Print More Money, and Embrace Gold

Disclaimer: Your capital is at risk. This is not investment advice.

This week I wrote a piece entitled “There is Never Just One Cockroach”, while Robin and Rashpal followed up with a mid-month flash note called “Silicon Valley Bank: Never Just One Cockroach”. Jinx, as they say in the playground. The quote is one of Warren Buffett’s, but it was amusing that we both had the same idea and drew the same conclusion from the recent banking crisis.

The idea is that when a bank goes down, other problems rise to the surface. First there were the failures of Signature and Silvergate, but they were “just crypto banks”, forced under by the powerful in a vain attempt to make life difficult for the sector. Charlie Erith wrote in ByteFolio that banking failures were an advert for bitcoin, and so it has proved.

Then came Silicon Valley Bank, followed by rumours around First Republic. Before you knew it, the almighty Credit Suisse came crashing down with 98% of its equity wiped out. The Swiss National Bank provided a $50 billion lifeline to stabilise the situation, which will ensure it fails slowly rather than quickly. Is this banking crisis over? Cockroach theory suggests you should be prepared for more because rate hikes are the smoking gun, and they continue at pace.

Larry Fink, CEO of the world’s largest asset manager, Blackrock, agrees. He wrote in his annual letter:

“There could yet be a third domino to fall. In addition to duration mismatches, we may now also see liquidity mismatches. Years of lower rates had the effect of driving some asset owners to increase their commitments to illiquid investments – trading lower liquidity for higher returns. There’s a risk now of a liquidity mismatch for these asset owners, especially those with leveraged portfolios.”

The ECB don’t seem to be too concerned, because they increased interest rates by 0.5% to 3.5% on Thursday as planned. Apparently, they went ahead with the hike despite a plunging Credit Suisse, so as not to cause alarm. There comes a point where good PR is not enough, and the facts will force events.

Next Wednesday the Fed plans to raise rates to 5% (last seen in 2007), and then on Thursday, the Bank of England to 4.25%. The markets are betting on a quick reversal soon after because they don’t believe higher rates can be sustained without economic carnage. 15 years of money printing, followed by harsh rate hikes, has its consequences.

What is the solution?

More printing.

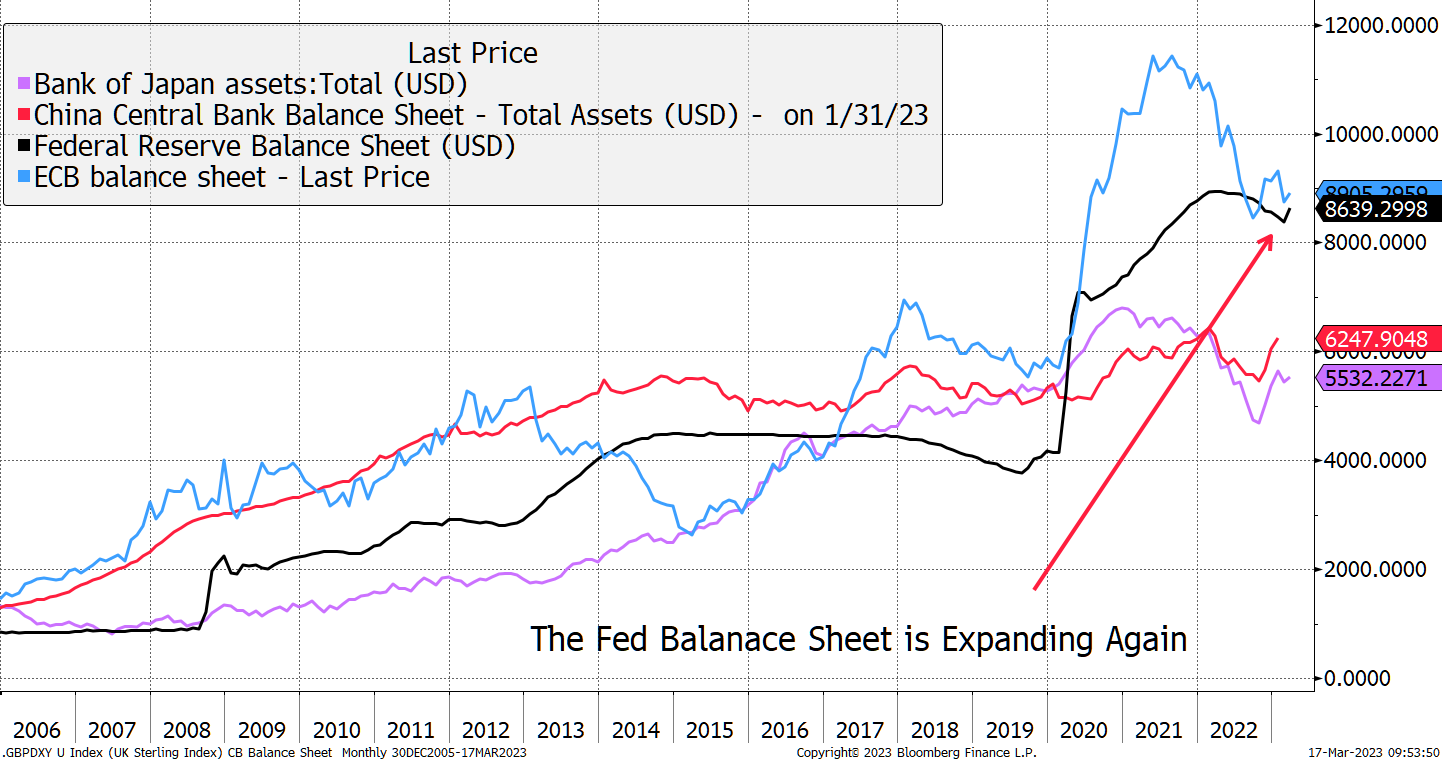

To stem the damage, the Federal Reserve has printed an additional $300 billion as reported on Wednesday night to prop up the banks. The attempt to reduce their balance sheet with quantitative tightening (winding down QE) hasn’t lasted long. Having grown it to nearly $9 trillion by April 2022, the past year has seen a contraction of $650 billion. That was until Wednesday, as the contraction has contracted by $350 billion.

Major central banks are expanding their balance sheets

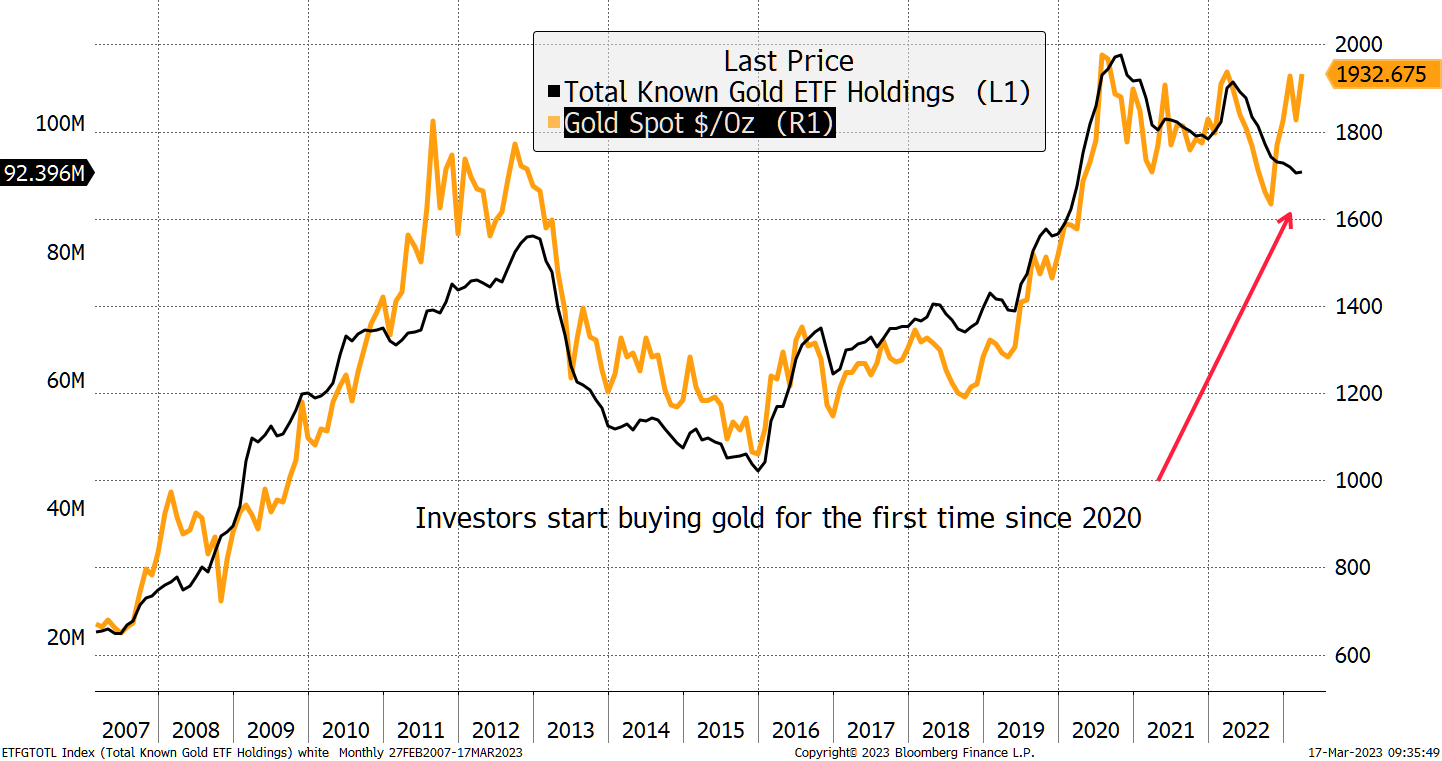

With expanding balance sheets and lower interest rates a step closer, the fight against inflation will have to take a back seat, which is good news for gold. Remarkably, and despite events around us, investors have been lightening up on gold for the past 2½ years. Yet the past few trading days have reported 0.5 million ounces purchased. I doubt this is an anomaly. It’s more likely to be the start of a lasting trend.

BOLD and the Balance Sheet

It is unsurprising that gold has been shunned by investors in recent years, but it is more relevant than at any time since the 1970s. China, and many other countries, have shunned US treasuries because they no longer trust them, and have instead, turned to gold. In the past few months, they have purchased over three million ounces, with no end in sight. It is time to embrace gold again, and it is remarkable how few professional investors take it seriously these days. More fool them, and more for us.

Have a great weekend. I’ll say more on gold on Tuesday.

Charlie

Comments ()