Stacks: Bringing Smart Contracts to Bitcoin

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: STX Token

Due to an abrupt growth in the popularity of Bitcoin smart contracts, the value of Stacks' native token, STX, has surged approximately 300% from the start of 2023. One key factor contributing to this demand is the rise in popularity of Bitcoin NFTs, also known as digital artifacts or Ordinals, which has led to an increased need for Bitcoin smart-contract capabilities provided by projects like Stacks. This Token Takeaway will delve into the fundamentals of Stacks, explore its importance in the Bitcoin ecosystem, and analyse the value proposition of the STX token.

Overview

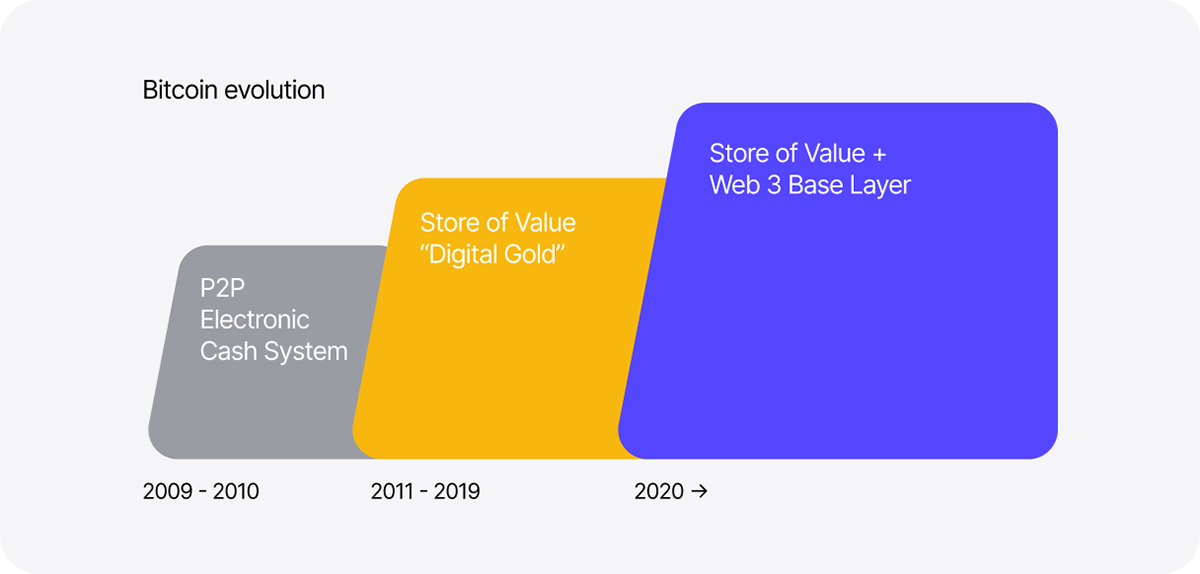

Stacks was first introduced in 2013 by Princeton University alumni Muneeb Ali and Ryan Shea with the primary vision to create a decentralised internet where internet companies “can’t be evil” (Stacks’ motto). Before rebranding to Stacks in 2020, the project was known as Blockstack. It was designed as a Layer-1 smart contracts blockchain that uses Bitcoin as its base layer. With Stacks, Bitcoin can enter a new era of smart contracts and programmability, opening a whole new world of technological possibilities for the network.

After years of research and development, the Stacks 2.0 mainnet finally went live in 2021. Within just one year of the mainnet launch, Stacks achieved over 350 million monthly API requests, 50k Hiro Wallet downloads, 2500 smart contract deployments, and the launch of numerous applications, making it the largest and fastest growing Web3 project on Bitcoin. Moreover, despite the efforts of competitors such as Rootstack and DeFiChain to offer comparable functionalities, Stacks continues to be the frontrunner in the field.

Despite the recent FTX collapse and extreme crypto market conditions in Q4, 2022, Stacks’ active addresses grew by 76%, while both average daily transactions and transactions-per-second (TPS) grew by 41.6% in the same period. Additionally, the network has also seen decent growth in smart contract deployments, registering a Compounded Annual Growth Rate (CAGR) of 19.2% in 2022. Stacks also has 87 applications built on it in various sectors, including NFTs, DeFi and Stacking (staking) pools.

How Does Stacks Work?

While Bitcoin is widely recognised as the most secure, stable, and decentralised blockchain in the industry, it's not without flaws. Although its PoW consensus, high hashrate, and maturity are commendable, it doesn't natively support full smart contract functionality. That's where Stacks comes in as a Bitcoin layer that enables smart contracts and dApps development on the Bitcoin blockchain . Using Stacks, developers can leverage the best of both worlds - Stacks’ smart contract features and Bitcoin’s security and stability - creating a perfect environment for applications.

Stacks uses Clarity, an open-source programming language specifically designed for smart contract development on the Stacks blockchain. It was developed by the Stacks foundation Hiro, Algorand and others. Clarity runs with clear syntax, and is highly predictable, decidable and offers secure and efficient development.

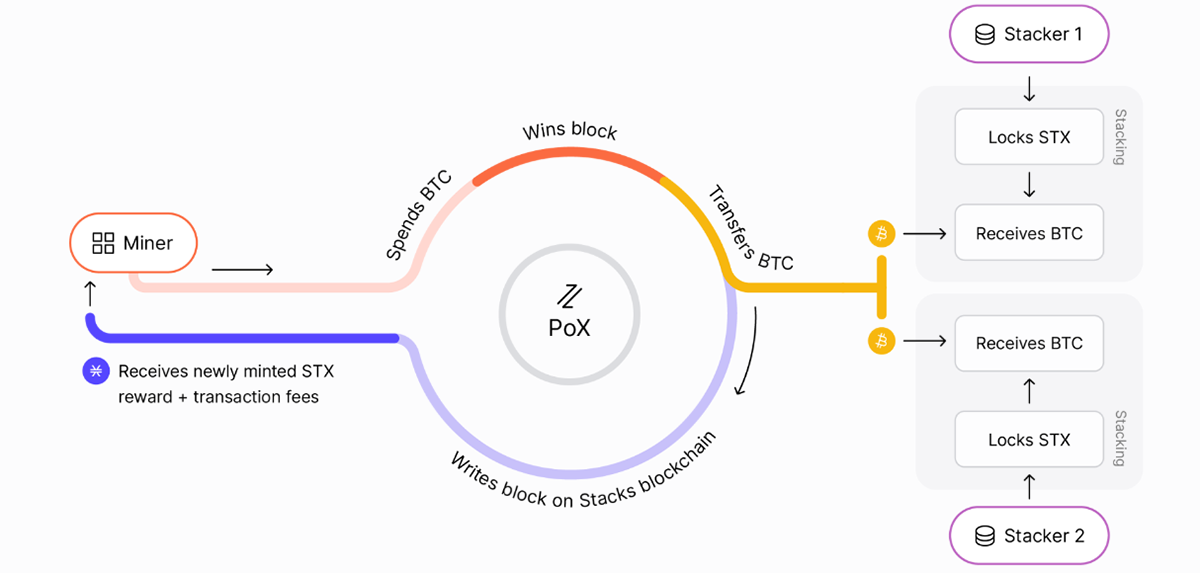

At the heart of Stacks architecture lies its unique Proof-of-Transfer (PoX) Consensus mechanism. Not only does PoX maintain network security, but it also connects the Stacks and Bitcoin networks.

Proof of Transfer (PoX) Consensus

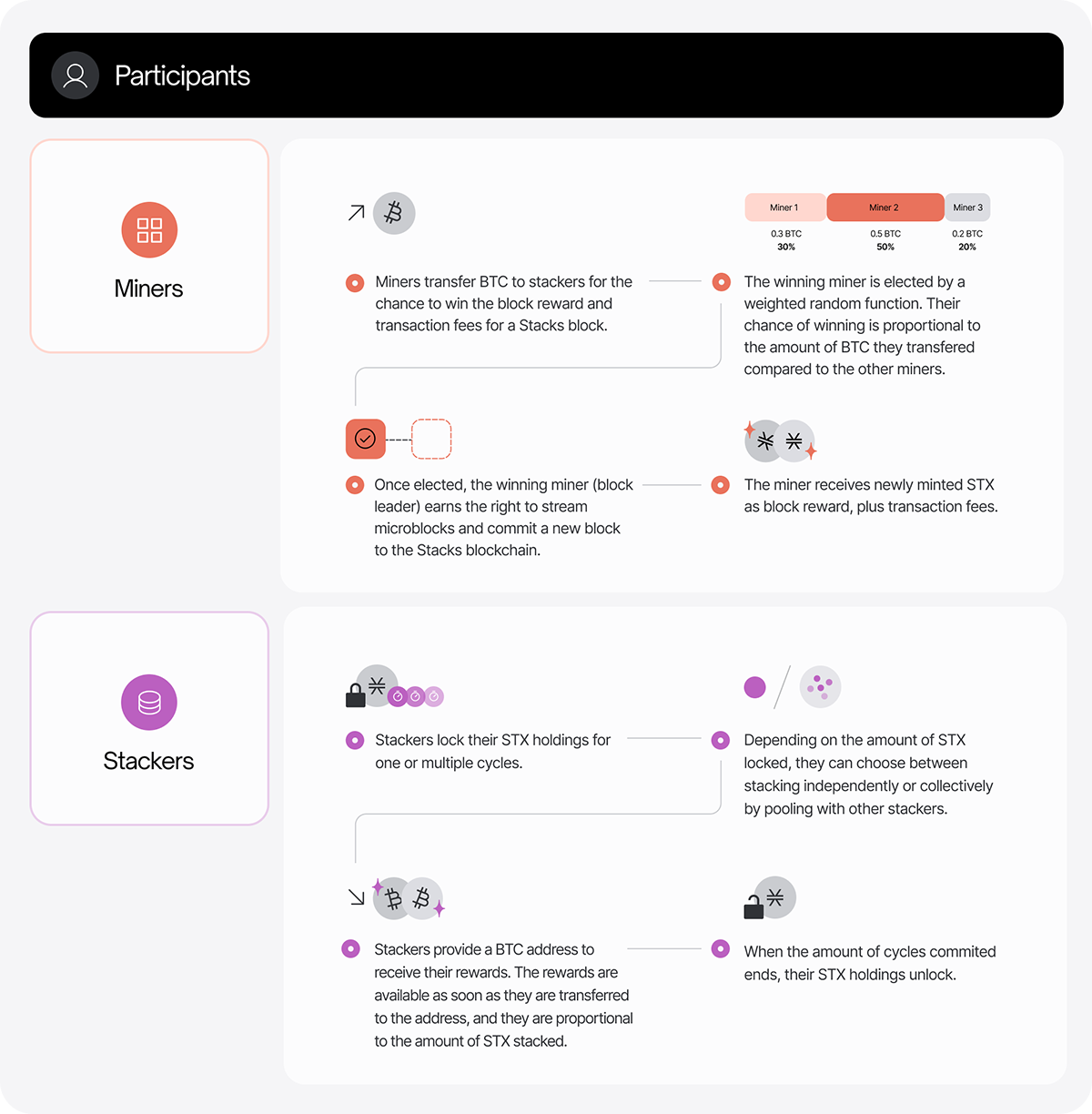

The PoX consensus algorithm shares similarities with the Proof-of-Burn consensus in that miners burn tokens during the consensus process. However, there is one key difference, instead of burning tokens, miners in PoX consensus transfer their tokens to other participants as incentives.

The infographic above illustrates how miners must commit/spend already mined BTC to create blocks on the Stacks blockchain. This BTC is then received by two Stackers (STX stakers) in exchange for staking their STX tokens. The incentives for miners are newly minted STX tokens and transaction fees on the Stacks blockchain. Essentially, the process can be compared to how PoW miners use electricity to earn BTC; PoX miners use BTC to earn STX and transaction fees. For a more detailed explanation, please refer to the image below.

Bitcoin NFTs

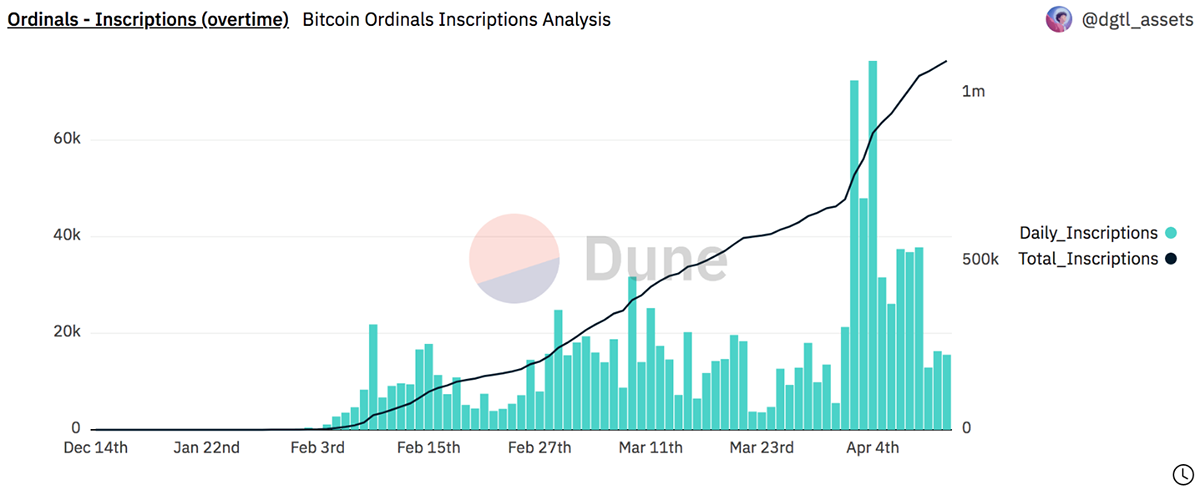

Bitcoin NFTs are digital artifacts that are permanent and immutable. Ordinals launched on 21 January 2023 and stores these digital artifacts on Bitcoin. Generally, when someone mentions digital artifacts or Ordinals, they’re most likely referring to Bitcoin NFTs.

Stating that Bitcoin NFTs exploded in popularity in recent months would be an understatement. More importantly, Bitcoin NFTs on Bitcoin layers like Stacks have also seen significant growth in popularity.

This is what Mubeen Ali said about Bitcoin NFTs and their storability on Bitcoin layers like Stacks:

“Ordinals on Bitcoin L1 are complementary to Bitcoin NFTs on L2s like Stacks. Ordinals have a natural limit on L1 scale, and L2s provide a clear scalability path. There is an active community of artists and creators on Stacks L2. People have minted 650K Bitcoin NFTs on the Stacks L2. All these NFTs are auto hashed to Bitcoin L1 and secured by Bitcoin in a scalable way.”

Digital artifacts have added a ton of non-financial data onto the Bitcoin Network, including images and audio, which has made it challenging for the network to manage. This is because Bitcoin was not originally designed for this amount of data and lacks the necessary features. As a solution, it is more practical to use application layers such as Stacks to create Bitcoin NFTs using Clarity smart contracts. By using Clarity smart contracts to create NFTs on Stacks, it prevents the Bitcoin Network from becoming congested and the transactions can still be settled on Bitcoin. This is the reason why the demand for Bitcoin smart contracts and Stacks increased significantly, sky-rocketing the STX price this year.

STX Tokenomics

STX, the native utility token of the Stacks ecosystem, was launched in an ICO in December 2017, raising $52m. The project also held two ICOs in 2019, raising $12.7m and $23m, respectively. Including all ICOs and Seed and Venture funding rounds, Stacks has raised a total of $93.8m in funding to date.

Stacks’s Regulatory Fiasco

The second 2019 ICO was actually approved by the SEC. Yes, Stacks launched the first-ever public offering for a crypto security.

On this unprecedented occasion, Muneeb Ali said:

“Our goals for working with regulators in the States were twofold. Primarily, we wanted to reach more retail investors who can be users of our network, and have a financial stake in the success of our ecosystem. Secondly, we identified Asia as a priority market, and our SEC qualification added weight to our strategic move toward Asia”

Initially perceived as positive news, the situation took a turn for the worse when Stacks announced in 2021 that it would cease submitting annual reports to the SEC, citing its belief that STX is not a security. In an effort to make the Stacks ecosystem decentralised, Muneeb Ali argued that "Hiro nor anyone else would play an essential managerial role that could reasonably be expected to be the driver of potential returns for Stacks holders", essentially violating the Howey Test of Securities law, making STX a non-security.

In my opinion, there was another reason why Stacks was trying to remove STX’s classification as a security. Being considered a security would mean that it couldn't be traded on US crypto exchanges, significantly limiting its exposure to the crypto community. Once STX was reclassified as a non-security, it was consequently listed on US exchanges, providing it with wider market access. OKCoin became the first US exchange to list STX after their team concluded it doesn’t classify as a security.

STX Utility and Price Analysis

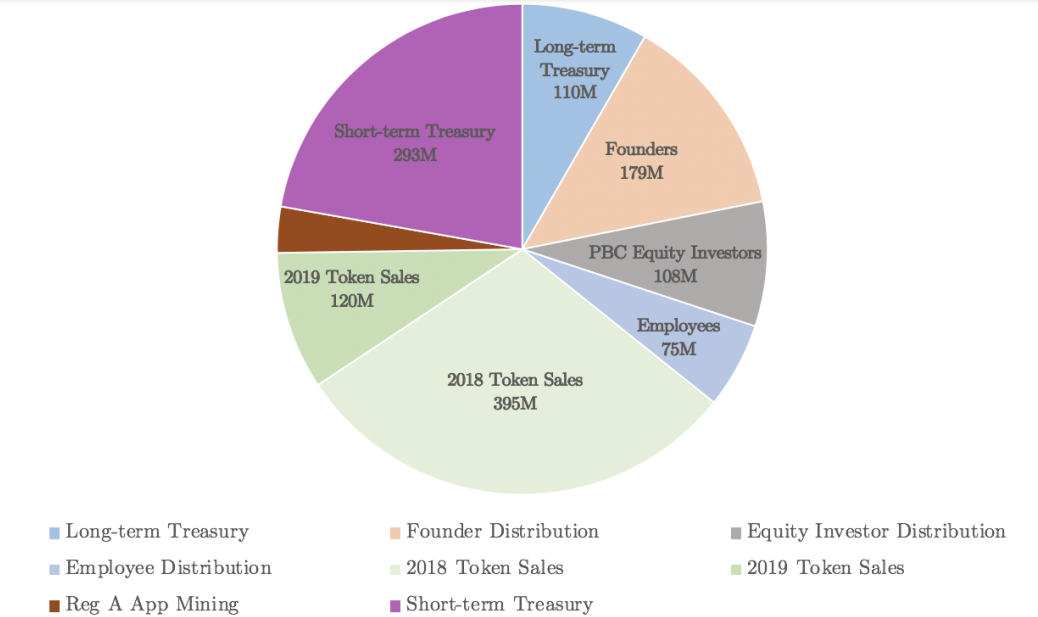

The project minted a total of 1.32 billion STX tokens at genesis. The initial token distribution was structured and executed as follows:

The STX token currently has a circulating supply of 1.37 billion, and its issuance process mirrors the halving cycle of Bitcoin. The total supply of STX tokens is not expected to surpass 1.818 billion.

As mentioned in the PoX consensus section, STX tokens are critical for the network to reach consensus. Stacking (Staking) STX on your own requires over 100k STX tokens. However, you can also stake via CEXs and Stacking Pools, which generally have a low or no minimum token requirement. Currently, over $400m worth of STX tokens are staked, and 2000 BTC have been distributed as incentives. On top of this, STX is also used to pay for all on-chain costs. Token holders also receive governance rights, which allow them to vote on proposals.

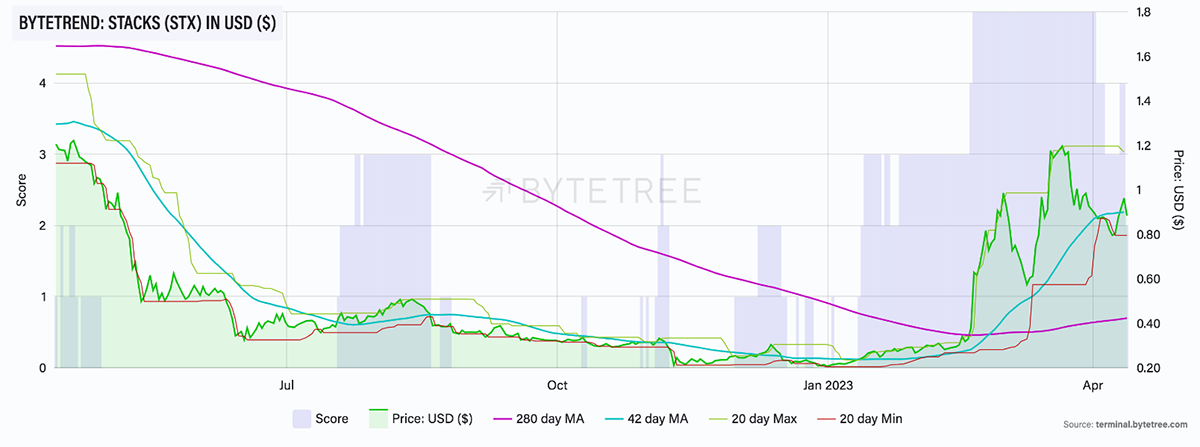

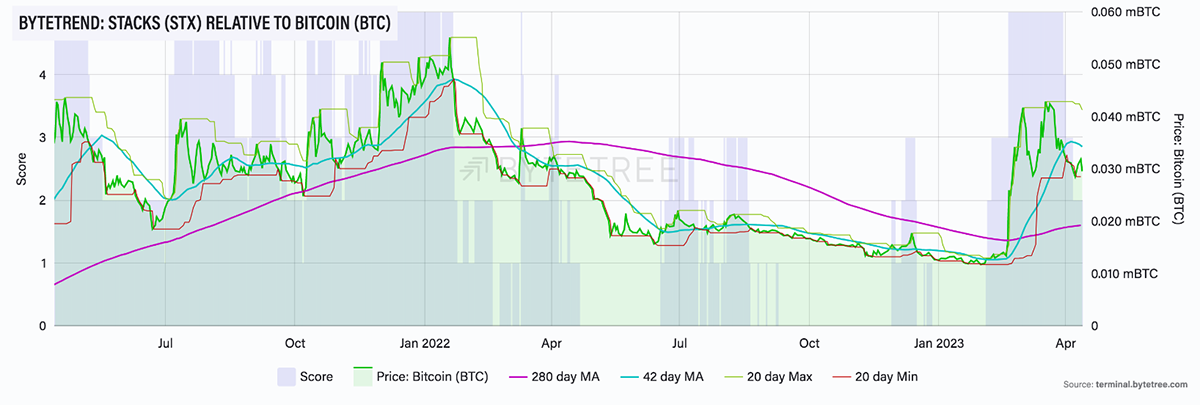

As illustrated above, after consistently making higher highs and higher lows throughout 2021, the token price suddenly dropped following BTC’s move from $35k to $47k in the first quarter of 2022. STX continued to decline the entire year.

Despite the recent strength in the price of bitcoin, the STX token has outperformed BTC in Q1 2023 due to the surge in Bitcoin NFTs. Following a strong start to the year, the STX token price has now retraced, dropping to a 2-star trend score relative to BTC. However, it’s worth noting that BTC continues to perform strongly, and very few crypto tokens are currently outperforming it. In comparison, the STX token currently scores a 4-star ByteTrend score in USD and is on an uptrend.

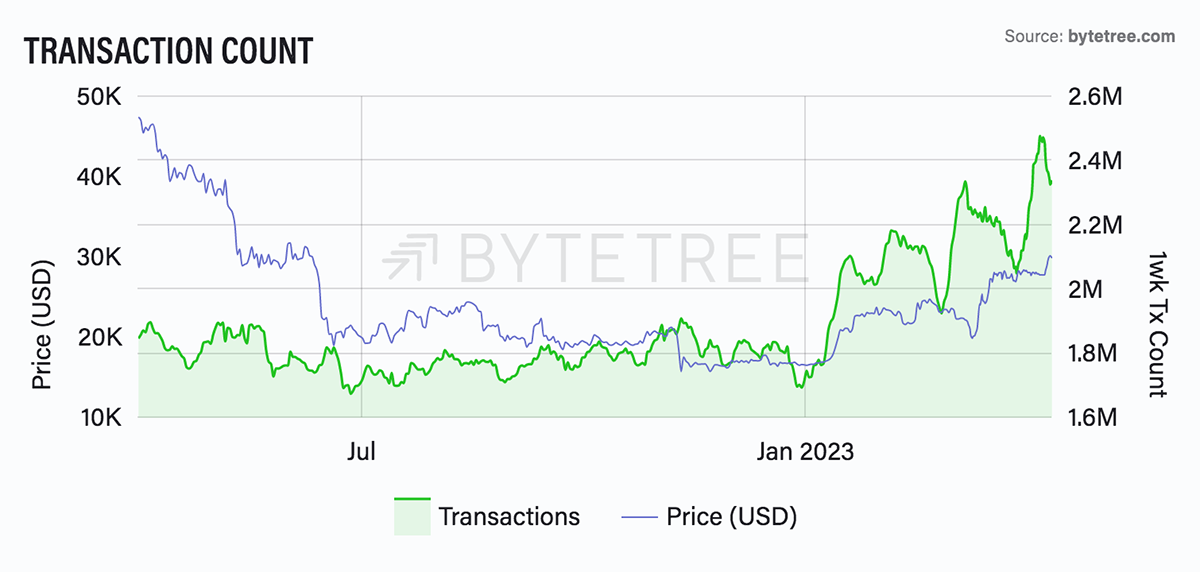

Bitcoin Network Analysis

As the Bitcoin Network serves as the foundation, it is crucial for the growth of the Stacks blockchain that it remains healthy. Given the rise in popularity of smart contracts and Ordinals, the on-chain activity on the Bitcoin Network surged significantly. The daily transactions on the network have surpassed 2.4 million, demonstrating higher network utility and demand. Moreover, as you can see in the chart below, the BTC price is proportional to the transaction count.

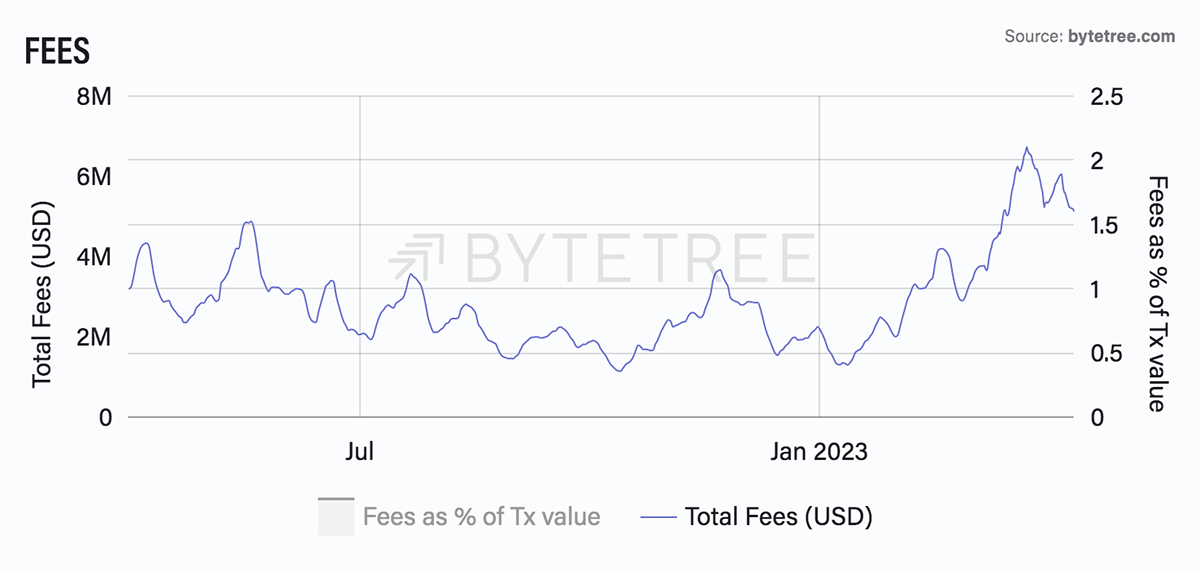

With increased demand and utility, the fees have also gradually gone up, as illustrated below.

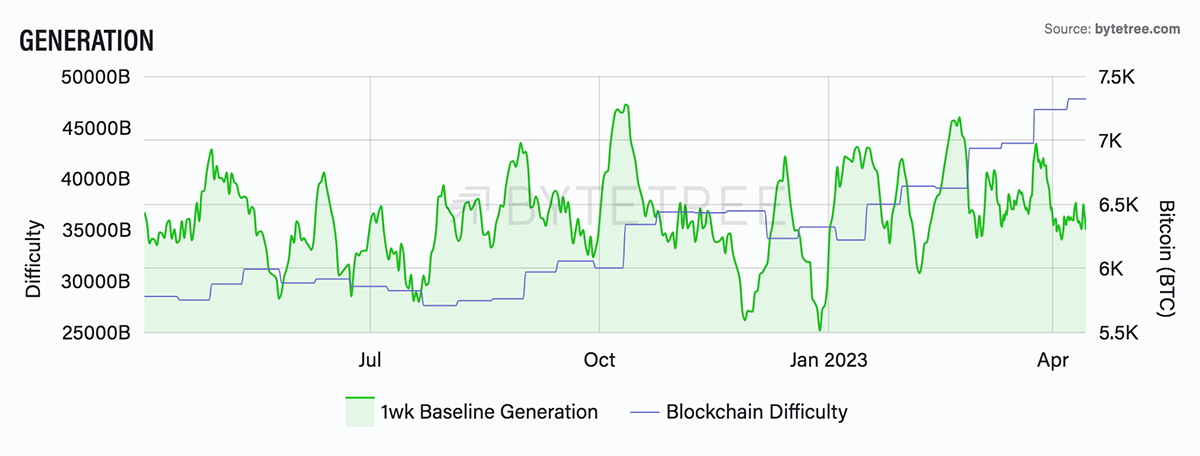

Increased fees result in increased incentives for miners, driving up the hashrate (difficulty to mine BTC) as illustrated below, making the network more secure.

Stacks is playing a significant role in unlocking new possibilities for Bitcoin, which is impressive. Projects that add real value to the base layer are highly appreciated, similar to the L2s of Ethereum. Nevertheless, it remains to be seen how long this trend will continue and if it can sustain its growth. In case there is a sudden decline in demand for smart contracts or Bitcoin NFTs, it could significantly affect the prices of both BTC and STX.

Conclusion

The emergence of Bitcoin NFTs has shown that there is real demand for smart contract functionality on Bitcoin, which is promising for protocols like Stacks. However, since Stacks 2.0 was launched fairly recently, and the recent surge in demand might be short-lived, it’s difficult to judge the sustainability of the project based on its past performance.

The future price performance and value of the STX token will depend on the Stacks platform's utility and the continued growth of its smart contracts and dApps. If the growth rate stagnates, it may discourage miners from spending BTC to earn STX. Nonetheless, Stacks' ability to bring the best of both worlds by providing a developer-friendly environment with Clarity is appealing. Considering that Bitcoin smart contracts are still in their early stages, Stacks may have significant value to contribute to the Bitcoin ecosystem.