Lido: A Liquid Staking Solution for Staked, Illiquid Tokens

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: LDO Token;

Lido, a decentralised liquid staking platform for Proof-of-Stake (PoS) chains like Ethereum and Solana, has made headlines since the start of this year. Its native token has shot up around 200%, and the platform TVL has increased by approximately 50%. Its frictionless staking services with additional benefits have attracted hundreds of thousands of users to the platform. This Token Takeaway will examine Lido’s fundamentals, its significance in the space, and the value proposition of its native LDO token.

Overview

Lido was launched in October 2020 by Konstantin Lomashuk, Vasiliy Shapovalov, and Jordan Fish with the primary vision to provide an efficient, third-party staking solution for Ethereum. All Lido services became available to users after the Ethereum 2.0 Beacon Chain went live in December 2020.

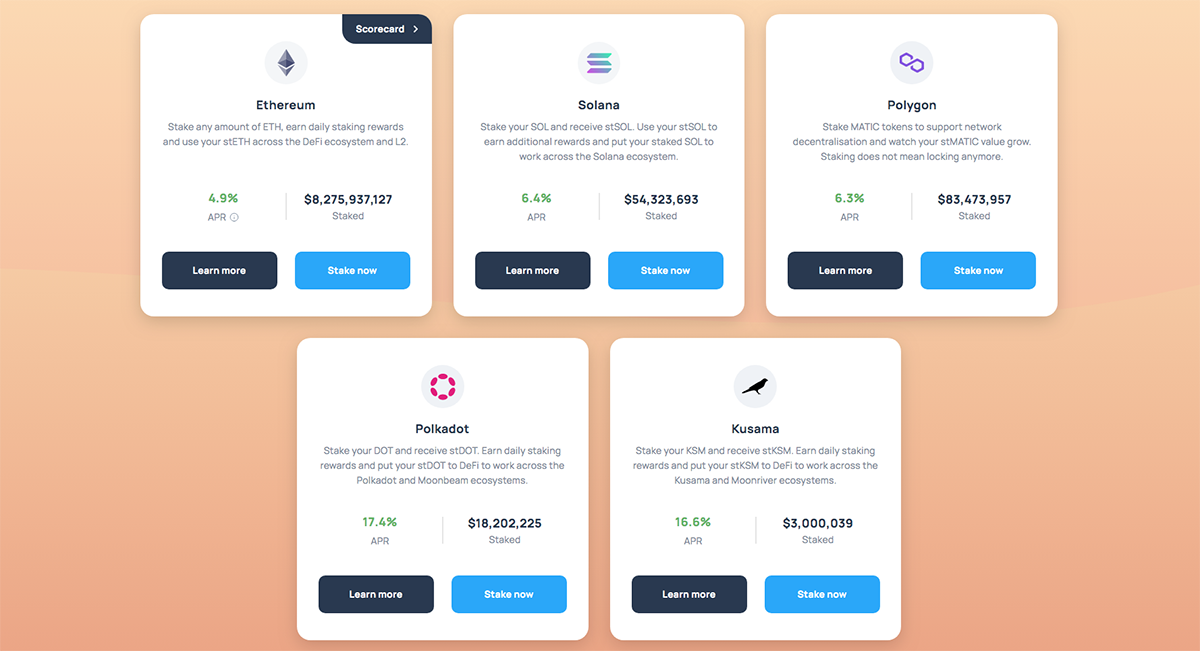

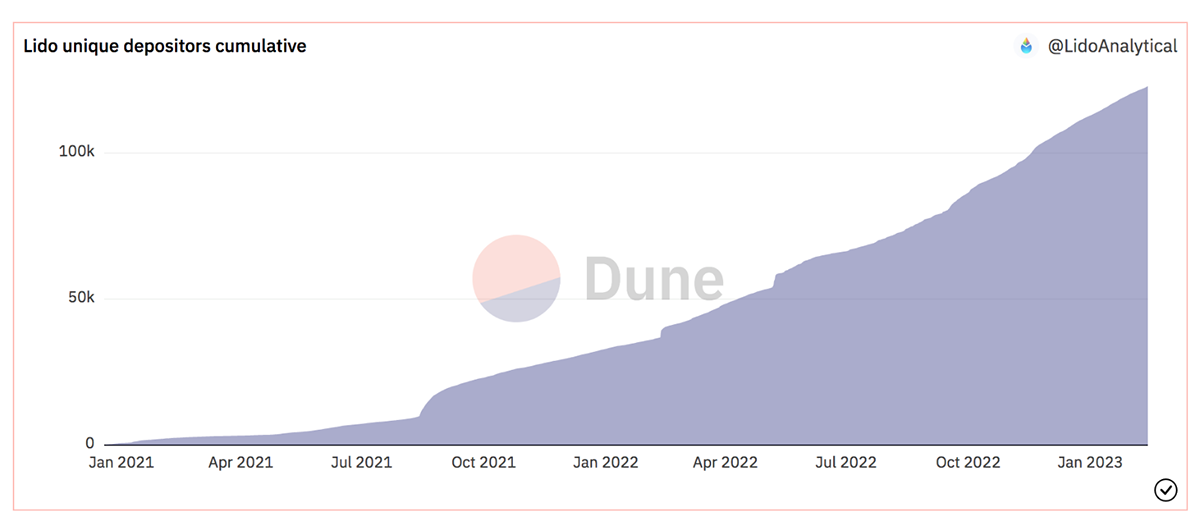

Today, Lido has over 273k stakers and offers staking services to multiple PoS chains, including Polygon, Solana, and Polkadot. Across these chains, over $8.4bn tokens are staked using Lido, of which $8.2bn (97.6%) are ETH. Furthermore, over 122k (45%) of all the stakers on Lido are staking ETH.

As illustrated in the above chart, the number of unique ETH stakers on Lido has seen consistent growth since its launch.

Why Does Ethereum Need a Staking Solution?

There are three main reasons why many ETH stakers have opted to stake with Lido instead of directly staking on Ethereum.

Indefinite Locking Period

After the start of Ethereum’s transition from Proof-of-Work (PoW) to PoS, users were allowed to stake their ETH on the Beacon Chain. However, once your tokens are staked, it is impossible to unstake those tokens at the moment. This means that your tokens are theoretically locked for an indefinite period of time. However, a recent announcement in relation to the Shanghai Hard Fork upgrade stated that ETH stakers will be able to unstake their tokens in 2023.

No Extended Utility

Since the tokens are locked, there is no way to trade or use them. Although ETH staking does provide an APY of 4.8%, there is no extended utility for these tokens. This essentially forces users to opt between staking APY or DeFi use cases/yields.

Staking Allowance of Only 32 ETH Multiples

The minimum staking requirement is 32 ETH, which, at the time of writing, is worth just under $50k. It’s safe to say that not all ETH holders have 32 ETH just sitting around to stake. Additionally, if you possess 50 ETH, you will only be able to stake 32 ETH. The remaining 18 ETH cannot be staked because staking is only possible in multiples of 32 ETH.

How Does Lido Work?

PoS is currently the most used consensus mechanism for blockchain networks. Native token holders of the respective blockchains stake their tokens (set up a validator node or delegate) on the mainnet to validate transactions and ensure on-chain security, receiving staking rewards in return. Setting up a validator node is somewhat complex and often requires technical knowledge and hardware to support the process to its full extent.

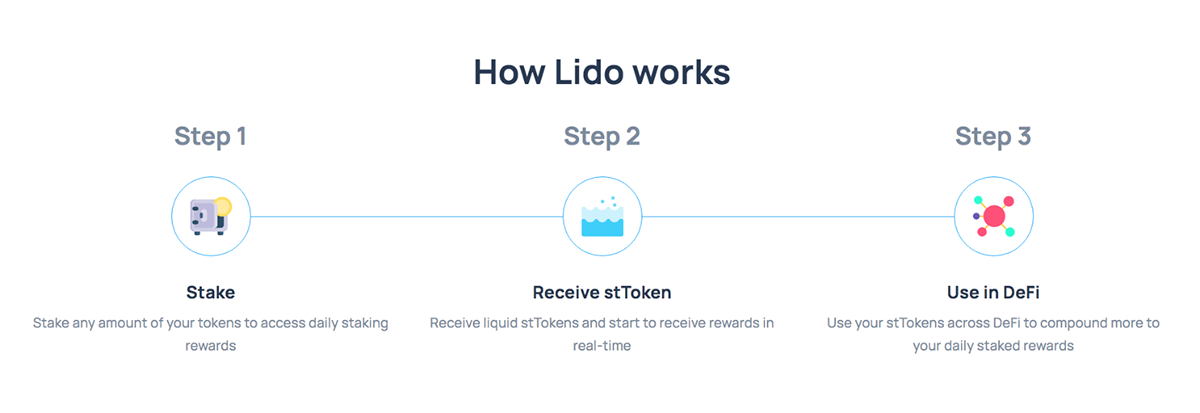

Lido eliminates all these complexities and uses an automated, decentralised and smart contract powered platform to provide a simple and liquid staking service. For example, if someone wants to stake through Lido, they can do that by simply depositing their tokens in a staking contract called the Lido Staking Pool. The liquid funds in the staking pool are then tailored to the staking requirements of respective ledgers and staked by Lido DAO authorised node operators. To represent the owner’s stake in the pool, depositors receive stTokens (Staked Tokens) in return, which are pegged 1:1 with the tokens staked on Lido. You can then use your stTokens for various DeFi use cases, creating a liquid market for staked tokens. More on that in the next section.

Out of the total staking rewards for users, Lido charges 10% in protocol fees, half of which goes to node operators and the other half to the DAO treasury.

Why Stake with Lido?

stTokens are basically derivatives of staked tokens. For example, when a user stakes ETH on Lido, stETH (ETH’s financial derivative) is given in return, representing the staked ETH. stETH is essentially an interest (staking reward) earning derivative.

Although stETH cannot be used to pay for gas fees on Ethereum, it has various other use cases in the industry. In the last few years, Ethereum-based DEXs and lending protocols have added utility for stETH. stETH can now be used as collateral on MakerDAO and on AAVE for borrowing, or it can be used to provide liquidity on Curve to earn a yield. This creates a liquid market with extended utility for staked ETH.

stETH maintains its peg through natural demand from its various use cases and arbitrage opportunities for traders. If you want to trade your stETH for ETH, you can do that via a stETH/ETH liquidity pool on Curve.

Due to the utility limitations for staked ETH, not to mention the lockup commitment, only 14% of the total ETH supply is currently staked. This is significantly lower than other top PoS networks like Solana (70.3%) and Cardano (71.3%). Nevertheless, it’s fair to anticipate that ETH staking will increase following the launch of the Shanghai Hard Fork. Considering 28% ($8.2bn) of $29.9bn worth of ETH staked on the Beacon Chain is done via Lido, it will also indirectly benefit Lido. We anticipate that this will cause a significant surge in Lido’s TVL, making it a more prominent player in the industry. This is also the reason behind the LDO token’s recent price surge.

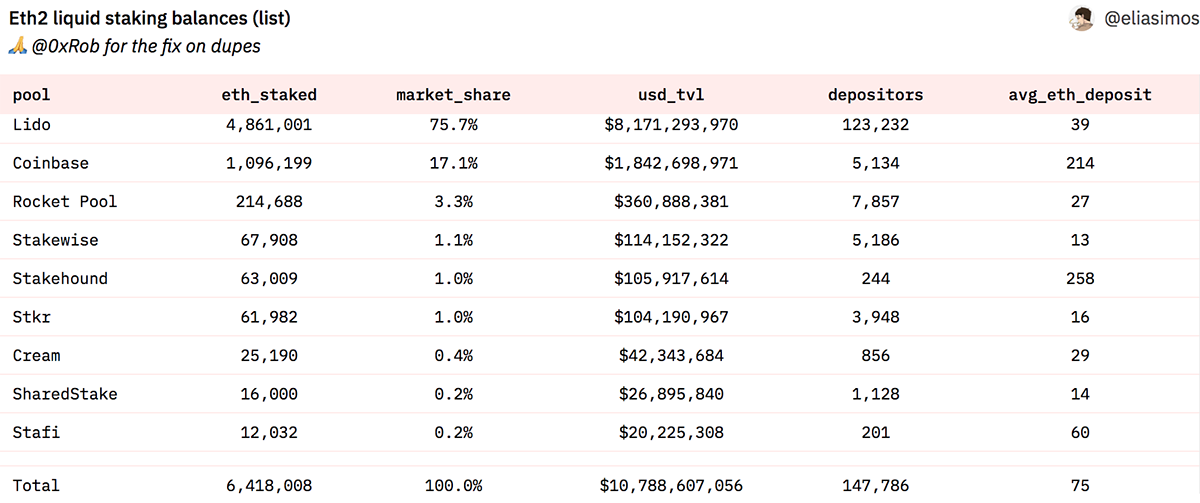

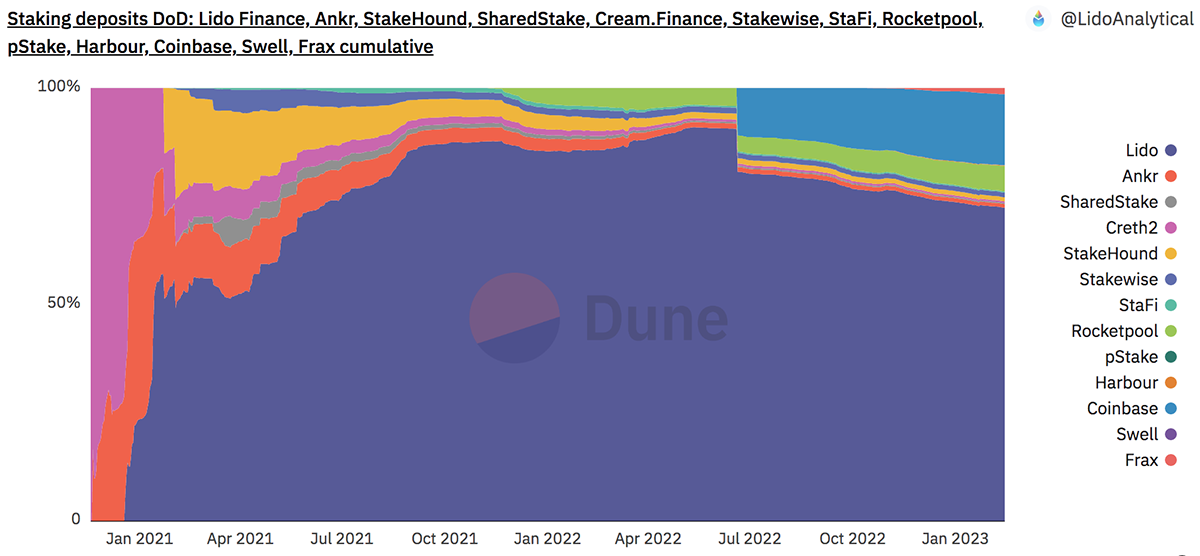

Not only is Lido dominating ETH liquid staking, but it is also responsible for 72% of all the staking deposits in the industry, as illustrated in the below chart.

Based on these metrics, it is without a doubt that Lido is the preferred and leading liquid staking platform in the industry, which makes it very attractive to new users.

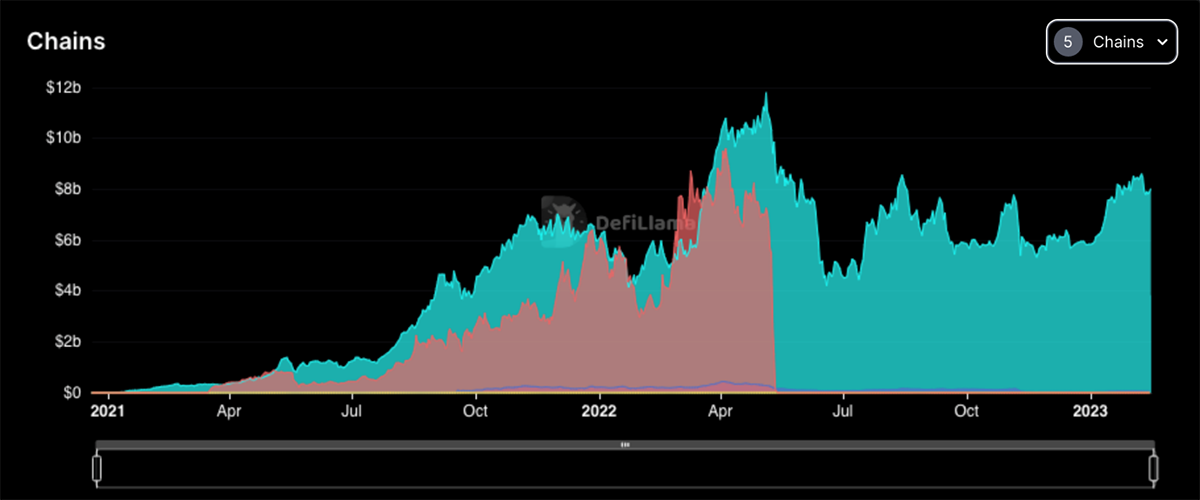

Moreover, the above chart highlights Lido’s TVL on five different chains. Three of them have miniscule TVL and are difficult to make out in the chart, but the blue fill represents Ethereum, and the red is Terra. As you’ve probably already deduced, the sudden drop of TVL on Terra marks the collapse of its ecosystem in May 2022, while the ETH TVL has been gradually growing since July 2022.

LDO Tokenomics

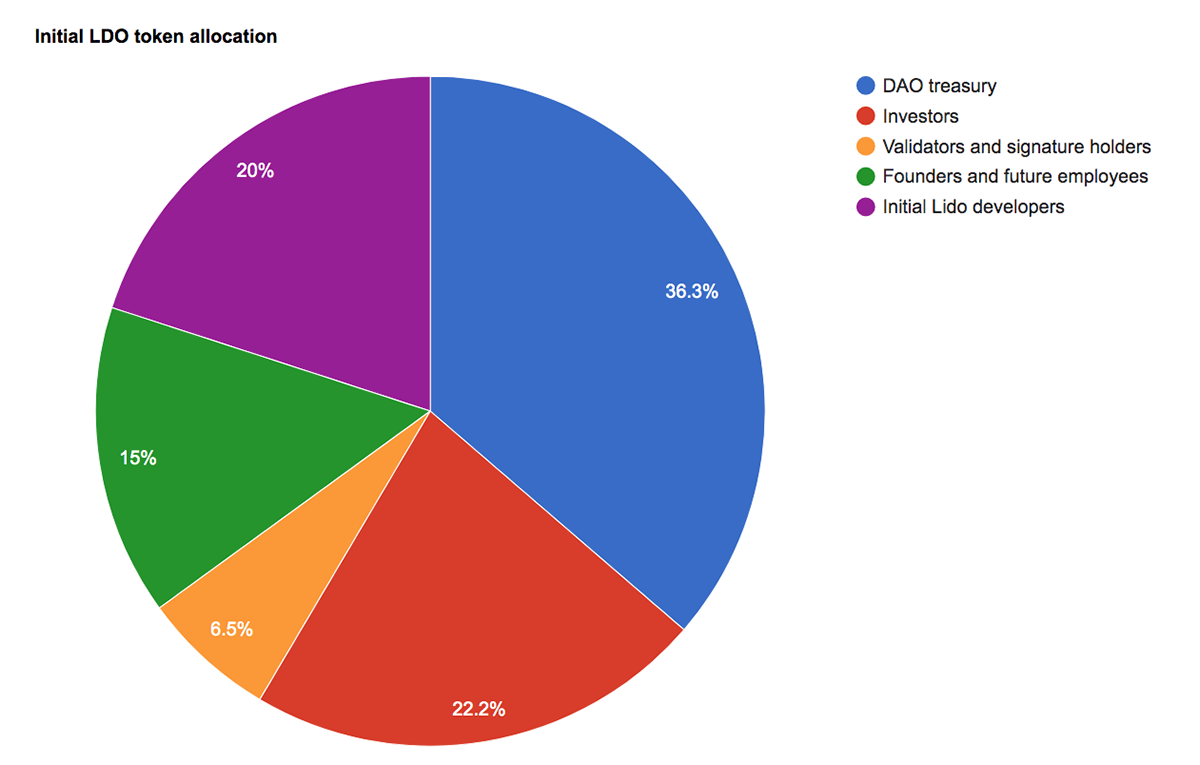

LDO, the native governance token of the Lido ecosystem, was launched in January 2021 with a max supply of 1 billion tokens, which were all minted at genesis. Initially, 64% of these tokens were owned by the founding members and locked for one year, with a vesting period of another year. The final token allocation was as follows:

The first funding round in May 2021 raised $73m and was led by Paradigm, while Coinbase Ventures, DragonFly Capital, Delphi Digital, and others also supported it. Andreessen Horowitz (a16z) led another funding round in March 2022, raising $70m in a private token sale. Finally, Dragonfly Capital bought 10 million (1% of the total supply) LDO tokens from the Lido DAO treasury at $1.45, or higher, per token.

Currently, there are 843 million LDO circulating in the market. According to data from Etherscan, there are over 28k LDO holders. However, the top 20 wallets (including the treasury wallet with 12.4%) hold a whopping 68% of the total LDO supply. As LDO tokens give governance rights to token holders (currently its only utility), the top 20 wallets collectively have an unfair advantage over network governance, which is a big concern for a supposedly decentralised network.

Lido Security

Lido uses a community-driven, smart contract powered automated approach for staking, which eliminates the possibility of human error. In case of emergencies or instances where funds are required, the DAO treasury holds $372m worth of funds. These funds are used for many reasons, including insurance funds, development grants, salaries, and legal requests. To ensure technical security, numerous security audits were performed on Lido smart contracts. All the risks highlighted in the audits were either fixed or acknowledged. Moreover, the Lido validators are not random but elected and authorised by the DAO to ensure asset safety.

stETH Depeg

Since stETH is an ETH derivative which is pegged to its price, it carries a risk of depegging in acute situations. As illustrated in the below chart, stETH made a low of around 0.93 ETH in June 2022.

A report by Nansen suggests that the main reasons for the stETH-depeg were the UST-depeg, over-leveraged borrowing on AAVE (see image below), whales and institutions dumping stETH, and a liquidity crunch on the stETH/ETH liquidity pool on Curve.

In an attempt to balance the liquidity on the original stETH/ETH liquidity pool, on 12 May 2022, Lido DAO announced the launch of another liquidity pool with a 13:1 stETH/wETH ratio and an additional 1 million LDO rewards for depositors in the first week.

Although the peg has now returned to normal, minor discrepancies often occur. Considering stETH retained its peg after multiple significant fiascos (i.e. the collapse of Terra, Celsius, and 3AC), it’s safe to say that the system works. Nevertheless, I wouldn’t go as far as to suggest that there is no risk of a depeg in the future.

Conclusion

As evident by all the platform metrics, Lido is indeed the most favoured liquid staking platform among users. It also shows that the services Lido provides are greatly valued in the industry.

Although the stETH-depeg in June 2022 caused some serious reputational damage, fear, and uncertainty, the fact that Lido DAO was able to bring the system back to normal helped reassure user and asset safety. With numerous well-known institutions and VCs backing Lido, its dominance in ETH liquid staking and the anticipated growth following the Shanghai Hard Fork showcase the strong potential for the platform. If stTokens maintain their peg and Lido continues to dominate this niche, Lido’s liquid staking ecosystem has a high potential for growth, which is critical for the success of the LDO token.