Is Bitcoin De-coupling From the Tech Narrative?

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 76

This week we ask whether the technical, on-chain and macro set-up is telling us that Bitcoin is starting to be treated as digital gold. We also give the usual updates on institutional investment flows and on-chain activity.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Eyes on BitDaq |

| On-chain | Transactions remain strong, miner selling easily absorbed |

| Macro | Will BTC’s narrative genuinely switch to digital gold |

| Investment Flows | Big inflows |

| Cryptonomy | Dictatorship growth |

Technical

Bitcoin has ploughed through its 280-day moving average (MA) with barely a stutter. This takes it to a healthy 4-star trend on ByteTrend, measured relative to the US$. To confirm the bull, we need two things: one is for the 280-day MA to start sloping upwards, and the second is for the 42-day MA to cross above the 280-day. Still a bit of work to do on both.

The last set-up we had like this was in April 2022, which turned out to be a false break. But back then, we were about to be hit with a tsunami of bad news. Now it’s reasonable to suggest that the market has been able to digest it.

Source: ByteTree

Short-term, bitcoin looks substantially “over-bought” on a relative strength index (RSI) measure. This is an oft-quoted topic that frequently unnerves investors, but in reality, it’s pretty noisy. You can see that the last time there was a sustained period above the 70-line on the daily chart was October 2020, when bitcoin was in the early stages of launching towards US$60,000. Basically, any investors who held back in October 2020 because they thought bitcoin was over-bought missed out on a 5-bagger. The intention to “buy on the pullback” is one of the most punitive strategies in investing because a) if something is on the march, you won’t get much of a pullback, and b) if it does pull back, there’s an inclination to want it to pull back more, and will miss it again.

Source: IG

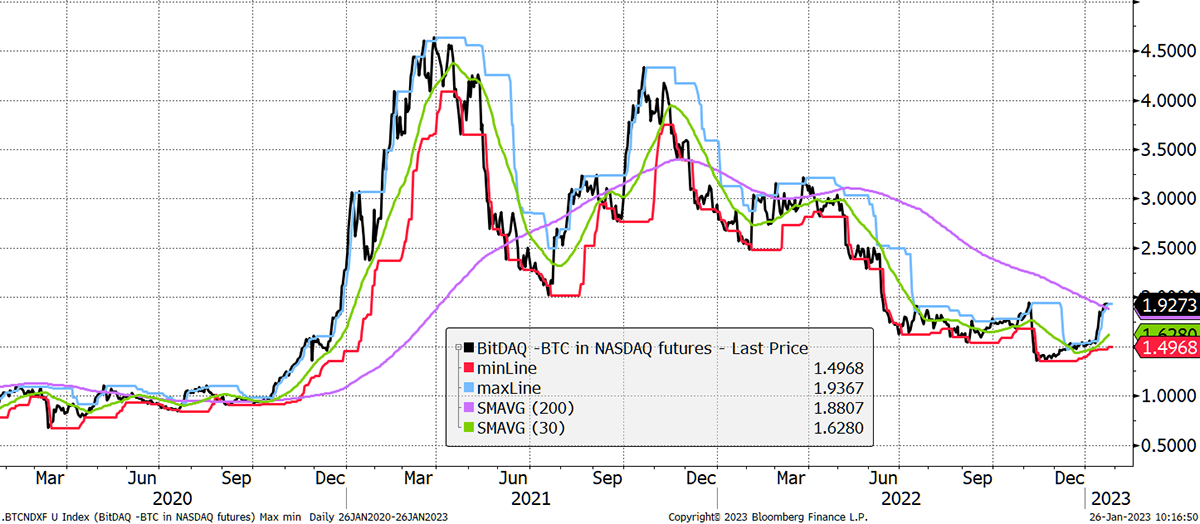

Another chart of interest is our old friend BitDaq, which measures bitcoin relative to the Nasdaq.

A couple of things: first, note how the relative performance is nudging above the 200-day MA. On ByteTrend, it would be on four stars. Second, even though bitcoin has been through a tough 18 months, it has still materially outperformed the Nasdaq over that timeframe. Is bitcoin de-coupling from the tech narrative and finally being treated as digital gold? Too early to be sure, but hugely bullish if it is.

More on this in the Macro section.

Source: Bloomberg

On-chain

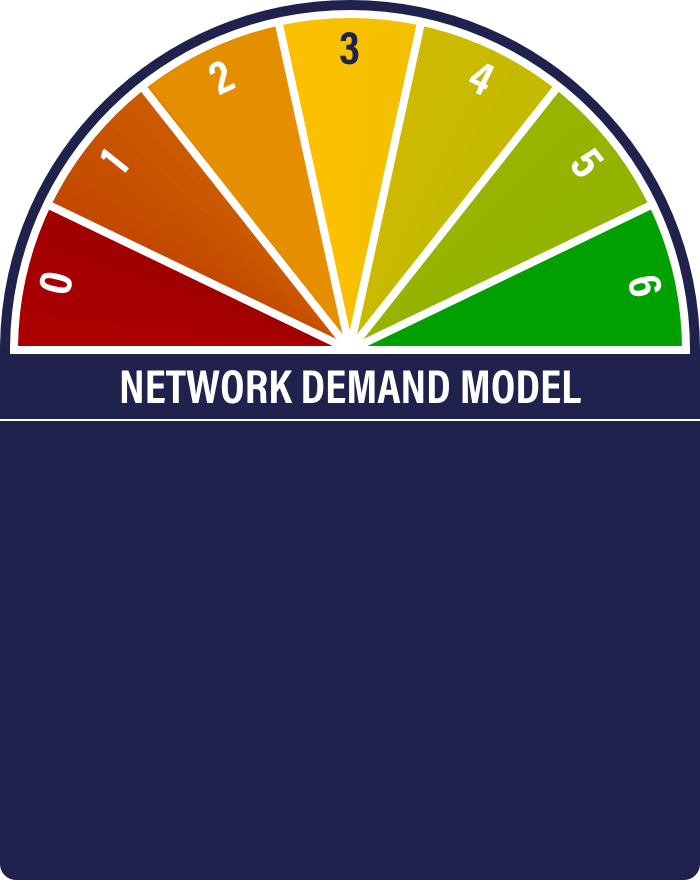

The Network Demand Model remains neutral at 3 out of 6.

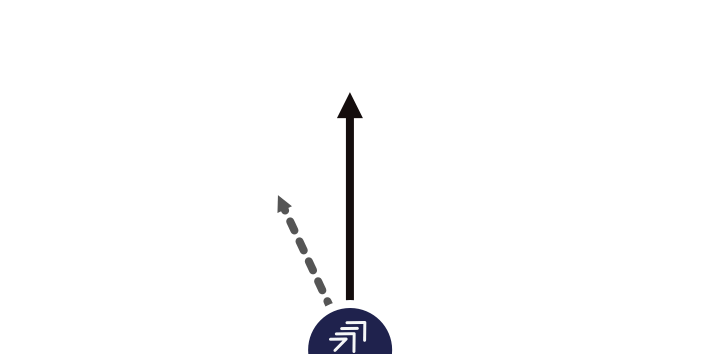

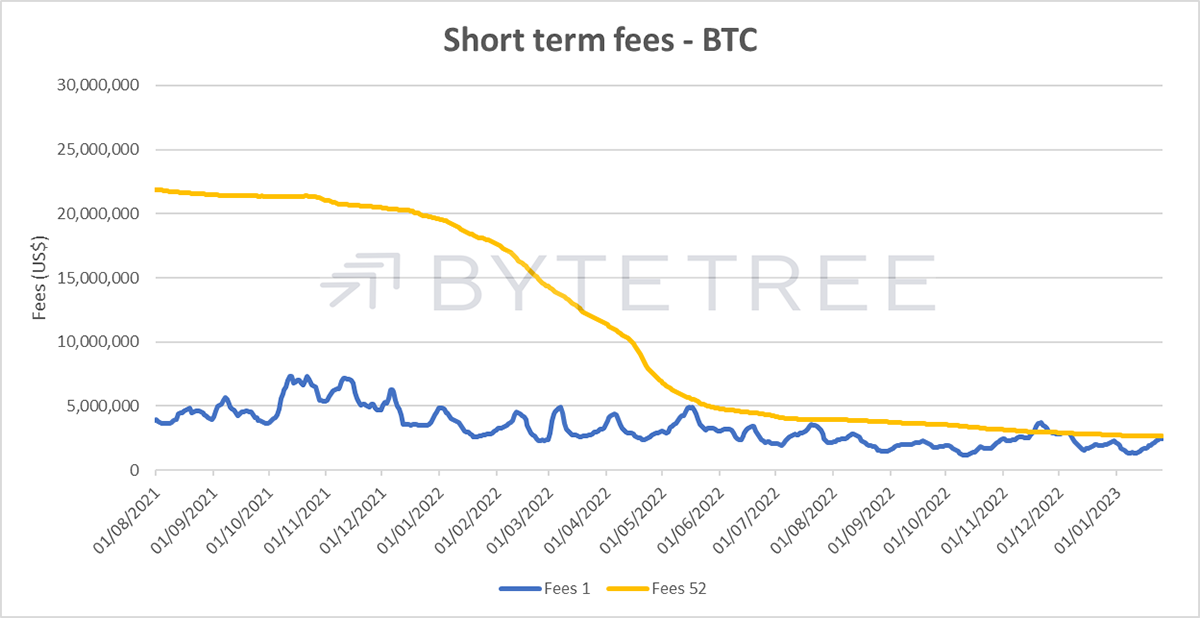

The fee indicators both remain OFF, and only one of the two transaction value indicators is ON. It won’t take much to turn the on, however, which would be consistent with low cycle behaviour. The short-term fee indicator, for example, is itching to break higher, as shown.

Source: ByteTree

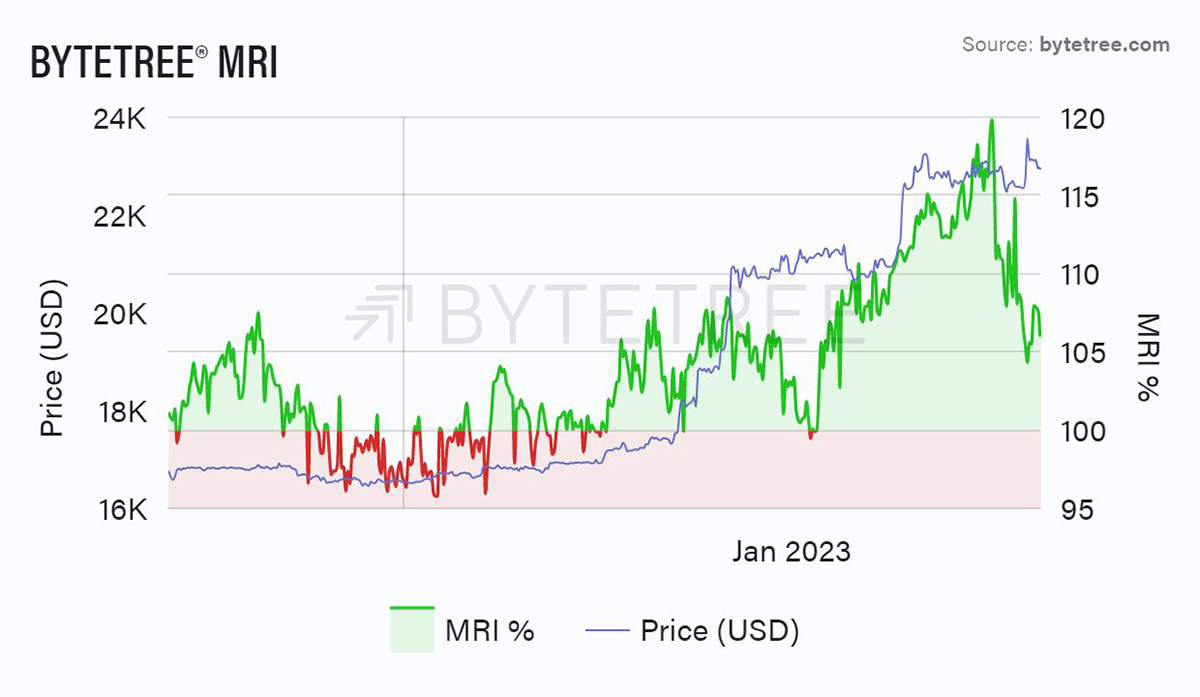

The miners have been taking advantage of the recent price strength to raise some cash, and we have seen a sharp uptick in the selling of unspent inventory over the last week, as shown in the MRI chart. It’s a sign of a healthy market that this has been easily absorbed and has had no impact on the price.

Source: ByteTree

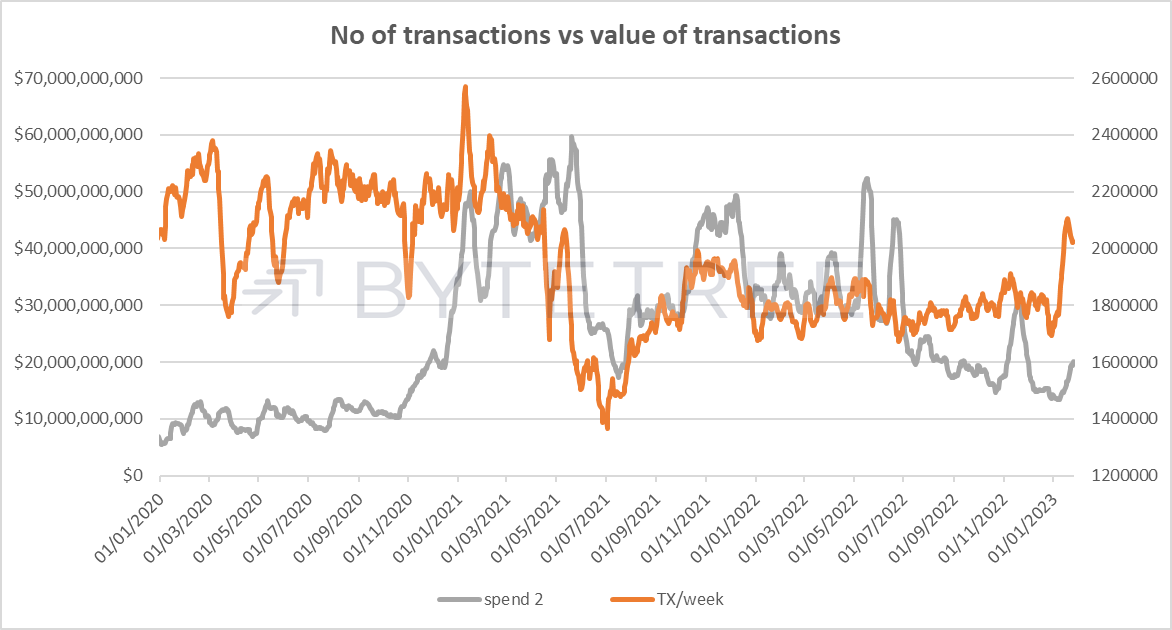

We’ve also seen a big jump in the number of transactions. There isn’t really a good comparison for this from the last cycle, although it is noticeable that there was a sharp increase in the number of transactions as markets recovered from the March 2020 “Covid collapse”. Given that there was no corresponding major increase in transaction value, it looks like it’s small investors taking advantage of the low prices and not whales. Perhaps the smart money in this asset class is in the streets and not in the boardrooms.

Source: ByteTree

Macro

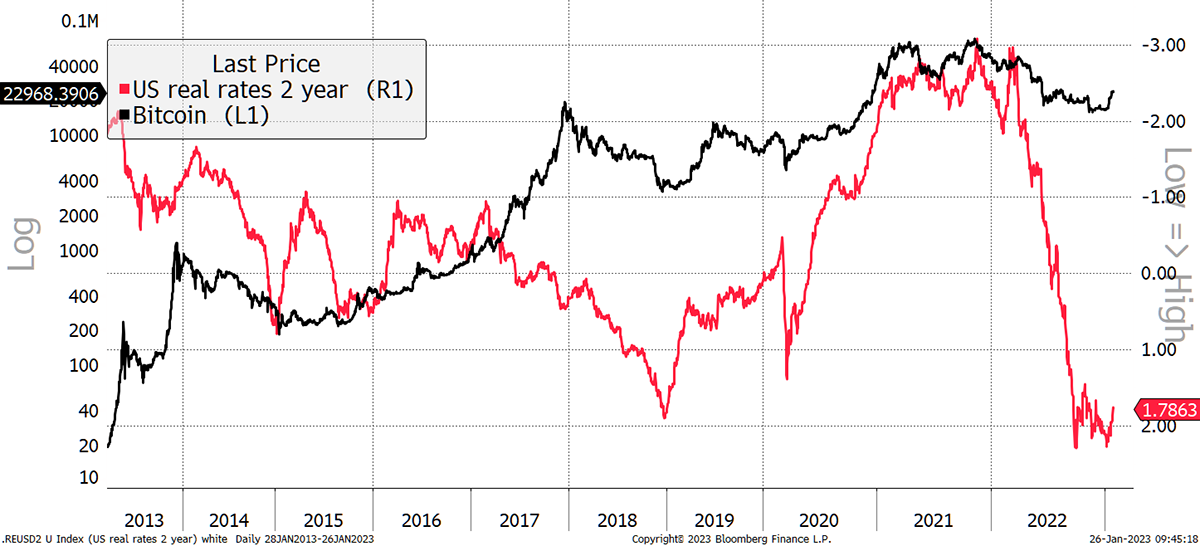

One of the more interesting charts we monitor is the relationship between bitcoin and US real interest rates. Real interest rates are the difference between inflation and interest rates.

At the moment, real interest rates are running at around +2.2% (US Fed Funds Rate 4.5% - 2-year inflation swaps 2.3%). You can see in the chart below how much this has changed since the start of 2022, when inflation was kicking off, and the central banks were starting to tighten. If recent history is any guide, one would expect real interest rates to mean revert back to a neutral setting. But mathematically, this can happen in one of two ways: either rates come down, or inflation goes up. It’s an important distinction. The first would typically be good for bitcoin, the second for gold. But could it be good for both?

Source: Bloomberg

If a fall in real rates is driven by rising inflation, it will prohibit the ability of central banks to lower interest rates and stimulate the economy. Given that we already have alarming evidence of an economic slowdown, this would entail that grim mix of stagnation and inflation – or stagflation. This would be a poor outcome for risky assets in general. The strong recent performance of gold can persuasively be attributed to a view that inflation is more deeply entrenched than believed, and that governments will not have the stomach to continue harming their economies by raising interest rates further. In other words, gold is telling us that real interest rates have peaked.

Alternatively, it might well be that inflation has been defeated and interest rates can be cut, a more benign outcome for “risk-on” assets, a category into which bitcoin clearly fits.

Back to the chart. Looking back at the behaviour of the bitcoin price, it has clearly been much happier when real interest rates are falling. But in previous episodes (particularly 2020), real interest rates have fallen in low inflation environments to stimulate growth. If we are entering a stagflationary environment, will bitcoin respond positively?

The answer to this goes back to the chart in the technical section, where we looked at bitcoin’s performance relative to the Nasdaq. This will tell us whether bitcoin is being treated as an exponential growth tech stock or whether it is being adopted as a long-term store of value.

The latter would be a far healthier outcome in our view, and as bitcoin rises while tech stocks flounder, it might finally be being used and treated as a grown-up asset.

Investment Flows

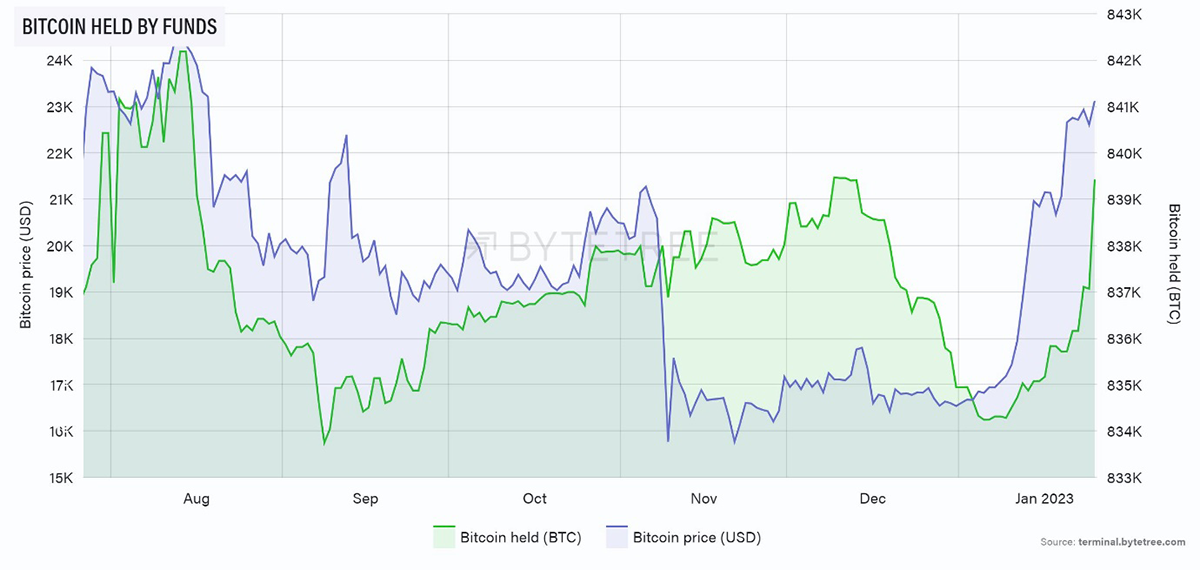

Good news. The Christmas hangovers are over, and investors are putting money back into bitcoin funds.

Assuming a price of US$23,000, it looks like crypto funds took in around US$54m yesterday alone. That’s a big number considering that the value of newly mined BTC per day (900) would be US$20.7m at the same price.

Source: ByteTree

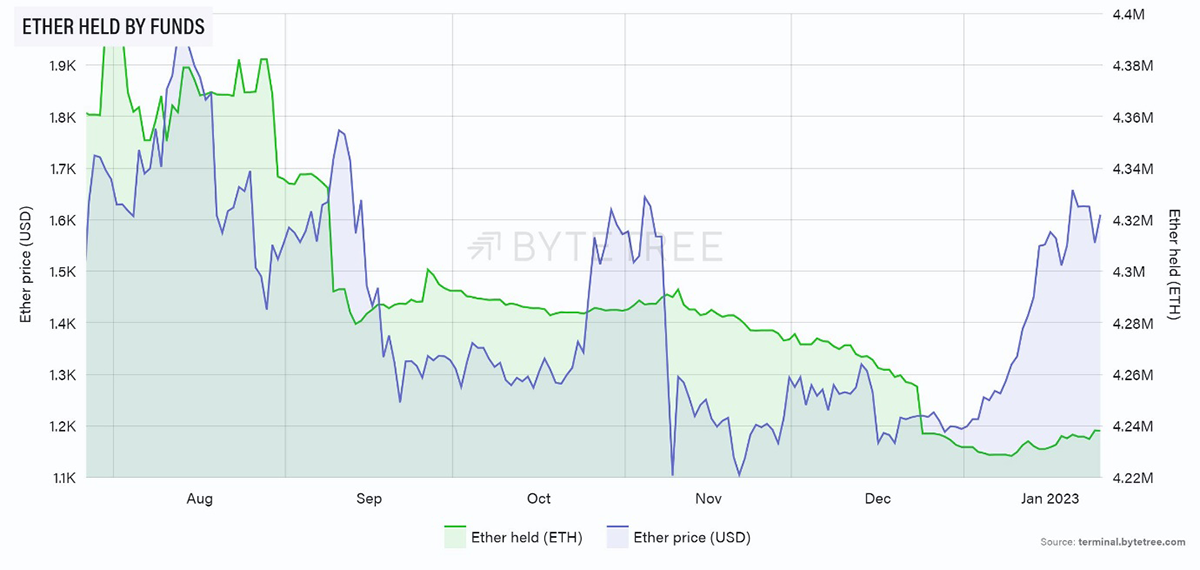

Ethereum isn’t seeing the same levels of enthusiasm, yet.

Source: ByteTree

Cryptonomy

First, a statistic. I only looked this up because I was interested in bitcoin’s potential customer base. This is in response to people who constantly rail on about it having no use case or intrinsic value. The simplistic idea being that anyone who lives in a dictatorship (which includes electoral autocracies), and therefore where ownership of assets and the rule of law is flimsy, will have a genuine use case for the technology.

And the answer is… 5.4bn people. 70% of the world’s population (from 49% in 2011, go dictatorships!), according to a report published last year by the University of Gothenburg. Bitcoin is a network asset, and this is its addressable market, not family offices on the calm banks of Lake Geneva.

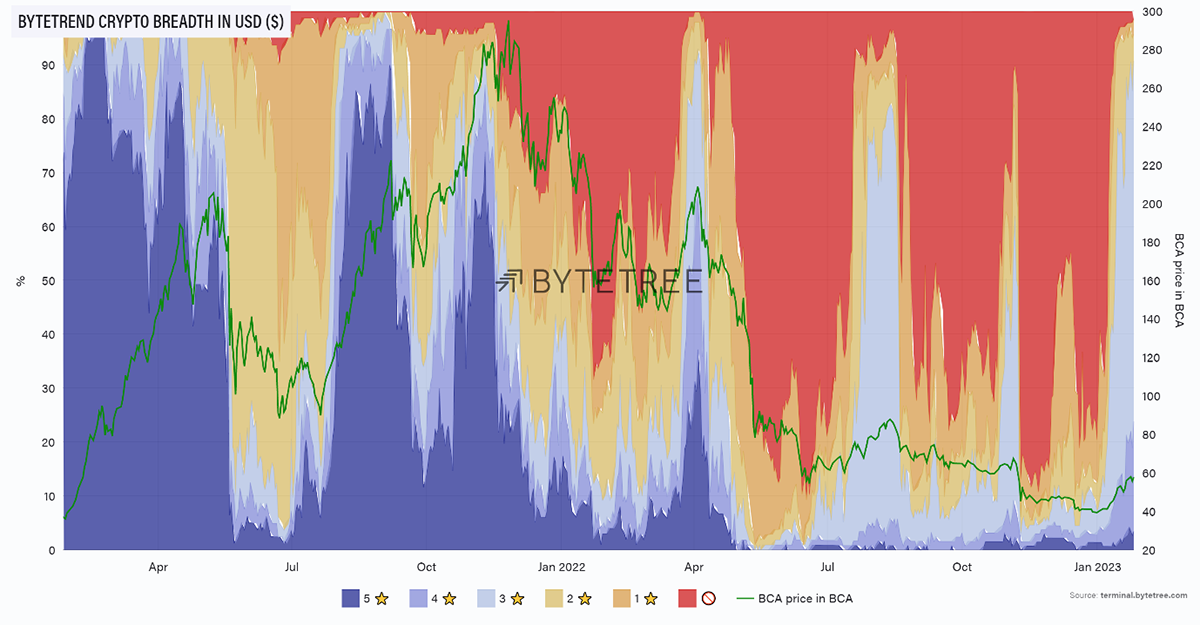

While everything in the crypto space has had a decent lift this month, it remains noticeable that leadership has come from bitcoin. Crypto breadth, looked at relative to US$, shows that just about everything has some sort of trend score (with a very healthy pick up in 4-star trends).

Source: ByteTree

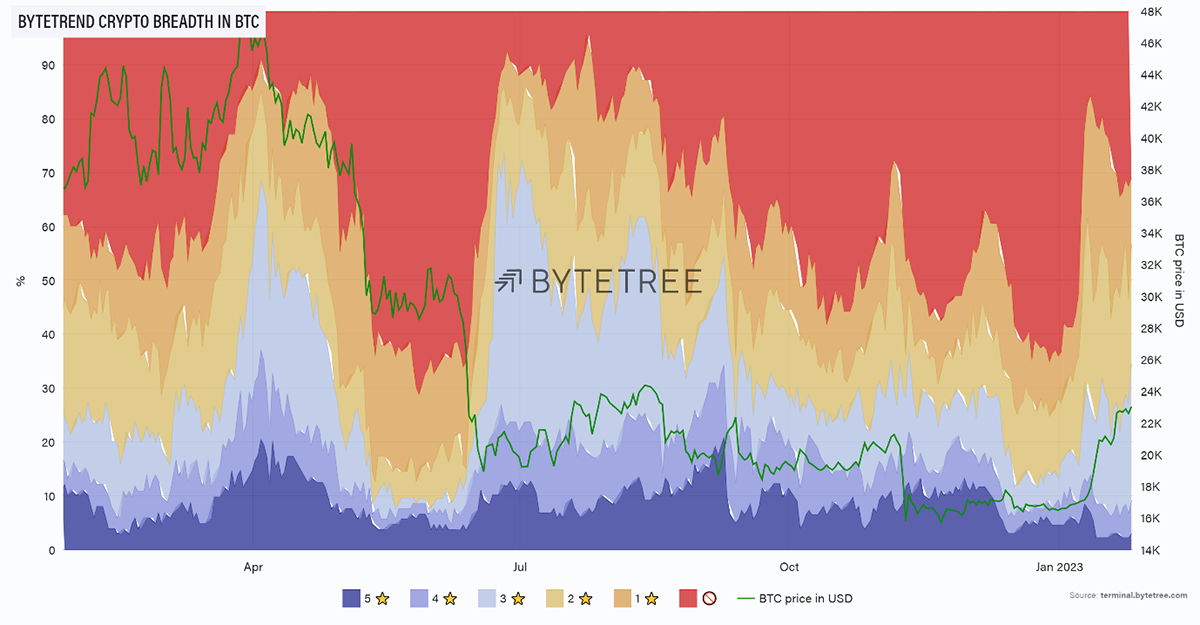

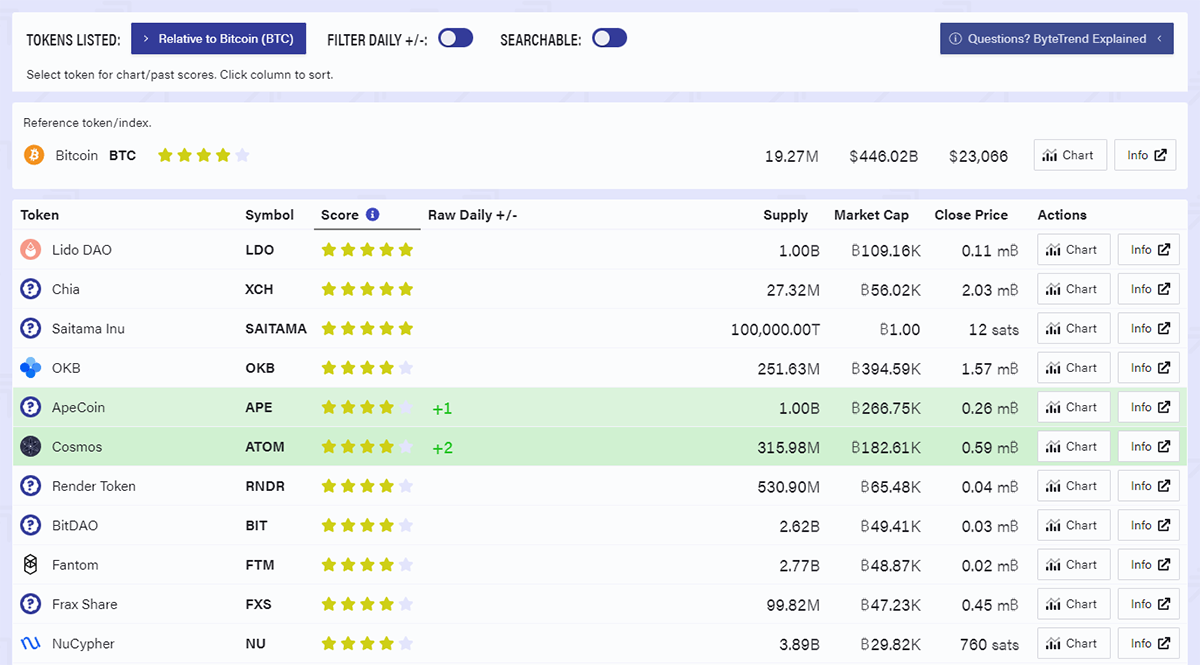

However, if we look at that compared to BTC, we see much more red sky and very few four or five stars.

Source: ByteTree

Again, this tells us that if the market has bottomed out, we’re still very early. You’d expect to see lots of blue on the bottom chart when we’re in the thick of a bull market as investors become more reckless and bid up lower-quality assets.

For your edification, here are the top-ranking 4- and 5-star trends against BTC this week. For those who are interested, you can read more about our portfolio picks in ByteFolio.

Source: ByteTree

Summary

We’re conscious that after a big price move, investors will be anxious as to what can go wrong. But all the things we consider are neutral to positive. There are signs that bitcoin is increasingly being treated by investors as a store of value and inflation hedge. The network is still tiny, given the potential market.