Calm before the storm?

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 71

A move down in real interest rates may provide relief and lead to a major resumption in activity given the technical set-up. Ethereum regains its poise following recent weakness.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Ultra-low volatility |

| On-chain | Institutions go quiet at the bottom |

| Macro | Real interest rates tick back down |

| Investment Flows | Flat |

| Cryptonomy | ETH-killers are very unhappy |

Technical

If history is any guide, something is about to happen.

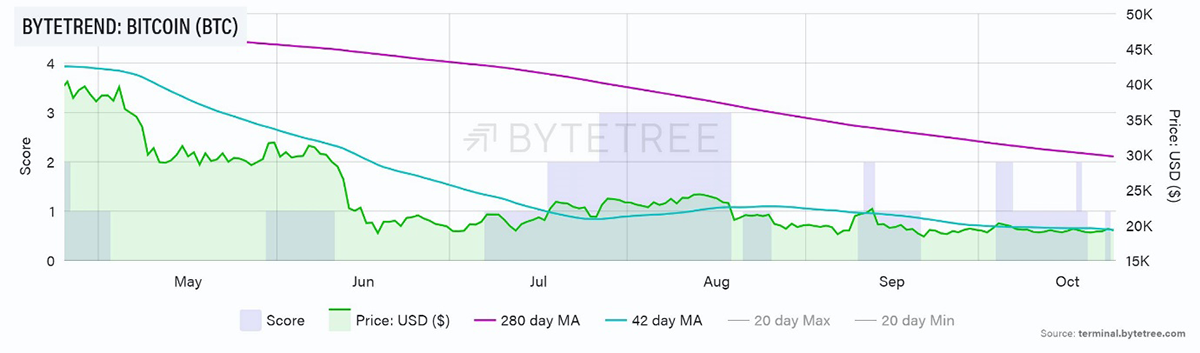

Bitcoin briefly flickered to life this week, but the stars have now been snuffed out on ByteTrend. The price has been almost spookily rangebound since mid-June. The tightness of the trading range suggests that a move out of it, one way or the other, will be decisive. The first main target should be the 42-day moving average, which is now being actively flirted with, as shown below.

Source: ByteTree. ByteTrend chart for BTC, in USD, over the past six months.

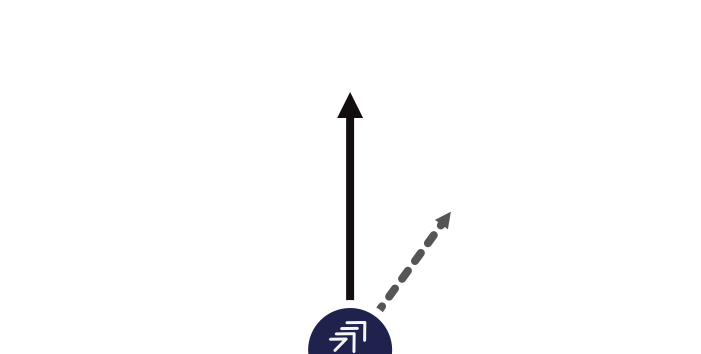

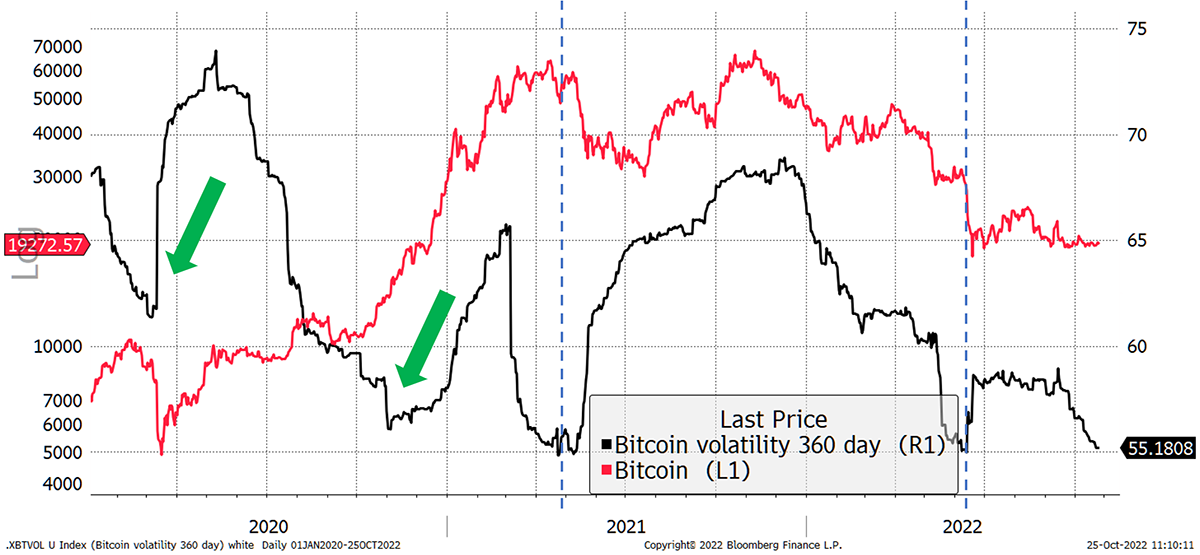

This period of calm means that the historic volatility has fallen sharply, as shown below. What you will note is that the last couple of times BTC 360-vol fell this far, it pre-empted painful sell-offs (blue dashed lines).

Source: Bloomberg

That said, this is not always the case. Low volatility may also mean that the speculative hordes have left the building, and we’re left with long-term holders. That being the case, there are few sellers left, and any change in the liquidity environment can trigger a sharp upward move. This is very much what we saw in 2020; firstly, at the start of lockdowns and secondly, in the Autumn when MicroStrategy and Stanley Druckenmiller first started buying (green arrows).

The technicals point to an imminent move one way or the other.

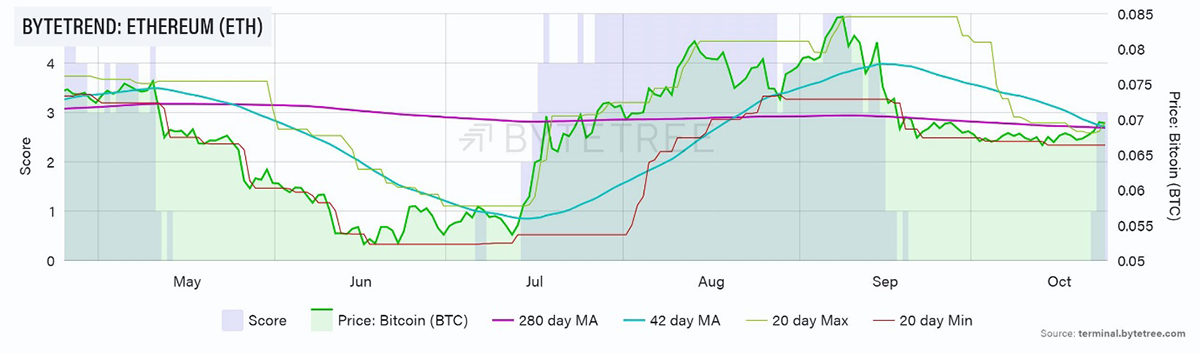

Also worth keeping an eye on this week is the ETH/BTC ratio. After declining since the successful completion of the Merge, the technicals are pointing to a bottoming out. Ethereum in BTC has moved to three stars and has broken back above the longer-term moving average.

Source: ByteTree. ByteTrend for ETH, relative to BTC, over the past six months.

On-Chain

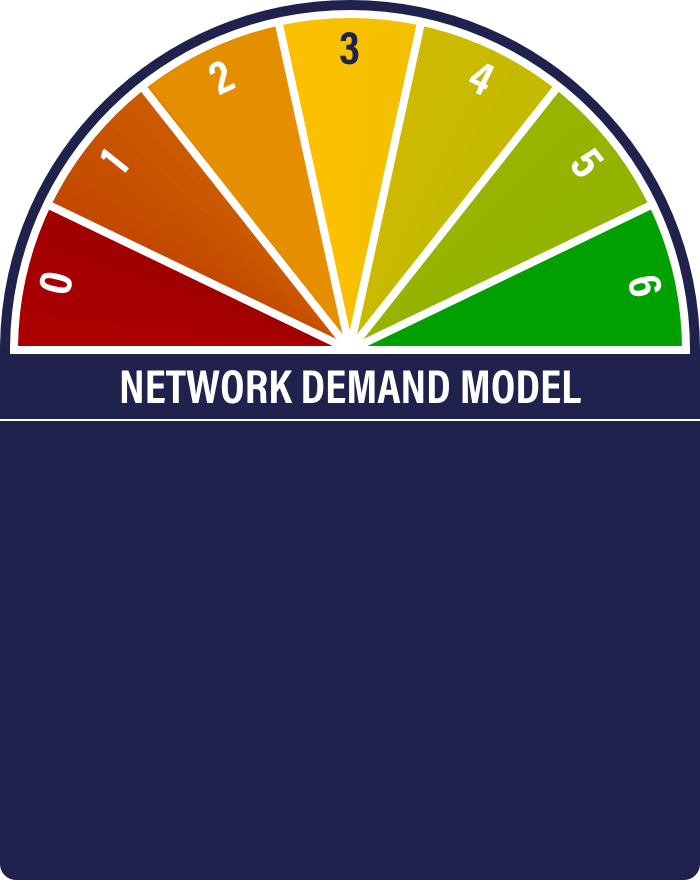

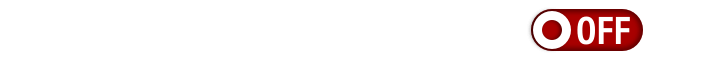

The Network Demand Model remains on 1/6, with only the velocity signal turned on. There is no sign that activity on the blockchain is picking up, when measured in value transacted over the network.

Source: ByteTree.

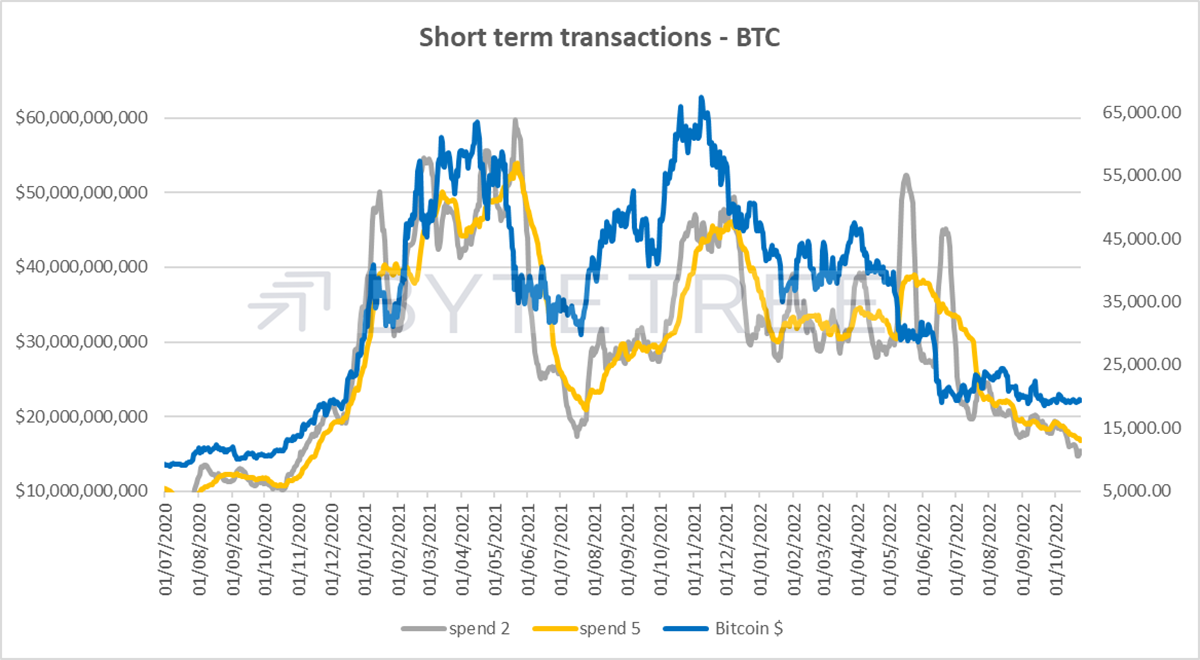

That said, what is interesting is that the current low level of transaction value is roughly equivalent to that seen in the middle of 2021, after the first major sell-off. Yet the number of transactions now is much higher. This is encouraging as it suggests that network usage among smaller players is increasing. Given that bitcoin was originally envisaged as a monetary network (as opposed to a store of value, which is ultimately a product of its utility), this is what its long-term success will hinge on.

Source: ByteTree.

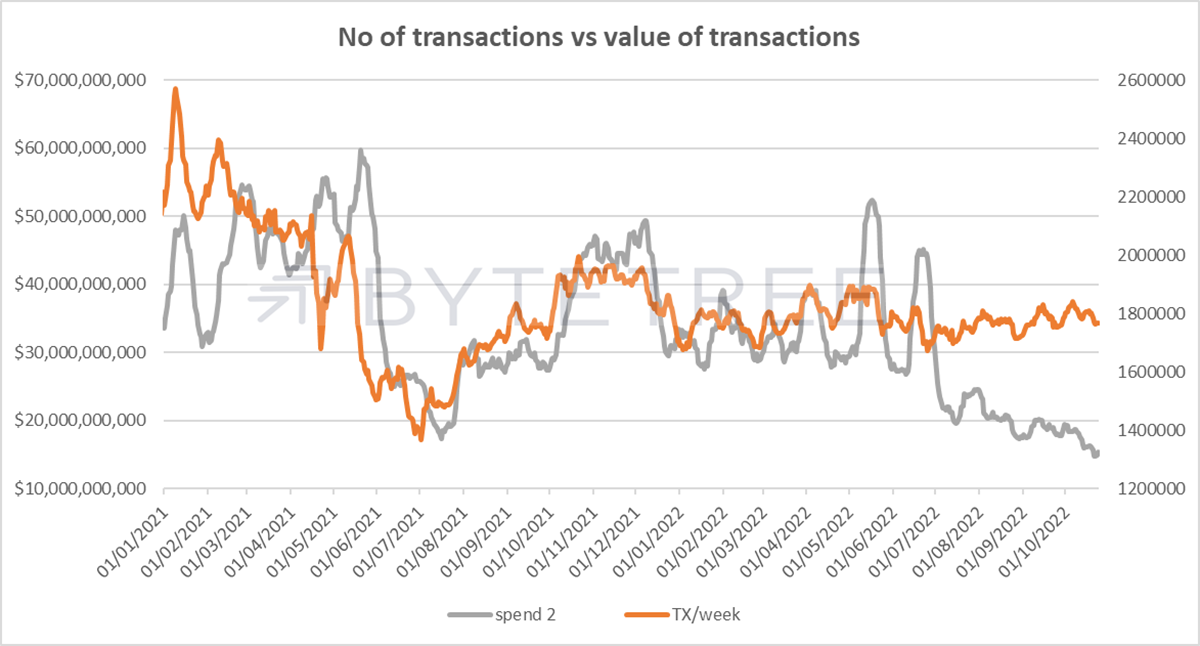

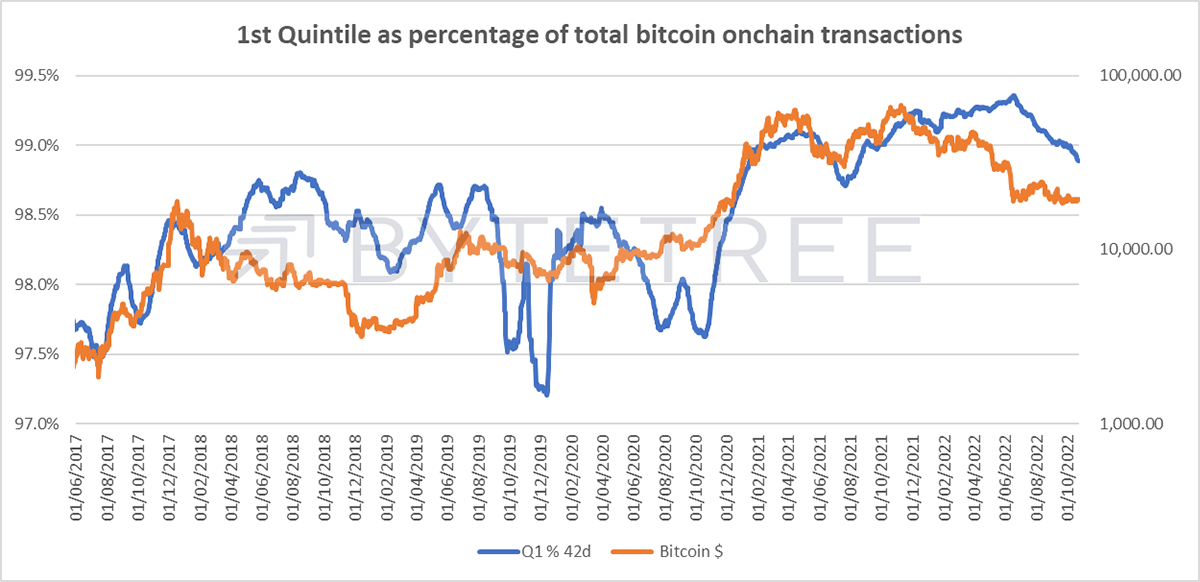

Much is written about institutional involvement in crypto, yet there is little evidence of this in the on-chain data. Our own Institutional Dominance Ratio (IDR), which shows the top quartile of transactions as a percentage of the total value of transactions, has been falling lately.

Source: ByteTree. On-chain IDR for Bitcoin (%) and price (USD), over the past 12 weeks.

This shouldn’t necessarily be seen as a bad thing. Looking back, we can see that the dominance of the largest traders is much more pronounced at the top of the market than at the bottom, as shown below. Could professional investors be a contrary indicator? Surely not!

Source: ByteTree.

Macro

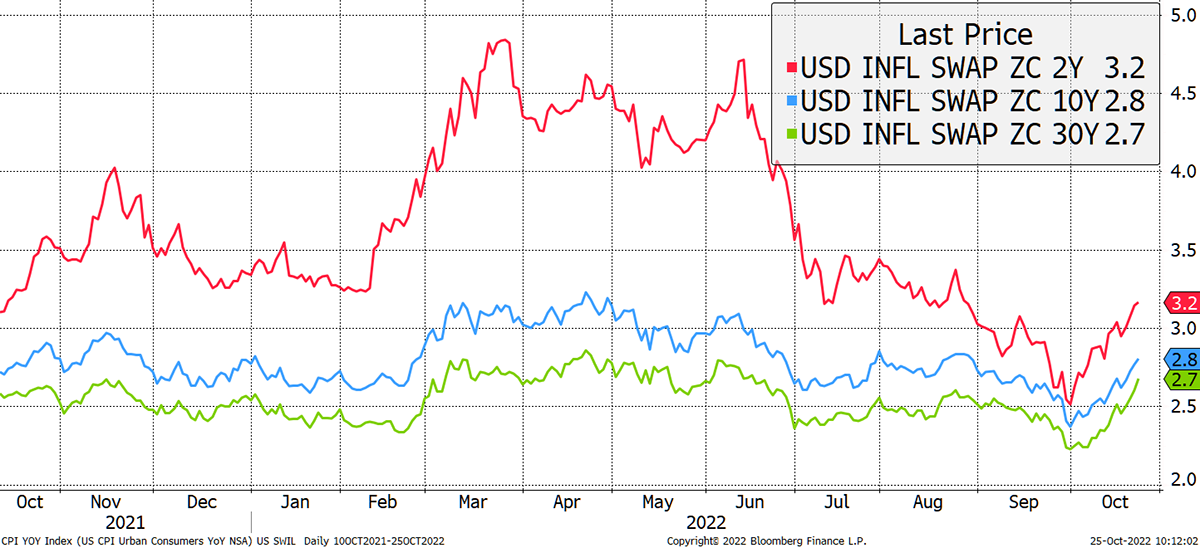

Bond markets are anticipating an uptick in inflation. You can see below that forward inflation swaps have been rising in October.

Source: Bloomberg

This has caused real interest rates to fall, which is typically bullish for gold and, one would hope, bitcoin.

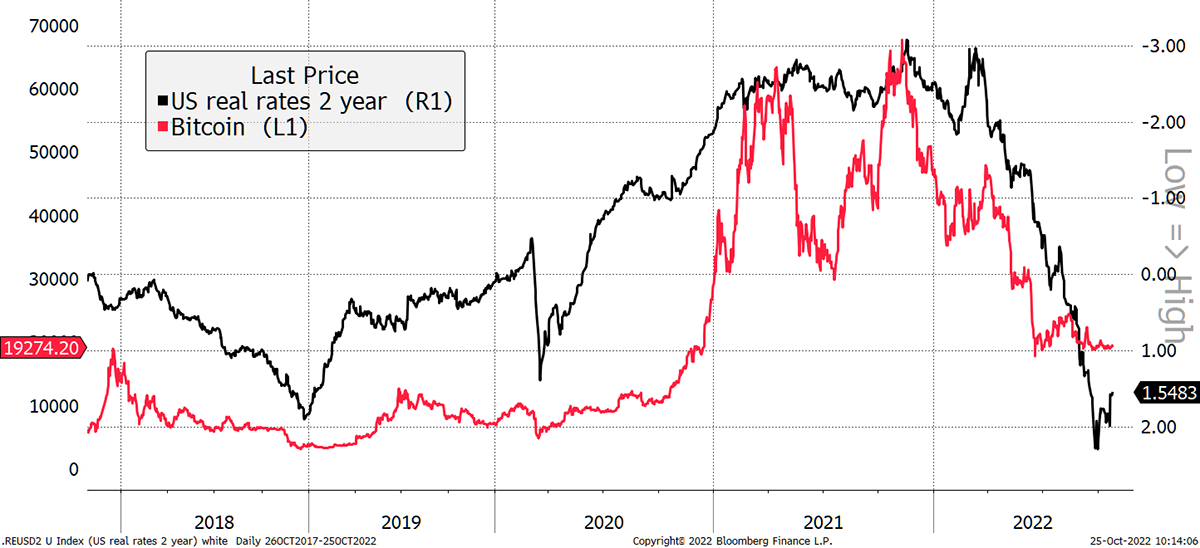

Source: Bloomberg

Bitcoin has historically been correlated with real interest rates, as you’d expect because they tell us about liquidity. If we see conditions continue to loosen, it would be the perfect launchpad for a crypto revival. The last time real rates were this high (note that the right-hand column is inverted) was at the bottom of the bitcoin market in 2018.

Source: Bloomberg

Investment Flows

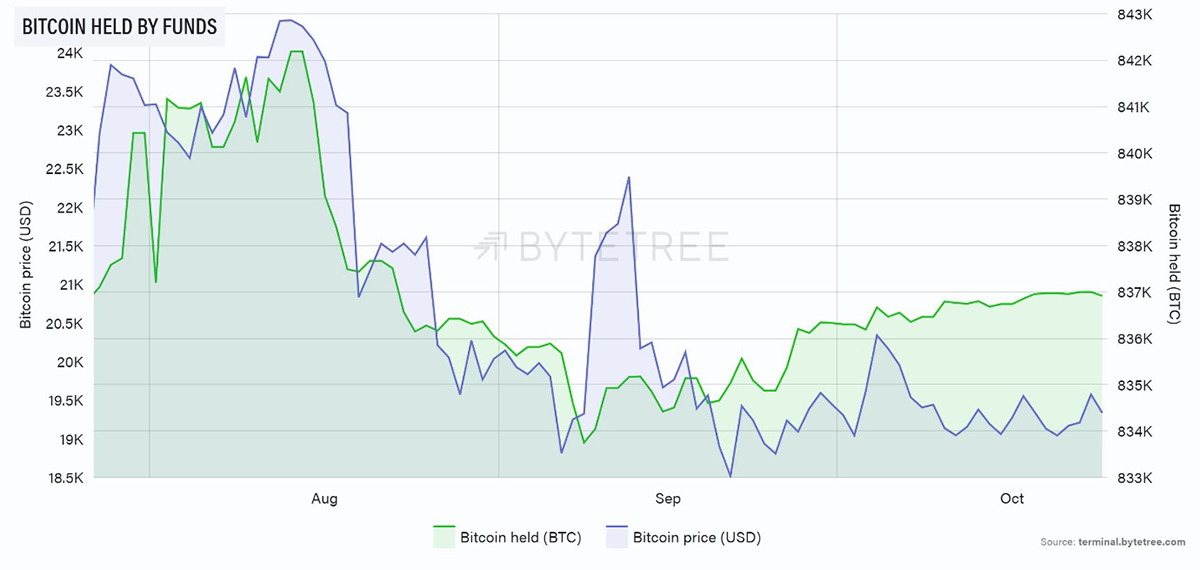

Nothing to report here this week. Fund holdings in both BTC and ETH have been almost completely flat.

Source: ByteTree. Bitcoin held by funds (BTC) and price (USD).

Source: ByteTree. Ethereum held by funds (ETH) and price (USD).

Cryptonomy

My colleague Ali picked up on a controversially-titled article this week, “The Ethereum Killers Are All Zombies Now”, written by Paul Brody of Ernst & Young. It makes the point that “the lesson from many different digital eco-systems suggests that we live in a winner-take-all environment”. Ethereum has been “the most dominant blockchain out there for business applications, with more than 60% of the decentralised finance (DeFi) market and 95% of all NFTs, and more developers than any other eco-system”.

Now that Vitalik and the gang have steered Ethereum safely to Proof of Stake, it seems probable that its dominance will prevail, especially with the upgrades still to come. In all fairness, it’s very hard to see alternatives making a big dent in terms of market share.

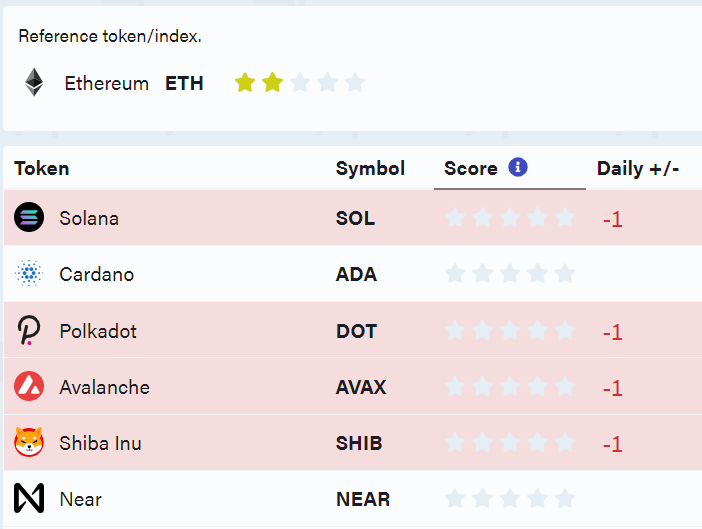

I’m sure there will be readers who will disagree with this, and we’d love to hear the arguments if so. But for the time being, it’s worth looking at what the market is thinking. As mentioned earlier, ETH’s price has recently sagged in the wake of the Merge, but even despite that, the alternatives are struggling. The table below is sorted by zero stars relative to ETH, and it’s dominated by the supposed ETH-killers (SOL, ADA, DOT, AVAX, NEAR).

Source: ByteTree.

It may well be that despite their technological brilliance, they’re already zombies - we’d certainly avoid these names until getting much greater clarity that they are gaining the traction they claim they deserve.

Summary

It feels like something large is about to happen. Judging which way the market moves from here is tough, and much depends on macro. That aside, there are good reasons to think the worst is behind us, particularly for the leaders.

Comments ()