How Twitter Under Elon Musk Will Drive Crypto

Disclaimer: Your capital is at risk. This is not investment advice.

They doubted it would happen, but it did. Musk now controls Twitter, and he will shake things up. Yesterday he announced that blue ticks will become a payable service which is entirely logical. This is important, and when you join the dots, you soon see where crypto comes in.

Despite not having millions of followers, I would gladly pay $8 for a blue tick because people have tried to impersonate my account with scams. Musk understands that $8 a month isn’t much, but practical enough to make it unviable for the bots to cause mischief. That small step will do wonders in boosting the quality and integrity of much of the content on Twitter.

His plans go deeper. As an alternative to paid advertising, where he wants less, he wants to enable premium content to bypass paywalls. This, he hopes, will make more high-quality content available on the platform, powered by fee sharing with content providers, in a model not dissimilar to Spotify.

I do not want to subscribe to multiple newspapers around the world. But every so often, I’d like to read that piece in the Wall Street Journal, the Economist or even the South China Morning Post. Written content has struggled to find a way forward, but given other media, such as music and film, have succeeded, one day it must. Musk’s Twitter will solve this.

In previous conversations, he wants Twitter to become the “everything app”, modelled on Chinese apps which incorporate payments, media, and services such as food delivery. But to go full ahead on this, first, he’ll have to master online payments. The trouble here is that he needs a global solution.

What’s important is that Musk is an expert on payments (alongside rockets, code, cars, energy, etc.), which is something we tend to forget. He had the vision back in the 1990s before most of us knew what WWW stood for.

Musk founded the online payments provider X.com, which later merged with PayPal (PYPL). There was a boardroom bust up with Peter Thiel, but that’s another story.

He is no longer connected to PayPal, but that wouldn’t be the answer anyway, because they have gone down the opposite route. They went all corporate and have been embracing political censorship if they disagree with your views. Recently they shut down the accounts for the “Free Speech Union” of all places. That is proof, if you ever needed it, that it’s their way or the highway. Services such as PayPal are highly unsuited for a platform like Twitter where different opinions are its reason to be.

Twitter needs a form of global and uncensored money, which neatly brings us onto crypto. Marc Andreessen, the co-founder of Netscape, describes how until 1993, it was illegal to use the internet for commercial transactions. After all, it had been funded by the government.

Two things helped the internet to take off. One was allowing payments and general commercial use, and the other, the government handed the internet over to the telecom companies. At least that’s the simple explanation. Internet traffic subsequently took off, but the inability to make secure payments held it back for several years, hence Musk’s creation of PayPal.

Andreessen has been one of bitcoin’s greatest supporters because it solves the “Original Sin of the Internet”.

By that, he means the original browser was unable to make payments. That is why the internet is so dependent on advertising, and it is why it is so hungry for our data to this day.

Andreessen had tried, back in 1993, to enable internet payments but the banks and credit card companies of that era were not interested. The centralised gatekeepers blocked it, just as they tried to do with crypto in recent years.

In the eyes of skeptics, crypto has no use case. For the bulls, there are already many use cases; it was just a matter of time before one came into the public spotlight. Crypto enables payments to take place over the internet in a secure manner, without a bank, and this can work for Twitter.

Money on Mars

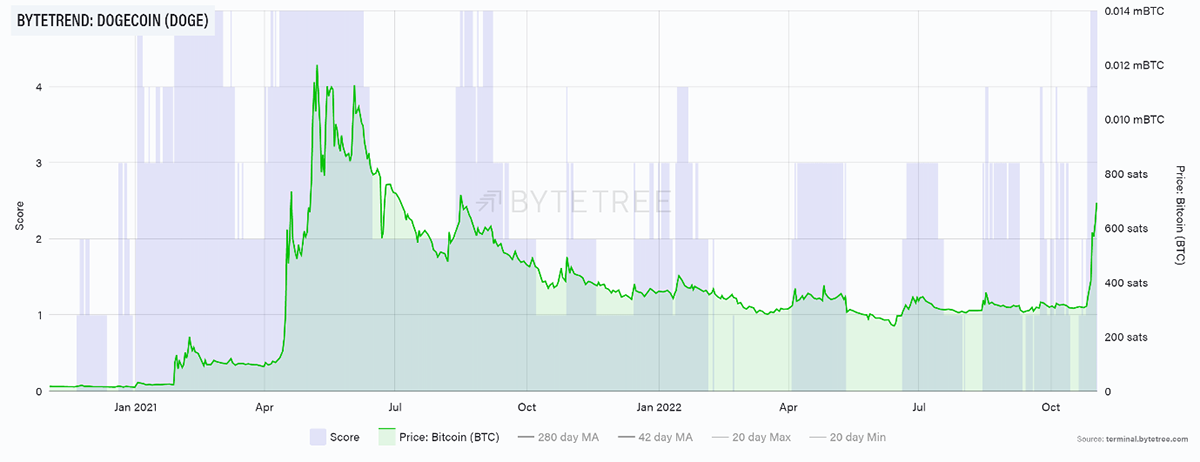

Musk bought bitcoin for Tesla and has long enjoyed Dogecoin, suggesting it will be the currency on Mars. The trouble is that most of us assume he is joking but can’t be sure. In any event, the Twitter takeover has seen DOGE more than double in BTC.

Be clear. At ByteTree, we think you should give DOGE a wide berth, but then none of us is planning to move to Mars.

It is not just Musk in the mix. Twitter’s founder, Jack Dorsey, left to focus on his other company, Block (SQ), which enables bitcoin payments. In case you are in any doubt about his vision, his Twitter profile simply says “#bitcoin”.

We don’t know how this will develop, but Musk and Dorsey are payment visionaries, and there is a problem that needs to be solved. It must be secure and globally accepted.

As Twitter integrates payments with social media, the possibilities explode and the use cases multiply. The everything app has the potential to grow the audience beyond political mudslinging, and in that sense, Twitter becomes the first major Web3 project to be delivered.

This is bullish for crypto and may be the trigger for institutional adoption. If crypto payments, ones which we barely notice, become part of our daily lives, the system will formally embrace the space. That will be a game changer as regulators will have to find a way forward. Once they do, crypto will become an acceptable asset class, and a financial tsunami will follow.

Thanks, Elon.

Comments ()