Go Liz - Embrace Crypto

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 64

The UK gets a new prime minister, Liz Truss, who we are hopeful is pro-crypto. She is certainly pro-deregulation and no supporter of the nanny state.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | An emerging alt rally |

| On-chain | Still sluggish |

| Macro | Inflation is under control |

| Investment Flows | Stable |

| Cryptonomy | Polygon |

The UK gets a new prime minister, Liz Truss, who we are hopeful is pro-crypto. She is certainly pro-deregulation and no supporter of the nanny state. It would be easy to doubt the impact of the UK’s crypto policy on the global market, but the Financial Conduct Authority (FCA) is an influential regulator. If restrictions were eased here, other countries would follow.

What crypto needs is for institutional investors to buy it. Bitcoin may prove to be more challenging because it consumes energy, despite many arguing its usefulness in balancing the energy system. Bitcoin can’t store energy, but it can store value created from otherwise surplus energy. Besides, the world needs a liquid digital alternative asset, although I don’t suppose the establishment share that view.

Most of the crypto leaders today are proof of stake. They aim to build a new financial system, and with a nod from above, huge amounts of capital will pour in. It’s not if but when.

We know the internet 2.0 trade is over. The leading internet stocks are overvalued, and investors want the next big tech trade. The answer, as it has been for some time, is crypto.

Go Liz.

Technical

By Charlie Morris

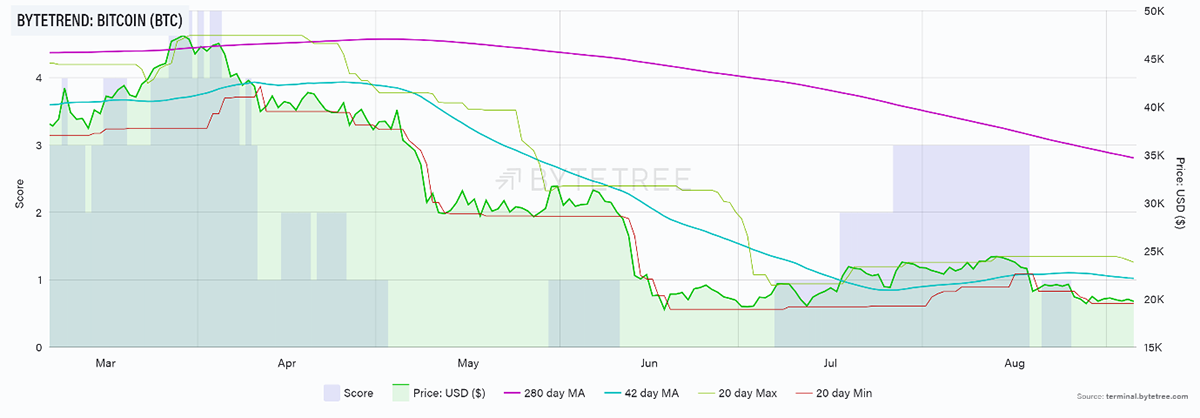

Bitcoin remains trendless and friendless. It is the crypto that is most influenced by external factors, which still drag on the space. Yet there are positives if you look closely. The 20-day max line is falling, and any strength from here will soon get noticed.

Bitcoin zero-star

Source: ByteTree. ByteTrend for Bitcoin (BTC), relative to USD, over the past 6 months.

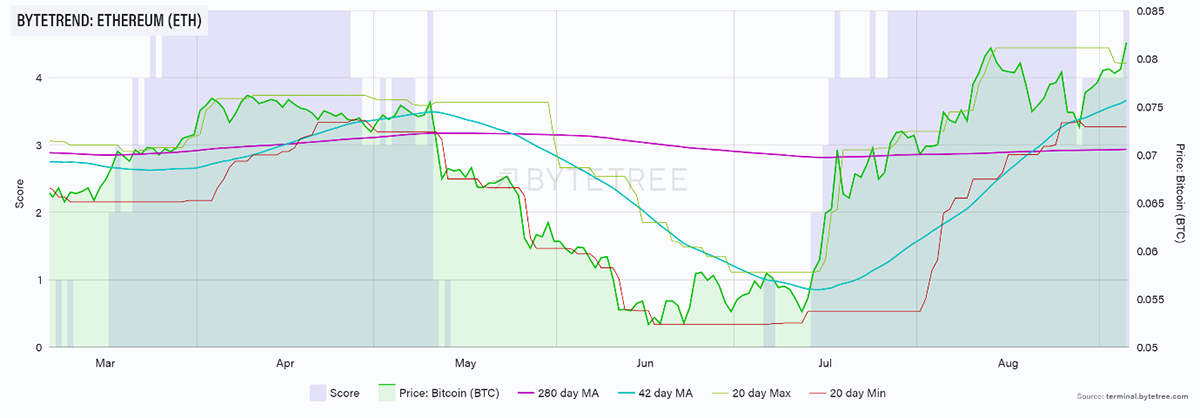

A stronger picture emerges in ETH, which has rallied harder and could see an imminent ByteTrend upgrade.

Ethereum 1-star

Source: ByteTree. ByteTrend for Ethereum (ETH), relative to USD, over the past 6 months.

ETH in BTC is now super-strong. You could be forgiven for wanting to switch. The Merge is upon us, and ETH is back in the news. It shifts from proof of work to proof of stake, which makes it a more acceptable asset for institutional investors. This could make a difference in time.

ETH in BTC 5-star

Source: ByteTree. ByteTrend for Ethereum (ETH), relative to BTC, over the past 6 months.

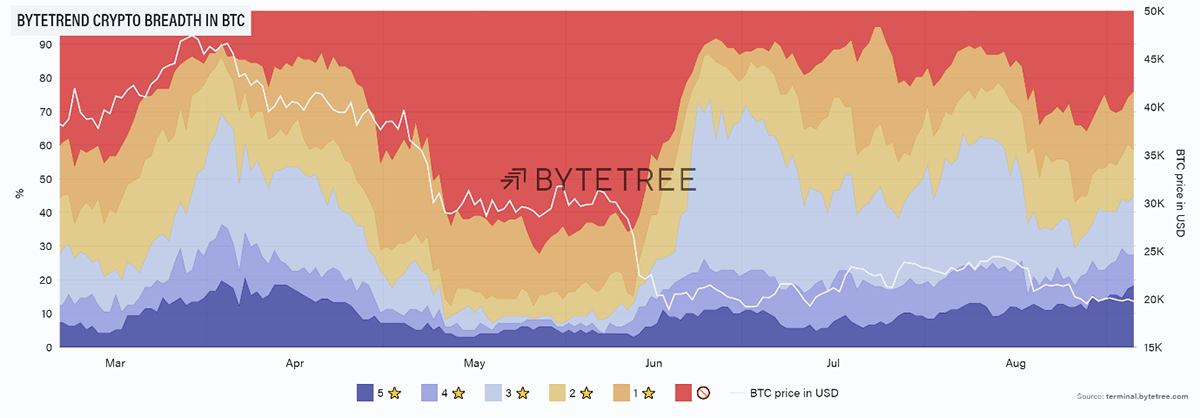

Yet bitcoin lags behind. In recent weeks, the number of strong trends in BTC (shown in blue) has grown.

Weak breadth

Source: ByteTree. ByteTrend crypto breadth chart, relative to BTC, with BTC price in USD overlayed.

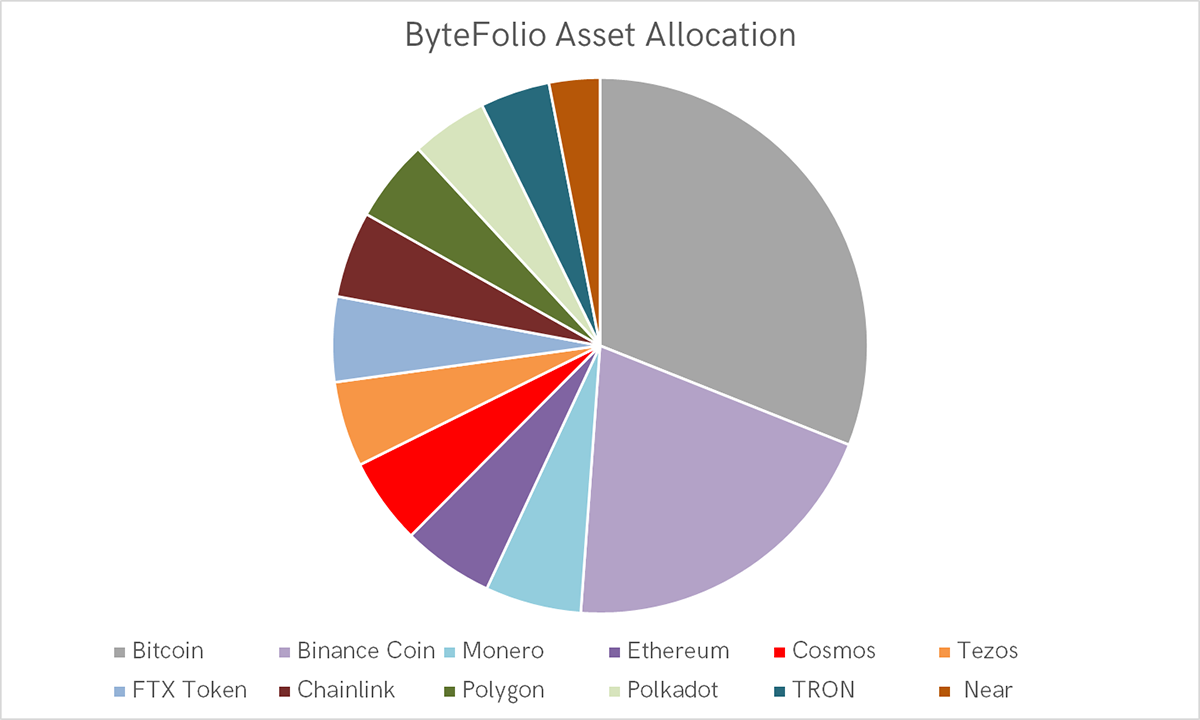

A gentle alt season has begun, and a number of new trends have emerged from the weakness in the second quarter, many of which have been picked up in the ByteTrend portfolio, ByteFolio.

Source: ByteFolio

On-chain

By Charlie Erith

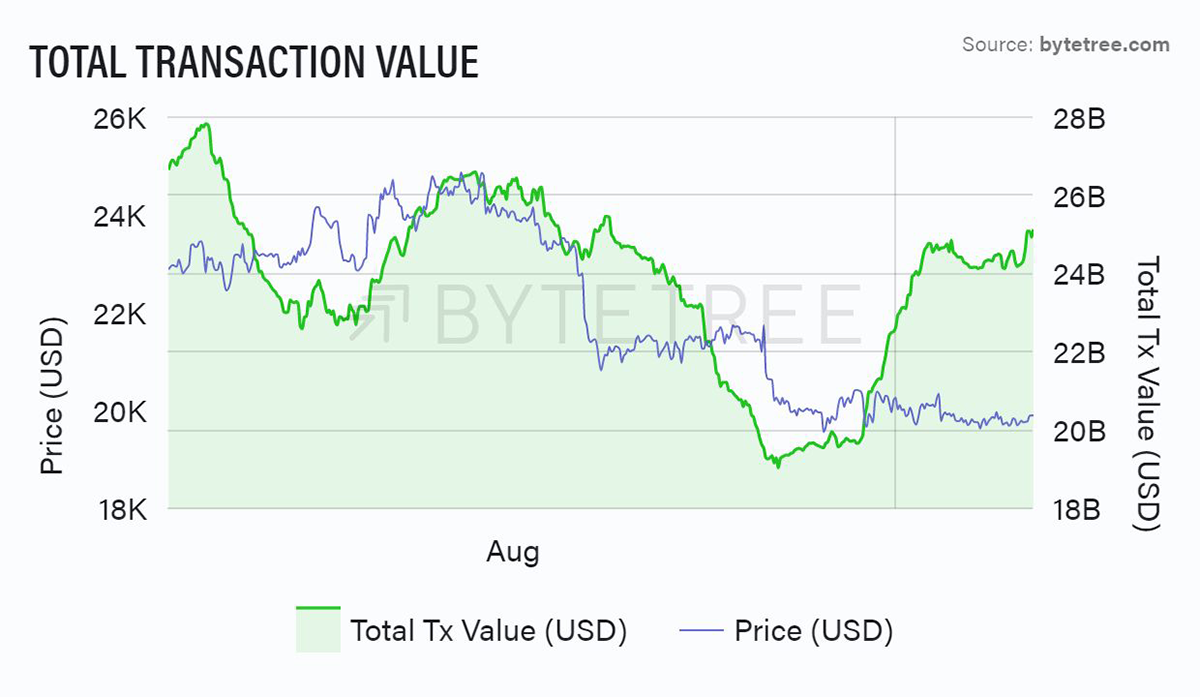

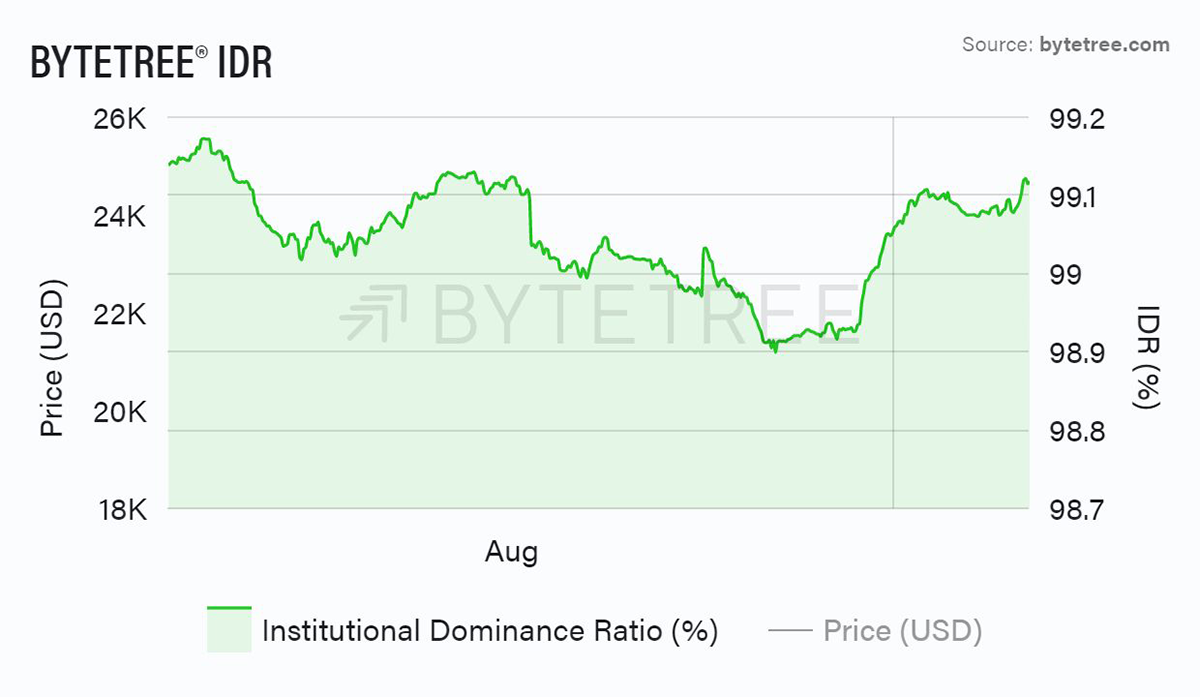

With the Northern Hemisphere returning from the beach, signs of life have been detected in the Bitcoin Network, although it’s far from cork-popping time. Last week saw a pick-up in transaction value, as well as a spike in IDR (Institutional Dominance Ratio), which tells us that the big players are back.

Source: ByteTree. Bitcoin total transaction value and BTC price in USD over the past 5 weeks.

IDR measures the percentage of transaction value that is accounted for by the top quintile (20%) of transactions; above 99% is generally seen as healthy. On the Terminal, you can also see similar pops in velocity and the transaction count (see “Charts”).

Source: ByteTree. ByteTree IDR (%) over the past 5 weeks.

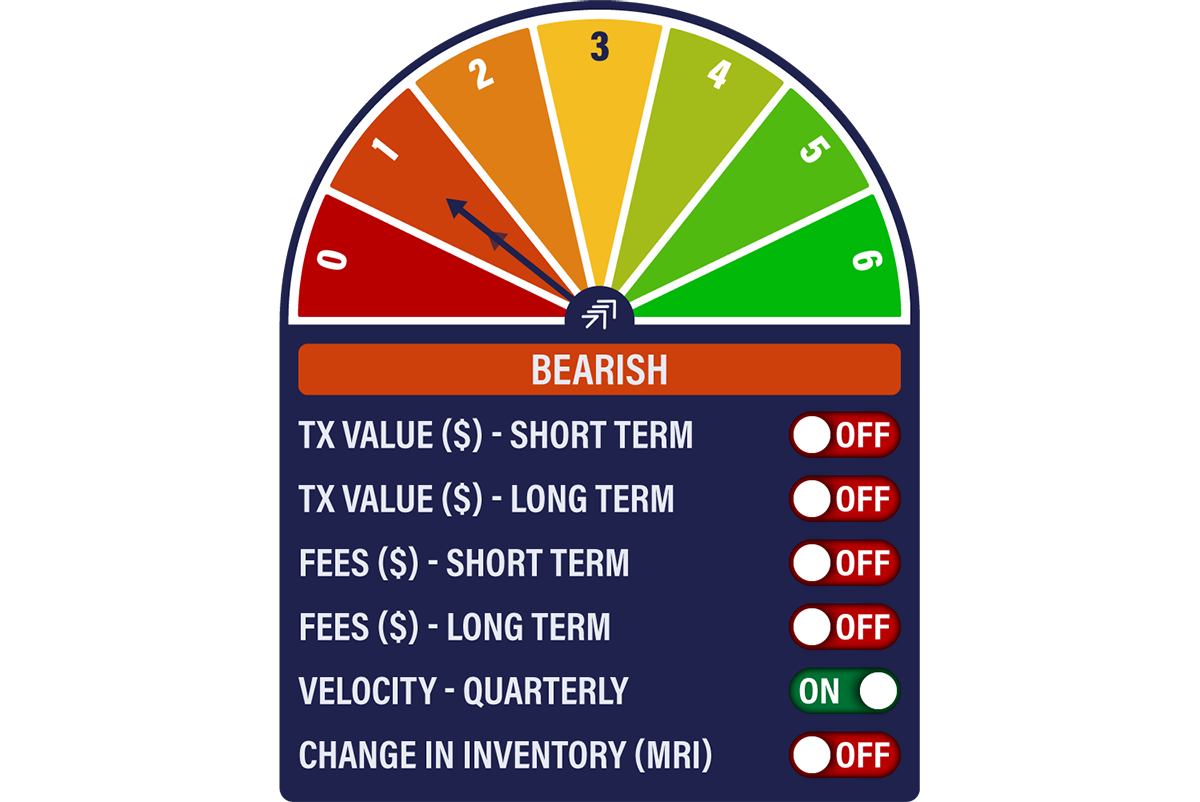

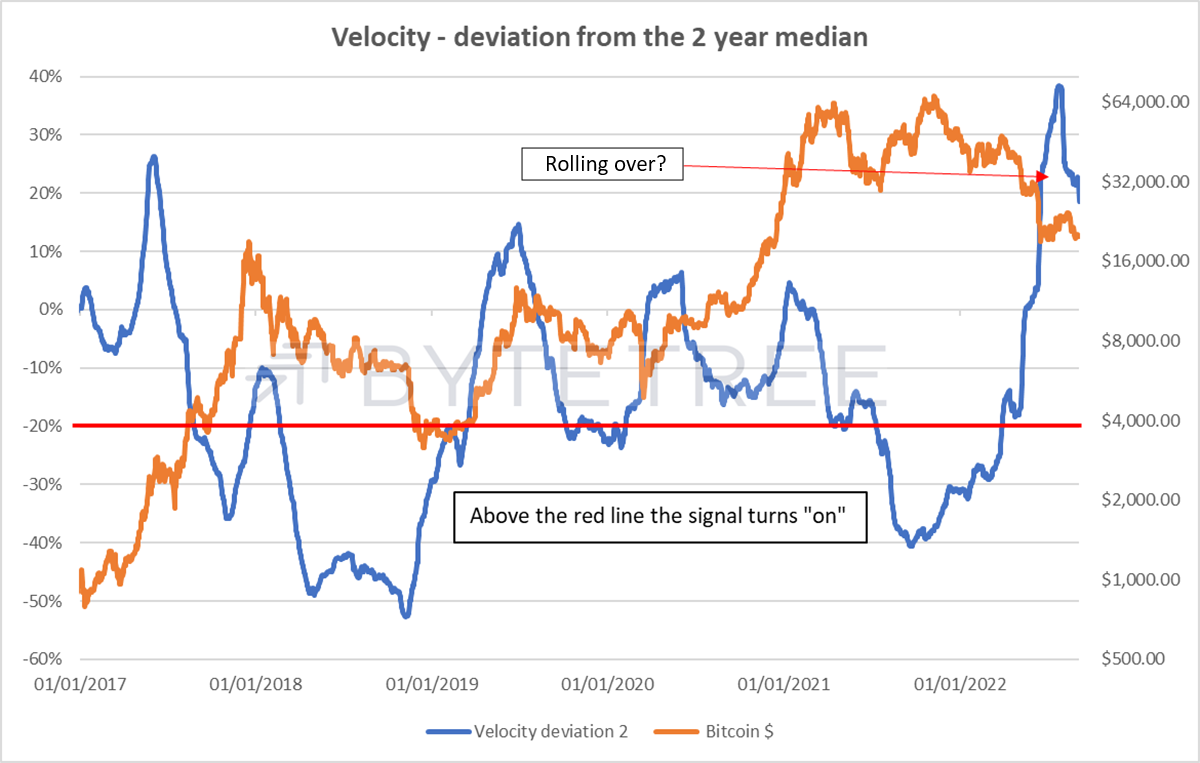

While this improvement is welcome, it is very far from a trend. The Network Demand Model remains on 1/6 with every indicator (including velocity, below) pointing south.

On this basis, there is no hurry to chase the market.

Source: ByteTree. Bitcoin 2-year median velocity (blue) and BTC price in USD (orange) since 2017.

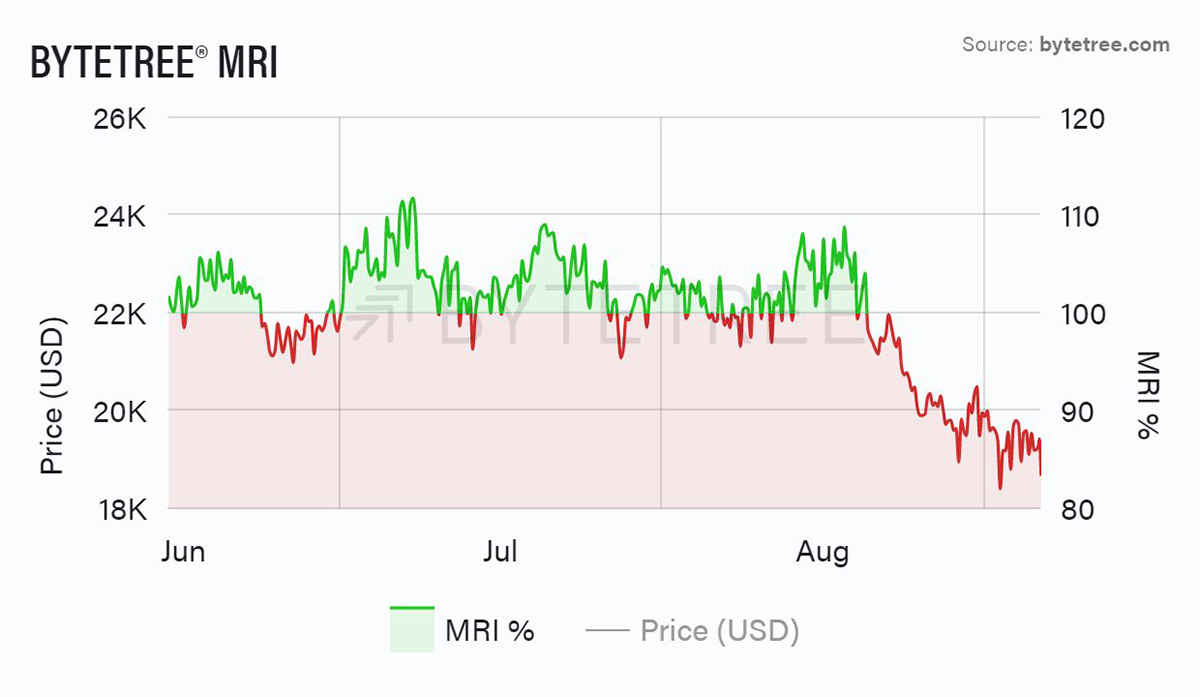

One other aspect of on-chain data leaving us uncomfortable is the build-up in unspent bitcoin inventory. For whatever reason, the miners have stopped selling, so you can see MRI moving sharply into the red.

Source: ByteTree. ByteTree MRI (%) over the past 12 weeks.

The flip side of this is an inventory build.

Source: ByteTree. Bitcoin miner inventory (BTC) over the past year.

It’s a bit weird that miners are hoarding at a time when energy prices have been moving sharply higher for most of the planet, because we would infer that margins are being squeezed from both ends.

We can only hope that the vast majority of miners are sourcing power at a much lower rate than is generally available. CryptoCompare’s mining calculatorsuggests mining is profitable at an electricity cost of around 8c/KWh at the current bitcoin price. While such prices are plausible in disparate, energy-rich places like Kazakhstan, Russia, Iceland or Kuwait, or anywhere where there is stranded power, it is a big stretch in the developed world.

The inventory build could yet be a problem for the bitcoin price, because if miners are waiting for higher prices and they don’t materialise, they will be forced sellers.

It also makes Ethereum’s switch to Proof of Stake look highly prescient.

Macro

By Charlie Morris

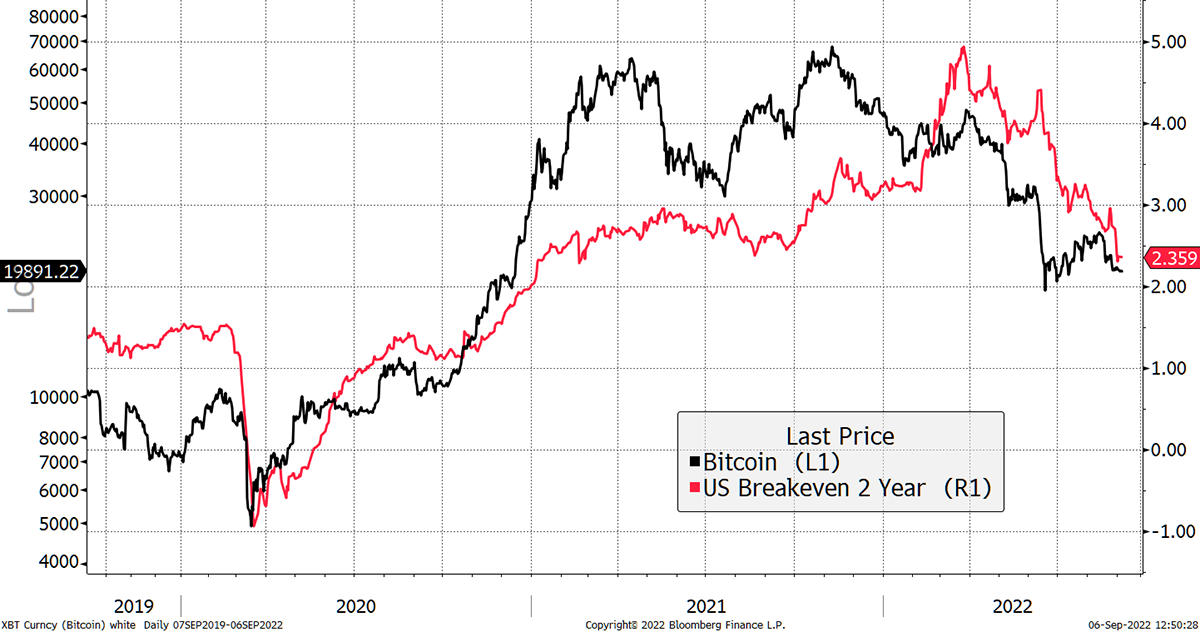

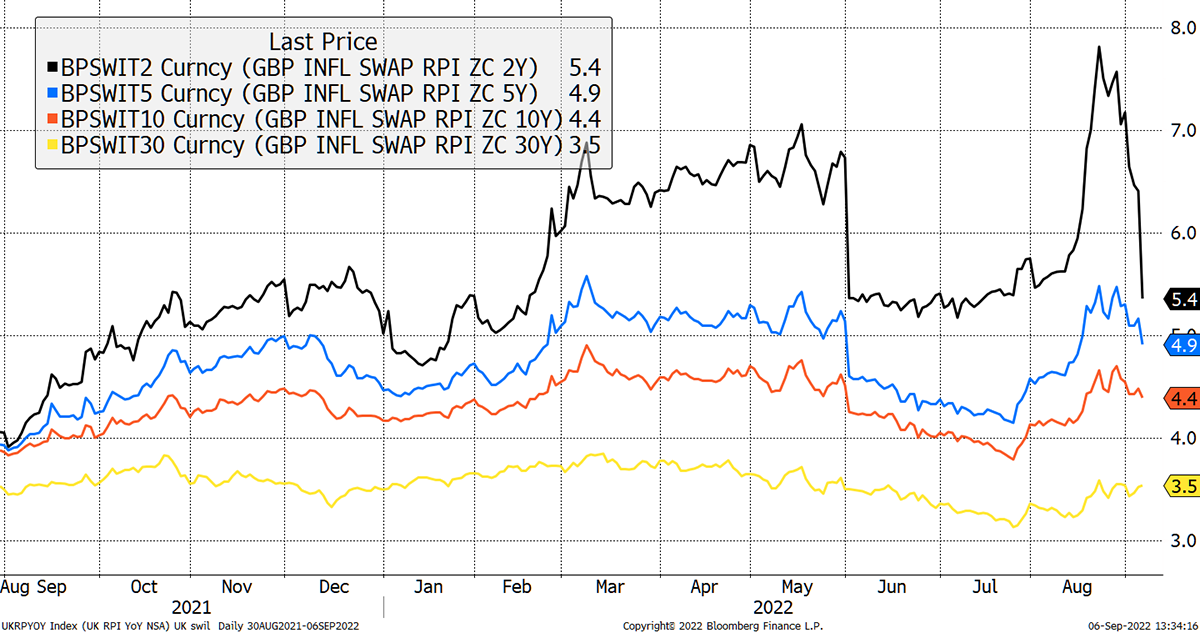

This chart tells the story well. Bitcoin has always enjoyed an inflationary narrative, and that is proving to be true. The trouble is, while people see rising prices all around them, the bond market sees something else.

Inflation is “under control”

Source: Bloomberg

When you see this sort of thing, yet everyone is certain that inflation will persist, it’s best to cross-check.

Inflation expectations in the UK are crashing down. It can’t all be down to Liz Truss, who is yet to start in Number 10.

UK inflation expectations fall too

Source: Bloomberg

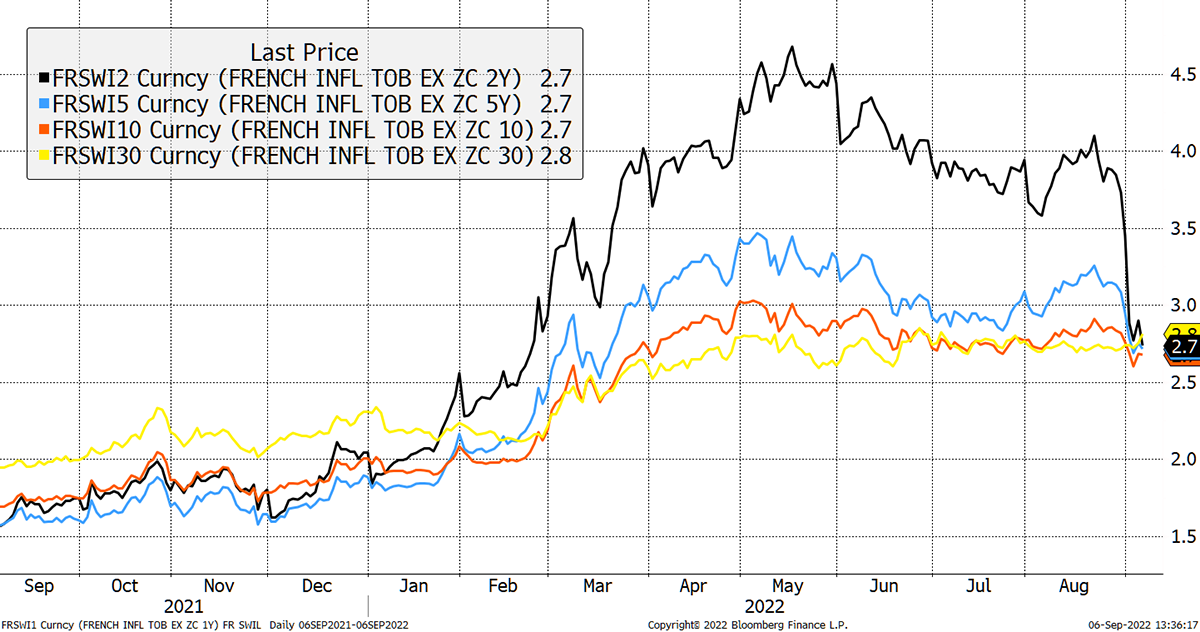

Checking again, the situation in France confirms this too.

…and in France

Source: Bloomberg

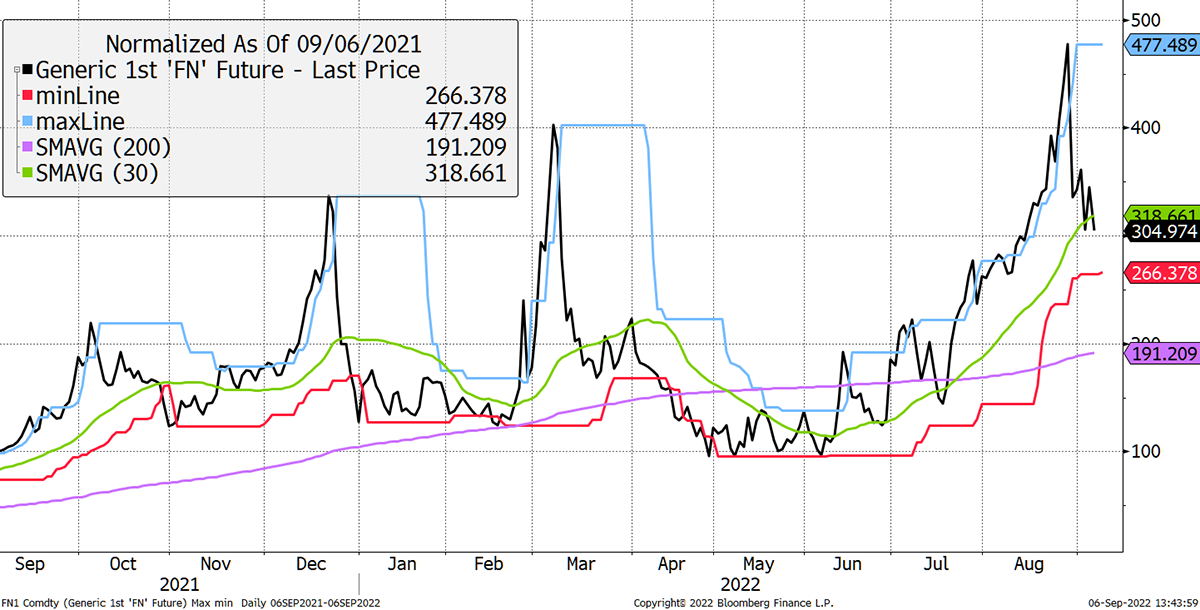

Since energy has been the principal problem, it can only mean that energy prices have cooled. UK natural gas is still 3x a year ago (chart rebased to 100), but this time next month, it will barely be higher on a year-on-year basis, despite gas remaining historically expensive.

Natural gas (5-star trend) still high, but rate of change will cool

Source: Bloomberg

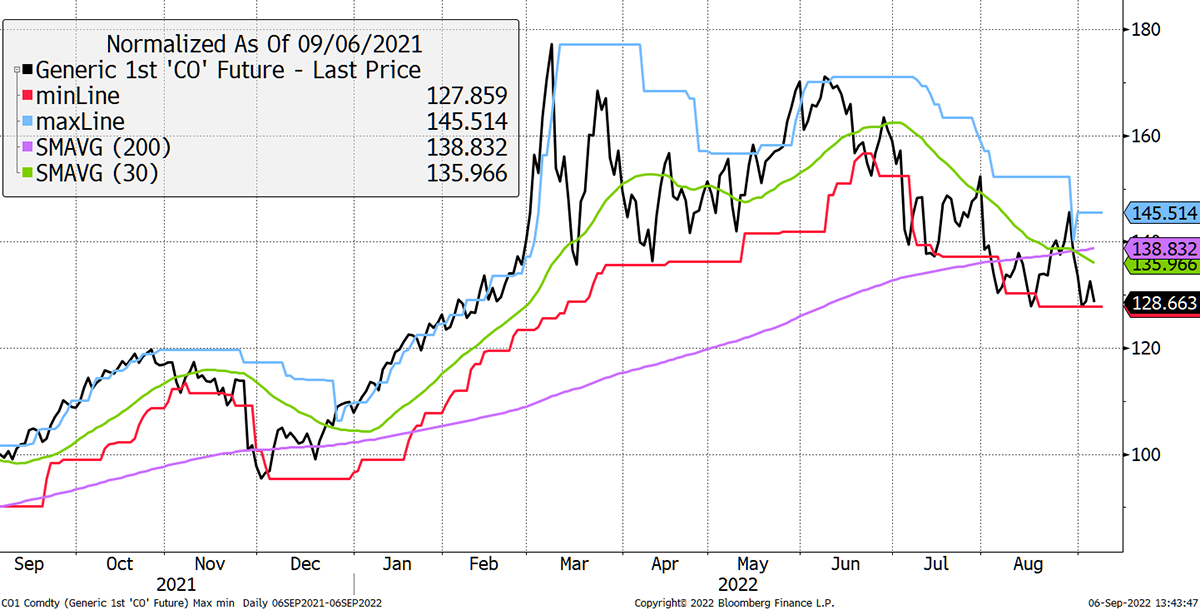

Oil too. The year-on-year change is up 28%, but this was 150% in March 2021 and has been cooling since.

Brent crude oil (1-star trend)

Source: Bloomberg

Inflation does not reflect high prices but the change in prices. We may be lumbered with higher energy costs, but if the markets don’t see them going higher, then inflation cools as it always looks ahead.

My view is that it won’t return to 2% as planned, because the world has changed. It may not be energy that drives it in the next round but wages, or simply the higher costs associated with the move from just-in-time supply chains to just-in-case.

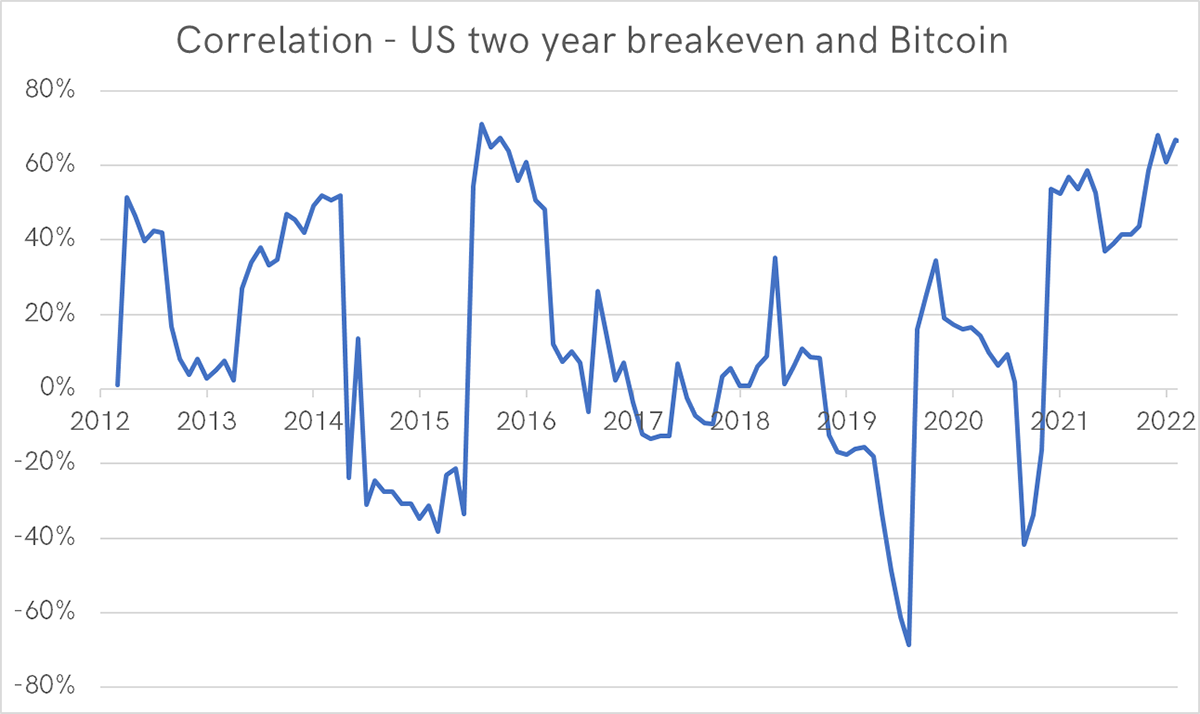

But then again, the US and Europe don’t own or control bitcoin as it is a global phenomenon. The bearish case goes back to the first chart against the US 2-year breakeven (inflation expectation).

Inflation is some sort of pull, whereby investors are attracted or distracted by the inflation hedge argument, but beyond that, it’s a free network that responds to a complex number of things. But one thing I can be certain of, is that the link between inflation and bitcoin is cyclical, and sooner or later, it will break down.

Source: Bloomberg

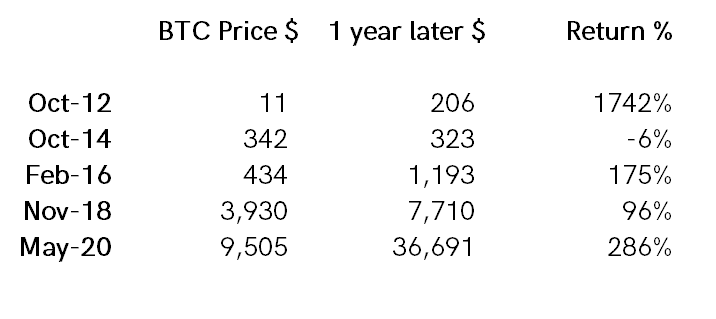

Previous high correlations occurred in:

It could be worse!

Investment Flows

By Charlie Erith

Fund holdings continue to be flat for both Bitcoin and Ethereum. It’s difficult to infer any price direction from this source. The amount of bitcoin being held by the funds we track is at the same level as late October 2021.

Source: ByteTree. Bitcoin held by funds (BTC) and BTC price (USD) over the past year.

Apart from a spike in June, ETH holdings have been on a downtrend since January.

Source: ByteTree. Ether held by funds (ETH) and ETH price (USD) over the past year.

Cryptonomy

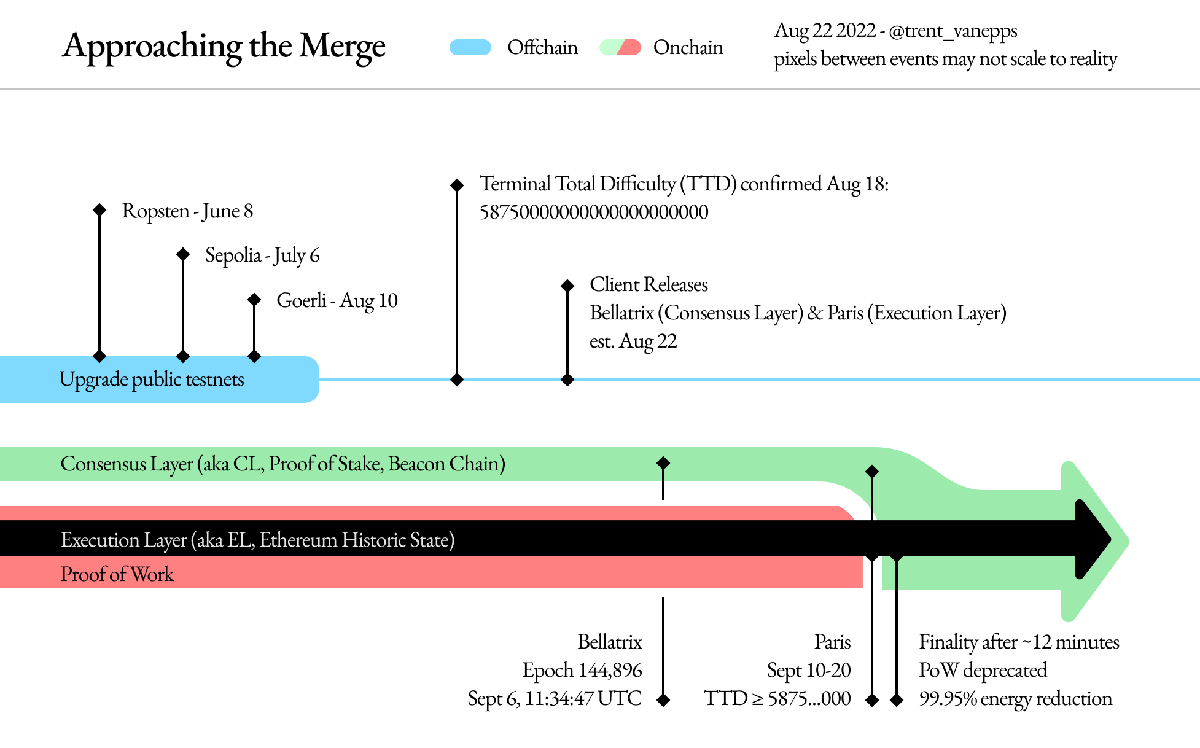

It’s hard to talk about much except the Merge in the world of crypto at the moment. This is Ethereum’s move of its consensus mechanism from energy-intensive Proof of Work to Proof of Stake. We recently wroteabout the ramifications, but now we’re in the thick of it. With any luck, we’ll be able to celebrate its completion next week or the week after.

Today sees the activation of a network upgrade, called Bellatrix, on the consensus layer. This will be followed by the execution layer’s transition from Proof-of-Work to Proof-of-Stake, called “Paris”, which according to the Ethereum blog, could take place anytime between 10-20th September. Paris will be triggered by the execution layer hitting a “Terminal Total Difficulty” level, after which the next block will be produced by a Beacon Chain validator. The Merge will be deemed complete in 12-13 minutes (2 blocks) after this has been completed.

One imagines it will be a long 12-13 minutes for the development bods.

This will result in a 99.75% reduction in energy usage. As discussed earlier in the on-chain section, with energy prices so elevated at the moment, a successful transition will make a compelling case for ETH’s continued outperformance of bitcoin.

Source: Ethereum

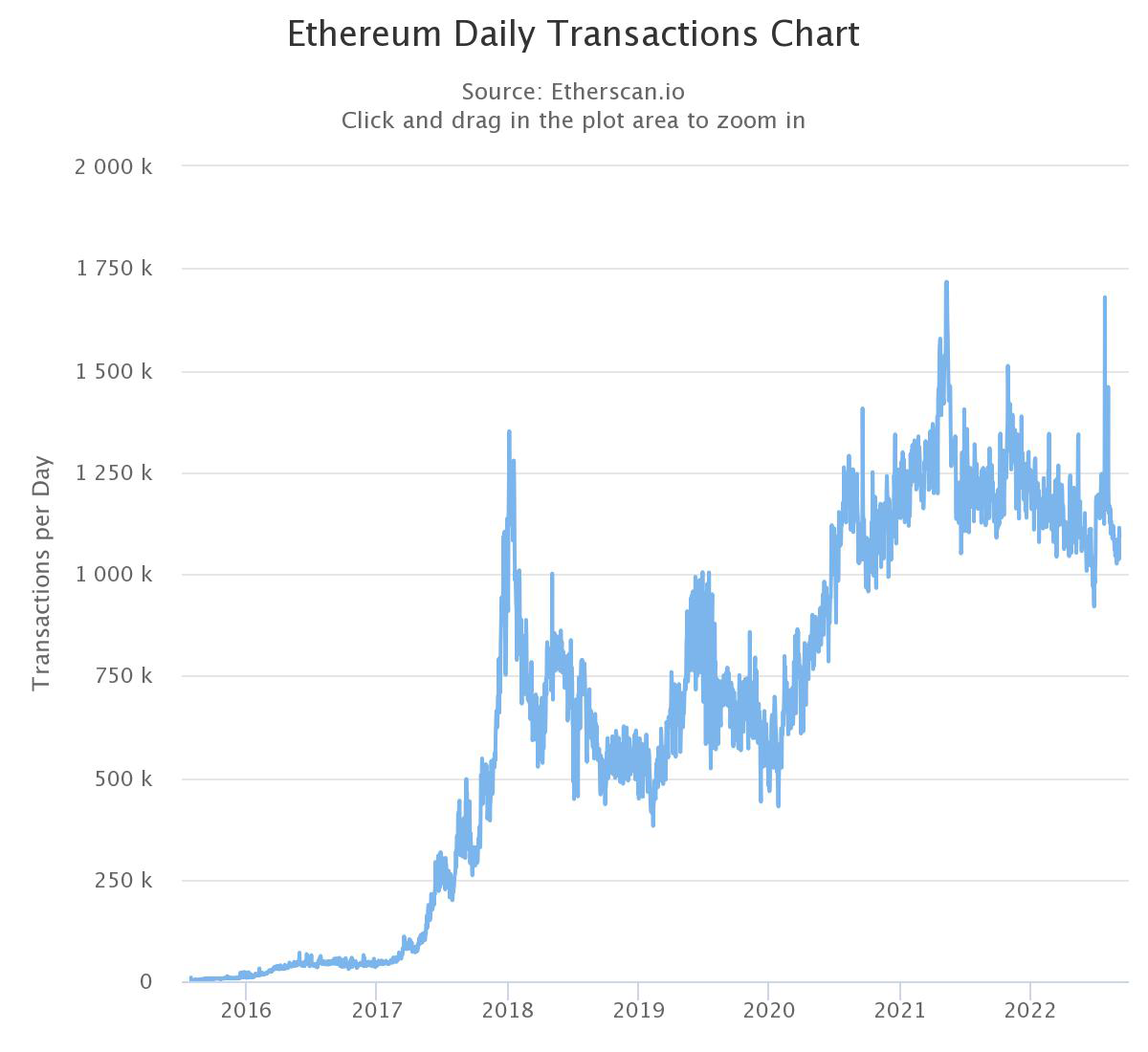

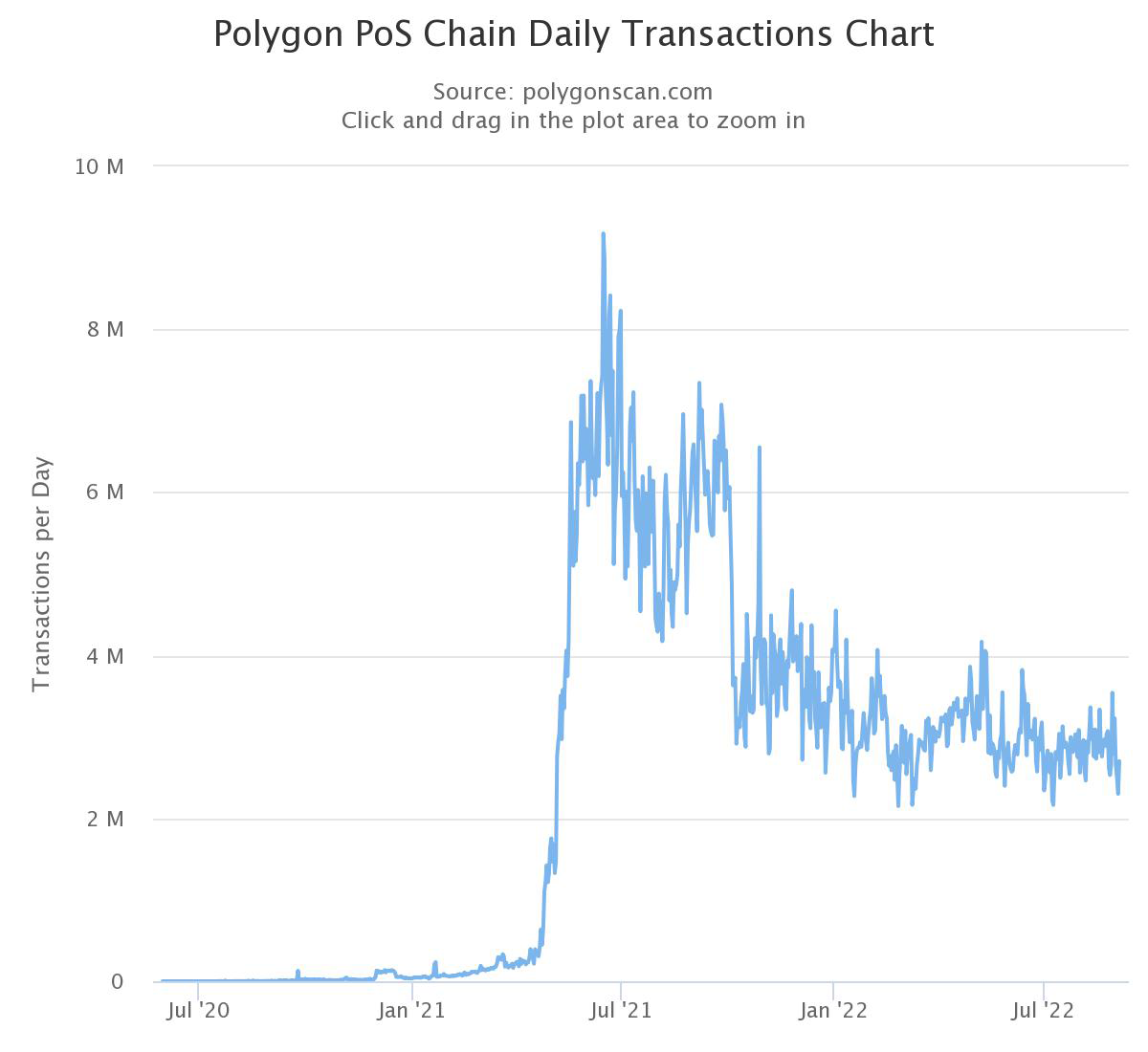

It will also be interesting to see how much the run-up to the Merge has impacted activity in the smart-contract sphere. As can be seen in the chart below, transactions have been soft through most of 2022.

Source: Etherscan.io

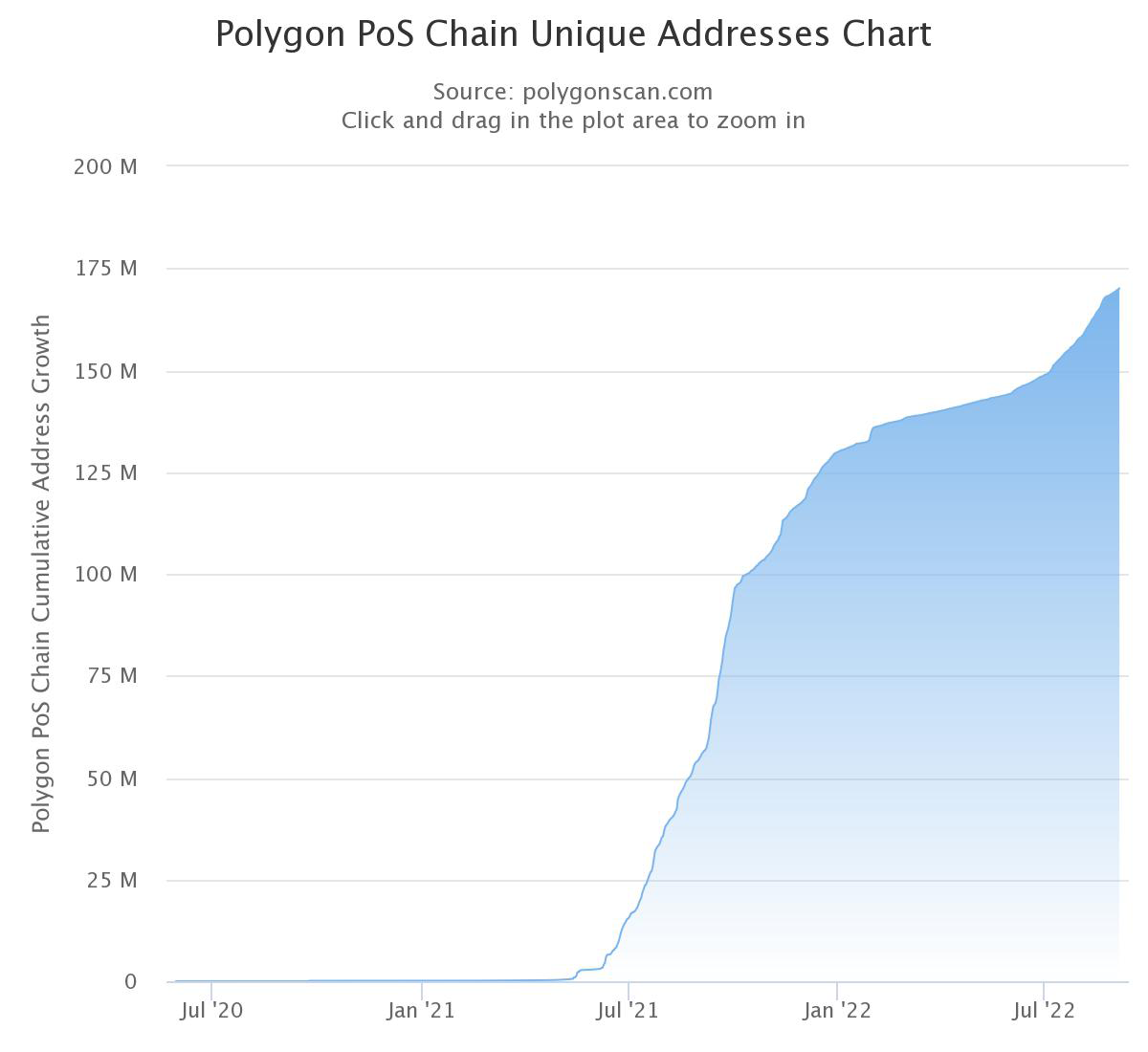

If developers and investors have been holding back activity until the Merge completes, it could also benefit scaling solutions such as Polygon (MATIC), which has also seen flat activity this year, in terms of transactions (below). In terms of the number of unique addresses, however, the picture remains highly constructive. We’ll be keeping a close eye on the data to see whether the rise in addresses is a lead indicator for a pick-up in activity.

Source: Polygon Scan

Source: Polygon Scan

Summary

It’s a waiting game before great things happen again, but we remain confident that bitcoin is underpinned at $20,000. Better things will come.

Comments ()