Fantom: A High-Performance Smart-Contract Blockchain Platform

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: FTM Token;

Fantom is a decentralised, open source blockchain platform for dApps and digital assets, offering high performance at a low cost. However, with Fantom targeting one of the most competitive crypto sectors, it has underperformed its competitors and recently seen a sharp decline in its TVL. Nevertheless, Fantom’s unique consensus mechanism and enhanced features still make it a contender in the space. This Token Takeaway outlines the fundamentals of Fantom and its native token FTM.

Overview

Fantom is a layer-1 smart contract platform aiming to improve upon existing blockchains by offering rapid throughput, high scalability and security. Headquartered in South Korea, the Fantom Foundation is responsible for its development. The project was founded by computer scientist Ahn Byung Ik in 2018. He served as its CEO until 2019 when he was succeeded by Michael Kong.

Fantom aims to develop an efficient blockchain that overcomes the shortcomings of previous PoW and PoS networks. It offers a developer-friendly platform with near-instant finality for smart-contract development through its innovative DAG-based consensus algorithm.

Lachesis

The launch of the Bitcoin blockchain was an immense leap towards a new technological revolution. Although its consensus mechanism offered great security and decentralisation, it required a significant amount of energy to operate and lacked basic scaling capabilities. Ethereum initially also took a similar approach and struggled with similar limitations. To solve this fundamental problem, Fantom developed a unique PoS consensus mechanism called the Lachesis Protocol (or Lachesis).

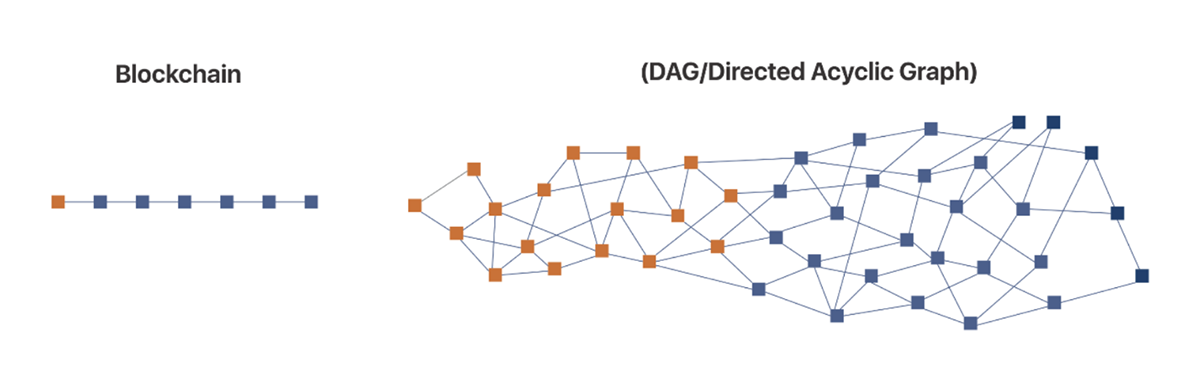

Lachesis is a Directed Acyclic Graph (DAG) consensus algorithm that enables fast and secure transaction processing. It works by having each node in the network create an event and broadcast it to the network. These events are then ordered into a timeline based on their relationships, forming a chain of events in a specific order. The events in the timeline are validated by a majority of nodes to ensure the integrity of the data and then added to the permanent storage on the network.

Additionally, in a DAG network, each node is connected and communicates its transactions to a random group of nearby nodes. This process of sharing information is referred to as “gossiping”. The transactions are then passed on from one group of nodes to another in a cascading manner. This creates significant potential for high Transactions Per Second (TPS) and Time To Finality (TTF) outputs.

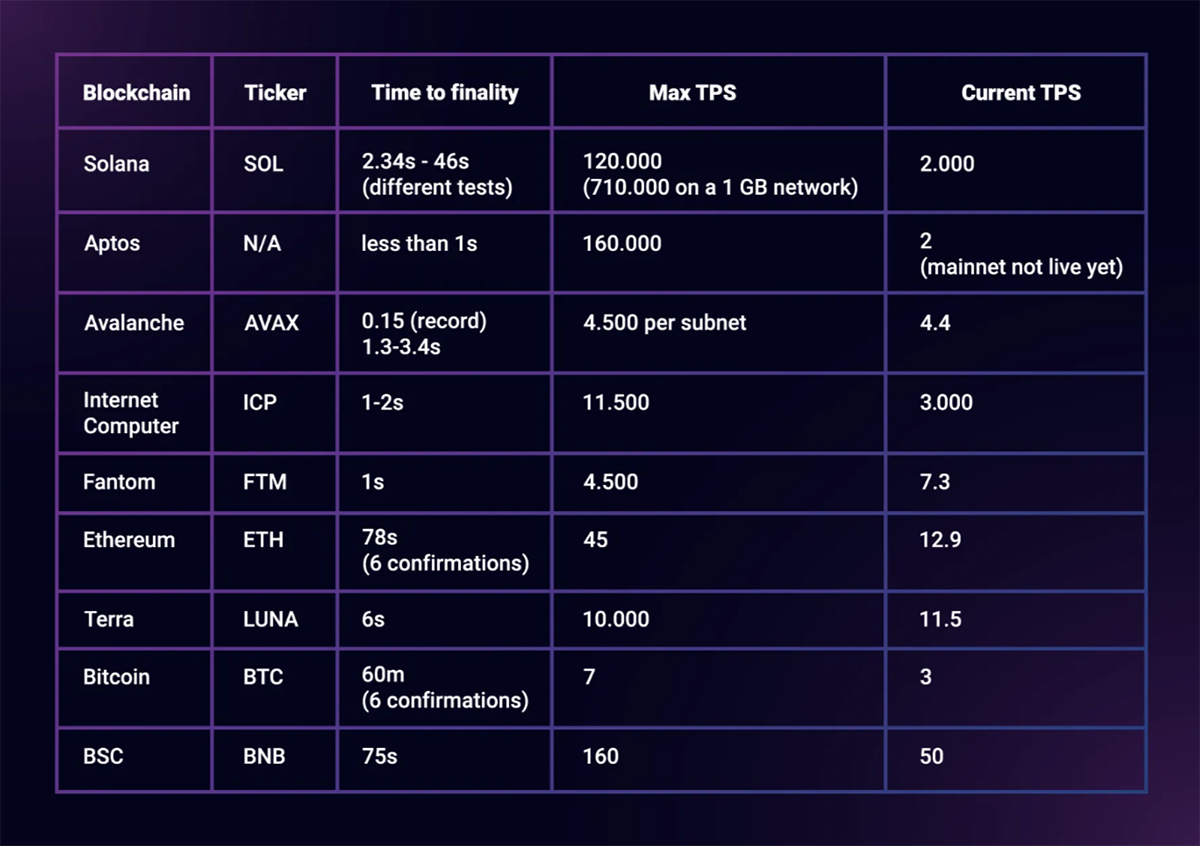

With Lachesis, Fantom can reach an almost instant transaction finality (1 second). As illustrated in the above table, this TTF capability is impressive compared to other blockchains in the industry. Top blockchains like Bitcoin and Ethereum reach finality in around 60 minutes and 78 seconds, respectively. Only select networks like Aptos, Avalanche, and ICP can provide a similar TTF.

Time to Finality (TTF) vs Transactions Per Second (TPS)

Fantom focuses on the Time to Finality (TTF) metric rather than Transactions Per Second (TPS) to measure network speed. Although TPS is commonly used for evaluating the performance of a blockchain, it has limitations in measuring the immutability and finality of transactions. TPS only measures the number of transactions processed in a second, but it does not account for the time it takes for a transaction to become final and irreversible. TTF is a more reliable indicator of speed as it measures the time from submitting a transaction to the point where it is confirmed and guaranteed to be irreversible, providing a more comprehensive measure of network performance. Additionally, TPS can be easily manipulated or optimised by processing low-value or non-critical transactions, while TTF is more resistant, making it a more robust and representative measure of the overall performance and capacity of a system.

Opera

Lachesis only represents the consensus layer, which can be plugged into any execution layer, such as EVM and Cosmos SDK. It inherently powers the Fantom Opera mainnet, the execution layer that provides an efficient environment to build and host dApps. It is fully permissionless, cheap, and open source and offers complete smart-contract support through Solidity.

While its 1-2 second TTF is remarkable, the TPS performance is less certain, with claims ranging from 1000 TPS to 80,000 TPS. In May 2018, the Fantom team promised that Opera would reach 300,000 TPS, but that goal hasn’t been achieved yet.

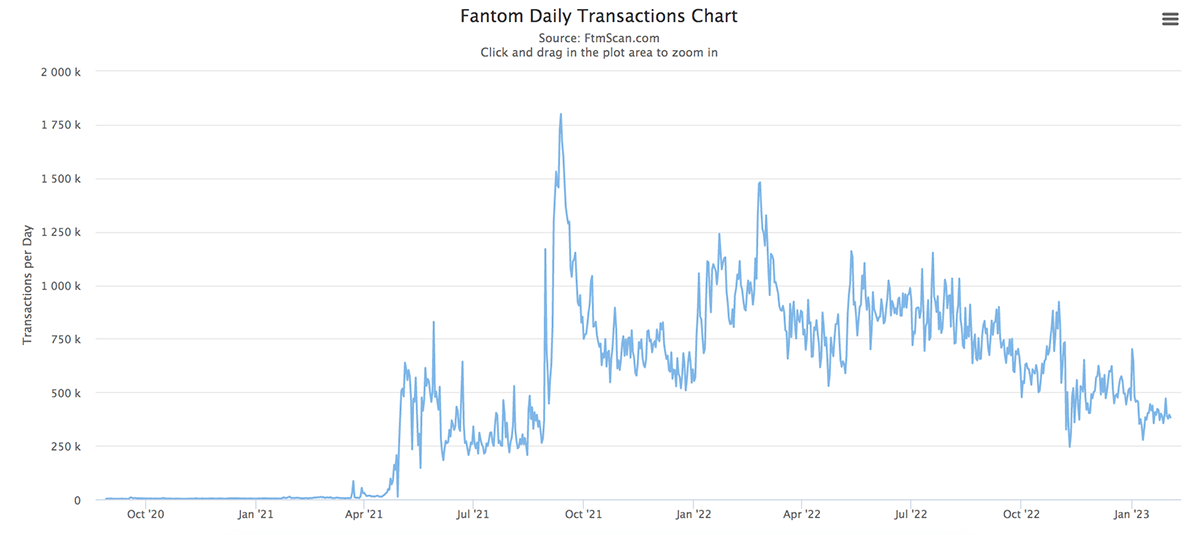

In 2021, Fantom managed an output of 10,000 TPS on seven test servers. Furthermore, on 12 September 2021, the mainnet achieved the highest average maximum of 20.8 TPS, processing an all-time high of 1.8 million transactions that day.

In essence, Fantom aspires to have low TTF and high TPS. Despite having already accomplished a quick TTF, combining it with a similarly high TPS will solidify Fantom’s position as a contender in this blockchain niche.

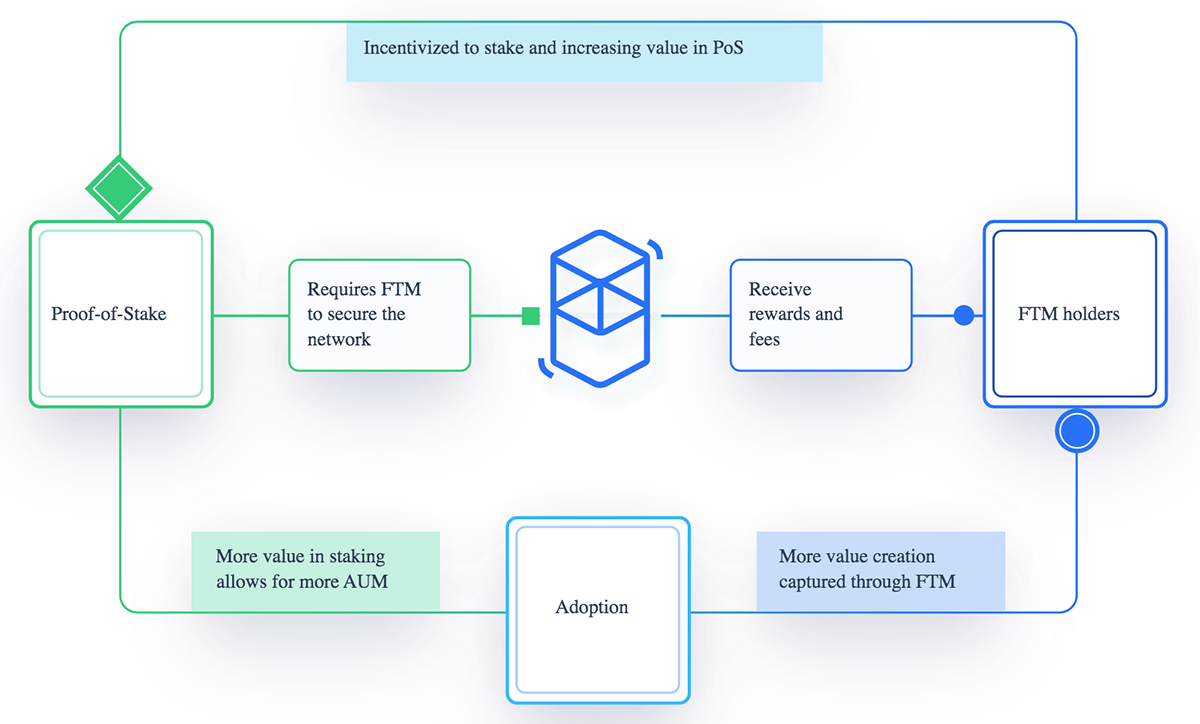

FTM Tokenomics

Fantom held a seed funding round in February 2018, raising $1.6m. Its native token, FTM, was publicly launched in an initial coin offering (ICO) in June 2018, raising $2.65m. Around the same time, Fantom held two private sales of FTM, raising a total of $37.7m. The three fundraises were supported by Obsidian Capital, 8Decimal Capital, Arrington XRP Capital, and many others.

The FTM token’s total max supply is 3.175bn FTM, with 2.7bn currently in circulation. The remaining supply is the pre-mined staking reward, which is forecasted to be periodically distributed in the coming years. In October 2022, Fantom governance passed a proposalto decrease the FTM inflation to 6% from the previous 13%. This decrease means that it will take less than five years for FTM to reach its max supply.

Currently, over 50% ($736m) of the FTM tokens on the market are staked on Fantom, removing a huge chunk of supply from circulation. On top of securing the network, FTM tokens are also used to pay for gas fees on Opera and give governance rights to token holders.

After you stake your FTM tokens, you can create sFTM tokens with a 1:1 value to the staked tokens. In addition to earning rewards from staking, you can use sFTM as collateral on Fantom Finance.

Moreover, 20% of the transaction fees on Fantom are burned. Currently, over 9 million FTM tokens, worth $4.9m, are burned. Once all the pre-mined staking rewards are distributed, FTM will become a deflationary token.

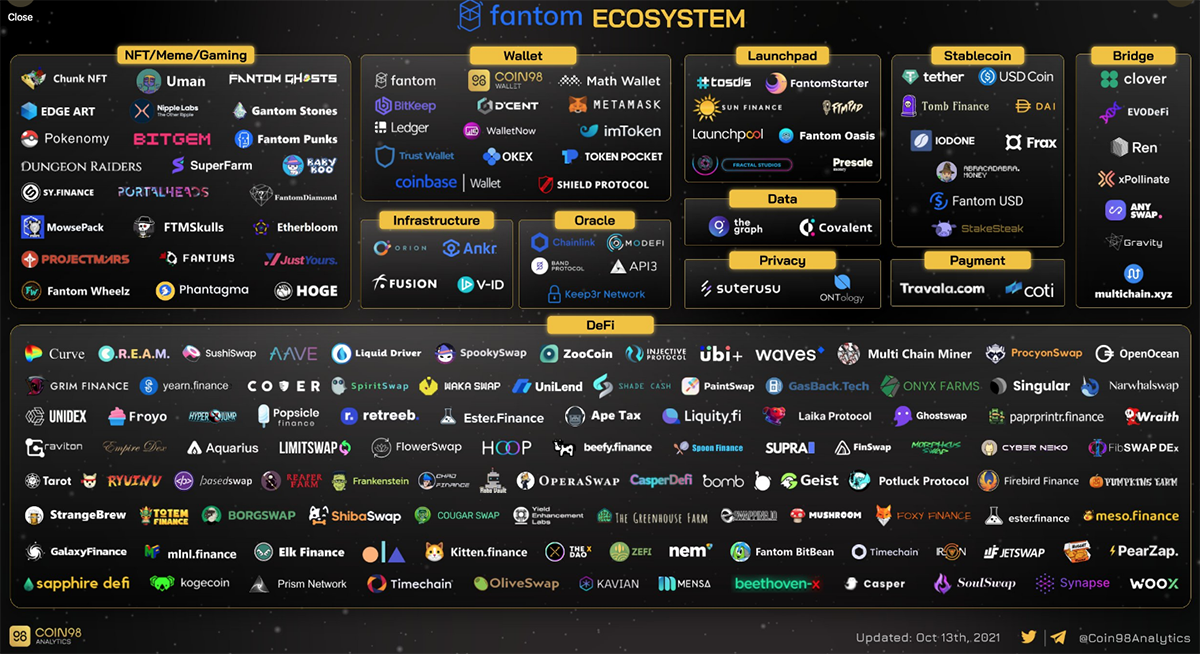

The Fantom Ecosystem

The Fantom ecosystem has 245 dApps in sectors including NFTs, GameFi, and DeFi. The dApps on Fantom collectively make up over $668m in TVL, down from $12.5bn in January 2022. Spookyswap, an automated market-making (AMM) decentralised exchange (DEX), and Giest Finance, a non-custodial, decentralised lending and borrowing protocol, are the top two dApps on Fantom with a TVL of $120m and $82m, respectively.

Competition

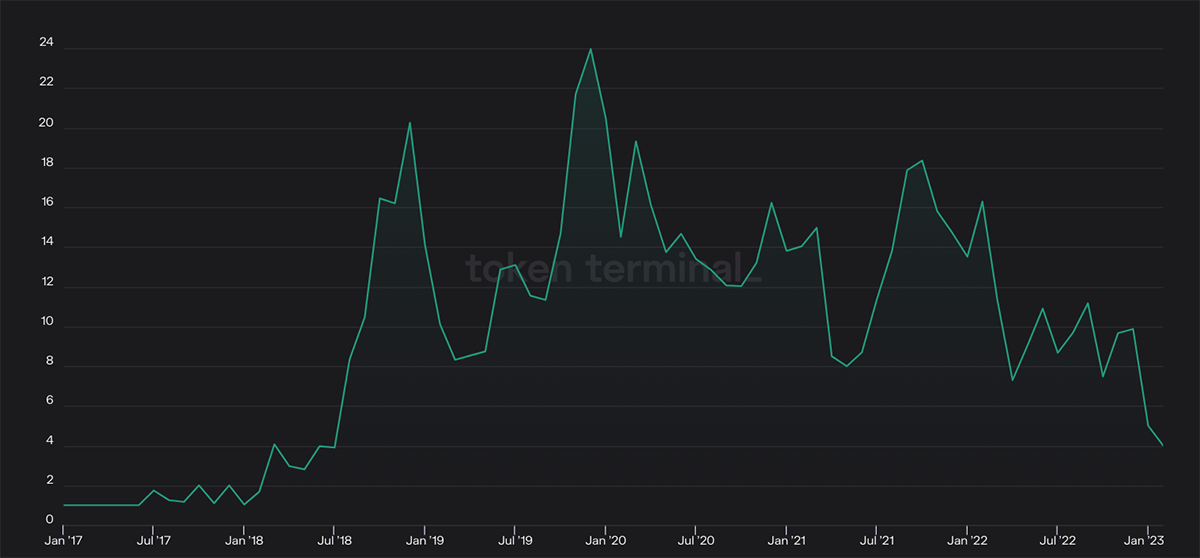

With numerous projects offering similar services, the competition in the smart contract space is fierce. Fantom’s main competitors include Ethereum, Solana, BSC, Polygon, Cardano, TRON, and NEAR, which offer comparable features such as dApps development, native tokens, and smart contract execution.

Each platform has advantages and disadvantages, but the intense competition in the market makes it challenging for new and smaller projects to establish themselves. Some platforms, like Ethereum, have a long history and a large ecosystem, which is understandably appealing to dApp developers. Others, like Solana and Polygon, prioritise high performance and scalability, making them more suitable for certain applications. Nonetheless, all platforms are constantly vying for a larger market share.

| Launch | Market Cap ($bn) | Ranking by Market Cap | TVL ($bn) | Staking Market Cap ($bn) | Unique Addresses (million) | |

| Fantom | 2018 | 1.4 | 40 | 0.67 | 0.73 | 42.4 |

| Ethereum | 2015 | 192.7 | 2 | 58 | 27.3 | 221.5 |

| BSC | 2020 | 48.5 | 4 | 8 | 7.2 | 247 |

| Polygon | 2017 | 9.5 | 10 | 1.6 | 3.9 | 217.9 |

| Solana | 2019 | 8.7 | 11 | 0.60 | 9 | - |

| TRON | 2018 | 5.6 | 17 | 5.35 | 2.57 | 139.8 |

Source: CoinMarketCap; DeFiLlama; Staking Rewards. Comparison of various smart-contract platforms.

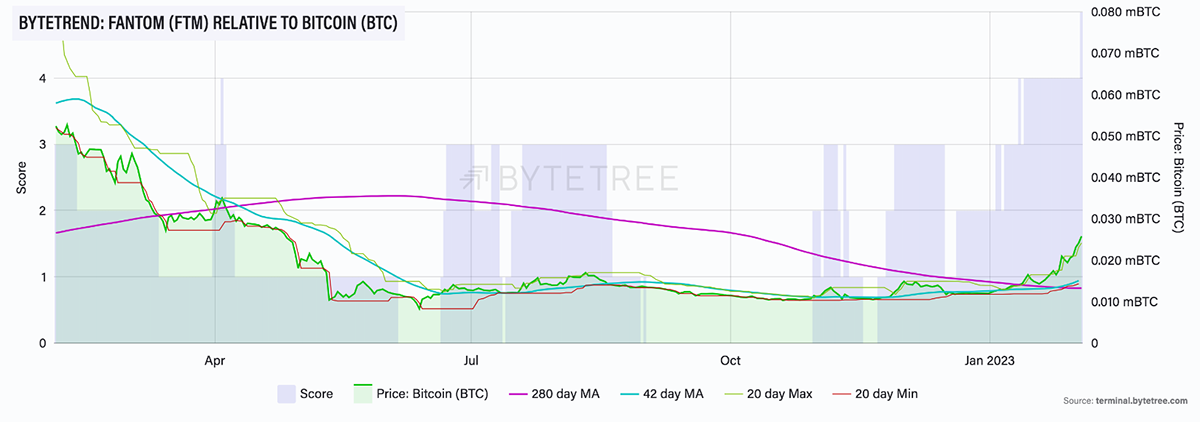

Despite being launched around the same time as other networks, Fantom has struggled to establish itself in the industry and has not gained the same level of widespread adoption. This can be attributed to several factors, including a lack of recognition and forgoing capitalising on popular trends like NFTs and the Metaverse.

Ultimately, as the competition in the smart contract arena continues to escalate, it will be imperative for platforms like Fantom to remain innovative and offer compelling features, continue to expand their dApp ecosystem, and, most importantly, draw in developers. Additionally, the ETH 2.0 launch poses a significant threat to Fantom’s growth, as its key selling point of high performance will soon be offered by Ethereum.

Partnerships

Fantom has partnered with Pakistan Private Educational Institutions Regulatory Authority (PEIRA) to upgrade their legacy systems. They will provide a custom blockchain Enterprise Resource Planning (ERP) software to audit databases, do real-time monitoring of system modifications, and verify certificates of accreditation. Moreover, Fantom will also helpthe Pakistan Punjab Prisons Department make efficient data-driven decisions using blockchain tools.

Fantom and Tajikistan’s Ministry of Industry and New Technologies are collaborating to establish a research and development centre. The goal is to educate local developers and promote the use of Fantom’s blockchain-based enterprise resource planning and management information system solutions. Fantom will also support the development of Tajikistan’s e-government infrastructure.

In 2022, Fantom formed a partnership with the University Network for Cryptocurrency and Blockchain (UNCB) in Australia to conduct all their Solidity workshops on the Fantom testnet. Furthermore, Fantom is sponsoring many of UNCB’s hackathons and educational lectures.

Future

In a recent letter, Andre Cronje, a member of the Fantom Foundation’s Board of Directors, highlighted several updates and initiatives for 2023. One of the key points mentioned was “Gas Monetization”, which will provide a performance-based income for dApp teams, promoting long-term sustainability. Additionally, “gas subsidies” will enable users to interact with Fantom dApps without paying gas fees, as these costs will be covered by another party (who that will be is unclear). Fantom will also develop new middleware, including the Fantom Virtual Machine (FVM) and a new storage mechanism. Currently, Fantom uses EVM for smart contract processing, but FVM will open up new opportunities and enable further growth for Fantom.

In addition to these technical advancements, the Fantom Foundation will focus on business development and improved marketing efforts to increase brand recognition. The letter also stated that Fantom is in a strong financial position (although it is unverified) and is not facing any difficulties despite the current market conditions and its ties with now bankrupt crypto trading/investing firm, Alameda Research. To support growth, Fantom will actively provide grants and funding through its ecosystem fund and Gitcoin Grants program, worth 335 million FTM ($207m at current price).

Conclusion

Fantom’s unique DAG-based algorithm, Lachesis, provides an efficient and high-performance blockchain platform. However, considering that its competitors can already match many of its features, Fantom’s addressable market is shrinking. With many highly capable blockchains and the upcoming fruition of ETH 2.0, Fantom carries a real risk of being left behind, casting doubt on its long-term sustainability.

Despite the challenges, Fantom still has an opportunity to establish itself in the industry. Its partnerships with governments and institutions demonstrate a focus on tackling real-world problems. Furthermore, Fantom’s ambitious plans highlight its commitment to delivering value to the industry, a critical factor for the success of the FTM token.