Chrono.tech: Reshaping Talent Acquisition Using Blockchain Technology

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: TIME;

Chrono.tech provides a range of products to enhance talent acquisition and human resource services with the help of blockchain technology. All can be accomplished using the Chrono.tech products suite, from hiring to getting hired, payroll, and payments. This Token Takeaway examines the fundamentals of the Chrono.tech ecosystem and its native token, TIME.

Overview

A few decades ago, it was almost impossible to hire or get hired for international remote work. People from developing countries couldn’t utilise their talents due to a lack of opportunities. But thanks to the internet, companies like Fiverr and Upwork revolutionised talent acquisition by allowing people to access task-based remote work globally. People can create profiles, market their services and skills to potential clients on the platform, or apply directly to the already available jobs.

To mirror the same concept using blockchain, Chrono.tech, a talent acquisition and payments ecosystem, was launched. The Chrono.tech product suite mainly focuses on connecting freelancers with global clients to find the best jobs that pay almost instantly in crypto. Similarly, businesses and customers can acquire talent internationally and set up a convenient payment structure. Chrono.tech brings in many elements from traditional recruitment companies, but their products are powered by smart contracts, eliminating the central authority.

The main question here is whether the talent acquisition and HR services actually need blockchain disruption, or is it unnecessary?

Launch and Funding

In 2016, Chrono.tech was launched in Australia by Sergei Sergienko, a Russian-Australian serial entrepreneur and investor. Sergienko is also the current CEO of Chrono.tech and co-founder of the crypto gaming platform, Crypto Gaming United (CGU).

Initially, Chrono.tech raised $5.4m from the TIME token sale in February 2017. More recently, in January 2022, Chrono.tech raised another $30m from an Australian asset manager, Mark Carnegie, and a European family office. According to a blog on their website, these funds will primarily be used for scaling and development of the Chrono.tech product suite, making the usage of these services more efficient and secure.

Ecosystem Products

Although Chrono.tech mainly focuses on HR services, its product suite is not just limited to that. They also have a crypto exchange, a multi-chain bridge, a payroll solutions application, and a stablecoin pegged 1:1 with the Australian dollar (AUD). Essentially, there are five products in the Chrono.tech ecosystem: LaborX, PaymentX, TimeX, TimeBridge and AUDT, and the next section will give a brief overview of each product.

LaborX

LaborX is the main product of Chrono.tech. It provides a blockchain-powered freelance marketplace, allowing jobseekers and clients from all over the world to connect and work on mutually agreed terms using smart contracts. The platform secures the payments beforehand and releases them once the finished work is submitted and accepted, eliminating the risk of clients failing to pay. This is achieved via a ‘digital contract’ and executed to pre-set parameters in the signed contract. In case of disagreements or altercations, a dispute service is offered to resolve the issue.

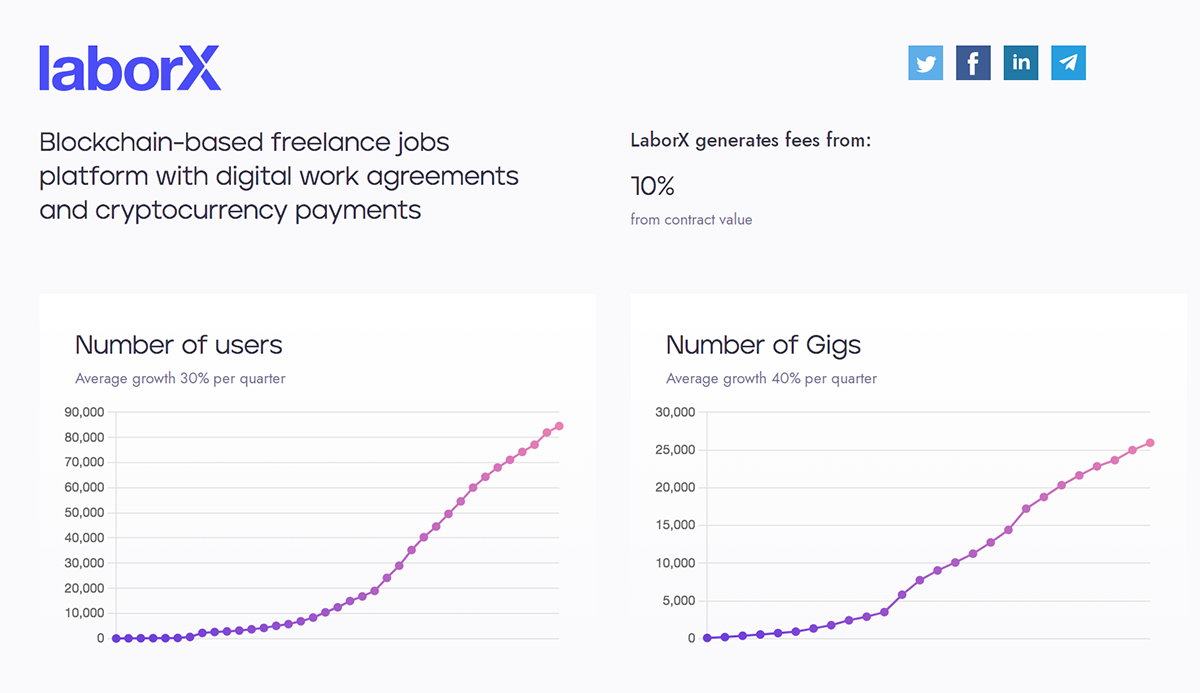

As illustrated in the below charts, the number of users and gigs on LaborX have shown gradual growth over time. As of October 2022, there are around 85k users and 26k gigs on the platform.

All platform payments are transacted in crypto, which empowers instant borderless payments and eliminates intermediaries and payment processing fees. However, the platform does charge a 10% commission from the freelancer, while the client must pay the gas fees on the respective blockchain used for payments. These commissions, along with other revenue streams in the ecosystem, are used to buy back TIME from circulation to reward its users. More on that in the “Tokenomics” section below.

PaymentX

PaymentX is a blockchain-based payroll solution that allows individuals and businesses to send and receive payments using crypto. Users can create professional invoices and set up recurring, one-click payment channels. In a world where numerous companies have employees working from all over the world, PaymentX allows them to manage their payroll operations frictionlessly, cheaply and quickly.

TimeX

Launched in 2019, TimeX is a plasma-based (Plasma is an Ethereum scaling solution) cryptocurrency exchange built by Chrono.tech. It is registered in Australia and is compliant with the Australian Transaction Reports and Analysis Centre (AUSTRAC), i.e. the Australian financial regulatory agency. It uses a hybrid of the CEX and DEX systems by leveraging the best of both worlds, including speed, privacy, security and transparency.

TimeBridge

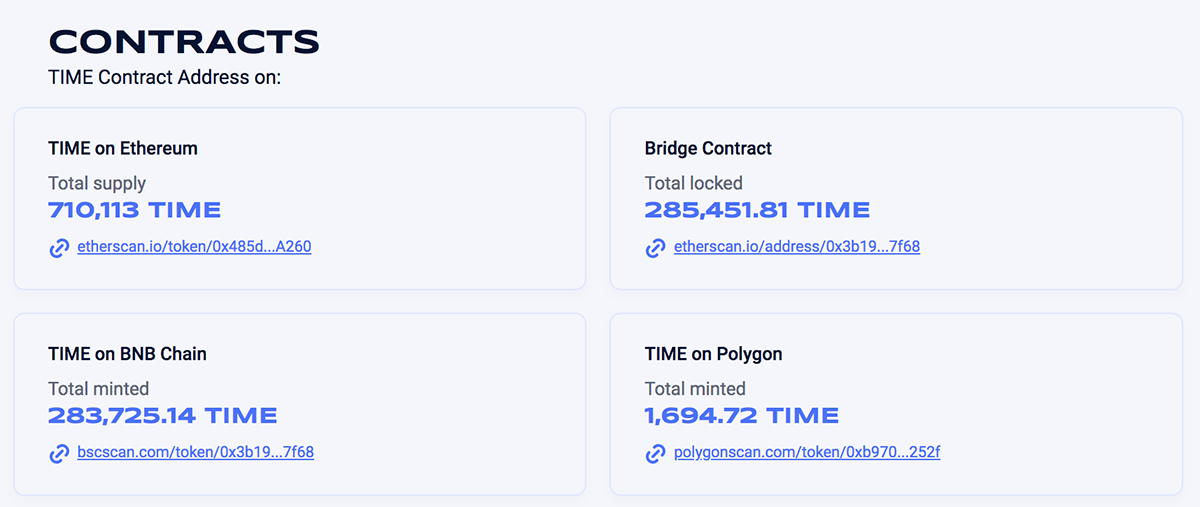

TimeBridge is a native multi-blockchain bridge that connects the native chain, Ethereum, with the BNB chain and Polygon. Users can connect their MetaMask wallet to the TIME Bridge and seamlessly transfer TIME tokens across these chains. Consequently, the TIME token gets further exposure to users on different chains and ecosystems. Moreover, users can transfer TIME to the BNB Chain, benefitting from the low gas fees (compared to Ethereum) when making transactions.

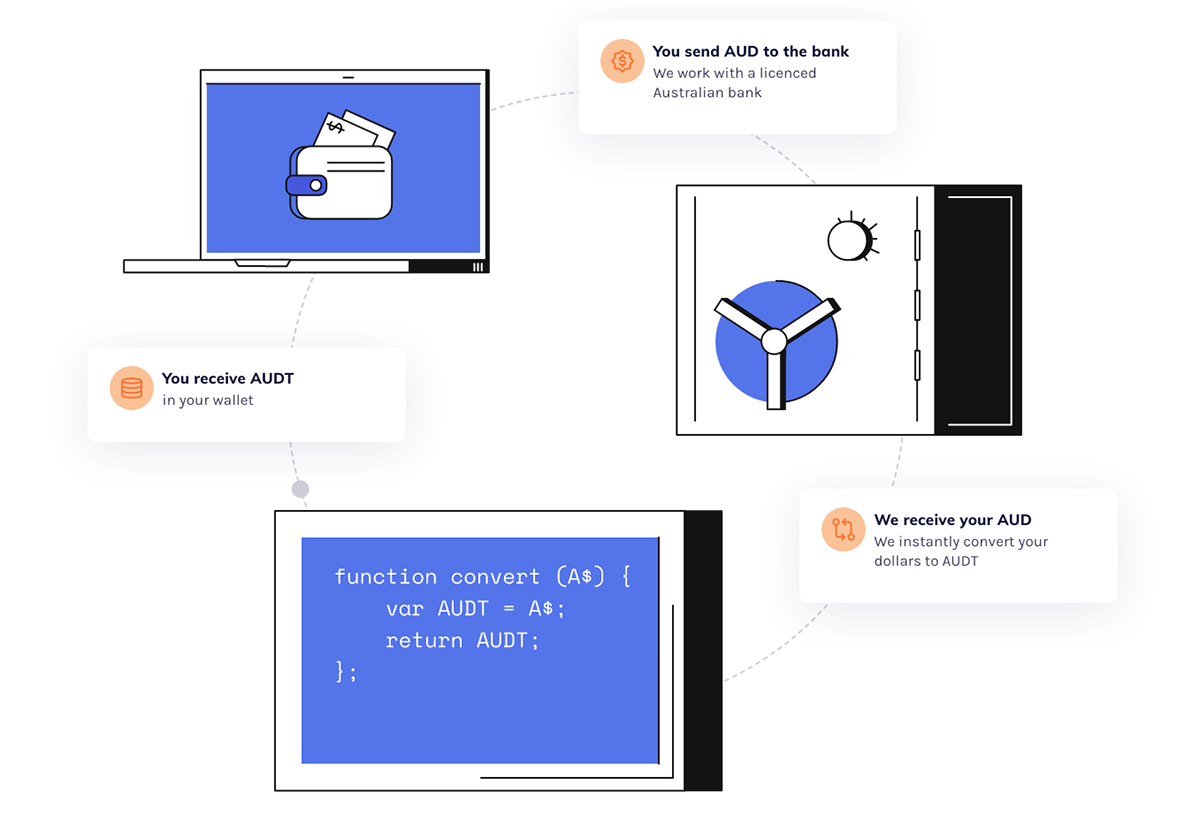

AUDT

Finally, AUDT is a 100% collateral-backed stablecoin pegged to the Australian dollar (AUD), with the funds securely stored in a licensed bank in Australia. According to their website, the legitimacy of these funds is audited by an AUSTRAC-registered third-party company on a regular basis. Currently, AUDT has $774m in marketcap according to TimeWrap.

Tokenomics

TIME was launched in 2017 with a fixed supply of 710,113 tokens, which is low compared to most cryptocurrencies in the industry. Initially, TIME was launched on the Ethereum blockchain as an ERC-20 token standard but was later updated to a newer standard, ERC-677. This update enabled TIME to perform cheaper, more efficient transactions and easily integrate with DeFi applications while remaining fully compatible with the original ERC-20 standard. Moreover, it also became the ecosystem’s native governance token, allowing its holders to participate in the Chrono.tech DAO, which gives the community more control and authority over the ecosystem’s development.

To increase the utility and demand of TIME, Chrono.tech launched TimeWrap, a DeFi staking program that currently holds 477,693, or 67.3%, of the total supply, locked by 812 stakers for a 4% APY reward issued in TIME tokens. These rewards are generated by utilising a portion of the revenue accumulated across all ecosystem products to buy back the TIME in circulation. As an additional incentive, these tokens are then used to offer freelancers a rebate of up to 5% of the platform fees, depending on their premium account status, which can be achieved by staking TIME on TimeWrap. This model removes a large chunk of TIME from circulation and creates scarcity.

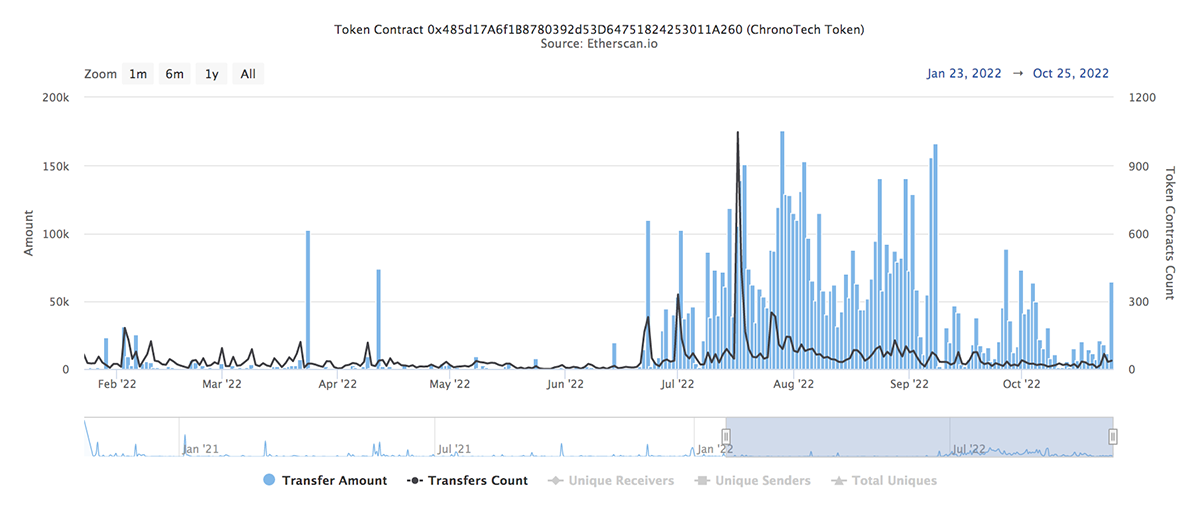

As illustrated in the chart below, after months of silence, the TIME transfer amount started to increase significantly at the end of June this year, with the total value transacted reaching over 150k TIME per day on multiple occasions. Although the performance has subdued since, the TIME token is still showing a decent amount of value transacted compared to the first half of 2022.

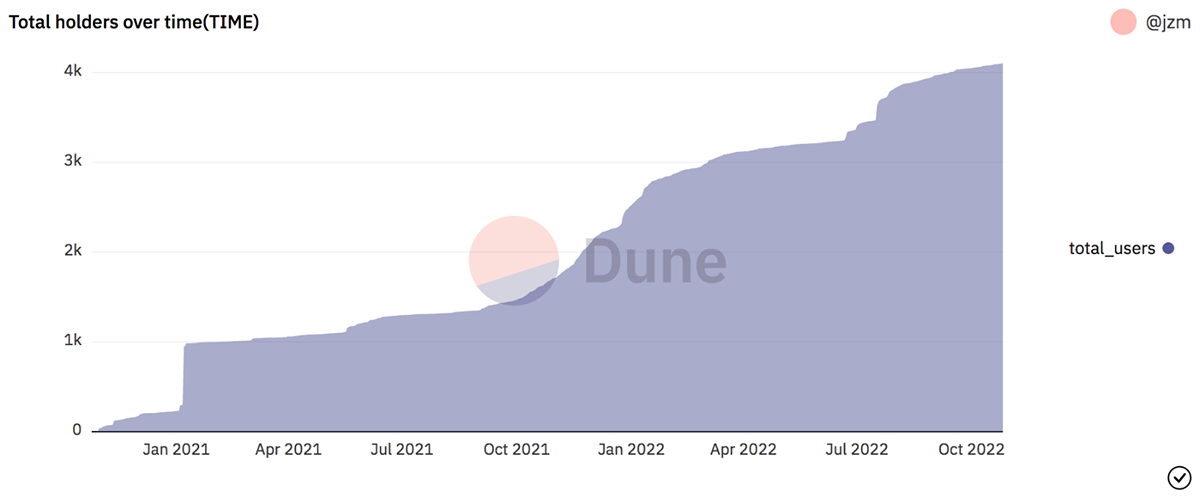

Total TIME holders have also shown gradual growth over time, as shown in the below chart.

Moreover, the TIME token is only listed on three major exchanges, i.e. Coinbase, Gate.io and KuCoin, drastically affecting its exposure to the users of exchanges like Binance, FTX, and many others. Given that the TIME token has been around since 2017, this could be one of the factors for its slow growth in comparison to other crypto tokens of the same age. With just around $42m in marketcap, it currently ranks 400th on CoinMarketCap.

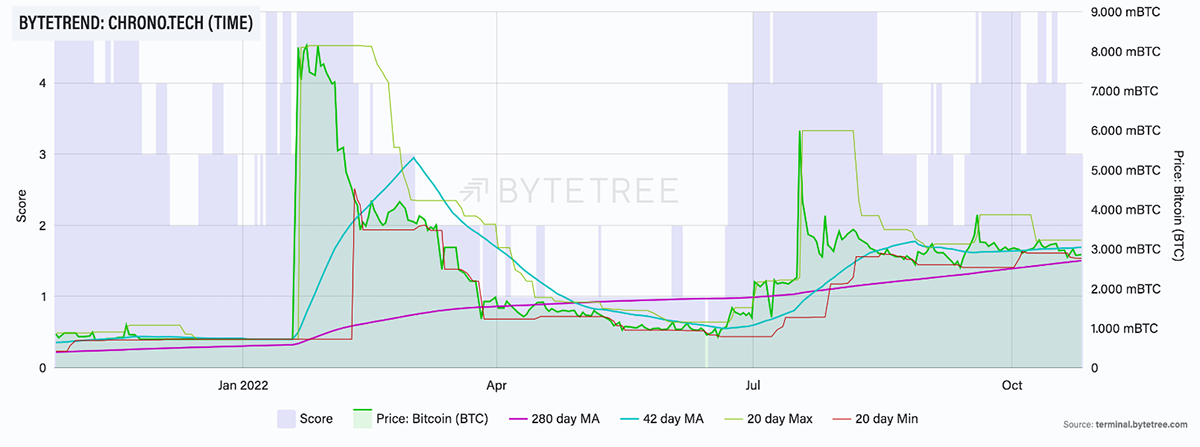

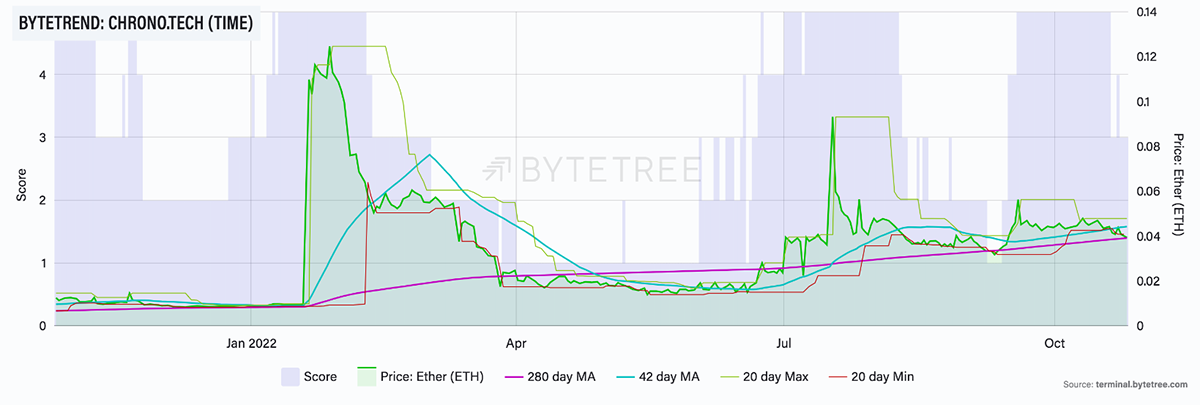

As illustrated in the below charts, TIME currently scores 3 stars against BTC and ETH on ByteTrend, showcasing a neutral, rangebound price trend.

Competition and Concerns

Chrono.tech’s freelance marketplace platform, LaborX, mainly competes with its traditional counterparts like Fiverr and Upwork. Compared to LaborX, these companies are enormous in every aspect. They possess a first-mover advantage in a winner-takes-most environment and use fiat currencies as their primary method of payment.

The main difference between LaborX and its traditional competition is that LaborX is decentralised and uses crypto for payments. Other than that, almost every LaborX feature is already available on traditional platforms. Most notably, the digital contract feature on LaborX is similar to the payments escrow on both Fiver and Upwork. The payments escrow secures the payment beforehand, reducing the risk of clients failing to pay.

Consequently, it boils down to LaborX being highly reliant as a blockchain-powered platform. However, competing against the leaders in this industry simply on the basis of the blockchain element is extremely difficult. There are already jobs available on many traditional platforms where the salary is paid in crypto. Moreover, if users want the payment in crypto, they can request and agree with the client to be paid in crypto instead of fiat. If the traditional companies realise the demand for crypto payments and start providing this feature, then LaborX’s business model becomes obsolete.

Similarly, TimeX is competing with other exchanges, which is one of the most competitive spaces in the crypto industry. There are roughly 600 exchanges worldwide, all providing similar features but with minor differences. However, TimeX is trying to target the Australian region, which decreases its competition to some extent. However, it still has to compete with behemoths like Binance, FTX, Coinbase, and Uniswap DEX.

Conclusion

The LaborX business model is undeniably poor. There’s utility for TIME, a poorly performing token, and also extreme competition with other more established products. This makes the TIME token a risky investment. Moreover, due to a very small window of an addressable market, the token’s future remains highly uncertain and unsustainable. This somewhat explains why TIME is not listed on many major exchanges, contributing to its severe underperformance over the years.

Still, LaborX has seen gradual growth in the number of users on the platform. Additionally, TimeWrap is trying to provide many benefits for TIME stakers, offering a premium account feature on LaborX, fees rebates, bonuses and rewards, to increase its demand. However, given its poor business model, high competition, and a tiny addressable market, the future of Chrono.tech is shaky. Basing its competitive edge on simply being a blockchain-based platform, in an already well-established market, is definitely a high-risk endeavour. To answer the initial question, Chrono.tech is trying to provide a blockchain solution for a non-existent problem.

Comments ()