The Turning Regulatory Tide

Disclaimer: Your capital is at risk. This is not investment advice.

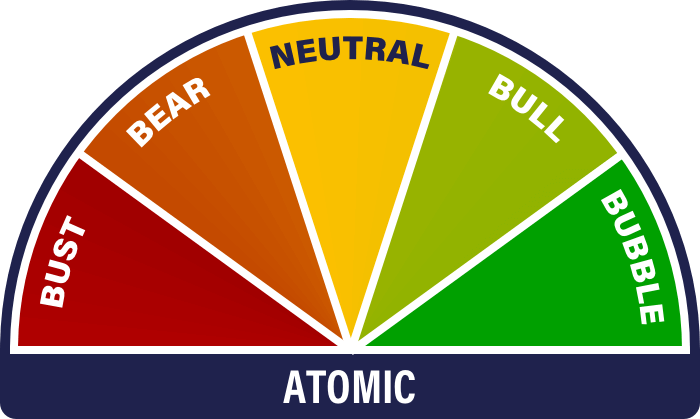

ATOMIC 82;

After the run-up this year so far, there should be little surprise and even less concern if the bitcoin price consolidates at these levels. The longer-term picture from both an on-chain and macro perspective remains solid, and the technicals are fine. Meanwhile, we ask whether the regulatory tide hasn’t just started to turn.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | The pause that refreshes |

| On-chain | Short-term activity slower, but long-term picture constructive |

| Macro | Inflation volatility bodes well for alternative assets |

| Investment Flows | ETH funds see inflows for the first time in a while |

| Cryptonomy | Regulatory arbitrage, the tide is turning |

Technical

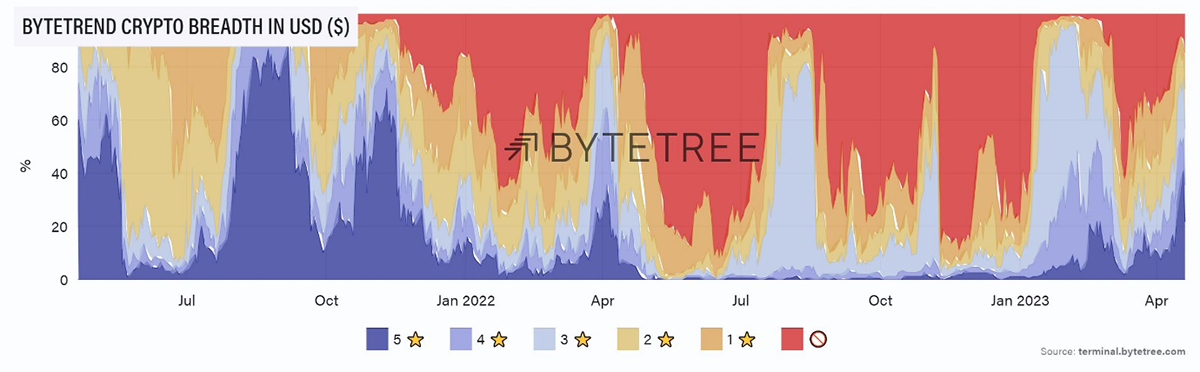

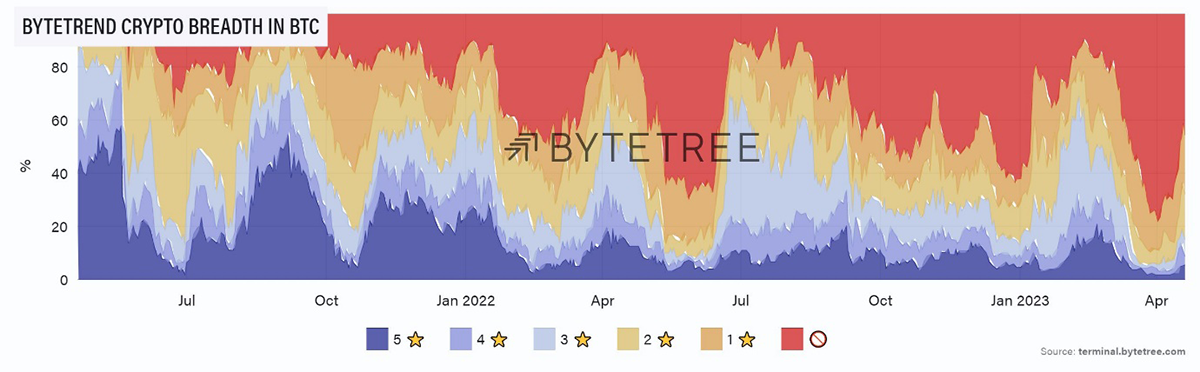

In US$ terms, crypto is now as strong as it’s been since November 2021. That can be seen in the breadth chart below, where the ByteTrend 5-star ratings (dark blue) have risen substantially. It corroborates our belief that the winter is over.

Source: ByteTree

As discussed a fortnight ago, bitcoin is at an obvious level of resistance in the US$29-30,000 area. It should be expected that there will be profit-taking here, but the longer the price stays in the range, the more the market will gain confidence that we have gained a new level. To this end, it is interesting to see that the volumes on Coinbase have been unspectacular. It suggests there is little in the way of panic, and many are happy to hold (on the ByteTree Terminal, you can adjust this chart for different exchanges, and the picture is similar).

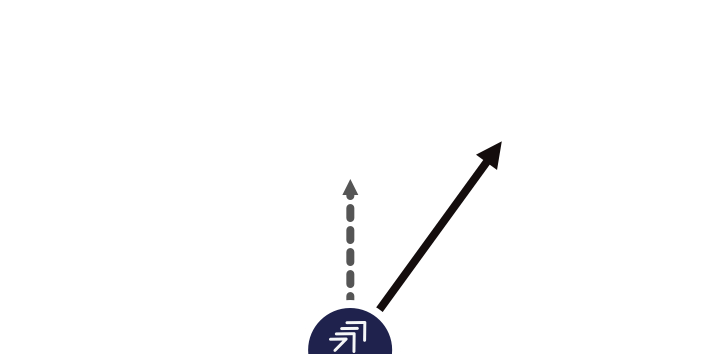

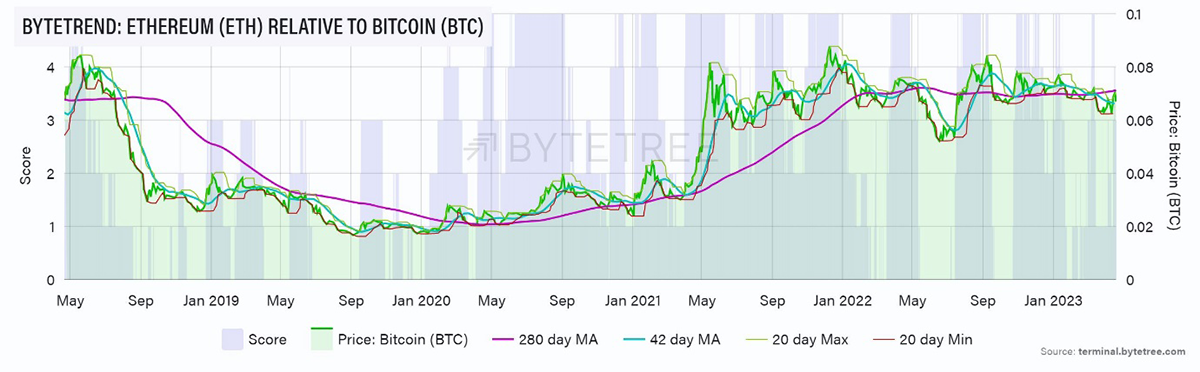

Interesting things are happening with ETH at the moment following the Shapella upgrade. Its price relative to BTC has been stuck in a range for over a year, as shown by the 280-day moving average below. But that moving average is tentatively starting to slope upwards. ATOMIC is sceptical about any imminent return of frenzied altcoin behaviour but will give credence to the idea that ETH can start to show some form.

Source: ByteTree

That’s partly because BTC has been so strong against the rest of crypto this year. This is shown by the amount of red sky on the breadth chart below. At worst, this suggests a short-term rally in the alts relative to BTC. Whether there is much follow-through is far harder to ascertain. We are heading into May…

Source: ByteTree

On-chain

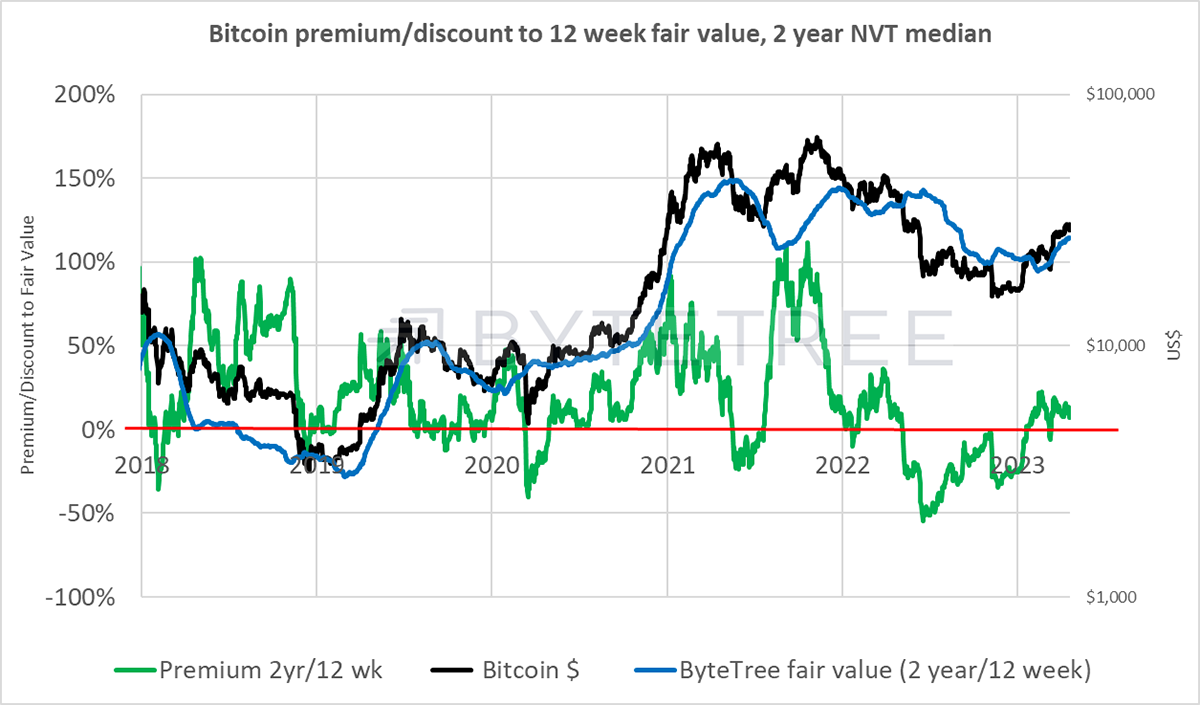

We’ve had some enquiries from readers about the disappearance of the bitcoin “Valuation” dials on the website. They were removed because we felt the methodology underlying them was no longer relevant. We maintain an internal valuation model that is far more dynamic than its predecessor and, at some stage, intend to bring it back.

For the time being, however, we will keep you regularly updated in this section. And today’s number is:

US$26,918

Here is how it has traded relative to fair value over the last five years. The main point is that there is no major departure from the price.

Source: ByteTree

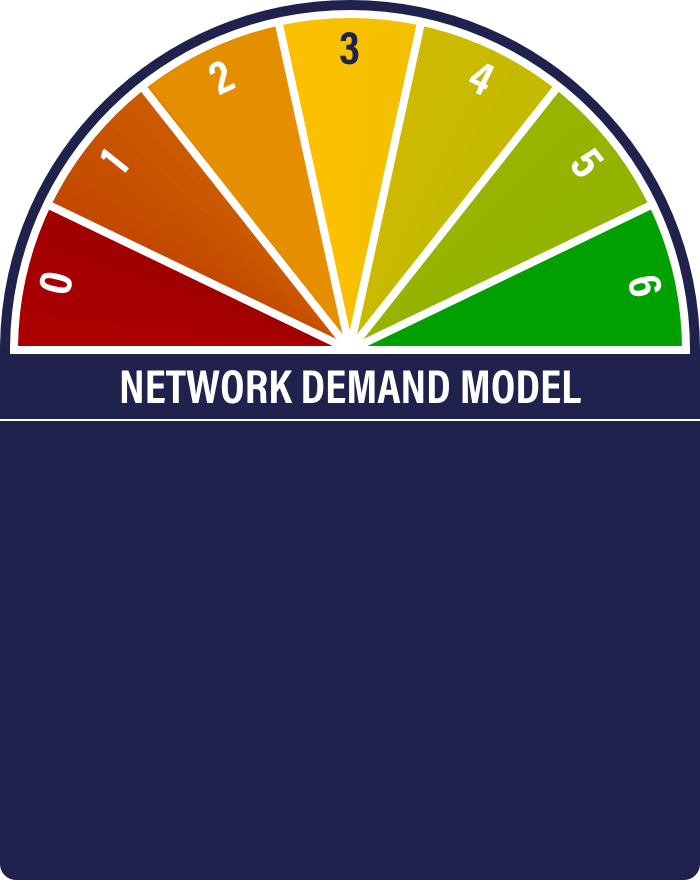

The Network Demand Model has cooled off and now reads 4/6. That’s still bullish.

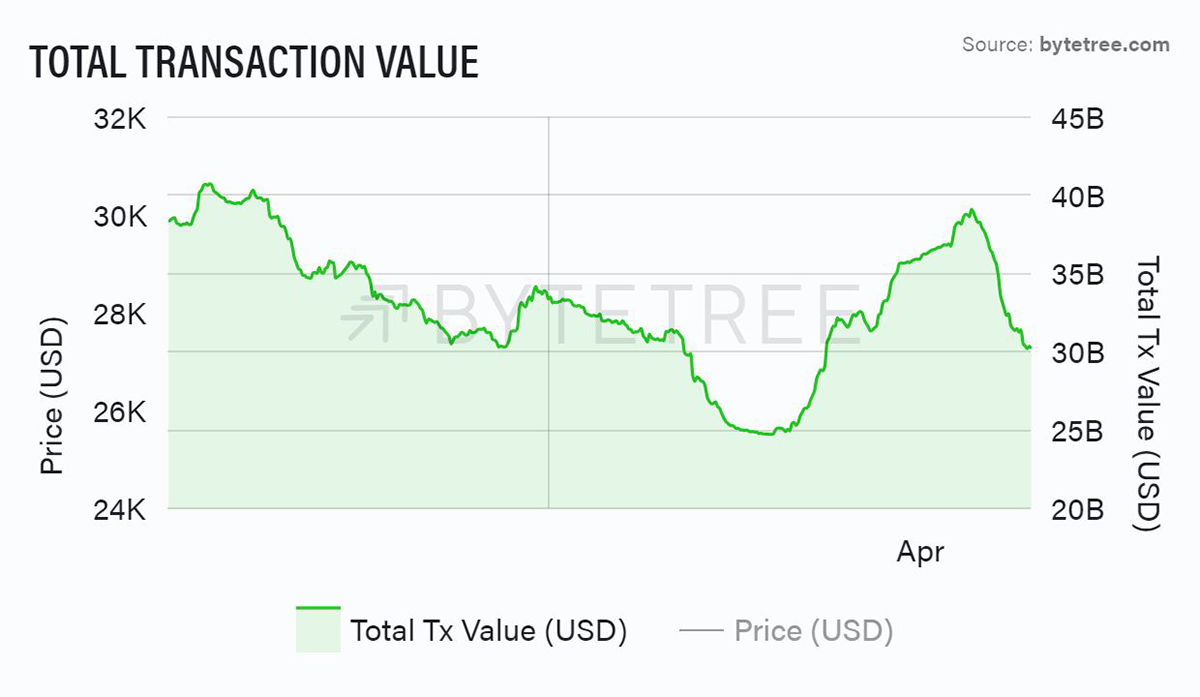

Short-term spend and Miner’s Rolling Inventory (MRI) are now both off. The former is notoriously volatile and reflects a dampening of on-chain transaction activity over the last couple of weeks, as shown here.

Source: ByteTree

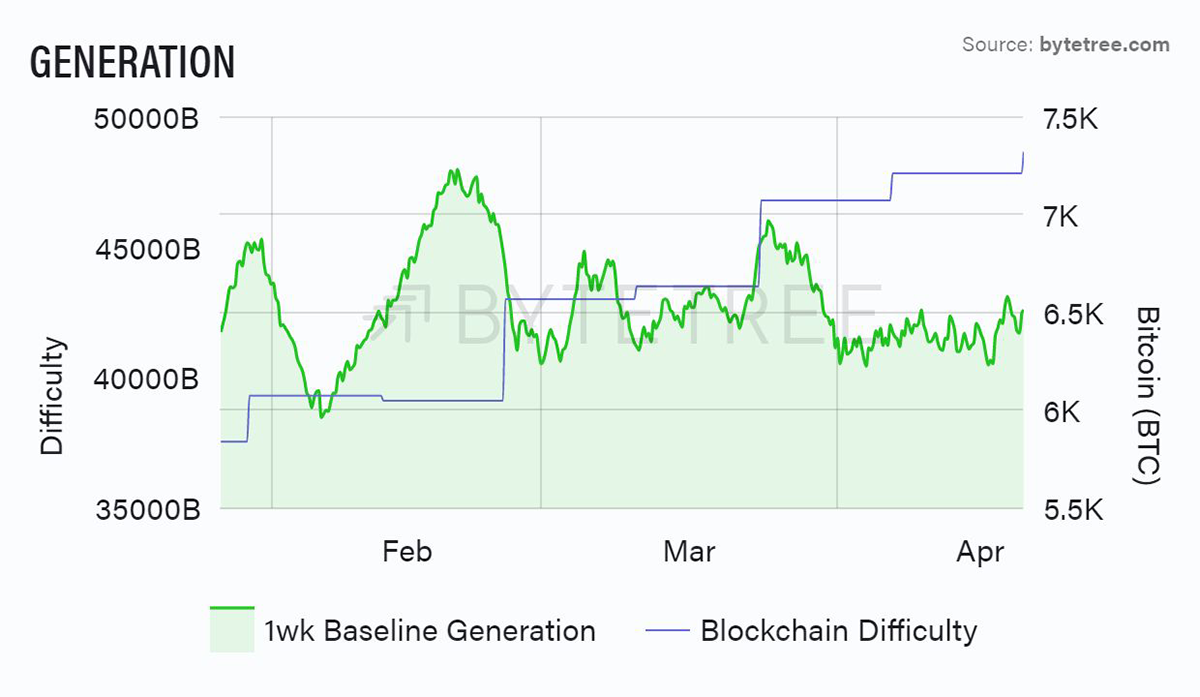

The miner behaviour is more interesting. Note that the “difficulty” level has again been adjusted higher, suggesting that more energy is being consumed by the network.

Source: ByteTree

One might therefore expect miners to be selling more into the market, but this is not the case. This tells us that there is no pressing need to unload inventory, which is healthy. Do they see a supply squeeze moving forward, or maybe their energy bills have come down?

We also see velocity tailing off. This tells how fast coins are changing hands. Again, it’s a sign of a relaxed ownership base. If there’s a renewed buying impulse, we’d expect this to rally again.

Source: ByteTree

Macro

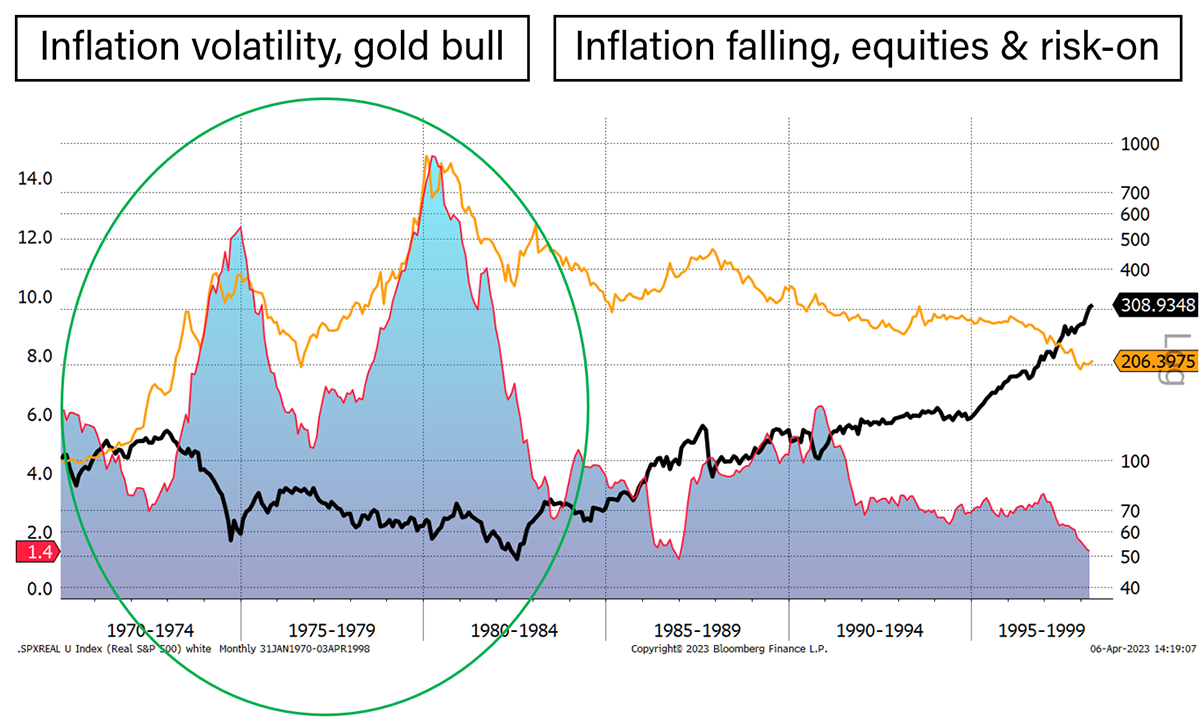

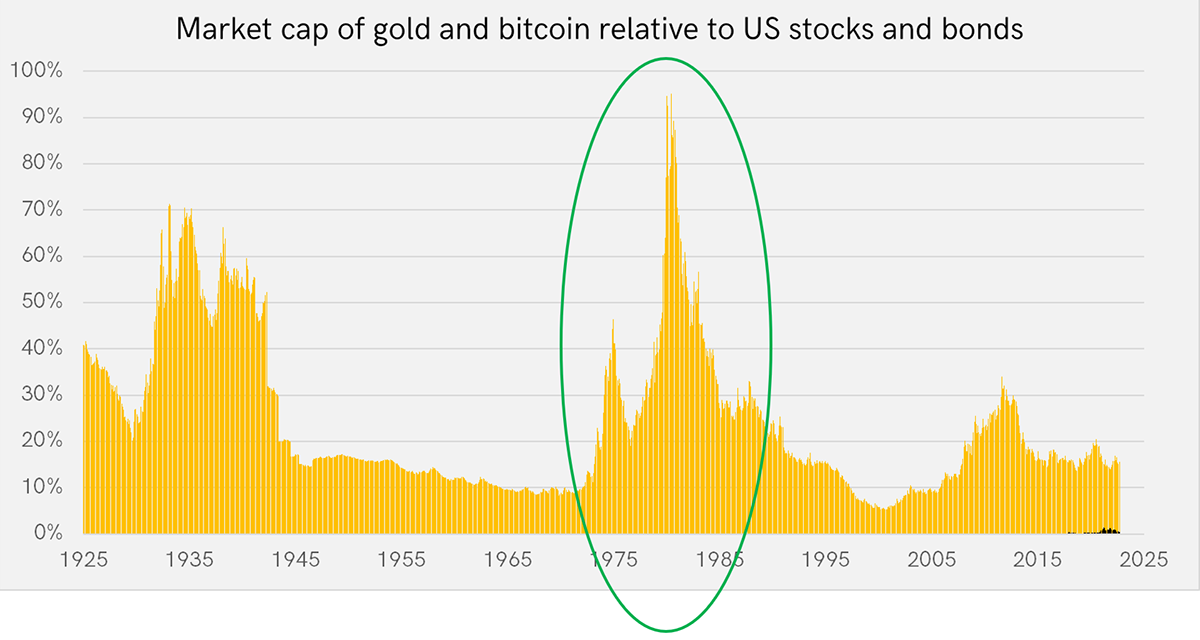

I’m indebted to Charlie Morris for providing the following charts, which show how important gold became in the investment mix during the days of high inflation volatility in the 1970s. The first picture shows how gold soared in price during that decade (it took 27 years for the S&P500 to catch up). The second shows how high gold grew as a percentage of stocks and bonds in that period (circled). If we are back in a period of high inflation volatility – as many, including ourselves, believe – this is an important reminder of the role that alternative assets play. And very few are prepared for this.

Source: Bloomberg, ByteTree Asset Management

Source: Bloomberg, ByteTree Asset Management

Why mention this in a Bitcoin newsletter? Well of course gold is no longer the only highly liquid alternative asset out there. Bitcoin is starting to become a credible alternative. Yet bitcoin has a market capitalisation of around US$500bn vs gold at US$13trillion. There is no obvious reason why, as comfort levels with ownership increase, it should not reach the same size one day.

Meanwhile, the general sense across the macro-sphere is that inflation is abating, although the March CPI print in the UK (+10.1% YoY) is unhelpful (though in large part distorted by the government’s intervention in the natural gas market). Following the OPEC supply-cut-induced bounce, the oil price has started to decline again, while the sight of Taiwanese export orders falling the most in 14 years (-25.7% YoY) and the Philadelphia Fed Manufacturing Index at its lowest level since May 2020 hardly persuades one that the outlook is rosy. Not that it will stop central banks from continuing to tighten.

The worry must surely be that an economic slowdown becomes much more pronounced in the months ahead. If that is compounded by things breaking more than they have done already, then politicians will demand looser settings, regardless of the ramifications for inflation. This is the big risk in markets and is the reason why investors would look for the safety of hard assets.

In this regard, the behaviour of the gold price will be important to watch. Gold has the ability to look around corners. It has yet to flinch.

Investment Flows

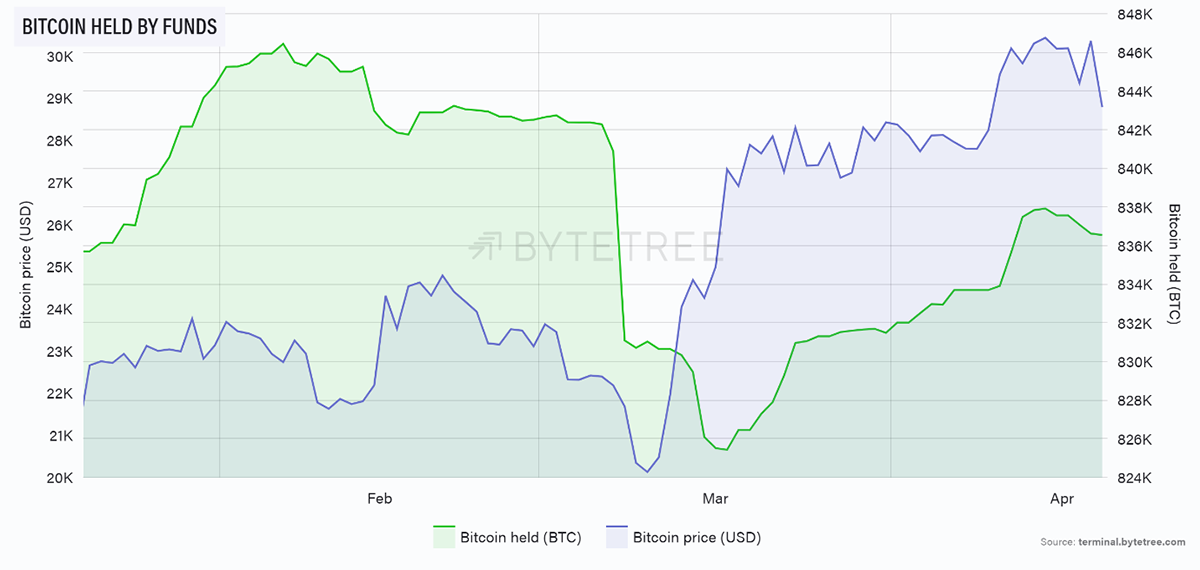

Bitcoin funds have seen some outflows over the last week. This is consistent with the idea of lightening up at US$29-30,000 but is barely discernible.

Source: ByteTree

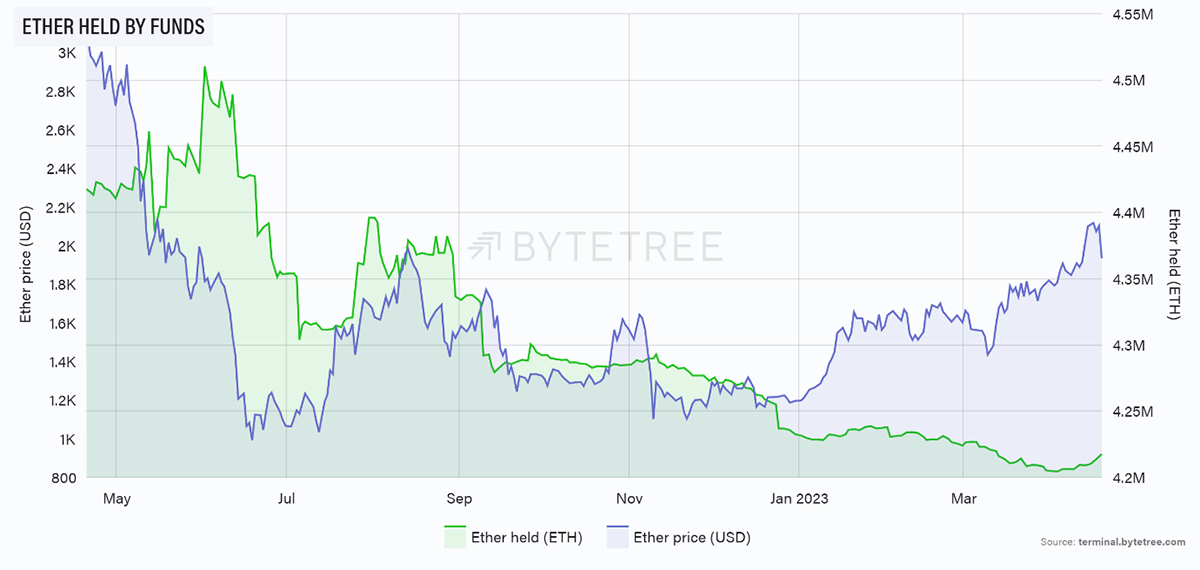

The Shapella upgrade has brought out some enthusiasm for ETH, on the other hand. The Funds see inflows for the first time in a while.

Source: ByteTree

Cryptonomy

There are some interesting developments as a consequence of what might be described as “regulatory arbitrage”. This is the idea that one regulatory jurisdiction benefits from the deficiencies of another. With the SEC in all-out assault mode on the crypto space, there is an opportunity for others to pick up the pieces.

Coinbase

In a tweet, Brian Armstrong, the CEO of Coinbase, said, “The UK is moving fast on sensible regulation to both drive economic growth AND consumer protection. Excited to keep investing in the UK”. Naturally the UK crypto community has interpreted this as Coinbase about to relocate lock, stock and barrel to the UK. It’s probably not the case, but it’s not a bad idea for Armstrong to play this game to highlight the incompetence and self-defeating nature of the SEC’s approach.

US House Financial Services Committee

Not that Gensler’s approach is without its critics in the highest levels of power in the US. It’s worth looking at this clip to see the withering criticism of the SEC’s agenda from the Chairman of the US House Financial Services Committee. In a separate part of the interview, we witness Gensler unable to answer a simple question as to whether ETH is a security or not, despite the blizzard of enforcement actions against the industry.

MiCA

Not to be outdone, hot-off-the-press news reaches us that the EU has voted in favour of a new crypto licensing regime, MiCA (Markets in Crypto Assets). This is likely to come into effect in around June 2024. It’s smart that the EU has led the way here because they will be able to set a standard for other global lawmakers. It won’t please everyone, but it is something.

Summary

We have argued in previous editions that Gensler’s weaponisation of the SEC runs against due process and the rule of law. It’s a shame his zeal wasn’t brought to bear before the collapse of multiple bad actors in the space. Nonetheless, it seems the approach is in the early stages of being discredited. One gets a sense of the regulatory tide starting to turn.