Most Cylinders Are Now Firing

Disclaimer: Your capital is at risk. This is not investment advice.

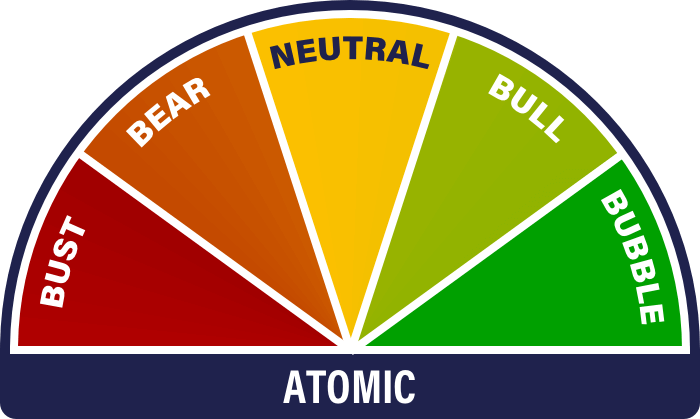

ATOMIC 75

Just about everything we see confirms the upgrade to BULL that we made at US$16,580 in November. The fact the bitcoin is now trading above the June low is hugely notable, as is the type and quality of buying.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Lower volatility, higher price |

| On-chain | Bitcoin’s Dunkirk |

| Macro | Asia’s animal spirits return |

| Investment Flows | Flows Quiet |

| Cryptonomy | Crypto good; bitcoin better |

Technical

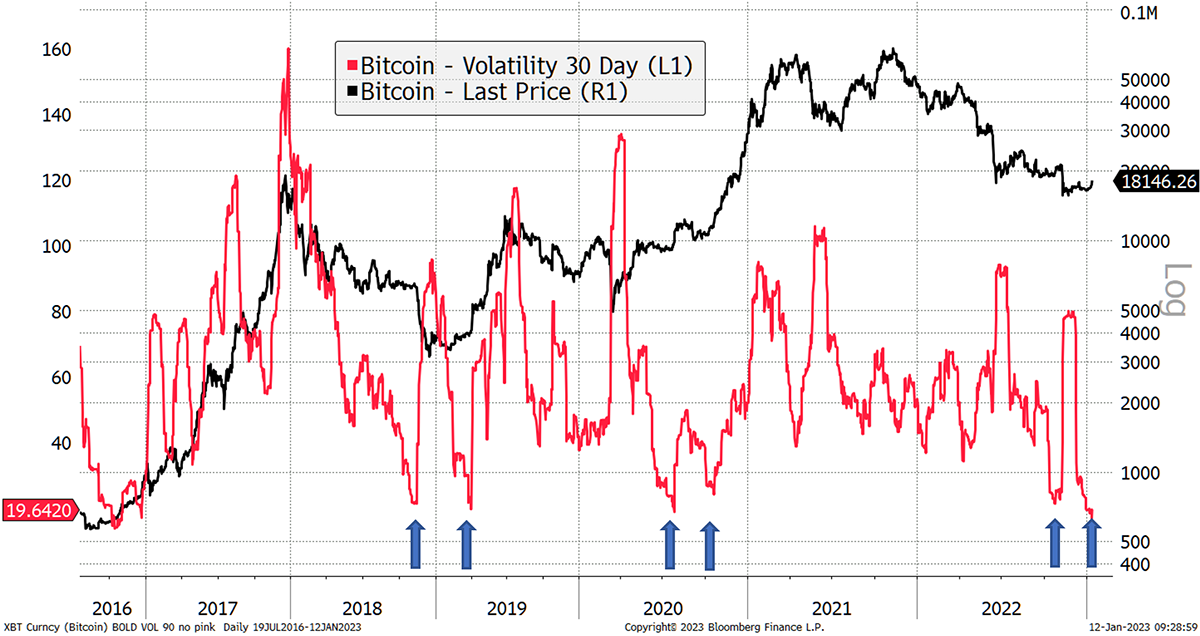

One of the features of recent bitcoin performance has been the declining volatility. Even though the price fell steeply last year, towards the end, this was increasingly via a kind of step function. Seen another way, the price was constantly trying to establish a level until “events” took over, as shown in the chart below.

Source: ByteTree, TradingView

Important: note how for the first time in this cycle, the highest price of the current step is higher than the low of the previous step. This is a strong indicator of a cycle bottom. Despite everything that’s happened, we have regained the June lows.

Now let’s check out the historic 30-day volatility of bitcoin. In the chart below, I’ve inserted block arrows at moments when volatility has decreased to the levels we see today. There were four bull signals and two bear signals in late 2018 before the final capitulation of that cycle, and late last year, before FTX collapsed. In all cases, low volatility was followed by big moves. The good news is this one has already started, and it’s bullish.

Source: Bloomberg

It’s already astonishing how similar this cycle is to previous ones. Here’s our epoch chart:

Source: ByteTree. Showing days since past “halving” events in 2012 (epoch 2), 2016 (3) and 2020 (4).

To add a bit of balance, ByteTrend remains in neutral territory, with BTC on a 3-star trend against the US$. With the 280-day moving average at US$23,300 and still sloping downwards, there’s a lot of work to be done to gain the last two stars. If the price stands still, that’ll happen in June, but we would expect it much sooner because price feels like a coiled spring.

Source: ByteTree

On-chain

They won’t admit it, but professional investors are often the worst timing indicators, particularly in early-stage and volatile assets. It’s understandable if you think about it: they’ve got jobs to protect. It doesn’t look great going to a board of trustees holding, say, crypto assets, which you don’t really understand, and then trying to explain not only why they’ve halved (and halved again in many cases) but also why you invested in the first place. Best to rid the portfolio of the wretched stuff before year-end and pretend it never happened.

Retail investors don’t have that problem. The only person they have to justify it to is themselves (and perhaps their significant other if they’ve over-committed).

If that’s right, it’s much more interesting when we see small but regular levels of activity, rather than the giants, return. The latter will reappear in due course when it becomes embarrassing not to hold crypto…and the cycle repeats…

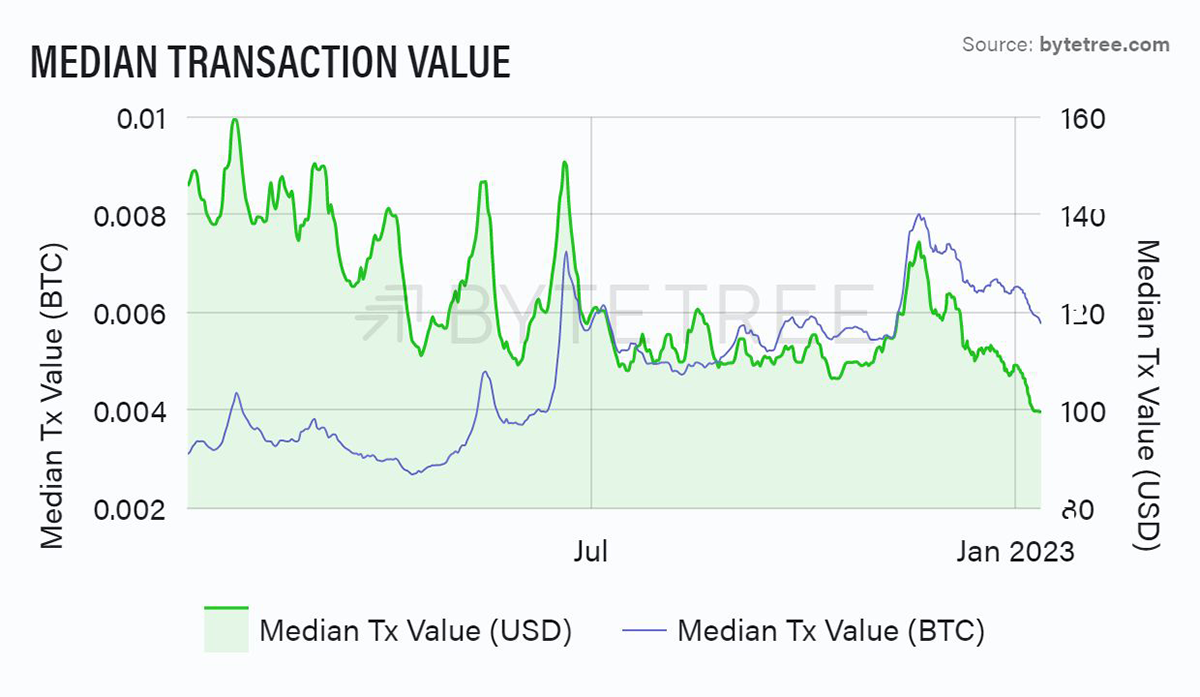

So, what we’ve noticed in the on-chain data recently might be significant. The median size of transaction has fallen in both $ and BTC terms…

Source: ByteTree

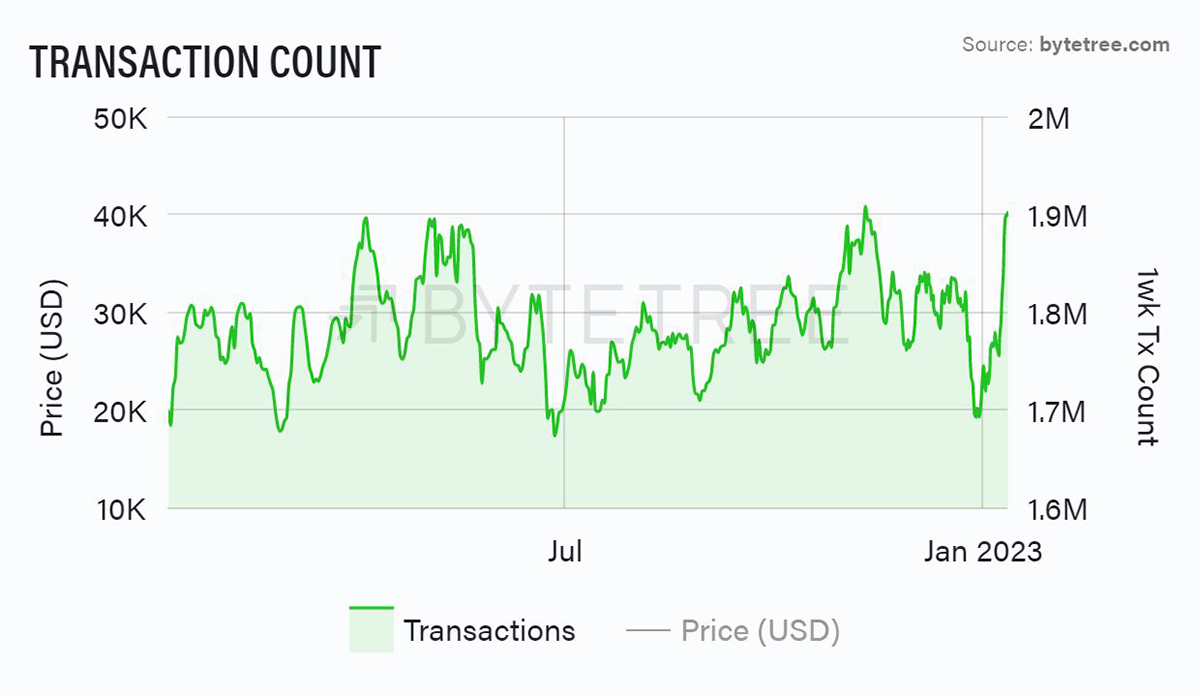

…but the number of transactions has normalised following the usual lull over the holidays. The little people are saving the day. Is this Bitcoin’s Dunkirk?

Source: ByteTree

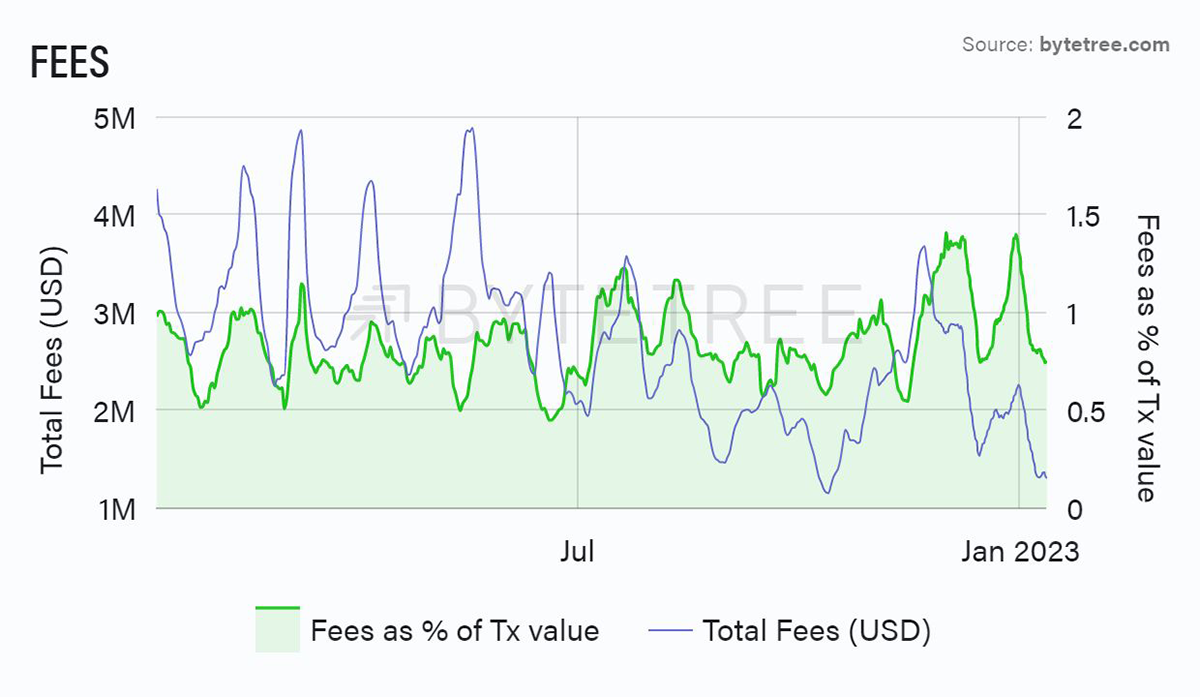

Interestingly it’s having no impact on fees, which are sinking to new lows, but that may also be a function also of the Segwit upgrade last year, which increased block space.

Source: ByteTree

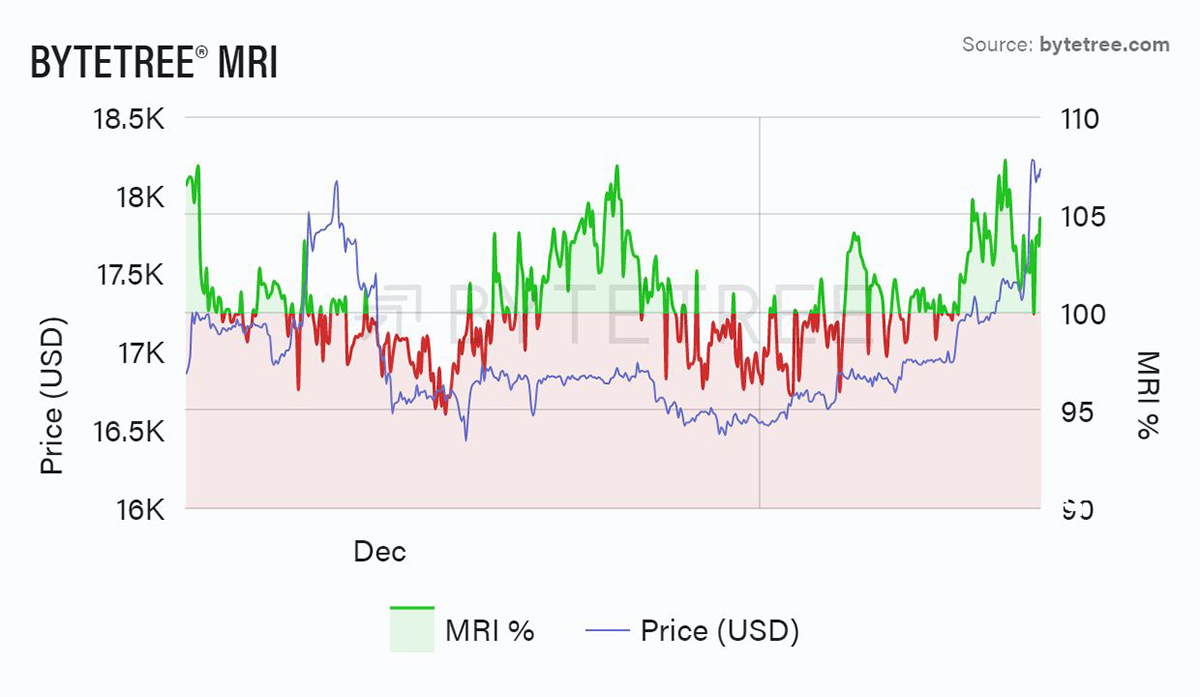

Not that the miners should be too bothered by the fee drop. This renewed activity is enabling them to unload inventory into the market with no impact on the price, as shown by the bounce in Miner’s Rolling Inventory (MRI*) over the last 5 weeks.

*This is the ratio between how much miners sell into the market and how much they generate, so a number over 100% represents a net decline in overall “unspent” inventory.

Source: ByteTree

This is good news as the unspent inventory continues to drop, tightening supply.

Source: ByteTree

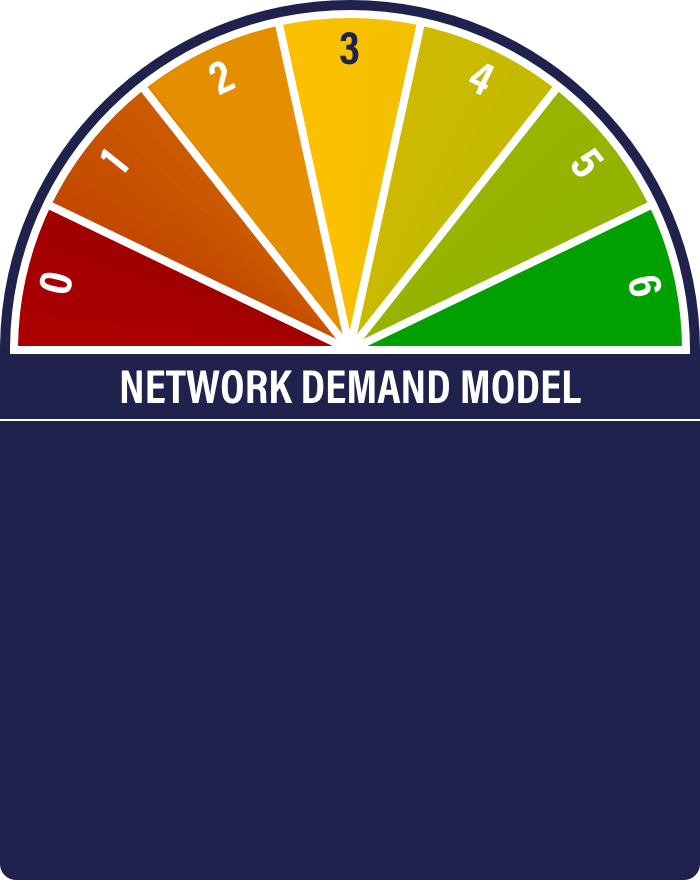

Lastly, the Network Demand Model last closed on a score of 2/6.

The movements in the model are pretty small at the moment, and it has wobbled between 2 and 5 over the last month. There is of course a large element of pro-cyclicality in its construction. If the bitcoin price holds and activity increases, it will move to a more positive setting rapidly.

Macro

It’s all about the dollar. Markets have taken the view that the worst of inflation, and thus monetary tightening, is behind us. Perhaps Jerome has achieved the one thing no one expected, namely a soft landing? Risk assets are stronger across the board, and crypto is no exception. Long may it last, although crypto’s real long-term driver will be adoption rather than macro. Still, if we return to an environment of lax policy-making and currency debasement (chances: high), the fundamental hard money properties of bitcoin will surely see it being more widely embraced.

Source: Bloomberg. A weak dollar eases pressure on risky assets.

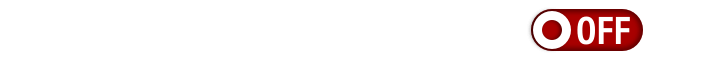

I don’t know about you, but I’ve recently sensed that the best time to hold BTC is while I’m asleep. There have been a number of days of late when the price has popped overnight, a sign that the Asian market has sprung back to life. We can see this in the chart below.

Source: Bloomberg, ByteTree

It seems that when Asia is bullish, bitcoin is bullish, so let’s hope this continues. Of course, renewed animal spirits from Asia could be linked to the abandonment of zero-Covid by the Chinese, as well as to the aforementioned dollar weakness. It would also be heartening to see more constructive price behaviour during US hours.

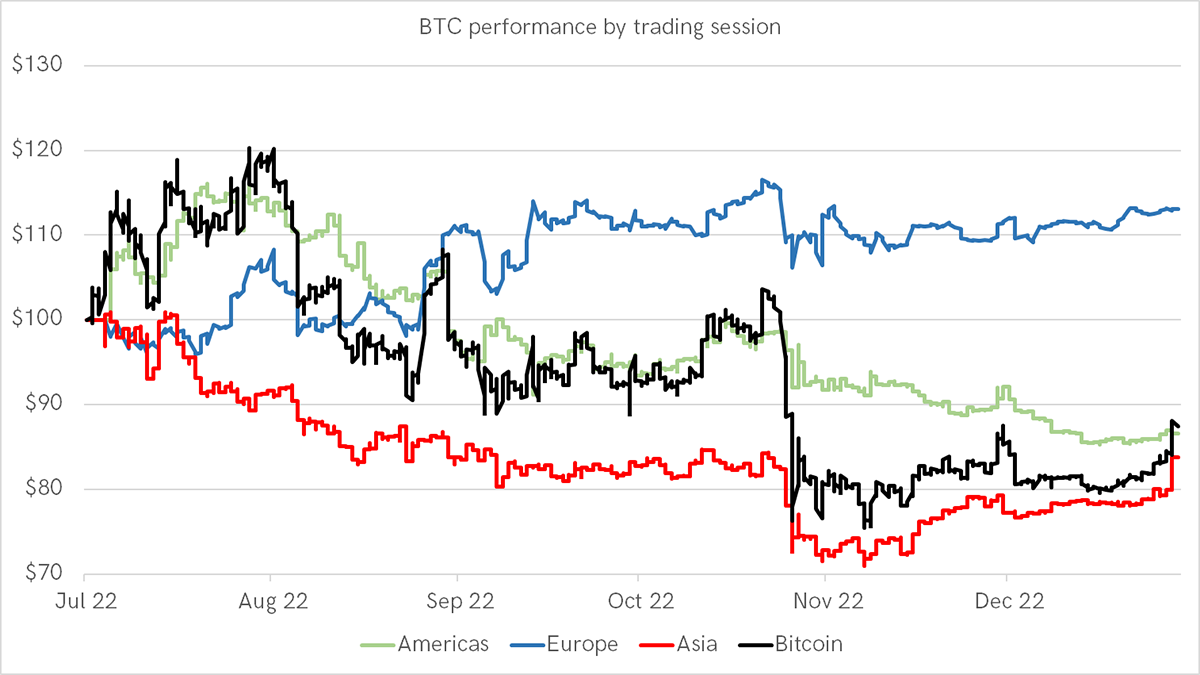

One thing that has been striking over the last few weeks is the price of gold, which has bounced 15% since the start of November. With inflation expectations easing, real interest rates have been climbing, which is not conventionally a good set-up for gold.

It also means the gold price is out of whack with our Fair Value model, as shown below. This could be for a couple of reasons:

a) Gold doesn’t think inflation has gone away

b) The price is being distorted by strategic buying (China added 30 tonnes in September)

Or the price is wrong.

Source: Bloomberg

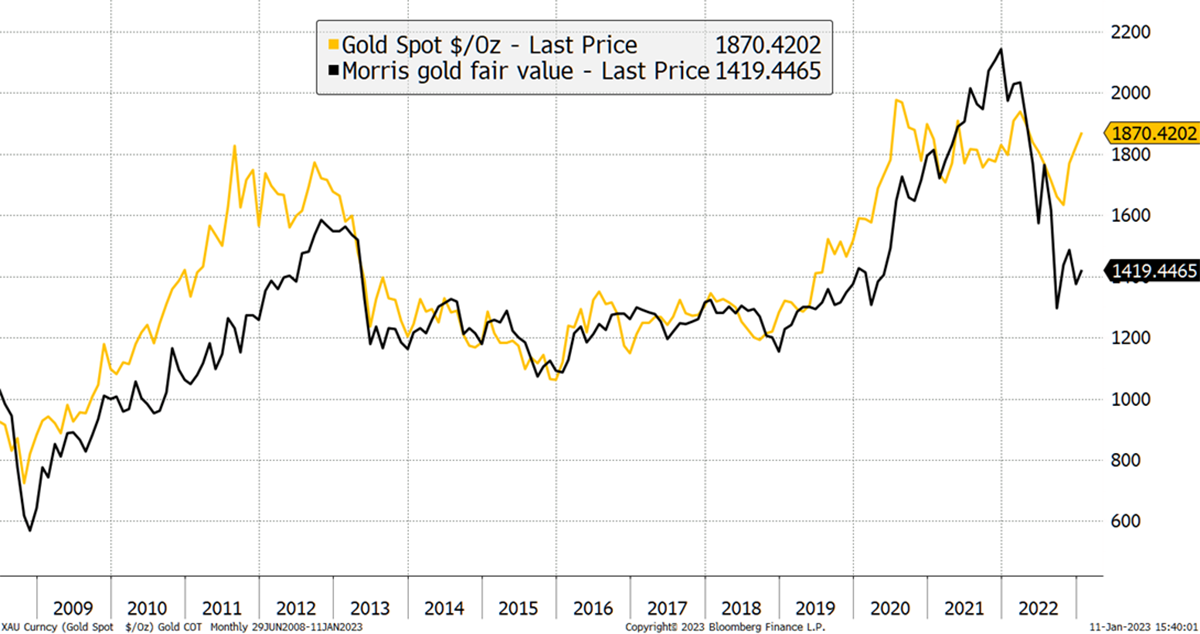

The better news is that on our models, bitcoin is below fair value. This is shown below, where we look at where bitcoin currently trades relative to the median “price to transaction value” multiple of the last 2 years. We take a rolling 12-week average of transaction value.

Source: ByteTree

Investment Flows

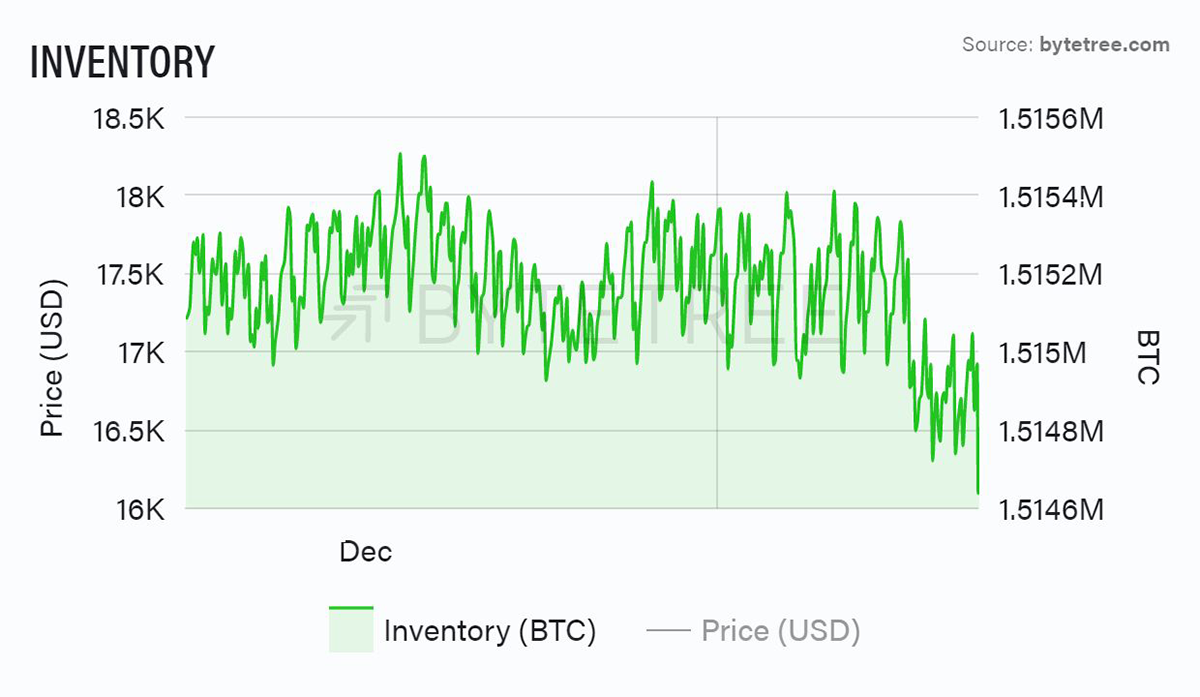

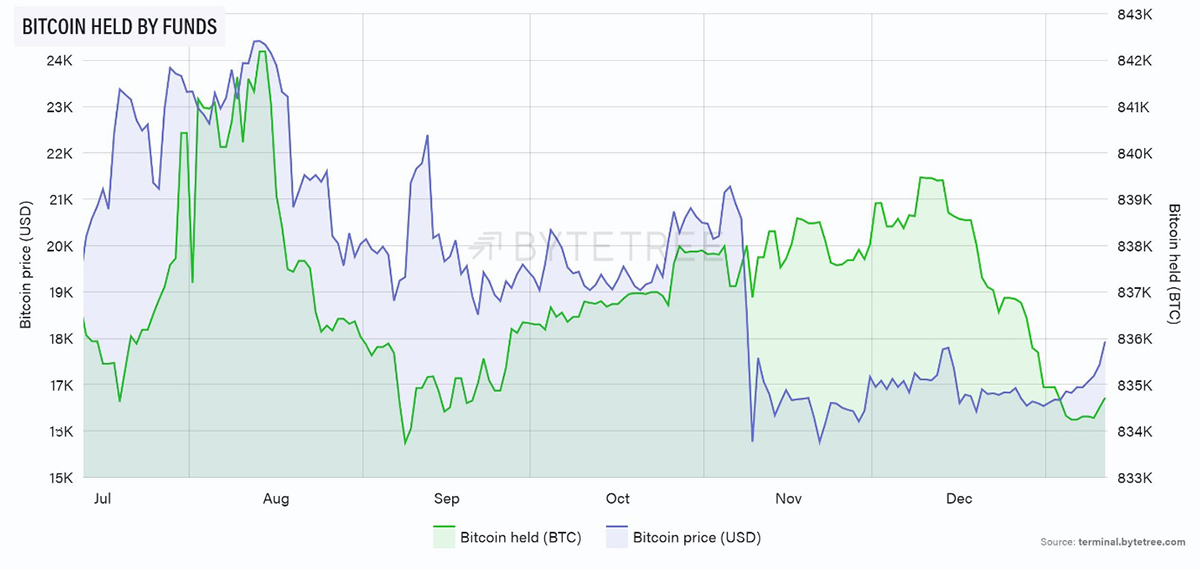

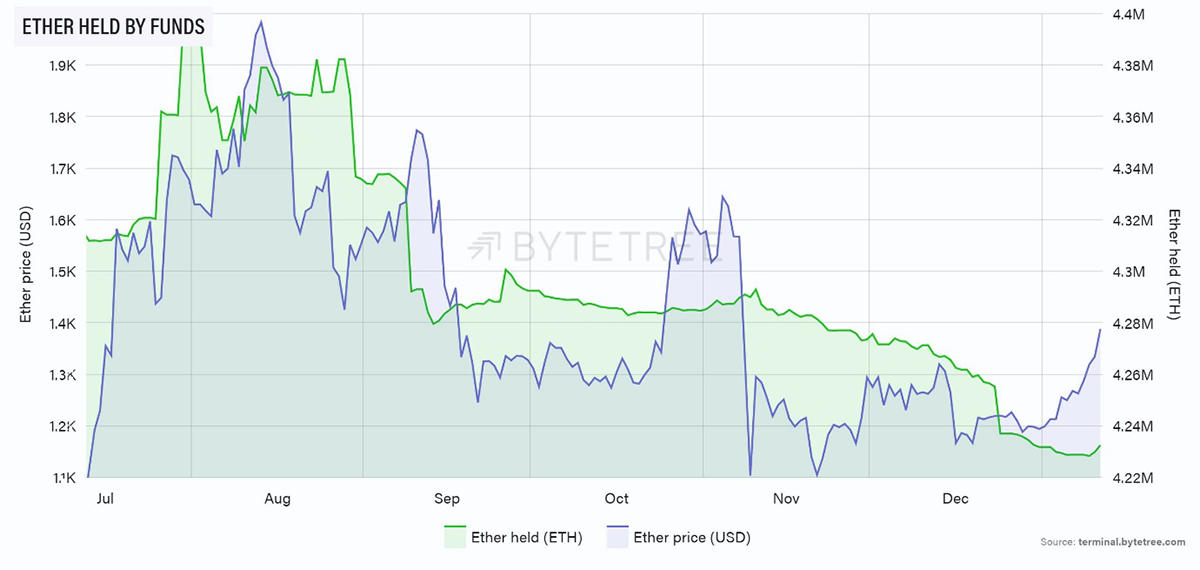

Not a huge amount to write about regarding ETF holdings. There was some year-end selling through December, but some appetite regained over the last couple of days.

Source: ByteTree

ETH is almost identical.

Source: ByteTree

Cryptonomy

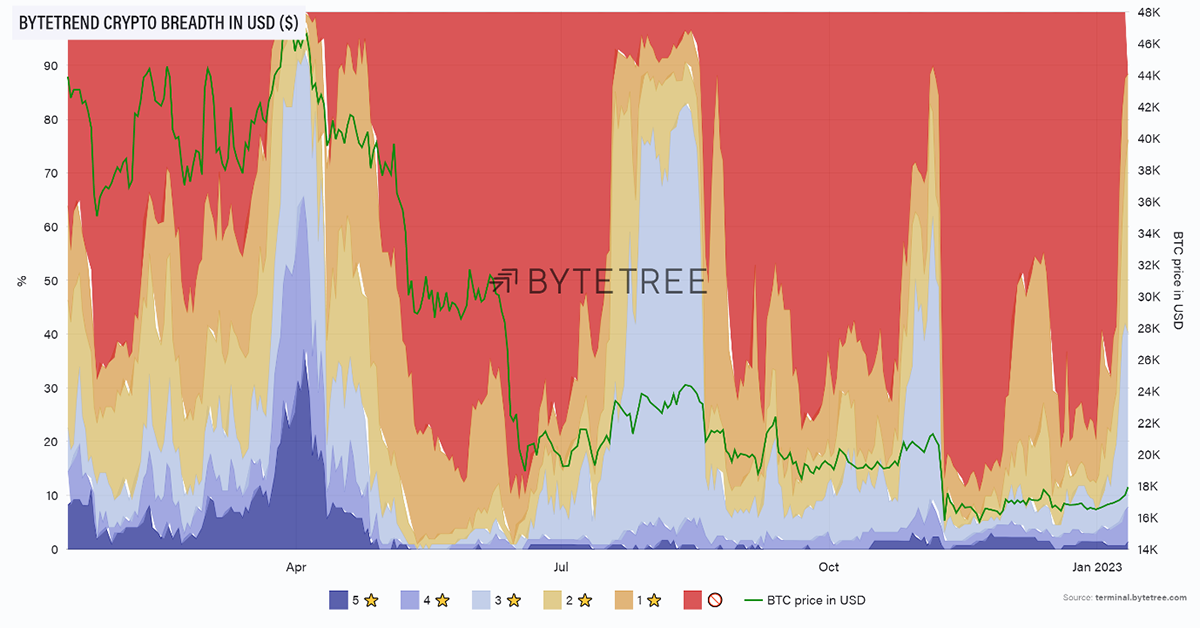

Breadth has picked up across the crypto universe. The chart below shows how the universe is trending relative to the US$. Large red skies, which is what we’ve seen most of the time during the last 12 months, are depressing. What we want to see is the opposite, and so the price behaviour since the start of the year is decidedly positive.

Source: ByteTree

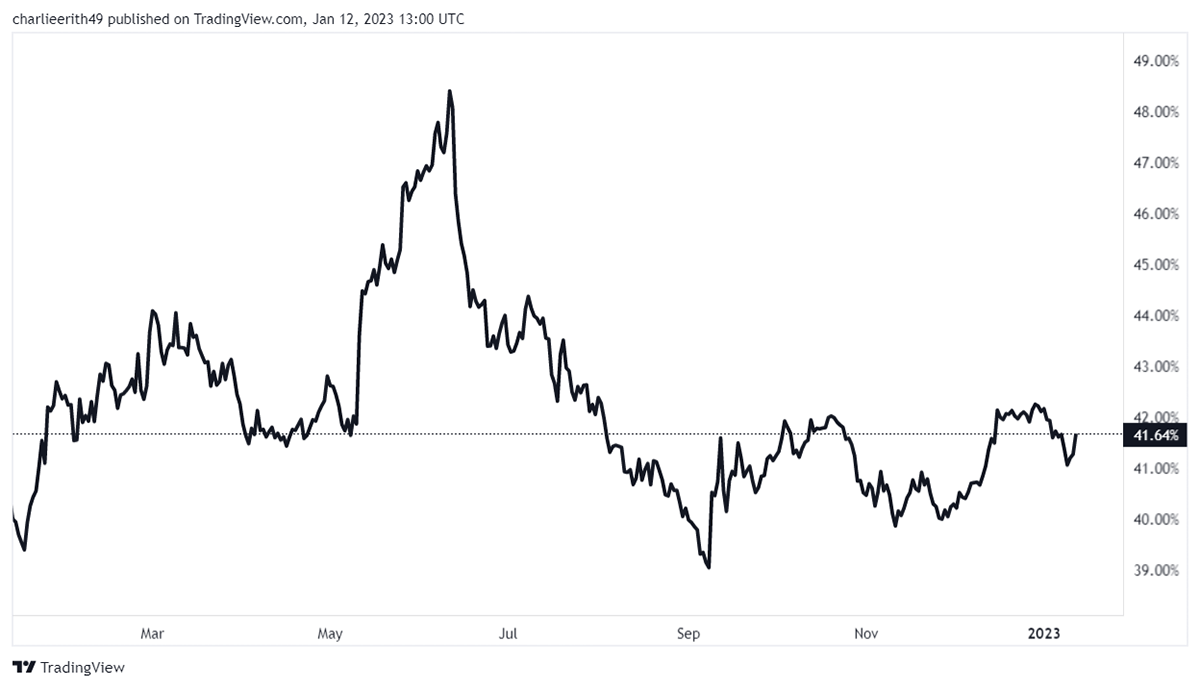

What is notable is that despite this improvement across the board, bitcoin dominance has been gently rising, as shown below. This is not a bad thing. It’s what we have observed at the beginning of previous cycles, and it makes sense. Investors want to own the highest quality, most pristine, and liquid asset when it’s available at what they consider to be a good price. If you’re a genuine long-term holder, why bother with anything else?

Source: Trading View

Conclusion

There are enough cylinders firing now for us to confidently assert that the bottom is in for bitcoin. It is an asset that relies on broader adoption, and that adoption will be, in part, driven by price resilience in the first instance, and appreciation thereafter. Barring any further accidents, the outlook for 2023 looks good.