Uptober - Fed's Gonna Buckle

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 68

The best thing about the KamiKwazi speech is that it has brought things to a head. The new UK government may have lost some credibility, but the trends (strong dollar, weak bonds) were already mature before he opened his mouth.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | BitDAQ hits 3 stars |

| On-chain | Stable |

| Macro | MicroStrategy vs Grayscale |

| Investment Flows | Fed’s gonna buckle |

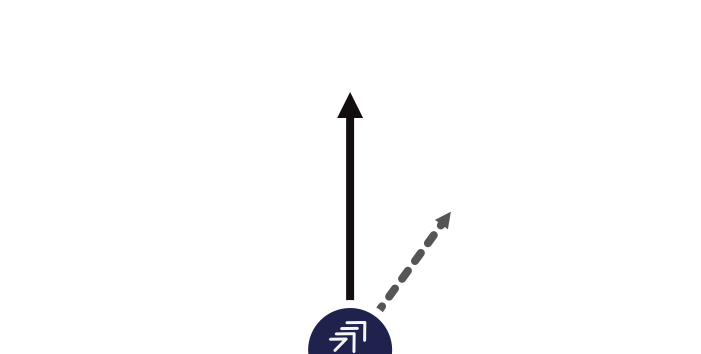

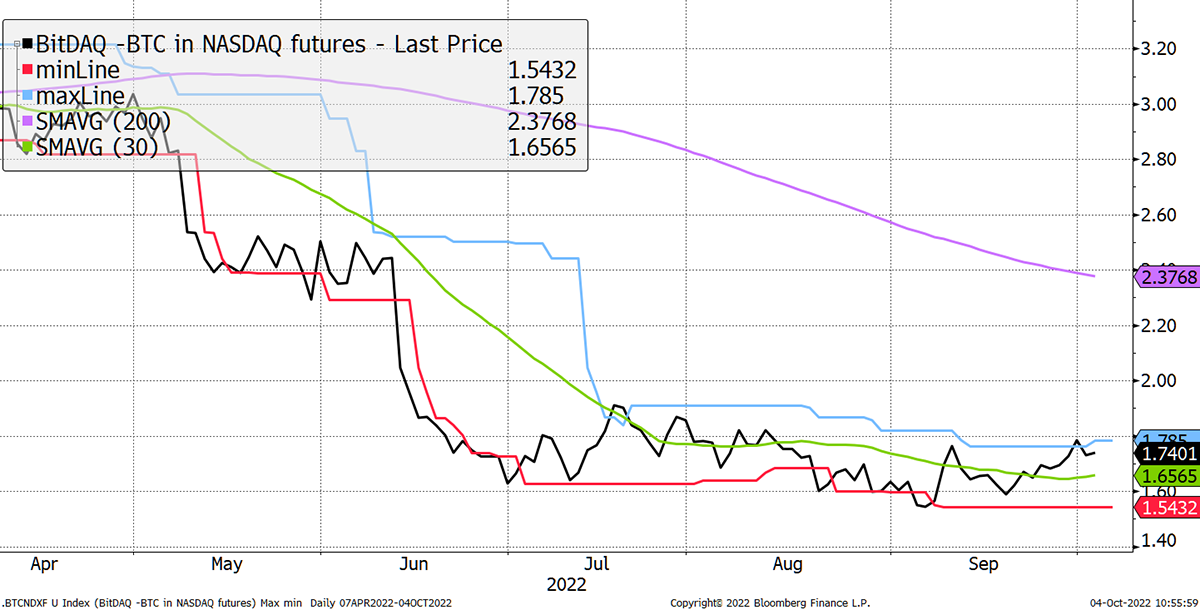

Technical

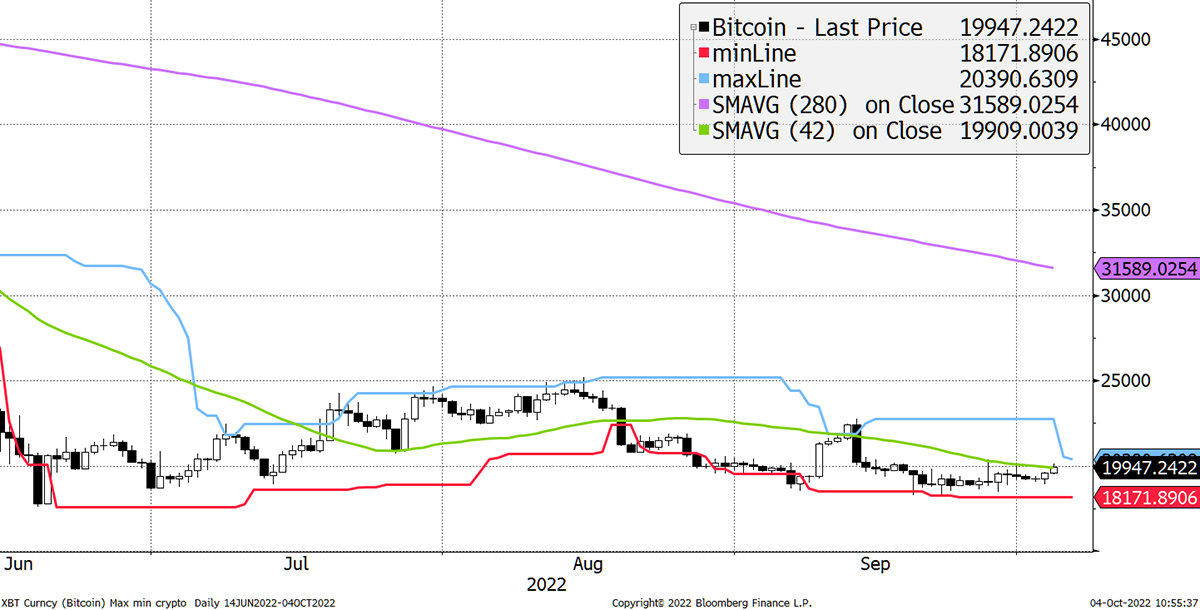

BitDAQ, bitcoin in NASDAQ, has just touched 3-stars for the first time since March. We should celebrate.

BitDAQ looking up

Source: Bloomberg

It simply means tech investors, of which there are many, will put bitcoin back on their radar. It will take time for BitDAQ to move to 5-star because the 200-day moving average is much higher and so hard to imagine this year. But by Q2 2023, it’s looking likely.

Bitcoin in USD will be lifted by two things. First, the USD may have peaked. Last week I showed the extent of the dollar overvaluation, which is the highest since 1985. Second, we are right to be hopeful. Bitcoin has held the low from June while stockmarkets have carried on falling – even while the dollar has surged.

Moreover, if Uptober can lift bitcoin a little, it will soon be 3-stars as the 42-day moving average turns up (42 crypto days is 30 TradFi days). Yet the longer term 280-day moving average is still challenging as it is 50% higher. It’ll come.

Bitcoin 2-star

Source: Bloomberg

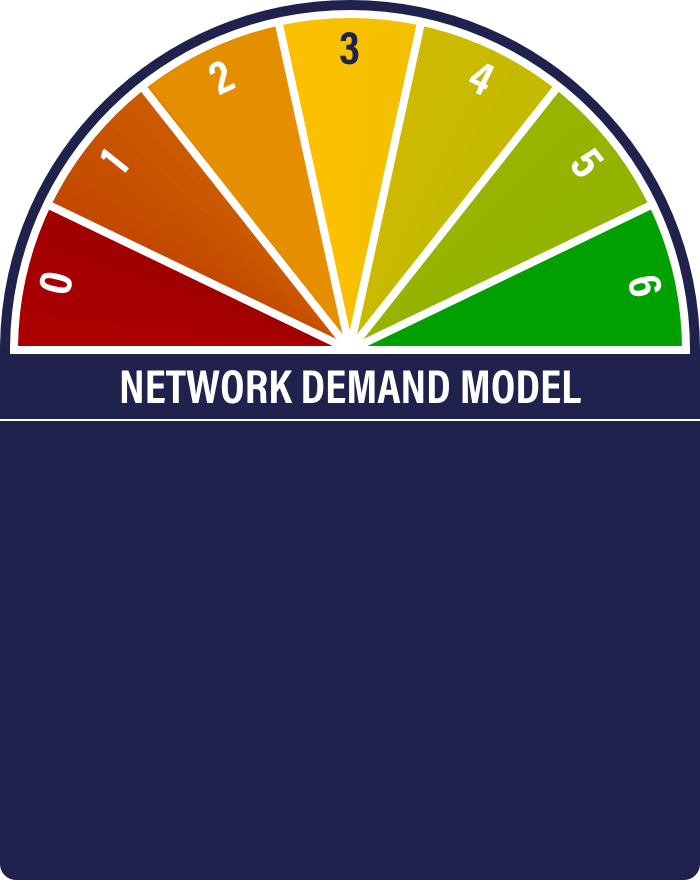

On-chain and Investment Flows

The Network Demand Model is 1/6 with just velocity ON. This is somewhat depressing, but following weakness since May 2021, the good news is that strength and stability will see the NDM upgrade quite quickly. In any event, unlike in 2019, the price will inevitably lead the network this cycle for the simple reason that bitcoin has not been forgotten this time round.

I like to point out that the weekly network sees $25bn change hands in contrast to $4bn back then. It is a reminder of how much this space has evolved.

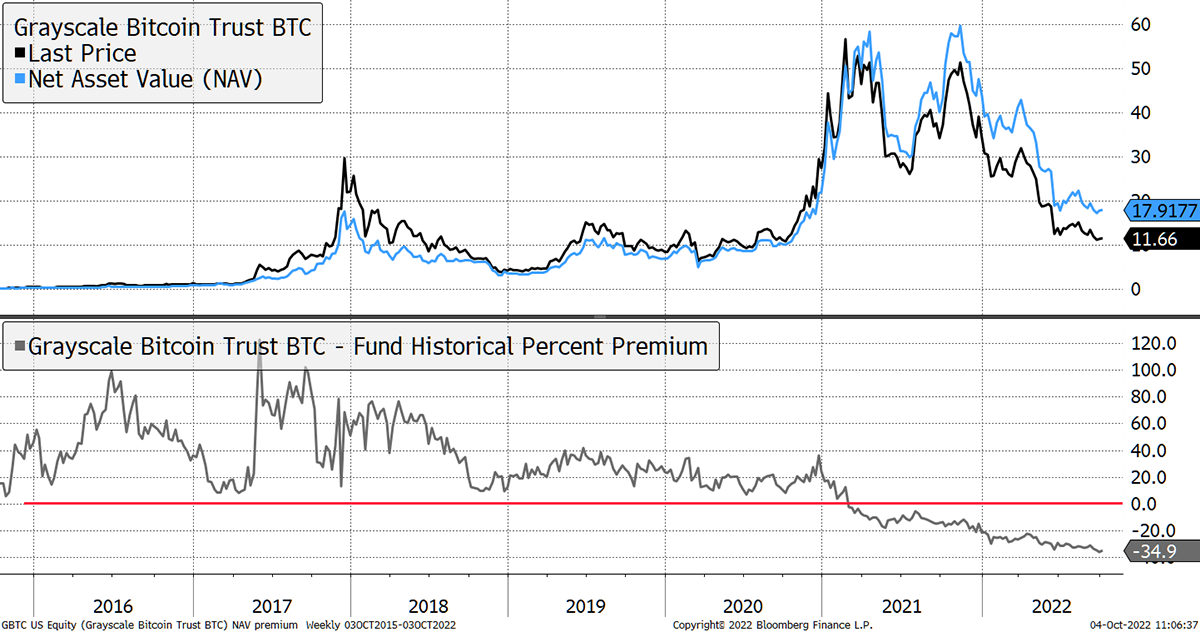

Yet there is a bizarre sentiment dichotomy that remains. Grayscale Bitcoin Trust (GBTC) trades on a 35% discount, whereas MicroStrategy (MSTR) trades on an 82% premium. Why?

GBTC has an angry shareholder base. Most of their assets were raised pre-2021, and many investors were more interested in arbitraging the premium than in holding bitcoin. They bought GBTC shares at net asset value and held them for six months before selling them into the market at a hefty premium. As that premium faded, there has been an overhang. GBTC holds $12.4 bn of bitcoin, with a market cap of $8bn. Clearly, there isn’t the demand for such a large stash at this point in the cycle. They also charge 2% p.a., which is expensive, especially given their size.

GBTC 35% discount

Source: Bloomberg

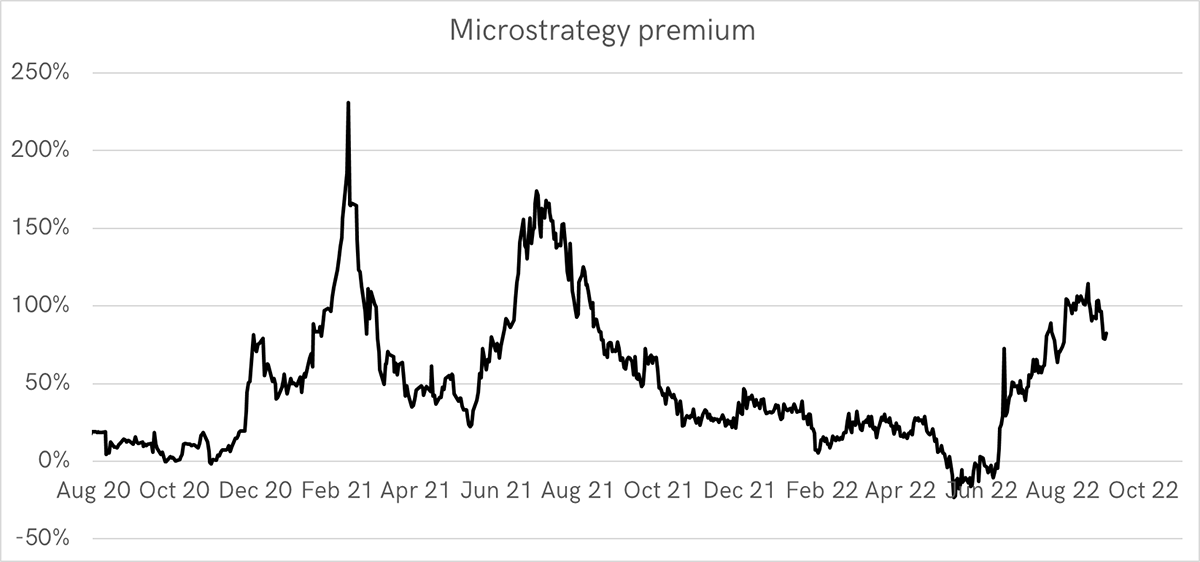

MSTR has a happy shareholder base because the bitcoin purchases in 2020 lifted the share price considerably. There are no fees, and the market cap is $2.5bn for bitcoin holdings of $2.5bn. The software business is worth something, but there is also considerable debt. Being smaller, there is less of an overhang, and there is leverage as the debt provides gearing as the price of bitcoin rises. Yet there’s also risk, because MSTR could go bust if bitcoin slumped below $10k.

MSTR 82% premium

Source: Bloomberg, ByteTree

It’s a funny one because it is rare to see such a divergence between two instruments. At an 82% premium, MSTR has less leverage because the excess returns are already baked into the current price. If it traded at a 35% discount like GBTC, it would be amazing because you would have a 3x upside on bitcoin. But here, at a premium, it is more likely to be 1x, so why take the risk?

The answer is liquidity.

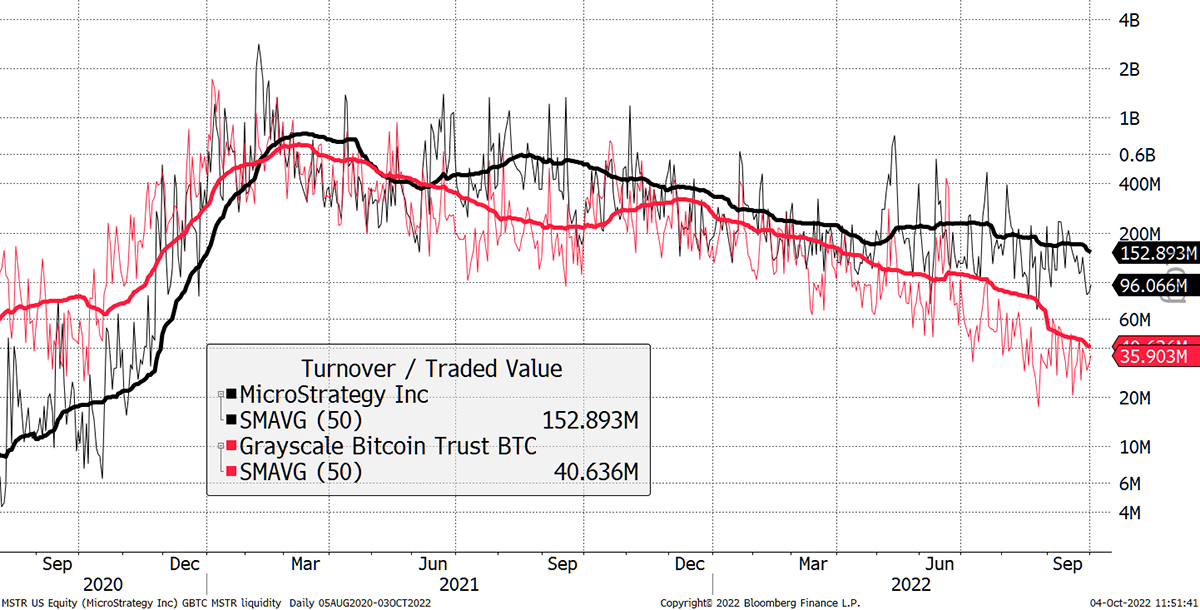

MSTR trades $150m per day in contrast to GBTC, which has slumped to $35m per day, having been more liquid in 2020. MSTR is 5x more liquid than GBTC and gaining.

The GBTC liquidity deficit

Source: Bloomberg

The bottom line is that Michael Saylor is better at marketing than Barry Silbert. Yet GBTC provides a margin of safety, whereas MSTR has materially higher risk. GBTC offers a better opportunity for the next bitcoin bull market.

If anyone was ever in doubt as to the concept of a liquidity premium, this is the best example I have ever seen. I would suggest that all assets with a liquidity premium should be given a wide berth.

Macro

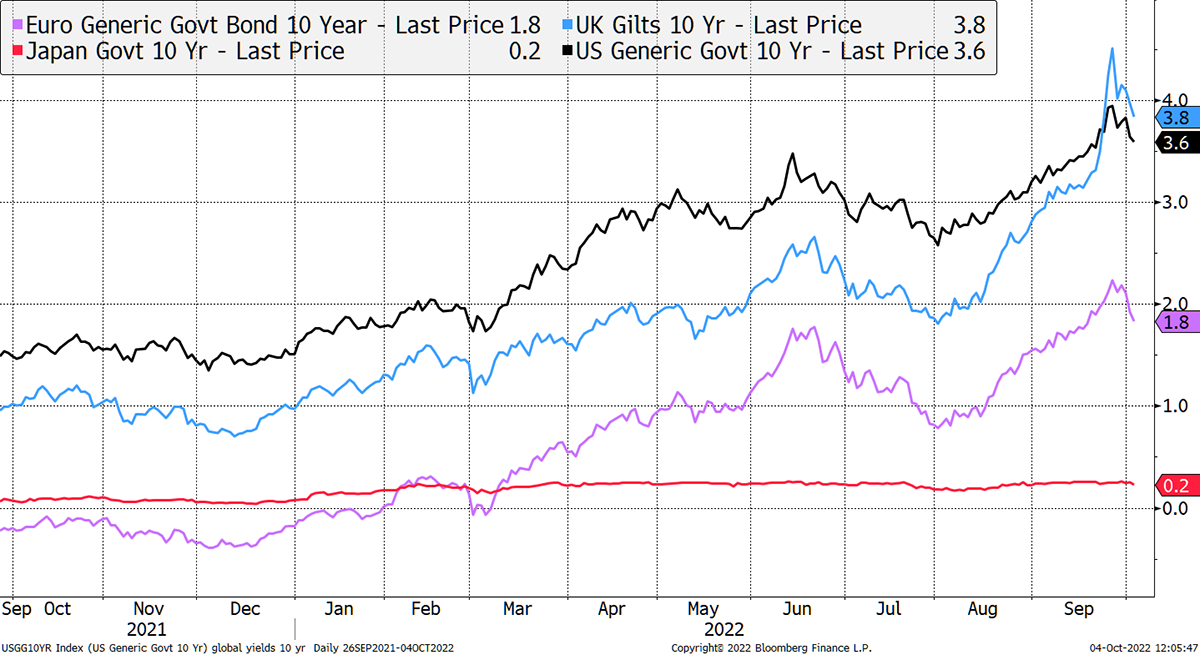

The best thing about the KamiKwazi speech is that it has brought things to a head. The new UK government may have lost some credibility, but the trends (strong dollar, weak bonds) were already mature before he opened his mouth. The Fed has acknowledged carnage in markets, and we can only suspect that the tightening programme will ease.

You can see that as bond yields have cooled in recent days. That has eased the dollar, lifted bonds, and been supportive for bitcoin and gold.

Fed’s gonna buckle

Source: Bloomberg

The early signs are that bitcoin was early into the collapse and will be early out. Dollar strength has led to high correlations, which will be key in the next macro shift. What the dollar pushed down will be the first to rally. I will write more about this important macro shift in Atlas Pulse on ByteTree tomorrow.

Summary

Uptober is here, and so far, so good.