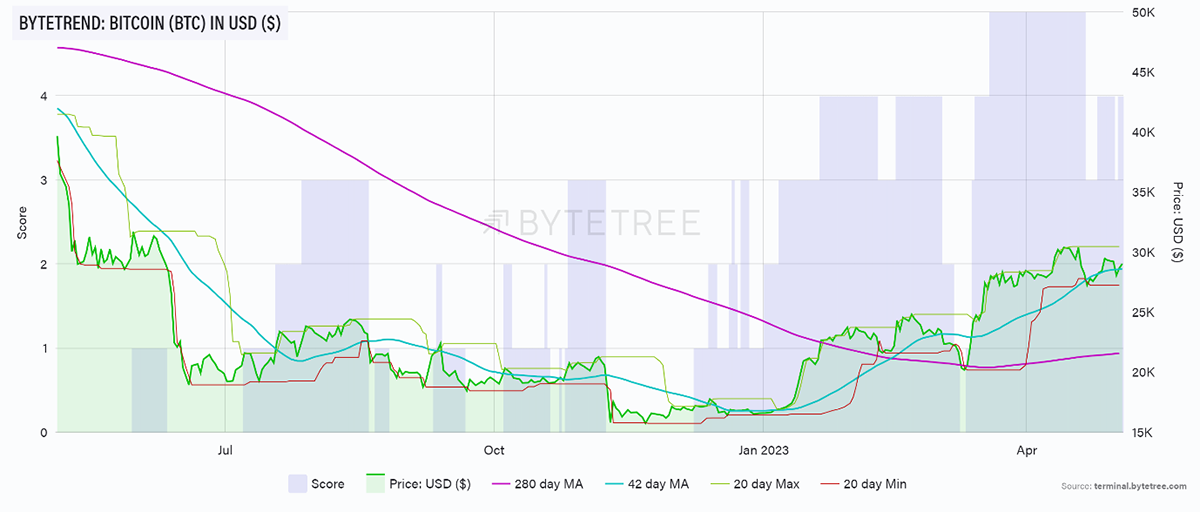

The bitcoin price continues to hover in a narrow band around US$29,000. The slight dip that we saw into the high US$27,000 area at the start of the week was quickly reversed higher, possibly a reaction to news of the First Republican Bank bail-out. As per previous editions, we had considered a re-test of the US$25,000 area plausible, given the resistance expected at US$30,000 and the extent of gains this year so far. That the price has bounced off a “higher low” is encouraging and sets up what is looking like a flag pattern.

Source: TradingView

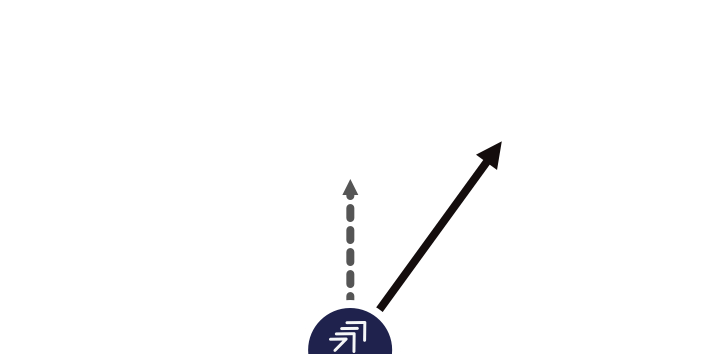

As far as our momentum indicators are concerned, bitcoin remains in an uptrend, scoring four stars on ByteTrend. The only dropped star is that the latest touch is on the min line, a minor consideration in a phase of consolidation.

Source: ByteTree Terminal

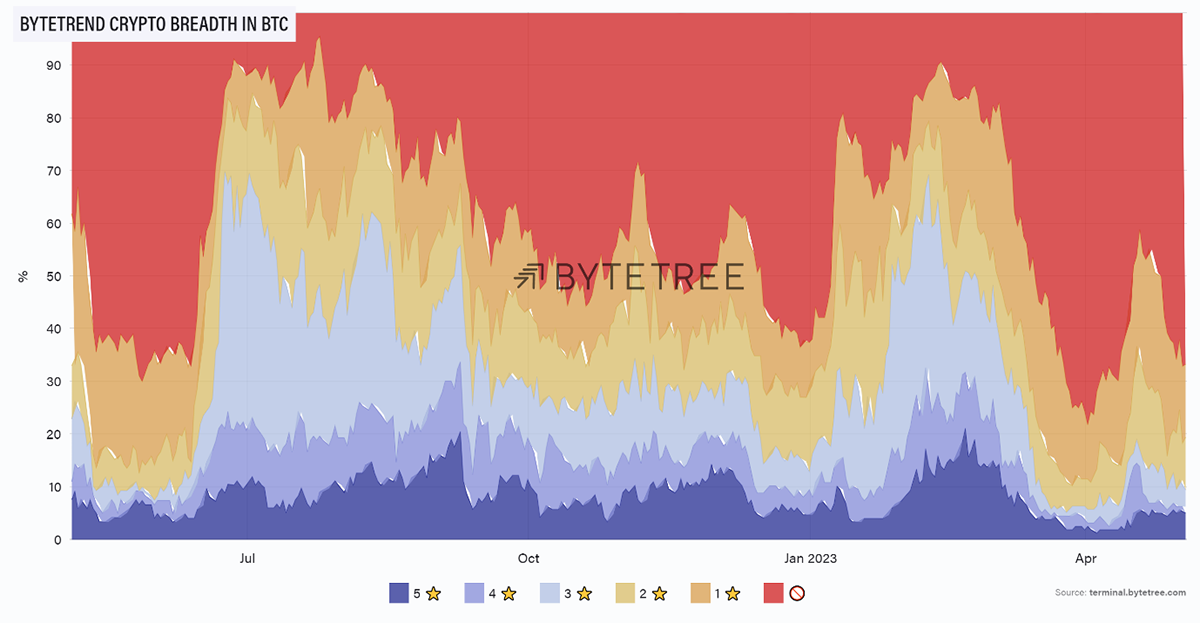

The recent pop in altcoin outperformance has also run out of steam, as ATOMIC expected. Look at the red skies below. That tells you how strong BTC has been against the rest of the field.

Source: ByteTree Terminal

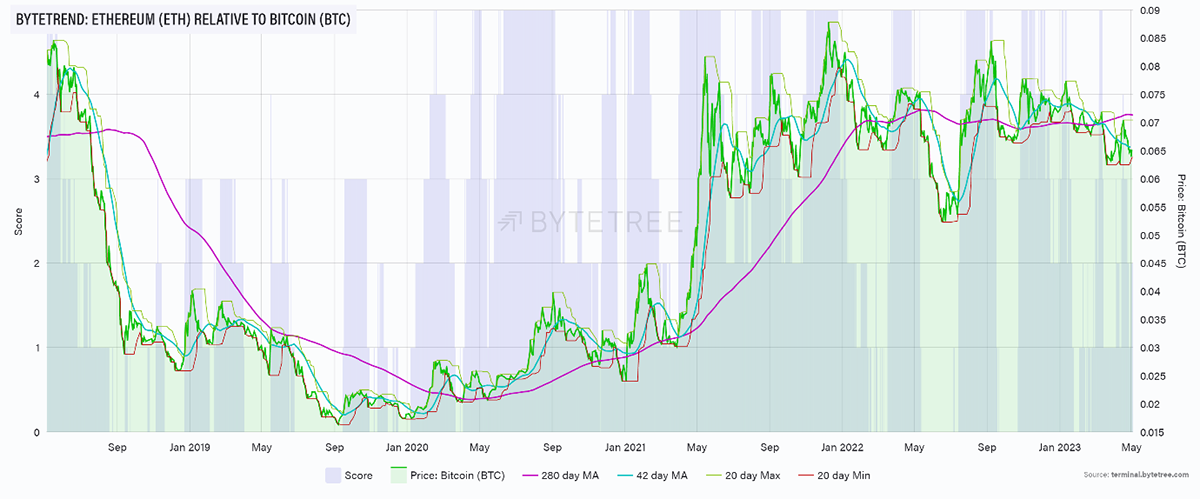

Ethereum is gamely trying to hang on but is now down to two stars relative to BTC. Despite its weakness, the longer-term moving average is flat. It’s like watching Coe vs Ovett in the 1500m in the 1980s, the big guns battling it out. Can you remember any of the others? OK, Steve Cram, but that was later.

Source: ByteTree Terminal

Lastly, note that the one-year base effects are soon going to start looking quite favourable as the horrors of May and June last year start to drop out. Purely psychological, of course, but it will be nice to tell your friends in July that 1-year performance is, say, +50% or so.

If that jinxes it, apologies.

On-chain

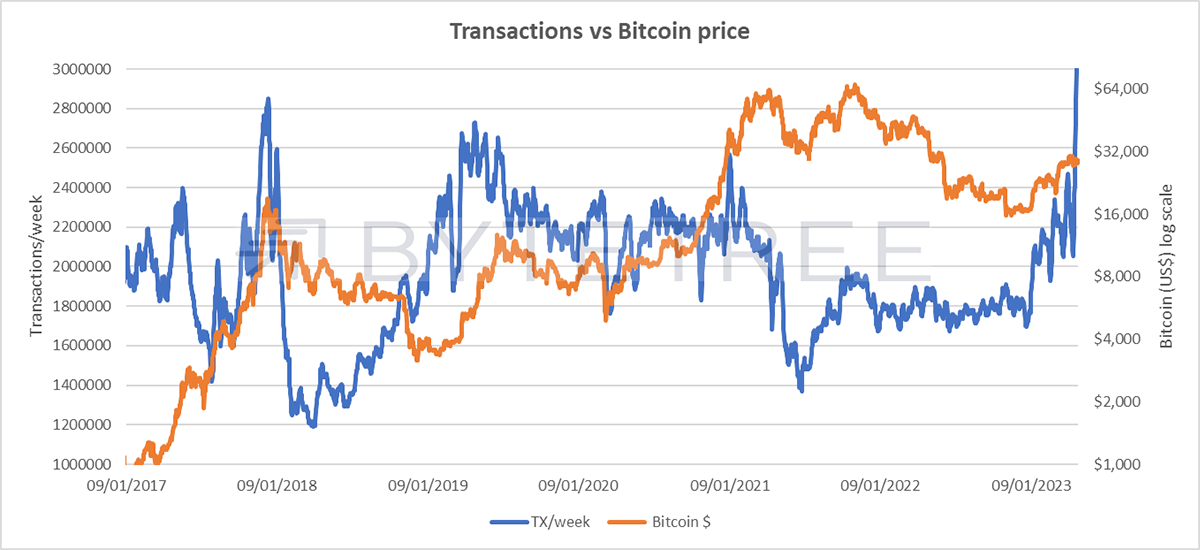

There’s absolutely nothing wrong with the Bitcoin Network at the moment. As mentioned in this week’s ByteFolio, the transaction count has been roaring higher and is now at all-time high levels. Our assessment remains unchanged:

As seen below, activity took off at the start of the year, with the news on Ordinals, a way of transcribing more data onto the blockchain. What some might have initially considered something of a fad has legs. We think it might be a sign that people are using Ordinals to build other apps (Mark found this one by way of example). It’s super-interesting because it expands bitcoin’s use case into far more than just a form of digital gold. It raises the potential that it becomes the security and settlement layer for a new smart contract and application ecosystem.

Source: ByteTree

This might also be a contributory factor in Bitcoin’s sector dominance this year, as described earlier.

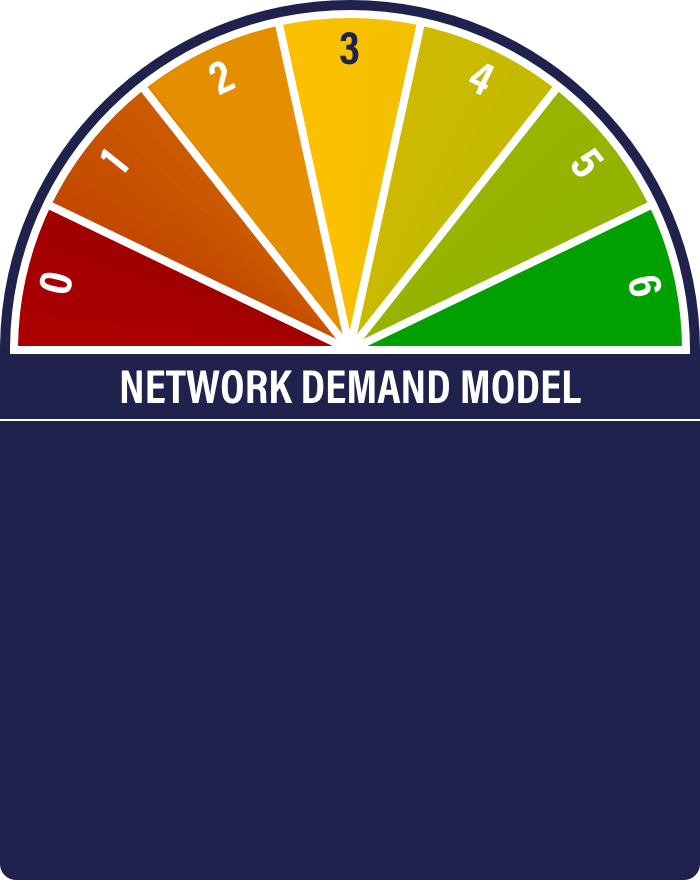

The Network Demand Model remains on a bullish 4/6.

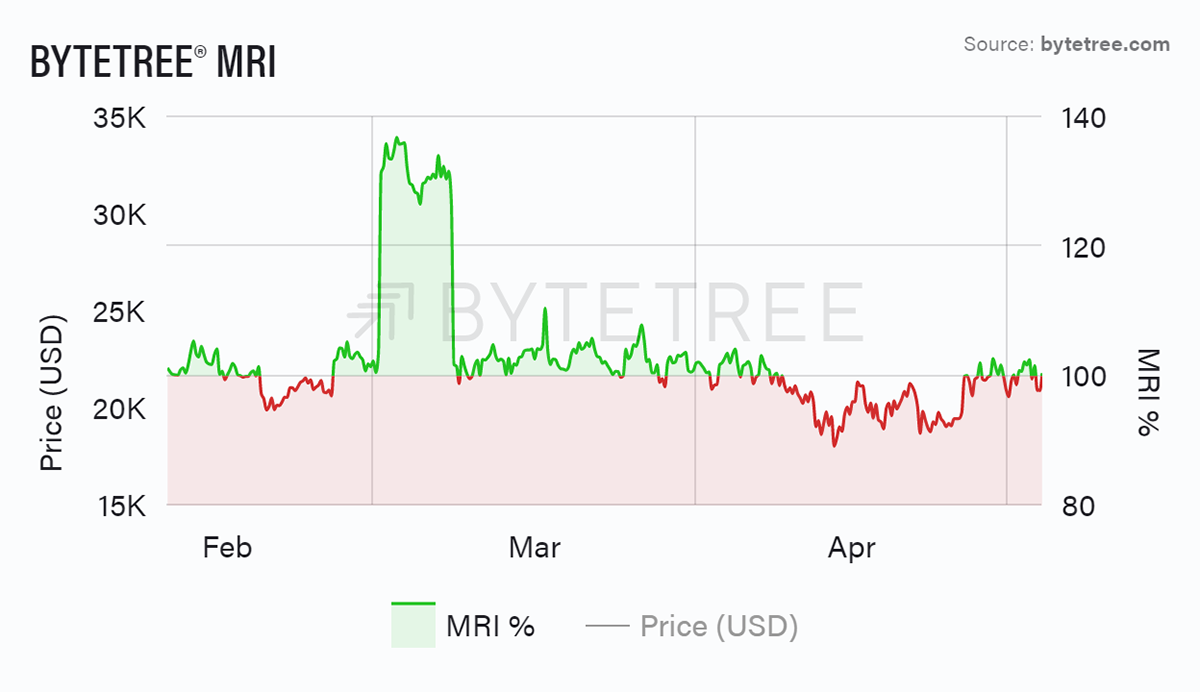

MRI remains off after mid-April weakness, but behaviour has normalised just recently.

Source: ByteTree Terminal

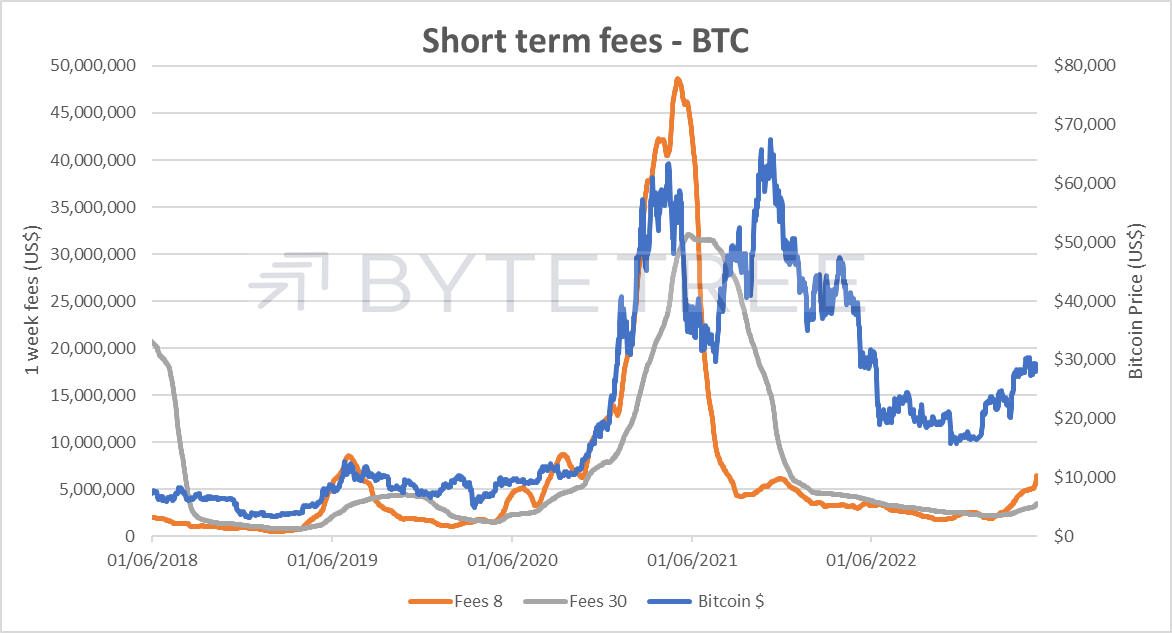

Short-term spend also remains off. The two spend (transaction value) components of the model are, of course, heavily price dependent. In a consolidation phase, it is therefore inevitable that they dither. Spend is more important for turning points, while fees demonstrate structural strength.

Because of the surge in transactions, fees are on fire. This is great for miners and, by extension, the solidity and security of the network.

It might also help explain why the miners are in no hurry to reduce inventory at the moment.

Source: ByteTree

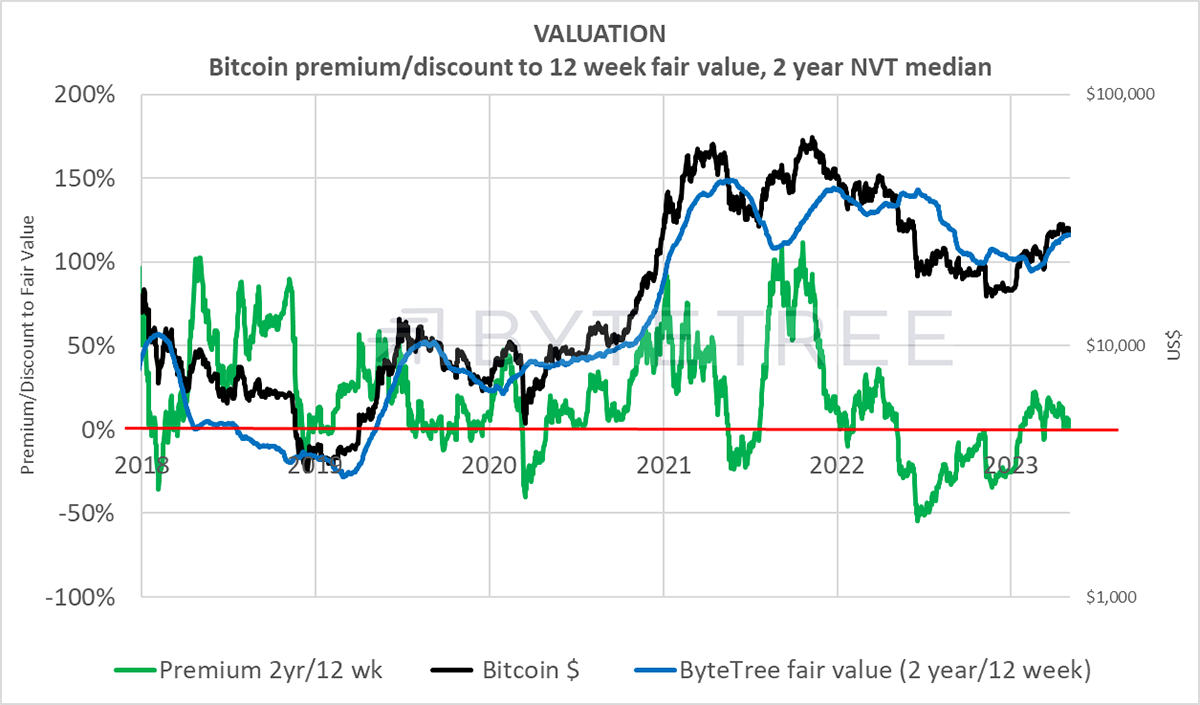

Our internal bitcoin valuation continues to creep higher and now stands at US$27,716. Nice to see that it was the level the price bounced off earlier this week, although we won’t claim causality. It does mean that we are squarely back in fair value territory.

Source: ByteTree

Macro

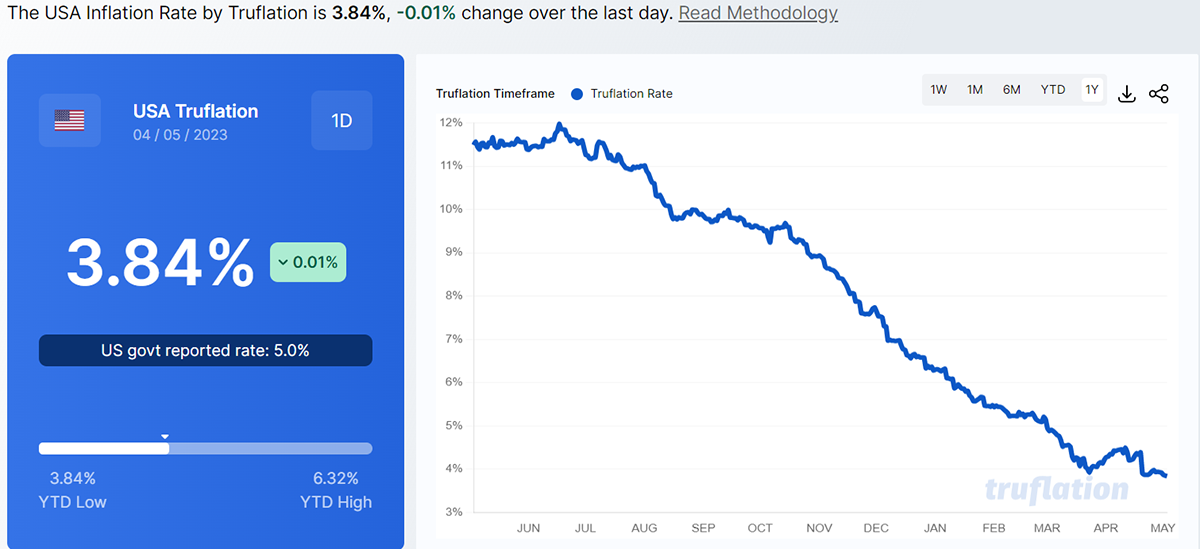

As the oil price sinks back below US$70/boe and another US bank fails, and with Truflation reporting inflation at 3.84% (see below), it seems likely that yesterday’s rate rise from the Fed is the last of the current cycle, and indeed they hinted as much in the commentary. It seems highly unlikely that inflation is about to run riot in the short term, although pressure will remain on wages, particularly in the public sector. The private sector has been doing a decent job of normalising the distortions created by the lockdowns, and it is a relief to see essentials start to reduce back to more normal levels.

Source: truflation

While it might reasonably be argued that the Fed has so far steered a commendable path, there must surely be a concern that central banks have already tightened too much. There is a lag effect in monetary policy, and yet things are already starting to break. It is also worth remembering that deflation in a world of ~US$300 trillion of debt, ageing populations, lower prices, economic stagnation, and lower tax takes is far more problematic than a sprinkling of inflation.

In this sense, the situation remains highly precarious. And because of the sensitivity of asset prices - and thus voting behaviour - to central government policymaking, we should expect greater volatility in policy settings and economic outcomes.

It is precisely this heightened environment of volatility that will continue to drive asset allocators into the arms of sound money and explains the continued interest in bitcoin, regardless of the regulatory headwinds it faces.

Investment Flows

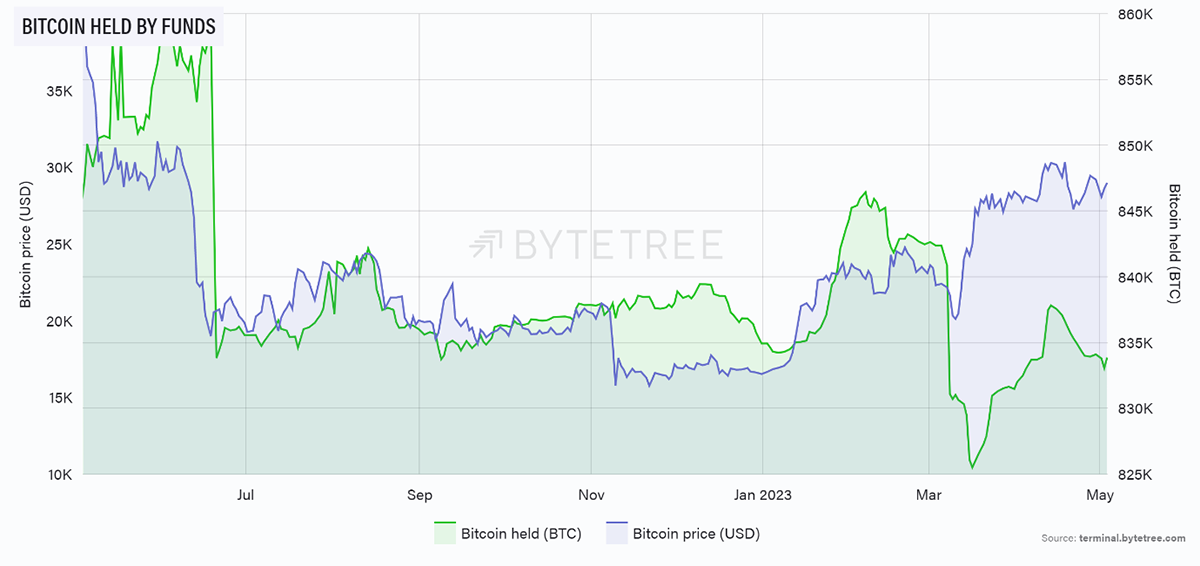

While BTC fund flows have stalled over the fortnight, the balance remains flat. Note that the BTC price has been a reasonable lead indicator of fund flows, proof, if any were needed, that this is largely seen as a speculative asset. It stands to reason, therefore, that any break above US$31,000 will see new money coming in.

Source: ByteTree Terminal

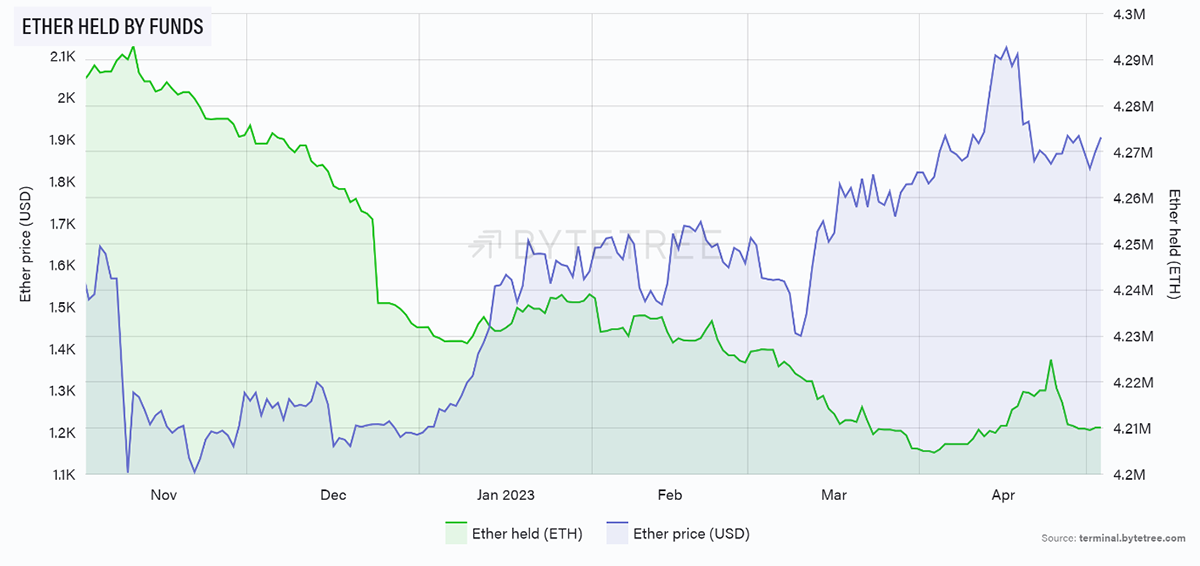

Ethereum has also seen a cooling off of enthusiasm after a bout of activity following the Shapella upgrade. These are, however, very small movements in the grander scheme of things.

Source: ByteTree Terminal

Cryptonomy

Coinbase

Things are getting pretty serious when a company sues its own regulator, but in a sense, that’s the problem. Coinbase doesn’t feel they are in an industry that is being regulated, certainly not by the SEC. They are simply on the receiving end of various enforcement actions, clearly designed to make life extremely difficult for the entire industry. The problem is that there is no guidance from the SEC as to how the law applies to crypto, so working within it is impossible. All Coinbase is asking for is for the regulator to share its answer to Coinbase’s petition on whether existing securities rule-making processes could be extended to the crypto industry. That petition is nearly a year old already, and a “yes” or “no” answer would do.

Bhutan

Bhutan, rather like El Salvador, is a country with considerable, but stranded, renewable energy resources; hydro in Bhutan versus geothermal in El Salvador. It’s therefore a brilliant idea to convert and store some of that energy by mining bitcoin. It turns out that this is exactly what Bhutan’s government have been doing, just like El Salvador. Now it turns out that they are in discussions with Singapore-listed company Bitdeer to finance access to 100MW of power and build a giant mining operation. This is not only good for geographically diversifying the spread of bitcoin mining – and therefore further shoring up bitcoin’s security - but must surely raise the prospect of other countries with renewable sources of energy doing the same. What are the chances that we see a mammoth and completely isolated solar farm in the Sahara Desert one of these days? Try and stop that, Mr Gensler.