Oil, Gold and Bitcoin

Disclaimer: Your capital is at risk. This is not investment advice.

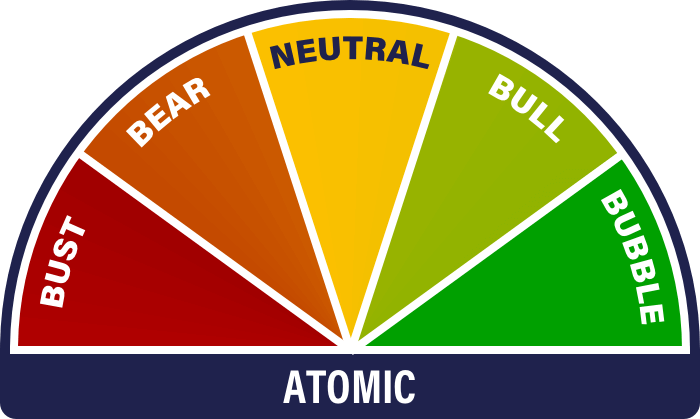

ATOMIC 81;

Bitcoin has met resistance at US$29,000, unsurprising given the technical picture, continued regulatory aggression in the USA and elements of on-chain activity that have softened. Against that, the macro backdrop remains supportive of hard money, and the longer-term indicators are fine. A pause for breath after this year’s substantial run is feasible, but structurally ATOMIC remains bullish.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Resistance at US$29,000 |

| On-chain | Transaction value softens |

| Macro | Oil and Gold |

| Investment Flows | Remain tentative |

| Cryptonomy | Twitter, Binance and MicroStrategy |

Technical

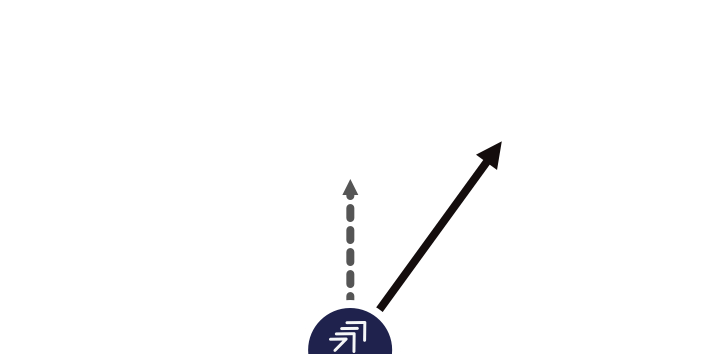

Bitcoin has traded sideways over the last fortnight. Looking at the longer-term picture, that shouldn’t come as a surprise. The US$29,000 level served as huge support in early and mid-2021, the latter when we thought the bull market was all over. Conversely, in June 2022, Bitcoin tried to find a base around here again, with a notable cluster of activity after the failure of LUNA. The subsequent failure of Celcius a month later broke the level and sent BTC into a tailspin down to ~US$16,000.

So there are huge psychological question marks as we reach this level. Those who bought here last year may be relieved to have a chance to exit without much punishment. Alternatively, they might reach the decision that they were right after all, just that the timing was poor.

Source: TradingView

ATOMIC’s conclusion is that if BTC breaks above US$29,000, it will take away a huge amount of selling pressure, with price momentum dragging in new buyers. But we’re not there yet, and it would be a surprise, from a technical perspective, if that happened soon. But it wouldn’t be a surprise if it happened eventually, assuming adoption continues to grow.

The downside risk at this point is back to around US$25,600 (the dashed line), where we saw resistance in August last year and February this year before the recent breakout. If the price corrects back there, it would make sense for long-term buyers to accumulate.

Of interest also is the ETH/BTC pair. After ETH re-rated against BTC in early 2021, it has been forming something of a “flag” pattern, of which it recently successfully tested the lower bounds. Again from a technical perspective, you’d expect that to resolve one way or the other in the second half of 2024, so a while to go yet. But it would be more consistent with post-halving alt-rallies that we have seen in the past. ATOMIC’s belief is that we are far from an altcoin blow-off in this cycle, and, therefore, there could be a lot of false and painful head-fake rallies.

Source: IG

On-chain

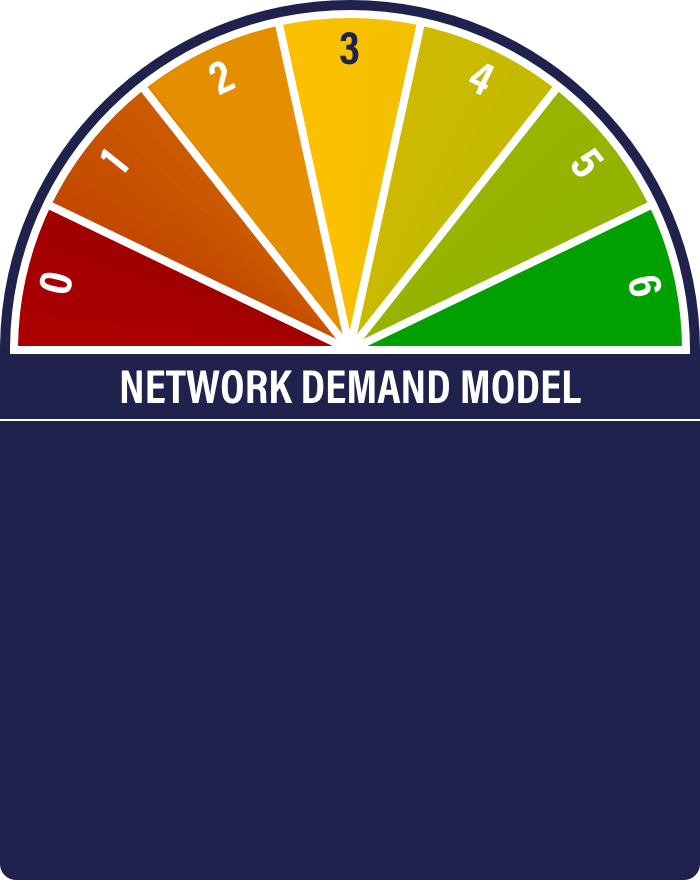

The Network Demand Model moves from 6/6 to 5/6 this week as the short-term transaction signal turns off. 5/6 remains bullish, however.

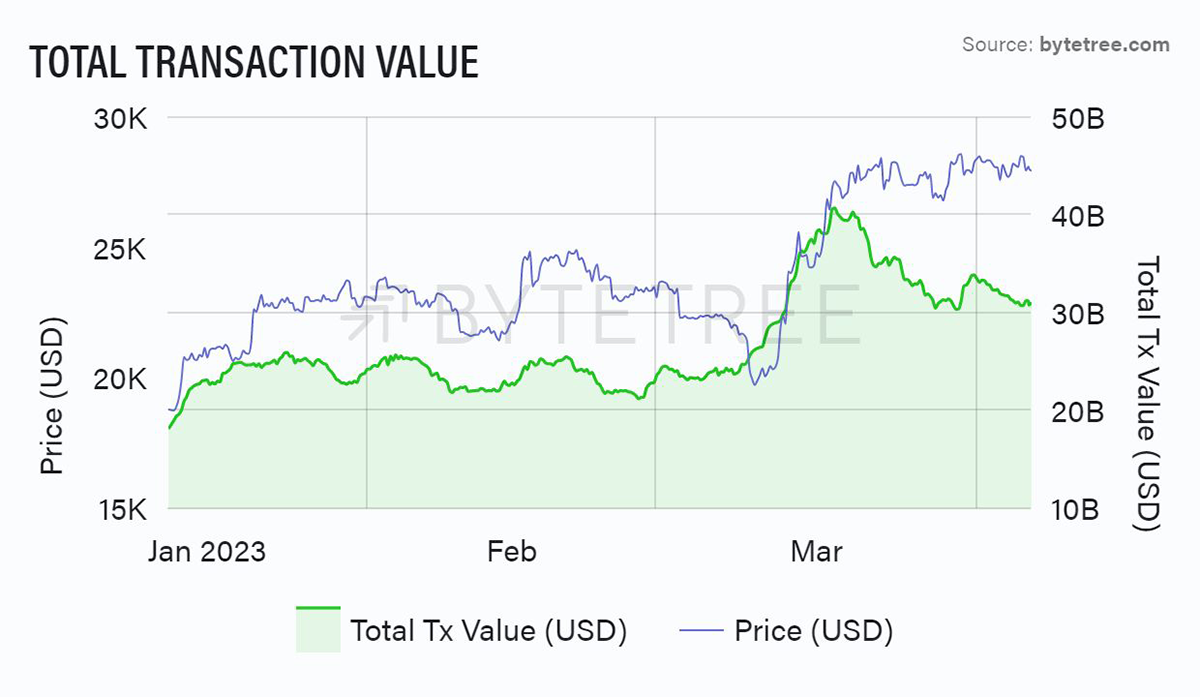

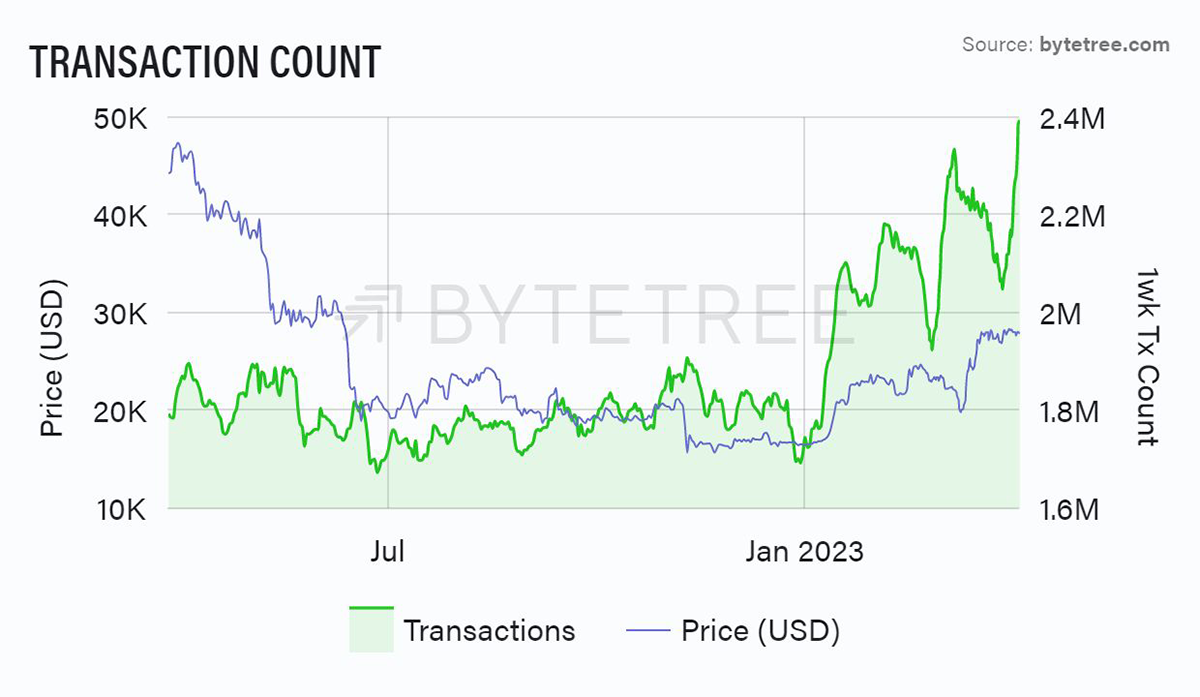

It’s an interesting development in the context of recent price behaviour. You can see from the chart below that the surge of activity that propelled BTC to current levels has subsided. It suggests that the network is taking a “wait-and-see” approach to the next move. If there is a break higher, expect a renewed surge in activity.

Source: ByteTree

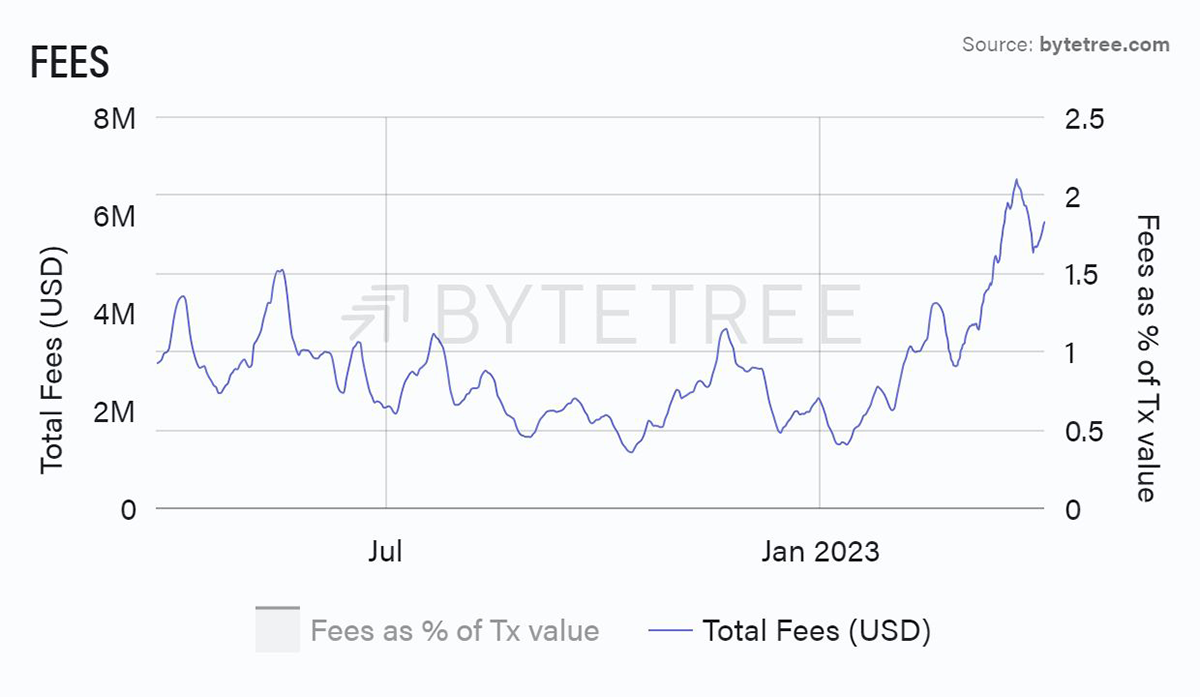

Other indicators of network activity remain constructive. The transaction count continues to break to new highs while the fees being generated for the miners also remain strong.

Source: ByteTree

Source: ByteTree

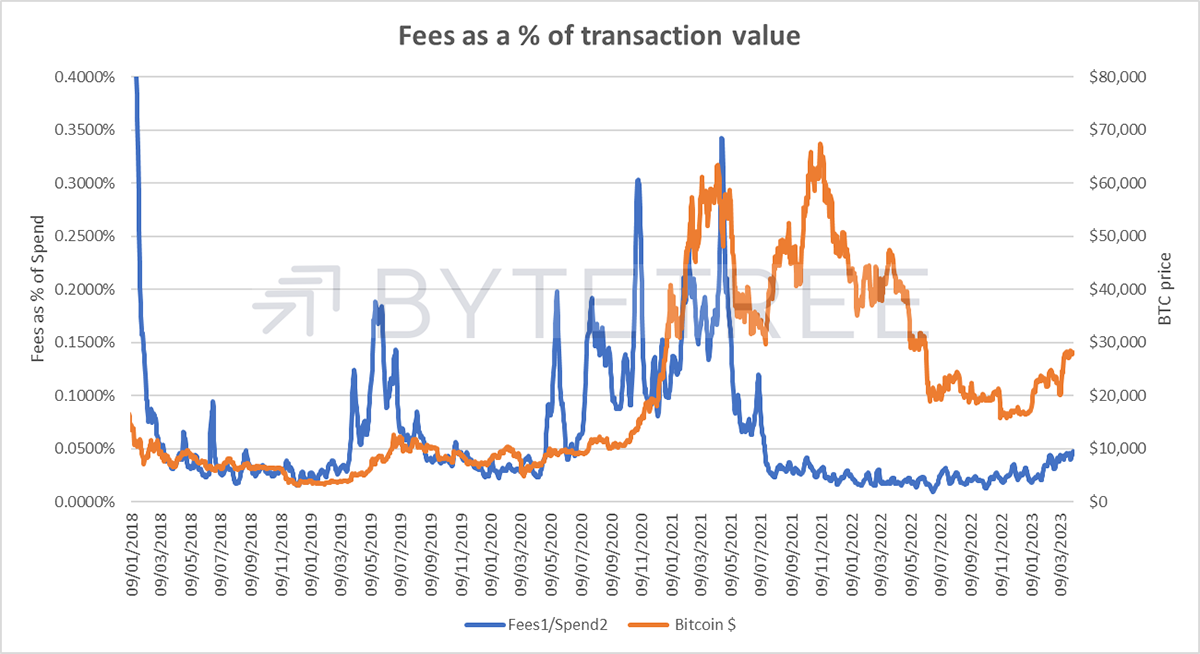

With the fees so strong, it might beg the question of when excessive fees start to choke off activity. If we look back to early 2018, it doesn’t appear that we are at a particularly worrying level. Fees as a percentage of overall transactions (shown below, taking a 1-week average of fees against a 2-week average of spend) seem to be more of a leading indicator of when we are heading into a big price move. We are below the levels shown before the 2019 and 2020 ramps.

Source: ByteTree

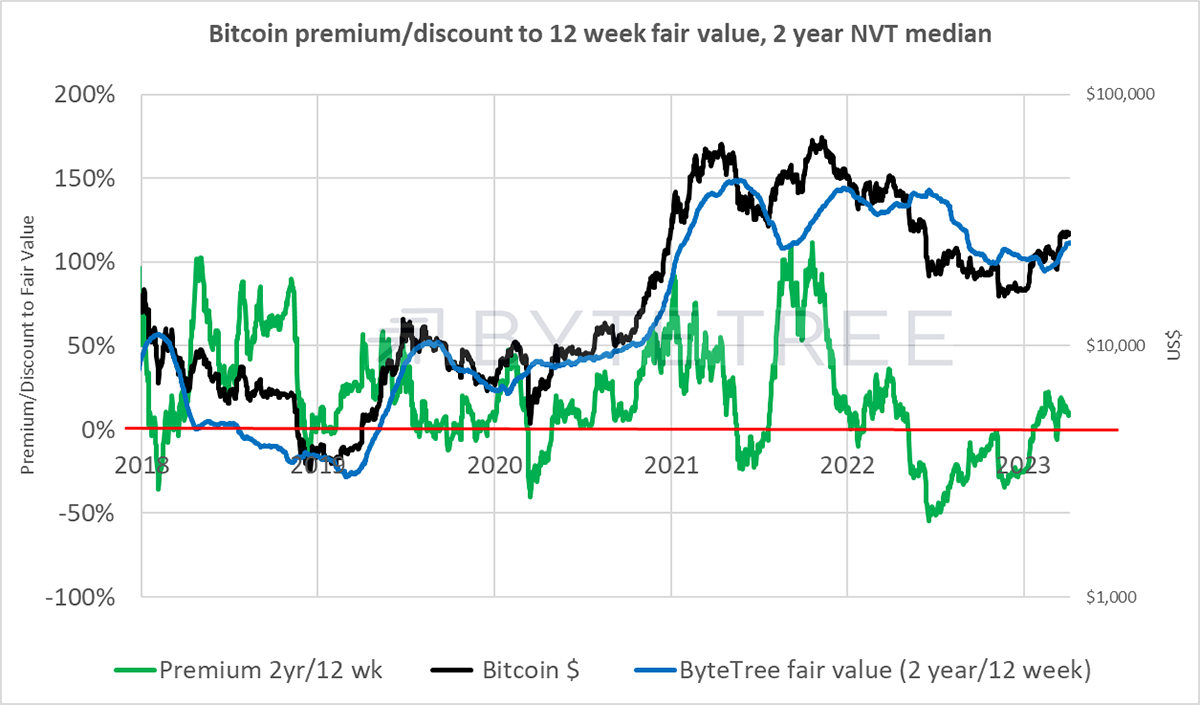

Finally, we’ve had a couple of readers asking where we are with regards to valuation. That’s shown in the chart below. Assuming the Bitcoin Network is expanding, and therefore that the multiple we apply to transactions should structurally increase, ATOMIC considers that a premium to fair value is justified.

As of last night, our fair value is US$25,857, or about where the lower price support level sits, as described in the technical section.

Source: ByteTree

Macro

The recent OPEC supply cut must have come as a setback to deflationistas. It is also a reminder of how prices are manipulated by centralised bodies and the weaponisation of energy.

The almost instant corollary was that the gold price moved above US$2,000. The reasons might have been two-fold: first, a higher oil price fans inflationary flames. Second, and perhaps more significantly, it seems a deliberate attempt to continue to undermine US hegemony. It is perhaps not a surprise, in hindsight, that the move comes barely a fortnight after China brokered a peace deal between Iran and Saudi Arabia.

Sovereign risk is now being factored into the gold price, a point discussed in the latest edition of Atlas Pulse.

If that is the case, why should we not factor in the same for bitcoin? As political tensions rise and economic fragility becomes ever more evident, it makes sense for gold’s digital equivalent to benefit from its role as a bearer asset.

The crypto market is intensely focused on the highly toxic regulatory barrage unfolding in the US at the moment. Still, those able to step back and take a longer view should consider the unfolding geo-political situation as a much more important value driver. Especially as it appears that outside the US, the regulatory attitude is significantly more benign.

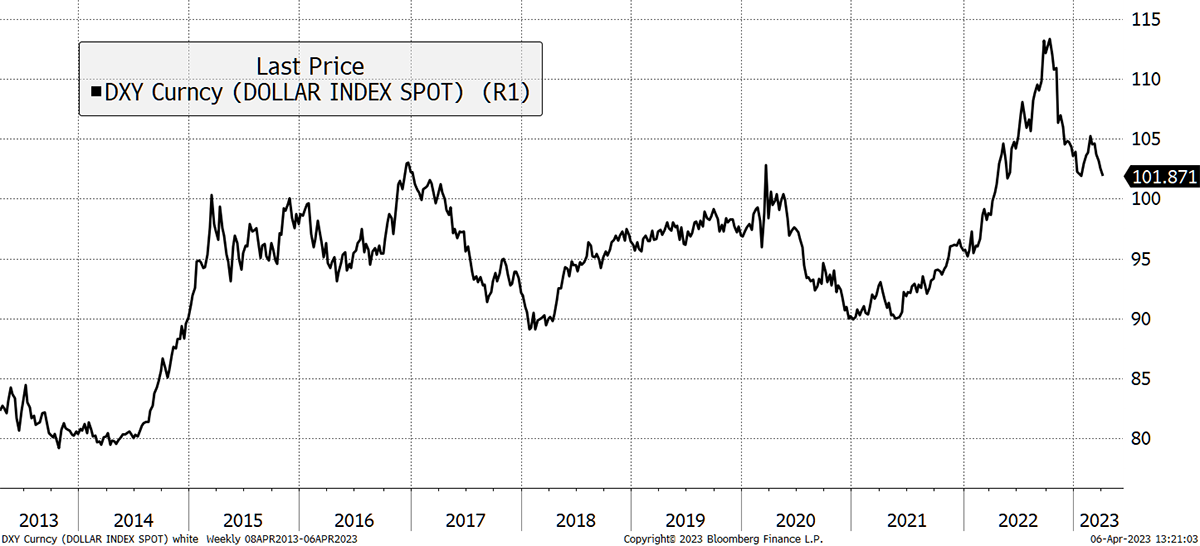

In that context, it is revealing to see the recent behaviour of the US dollar.

Source: Bloomberg

Investment Flows

The ETF market has been pretty steady, with net inflows into BTC in April so far. This includes a 570 BTC increase in BITO, the US futures ETF, showing that not everyone is deterred by the ongoing regulatory assault on the space over there.

Source: ByteTree

Flows into ETH, on the other hand, are moribund. They almost look like a contrary indicator! One interpretation might be that non-specialist institutional flows are more interested in the store of value argument for bitcoin than the Web3 narrative for ETH at the moment.

Source: ByteTree

Cryptonomy

MicroStrategy

MicroStrategy has announced the purchase of another chunk of BTC, this time 1,045, at the cost of US$23.9m. The average price of the company’s 140,000 BTC is US$29,80. Thus, any fears of the company’s solvency can be tossed out of the window. Saylor’s timing has, on more than one occasion, marked an interim top in the price, so there will be a few nervous traders out there. Still, that’s a tad harsh as on 27 March, MicroStrategy announced they had bought 6,455 BTC at an average price of around US$24,941. The company now owns 0.75% of coins that will ever be in existence, and since Saylor embarked on the journey, the share price has risen 95%. Interestingly the company also announced it had paid off a US$205m loan from Silvergate, financed via a sale of shares. It might be a recognition from Saylor that Bitcoin and leverage aren’t good companions.

Source: Bloomberg, ByteTree Asset Management

Musk/Doge/Twitter

Twitter users will have noticed that Elon Musk changed the existing logo from blue bird to Doge a couple of days ago. The man moves in mysterious ways, but there is normally some sort of signalling going on. In Twitter’s case, it continues to raise the fascinating prospect of how the platform evolves into the future. Musk is clearly a man with a vision for a planetary network of value transference, and Twitter is the obvious vehicle. He already knows about payments (PayPal) and also owns the most comprehensive satellite network ever built (Starlink). Join the dots.

Binance

The next big scare story in the crypto sector is coming to you soon. Binance has been hit by a lawsuit from the CFTC (the Commodity Futures Trading Commission), who were generally regarded as the more crypto-friendly US regulator, although that can now be discounted. Since this publication wrote a year ago (these things are hard to forget) that the LUNA debacle was unlikely to be systemic, the author is coy about predicting a non-event. But it seems unlikely that this will unhinge underlying crypto technology in anything but the very short term. Binance US is nothing like FTX, for example, and this is as much about rival regulatory agencies flexing their muscles in order to assert their pre-eminence. It will be interesting to watch events unfold.

Summary

Political tension is driving increased interest in alternative assets. Bitcoin stands to be a long-term beneficiary of this. Short term, we might see consolidation at current levels, but this should be seen as a natural stepping stone in its progress.